Risk-Taking Channel of Monetary Policy Model

Diunggah oleh

Paul Rosado OlivosDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Risk-Taking Channel of Monetary Policy Model

Diunggah oleh

Paul Rosado OlivosHak Cipta:

Format Tersedia

Risk-Taking Channel of Monetary Policy:

A Global Game Approach

Stephen Morris

Princeton University

Hyun Song Shin

Princeton University

January 25, 2014

Abstract

We explore a global game model of the impact of monetary policy shocks. Risk-neutral

asset managers interact with risk-averse households in a market with a risky bond and a

oating rate money market fund. Asset managers are averse to coming last in the ranking

of short-term performance. This friction injects a coordination element in asset managers

portfolio choice that leads to large jumps in risk premiums to small future anticipated

changes in central bank policy rates. The si!e of the asset management sector is the key

parameter determining the extent of market disruption to monetary policy shocks.

"irst version. #omments are most welcome.

1

1 Introduction

Monetary policy announcements sometimes exert an apparently disproportionate impact on

maret interest rates! "he #taper tantrum$ in the summer o% 201& is an example o% such

an episode, 'hen maret interest rates (umped %ollo'ing remars )y the *ed +hairman, ,en

,ernane, on the eventual #tapering$ o% the pace o% asset purchases )y the *ederal -eserve!

"he taper tantrum o% 201& is )ut a recent case o% the general phenomenon in 'hich monetary

policy shocs are associated 'ith changes in the ris premium inherent in maret prices, over and

a)ove any change in the actuarially %air long term interest rate implied )y the expectations theory

o% the yield curve! Shiller, +amp)ell and Schoenholt. /101&2 document the early evidence!

Hanson and Stein /20122 and 3ertler and 4aradi /201&2 add to the accumulated evidence that

monetary policy appears to operate through changes in the ris premium inherent in asset prices,

in addition to change in the actuarially %air long5term rate!

"he %act that the ris premium 6uctuates so much opens up a gap )et'een the theory and

practice o% monetary policy! 7iscussions o% central )an communication o%ten treat the maret

as i% it 'ere an individual 'ith )elie%s! "ransparency over the path o% %uture policy rates is seen

as a device to guide long term rates, and crucially, such guidance is seen as something amena)le

to 8ne5tuning! "he term #maret expectations$ is o%ten used in connection 'ith central )an

guidance! 9lthough such a term can serve as a shorthand, it creates the temptation to treat

the #maret$ as a person 'ith coherent )elie%s! "he temptation is to anthropomorphi.e the

maret, and endo' it 'ith attri)utes that it does not have /Shin /201&22!

Ho'ever, the #maret$ is not a person! Maret prices are outcomes o% the interaction o%

many actors, and not the )elie%s o% any one actor! :ven i% prices are the average o% individual

expectations, average expectations %ail even the )asic property o% the la' o% iterated expecta5

tions! ;n other 'ords, the average expectation today o% the average expectation tomorro' o%

some varia)le is not the average expectation today o% that varia)le /9llen, Morris and Shin

/200<22!

;n this paper, 'e explore a glo)al game model o% the transmission o% monetary policy 'ith

2

heterogenous maret participants! =ur model has the %eature that monetary policy exerts a

direct impact on ris premiums through the ris5taing )ehavior o% maret participants!

;n our model, ris5netural investors, interpreted as asset managers, interact 'ith ris5averse

households in a maret %or a risy )ond! 9lthough the asset managers are motivated )y long5

term %undamental asset values, there is an element o% short5termism generated )y the aversion

to coming last in short5term per%ormance ranings among asset managers! >e interpret the

%riction as the loss o% customer mandates o% the asset managers, consistent 'ith the empirical

evidence on the sensitivity o% %und 6o's to %und per%ormance! "hus, the #%riction$ in the model

is that relative per%ormance matters %or %und managers!

"he importance o% relative raning in(ects spillover e?ects across asset managers and an

endogenous coordination element in their port%olio choice! "he cost o% coming last generates

)ehavior that has the out'ard appearance o% shi%ts in pre%erences! Just as in a game o% musical

chairs, 'hen others try harder to gra) a chair, the more e?ort must )e expended to gra) a

chair onesel%! "he ensuing scram)le %or the relatively sa%er option o% selling the risy )ond

in %avor o% the short5term asset leads to a (ump in the yield o% the risy )ond that has the

out'ard appearance o% a sudden (ump in the ris aversion o% the #maret$! "he glo)al game

approach permits the solution o% the trigger level o% the 6oating interest rate 'hen the scram)le

ics in! "hus, 'hen the central )an signals higher %uture rates, the impact on asset prices is

o%ten a)rupt as the ris5taing )ehavior o% maret participants undergoes discrete shi%ts! >e

du) this channel o% the transmission o% monetary policy the #ris5taing channel$ o% monetary

policy, %ollo'ing ,orio and @hu /20002 'ho 8rst coined the term!

