Projectreport Daburindialimited 1st 101008044158 Phpapp01

Diunggah oleh

Deepesh SharmaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Projectreport Daburindialimited 1st 101008044158 Phpapp01

Diunggah oleh

Deepesh SharmaHak Cipta:

Format Tersedia

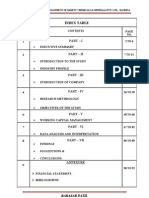

TABLE OF CONTENT

TOPICS DESCRIPTION

PAGE NO

Acknowledgement..

Business portfolio of Dabur.

Introduction to Dabur...

About market research.

Steps of market research..

Data analysis and findings for corn flour....................

Data analysis and findings for lemoneeze...................

Data analysis and findings for capsico................

Data analysis and findings for coconut milk..

Data analysis and findings for honey...............

Data analysis and findings for tomato puree.

Data analysis and findings for tomato paste..

Data analysis and findings for snack dressing

Data analysis and findings for tomato ketchup.

Data analysis and findings for pineapple slice

Data analysis and findings for fruit cocktail..

Data analysis and findings for mango pulp.

Data analysis and findings for keora water....................

Conclusion and recommendations.

About institutions sales ..

Bibliography

7

8

9-16

17

18

19-22

23-25

26-27

28-30

31-33

34-37

38-39

40-42

43-46

47-49

50-53

54-55

56-57

58

59-60

61

4

DECLARATION

I DILEEP SINGH SHEKHAWAT student of PGDM studying at UDAI

INSTITUTE OF MANAGEMENT STUDIES-JAIPUR, hereby declare that the project

work entitled FIND OUT THE PERFORMANCE OF DABUR PRODUCTS AND

PROMOTING INSTITUTIONAL SALES was carried out by me in partial

fulfillment of the requirement for the award of the degree of PGDM.

This project was undertaken as a part of academic curriculum according to the

AICTE rules and norms and it has not commercial interest and motive. It is an

original work done entirely by me and is based on my own observations. The facts

presented here are true to the best of my knowledge.

I also declare that this report has not been submitted to any other organization

for any other purpose

5

ACKNOWLEDGEMENT

I offer a great many thanks to a great many people who helped and supported

me during the project. My deepest thanks to Dr. Ruby Dwivedi ,The Guide of

the project for guiding and correcting various documents of mine with

attention and care. She has taken pain to go through the project and make

necessary correction as and when needed. I express my thanks to the

Director of, Udai institute of management studies-jaipur, for extending his

support. My deep sense of gratitude to Mr. Sumit Kumar Gupta-

Sr.business development officer, Dabur India ltd. support and guidance.

Thanks and appreciation to the helpful people at Dabur India ltd., for their

support. I would also thank my Institution and my faculty members without

whom this project would have been a distant reality. I also extend my

heartfelt thanks to my family and well wishers.

I am very thankful to everyone who all supported me, for I have completed

my project effectively and moreover on time.

I am equally grateful to my teacher Dr. Tanjul saxena; she gave me moral

support and guided me in different matters regarding the topic. she had been

very kind and patient while suggesting me the outlines of this project and

correcting my doubts. I thank her for her overall supports.

Last but not the least, I would like to thank my parents who helped me a lot

in gathering different information, collecting data and guiding me from time

to time in making this project .despite of their busy schedules ,they gave me

different ideas in making this project unique.

Thanking you

Dileep singh shekhawat

Udai institute of management studies-jaipur

PGDM-2009-2011

6

Business portfolio of Dabur

PERSONAL CARE:-Dabur has a wide

range of personal care products and some

products as Dabur amla hair oil, vatica

sampoo, dabur gulabari, u veda etc.

HEALTH CARE :-Dabur chyawanprash,

Dabur Shwaasamrit, Dabur Pilochek, Dabur

heal-ek, Hajmola Candy, PudinHara,

Dabur Blood Purifier etc.

Home care &Food products:-

Tomato ketchup

Lemoneeze

Capsico

Cornflour

Pineapple slice

Fruit cocktail

Tomato puree

Real juice segment

Real

Active

burrst

7

Introduction to Dabur

FOUNDER AND LEADERS

Founding Thoughts: "What is that life worth which cannot bring comfort

to others"

The story of Dabur began with a small, but visionary endeavour

by Dr. S. K. Burman, a physician tucked away in Bengal. His

mission was to provide effective and affordable cure for ordinary

people in far-flung villages. With missionary zeal and fervour, Dr.

Burman undertook the task of preparing natural cures for the

killer diseases of those days, like cholera, malaria and plague.

Soon the news of his medicines traveled, and came to be known. as the trusted 'Daktar'

or Doctor who came up with effective cures. And that is how his venture Dabur got its

name - derived from the Devanagri rendition of Daktar Burman.Dr. Burman set up

Dabur in 1884 to produce and dispense Ayurvedic medicines. Reaching out to a wide

mass of people who had no access to proper treatment. Dr. S. K. Burman's

commitment and ceaseless efforts resulted in the company growing from a fledgling

medicine manufacturer in a small Calcutta house, to a household name that at once

evokes trust and reliability.

Dabur india ltd. Is the fourth largest FMCG company in india with the revenues of

us$ 750 million (3390 crore) and market capitalization of us$ 3.5 billion (over RS

16000 crore)building on a legacy of quality and experience of over 125 years. dabur

operates in key consumer products categories like hair care, oral care, health care, skin

care, home care & foods.

8

DABUR AT-A-GLANCE

Dabur India Limited has marked its presence with significant achievements and today

commands a market leadership status. Our story of success is based on dedication to

nature, corporate and process hygiene, dynamic leadership and commitment to our

partners and stakeholders. The results of our policies and initiatives speak for themselves.

Leading consumer goods company in India with a turnover of Rs. 2834.11 Crore

(FY09)

3 major strategic business units (SBU) - Consumer Care Division (CCD),

Consumer Health Division (CHD) and International Business Division (IBD)

3 Subsidiary Group companies - Dabur International, Fem Care Pharma and newu.

17 ultra-modern manufacturing units spread around the globe

Products marketed in over 60 countries

Wide and deep market penetration with 50 C&F agents, more than 5000

distributors and over 2.8 million retail outlets all over India

SHORT DESCRIPTION OF 3 MAJOR STRATEGIC BUSINESS UNITS (SBU)

Consumer Care Division (CCD):-

Adresses consumer needs across the entire FMCG spectrum through four distinct

business portfolios of Personal Care, Health Care, Home Care & Foods.

Master Brands:

Dabur - Ayurvedic healthcare products

Vatika - Premium hair care

Hajmola - Tasty digestives

Ral - Fruit juices & beverages

Fem - Fairness bleaches & skin care products

9 Billion-Rupee brands: Dabur Amla, Dabur Chyawanprash, Vatika, Ral, Dabur Red Toothpaste,

Dabur Lal Dant Manjan, Babool, Hajmola and Dabur Honey

Strategic positioning of Honey as food product, leading to market leadership (over

75%) in branded honey market

Dabur Chyawanprash the largest selling Ayurvedic medicine with over 65%

market share.

9

Vatika Shampoo has been the fastest selling shampoo brand in India for three years

in a row

Hajmola tablets in command with 60% market share of digestive tablets category.

About 2.5 crore Hajmola tablets are consumed in India every day

Leader in herbal digestives with 90% market share

Consumer Health Division (CHD)

Offers a range of classical Ayurvedic medicines and Ayurvedic OTC products that deliver

the age-old benefits of Ayurveda in modern ready-to-use formats

Has more than 300 products sold through prescriptions as well as over the counter

Major categories in traditional formulations include:

- Asav Arishtas

- Ras Rasayanas

- Churnas

- Medicated Oils

Proprietary Ayurvedic medicines developed by Dabur include:

- Nature Care Isabgol

- Madhuvaani

- Trifgol

Division also works for promotion of Ayurvedic through organized community of traditional

practitioners and developing fresh batches of students

International Business Division (IBD)

Caters to the health and personal care needs of customers across different international markets,

spanning the Middle East, North & West Africa, EU and the US with its brands Dabur & Vatika

Focus markets:

- Nigeria

- Bangladesh

- Nepal and US

10

VISION AND PRINCIPLES

"Dedicated to the halth and well being of every household"

This is our company. We accept personal responsibility, and accountability to meet business

needs.

