Chapter 10 - The Financial Plan

Diunggah oleh

Abdul Basit0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

33 tayangan4 halamanentrepreneurship financial plan preparation

Judul Asli

Chapter 10- The Financial Plan

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inientrepreneurship financial plan preparation

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

33 tayangan4 halamanChapter 10 - The Financial Plan

Diunggah oleh

Abdul Basitentrepreneurship financial plan preparation

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

1 | P a g e

The Financial Plan Chapter 10

Operating and Capital Budgets

In proprietorship, owner prepares that whereas in partnership/corporation, Managers

prepare it and owner approves it.

First find expected sales and from it, find the cost of these sales and ending inventory.

Important considerations are total production required and level of inventory

Second find Operating Costs that includes Fixed Expenses like rent, utilities, salaries

interest, deprecation and Variable Expenses like Adv. and Selling expenses etc.

Capital Budget provides the basis for expenditures impacting business for more than

one year e.g. new equipments, vehicles, computers or new factory etc.

Proforma Income Statement

Proforma income is the projected net profit calculated from projected revenues minus

projected costs and expenses

Preparing the Proforma Income Statement involves, calculate Sales by months, basis

may be marketing research, industry sales and some trial experiences. Certain

forecasting techniques like survey of buyers intentions, sales force opinions, expert

opinions etc can be used to calculate the sales.

List down Projected Operating Expenses that shall have room for adjustment. E.g.

selling expenses increase with increase in business sales and they are usually high in

start.

Finding cost of goods sold that can be either computed variable cost of production and

times number of units sold or by industry percentage of sale

Salaries and wages can be calculated by number of employees required and their roles.

Increased insurance costs, trade show participation or added space for warehousing

shall also be considered. Unusual expenses like Trade Show participation etc shall be

flagged at the bottom of Proforma Income Statement.

New machinery depreciation shall be added

Proforma Income statement shall be prepared First year month wise, and for the year 2

and 3, it shall also be prepared year wise. This can be done through calculating

percentages of cost of goods sold and operating expense in relation to the sales and

multiplying these percentages with the next year forecasted figures.

2 | P a g e

For projected expenses in year 2 and 3, first look at the expenses that remain stable

e.g. depreciation, utilities, rent, insurance etc. Be conservative for initial planning

purposes.

In case of an Internet Startup, purchase/lease computers, extensive advertising

expenses e.g. banner advertisement, Search Engine Listing etc, and inventory

expenses are more important.

Proforma Cash Flow

Cash flow is the difference between cash receipts and cash payments (not all sales are

made in cash and not all bills are paid in cash)

Deprecation expense dont account for cash outflow, similarly in an internet startup, fee

going as merchant charges through credit card transactions sales are not received by

the companies.

Using profit as the only measure of a success may mislead if there is a negative cash

flow

Mostly used method for calculating cash flow is Indirect method, objectives of which is

to understand that there are some adjustments that need to be made to the net income

based on the fact that actual cash may or may not have actually been received or

disbursed (figure 10.5)

Monthly projections of cash flow shall be prepared.

If disbursement are more than receipts, entrepreneur has to borrow or use cash in bank

an if receipts are more, he shall invest in short term or deposit in banks

It is difficult to project cash flows on exactly on the basis of monthly receipts and

disbursements. One method is anticipate that 60% of sale in each month is received as

cash and 40% in the subsequent month.

Per month cash flow helps in determining level of borrowings and surplus cash can be

used to repay any debt or invested in highly liquid assets or used to purchase any new

equipment.

3 | P a g e

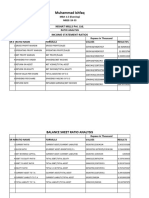

Proforma Balance Sheet

Summarizes the projected assets, liabilities and net worth of the business. It depicts the

situation of the business at end of the year.

Assets represents items that are owned or available to be used by the business.

Divided in to Current Assets, those are highly liquid assets including cash or can be

converted in to cash and consumed in a period of less than one year. Fixed Assets are

tangible and will be used over a long period of time.

Liabilities represent every thing that is owed to the creditors. Current Liabilities are

those which are due within a year whereas Long term Liabilities includes loans/debts

taken by the business for a long time period.

