SecReg Outline LMFG

Diunggah oleh

Erin Jackson0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

224 tayangan50 halamanThis document provides an overview and summary of securities law and the Securities and Exchange Commission (SEC). It discusses key topics such as what constitutes a security, disclosure requirements, acts such as the 1933 and 1934 Securities Acts, the role of the SEC and self-regulatory organizations, and landmark Supreme Court cases related to defining a security.

Deskripsi Asli:

SecReg

Judul Asli

49433709 SecReg Outline LMFG

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document provides an overview and summary of securities law and the Securities and Exchange Commission (SEC). It discusses key topics such as what constitutes a security, disclosure requirements, acts such as the 1933 and 1934 Securities Acts, the role of the SEC and self-regulatory organizations, and landmark Supreme Court cases related to defining a security.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

224 tayangan50 halamanSecReg Outline LMFG

Diunggah oleh

Erin JacksonThis document provides an overview and summary of securities law and the Securities and Exchange Commission (SEC). It discusses key topics such as what constitutes a security, disclosure requirements, acts such as the 1933 and 1934 Securities Acts, the role of the SEC and self-regulatory organizations, and landmark Supreme Court cases related to defining a security.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 50

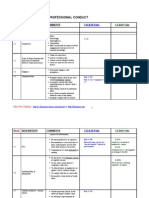

SEC REG: Prof.

Horwich, Spring 2011

Securities law all about disclosure

y First: cover what is a security?

y Most of class: disclosure

o What is disclosure?

o When must it be provided?

o What meets the required standard / is correct?

y If done incorrectly:

o Civil liability

o SEC enforcement

o Etc.

Securities Law overview

y Statute and rule based

y Until 2002, fundamentally securities law about disclosure

y Since 2002, SOx passed - in response to scandals at Enron, Worldcom, etc.

o Brought securities law into corporate governance for first time

o Dodd-Frank has added further: federal law into corporate governance

Deals with voting, proxy statements, etc.

y IPO cornerstone of what securities act is about

y Any sale of securities must either be registered or exempt (essence of 5)

y Under what circumstances can securities be sold without registration

o Usually about institutional investors

Hedge funds

PE funds

Pension plans

Insurers

y I [primary] Public [IPO] X [secondary]

o Must comply with 5

y Materiality:

o Defined by SCOTUS for when disclosure of material info is required

o Varies depends on nature of info; and may have party protections from liability for certain

situations

y Reporting regime

o 10-K, 10-Q annually, quarterly reporting required

o Specific events that trigger filing: within 4 days after event: 8-K

o S-K: SEC picks and chooses from items for various disclosure requirements for filings

S-1: for IPO filings

S-3: for already public companies

10-K, 10-Q, 8-K, etc

Securities Acts

y Securities Act of 1933 covers basics

o Describes what must be given in a public offer mandatory disclosures / requirements

o 11 very limited right of action for false or misleading info in registration statement

y Securities Exchange Act of 1934 deals with markets for trading mostly

o Periodic reporting regime: not real-time, but through forms

o Deals with public companies

o 10b-5

y Acts have 2 different numbering schemes can tell where rule is from

o 3 digits: Securities Act of 1933

o #letter-#: Securities Exchange Act of 1934

y Now: SEC has integrated disclosure

o Can incorporate elements needed from S-K into S-3 registration doc

SEC

y 5 members, appointed by the Pres

y No more than 3 from any one party

y 1 chairman

y Formerly had to be unanimous, but no longer often division of 3-2

o Courts have occasionally invalidated SEC rules

y SEC generally thought of as good agency until Madoff debacle

o Has tarnished reputation very badly, with Congress reluctant to give them $$$ for enforcement

under Dodd-Frank (100+ new complicated rules and additional responsibilities)

o Tension over budgetary process (ongoing political issue)

y 5 divisions

o Division of corporation finance deals with most issues from this class

o Other divisions:

Trading and markets

Investment management (mutual funds, investment advisors, etc)

Civil enforcement (SEC doesnt prosecute crimes)

Risk, strategy and financial innovation (new division)

y Regional offices deal primarily with enforcement matters

y Criticism of SEC from flaws in enforcement and

SRO self-regulatory organization

y NYSE, NASDAQ, etc. registered exchanges

y Have obligation to enforce securities law

y SEC disciplines exchanges that fail to enforce the law

FINRA Financial Industry Regulatory Authority

y Enforcement arm to fulfill responsibility under securities law

CFTC Commodities Future Trading Commission

y Look a lot like securities now

y Congress has allocated lots of these to SEC and CFTC

o Both now in effort to adopt regulations under Dodd-Frank for responsibility for enforcement

What is a security?

y 2(a)(1) of 1933 Act:

y 3a-10 of 1934 Act:

y Both begin by saying unless the context otherwise requires

***

Class #2 1/4/11

SEC v. W.J. Howey Co. (1946, pg. 21): Supreme Court grappled with definition of an investment contract where

SEC asserted that marketing of land contracts to a citrus grove was an attempt to sell securities without

registering, in violation of Section 5.

y Whether or not this is an investment contract

1. Invests money

2. Common enterprise pooling of funds

Opportunity to contribute money and share in profits of large citrus fruit enterprise

managed and partly owned by Howey

3. Expect profits

4. Solely based on efforts of others

y Investment contract (one of statutory criteria from both acts)

y No consumption in Howey

5(c) bottom of p9 unlawful for any person to sell [or offer] any securityunless registration has been filed

y Violation even if no one bought, only if offered is violation

CASE: Marine Bank v. Weaver, 1982, p24 bank certificate of deposit to secure a bank loan to Columbus Packing;

in return, Weavers share in Columbus net profits

y Columbus goes bankrupt court said Weavers didnt purchase a security

o SCOTUS said securities law covered those instruments ordinarily and commonly considered to be

security

These are not those commonly thought covered by securities law

Often private offerings are not considered securities doesnt mean its not covered

court more focusing on the one-on-one nature of this transaction

y Securities are usually tradable, and these certainly are NOT

y No disclosure document

o Perhaps main motivation was for consumption

Veto right is not characteristic of security

y Do we need to extend securities law to cover this, or is this already regulatory ways to cover this?

o Factors in Marine Bank demonstrate variety of factors to tick off

Federal Law vs. State Law

y Tunnel vision in this course because only looking at federal law, even though state law may apply in many

of these transaction

y One distinction to extent money is at risk doesnt seem to be a factor federal courts take into account in

interpreting federal laws

o Versus state laws, which state courts may take into account when interpreting whether security

or not at state level

CASE: US Housing Foundation, Inc. v. Forman, 1975, p28

y Issue that use of the word stock literally automatically qualifies the element as a stock

o SCOTUS held use of the word not dispositive

y Facts of stock

o Not used in profit-making effort, but instead intended for consumption

o Issued by Riverbay, a non-profit cooperative housing corporation under UHF

o Purchased by tenants of Co-op City can only acquire if tenant, and if tenant no choice to acquire

stock (its required)

Stock amount 18 shares per room, at price of $25 per share

Ownership of shares entitled owner to tenancy (vs in Howey, ownership of stock didnt

entitle owner to right to occupy land)

y Plaintiffs complaining about anti-fraud

o Alleged deception likely claim under 10(b)-5, p384 unlawful to make any untruthful

statement in connection with the purchase or sale of any security (applies to all sections)

If no security involved, then no claim

y Issue: is this stock in question actually a security? If not, then doesnt apply under 10(b) - 5

o Stock no ordinary characteristics traditionally associated with stock: (p31 top)

Most common feature no dividends contingent upon an apportionment of profits

Not negotiable

Cannot be pledged or hypothecated non-transferrable

No voting rights in proportion to the number of shares owned

Cannot appreciate in value

o Investment Contract did put money in with common enterprise, but no motivation to get

profits

Different from Howey intended for consumption, not for profits

y when a purchaser is motivated by a desire to use or consume the item

purchased to occupy the land or to develop it themselves the securities law

doesnt apply

o One sticky point: rent reduction possible when net income from commercial facilities applied