We all are leaders in our area of responsibility, with a deep commitment to deliver results. We are

determined to be the best at doing what matters most.

People are our most important asset. We add value through result driven training, and we

encourage & reward excellence.

We have superior understanding of consumer needs and develop products to fulfill them better.

We work together on the principle of mutual trust & transparency in a boundary-less

organization. We are intellectually honest in advocating proposals, including recognizing risks.

Continuous innovation in products & processes is the basis of our success.

We are committed to the achievement of business success with integrity. We are honest with

consumers, with business partners and with each other.

11

STRATEGIC INTENT

We intend to significantly accelerate profitable growth. To do this, we will:

Focus on growing our core brands across categories, reaching out to new geographies, within and

outside India, and improve operational efficiencies by leveraging technology

Be the preferred company to meet the health and personal grooming needs of our target

consumers with safe, efficacious, natural solutions by synthesizing our deep knowledge of

ayurveda and herbs with modern science

Provide our consumers with innovative products within easy reach

Build a platform to enable Dabur to become a global ayurvedic leader

Be a professionally managed employer of choice, attracting, developing and retaining quality

personnel

Be responsible citizens with a commitment to environmental protection

Provide superior returns, relative to our peer group, to our shareholders

MILESTONES TO SUCCESS

1884 - Established by Dr. S K Burman at Kolkata

1896 - First production unit established at Garhia

1919 - First R&D unit established

Early 1900s - Production of Ayurvedic medicines.

1930 - Automation and upgradation of Ayurvedic products manufacturing initiated

1936 - Dabur (Dr. S K Burman) Pvt. Ltd. Incorporate

1940 - Personal care through Ayurveda

1949 - Launched Dabur Chyawanprash in tin pack

1957 - Computerisation of operations initiated

1970 - Entered Oral Care & Digestives segment

1972 - Shifts base to Delhi from Calcutta

1978 - Launches Hajmola tablet

1979 - Dabur Research Foundation set up

1979 - Commercial production starts at Sahibabad, the most modern herbal medicines plant at

that time

1984 - Dabur completes 100 years

1988 - Launches pharmaceutical medicines

1989 - Care with fun

The Ayurvedic digestive formulation is converted into a children's fun product with the launch

of Hajmola Candy. In an innovative move, a curative product is converted to a confectionary

item for wider usage.

1994 - Comes out with first public issue

1994 - Enters oncology segment

1994 - Leadership in health care

1996 - Enters foods business with the launch of Real Fruit Juice

1998 - Burman family hands over management of the company to professionals

12

2000 - The 1,000 crore mark

Dabur establishes its market leadership status by staging a turnover of Rs.1,000

2001 - Super specialty drugs

2002 - Dabur record sales of Rs 1163.19 crore on a net profit of Rs 64.4 crore

2003 - Dabur demerges Pharmaceuticals business

2007 - Celebrating 10 years of Real

2007 - Dabur Foods merged with Dabur India

2008 - Acquires Fem Care Pharma

2009 - Dabur Red Toothpaste joins 'Billion Rupee Brands' club

Dabur Red Toothpaste becomes the Dabur's ninth Billion Rupee brand. Dabur Red Toothpaste

crosses the billion rupee turnover mark within five years of its launch.

SUSTAINABILITY REPORT

At Dabur, environment and nature is the lifeline of our business. With a portfolio of Ayurvedic and

nature-based products, conservation of nature & natural resources is deep rooted in our organizational

DNA, and in every aspect of our ever-growing business. We, at Dabur, have not merely incorporated

the concept of sustainability into the core of our business but have, in fact, expanded it to encompass

our aspirations and responsibilities to the society and to the environment. It is this concept that inspires

us to optimize our business performance to tackle the new and growing challenges of environment and

technology.

It is a concept on which we aspire to build an organization that will continue to increase value for all

our stakeholders for generations to come, through intensive focus on Conservation of Energy and

Technology Absorption, along with Health, Safety and Environment Protection.

CONSERVATION OF ENERGY

Dabur has been undertaking a host of energy conservation measures. Successful implementation of

various energy conservation projects have resulted in a 13.8% reduction in the Companys energy bill

in the 2008-09 fiscal alone. What was noteworthy was the fact that this reduction has come despite an

8-9% volume increase in manufacturing, and an average 11.7% increase in cost of key input fuels.

The host of measures key among them being use of bio-fuels in boilers, generation of biogas and

installation of energy efficient equipment helped lower the cost of production, besides reduce

effluent and improve hygiene conditions & productivity.

13

Technology Absorption

Dabur has also made continuous efforts towards technology absorption and innovation, which have

contributed towards preserving natural resources. These efforts include:

Minimum use of water in process by pre-concentration of herbal extract and reduction in

concentration time

Uniform heating in VTDs by hot water as against steam earlier, resulting in 30% reduction in

bulk wastage by using non-stick coating and formulation change

Improvement in water treatment plant through introduction of RO (Reverse Osmosis) system

for DM water, reutilization of waste water from pump seal cooling and RO reject waste-water

management

Introduction of water efficient CIP system with recycling of water in fruit juice manufacturing

Development of in-house technology to convert fruit waste into organic manure by using the

culture Lactobacilus burchi

The Company has achieved a host of significant benefits in terms of product improvement, cost

reduction, product development, import substitution, cleaner environment and waste disposal, amongst

others.

HEALTH SAFETY & ENVIRONMENTAL REVIEW

Renewing the commitment to Health Safety and Environment, Dabur has formulated a policy focusing

on People, Technology and Facilities. A dedicated Safety Management Team has also been put in

place to work towards the prevention of untoward incidents at the corporate and unit level, besides

educate & motivate employees on various aspects of Health, Safety and Environment.

14

The Company is also continuously monitoring its waste in adherence with the pollution control norms.

In pursuance of its commitment towards the society, efforts have also been initiated to conserve and

maintain the ground water level. The efforts include implementation of rainwater harvesting, which

has delivered encouraging results and has put the company on the path to becoming a Water-Positive

Corporation.

Dabur also initiated a Carbon Foot Print Study at the unit level with an aim to become a carbon

positive Company in years to come.

At Dabur, we are committed to sustainable development throughout our diverse operations. And, we

will strive to translate the good intentions into concrete and lasting results, contributing to the ultimate

good of the society.

IT INITIATIVES

At Dabur India Limited, knowledge and technology are key resources which have helped the Company

achieve higher levels of excellence and efficiency. Towards this overall goal of technology-driven

performance, Dabur is utilizing Information Technology in a big way. This will help in integrating a

vast distribution system spread all over India and across the world. It will also cut down costs and

increase profitability.

Our major IT Initiatives

Migration from Baan and Mfg ERP Systems to centralized SAP ERP system from 1st April

2006 for all business units.

Implementation of a country wide new WAN Infrastructure for running centralized ERP

system.

Setting up of new Data Centre at KCO Head Office.

Extension of Reach System to distributors for capturing Secondary Sales Data.

Roll out of IT services to new plants and CFAs.

Future Challenges

Forward Integration of SAP with Distributors and Stockists.

Backward Integration of SAP with Suppliers.

Implementation of new POS system at Stockist point and integration with SAP-ERP.

Implementation of SAP HR and payroll.

SAP Roll-out to DNPL and other new businesses.

15

MARKET RESEARCH

Market research is a process to find out the specific problem and opportunities. it may

also use for a product-preference test, a sales forecast or an advertising evaluation. we

define market research as the systematic design, collection, analysis, and reporting of

data and findings relevant to a specific marketing situation facing by a company .

In other words the activities undertaken by an organization to determine the nature of

its customers and competitors, as well as the demand for its products or services along

with the features that customers prefer in similar products or services.

