Ir 595

Diunggah oleh

Gaurav Singh PannuJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ir 595

Diunggah oleh

Gaurav Singh PannuHak Cipta:

Format Tersedia

1

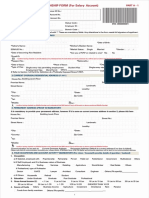

IR 595

March 2014

IRD number application individual

To apply for an IRD number for you or for a child in your care

1. Use the applicant checklist on page 2, complete the form on page 3 and sign the declaration on page 4. Take the form with current

supporting documents (documents that have not expired), for an In person verification to an authorised Inland Revenue agent.

These are:

Automobile Association (AA) Driver Licensing Agents

PostShops and selected New Zealand Postshops.

2. You must provide one original document from Category A, and one original document from Category B with your application, as well as a

legible photocopy of each of your documents.

Category A documents

Full New Zealand birth certificate issued on or after 1 January 1998

New Zealand passport*

Overseas passport* (with New Zealand Immigration visa/permit or entry stamp, or call Inland Revenue on 0800 227 774 for exempt list)

New Zealand emergency travel document

New Zealand firearm or dealers licence

New Zealand refugee travel document

New Zealand certificate of identity (issued by Department of Labour or Department of Internal Affairs)

New Zealand citizenship certificate

* If you are providing a passport please photocopy the page/s showing your photo, name, any pages showing current work, visitor permits or residency

documents, and a specimen signature.

Category B documents

New Zealand driver licence

New Zealand 18+ card

New Zealand student photo identification card

A letter confirming registration as a student in New Zealand**

An offer of employment letter from your employer, on their company letterhead with start date of employment**

International Drivers Permit (issued by a member country of the UN Convention on Road Traffic)

Overseas Drivers Licence (accompanied by an English translation completed by an LTNZ authorised translator, if not already in English)

** If this document is used you must provide a document from category A that contains a photo.

If youre not able to provide the required documents from category A and category B, please call us on 0800 227 774 to discuss your

options.

3. If the documents you provide are in another name, you must provide an original document that confirms how your name was changed,

eg, marriage certificate, deedpoll, change of name certificate, civil union certificate, and a legible photocopy of that document.

4. If you are applying for a child who is in your care and they are under 16, you must provide:

For the child

One original category A or B document and a legible photocopy

For you

Full proof of your own identitysee 2 above.

An original document and legible photocopy which shows the relationship between you and the child, if not already shown in the

category A document for the child, for example:

a New Zealand full birth certificate issued on or after 1 January 1998 for the child

court documents showing child and caregiver names eg adoption papers, parenting orders, guardianship orders

a Statutory declaration (IR 595D)you can download this from www.ird.govt.nz

Note: If youre the parent of a new baby and you havent registered their birth yet, you can apply for your babys IRD number at the same time as

you complete the birth registration form. You dont need to complete this form or provide verification at an authorised agent if you do this.

5. The completed application form and the photocopies youve provided will be kept by the person who verifies the application. They will

forward the application and photocopies to Inland Revenue and return the original documents to you. You will receive your IRD number

from Inland Revenue within 810 working days of Inland Revenue receiving the application form.

2

Notes

Completed each part of form marked

Question 1 children under 16

If youre making the application on behalf of a child, the IRD number shown here must belong to the person who will be providing the relevant

documents identifying their relationship to the child.

If youre making the application on behalf of a child for Working for Families Tax Credits, the IRD number shown here must belong to the principal

childcarer.

Question 2 applicant information

If youre completing the application for a child, enter the child information in this section.

If youre completing the application for yourself, enter your information in this section.

If you are using a preferred name, that is dierent from your given name, you must provide documentation conrming your preferred name.

Question 7 address information

Residential address

Please show a physical address, not a PO Box number or private bag. If you have a rural address, write the property and/or rural road name on line 1

and the rural delivery (RD) number and town on line 2.

If you want your correspondence sent overseas please show the address you want it sent to.

Postal address complete only if its dierent from the residential address. Show one of the following:

PO Box

Line 1 PO Box number

Line 2 box lobby

private bag

Line 1 private bag number

Line 2 box lobby

Dont show your tax agents address here.