Kind-of like profit, but didnt weigh heavily in courts view because purpose was to live in

space and not to generate profit

CASE: SEC v. Edwards, 2004, p33 rare 9-0 securities-related decision, prof doesnt quite know why SCOTUS took

it

y Issue: If fixed return, then can it be an investment contract?

o Court held doesnt matter, still a profit, whether fixed or variable return

Common Enterprise

y Easy to understand under Howey case

y But in general, raises more questions for lower courts to deal with

y Common interest what is this?

o Lower courts have generated 3 different tests of commonality

Will depend on which Appellate court you get for what the test will be

y ***3 Tests for Common Interest:

1. Broad, vertical commonality

y Whether generates profits is dependent on promoter; but promoters success and

success of investment is unrelated

2. Strict, vertical commonality

y Whether generates profits is dependent on promoter; but here promoters compensation

is variable with success of investment enterprise

3. Horizontal commonality

y Pool assets of all parties, with multiple investors, and then share profits based on results

of pooled investments in totality

y Still dependent on promoter

y Why?

o Because securities law deals with more than just public transactions applies to private too

Cant single out one factor from Weaver as dispositive

o Can have vertical commonality in almost all situations

o One other factor Howey discussed solely on efforts of others; court later watered down this 4

th

standard changed to primarily profits driven by efforts of others

Problem 2-1, p33

y Jaguar is going to develop a new car; prototype but no production until enough people willing to buy

o Request deposit, with car delivery in 3 years

o Anticipated when cars are delivered, will be worth 3 times price of down payment

y Issue: are those who put down down-payment, are they buying a security?

o What will Jaguar do with money?

Pool assets to build cars

Promoter is given money

People will have something valuable to re-sell

o Perhaps common enterprise?

o Is this an investment contract?

BUT:

y Is there any real profit for Jaguar?

o Potentially like broad vertical commonality

Is this for consumption or profit?

o After-market is where profit will come, not created by Jaguar

y Take-away: what defines a security isnt so clear profit-making schemes dependent in large measure by

promoter, then securities laws may supply (even if not conventional security)

o Driven by nature of arrangement

Class #3: 1.5.11

Problem 2-2, p40 property sold $90M in debt securities to 20 investors; needs an additional $10M entered

agreement with Handsome Trust investing $10M for right to % of net profits of properties

y Issue: is this an investment contract?

y 4 factors: on balance, looks like investment contract

o investing $

o in common enterprise?

Vertical works

y Promoter, MPI, is using assets from first 20 investors

Horizontal?

y All $ is necessary to make deal, so perhaps necessary

o Profits yes

o Handsome dependent on efforts of promoter

y Security? Looks like one

o NOTE: Promoters like to have investors do something that addresses 4

th

criteria, to say success

of deal required efforts to person who fronted money to financial outcome of enterprise, and

thus not a security

Problem 2-5, p45 Japanese fast food restaurants investment of $35K plus percentage of gross then train

franchisee, provide equipment, ads, supervise restaurants

y Issue: is this investment contract?

o NO

Investing $, common enterprise, for profits

Violates 4

th

factor: need both efforts franchisor cant get $$$ without work by

franchisee

y What if franchisee didnt have to be on-site managersdoes this change situation?

o Can become continuum as facts change and move away from franchisee involvement

o NOTE: what agreement provides versus actuality changes whether or not looks like investment

contract

Sale of Business Doctrine if you transferred entire business, even if through stock, then wouldnt function as

transferring a security

y SCOTUS disagreed in Landreth case (1985, p45) if it has what we qualify as stock from Forman case, then

its stock!

o Howey test was not relevant

Doesnt have to satisfy investment contract test if its stock

Fact that transaction was private doesnt tell whether its a security in the first place

Problem 2-6, p48 Sam buying Hillarys real estate brokerage firm Vistas; ways to structure the transaction

Hillary wants him to purchase all her stock, but Sam wants to assume all assets and liabilities

y Issue: how does transaction structure affect whether this involves security or not?

Problem 2-7, p48 have to buy shares of stock in CART to race car; transfer of shares requires approval of Board,

with failure to race may result in stock revocation; S/H are entitled to dividends, although rare

y Issue: is this a security?

o Under Forman, not security just because called it stock title isnt despositive

o Also under Forman, stocks main purpose was consumption; like here, stocks main purpose was

to allow opportunity to race

y Conclusion: NOT securities

o Gives dividends, voting rights

o BUT Not transferrable without approval

2(a)(1) (1933) or 3a-10 (1934) Defining Security

y 33 Act: Note is security a note?

o 2(a)(1) blanket statement, any note

o 3(a)(3) exempted securities (p5)

Entire 33 Act doesnt apply to any of following securities

y Maturity of which is not to exceed 9 months short-term notes are NOT

covered

y 33 Act 17, p21 unlawful to sell any security where misrepresentation is made

o But doesnt apply to short-term notes?

o But no! says exemptions to 3 do NOT apply

y 34 Act: 3a-10, p282: any notebut shall not include any short term-note, 9 months or less

o Not an exemption, just excluded all together

y Both intended to mean commercial paper of high quality

o Notes sold by business entities to finance their ongoing operations

o Courts rely on introductory language in statuteunless context otherwise requires

Have free reign about whether or not to apply that language

10b-5 who can be sued?

CASE: Reves v. E&Y, 1990, p66

y Issue: are the demand notes issued by the Farmers Coop securities?

o Court held YES

y Reasoning:

o Family resemblance test longer term note (more than 9 months) presumed to be covered by

statute, unless you can show it resembles family of notes that arent covered

List (p69) consumer finance note, mortgage note, personal loan from bank note, etc.

not covered

o 4 factors:

1. Assess motivations of reasonable seller and buyer

2. Plan of distribution whether theres a market for the notes

3. Publics reasonable perceptions

4. Risk-reducing factor

y Justice Marshall: said it could be longer than 9 months, thus not necessarily long term

y Justice Stevens joined in judgment held only intended for commercial paper, not investment securities

Problem 2-11 broker addicted to gambling; to pay off debts went to clients for loans, and gave promissory notes

with 8% interest, payable on demand

y Issue: are these securities?

o Motivations?

o No broad distribution / marketing of notes

o Does sophistication make a difference?

Court held that b/c investors werent sophisticated, court didnt put much weight on this

factor

o Risk-reducing factor?

No Action letter: lawyer uncertain what rule would be under securities law

y Can write letter to staff giving facts and ask if use exactly what is said, then SEC will not take action

y Letters are public to function almost as precedent but not binding, and essentially only Yes or No

Problem 2-12 based on SEC no-action letter; to finance homebuilding, borrows money specific to property

gives note with mature date 9 months from closing of loan with 1 renewal option; secured by deed of trust on

property; lenders not partaking in profits

y Issue: is this a security?

o Motivation? For short-term loans

o Broad distribution? Problem doesnt suggest so 25 sold per parcel

o Etc.

o SEC staff refused to give no-action response

Perhaps too broad? Is 25 too many? We dont know

Derivatives

y Regulation of derivatives big part of Dodd-Frank Act

y Derivative instrument or interest that derives its value from something else

o Ex: stock option

o Ex: credit default swap (like those AIG sold)

Agreements on part of AIG that said debt of particular company (e.g., bonds of Lehman),

if defaulted, then AIG would pay holder of swap a certain amount of $

y Value of swap would change based on credit-worthiness of underlying bond

y Value of swaps went up when Lehman more risky

o Markets were unregulated believed by those behind Dodd-Frank that these were behind

financial crisis; therefore Dodd-Frank reversed switch and now requires that derivatives be

regulated, but goal is to make them a standard fungible instrument

Formerly were unique now want them to be more like a stock, which is the same for all