MARKET RESEARCH PROCESS(HOW DONE MARKET RESEARCH )

DEFINE THE

RESEARCH PROBLEM

DEVELOP THE

RESEARCH PLAN

COLLECT THE

INFORMATION

ANALYZE THE

INFORMATION

PERCENT THE

FINDINGS

MAKE THE

DECISION

16

STEP-1(DEFINE RESEARCH PROBLEM):-

Dabur India Ltd. has a big product line of home made (cooking pastes and purees) and

other items which mostly uses in Indian kitchen. The research problem is to find out

the market share, competitors of Dabur in same product line and also find out

market size for all the products to which they have lunched.

They are also planning to launch some products such as mango pulp, tomato paste,

snack dressing etc so that also need to find out market size for these products and

leading organizations in this product line.

STEP-2 (DEVELOP THE RESEARCH PLAN):-

DATA SOURCE: - data source is primary data and sample size was one

hundred fifty. Primary data was collected through survey questionnaire because

survey are the best suited for the descriptive research. it is used to learn about

peoples knowledge, beliefs, preference and satisfaction.

RESEARCH INSTRUMENTS:-The instrument that I used in my research

was questionnaire.

SAMPLING PLAN:-

SAMPLING UNIT:-I include to all those institutions (hotels and restaurants) in

my sampling unit who has its own store to cater the facilities to inside and

outside visitors.

SAMPLE SIZE:-The sample size was one hundred fifty.

STEP-3(COLLECT THE INFORMATION)

I was collect the information through the questionnaire. And after collecting the

relevant information store it in excel format.

STEP-4(DATA ANALYSIS):-

Now i am going to have a inside of my research

17

DATA ANALYSIS FOR MY RESEARCH PROJECT

PRODUCT CORN FLOUR

BRAND USING ANALYSIS OF CORNFLOUR

BRAND NAME NO. OF ACCOUNTS USE

WEEKFIELD 77

BEE GEE INDIA (THREE BIRDS) 43

SHREE FOODS 9

LEMELA 7

NEATURE 1

BROWN ANDPOLSION 1

DABUR 10

NOT USING 2

TOTAL 150

WEEKFIELD

51%

BEE GEE INDIA

(THREE BIRDS)

29%

SHREE FOODS

6%

LEMELA

5%

NEATURE

0%

BROWN AND

POLSION

1%

DABUR

7%

NOT USING

1%

EXISTING BRANDS AND MARKET SHARE

WEEKFIELD

BEE GEE INDIA (THREE BIRDS)

SHREE FOODS

LEMELA

NEATURE

BROWN ANDPOLSION

DABUR

NOT USING

18

FINDINGS AND RECOMMENDATIONS FOR CORNFLOUR

After analyze the data there are some findings in terms of different brands available in

market and their market share.

After analysis the data I found that there are seven (7) brands available in market

named as-

WEEK FIELD :week field is the market leader with share of fifty one (51%)

percent. more then 50 percent market is captured by week field.

BEE GEE INDIA (THREE BIRDS):-it is the second brand in the market with

twenty nine (29%) percent market share. it is the market challenger with 29

percent market share. it is local brand of jaipur .

SHREE FOODS:-it is catered by shree foods ltd. it is also local brand of jaipur.

it has six (6%) percent market share.

DABUR (NATURES BEST):-it has seven (7%) percent market share.

LEMELA:-it has five (5%) percent market share.

BROWN & POLSON:-it has captured one (1%) percent market.

NEATURES:-it has one (1%) market share .

NOT USING: - there are two (2%) accounts who dont use corn flour.

RECOMMENDATIONS:-

As far as I thing there is no problem in the quality of Dabur corn flour because at

the time of data collection I asked no. of questions to users in terms of quality,

rate and pack size. According to some users it is little bit expensive.

Peoples are not aware about Dabur corn flour.

We require to do advertisement and marketing.

19

MARKET SIZE ANALYSIS

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 148

NO. OF ACCOUNTS NOT USING 2

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to market research findings there are ninety (99%) percent

institutions are using corn flour and there is only one (1%) percent institutions

are not using corn flour.

If we talk about the consumption, there is no more consumption. Two and three

big institutions are using more than 100kg corn flour ,remaining all institutions

are using 20-30 kg corn flour.

NO. OF ACCOUNTS

USING

99%

NO. OF ACCOUNTS

NOT USING

1%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: C0RNFLOUR

20

PACK SIZE (USED) ANALYSIS OF CORNFLOUR

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

1 KG 109

2 KG 22

5 KG 17

NOT USING 2

TOTAL 150

FINDINGS:-

According to pack size (used) analysis there are seventy three (73%) percent

institutions are using pack size of one (1) kg.

Fifteen percent institutions are using pack size of two (2) kg.

Eleven percent institutions are using pack size of five (5) kg.

RECOMMENDATION:-

According to research findings most of institutions are using one (1) kg pack

size thats why we should produce one (1) kg pack size more. Because they

takes small pack size from store on daily bases.

1 KG

73%

2 KG

15%

5 KG

11%

NOT USING

1%

PACK SIZE (USED) ANALYSIS

1 KG

2 KG

5 KG

NOT USING

21

BRAND USING ANALYSIS OF LEMONEEZE

BRAND NAME NO. OF ACCOUNTS USE

LEMONEEZE(DABUR) 3

ROYAL BURTON 1

LIMECARDILE 2

USING FRESH LEMONS 146

TOTAL 152

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share.

After analysis the data I found that there are three (3) brands available in market named

as-

LEMONEEZE (DABUR):-it has two (2%) market share.

ROYAL BURTON:-it has one (1%) market share.

LIMECARDILE:-it also has one (1%) market share, people are aware about

this product. it uses as complimentary.

USING FRESH LEMONS:-approximately ninety six (96%) percent

institutions are using fresh lemons.

It is mostly used in summers (April to June )

LEMONEEZE(DABUR)

2%

ROYAL BURTON

1%

LIMECARDILE

1%

USING FRESH LEMONS

96%

EXISTING BRANDS AND MARKET SHARE

LEMONEEZE(DABUR)

ROYAL BURTON

LIMECARDILE

USING FRESH LEMONS

22

PACK SIZE(USED)ANALYSIS OF LEMONEEZE

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

250 ML 2

750 ML 3

1 LTR 1

NOT USING (USING FRESH LEMONS ) 144

TOTAL 150

FINDINGS:-

According to analysis there are different sizes (250,750 ml & 1 liter) are

available in market. The pack size of lemoneeze is not required to

change.

250 ML

1%

750 ML

2%

1 LTR

1%

NOT USING (USING

FRESH LEMONS )

96%

PACK SIZE (USED)ANALYSIS

250 ML

750 ML

1 LTR

NOT USING (USING FRESH

LEMONS )

23

MARKET SIZE ANALYSIS OF LEMONEEZE

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 6

NO. OF ACCOUNTS NOT USING 144

TOTAL SAMPLE SIZE 150

FINDINGS:

According to research finding there are only four (4%) percent

institutions are using lemoneeze and ninety six (96%) percent

institution are using fresh lemons.

The market is not potential for this type of product because it is mostly

used by big institutions. it can be introduce in only big institutions.

People are more habitual to use fresh lemons.

People are not aware about this product thats why we required to do

advertisement and approaching to big institution.

NO. OF ACCOUNTS

USING

4%

NO. OF ACCOUNTS

NOT USING

96%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

24

BRAND USING ANALYSIS OF CAPSICO

BRAND NAME NO. OF ACCOUNTS USE

CAPSICO 28

TABASCO 32

NOT USING 90

TOTAL 150

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are two (2)

brands available in market named as-

CAPSICO:-it has nineteen (19%) percent market share and there is no problem

in terms of quality and rate.

TABASCO:-it has twenty one (21%) percent market, it is the competitor of

capsico (Dabur).

It is mostly used by star category institution thats why we need it approach in

big institution.

There are two brands available in market and having same pack size(60ml)

CAPSICO

19%

TABASCO

21%

NOT USING

60%

EXISTING BRANDS AND MARKET SHARE

CAPSICO

TABASCO

NOT USING

25

PACK SIZE(USED)ANALYSIS OF CAPSICO

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

THE EXISTING BRANDS ARE HAVING SAME

PACK SIZE (60 ML).

MARKET SIZE ANALYSIS OF CAPSICO

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 60

NO. OF ACCOUNTS NOT USING 90

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to research findings if we talk about the market size, there is the

forty (40%) percent market is potential to buy capsico. other remaining

institution are not using product like capsico. we need to approach in big

institution (star category).