Question 9 temporary tax exemption on foreign income (Complete this question if you are continuing to receive income from overseas)

You qualify for a temporary tax exemption on foreign income for four calendar years (up to 49 months) if you meet both of these requirements:

You qualied as a tax resident in New Zealand on or after 1 April 2006.

You havent been a New Zealand tax resident at any time in the past 10 years prior to your arrival date in New Zealand.

Please note:

You can only claim this exemption once.

You cant receive Working for Families Tax Credits while being tax-exempt from foreign income.

For more information on temporary tax exemption on foreign income, go to www.ird.govt.nz

Question 10 non-resident contractor

If you have arrived in New Zealand to work as an independent contractor (whether the person paying you is a New Zealand resident or not) you will be

a non-resident contractor for the rst 183 days (in any 12-month period) of your presence in New Zealand.

You arent an independent contractor if you are working as an employee receiving salary and/or wages from an employer.

Nominated persons

We cant discuss your tax aairs with anyone except you. However, you can nominate someone else to do this for you and have access to your

Inland Revenue records once you have received your IRD number.

Youll still be responsible for your own tax aairs, so youll need to make sure any returns are led and tax is paid by the due date.

For more information, or to nominate someone to act on your behalf, complete an Elect someone to act on your behalf (IR 597) form. You can get this

from www.ird.govt.nz or by calling 0800 257 773 (remember to have your IRD number with you).

Applicant checklist

Have you:

provided a current category A original document and photocopy/s?

provided a current category B original document and photocopy/s?

provided current photocopies of any additional documents?

provided linking documentation for child?

completed your part of the application form?

signed the application?

Please tear o this portion after you have had your identity veried in person and keep it for your records.

3

IR 595

March 2014

IRD number application individual

Children under 16

1. If you are applying for a child, print your own IRD number here.

Applicant information

2. Name of applicant as shown on identity documents

First name(s)

Surname

Title Mr Mrs

Miss

Ms Other

Preferred name First name(s)

(refer to notes page) Surname

3. Date of birth

Day / Month / Year

4. Please tick to show if you are:

applying for an IRD number

requesting confirmation of your IRD number

5. Previous name First name(s)

(maiden name, known as,

change of name)

Surname

Address information

7. Residential address (not a PO Box or private bag number)

Street address

Suburb or RD Town or city Country Postcode

Current postal address (only if its different from your home or street address)

Street address

Suburb or RD Town or city Country Postcode

Previous address (this will help us to confirm your IRD number if one may have been issued previously)

Street address

Suburb or RD Town or city Country Postcode

8. Contact number(s) (include area code)

Daytime Evening Fax Mobile

Email

Tax exemption and non-resident contractor information (refer to notes page before answering)

9. Do you qualify for a temporary tax exemption on foreign income?

Yes

No

If Yes, please print date of arrival in New Zealand.

Day Month Year

10. Are you a non-resident contractor?

Yes

No

OFFICE USE ONLY

IRD number issued/conrmed

Please read the Notes section before you complete this application

Please complete this application using capital lettersdont use abbreviations

Please complete application in blue and/or black pen.

(8 digit numbers start in the second box. )

4

Stamp

Verifier use only

Information verified by

Print name Name of organisation and branch

Date

Day Month Year

Documents provided

Adult Category A Yes/No

Category B Yes/No

Category C Yes/No (IRD verifier only if Yes, please note reason Cat.C has been accepted)

Urgent Yes/No (if Yes, please note reason why urgent)

Notes

Child Category A Yes/No

Category B Yes/No

Linking document Yes/No

Urgent Yes/No (if Yes, please note reason why urgent)

Notes

Identified by interview:

(tick if applicable) Date interviewed

Day Month Year

Non-resident contractors/entertainers

Company

Employment start date

Employment end date

Privacy

Meeting your tax obligations means giving us accurate information so we can assess your liabilities or your entitlements under the Acts we

administer. We may charge penalties if you dont.

We may also exchange information about you with:

some government agencies

another country, if we have an information supply agreement with them

Statistics New Zealand (for statistical purposes only).

If you ask to see the personal information we hold about you, well show you and correct any errors, unless we have a lawful reason not to.

Call us on 0800 377 774 for more information. For full details of our privacy policy go to www.ird.govt.nz (keyword: privacy).

Declaration please read carefully before signing

I declare that the information in this form is true and correct.