Ex: no one knew how many swaps were out there for Lehman because unregulated, and

didnt require ownership of underlying stock

y $63T in existence at time of Lehman crash mostly netted out, but didnt know it!

o Law not yet adopted because rules required to be created by SEC and FCTC

Class #4 1/10/11

Secondary trading take place after company issues shares

y If publicly traded on registered exchange as exchange-traded or OTC

o Registered under the exchange act, and to regulate broker-dealers who trade on the exchange

Ex: NYSE, Nasdaq

y Formerly membership-owned exchanges

y Now, for-profit stock corporations, almost all publicly owned

y Trading formerly done on the floor

o Now, mostly electronic

OTC one broker puts in bid price, and seller asks a specific price

y System puts the two sides together

Derivatives trading in indices based on large group of stocks (like S&P 500), or trading in futures or options

y Commodity markets relating to securities

Foreign private issuers have disclosure requirements, which are more lenient than domestic companies, in

order to be listed on exchange

y Still have to comply with same fundamental disclosure needs

y Regulation S mechanism by which US and foreign companies can raise capital overseas without

registering in US

Efficient Capital Markets Hypothesis

y Weak form

o

y Semi-strong form

o All public information is reflected in the trading price

y Strong form

o All information, public or private, is reflected in the trading price

If you cant beat the market, why pay for research?

y Regulation FD fair disclosure prohibits senior management from disclosing info on a selective basis

o Has to be given to public simultaneously

Issue with EMH: How does momentum factor in to EMH?

y Emotional factors arent built in, but still can play into stock price

y EMH is a hypothesis, but its the only SEC uses in imposing disclosure requirements

y Debate in academia about whether we should even have mandatory regime of disclosure

Why disclose?

y Managers want to minimize risk have incentive to disclose more about company because investors may

be willing to pay more for less risk

o Managers may also own securities in their company, and therefore want benefits of stock price

o If bad news, then 2 options:

Dont give out the bad news but then increases risk

Absorb cost anyway and relay all info

y Company absorbs costs of disclosure

o Use good rep i-bankers to bring info to market

o May voluntarily list on exchange

y Counterarguments for disclosure (per Easterbrook and Vischal), p253:

1. May conceal bad news, lie, etc.

2. Also, dredging up information is wasteful mandatory disclosure is standardized and simplifies /

eliminates waste; but investors always want more counter is that who says Congress or SEC are

best to say what info is needed, and when is enough

y Disclosure can be heavy, expensive burden, particularly after SOx

o Thus, many companies re-privatized!

TO do so, must make additional, quite intrusive disclosures before doing so

Class #5: 1.11.11

How to Raise Capital & Comply with Law

Section 5 requirements re: registration

y 12(a)(1) allows for nullification of sale, can get $ back if fail to register per Sec. Act

o Very little burden on plaintiff only have to say no registration statement on file when purchased

security; defendant has to prove exception

Historical Background / Framework

y Issuer, 2(a)(4) entity that issues securities

y Underwriter, 2(a)(11) buy securities from issuer to sell to buyers (institutional investors, retailers, etc)

o Aka: Broker-dealer

o Structural process that fits into Sec. Act

o Role: gets involved in sale of securities, provides advice

Ex: will the market buy them, what needs to be done to make the securities attractive to

the market, etc.

y Primary or Secondary offering

o Primary initial registered offering from company

Common stock, preferred stock or bonds

o Secondary secondary market

o Can have both primary, with sales revenue to company, and secondary, with sales revenue to

those cashing out

Underwriting

y 2 types:

o Firm commitment

Eve of offering: underwriter buys securities from company, and then undertakes risk of

selling to public (capital at risk)

o Best efforts

Takes fee in exchange for best efforts to sell securities to market

y 3 types:

o Straight

o Mini-maxi

o All or none

y Dont have to have an underwriter

o Can have an auction instead; ex: Google

Broker Structure

y Managing Underwriters lead underwriters get larger commission, more shares, determine who else to

include

y Syndicate other key underwriters to support the offering

y Selling Group take some of shares and resell to public via retail for broader market availability

2(a)(3) defines terms offer and sell p2

y Negotiations between issuer and underwriter terms shall not include preliminary negotiations or those

in privity (excluded from the definition)

Over-allotment limited by industry to 15% of offering

y Ex: 90M by company, 10M internal 100M total

o But if company kept 20M shares, you may want to know if those will end up on market

Leads to lock-up agreements

Underwriter Impact

y Reputation has strong impact on offering and public view of risk in purchasing securities

o Also concerned about its own reputation want good company to underwrite, makes

underwriters more selective

y Liability

o 11 liability for anyone thats part of the offering if theres fraud or misleading information in

disclosure statute lays out who, but almost everyone can be sued

Integrated Disclosure Statement

y Allows companies to register using past filings, such as 10-K, 10-Q, 8-K

o How do underwriters protect themselves?

Underwriting Industry: very concentrated

y Ex: P124, Tombstone ad

o Top: managing underwriters

Underwriting agreement executed with the issuer

o Middle: syndicate

Selected dealer agreement establishes obligations of each member

o Bottom: major bracket more retail firms

Agreement among underwriters additional broker-dealers to assist the syndicate

o Look at how things have changed in 6 years!

Lehman = gone

JP Morgan = now JP Morgan Chase

Goldman, Morgan Stanley = now bank holding companies

y Cyclical nature of business

Timeframe

y Pre-filing period

y Filing time

y Waiting period underwriters talking to clients: gauge interest, but cant actually offer sale obtain

commitment

o Select price range for IPO; ex: $20 - $23

y Effective upon sale

o Ex: if strong interest, then maybe IPO price will go up$28

o Eventually market dictates price limited ability in underwriting group to participate in market

5: core of 33 Act

y If ever going to sell security, must register transaction with SEC or have exemption

o Registered offering = registers transaction

y Statute works from bottom-up

y 5(c) cannot offer in any way to buy or sell until registration statement filed with SEC

o Policy: why?

No offers until theres disclosure out there!

Cant condition or influence market for securities until disclosure is on file and available to

anyone who wants it

y 5(a) unless registration statement in effect, then

o Can sell now that disclosure is FINAL

y 5(b) purpose for having a prospectus

o Prospectus defined, 2(a)(10) prospectus, notice, circular, advertisement, letter, or

communication, written or by radio or television, which offers any security for sale or confirms

the sale of any security

Rule 405 deals with VM and other electronic communications

Any writing about sale must comply with SEC requirements re: what contents must be

o 5(b)(2) deals with prospectus that must be delivered with actual sale

7 provides registration statement shall contain whatever SEC says it shall contain

y Used to be listed in detail but now is just in forms S-1 (p192, p195), S-3, S-4 (used to combine

registration statement and proxy statement), etc

o Lists each item that must be included in registration statement, and prospectus is 98% of what

must be included

Lawyers & iBankers roles to dig into company to find everything necessary for SEC registration statement

y Rule 408 in addition to info required to be included in registration statement, must also add information

to demonstrate the required statements are not misleading

o Requires very intensive factual investigation

y Registration statement typically requires 3 years of audited financial statements

y Give opinion at end of day that statement is factually issued

y In-house counsel may not be of help if havent dealt with disclosure

y Lawyers draft disclosure statement, and have sr. leadership review it / gather whatever additional

information needed

o Need to conduct due diligence to avoid liability and sanction under 11

Likely not lawyers liable, but client will be!