NO. OF ACCOUNTS

USING

40%

NO. OF ACCOUNTS

NOT USING

60%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: CAPSICO

26

BRAND USING ANALYSIS OF COCONUT MILK

BRAND NAME NO. OF ACCOUNTS USE

THAILAND(king thai) 4

DABUR 9

CHOCO 1

CHAOCOH(IMPORTED) 10

CANZ 4

NESTLE 2

NOT USING 120

TOTAL 150

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are six (6)

brands available in market named as-

THAILAND (KING THAI):-it is the imported brand from Thailand. it has one

(1%) percent market share.

DABUR:-it is the second popular brand in market with the six (6%) percent

market share.

CHOCO:-it has one (1%) market share.

THAILAND(king

thai)

2%

DABUR

6%

CHOCO

1%

CHAOCOH(IMPORTED

)

7%

CANZ

3%

NESTLE

1%

NOT USING

80%

EXISTING BRANDS AND MARKET SHARE

THAILAND(king thai)

DABUR

CHOCO

CHAOCOH(IMPORTED)

CANZ

NESTLE

NOT USING

27

CHAOCOH (IMPORTED):-it is also imported brand and it is the first

popular brand with seven (7%) market share.

CANZ:-it is the third popular brand with three (3%) market share.

NESTLE:-it has one (1%) percent market share.

MARKET SIZE ANALYSIS OF COCONUT MILK

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 30

NO. OF ACCOUNTS NOT USING 120

TOTAL SAMPLE SIZE 150

FINDINGS :-

If we talk about the market size of coconut milk than there are only twenty (20%)

percent institution which is using coconut milk and eighty (80%) institutions are

not using coconut milk, most of institutions are using coconut cream and coconut

powder.

According to feedback it is used in preparing sea food.

NO. OF ACCOUNTS

USING

20%

NO. OF ACCOUNTS

NOT USING

80%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: COCONUT MILK

28

PACK SIZE(USED) ANALYSIS OF COCONUT MILK

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

200 ML 9

400 ML 19

1 KG 2

NOT USING 120

TOTAL 150

FINDINGS:-

The coconut milk is available in different-2 pack size (200,400ml &1kg) and

pack type is also different. Some companies have introduced it in tetra pack

and some companies also introduced in tin packing.

200 ML

6% 400 ML

13%

1 KG

1%

NOT USING

80%

PACK (USED)SIZE ANALYSIS

200 ML

400 ML

1 KG

NOT USING

29

BRAND USING ANALYSIS OF HONEY

BRAND NAME NO. OF ACCOUNTS USE

DABUR 134

MARRY FOODS 2

NOT USINS 13

TOTAL 149

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are two (2)

brands available in market named as-

REAL HONEY (DABUR):-Real honey (Dabur) is the market leader with the

ninety (90%) percent market share. Most of the market is captured by Dabur

honey. There is no complained in terms of quality and rate. but now the share of

Dabur honey is decreasing day by day, due to some reason-

There is no pack size less than 500 Grm (institutional).

Now days institutions has started using small pack size(15 grm) it is known as

Honey on the table.

DABUR

90%

MARRY FOODS

1%

NOT USINS

9%

EXISTING BRANDS AND MARKET SHARE

DABUR

MARRY FOODS

NOT USINS

30

HONEY(MARRY FOODS-MUMBAI):-It is the new emerging company and

catering small honey pouch packing known as HONEY ON THE TABLE .it

has captured one (1%)percent market share.

MARKET SIZE ANALYSIS OF HONEY

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 137

NO. OF ACCOUNTS NOT USING 13

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to research findings ninety one (91%) percent institutions

are using honey. There are only nine (9%) percent institution are not

using honey. Thats why the ninety percent market is potential.

NO. OF ACCOUNTS

USING

91%

NO. OF ACCOUNTS

NOT USING

9%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: HONEY

31

PACK SIZE(USED) ANALYSIS OF HONEY

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

250 GRM 1

500 GRM 40

15 GRM(HONEY ON TABLE POUCHE ) 1

1 KG 95

N0T USING 13

TOTAL 150

RECOMMENDATION:-

There is no problem in terms of packing type and packing size but

according to market share analysis the market share of real honey (Dabur)

Is decreasing day by day. Because there is a pack size of 15grm pouch

(Honey on the table) is launched by marry foods Ltd-Mumbai and

institutions are more interested to use it.

So to maintain the market share we also need to launch this type of pack

size.

250 GRM

1%

500 GRM

27%

15 GRM(HONEY ON

TABLE POUCHE )

1%

1 KG

63%

N0T USING

8%

PACK SIZE (USED) ANALYSIS

250 GRM

500 GRM

15 GRM(HONEY ON TABLE

POUCHE )

1 KG

N0T USING

32

BRAND USING ANALYSIS OF TOMATO PUREE

BRAND NAME NO. OF ACCOUNTS USE

KAYTIS 39

GOLDEN CROWN 26

DABUR(NATURES BEST ) 2

NOGA 8

FRUTINS 19

TOPS 8

KISSAN 2

MORTAN 7

MID LAND 3

GURUJI 2

NOT USING 34

TOTAL 150

KAYTIS

26%

GOLDEN CROWN

17%

DABUR(NATURE,S

BEST )

2%

NOGA

5%

FRUTINS

13%

TOPS

5%

KISSAN

1%

MORTAN

5%

MID LAND

2%

GURUJI

1%

NOT USING

23%

EXISTING BRANDS AND MARKET SHARE

KAYTIS

GOLDEN CROWN

DABUR(NEATURS BEST )

NOGA

FRUTINS

TOPS

KISSAN

MORTAN

MID LAND

GURUJI

NOT USING

33

FINDINGS AND RECOMMENDATION

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are six (6)

brands available in market named as-

KAYTIS:-It is the market leader with twenty three (23%) percent market share. It

is the most popular brand in the market.

GOLDEN CROWN:-It is the market challenger with seventeen (17%) percent

market share. It is the second most preferred brand in the market.

NEATURS BEST (DABUR):-It has two (2%) percent market share

NOGA:-It has five (5%) percent market share.

FRUTINS:-It has thirteen (13%) percent market share.

TOPS:-It has five (5%) percent market share.

KISSAN:-it has one (1%) percent market share.

MORTAN: - it has five (5%) percent market share.

MID LAND: - it has two (2%) percent market share.

GURUJI: - it has one (1%) percent market share.

NOT USING:-There are approximately twenty three (23%) percent institutions are

not using tomato puree. They prefer to use fresh tomatoes.

RECOMMENDATION:-

During the data collection I found that our tomato puree (Dabur) is little bit expensive

and others brands are available between 35-40 rupees. Our competitor golden crown is

selling tomato puree at the rate of forth rupees(40).

34

PACK SIZE(USED)ANALYSIS OF TOMATO PUREE

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

825 GRM 77

850 GRM 39

NOT USING 34

TOTAL 150

FINDINGS:-

According to pack size (used) analysis there are two pack size (825 & 850 GRM)

available in the market. Eight hundred twenty five (825 GRM) pack size is the standard

pack size available in the market. Some institutions are also using pack size of 850

grm.

825 GRM

51%

850 GRM

26%

NOT USING

23%

PACK SIZE (USED) ANALYSIS

825 GRM

850 GRM

NOT USING

35

MARKET SIZE ANALYSIS OF TOMATO PUREE

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 116

NO. OF ACCOUNTS NOT USING 34

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to research findings the seventy seven (77%) percent institutions are using

tomato puree and there is twenty three (23%) percent institutions are not using tomato

puree because they prefer to use fresh tomatoes.

NO. OF ACCOUNTS

USING

77%

NO. OF ACCOUNTS

NOT USING

23%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: TOMATO PUREE

36

BRAND USING ANALYSIS OF TOMATO PASTE

BRAND NAME NO. OF ACCOUNTS USE

P&R 10

NOT USING 140

TOTAL 150

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there is only (1)

brands available in market named as-

P&R:-There is only one brand available in the market and there is only seven (7%)

percent institutions are using tomato paste. the most of institutions are not using

tomato paste because there is no requirement of tomato paste and if required than they

prepare by using fresh tomatoes.