Owner Equity represents excess of all assets over all liabilities showing net worth of the

business. It is the amount invested by the owner. Profits are shown as Retained

Earnings in the Proforma Balance Sheet.

Break Even Analysis

Break Even is the volume of sales where the venture neither makes a profit nor incur a

loss. This point dictates volume of sales need to cover Total Variable and Fixed

Expenses.

It is important to find out when a profit may be achieved thus showing financial potential

for the startup business. Break Even analysis shows how much units must be sold or

how much sales volume must be achieved in order to break even.

Determining the Break Even Formula

Total Revenue (TR) = Total Cost (TC)

Where TR = Selling Price x Quantity (SP x Q)

And TC = Total Fixed Cost (TFC) + Total Variable Cost (TVC)

SP x Q = TFC + TVC

where TVC = Variable cost per unit x Qty (VC/Unit x Q)

SP x Q = TFC + VC/Unit x Q

(SP x Q) VC/Unit x Q = TFC

Q(SP VC/Unit)) = TFC

Q = TFC/SP-VC/unit

Which is the break even quantity

There is a major problem in declaring which cost is variable and which is fixed.

Reasonably deprecation, salaries, wages, rent and insurance are considered as fixed

whereas materials, selling expenses and direct labor are taken as variable costs.

Companies having more than one product, Break Even is calculated for every product

differently.

4 | P a g e

Proforma Sources and Uses of Funds

Summaries all the projected sources of funds available for the venture and how these

funds will be disbursed.

Purpose is to show how net income and financing were used to increase assets or pay

off debts.

Typical sources of funds are from operations, new investments, long term borrowings

and sale of assets. Profit is also included as source of fund and deprecation is added

back as it does not go out of pocket.

Applications of funds may include increased assets, retire long term liabilities, reduce

owner equity and pay dividends.

The statement of Proforma Sources and Application of funds statement helps the

entrepreneur and investors in understanding the financial well being of the company

and effectiveness of financial management policies of the company.

Software Packages

Used for tracking financial data and generate financial statements. Other purpose may

include check writing, payroll, invoicing, inventory management, bill paying, credit

management and taxes. They are helpful in presenting different scenarios and to asses

their impact on the Proforma statements. MS Excel, Quick Book, Peach Tree

Accounting, MS Financial Manager are few good options as ready made packages.

Startup Company shall select very simple and easy to use soft wares.

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Vacancy 130817Dokumen15 halamanVacancy 130817Abdul BasitBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Usman Internship at PTCLDokumen36 halamanUsman Internship at PTCLAbdul BasitBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Order: Dated: February 1, 2016Dokumen1 halamanOrder: Dated: February 1, 2016Abdul BasitBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Sap Ides DetailsDokumen1 halamanSap Ides DetailsAbdul BasitBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Marketing Chap 1Dokumen3 halamanMarketing Chap 1Abdul BasitBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Valid: Validvce - Free Valid Vce Dumps For Certification Exam Test PrepDokumen4 halamanValid: Validvce - Free Valid Vce Dumps For Certification Exam Test PrepAbdul BasitBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Project Activities: Generating The Work Breakdown Structure (WBS)Dokumen12 halamanProject Activities: Generating The Work Breakdown Structure (WBS)Abdul BasitBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Chapter 1Dokumen6 halamanChapter 1Abdul BasitBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Chapter 1Dokumen6 halamanChapter 1Abdul BasitBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Research DesignDokumen4 halamanResearch DesignAbdul BasitBelum ada peringkat

- Fi 1Dokumen19 halamanFi 1Abdul BasitBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Net SolDokumen25 halamanNet SolAbdul BasitBelum ada peringkat

- AgesDokumen1 halamanAgesAbdul BasitBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Marketing Chap 1Dokumen3 halamanMarketing Chap 1Abdul BasitBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Affidavit of Guarantee Form.Dokumen1 halamanAffidavit of Guarantee Form.Abdul BasitBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Controlling: I. Definition and Nature of Management ControlDokumen10 halamanControlling: I. Definition and Nature of Management ControlNicole Andrea Tuazon100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Finman2 Module 2Dokumen17 halamanFinman2 Module 2Franz Ervy MallariBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Learning Unit 2 - Cost Concepts and ClassificationDokumen17 halamanLearning Unit 2 - Cost Concepts and ClassificationNashmita SinghBelum ada peringkat