Important lesson: verify everything

SEC in action

y If SEC suspects anything, they go out and review!

o Criminal offense to represent SEC has approved issuance of securities or contents of documents

o Provide comment letter

y 8 taking effect of registration statements

o 8(a) - once registration filed, then becomes effective 20 days after filing date

o SEC typically takes longer than 20 days for review; if SEC believes something deficient can bring

stop order proceeding (under 8(b)) to refuse to allow registration statement becomes

effective

o 8(d) can issue stop suspension order after effective date also to require statement be

amended

y Note: Didnt have rules for pre-filing period really until 2005

Amendments

y Rule 473 can delay an amendment to prevent 20 days effectiveness period and await SEC comments

o Note 24, p153 put something on front of registration statement to say this will be deemed

amended from time to time until this is a delay amendment

y Rule 461 can request acceleration from SEC to move up from 20 days of last amendment

o 461(b)(2) SEC wants satisfactory assurance that correct material is public

o Note: 48 hours desired to have prospectus in hand for prospective buyers, before registration

statement is effective

y Preliminary prospectus has red legend on it saying its prelim, subject to change (called red herring)

o Changes every time registration is amended

Notes

y Very expensive process, lawyers and ibankers to pay

Class #6: 1.12.11

Registration Statement Review:

y 8 provision dont apply here; principal exemptions under 4

o Otherwise, 5 always applies

y Exemption ex: 4(2) transactions of issue not involving any public offering

o Public offering not defined in statute so courts have told us what it is

y Reminder: 5(c) prohibits any offers or sales until registration statement filed

y 2(a)(3) brief overview of offer to buy or offer to sell, with carve-out for issuer and those in

underwriting group

5(c) limitations

y Prohibition kicked off by company going in registration

y What defines this in registration point?

o Not defined legally, so most parties are cautious

o If you overstep, SEC can stop you issue stop order but also claim you violated securities laws and

either injoin your offering or at least delay it

Can be very costly in terms of timing your offering right

y Before 2005, what you could do in pre-filing period was unclear; in 2005, new 160-series of rules that say

if you do X and dont do Y, you wont have violated 5(c)

o Safe harbor provisions follow the rule roadmap so you dont violate the law

o During waiting period: deemed to be complaint if you follow 10

Rule 163.A, p90 Exemption attempted compliance is not exclusive

y Available to all issuers, for disclosures more than 30 days prior to the filing date

y No protection for underwriter, only issuer

y Cannot refer to offering

y Prevent redistribution of document in 30 day window

WKSI well-known seasoned issuers: greater flexibility still

y More info out on company under 34 Act, so SEC gives them more flexibility

Rule 135, p50 allows issuer to announce intention to make offering prior to filing date; strictly limits what can be

disclosed

y No anticipated price

y No telling underwriters

y Legend on doc that says it doesnt constitute offer (common in words of rule)

y Only way can disclose impending offering before registration has been filed

o Exception now for WKSI companies

Rule 169, p96 mostly for non-reporting issuers; for company not reporting under 34 Act can, in pre-filing

period, release regularly timed releases in same manner and timing

y Not targeted to investors because SEC says thats just raising companys profile proceeding the filing

thats an offer and is NOT allowed

Problem 4-1, p166; Omega

y Needs $50 70M through IPO; registration statement planned for 5/1

y Issue: on 2/10, VP of marketing runs ads in Business Week; is this an offer?

o Under 163(a), have to prevent re-circulation within 30 days of filing

o Under 169, there may be a problem now that its in Business Week, looks like its targeted to

investors not allowed to allow qualification as exemption under 169(d)(3)

Also potential issue under 169(d)(2) has timing, manner or form changed?

o Change the scenario under 5(a)(2), if same ad running for years, is this an offer?

No, doesnt require business to suspend business ops

Problem 4-2, p167

y 2/14, VP Finance invites 5 ibanking firms to discuss firms interest in underwriting

y 2/15, execute draft agreement

y Issue: is this an offer?

o Under 5, not an offer

o 5(c) doesnt apply; no interstate commerce

y Issue: is Hedley an underwriter?

o Under 2(a)(11) must participate in distribution for issuer; Hedley signed up to do just this fits

the statutory definition

Problem 4-3, p167

y Head of Hedley faxes underwriting agreement to NY offices

y Issue: is this covered?

o Under 2(a)(3) no, still within underwriting firm

Problem 4-4, p167

y Letter circulate to 80 brokerage houses to participate as co-underwriters

y Issue: how do statutes apply?

o 2(a)(3) privity of contract with an issuer this communication is allowed

Problem 4-5, p167

y Communication with smaller firms not underwriting being offered commission to sell

y Issue: how do statutes apply?

o 2(a)(11) not excluded from

Soliciting others for selling, not underwriting, is NOT covered in this provision; because

NOT in privity

y Technically underwriters under this statute, but NOT in privity (from 2(a)(3))

thus not protected re: sale

y Policy: shielding early stages of process to allow for effective raising of capital, but if not in privity then

not protected not allowed to move into sale concerns

Problem 4-6, p167

y 3/15, PR team prepares brochure highlighting companys new developments also indicates intent to

make IPO and estimates of future production capacity

y Issue: is this a violation of 5(c)?

o Rule 135 No legend

o Rule 163.A cannot refer to offering

Also, how going to prevent redistribution within 30 day period

o Rule 169 - Only facts and not forward looking info

y Conclusion: clearly an offer, not protected by any of the 3 rules above

Problem 4-7, p167

y 4/5, journalists and others invited to tour and see expansion plans runs in newspapers

y Issue: is there violation?

o Rule 163.A within 30 day window, so doesnt apply

o Rule 135 ok, because no mention of proposed offering; therefore, not 135 statement

o Rule 168, p94 issuer required to file reports under exchange act not available to non-reporting

company

o Rule 169 this one applies! Cant be directed at investors, so depends on which types of mags /

journalists are invited, and to whom they write

Problem 4-8, p167

y 4/8, Hadley issues on letterhead announcement to financial wire services re: upcoming IPO through

syndicate with 4M shares; Omega posts to website

y Issue: is Hadleys action permissible under securities act?

o Under 5(c), No! This looks like an offer and thus is a violation

None of these rules give underwriter exemptions

y Policy: why dont rules give underwriter exemptions, nor under Rule 135 do the rules allow the issuer to

even tell who the underwriter is!

o Might cause interested investors to approach underwriters violates the rules

Problem 4-9, p168

y 4/27 annual report; mentions expected IPO

y Issue: is Hadleys action permissible under 5(c)?

o Safe harbor possible? Rule 163.A only applies within 30 days, this doesnt qualify

o Rule 135 discloses info not allowed under 135, doesnt apply

o No also violation under 169 like advertising offer, b/c aimed at investors; also, forward-

looking statements

Time, manner and form = upgraded the annual report manner of presentation / profile

is raised; not really presented in the same way

y Tension between need to communicate and ensuring communication is not

incomplete but doesnt cross the line addressing the offering difficult to balance

***

Class #7: 1.18.11

Problem 4-10, p168 -

y 4/28 Omega places Alices (VP of finance) presentation on website and she remarks on expected future

earnings

y Issue: is Alices action permissible under 5(c)?

o No also violation under 169 advertising offer, aimed at investors

o Invitation excepted before company in pre-registration, so this helps

o Talk about expansion but not about offering? no comment or perhaps should withdraw

acceptance of invitation like quiet period

Rules more flexible now than they once were; risky thing to do, before anything is filed, to

talk about the company, and any future plans, publicly

o Info goes well beyond a Rule 135 statement p121, bottom written communication is

anywritten, printed, radio or TV, or graphic comm. (includes anything online)

Problem 4-11, p168 -

y Late April broker writes to Hedley offering to purchase shares

y Issue: is this permissible?

o No violation under 2(a)(3) and 5(c)

5(3) prohibits offers to buy as well as offers to sell

Waiting Period

y Period after pre-filing period, now weve filed rules change significantly

y 5(c) no longer applies

y 5(b) now in charge

o 5(a) continues to bar sales after registration statement is filed

o BUT 5(b)(1) governs the start of sales efforts after registration but before IPO date