P&R

7%

NOT USING

93%

EXISTING BRANDS AND MARKET SHARE

P&R

NOT USING

37

PACK SIZE(USED)ANALYSIS OF TOMATO PASTE

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

MOST OF INSTITUTIONS ARE NOT USING

TOMATO PASTE AND THE ONLY EXISTING

BRAND HAVING 3 KG (TIN) PACK SIZE

MARKET SIZE ANALYSIS OF TOMATO PASTE

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 10

NO. OF ACCOUNTS NOT USING 140

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to market size analysis there are only seven (7%) percent institution are

using tomato paste and ninety three (93%) percent institutions are not using

tomato paste. Thats why the market is not potential for this type of product.

NO. OF ACCOUNTS

USING

7%

NO. OF ACCOUNTS

NOT USING

93%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: TOMATO PASTE

38

BRAND USING ANALYSIS OF SNACK DRESSING

BRAND NAME NO. OF ACCOUNTS USE

NESTLE 10

KISSAN 2

HEINZ 4

CROSS&BLACKWELL 5

BLACK & BARRIES 1

NOT USING 128

TOTAL 150

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are six (6)

brands available in market named as-

NESTLE: - it has seven (7%) percent market share.

KISSAN: - it has one (1%) percent market share.

HEINZ: - it has three (3%) percent market share.

CROSS & BLACKWELL: - it has three (3%) percent market share.

BLACK & BARRIES: - it has one (1%) percent market share.

NOT USING: - it has eighty five (85%) percent market share.

NESTLE

7%

KISSAN

1%

HEINZ

3%

CROSS&BLACKWELL

3%

BLACK & BARRIES

1%

NOT USING

85%

EXISTING BRANDS AND MARKET SHARE

NESTLE

KISSAN

HEINZ

CROSS&BLACKWELL

BLACK & BARRIES

NOT USING

39

PACK SIZE (USED)ANALYSIS OF SNACK DRESSING

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

200 ML 4

1 KG 6

1.2 KG 12

NOT USING 128

TOTAL 150

FINDINGS:-

After analyzing the data there are different pack size (200ml, 1&1.2kg)

available in the market. Most of companies prefer 1.2kg (bottle) pack size.

200 ML

3%

1 KG

4%

1.2 KG

8%

NOT USING

85%

PACK SIZE (USED) ANALYSIS

200 ML

1 KG

1.2 KG

NOT USING

40

MARKET SIZE ANALYSIS OF SNACK DRESSING

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 22

NO. OF ACCOUNTS NOT USING 128

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to research findings only fifteen (15%) percent institutions

are using snack dressing and eighty five (85%) percent institutions are

not using snack dressing.

But according to data findings I cant say that market is not potential

but most of institutions use tomato ketchup and other alternatives at

the requirement of snack dressing.

NO. OF ACCOUNTS

USING

15%

NO. OF ACCOUNTS

NOT USING

85%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: SNACK DRESSING

41

BRAND USING ANALYSIS OF TOMATO KETCHUP

BRAND NAME NO. OF ACCOUNTS USE

NESTLE 16

KISSAN 30

PINKS 21

MAGGI 33

TOPS 10

HALLS 3

HEINZE 4

RACY 15

GOLDEN CROWN 8

CROSS WELL 7

KAYTIS 3

TOTAL 150

NESTLE

10%

KISSAN

20%

PINKS

14%

MAGGI

22%

TOPS

7%

HALLS

2%

HEINZE

3%

RACY

10%

GOLDEN CROWN

5%

CROSS WELL

5%

KAYTIS

2%

EXISTING BRANDS AND MARKET SHARE

NESTLE

KISSAN

PINKS

MAGGI

TOPS

HALLS

HEINZE

RACY

GOLDEN CROWN

CROSS WELL

KAYTIS

42

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are six (6)

brands available in market named as-

NESTLE: - It has ten (10%) percent market share.

KISSAN: - It has twenty (20%) percent market share.

PINKS: - It has fourteen (14%) percent market share.

MAGGI: - It is the market leader with twenty two (22%) percent market share.

TOPS:- It has seven (7%) percent market share.

HALLS: - It has two (2%) percent market share.

HEINZE: - It has three (3%) percent market share.

RACY: - It has ten (10%) percent market share.

GOLDEN CROWN: - It has five (5%) percent market share.

CROSS WELL: - It has five (5%) percent market share.

KAYTIS: - It has two (2%) percent market share.

43

PACK SIZE(USED)ANALYSIS OF TOMATO KETCHUP

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

1 KG 120

1.2 KG(KISSAN) 30

TOTAL 150

FINDINGS:-

After analyzing the data there is different pack size (1&1.2kg) available in

the market. Most of companies prefer 1kg (bottle) pack size. kissan has

introduced 1.2kg pack size as institutional pack size but most preferred pack

size is 1 kg.

1 KG

80%

1.2 KG(KISSAN)

20%

PACK SIZE (USED)ANALYSIS

1 KG

1.2 KG(KISSAN)

44

MARKET SIZE ANALYSIS OF TOMATO KETCHUP

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 150

NO. OF ACCOUNTS NOT USING 0

TOTAL SAMPLE SIZE 150

FINDINGS:-

After analysis the data I found that there is not a single institution which is not using

tomato ketchup. The market is (100%) potential.

NO. OF ACCOUNTS

USING

100%

NO. OF ACCOUNTS

NOT USING

0%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT : TOMATO KETCHUP

45

BRAND USING ANALYSIS OF PINEAPPLE SLICES

BRAND NAME NO. OF ACCOUNTS USE

KAYTIS 52

GOLDEN CROWN 25

FRUTINS 27

NOGA 7

MIDLAND 3

NATURAL 1

MORTAN 6

TOP'S 11

DABUR 1

KISSAN 1

NOT USING 16

TOTAL 150

KAYTIS

34%

GOLDEN CROWN

17%

FRUTINS

18%

NOGA

5%

MIDLAND

2%

NATURAL

1%

MORTAN

4%

TOP'S

7%

DABUR

1%

KISSAN

1%

NOT USING

10%

EXISTING BRANDS AND MARKET SHARE

KAYTIS

GOLDEN CROWN

FRUTINS

NOGA

MIDLAND

NATURAL

MORTAN

TOP'S

DABUR

KISSAN

NOT USING

46

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are six (6)

brands available in market named as-

KAYTIS: - It has thirty four (34%) percent market share.

GOLDEN CROWN: - It has seventeen (17%) percent market share.

FRUTINS: - It has eighteen (18%) percent market share.

NOGA: - It has five (5%) percent market share.

MID LAND: - It has two (2%) percent market share.

NATURAL: - It has one (1%) percent market share.

MORTAN: - It has four (4%) percent market share.

TOPS:- It has seven (7%) percent market share.

DABUR: - It has one (1%) percent market share.

KISSAN: - It has one (1%) percent market share.

NOT USING: - It has ten (10%) percent market share.

NOTE:-Most of institutions are prefer to use pineapple slice (tin pack).They

dont prefer to use fresh pineapple.

47

PACK SIZE(USED)ANALYSIS OF PINEAPPLE SLICES

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

ALL EXISTING BRAND HAVING SAME PACK SIZE = 850 Grm

MARKET SIZE ANALYSIS OF PINEAPPLE SLICES

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 134

NO. OF ACCOUNTS NOT USING 16

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to market size analysis there are eighty nine (89%) institutions are

using pineapple slice and only eleven (11%) institutions are not using pineapple

slice. Thats why I can say that the market is potential for pineapple slice.

Most of institutions are prefer to use pineapple slice (tin pack).