I authorise Inland Revenue to contact any agency that issued a document I have used in support of this application, to verify the details of

that document for the purpose of this application.

I have read the privacy statement above before signing this declaration.

Signature Date

Day Month Year

Please complete the applicant checklist on page 2.

DO NOT post your application to Inland Revenue, take this form with current supporting documents to a verifier.

RESET form

Anda mungkin juga menyukai

- Ir 595Dokumen4 halamanIr 595ghostvalleyBelum ada peringkat

- IRD Number Application - Individual: Statutory Declaration (IR 595D) - You Can Download This FromDokumen4 halamanIRD Number Application - Individual: Statutory Declaration (IR 595D) - You Can Download This FromMarco AbreuBelum ada peringkat

- NatWest Current Account Application Form Non UK EU ResDokumen17 halamanNatWest Current Account Application Form Non UK EU ResL mBelum ada peringkat

- IRDDokumen6 halamanIRDKKBelum ada peringkat

- How to Buy a Home in USA; Complete Guide to American Dream: Foreign Consulting, #1Dari EverandHow to Buy a Home in USA; Complete Guide to American Dream: Foreign Consulting, #1Belum ada peringkat

- t1261 Fill 23eDokumen2 halamant1261 Fill 23eVladimirBelum ada peringkat

- How To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreDari EverandHow To Get IRS Tax Relief: The Complete Tax Resolution Guide for IRS: Back Tax Problems & Settlements, Offer in Compromise, Payment Plans, Federal Tax Liens & Levies, Penalty Abatement, and Much MoreBelum ada peringkat

- Individuals Fund Application April 2020: Privacy and EligibilityDokumen19 halamanIndividuals Fund Application April 2020: Privacy and EligibilityJordan BrodieBelum ada peringkat

- Account Opening Form (Individual - Single) : A. Applicant/Customer Identification ParticularsDokumen10 halamanAccount Opening Form (Individual - Single) : A. Applicant/Customer Identification Particularssujit kcBelum ada peringkat

- SLAMCI - Account Opening Form (IndividualDokumen6 halamanSLAMCI - Account Opening Form (IndividualNoknik OllirecBelum ada peringkat

- SUA Form DanelDokumen2 halamanSUA Form DanelDanel SanchezBelum ada peringkat

- Claim To Personal Allowances and Tax Repayment by An Individual Not Resident in The UKDokumen4 halamanClaim To Personal Allowances and Tax Repayment by An Individual Not Resident in The UKNab SahBelum ada peringkat

- Employee Application Form: Personal DetailsDokumen4 halamanEmployee Application Form: Personal DetailsaliceliaaliceliaBelum ada peringkat

- Allied Car Finance Application FormDokumen21 halamanAllied Car Finance Application FormSuhail AhmedBelum ada peringkat

- United Kingdom: To Be Completed by The CustomerDokumen4 halamanUnited Kingdom: To Be Completed by The CustomerTeja VaitlaBelum ada peringkat

- Current Account Application Form For Non-UK EU ResidentsDokumen11 halamanCurrent Account Application Form For Non-UK EU ResidentsarayBelum ada peringkat

- Application For Permanent Account Number (Pan) : IndividualsDokumen3 halamanApplication For Permanent Account Number (Pan) : IndividualsBharat PangeniBelum ada peringkat

- Tax Residency Form: Last NameDokumen1 halamanTax Residency Form: Last NameDumitru StratanencoBelum ada peringkat

- INZ 1202 Parent Category EOI OCT22 v2Dokumen20 halamanINZ 1202 Parent Category EOI OCT22 v2Adrian PelayoBelum ada peringkat

- NZMIT No 2 Fund Investment Application FormDokumen4 halamanNZMIT No 2 Fund Investment Application FormKing fairBelum ada peringkat

- Bond Refund FormDokumen2 halamanBond Refund FormJofamu100% (1)

- Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowDokumen2 halamanFatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned BelowRaviJhaBelum ada peringkat

- R43 2019 PDFDokumen4 halamanR43 2019 PDFDavid Mark AldridgeBelum ada peringkat

- NWB50014 Add A New Party To An Account 030615Dokumen7 halamanNWB50014 Add A New Party To An Account 030615SumBelum ada peringkat