- AnnualReport2010.Ittehad ChemicalsDokumen56 halamanAnnualReport2010.Ittehad Chemicalsusman_asif_6Belum ada peringkat

- Introduction of Working CapitalDokumen2 halamanIntroduction of Working Capitalpurna3195592100% (6)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Accounting FactsheetDokumen1 halamanAccounting FactsheetBhumika MehtaBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Comparison Between Online TradingDokumen18 halamanComparison Between Online TradingTulsi ThakarBelum ada peringkat

- Ch12 P11 Build A ModelDokumen7 halamanCh12 P11 Build A ModelRayudu RamisettiBelum ada peringkat

- Account Head of VertexDokumen32 halamanAccount Head of Vertexripon_84Belum ada peringkat

- EntrepDokumen30 halamanEntrepTrixie Delos Santos100% (1)

- Mudek V Kerajaan MalaysiaDokumen16 halamanMudek V Kerajaan MalaysiaezmanzulkarnaenBelum ada peringkat

- SD19 SBRIRL AnswersDokumen10 halamanSD19 SBRIRL AnswersVasunBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Business Plan VineethDokumen13 halamanBusiness Plan VineethMuhammad Aslam C50% (2)

- Ratio Analysis and Excel TemplatesDokumen4 halamanRatio Analysis and Excel Templatesmartain maxBelum ada peringkat

- BBFA2103 Financial Accounting and Reporting 1 OUMDokumen369 halamanBBFA2103 Financial Accounting and Reporting 1 OUMUmmu Aiman Ayub100% (3)

- XADVAC2 Notes To Buscom PDFDokumen4 halamanXADVAC2 Notes To Buscom PDFbrianneBelum ada peringkat

- Fundamental Analysis:: Shareholding PatternDokumen7 halamanFundamental Analysis:: Shareholding PatternVikas SharmaBelum ada peringkat

- Interloop Limited Income Statement: Rupees in ThousandDokumen13 halamanInterloop Limited Income Statement: Rupees in ThousandAsad AliBelum ada peringkat

- Edison Investment Research PolyMet ReportDokumen16 halamanEdison Investment Research PolyMet ReportSteve TimmerBelum ada peringkat

- 213a - Financial AccountingDokumen22 halaman213a - Financial AccountingTayyebKhalilArainBelum ada peringkat

- Cash Flow For Study29072021Dokumen60 halamanCash Flow For Study29072021URABelum ada peringkat

- Net Working Capital and CCCDokumen9 halamanNet Working Capital and CCCJomar TeofiloBelum ada peringkat

- ESP - Application FormDokumen9 halamanESP - Application FormgimagBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- BASF Report 2019Dokumen301 halamanBASF Report 2019swarnaBelum ada peringkat

- Project Profiles 75Dokumen2 halamanProject Profiles 75pradip_kumarBelum ada peringkat

- Advanced Accounting Accounting Standards Suggested Answers PDFDokumen58 halamanAdvanced Accounting Accounting Standards Suggested Answers PDFanupBelum ada peringkat

- Advertising Agency Business PlanDokumen26 halamanAdvertising Agency Business PlanxolilevBelum ada peringkat

- McDonalds Financial AnalysisDokumen11 halamanMcDonalds Financial AnalysisHooksA01Belum ada peringkat

- Chapter 18 Cost Accounting.Dokumen19 halamanChapter 18 Cost Accounting.Kheng BinuyaBelum ada peringkat

- Financial AccountingDokumen24 halamanFinancial AccountingGiang PhungBelum ada peringkat

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurDari Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurPenilaian: 4 dari 5 bintang4/5 (2)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureDari EverandSummary of Zero to One: Notes on Startups, or How to Build the FuturePenilaian: 4.5 dari 5 bintang4.5/5 (100)