"he ey parameter %or the strength o% the ris5taing channel is the si.e o% the asset manage5

ment sector! Auantities thus matter! >hen the sector is large relative to ris5averse households,

ris premiums can )e driven very lo' )y signalling lo' %uture policy rates! ;n return, ho'ever,

the central )an must accept a narro'er region o% %undamentals 'hen ris premiums can )e

ept lo', and a larger (ump in ris premiums 'hen the policy stance changes!

=ur results hold several implications %or the conduct o% monetary policy, )ut 'e postpone

discussion o% the implications until Section 4! >e 8rst present the model and the solution!

&

Model

"here are t'o groups o% investors! *irst, there is a continuum o% ris5neutral investors inter5

preted as asset managers! 9sset managers are indexed )y the unit interval B0, 1C! "hey are

re'arded 'ith a constant %raction o% the terminal value o% their port%olio holding and consume

once only at the terminal date! 9sset managers do not discount the %uture!

9lthough asset managers care a)out long5term asset values, they su?er %rom #last5place

aversion$ in that they are su)(ect to a penalty /to )e descri)ed )elo'2 i% they are raned last

in the value o% their short5term port%olio! >e interpret this penalty as the loss o% customers

su?ered )y the asset manager, as re6ected in the empirical evidence on the positive relationship

)et'een %und 6o's and %und per%ormance!

"he second group o% investors are ris5averse household investors! "hey do not discount the

%uture, they consume once only at the terminal date, and )ehave competitively!

9ll investors %orm port%olios )et'een t'o types o% assets 5 a long5term asset and a short5term

asset! "he long5term asset is a risy .ero coupon )ond that pays only at the terminal date,

)ut the payo? is risy! "he expected payo? at the teriminal date is v 'ith variance

2

! "here

is an outstanding amount o% S units o% the risy )ond!

"he short5term asset is a 6oating rate money maret %und or )an account, and is supplied

elastically! "here is uncertainty over the interest rate ruling over the next interval o% time, )ut

investors have precise signals o% the interest rate! Ho'ever, the interest rate is not common

no'ledge )et'een investors! "he in%ormation structure 'ill )e descri)ed more %ormally )elo'!

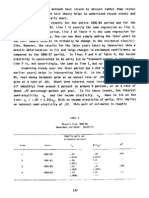

!1 "enchmark Three Period Model

>e 8rst examine the )enchmar version o% our model 'here has three dates, 0, 1 and 2! "he

timeline is depicted in *igure 1!

9t date 1, asset managers choose ho' much o% the risy )ond to hold! :ach have one unit

o% 'ealth, 'hich they can allocate )et'een the risy )ond and the 6oating rate account! 9sset

managers cannot )orro' and cannot tae short positions!

4

Trading date

common knowledge;

known but not

common knowledge;

Switching strategy

around threshold

realized;

Consumption

takes place

realized

"igure $. Time line for three period model

"he reali.ed value o% the risy )ond is uncertain, 'ith expected value v! ;nvestors can earn

interest rate 1 D r in the 6oating rate money maret account )et'een date 1 and date 2! "he

price o% the risy )ond p is determined )y maret clearning!

Households have mean5variance pre%erences, and at date 1, they su)mit a competitive de5

mand curve %or the risy )ond! Household h has utility %unctionE

U

h

F vy

1

2

h

y

2

2

D /e py2 /12

'here y is the risy )ond holding o% the household, e is the endo'ment and is ris tolerance!

>e assume that the endo'ment e is large enough that the 8rst5order condition determines

the optimal port%olio! *rom the 8rst5order condition 'ith respect to y and summing across

households, the aggregate demand %or the risy )ond %or the household sector is

p F v

2

h

h

y

F v cy /22

'here c is the positive constant de8ned as c F

2

/

h

h

, and

h

h

is the aggregate ris

tolerance %or the household sector as a 'hole! *igure 2 sho's the determination o% the price p

5

"igure %. Market clearing of the long asset. The price of the long asset at date $ is p. Asset managers

hold A units and households hold S A units.

o% the risy )ond %rom maret clearing! 9sset managers hold A units o% the )ond, 'here A is

exogenous %or no'! Households hold the remainder S A! "he price p and the resulting ris

premium v/p clears the maret )y re'arding households %or )earing ris!