- Tab Banking Form With Income Undertaking11111Dokumen5 halamanTab Banking Form With Income Undertaking11111Mahakaal Digital Point100% (1)

- Form 60 (PAN or FORM 60 Is Mandatory, If Form 60 Is Selected Then, Income Details Are Mandatory. If Total Income Taxable inDokumen4 halamanForm 60 (PAN or FORM 60 Is Mandatory, If Form 60 Is Selected Then, Income Details Are Mandatory. If Total Income Taxable inkkeyartBelum ada peringkat

- Application Form: Section A - Investor DetailsDokumen3 halamanApplication Form: Section A - Investor Detailsmarianne10Belum ada peringkat

- Ir 219Dokumen2 halamanIr 219Shaun LeeBelum ada peringkat

- INZ 1189 Tourist Business Visitor Visa App JUL21 1.0Dokumen12 halamanINZ 1189 Tourist Business Visitor Visa App JUL21 1.0KhanBelum ada peringkat

- Salary Account Opening FormDokumen12 halamanSalary Account Opening FormVijay DhanarajBelum ada peringkat

- FATCA CRS DeclarationDokumen4 halamanFATCA CRS Declarationashokdas test5Belum ada peringkat

- (Myanmar) Application of Limited Tax Rate On Domestic Source IncomeDokumen3 halaman(Myanmar) Application of Limited Tax Rate On Domestic Source IncomeTha OoBelum ada peringkat

- Expression of Interest Form: Principal ApplicantDokumen36 halamanExpression of Interest Form: Principal ApplicantMsp SysBelum ada peringkat

- DateDokumen4 halamanDatechatiresBelum ada peringkat

- Change of Details Form Generic Do-Ec-087Dokumen2 halamanChange of Details Form Generic Do-Ec-087AlvaroBelum ada peringkat

- Current Account Opening Form Single PDFDokumen4 halamanCurrent Account Opening Form Single PDFSourabh TiwariBelum ada peringkat

- IMM5524 EgggkDokumen3 halamanIMM5524 EgggkMantosh SinghBelum ada peringkat

- Ca5400 Application For A National Insurance NumberDokumen4 halamanCa5400 Application For A National Insurance NumberSamuel MutahiBelum ada peringkat

- T1 - 2019 ReturnDokumen8 halamanT1 - 2019 ReturnYuan LiangBelum ada peringkat

- US - CBP Form 5106 (03-2019)Dokumen4 halamanUS - CBP Form 5106 (03-2019)Regina HuiBelum ada peringkat

- N 400Dokumen20 halamanN 400Leo FerrBelum ada peringkat

- Complete This Form in Two WaysDokumen4 halamanComplete This Form in Two WaysJohn TengcoBelum ada peringkat

- Transmission Request FormDokumen4 halamanTransmission Request FormVinayak SavanurBelum ada peringkat

- Personal Current Acc App SoleDokumen7 halamanPersonal Current Acc App Soleaiss.ay.moussBelum ada peringkat

- Checklist Visitor Tourist Business-Singapore-Final Version 180516Dokumen12 halamanChecklist Visitor Tourist Business-Singapore-Final Version 180516Anonymous GxsqKv85GBelum ada peringkat

- 2020 - Income Tax - If CPP-D Is Non-Taxable Due To Retroactive Changes Regulation in 2023Dokumen8 halaman2020 - Income Tax - If CPP-D Is Non-Taxable Due To Retroactive Changes Regulation in 2023api-348726621Belum ada peringkat

- Non-Resident Landlord Tax FormDokumen3 halamanNon-Resident Landlord Tax FormtinyharbsBelum ada peringkat

- KYC Updation Form - DSL - NSDL - 1615548970Dokumen10 halamanKYC Updation Form - DSL - NSDL - 1615548970raj kiranBelum ada peringkat

- Unemployment Insurance Claim Application: Claimant InformationDokumen5 halamanUnemployment Insurance Claim Application: Claimant InformationPEnelopEBelum ada peringkat

- W-7 FormDokumen1 halamanW-7 FormRaviLifewideBelum ada peringkat

- Paper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementDokumen4 halamanPaper Filing Instructions - Spouse ITIN Cases & Joint Declaration StatementKarthik NieBelum ada peringkat