NO. OF ACCOUNTS

USING

89%

NO. OF ACCOUNTS

NOT USING

11%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT : PINEAPPLE SLICE

48

BRAND USING ANALYSIS OF FRUIT COCKTAIL

BRAND NAME NO. OF ACCOUNTS USE

KAYTIS 46

GOLDEN CROWN 25

NOGA 4

FRUTINS 28

TOP'S 10

MIDLAND 4

MORTAN 6

DABUR 1

NATURAL 1

NOT USING 25

TOTAL 150

KAYTIS

31%

GOLDEN CROWN

17%

NOGA

2%

FRUTINS

19%

TOP'S

7%

MIDLAND

2%

MORTAN

4%

DABUR

1%

NATURAL

1%

NOT USING

17%

EXISTING BRANDS AND MARKET SIZE

KAYTIS

GOLDEN CROWN

NOGA

FRUTINS

TOP'S

MIDLAND

MORTAN

DABUR

NATURAL

NOT USING

49

FINDINGS:-

After analyze the data there are some findings in terms of different brands available in

market and their market share. After analysis the data I found that there are six (6)

brands available in market named as-

KAYTIS: - It has thirty one (31%) percent market share.

GOLDEN CROWN: - It has seventeen (17%) percent market share.

NOGA: - It has two (2%) percent market share.

FRUTINS: - It has ninteen (19%) percent market share.

TOPS:- It has seven (7%) percent market share.

MIDLAND: - It has two (2%) percent market share.

MORTAN: - It has four (4%) percent market share.

NATURES BEST (DABUR):- It has one (1%) percent market share.

NATURAL: - It has one (1%) percent market share.

NOT USING: - It has seventeen (17%) percent market share.

50

PACK SIZE (USED )ANALYSIS OF FRUIT COCKTAIL

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

840 Grm 100

850 Grm 25

NOT USING 25

TOTAL 150

FINDINGS:-

According to pack size (used) analysis there are two pack sizes (840 & 850

grm) available in the market. The pack size of 840 grm is preferred more by

companies rather than 850 grm.

840 Grm

67%

850 Grm

16%

NOT USING

17%

PACK SIZE (USED) ANALYSIS

840 Grm

850 Grm

NOT USING

51

MARKET SIZE ANALYSIS OF FRUIT COCKTAIL

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 125

NO. OF ACCOUNTS NOT USING 25

TOTAL SAMPLE SIZE 150

FINDINGS:-

At the behalf of findings I can say that the eighty three (83%) percent institutions are

potential to buy fruit cocktail and only seventeen (17%) percent institutions are not

potential to buy fruit cocktail, thats why the market is potential for buying fruit

cocktail.

NO. OF ACCOUNTS

USING

83%

NO. OF

ACCOUNTS

NOT USING

17%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: FRUIT COCKTAIL

52

BRAND USING ANALYSIS OF MANGO PULP

BRAND NAME NO. OF ACCOUNTS USE

KAYTIS 28

NOT USING (USING FRESH MANGOES OR NOT) 122

TOTAL 150

FINDINGS:-

According to research findings there is only one brand catered by kaytis foods

Ltd. Nineteen (19%) percent institutions are there which is using mango pulp

and other remaining eighty one (81%) percent institutions are not using mango

pulp.

Most of institutions prefer to use fresh mangoes and there is no more

requirement of mango pulp.

PACK SIZE ANALYSIS OF MANGO PULP

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

ONLY ONE BRAND EXISTS IN THE

MARKET HAVING PACK SIZE OF 840Grm

KAYTIS

19%

NOT USING (USING

FRESH MANGOES OR

NOT)

81%

EXISTING BRANDS AND MARKET SHARE

KAYTIS

NOT USING (USING FRESH

MANGOES OR NOT)

53

MARKET SIZE ANALYSIS OF MANGO PULP

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 28

NO. OF ACCOUNTS NOT USING 122

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to research findings there is only nineteen (19%) percent institutions

are using mango pulp and remaining eighty one (81%) percent institutions are

not using mango pulp. Thats why according to my opinion the market is not

potential for mango pulp.

According to users opinion the requirement of mango pulp is no more and if

some time there is required then they prefer to use fresh mangoes.

NO. OF ACCOUNTS

USING

19%

NO. OF ACCOUNTS

NOT USING

81%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT: MANGO PULP

54

BRAND USING ANALYSIS OF KEORA

BRAND NAME NO. OF ACCOUNTS USE

DABUR 133

NOT USING 17

TOTAL 150

FINDINGS:-

If we talk about the keora water, there is eighty nine (89%) percent institutions

are using keora water and remaining eleven (11%) percent institutions are not

using.

0nly Dabur is there to cater keora water.

People are brand loyal of rose & keora water cater by Dabur.

PACK SIZE (USED)ANALYSIS OF KEORA

AVAILABLE PACK SIZE NO. OF ACCOUNTS USING

THERE IS ONLY ONE BRAND (DABUR KEORA ) AVAILABLE IN

MARKET HAVING PACK SIZE -250 ML.

DABUR

89%

NOT

USING

11%

EXISTING BRANDS AND MARKET SHARE

DABUR

NOT USING

55

MARKET SIZE ANALYSIS OF KEORA

TYPES OF ACCOUNTS NO. OF ACCOUNTS

NO. OF ACCOUNTS USING 133

NO. OF ACCOUNTS NOT USING 17

TOTAL SAMPLE SIZE 150

FINDINGS:-

According to market size analysis eighty nine (89%) percent institutions are

using keora water and remaining others are not using keora water.

Each and every institution are using keora water may be they are using in less

quantity.

It is used for fragrance to preparing rice, Biryani etc.

NO. OF ACCOUNTS

USING

89%

NO. OF ACCOUNTS

NOT USING

11%

MARKET SIZE ANALYSIS

NO. OF ACCOUNTS USING

NO. OF ACCOUNTS NOT USING

PRODUCT : KEORA

56

CONCLUSION AND RECOMMENDATIONS

There is no complained in terms of quality, pack type and pack size.

People/institutions are not aware about Dabur (homemade) products.

According to my opinion our products is little bit expensive rather than our

competitor.

If we want to go further and want to increase our market share, we have to do

marketing and advertisement also.

According to my opinion we should recruit individual DISTRIBUTERS.

Question rise-but why because our distributer is also having distributer

ship of golden crown, nestle, amul, red bull etc. There is no problem from

them which is catering to different segment AND different product line but

if we talk about the golden crown, it is catering same product line and same

segment.

When our distributer gives price list in any institution then he gives both-

(Dabur & golden crown) and final call converts for golden crown in

maximum cases because the products of golden crown is little bit chipper

rather than Dabur products. And there is no problem in terms of quality,

pack type and pack size etc.

If it is not possible than marketing for Dabur product should be separately.

EFFECTIVE SALES PROCESS (model):-

To make sales effective the following process should be follow:-

NEED RECOGNIZATION:-first we required to recognizing the need of

consumers, what actually they want to buy.

FORMULATE SOLUTION:-Than find out the alternate solutions and choose

the best one.

CLOSE THE SALES:-

DELIVER AND EVALUATE:-Deliver and evaluate that, it is sufficient to

satisfy the need and wants of consumers.

ESTABLISH RELATIONSHIP:-Make relationship and maintain to that.

57

ABOUT INSTITUTIONAL SALES

Intuitional Sales is similar as corporate sales, here we sell products/Services/Solutions

to other organizations. its also called B2B Sells.

For an eg. we sell one AC to a customer for his personel uses its B2C Selling, where as

in instituional sales we sell in bulk quantities for eg. Selling 300-1000 AC to one new

opening hotel.

Institutional Sales does not involve the channel of dealers/distributors, its the direct

sales for company to company

Dabur Foods Ltd, the foods and beverage arm of FMCG major Dabur india Ltd, in an

ffort to increase its focus on the food services market has launched various new

products catering specifically to institutional channels.

"We have recently launched four new products pineapple slices, fruit cocktail,

tomato puree & corn flour. these products have been launched under Dabur's Nature

Best brand that exclusively caters to the food services sector.

58

The company is looking at developing its product portfolio by foraying into products

such as tomato-based dressings for snacks, other sauces and dips. The company

already caters to Jet Airways, Kingfisher Airlines, the India Hotels Company and the

Oberoi group of hotels and resorts, amongst others.

"The market for institutional sales of beverages is about Rs 110 crore, where we

already have about 50 per cent market share through the sales of our juice brand Real.