Bars any prospectus but defined broadly under 2(a)(10) no written, radio or TV

transmissions

y Oral offers ARE allowed

y Does communication constitute a prospectus?

o 5(c) prohibited any offer to buy or sell, nothing in 5(b) that prohibits oral solicitations, nor does

it require conformity to any requirements

o 12(a)(2) 33 rule on truth / material facts

o SEC enforcement provision Rule 17(a) can make offer, not flatly prohibited but focused on

written communication

y Start sending customers prospectus may wait until after SEC notes

o Important because:

Marketing shares to get people to buy

Determine supply and demand point

y SEC sets own rules for what content must be, pursuant to 10 and

o Rule 430 requirements for preliminary prospectus (doesnt require all deal related info to be

included) part I of registration statement

Part II are materials included in registration statement, but doesnt have to be in

prospectus

2(a)(10) bottom, p3 ad shall not be deemed a prospectus if it states from whom a written prospectus

meeting the requirements of section 10 may be obtained and, in addition, does no more than identify the

security, state the price thereof, state by whom orders will be executed, and contain such other information as

the Commission, by rules or regulations deemed necessary or appropriate in the public interest and for the

protection of investors, and subject to such terms and conditions as may be prescribed therein, may permit.

y 2(a)(10)(b) tombstone, NOT a prospectus

Rule 134, p47 another thing NOT deemed a prospectus

y Used primarily by underwriter for use with investors

y Can send something to customer to allow them to express if they have any interest

y Does require a legend, per 16, p134

y Rule 134(d) may solicit from the recipient of the communication an offer to buy the security or request

the recipient to indicate whether he or she might be interested in the security, if the communication

contains substantially the following statement: No offer to buy the securities can be accepted and no part

of the purchase price can be received until the registration statement has become effective, and any such

offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time prior to

notice of its acceptance given after the effective date.

o Separate permitted communication during waiting period

Rule 405 defines free writing prospectus

y If it isnt under Rule 134, and isnt a preliminary prospectus, then its a free writing prospectus

***Prospectus Options:

y Rule 430 complies with 5(b)(1) and 10

y 2(a)(10)(b) carves out of 10

o Rule 134

y Rule 433

Rule 164 and 433 must satisfy free writing prospectus, p144

y Can say more than or cover things that arent in preliminary prospectus

o But must be consistent with preliminary prospectus

y Not part of registration statement (unless you choose to file it as part of reg statement dont do this!)

y Must contain a legend informing reader that registration statement is filed, and how they can get copy of

preliminary prospectus EDGAR website, SEC, or call toll-free # from underwriter

y Can also provide hyperlink to website of issuer or underwriter (this is something you can add), but still

have to give URL for registration statement

y Issues:

o Can create more risk for issuer

o If hyperlink other things to free writing prospectus, may be deemed to be part of it want to keep

anything else on website separate to not allow courts to see it as one

y Filing with SEC:

o Free writing: must be filed on same day as first use

o Journalistic report will be deemed free writing prospectus once it appears; doesnt have to have

legend, but has to be filed with SEC within 4 days of issuer or underwriter becoming aware of it

y Purpose: can have additional disclosures as long as not inconsistent with preliminary prospective, have a

legend, and filed same day as first use

o NOTE: If WKSI, can use free writing prospectus prior to filing of registration statement, as long as

filed on date registration is filed also

Rule 15c2-8: Free writing prospectus can only be used with people who have received preliminary prospectus

before or concurrent with free writing prospectus, if not reporting company yet

y If electronic, then can accomplish delivery requirement of prelim prospectus by having link in free writing

prospectus

y If seasoned issuer, can deliver free writing without prelim prospectus, BUT must provide that registration

statement is filed in legend (required)

P147, d(1) any offering participant other than issue shall file

Rule 164(a) In connection with a registered offering of an issuer meeting the requirements of this section, a

free writing prospectus, as defined in Rule 405, of the issuer or any other offering participant, including any

underwriter or dealer, after the filing of the registration statement will be a section 10(b) prospectus for purposes

of section 5(b)(1) of the Act provided that the conditions set forth in Rule 433 are satisfied.

y SEC complies with 5(b)(1) as complaint with 10(b) as long as you satisfy Rule 433

y Rule 164 gives some leeway if miss something (no legend, forget to file, etc), as long as in good faith and

quickly rectify, then wont lose protection of Rule 433

o Broad concept because encompasses anything thatll be linked to preliminary prospectus

Anything linked is free writing prospectus

Road Show, p150, Rule 433(h) - definitions

y When management of company and underwriters travel around to major investment centers and put on

presentations to prospective (usually only institutional) investors

o Formerly invitation only, closed

o Oral presentations are fine BUT if start handing something out, ppt slides, etchave to comply

with 10

o If record / graphic road show possible and popular, but still must follow rules

Generally need not be filed; BUT if road show is for common stock by non-reporting

company, and graphically recorded, then must be filed unless issuer makes it available for

anyone to see

y Road show = an offer that contains a presentation regarding an offering by one or more members of the

issuers management and includes discussion of one or more of the issuer, such management, and the

securities being offered

y Brokers go out, drum up interest, etc.

Rule 15c2-8: SEC will not grant acceleration until confirm everyone on interested list rules require most recent

prelim prospectus (red herring) must be distributed at least 48 hours before any confirmed sales

y Allows seller enough time to review if they want to change / sell / cancel order

Problem 4-12, p176

y Broker telephones client and strongly recommends stock he sends prelim prospectus

y Issue: does this violate any securities law?

o NO allowed because done orally; doesnt have to have prospectus first

Problem 4-13, p177

y Broker follows-up sends letter saying still good buy

y Issue: does this violate any securities law?

o YES! Should comply with securities law

Rule 433 has to be filed too extreme for this case, where the note itself has to be filed

with SEC

Rule 134 ok, could consider as not a prospectusbut cant put in personal opinion if

included, must have legend (from 134(d))

If really wants to use this document as described in problem, then need to file it with SEC

probably extreme; more likely to just rely on telephone

y More grey area: voicemails just leave name, call back re:

Class #8: 1.19.11

INSERT MISSING NOTES:

Problem 4-14, p177

y Sum:

y Issue:

Problem 4-15, p177

y Sum:

y Issue:

Problem 4-16, p177

y Sum:

y Issue:

o Covered by 2(a)(10)(b)?

Problem 4-17, p177

y Multiple underwriters prepare and distribute own sales brochures to broker and potential customers; not

shared with other underwriters in offering and not filed with SEC

y Issue:

o Free writing prospectus needs legend and to be filed

o Any writing thats not prelim prospectus thats used during waiting period has to find a lawful

home somewhere

Not tombstone beyond 2a10b

Beyond Rule 134

Only remaining lawful alternative is Rule 433 to comply with all requirements is

offering participant used in Rule and refers to underwriters

y Have to know price range has been disclosed (pre-condition for free writing

prospectus in connection with non-public company)

Problem 4-18, p177

y Omegas registration statement lists its web site address there has hyperlink to trade pub touting

Omegas more recent product

y Issue:

o Ok re: prospectus; dont have to worry about fulfilling requirements for free writing prospectus

o What about trade pub article being reproduced?

Ok to advertise current products during waiting period Rule 169 expressly includes

under 169(b)(1)-2

y BUT If on website for first time after filing, then not same time, manner or form

(169(d)(2)) becomes free writing prospectus now under Rule 433

Under Rule 433, has to be filed with SEC, includes legend, click through prospectus to get

to ad, etc. because has to show delivered concurrently or previously

y These are the risks for companies going public

y Any info that will color investors perspective on whats being offered, then need

the stop, look and listen warning

o Ex: Goldman Sachs revamped efforts over weekend to only sell to

offshore clients re: Facebook shares to avoid being non-compliant

Problem 4-19, p177

y Alice, VP Finance, undergoes interview with underwriters digitally recorded and placed on Hadleys

website and available to public

y Issue:

o This is a free writing prospectus

But open interview with journalist covered under Rule 433(f)

File within 4 days and not paid for interview with public then ok

o What if considered a road show?