- Account Opening FormDokumen9 halamanAccount Opening FormTej AsBelum ada peringkat

- Information Referral: Section A - Information About The Person or Business You Are ReportingDokumen3 halamanInformation Referral: Section A - Information About The Person or Business You Are ReportingAndrea BradleyBelum ada peringkat

- Account Update Form PDFDokumen2 halamanAccount Update Form PDFjohn lerry loberioBelum ada peringkat

- Ir744 PDFDokumen4 halamanIr744 PDFAnonymous RCSnYul44lBelum ada peringkat

- FCB Acc OpeningAppFormCorporate 2Dokumen12 halamanFCB Acc OpeningAppFormCorporate 2Matthew12Alexander12Belum ada peringkat

- Company DetailsDokumen1 halamanCompany DetailsGaurav Singh PannuBelum ada peringkat

- WMI Monthly Report Apr 2012Dokumen2 halamanWMI Monthly Report Apr 2012Gaurav Singh PannuBelum ada peringkat

- April 2014Dokumen3 halamanApril 2014Gaurav Singh PannuBelum ada peringkat

- MercuryDokumen2 halamanMercuryGaurav Singh PannuBelum ada peringkat

- Cover Letter Feb 2014Dokumen1 halamanCover Letter Feb 2014Gaurav Singh PannuBelum ada peringkat

- Amity Synopsis FormatDokumen4 halamanAmity Synopsis FormatJagadeesh VellaichamyBelum ada peringkat

- Affidavit ProprietorshipDokumen2 halamanAffidavit Proprietorshipsumana rani100% (1)

- Petition To Appoint GuardianshipDokumen2 halamanPetition To Appoint GuardianshipaldinBelum ada peringkat

- Cargolift Shipping, Inc. vs. L. Acuario Marketing Corp.Dokumen14 halamanCargolift Shipping, Inc. vs. L. Acuario Marketing Corp.Ailein GraceBelum ada peringkat

- Admissions: Balby Central Primary School Policy ForDokumen5 halamanAdmissions: Balby Central Primary School Policy ForcentralwebadminBelum ada peringkat

- APM Act 1965 1 PDFDokumen13 halamanAPM Act 1965 1 PDFgopinadh.civil gopinadhBelum ada peringkat

- HEARTLAND PAYMENT SYSTEMS, INC. v. COMMER - Document No. 11Dokumen3 halamanHEARTLAND PAYMENT SYSTEMS, INC. v. COMMER - Document No. 11Justia.comBelum ada peringkat

- Ocsio Vs CADokumen7 halamanOcsio Vs CAJohnde MartinezBelum ada peringkat

- APEC ArchitectDokumen6 halamanAPEC Architectsarah joy CastromayorBelum ada peringkat

- 4 CasessDokumen8 halaman4 CasesssideshowjowellaBelum ada peringkat

- United States Court of Appeals, Fourth CircuitDokumen4 halamanUnited States Court of Appeals, Fourth CircuitScribd Government DocsBelum ada peringkat

- Sardis 7.1 - Buckler and RobinsonDokumen235 halamanSardis 7.1 - Buckler and Robinsongezedka100% (1)

- BPI v. SuarezDokumen2 halamanBPI v. SuarezMarrielDeTorresBelum ada peringkat

- TranspoDokumen3 halamanTranspoteabagmanBelum ada peringkat

- Administrative Proceedings CasesDokumen7 halamanAdministrative Proceedings CasesHenteLAWcoBelum ada peringkat

- Sps. Domingo v. RocesDokumen12 halamanSps. Domingo v. Rocesalexis_beaBelum ada peringkat

- Public NuisanceDokumen13 halamanPublic Nuisancevaishali guptaBelum ada peringkat

- VP HDRI Skydomes II CatalogDokumen42 halamanVP HDRI Skydomes II CatalogvicBelum ada peringkat

- Enrolment Form: ) I11i'14ii LDokumen2 halamanEnrolment Form: ) I11i'14ii LHrushikesh PatelBelum ada peringkat

- Borromeo vs. Manila Electric Railroad and Light CoDokumen2 halamanBorromeo vs. Manila Electric Railroad and Light CosodapecuteBelum ada peringkat