9lthough asset managers consume once at the terminal date /date 22, they su?er %rom last

place aversion!

1

>e assume that there is a penalty su?ered )y any asset manager 'hose port%olio

value is raned last at date 1! "he penalty is in the %orm o% a decline in the asset managerGs

%unds under management, interpreted as 'ithdra'als )y their customers!

;n particular, i% any asset manager is raned last /or eHual last2 at date 1, and proportion x

o% asset managers has a strictly higher port%olio values, then the asset managerGs %unds under

management declines )y a %actor o% x, 'here is a positive constant strictly )et'een 0 and

1! ;n other 'ords, i% the asset manager initially holds 1 dollar o% %unds under management, )ut

comes last, and proportion x o% %und managers has strictly higher port%olio value, then the asset

1

The term &last place aversion' is taken from (uell) et al. *%+$,- who have used the concept in the very

di.erent context of the welfare economics of social deprivation.

<

managerGs %unds under management shrins toE

1 x /&2

9t date 1, asset managers allocate their %unds under management )et'een the risy )ond

and the 6oating rate account! "he asset managers initially start 'ith a holding o% A units o%

the risy )ond! ;% they choose to hold the )ond, each unit o% the )ond yields expected payo?

o% v!

;% the asset manager decides to sell the risy )ond, their sell order is executed simultaneously

'ith the other asset managers 'ho have decided to sell! "he aggregate sale o% the risy security

is matched 'ith the competitive demand curve o% the household investors, and each seller is

matched 'ith household )uyers!

;% proportion x o% the asset managers decide to sell their risy )ond holding, the total supply

o% the risy )ond is xA, and each seller has eHual chance o% placed in the Hueue B0, xC %or order

executiion! "here%ore, i% x asset managers sell the risy )ond, the expected revenue %rom sale

o% one unit is

p

1

2

cx /42

*igure 2 depicts the expected revenue curve p

1

2

cx, 'hose slope is hal% o% the competitive

demand curve p cx!

3iven the last place aversion o% the asset managers, the expected payo? %rom holding the

risy )ond 'hen proportion x sell the risy )ond is

u/x2 F v /1 x2 /52

9lthough the asset manager is ris5neutral and has a long hori.on, the short5term %riction %rom

last place aversion generates element o% short5termism!

;% the asset manager sells the risy )ond at date 1, the proceeds o% the sale are put into the

6oating rate account, 'here it earns interest rate r! Hence, the expected payo? o% the asset

manager %rom selling the risy )ond 'hen proportion x sell is given )y

w/x2 F /1 D r2

p

1

2

cx

/<2

I

"igure ,. /ayo. functions from holding long-dated security and switching to oating rate

*igure & plots the payo?s %rom the t'o strategies as a %unction o% x, the proportion o% asset

managers 'ho sell! "he payo? di?erence u /x2 w/x2 is indicated )y the shaded region!

"he payo? %unctions u/x2 and w/x2 are linear in x, and the payo? di?erence u/x2 w/x2 is

monotonic in x! ;% either u/x2w/x2 is positive %or all x, or negative %or all x, then the pro)lem

is trivial as asset managers have dominant actions! "here%ore, in 'hat %ollo's, 'e %ocus on the

case 'hen u/x2 w/x2 crosses the hori.ontal axis at some point!

! Global Game

"he 6oating rate r ruling )et'een date 1 and date 2 is uncertain, )ut investors have good

in%ormation a)out it! 9t date 1, asset manager i o)serves signal

i

o% the true interest rate r

given )y

i

F r D s

i

/I2

'here s

i

is a uni%ormly distri)uted noise term, 'ith reali.ation in B, C %or small positive

constant ! "he noise terms {s

i

} are independent across asset managers! >e %urther assume

that the ex ante distri)ution o% r is uni%orm! "he assumption that r and the noise term s

i

are uni%ormly distri)uted is %or expositional simplicity only! "he solution to )e o)tained )elo'

1

holds under general conditions on the ex ante distri)ution o% r and the noise structure /Morris

and Shin /200&, section 222!