Doesnt have to be filed as long as its posted online / graphic communication made

available and openly to public

y Slightly ambiguous as to how its availablejust issuers website? Underwriters

website?

o Issuers website doesnt have to be filed conventionally itll be here

o Underwriters website seems to need it to be filed

Must include issuer and not just underwriters

Problem 4-20, p177

y Alice sends email to all employees speaks optimistically about Omegas future then posted on popular

online chat room

y Issue:

o Should attach prospectus with email

o Should file with SEC same day as email

o Include legend

y What if VM?

o Not oral communication lots of VM these days distributed as attachments to emails!

Class #9: 1.24.11

5 path to registration

y Potential exempt via 4

y Pre-filing period

y Waiting period

o Prospectus

o Free writing prospectus (if any)

y (Acceleration to) Effective Date

y Post-filing period

o Final prospectus

y Later: secondary Market

o 34 Act reporting requirements

5 after Effective Date

y 5(a) - prohibits sales until effective

y Can now make sales, send bills in form of confirmation

o Now at effective point, 5(a) is gone

o 8 is also not application

Only 5 requirement left is prospectus delivery requirement from 5(b)

o Now will also distribute final prospectus

What happens in post-effective period if

y Something wrong in prospectus OR

y Facts change from what was recorded in prospectus on effective date

Rule 430(a), p138

y Caption prospectus for use prior to effective date

o But suggested final prospectus needs offering price and other details that are allowed to be

omitted from prelim prospectus

o Rules proscribe final prospectus can be created from prospectus thats missing info, but then filed

as addendum to prospectus within 15 days of effective date, and is then deemed part of the

prospectus once filed

o Final prospectus becomes selling doc

Rule 433: If use free writing prospectus after effective date:

y Legend

y Filing requirement

y Note: these 2 requirements not eliminated after effective date

Rule 2(a)(10)(a), p3

y except that (a) a communication sent or given after the effective date of the registration statement

(other than a prospectus permitted under subsection (b) of section 10) shall not be deemed a prospectus

if it is proved

y Can continue to use free writing prospectus but note, if going to use 433 prospectus, should probably

deliver final first or concurrently

o Seems silly (to Prof) to file free writing prospectus after already effective

Prospectus Requirements post-effective date

Former: Cant solicit without delivering final prospectus

Current: SEC has relaxed these rules

y Ex: Rule 172 can send a confirmation without it being a prospectus

o Also if deliver a certificate for security doesnt have to give prospectus first

4 Exemptions

y 4(1) exempts transactions NOT by issuer, underwriter, or dealer

y 4(2) exempts transactions by issuer NOT involved in IPO

y 4(3) gives complex rules for dealer acting as an underwriter

y 4(4) when customer comes to broker unsolicited and asks to buy exempt from 5 and from prospectus

delivery requirements

Rule 173

y Underwriter must deliver a final prospectus within 2 days of effective date; BUT sufficient to satisfy simply

by giving people a notice that registration made pursuant to prospectus

o Giving notice under 172(a)(1) NOT a prospectus; satisfies requirement from Rule 153

Big exception: 4(4)

Rule 153 for already public organizations

y Relaxes rules re: delivery requirements from 5(b)(2)

y Have to be already listed on exchange before effective date

o Delivery requirement then only 25 days (not 40 or 90 days as seen in 4(3)

Problem 4-21, p181

y Omegas registration with 2M shares with IPO price of $15 pps effective on July 1 after, shares will trade

on NASDAQ

y Hadley emails copies of WSJ to customers, including info not filed with SEC email contains hyperlink to

final prospectus online

y Issue:

o Covered because had hyperlink right to final prospectus satisfies deliver requirement,

concurrent is OK

Writing now evolved to encompass electronic communications

Problem 4-22, p181

y Hadley emails confirmations of sales to all customers who made offers to purchase; earlier given prelim

prospectus and most consented to ecopy; informs customers to where to find term sheet online

y Issues:

o Is confirmation a prospectus?

Under 2(a)(10) if this is a prospectus which must be accompanied by final prospectus

Exempt from delivery requirements under 5(b)(1), not a prospectus

Filing under Rule , p147

y When not part of filing requirement, under d(1)(i)

Problem 4-23, p181

y One of underwriters sold entire allotment by 7/5; on 7/10 one of brokers suggests a customer purchase a

block on NASDAQ, and he agrees; must the underwriter forward a final prospectus to client?

y Issue:

Problem 4-24, p181

y

Problem 4-25, p182

y Unsolicited transaction exempt under 4(4) from 5, and also thus exempt from delivery requirements

Problem 4-26, p182

y Hadley makes term sheet available

y 15(c)(2)(8) by Hadley providing term sheet, its requirements are fulfilled

o Brokers must have all necessary documents prelim prospectus, term sheet, etc.

Analysis Order

y 4(4) to see if any exemptions from delivery

y If delivery requirement, analyze under Rules 172, 173, and 174

y If already traded, Rule 153

Class #10: 1.25.11

Decision Tree requirement for registration:

y 5 applies equally to any seller

y Exemptions that exclude compliance with 5

o Some under 4

o Use S-1

y Route #1: non-public company (from yesterday)

y Route #2: already public company

o Still has to comply with 5 unless transaction is exempt

o Different route following cap markets hypothesis

o Use S-3 : other alternative for fundamental sales by issuer to public

Integrated disclosure system mostly S-3

y If already filing 10-K, 10-Q, and 8-K forms then can be incorporated by reference in S-3

o Means that all items that you have to respond to in S-3 can be satisfied using existing forms and

their data

o Standards in S-3 as to who can use it

Qualifications for issuer to see if they satisfy standards to qualify

Which transactions can it be used for

y Can rarely use integrated disclosure for S-1, under 7

y Missing from 3 forms that must be added in S-3:

o Elements of specifics regarding issue:

Use of proceeds

Distribution method

Price

Underwriters

Levels of Issuers

y WKSI Well Known Seasoned Issuer

o Can use S-3; doesnt take a lot to be a WKSI: $700M of market cap (# common shares outstanding

* pps)

y Seasoned Issuer

o Filing under for at least 12 months, but doesnt meet WKSI

o Can use S-3

y Unseasoned Issuer

o 34 Act company, BUT doesnt meet requirements of seasoned issuer

y Unregistered Issuer

o Fall under Rule 433(b)

Rule 163, p88 only for WKSI ISSUER

y Allows WKSI to make offer prior to registration statement (overrules 5(c) for WKSI)

y 163(a) any written communication that is an offer made in reliance on this exemption will be a free

writing prospectus as defined in Rule 405 and a prospectus under section 2(a)(10) to be covered by the

registration statement to be filed; and (b) exemption from section 5(c)

o Issuer-only rule

o Treated as free writing prospectus i.e., must be filed with SEC and have legend

Note: if legend omitted and good-faith attempt to comply, then not violation iffiled

asap after discovery that need to file

Rule 168, p ONLY FOR ISSUER

y Allows issuer to include forward-looking material, but still limited by time, manner, and form

o Also cannot refer to offering

y Still have Rule 135 available

y Brokers could also use Rule 134, at least during waiting period

y Parallel that allows company to continue to disclose info as it has done in the past, even as its embarking

on new offering

Rule 137, 138, 139 FOR BROKERS

y Acknowledge appropriateness for brokerage community to continue doing what its been doing, so long

as it doesnt attempt to condition the market

y Idea: if already public and trading, why do we care anyway?