- 1994 Weyer Family Limited Partnership Et. Al. v. Rosenboom Machine & ToolDokumen5 halaman1994 Weyer Family Limited Partnership Et. Al. v. Rosenboom Machine & ToolPriorSmartBelum ada peringkat

- Transportation Law OutlineDokumen3 halamanTransportation Law OutlineJm EjeBelum ada peringkat

- Gillaco vs. Manila RailroadDokumen3 halamanGillaco vs. Manila RailroadStephanie Reyes GoBelum ada peringkat

- Seville Classics v. Neatfreak - ComplaintDokumen89 halamanSeville Classics v. Neatfreak - ComplaintSarah BursteinBelum ada peringkat

- Succession HandoutDokumen21 halamanSuccession HandoutAsliah G. MapandiBelum ada peringkat

- 7 Thomas EdisonDokumen4 halaman7 Thomas EdisonYair ArangoBelum ada peringkat

- Francisco v. GSISDokumen2 halamanFrancisco v. GSISLoi VillarinBelum ada peringkat

- Wells Fargo Vs CIRDokumen2 halamanWells Fargo Vs CIREmil BautistaBelum ada peringkat

- Required Documents For Processing of Grant CM 1111Dokumen1 halamanRequired Documents For Processing of Grant CM 1111Naeem Ahmad50% (2)

- Apo Fruits Corporation v. Land Bank of The PhilippinesDokumen4 halamanApo Fruits Corporation v. Land Bank of The PhilippinesJoshua TanBelum ada peringkat

- Republic of The Philippines Regional Trial Court 5 Judicial Region Ligao City Branch 11Dokumen10 halamanRepublic of The Philippines Regional Trial Court 5 Judicial Region Ligao City Branch 11Jasmine Montero-GaribayBelum ada peringkat

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDari EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantPenilaian: 4 dari 5 bintang4/5 (104)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyDari EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyPenilaian: 5 dari 5 bintang5/5 (1)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationDari EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationPenilaian: 4.5 dari 5 bintang4.5/5 (18)

- How To Budget And Manage Your Money In 7 Simple StepsDari EverandHow To Budget And Manage Your Money In 7 Simple StepsPenilaian: 5 dari 5 bintang5/5 (4)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDari EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassBelum ada peringkat

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDari EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsBelum ada peringkat

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsDari EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsPenilaian: 3 dari 5 bintang3/5 (2)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Dari EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Penilaian: 3.5 dari 5 bintang3.5/5 (9)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Dari EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Penilaian: 5 dari 5 bintang5/5 (89)

- The Best Team Wins: The New Science of High PerformanceDari EverandThe Best Team Wins: The New Science of High PerformancePenilaian: 4.5 dari 5 bintang4.5/5 (31)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDari EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsBelum ada peringkat

- Legal Writing in Plain English: A Text with ExercisesDari EverandLegal Writing in Plain English: A Text with ExercisesPenilaian: 3 dari 5 bintang3/5 (2)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeDari EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifePenilaian: 5 dari 5 bintang5/5 (4)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningDari EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningPenilaian: 4.5 dari 5 bintang4.5/5 (8)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsDari EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsPenilaian: 4 dari 5 bintang4/5 (4)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherDari EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherPenilaian: 5 dari 5 bintang5/5 (14)

- How to Save Money: 100 Ways to Live a Frugal LifeDari EverandHow to Save Money: 100 Ways to Live a Frugal LifePenilaian: 5 dari 5 bintang5/5 (1)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersDari EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersPenilaian: 5 dari 5 bintang5/5 (2)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitDari EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitBelum ada peringkat

- Employment Law: a Quickstudy Digital Law ReferenceDari EverandEmployment Law: a Quickstudy Digital Law ReferencePenilaian: 1 dari 5 bintang1/5 (1)

- Sacred Success: A Course in Financial MiraclesDari EverandSacred Success: A Course in Financial MiraclesPenilaian: 5 dari 5 bintang5/5 (15)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayDari EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayPenilaian: 3.5 dari 5 bintang3.5/5 (2)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestDari EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestPenilaian: 5 dari 5 bintang5/5 (1)

- The Ultimate 7 Day Financial Fitness ChallengeDari EverandThe Ultimate 7 Day Financial Fitness ChallengePenilaian: 5 dari 5 bintang5/5 (1)