Dabur Foods, a 100% subsidiary of Dabur India Ltd, is now focusing on institutional

sales in a big way. Though retail sales still rules the roost (75% of the sales comes

from this segment), the institutional pie is clocking faster growth rates. The latter is

growing at 45% per annum whereas the former is growing at 35%. Says Amit Burman,

ED, Dabur India Ltd, "The institutional segment will be a growth driver for us in the

near future." Keeping this in mind, the company recently partnered with Cafe Coffee

Day and launched Real Fruit fusion, a range of smoothies with the Real fruit juice

being a core ingredient. The food major has invested Rs 15 lakh in this project.

INSTITUTIONAL SALES CHANNELS OF DABUR INDIA LTD.

INDIA LTD.

INSTITUTION

AL SALES

RETAILERS MORDEN TRADE

RESTAURANT

HOTELS

RESORTS

CORPORATE

OFFICES

AIR LINES

BIG MALLS

59

BIBLIOGRAPHY

http://www.Dabur.com

http://www.google.co.in/

http://www.just-food.com

http://www.thehindubusinessline.com

http://www.imcri.org

http://www.scribd.com

Anda mungkin juga menyukai

- Dabur India's Market Research for Institutional Sales Performance AssessmentDokumen71 halamanDabur India's Market Research for Institutional Sales Performance AssessmentSiddharth SanghviBelum ada peringkat

- Dabur India's Market Research for Institutional Sales Performance AssessmentDokumen59 halamanDabur India's Market Research for Institutional Sales Performance AssessmentKeshav KalaniBelum ada peringkat

- Dabur India Limited: Marketing Research for Assessing Performance of Dabur Products and Promoting Institutional SalesDokumen62 halamanDabur India Limited: Marketing Research for Assessing Performance of Dabur Products and Promoting Institutional SalesBimal SinghBelum ada peringkat

- Infinity Management & Engineering College Sagar, M.P.: Marketing Research For Assessing Performance of Dabur ProductsDokumen63 halamanInfinity Management & Engineering College Sagar, M.P.: Marketing Research For Assessing Performance of Dabur ProductsHoney AliBelum ada peringkat

- Dabur IndiaDokumen84 halamanDabur Indiatariquewali11Belum ada peringkat

- Employee Motivation Study at DaburDokumen84 halamanEmployee Motivation Study at DaburGuman SinghBelum ada peringkat

- Dabur CRM Project ReportDokumen84 halamanDabur CRM Project ReportRaj ShekharBelum ada peringkat

- Dabur Project ReportDokumen77 halamanDabur Project ReportDeepankar Chaudhary0% (1)

- Project Report File DaburDokumen80 halamanProject Report File DaburAsh RoyBelum ada peringkat

- Project Report On DaburDokumen100 halamanProject Report On Daburrohit_n16100% (2)

- Visual Display of Dabur's Health Products in LucknowDokumen101 halamanVisual Display of Dabur's Health Products in LucknowManjeet SinghBelum ada peringkat

- Visual Display of Dabur's Health Products in LucknowDokumen102 halamanVisual Display of Dabur's Health Products in LucknowManjeet SinghBelum ada peringkat

- ReportDokumen99 halamanReportStarBelum ada peringkat

- Summer Training Reporton Dabur India Ltd. (Working Capital Analysis of Major FMCG Companies) For Bba and Mba StudentsDokumen52 halamanSummer Training Reporton Dabur India Ltd. (Working Capital Analysis of Major FMCG Companies) For Bba and Mba Studentssandeep sheoran67% (3)

- Dabur Project ReportDokumen80 halamanDabur Project ReportAsh RoyBelum ada peringkat

- Dabur Project - 11111Dokumen32 halamanDabur Project - 11111King Nitin Agnihotri0% (1)

- Dabar Projects - 1Dokumen87 halamanDabar Projects - 1Mayank Jain NeerBelum ada peringkat

- Project On Dabur India Ltd. by Rahul GuptaDokumen85 halamanProject On Dabur India Ltd. by Rahul Guptargupta_0011175% (8)

- A Project Report ON DABUR MARKETING MIXDokumen40 halamanA Project Report ON DABUR MARKETING MIXYash RankaBelum ada peringkat

- Dabur University Report on Sales Promotion ToolsDokumen78 halamanDabur University Report on Sales Promotion ToolsNisha PatelBelum ada peringkat

- Dabur Marketing Project ReportDokumen12 halamanDabur Marketing Project ReportYash Raj57% (7)

- Dabur Project Report Performance AppraisalDokumen65 halamanDabur Project Report Performance AppraisalJagjit Kaur100% (1)

- Strategic Planning of Dabur Nepal Pvt. LtdDokumen19 halamanStrategic Planning of Dabur Nepal Pvt. Ltdbijaya bhandariBelum ada peringkat

- DABUR DivyaDokumen12 halamanDABUR DivyadurgeshtomerBelum ada peringkat

- dabur fiDokumen31 halamandabur fiRajpurohit DalpatBelum ada peringkat

- Final Project DaburDokumen78 halamanFinal Project DaburRohit KapoorBelum ada peringkat

- Dabur Chyawanprash Marketing AnalysisDokumen40 halamanDabur Chyawanprash Marketing AnalysisAlok NayakBelum ada peringkat

- A Project On Marketing Strategies of Dabur ProductsDokumen101 halamanA Project On Marketing Strategies of Dabur ProductsSami Zama100% (1)

- Marketing Strategy of Dabur ChwanprashDokumen87 halamanMarketing Strategy of Dabur Chwanprashtalvinder_singh54Belum ada peringkat

- Dabour Project123Dokumen76 halamanDabour Project123Deepak SinghalBelum ada peringkat

- Project On Dabur India LTD by Rahul GuptaDokumen85 halamanProject On Dabur India LTD by Rahul GuptasbBelum ada peringkat

- Dabur Chyawanprash, The Health Giver: 'Immunity, Now Sugar-Free'Dokumen5 halamanDabur Chyawanprash, The Health Giver: 'Immunity, Now Sugar-Free'Mini VarmaBelum ada peringkat

- Dabur India Ltd Corporate Analysis ReportDokumen24 halamanDabur India Ltd Corporate Analysis ReportNagasai ThuBelum ada peringkat

- Dabur ResearchDokumen22 halamanDabur ResearchPriyanka DheliaBelum ada peringkat

- Strategy of Dabur With Special Reference To Dabur Chyawanprash For Rural MarketDokumen117 halamanStrategy of Dabur With Special Reference To Dabur Chyawanprash For Rural MarketVivek Singh100% (2)

- HarshvardhanDokumen41 halamanHarshvardhanUP 16 GhaziabadBelum ada peringkat

- DABURDokumen17 halamanDABURchetanmattu67% (3)

- Dabur Assignment 30 Nov 22Dokumen32 halamanDabur Assignment 30 Nov 22Dhruv AroraBelum ada peringkat

- Mma 2Dokumen22 halamanMma 2Md.sabbir Hossen875Belum ada peringkat

- DaburDokumen4 halamanDaburJibin SabuBelum ada peringkat

- Term Paper of MKTDokumen23 halamanTerm Paper of MKTnewaranilBelum ada peringkat

- Dabur ProjectDokumen67 halamanDabur Projectdeepica007Belum ada peringkat

- Group 8 - Section ADokumen21 halamanGroup 8 - Section ASanJana NahataBelum ada peringkat

- Business Communication: Dabur India LTDDokumen30 halamanBusiness Communication: Dabur India LTDshashank nutiBelum ada peringkat

- Marketing Strategies of Dabur India Ltd.,67Dokumen67 halamanMarketing Strategies of Dabur India Ltd.,67aksahni09Belum ada peringkat

- Final Project Report DaburDokumen69 halamanFinal Project Report DaburVidhu LatherBelum ada peringkat

- Project O N Dabur I Ndia Pvt. L TDDokumen24 halamanProject O N Dabur I Ndia Pvt. L TDRagzAmmyBelum ada peringkat

- Dabur ProjectDokumen66 halamanDabur ProjectPrashant ShingoteBelum ada peringkat

- Salman Khan - Doc123456Dokumen85 halamanSalman Khan - Doc123456Savvy TagraBelum ada peringkat