,ased on their respective signals, asset managers decide 'hether to hold the risy )ond or

sell it! Since asset managers are ris5neutral, it is 'ithout loss o% generality to consider the

)inary choice o% #hold$ or #sell$! 9 strategy %or an asset manager is a mappingE

i

{Hold, Sell} /12

9 collection o% strategies /one %or each asset manager2 is an equilibrium i% the action prescri)ed

)y iGs strategy maximi.es iGs expected payo? at every reali.ation o% signal

i

given othersG

strategies!

9s the 8rst step in the solution, consider s'itching strategies o% the %orm

Sell i% >

Hold i%

/02

%or some threshold value

! >e 8rst solve %or eHuili)rium in s'itching strategies! >e search

%or threshold point

such that every asset manager using the same s'itching strategy around

! >e appeal to the %ollo'ing result in glo)al games! -ecall that x is our notation %or the

proportion o% investors 'ho sell!

#emma 1 Suppose that investors follow the switching strategy around

. Then, in the limit

as 0, the density of x conditional on

is uniform over the unit interval B0, 1C.

"o mae the discussion in our paper sel%5contained, 'e present the proo% o% Jemma 1! *or

economy o% argument 'e sho' the proo% only %or the case o% uni%ormly distri)uted r and uni%orm

noise! Ho'ever, this result is Huite general, and does not depend on the assumption o% uni%orm

density over r and uni%orm noise /Morris and Shin /200&, Section 222!

"he distri)ution o% x conditional on

can )e derived %rom the ans'er to the %ollo'ing

HuestionE

#My signal is

! >hat is the pro)a)ility that x is less than zK$ /A2

0

"igure 0. 1eriving the subjective distribution over x at switching point

"he ans'er to Huestion /A2 gives the cumulative distri)ution %unction o% x evaluated at z, 'hich

'e denote )y G/z|

2! "he density over x is then o)tained )y di?erentiating G/z|

2! "he

steps to ans'ering Huestion /A2 are illustrated in *igure 4!

>hen the true interest rate is r, the signals {

i

} are distri)uted uni%ormly over the interval

Br , r D C! ;nvestors 'ith signals

i

>

are those 'ho sell! Hence,

x F

r D

2

/102

>hen do 'e have x < zK "his happens 'hen r is lo' enough, so that the area under the

density to the right o%

is sHuee.ed! "here is a value o% r at 'hich x is precisely z! "his is

'hen r F r

0

, 'here

r

0

D

2

F z /112

or

r

0

F

D 2z /122

10

Anda mungkin juga menyukai

- Ch18 FinancialRisksDokumen37 halamanCh18 FinancialRiskssamuel_dwumfourBelum ada peringkat

- The Driving Force of Swap SpreadsDokumen38 halamanThe Driving Force of Swap SpreadsarunspeakersBelum ada peringkat

- Financial Risk Management: A Simple IntroductionDari EverandFinancial Risk Management: A Simple IntroductionPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- Risk ManagementDokumen125 halamanRisk ManagementĐəəpáķ ĞákháŕBelum ada peringkat

- Chapter 20 Interest Rate Risk: 1. ObjectivesDokumen14 halamanChapter 20 Interest Rate Risk: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Two Type of Margins Have Been SpecifiedDokumen8 halamanTwo Type of Margins Have Been SpecifiedPraveen KumarBelum ada peringkat

- Market Efficiency and Share ValuationDokumen8 halamanMarket Efficiency and Share Valuationsamuel_dwumfourBelum ada peringkat

- Forecasting Asset Class ReturnDokumen4 halamanForecasting Asset Class ReturnkypvikasBelum ada peringkat

- A STUDY ONdgdsgDokumen71 halamanA STUDY ONdgdsgSaidi ReddyBelum ada peringkat

- AFF9260 WEEK 5 – Tutorial Questions on Risk and UncertaintyDokumen3 halamanAFF9260 WEEK 5 – Tutorial Questions on Risk and UncertaintyMinh VănBelum ada peringkat

- CH 09Dokumen15 halamanCH 09Junaid JamshaidBelum ada peringkat

- TN38 Primus Automation Division 2002Dokumen11 halamanTN38 Primus Automation Division 2002mylittle_pg100% (1)

- Sleepless L.A. - Case AnalysisDokumen6 halamanSleepless L.A. - Case AnalysisSreenandan NambiarBelum ada peringkat