o Answer: if brokers could hype market in any way, want to be sure those buyers have info they

need before committing themselves to buy

o Whats in S-3 (or S-1 for unseasoned issuer) will tell what companys going to do with money

SEC wants this info in registration statement and disclosed

y Apply throughout all periods

y NOTE: doesnt include 135(a) that ONLY applies to mutual funds

y 137 allows broker-dealers who arent part of offering to continue in what theyve been doing (aka

nothing to gain by hyping interest in offering)

y 138 only available when it is reporting company and CURRENT in 34 Act reporting

o Available whether or not participating in offering, but limited exception = can only comment on

securities that are NOT economic equivalent of offering

Ex: if stock offering, then can comment on debt, but NOT on stock price

y 139 allows broker, whether or not participant in underwriting, to continue what its been doing if

company qualifies for S-3 AND current in 34 Reporting AND already been commenting on company in the

same way

o Alternative: can issue a report about industry in which company is involved, as long as issuer is

reporting company and report has info on substantial # of similar companies

Substantial vague word, may be factor based on industry or court

Problem 4-27, p191

y Omega now a reporting company eligible to use S-3 but not a WKSI

y 4/15 just before filing, PR prepared a brochure highlighting companys development - indicates intent

for offering and estimates future production capacity

y Issue:

o Not a WKSI, so cant use free writing prospectus prior to filing

o Rule 135 not available

o Rule 168 available but 168(c) exclusion exists around any communication containing info

related to offering; therefore, the brochure as is stands is INVALID

Problem 4-28, p191

y Now issuer is WKSI

y Issue:

o Can use more flexible Rule 163

WKSI can publish info before registration is filed

Can function as free writing prospectus: but still need to file and have legend (combine

Rule 163 with Rule 430)

Problem 4-29, p191

y Issuer is WKSI and brochure prepared by broker; circulated it on 5/2 to institutional clients

y Issue:

o Rule 168 is ONLY for issuer, and this is an underwriter not available

o Rule 137 is ONLY for non-participating brokers not available

o Rule 138 is ONLY for not same security as issue not available

o Rule 139 issuer-specific report; could use if the below are true:

Issuer must be eligible for S-3: yes

Current in 34 Reporting: yes

Already commenting in same way: yes

o Rule 433 allows underwriter to participate in something like this after registration if free writing

prospectus requirements are met:

Legend

Filed

Etc.

NOTE: in reality, managing underwriter would KILL if this actually happened!

Problem 4-30, p191

y If issuer cant use S-3, does Problem 4-29 change?

y Issue:

o Rules 137 139 not available because 1) participating broker; 2) same as issuing security; and 3)

cant use S-3

o Rule 433 follow free writing post-registration rules and then can use this!

Problem 4-31, p191

y 5/1 after filing registration statement, issuer placed on web site a section labeled Historical

Developments with a report on Omega prepared by non-participating in offering

y Issue:

o Rule 137 protected for broker

o What about Omega / rule for issuer?

Rule 168 for reporting companies with forward-looking info, BUT has to be same time,

manner and form

y Violation!

Rule 433(e)(1) re: items on issuers website

y 433(e)(2) allows separate section of companys website to contain historical

info thats not linked to any offering materials

Problem 4-32, p191

y C-suite execs meeting with journalists just minutes before statement is effective; Omega provides

hyperlinks to some of these stories that arise

y Issue:

o Rule 168 prohibited to talk about offering

o Rule 433(f)(1)(ii) treat as free-writing prospectus

Issuer has to file within 4 days re: journalist articles

NOTE: really quit talking to press to avoid these scenarios

y Dont do this not good form

Problem 4-33, p192

y Broker made plans to send to several institutional clients as email day after filing confirming its purchase

of Omega shares

y Issue:

o Must satisfy what requirements to deliver prospectus:

Rule 174(b) reporting company, doesnt need to send prospectus

Rule 172 dont have to send prospectus with confirmation

NOTE: Free writing prospectus under Rule 433(b)(1) for WKSI and seasoned issuer dont have to deliver

prospectus as long as its filed

Class #11: 1.26.11

Rule 415 shelf registration rule

y Historical idea: Takedown take securities off the shelf and sell them

y Lots of sub-categories under this rule

y If shelf is S-3, constantly kept up-to-date by filing forms as required doesnt become stale because of

integrated disclosure system auto updates every time you file something under 34 Exchange Act

y Note: Every quarter want registration statement out there getting updated every quarter by new filings

y Delayed basis:

o When looking for market to be right

Ex: want to sell bonds, but only want to sell when market is right

y List class but not price then can list them immediately when market is better

y Have effective registration statement, then take down bonds when ready to

market with price

y Condition:

o Will have shelf continually updated by quarterly filings, so have to commit that if fundamental

change to any info, then will amend registration statement

Telling SEC: let us go effective, and then if anything fundamental well be sure to update it

y S-3 filers: will be incorporated likely by reference

y If not, have to file post-effective amendment, which wont become effective for

48 hours

y Hiccup: what is fundamental vague; more than material, but what we dont

know

y Becoming standard for most companies

Rule 415.1.b / Rule 462(b) - Automatic shelf

y For WKSIs only - As part of increased flexibility with 33 Act

y Goes effective IMMEDIATELY

y Have to file a new one every 3 years (or they expire)

y Poised to raise money on a moments notice; effective with flexibility id classes of stock without pricing

or listing volume

Rule 430.B how much can leave out of shelf registration

y When know if doing takedown, then can file remaining docs / fill in blanks and go ahead with offering

y Sets forth contents required for base prospectus thats part of registration statement not a final

prospectus, but becomes final when supply missing info

o Registration is active, but prospectus not final

o Does become part of registration statement when final deals with 11

11 civil liability options for truth / completeness in registration statement

Rule 424

y Provides mechanism and sets for how to supply missing info: pricing info, # shares, method of distribution

Problem 4-34, p199

y S-3 eligible company; common stock already trading, wants to register convertible bonds to 50 shares at

option of bond holder

y Company wants to sell bonds at 11% but market is 12% - doesnt want to sell yet, wants to wait until

interest rates drop and be ready; files self registration statement

y Issue:

o 2(a)(3) when a sale occurs, has a carve-out for ____

But really an offer of underlying security offering both bond and stock, unless terms of

conversion right are that it cant take place until some date in future after sale of bonds

o Will shelf registration be allowed for both securities?

415(a)(1)(10) securities registered on Form S-3 which are to be offered and sold on an

immediate, continuous or delayed basis by or on behalf of the registrant, a majority

owned subsidiary of the registrant or a person of which the registrant is a majority-owned

subsidiary

y Shelf registration statement to encompass 2 classes of securities (stock and bond) combined under this

rule as under 1 registration statement

Problem 4-35, p199

y Company considering raising capital, but dont know what kind of security want to issue

y Issue:

o If S-1 company, can it use shelf reg to register multiple classes of securities without committing to

what securities it will sell?