- STUDY 0f Marketing Strategy & PRODUCT LINE": A Project ONDokumen72 halamanSTUDY 0f Marketing Strategy & PRODUCT LINE": A Project ONHoney AliBelum ada peringkat

- Dabur India LimitedDokumen31 halamanDabur India LimitedNikita GheradeBelum ada peringkat

- Chapter-1: Introduction To DaburDokumen33 halamanChapter-1: Introduction To DaburShashwat AnandBelum ada peringkat

- Improving Agricultural Impact: Empowering INGOs to Establish and Enhance Their Food Security ProgramsDari EverandImproving Agricultural Impact: Empowering INGOs to Establish and Enhance Their Food Security ProgramsBelum ada peringkat

- Corporate Social Responsibility: Doing the Most Good for Your Company and Your CauseDari EverandCorporate Social Responsibility: Doing the Most Good for Your Company and Your CausePenilaian: 3.5 dari 5 bintang3.5/5 (2)

- Grow Your Clinic: And amplify your impact as a clinic for goodDari EverandGrow Your Clinic: And amplify your impact as a clinic for goodBelum ada peringkat

- Mastering Your Wellness Business: Helping You Put the Pieces TogetherDari EverandMastering Your Wellness Business: Helping You Put the Pieces TogetherPenilaian: 5 dari 5 bintang5/5 (1)

- Strategy in Global EnvironmentDokumen1 halamanStrategy in Global EnvironmentDeepesh SharmaBelum ada peringkat

- Student Declaration: Comparative Study On Financial Performance of Himalaya Bank Limited and Nabil Bank LimitedDokumen1 halamanStudent Declaration: Comparative Study On Financial Performance of Himalaya Bank Limited and Nabil Bank LimitedDeepesh SharmaBelum ada peringkat

- Strategy in Global EnvironmentDokumen1 halamanStrategy in Global EnvironmentDeepesh SharmaBelum ada peringkat

- Roc Roic Roe PDFDokumen69 halamanRoc Roic Roe PDFCharlie NealBelum ada peringkat

- Bonafide Certificate: Certified That This Project Report Titled "A Comparative Study OnDokumen2 halamanBonafide Certificate: Certified That This Project Report Titled "A Comparative Study OnDeepesh SharmaBelum ada peringkat

- Particulars Jul-12 AssetsDokumen14 halamanParticulars Jul-12 AssetsDeepesh SharmaBelum ada peringkat

- RahulDokumen25 halamanRahulDeepesh SharmaBelum ada peringkat

- Working Capital Management PROJECT REPORT MBADokumen90 halamanWorking Capital Management PROJECT REPORT MBABabasab Patil (Karrisatte)100% (14)

- Comparative Study on Financial Performance of Himalayan Bank and Nabil BankDokumen2 halamanComparative Study on Financial Performance of Himalayan Bank and Nabil BankDeepesh SharmaBelum ada peringkat

- Kist Bank's Financial Performance AnalysisDokumen14 halamanKist Bank's Financial Performance AnalysisDeepesh SharmaBelum ada peringkat

- Ariba Working Capital ManagementDokumen2 halamanAriba Working Capital ManagementDeepesh SharmaBelum ada peringkat

- cfs{ifs 5fkf lj1fkg agfpg ;fdfGo l;4fGtDokumen3 halamancfs{ifs 5fkf lj1fkg agfpg ;fdfGo l;4fGtDeepesh SharmaBelum ada peringkat

- DaburDokumen98 halamanDaburRam KumarBelum ada peringkat

- Chap 1Dokumen4 halamanChap 1Deepesh SharmaBelum ada peringkat

- DaburDokumen1 halamanDaburDeepesh SharmaBelum ada peringkat

- DaburDokumen1 halamanDaburDeepesh SharmaBelum ada peringkat

- GodDokumen1 halamanGodDeepesh SharmaBelum ada peringkat

- Son of The Hell QueenDokumen115 halamanSon of The Hell Queen19ECE38 Veerasuriyan K BBelum ada peringkat

- Knotless Bankart Repair Using The Labral SwiveLock® and FiberStick™Dokumen6 halamanKnotless Bankart Repair Using The Labral SwiveLock® and FiberStick™savvoBelum ada peringkat

- Puc Certificate New 5794Dokumen1 halamanPuc Certificate New 5794dilip polutionBelum ada peringkat

- (PPT) Arresting Cracks in Steel BridgesDokumen61 halaman(PPT) Arresting Cracks in Steel BridgesShaileshRastogiBelum ada peringkat

- Environmental Movements in IndiaDokumen2 halamanEnvironmental Movements in IndiaAnonymous Wz2iwNeGRDBelum ada peringkat

- 7 - GravitationDokumen5 halaman7 - GravitationAvik DasBelum ada peringkat

- Design MilestonesDokumen1 halamanDesign MilestonesRajBelum ada peringkat

- OHS Safety & Risk ManagementDokumen9 halamanOHS Safety & Risk ManagementJosephine ChirwaBelum ada peringkat

- Occurrence and Use of Hallucinogenic MusDokumen125 halamanOccurrence and Use of Hallucinogenic MusKevin Huamán AvilésBelum ada peringkat

- White America vs. Other Americas. TALKING To The DEADDokumen2 halamanWhite America vs. Other Americas. TALKING To The DEADRadu BortesBelum ada peringkat

- Proposal Tripurainfo Job PortalDokumen10 halamanProposal Tripurainfo Job PortalEkta DevBelum ada peringkat

- Preparing Equipment CalibrationDokumen1 halamanPreparing Equipment CalibrationGlobal QualityBelum ada peringkat

- Small DenseDokumen19 halamanSmall DenseFranky SantosoBelum ada peringkat

- 400x350 CNEA 5132Dokumen5 halaman400x350 CNEA 5132ichaBelum ada peringkat

- Instructions for Diesel Engine Setting/Locking Tool KitDokumen6 halamanInstructions for Diesel Engine Setting/Locking Tool KitCatalin CarpinisBelum ada peringkat

- Entrepreneurship Chapter 9 MCQsDokumen4 halamanEntrepreneurship Chapter 9 MCQsTooba0% (1)

- Chapter 03 The Eye and RetinaDokumen10 halamanChapter 03 The Eye and RetinaSimrat WBelum ada peringkat

- Obw - Jeeves - and - Friends - Short - Stories 2Dokumen13 halamanObw - Jeeves - and - Friends - Short - Stories 2Victoria AvisBelum ada peringkat

- Tridacna Giant ClamDokumen15 halamanTridacna Giant ClamBechah Kak MaBelum ada peringkat

- Chemical Engineering Science: Ishara Dedunu Kamalanathan, Peter James MartinDokumen11 halamanChemical Engineering Science: Ishara Dedunu Kamalanathan, Peter James MartinarulrajasiBelum ada peringkat

- Main IdeaDokumen17 halamanMain IdeaRonald heart100% (1)

- Aquacal Heat Pump Manual MultilanguageDokumen214 halamanAquacal Heat Pump Manual MultilanguageavillafanaBelum ada peringkat

- Sepam 100 LD PresentationDokumen11 halamanSepam 100 LD Presentationalisann87Belum ada peringkat

- Complete Feed Mills Plant and MachinesDokumen12 halamanComplete Feed Mills Plant and MachinesMohamed Abdullahi Mohamut100% (1)

- The Rædwald Bestiary: by Lee ReynoldsonDokumen16 halamanThe Rædwald Bestiary: by Lee ReynoldsontomBelum ada peringkat

- Kavya SRPDokumen10 halamanKavya SRPMadhuBelum ada peringkat

- Reach IPS Partners With Texas Based Cyber Trust AllianceDokumen4 halamanReach IPS Partners With Texas Based Cyber Trust AlliancePR.comBelum ada peringkat

- Middle Course of River PowerpointDokumen5 halamanMiddle Course of River Powerpointapi-26597187Belum ada peringkat

- Collins Birds of The WorldDokumen529 halamanCollins Birds of The WorldMatias Techera100% (1)

- Internship Cafe Coffee Day ReportDokumen88 halamanInternship Cafe Coffee Day ReportPoojaBelum ada peringkat