- Retirement FundsDokumen29 halamanRetirement FundsAlfred NettoBelum ada peringkat

- FIRE 316 Fall 2014 Midterm 1 Review OutlineDokumen5 halamanFIRE 316 Fall 2014 Midterm 1 Review OutlinepoprocksandcokeBelum ada peringkat

- Analyzing Risk and Return in Commodity FuturesDokumen5 halamanAnalyzing Risk and Return in Commodity FuturesSaggam RaviBelum ada peringkat

- Black Faj89: Universal HedgingDokumen7 halamanBlack Faj89: Universal Hedgingnliu02Belum ada peringkat

- Arbitrage Trade Analysis of Stock Trading in NSE and BSE MBA ProjectDokumen86 halamanArbitrage Trade Analysis of Stock Trading in NSE and BSE MBA ProjectNipul Bafna100% (3)

- 807512Dokumen24 halaman807512Shweta SrivastavaBelum ada peringkat

- Margin-Based Asset Pricing and Deviations From The Law of One PriceDokumen43 halamanMargin-Based Asset Pricing and Deviations From The Law of One PriceDiego MakaseviciusBelum ada peringkat

- BNP Derivs 101Dokumen117 halamanBNP Derivs 101hjortsberg100% (2)

- Exploring The Volatility of Stock Markets: Indian ExperienceDokumen19 halamanExploring The Volatility of Stock Markets: Indian ExperienceAnantdeep Singh PuriBelum ada peringkat

- International Bond Market ParticipantsDokumen6 halamanInternational Bond Market ParticipantsNandini JaganBelum ada peringkat

- SSRN Id2403067Dokumen19 halamanSSRN Id2403067soumensahilBelum ada peringkat

- Lecture 1. Introduction: Financial Risk ManagementDokumen44 halamanLecture 1. Introduction: Financial Risk Managementsnehachandan91Belum ada peringkat

- Predictive Power of YIeld CurveDokumen24 halamanPredictive Power of YIeld CurveRavi KumarBelum ada peringkat

- Modern Financial Management Solutions ManualDokumen559 halamanModern Financial Management Solutions Manualrutemarlene40Belum ada peringkat

- CAPM - Capital Asset Pricing Model ExplainedDokumen36 halamanCAPM - Capital Asset Pricing Model ExplainedJithesh JanardhananBelum ada peringkat

- An Optimal Hedge Ratio Discussion-One Size Does Not Fit AllDokumen19 halamanAn Optimal Hedge Ratio Discussion-One Size Does Not Fit AllJonny SvenssonBelum ada peringkat

- Value at RiskDokumen28 halamanValue at RisktitanBelum ada peringkat

- Literature Review Foriegn ExchangeDokumen9 halamanLiterature Review Foriegn Exchangeonline free projects0% (1)

- The Shri Ram School First Term Examination - 2007-08 Class - XII EconomicsDokumen12 halamanThe Shri Ram School First Term Examination - 2007-08 Class - XII EconomicsMeetika MalhotraBelum ada peringkat

- OTS Prepay and Valuing Individual Mortgage Servicing Contracts - A Comparison Between Adjust Rate Mortgages and Fixed Rate MortgagesDokumen16 halamanOTS Prepay and Valuing Individual Mortgage Servicing Contracts - A Comparison Between Adjust Rate Mortgages and Fixed Rate MortgagesfhdeutschmannBelum ada peringkat

- Investing Risks and Options OpportunitiesDokumen74 halamanInvesting Risks and Options OpportunitiesAzaruddin Shaik B PositiveBelum ada peringkat

- Risk-Free Rate for CAPM Depends on Investment HorizonDokumen9 halamanRisk-Free Rate for CAPM Depends on Investment HorizonAnindita SahaBelum ada peringkat

- Dynamic Interrelationships Between Macroeconomic Indicators Global Stock Market and Commodities Prices and Jakarta Composite Index (JCDokumen34 halamanDynamic Interrelationships Between Macroeconomic Indicators Global Stock Market and Commodities Prices and Jakarta Composite Index (JCJosua PardedeBelum ada peringkat

- Risk Management Beyond Asset Class Diversification (Page, 2013)Dokumen8 halamanRisk Management Beyond Asset Class Diversification (Page, 2013)Francois-Xavier AdamBelum ada peringkat