NO! Rule 430B allows for flexibility if you file an S-3

y Doesnt apply here

o If could use S-3 but is a WKSI, then use Rule 415.a.1.10

o If WKSI, can list everything without specifying

NOTE: as you go up scale from S-1 to WKSI, greater flex possible

y Efficient market theory: larger market cap of company, more amount of info

available, more flexibility available

Problem 4-36, p200

y Small unseasoned company has OTC market shares traded reporting co for less than 1 year; stockholder

wishes to sell significant amount of stock

y Issue: can she register her shares for secondary offer sale?

o Rule 415.a.1.i permits secondary offering

o Any registration statement still has to be filed by issuer and signed S/H could have contractual

right to force issuer to do sobut

Problem 4-37, p200

y WKSI that encourages employees to own stock in company; has program to buy as payroll deduction

y Issue: does this need registration statement?

o Continuous offering, so good candidate for shelf registration

o Rule 430A can leave off lots of info and supply as sales are made by filing prospectus

supplement from time to time

NOTE: Shelf is important and flexible tool for corporate financing

y Offerings that facilitate capital raising and, in some cases, employee ownership participation

TIMELINE

y Carries as long as 3 years past filing date

y Post-effective period 2 concerns:

1. Find out something wrong with registration statement on effective date: material inaccuracy

Exposes issuer to liability under 11

Must file post-effective amendment to correct info not effective until amendment is

effective therefore if any further sales made pursuant to registration statement, tried to

limit liability for sales coming after

y Most sales are immediate and therefore shouldnt make difference when

amendment occurs in practice, but still important

2. Facts change after effective date: supplementing info

Issue: secondary market or further sales after effective date

y Remember: prelim prospectus cant be circulated for offers; but final prospectus

can be

o Thus can amend registration statement but can correct sticker (p207)

Rule 424 sticker to update prospectus

y Also amend registration statement, as common practice

12(a)(2) requirement of truthfulness

Rule 10b-5 ______

Problem 4-38, p201

y Registration statement became effective 7/12, and reporting owning 900K acres; on 7/18, 350K acres lost

to forest fire

y Issue:

o No complaints because accurate on effective date

o What if surveyor error and had less than 900K acres?

Creates 11 liability because statement inaccurate on effective date

8 stop order approach?

8(b) refusal order

y Bars filed registration statement from becoming effective

y Limited use only for patent misstatements and omissions

o Notice of hearing required within 10 days of the statements filing - and then hearing occurs

within 10 days of notice

o 8(a) requires registration statement become effective within 20 days of its filing small

window for refusal order

o Rule 473 procedure for a permanent delaying amendment continuously tolls the

commencement of the 20 day period (mitigates the 20 days under 8(a))

8(d) stop order

y More frequently used than 8(b) refusal orders

y Allows SEC to stop if appears registration statement contains untrue statement(s) of material fact; used

even when the offering has been completely sold

y Serves as a notice to investors materially misleading disclosures from registration statement

o Can be used before and after effective date

o 8(e) can issue stop order solely on basis of issuer or underwriters failure to cooperate with SEC

investigation

Post-effective Period Changes to be Materially Misleading

y 8(d) Note: does NOT include changes that make truths at time of registration statement now misleading

during post-effective period

o Makes 8(d) consistent with 11 liability exists when materially misleading at effective time

y 12(a)(2) available for those who purchase security which has registration statement become misleading

after effective date

y 8A SEC can issue cease and desist order or invoke 20 to obtain federal court orders to prevent violation

of SEC Acts (for ex: under 17(a) for antifraud)

5(c) no offers to buy or sell allowed when refusal or stop order issued

y If reg statement already effective, then 5(c) bars any public proceeding or exam under 8

8(e) investigations under 8 that are NOT public

8A gives SEC power on emergency basis to enter cease and desist order administratively

y Not common, but SEC doesnt independently investigate facts; rely on company for facts

8-K form used to correct registration

y Thus market has everything available thats current

y 8.01 allows 8-K to be used for reporting any material developments

y Nothing mandates disclosure of any material event, BUT protects company from 11 liability so

companies use 8-K at their discretion

***

Trading Rules

y Covers what happens after effective date and offering as trading develops

y Trading market allows for possibility of manipulation particularly if market goes down

Desire to have liquidity; but also restraints that prevent manipulating price in period after

offering

y Regulation M out of 34 Exchange Act p801

o Act deals with secondary market and trading

o Puts limits on purchases under certain circumstances lots of definitions, but also lots of

exemptions

Ex: Research reports (from Rules 138 / 139) considered exceptions

If actively traded, then exempt

y Actively traded = >$1M traded per day, public float of $150M+

Reg M, Rule 102 prohibits ___ by issuer during this period

o Designed to allow trading after IPO, but limiting to restrain manipulation

Class #12: 1.31.11

Problem 4-40, p210

y Status as of March 12

th

on day of purchase, not yet an underwriter

y Restricted Period, 2 For all other securities, the period beginning on the later of five business days

prior to the determination of the offering price or such time that a person becomes a distribution

participant, and ending upon such person's completion of participation in the distribution

o March 15 5 = March 10

th

; distribution participant = March 15

th

(winning bid awarded) later of

two, thus March 15

th

begins restricted period

o But Hedley didnt know if theyd be accepted; dont fit test of prospective underwriter no

reason to believe they knew theyd win

o If bought on March 12

th

, then ok NO violation

Rule 100, p804 Regulation M

Rule 104 Stabilization

y What an underwriter can do during an offering pre-offering and post-offering activities, that will be

permissible and not violate Rule 101

y Rule 508(l) - Have to disclose in prospectus registration statement

y Allows underwriters to initiate and change stabilizing bids based on price in principal market

o So long as bid does NOT exceed offering price

y Only permissible to prevent or retard a decline in price cannot be used to move it up

o If offering is made at the market then cant stabilize

o CANNOT stabilize at price higher than offering price no higher than last independent price

If no market, then can stabilize no higher than offering price if stabilizing bid was made

before market developed (rare)

o Can increase stabilizing price only if someone else has moved the price up must follow market

Problem 4-41, p212

y Maintained bid at $9 prior to effective date to absorb selling interest at that price

y Last quoted price before offering - $9.25

y Last sale was $9.50; Hedley then increases bid to $9.50

o Can initiate stabilization NO HIGHER than last independent bid

o Thus this is OK (cant go above it)

International IPOs

y Foreign-private issuer non-governmental entity, organized in a foreign country, organized in the US

markets

o Use forms F-1 or F-3, parallels (but not identical) S-1 and S-3; somewhat loosening of disclosure

standards to facilitate access to US capital markets

US companies selling overseas

y Implications re: interstate commerce

y Rule903(b) under Regulation S -in effect a safe harbor; if you fit within one of categories within

Regulation S; then wont have to comply with 5

o Only outside of 5, not any other rules

o Registration exemption (NOT a fraud exemption)

Regulation S

y Little risk that securities will bounce back into US as run around 5

y Category 1: Foreign Issuers with no substantial US market interest; overseas directed offerings; securities

back by full faith and credit of foreign government; employee benefit plans

y Category 2: Reporting US issuers debt securities; foreign issuers debt securities; reporting foreign issuers

equity securities

y Category 3: all other issuers

o Greatest restrictions among 3 categories

y 2 basic requirements:

o Transaction is offshore as defined in rules

Sales made in foreign exchange trading floor

In offshore market and not pre-arranged to flow back to US

o No offers made to US persons

y NOTE: If a single offering, have to find a single exemption that covers all the sales

o If you have a valid Regulation S exemption, then there wont be integration dependent upon

Regulation S exemption being fully complied with (???)

Regulation S issues with internet

y If can access offering online from US portal, then its considered offering to US

o Therefore must assure that only qualified investors (those allowed to buy overseas) are the only

with web access to site, or use password

Based on what local law requires

y Ex: if offered in Spain, must comply with Spanish laws

o Comply with US law if comply with Regulation S then dont need

registration statement in US

Rule 135(c) allows US journalists to attend press conferences overseas, as long as press conference held

overseas and with no offering in US

Problem 4-42, p230

y Textron common stock on LSE and NYSE; of trading volume on each

y Issues:

o Regulation S?

Not Category 1 because US market

y P181 substantial US market interest defined 20%+ on NYSE, and less than

55% on single other country exchange

Rule 902(b)(1)

y (i) no because no substantial US interest in securities being offered

Category 2 YES!

y Foreign-private issuer offering securities overseas registered and reporting

under 34 Exchange Act

y Sale to US citizens overseas?

o NO because US person; Rule 902(k) any natural person resident in US