- Fianl ProposalDokumen6 halamanFianl ProposalsaeedktgBelum ada peringkat

- Solutions Manual Chapter Twenty-Two: Answers To Chapter 22 QuestionsDokumen8 halamanSolutions Manual Chapter Twenty-Two: Answers To Chapter 22 QuestionsBiloni KadakiaBelum ada peringkat

- Chapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1Dokumen16 halamanChapter 19 Foreign Exchange Risk: Answer - Test Your Understanding 1samuel_dwumfourBelum ada peringkat

- A Comparative Study of Invest Shield Life of ICICI PrudentialDokumen89 halamanA Comparative Study of Invest Shield Life of ICICI PrudentialSushil KumarBelum ada peringkat

- Discount Rate and DCF AnalysisDokumen10 halamanDiscount Rate and DCF AnalysisshlakaBelum ada peringkat

- Synthesis On Stock ValuationDokumen2 halamanSynthesis On Stock ValuationRu MartinBelum ada peringkat

- Dtirm (2) - 20170901-19594896Dokumen32 halamanDtirm (2) - 20170901-19594896Bhavik Solanki100% (2)

- Exchange Rates ForecastingDokumen25 halamanExchange Rates ForecastingBarrath RamakrishnanBelum ada peringkat

- Chap11 Liquidity and Reserve Management Strategies and PolicyDokumen24 halamanChap11 Liquidity and Reserve Management Strategies and PolicySangram Panda100% (1)

- Research TopicsDokumen10 halamanResearch Topicspgk242003Belum ada peringkat

- International FinanceDokumen20 halamanInternational FinancecoffeedanceBelum ada peringkat

- Chapter 19 Foreign Exchange Risk: 1. ObjectivesDokumen32 halamanChapter 19 Foreign Exchange Risk: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Interest Rate FuturesDokumen19 halamanInterest Rate FuturesJimit ShahBelum ada peringkat

- Analyzing Volatility Risk and Risk Premium in Option Contracts: A New TheoryDokumen56 halamanAnalyzing Volatility Risk and Risk Premium in Option Contracts: A New TheorythealkpBelum ada peringkat

- Research ArticleDokumen18 halamanResearch Articlemainak.chatterjee03Belum ada peringkat

- Unified Bonds 20141008Dokumen57 halamanUnified Bonds 20141008datsnoBelum ada peringkat

- The Price of An Asset - Interest Rates - Market Volatility - Market LiquidityDokumen41 halamanThe Price of An Asset - Interest Rates - Market Volatility - Market LiquidityΚωνσταντίνος ΑμπατζήςBelum ada peringkat

- Exposure and Risk in International FinanceDokumen25 halamanExposure and Risk in International Financeravi_nyseBelum ada peringkat

- Pricing Default Swaps: Empirical EvidenceDokumen49 halamanPricing Default Swaps: Empirical EvidencenopatBelum ada peringkat

- Financial Economics: A Simple IntroductionDari EverandFinancial Economics: A Simple IntroductionPenilaian: 5 dari 5 bintang5/5 (5)

- Exchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsDari EverandExchange Rate Determination Puzzle: Long Run Behavior and Short Run DynamicsBelum ada peringkat

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyDari EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyPenilaian: 3 dari 5 bintang3/5 (2)

- I-l-ED States: Titative RevieDokumen10 halamanI-l-ED States: Titative ReviePaul Rosado OlivosBelum ada peringkat

- CL1 LucasMDUSAop.11-20 PDFDokumen10 halamanCL1 LucasMDUSAop.11-20 PDFPaul Rosado OlivosBelum ada peringkat

- I-l-ED States: Titative RevieDokumen10 halamanI-l-ED States: Titative ReviePaul Rosado OlivosBelum ada peringkat

- CL1 LucasMDUSAop.21-30 PDFDokumen10 halamanCL1 LucasMDUSAop.21-30 PDFPaul Rosado OlivosBelum ada peringkat

- 12 de Agosto (Schmalensse)Dokumen6 halaman12 de Agosto (Schmalensse)Paul Rosado OlivosBelum ada peringkat

- CL2 HyunSongShin 1.11-20Dokumen10 halamanCL2 HyunSongShin 1.11-20Paul Rosado OlivosBelum ada peringkat

- I-l-ED States: Titative RevieDokumen10 halamanI-l-ED States: Titative ReviePaul Rosado OlivosBelum ada peringkat

- Calculating Implied Volatility Using Black-Scholes ModelsDokumen4 halamanCalculating Implied Volatility Using Black-Scholes Modelsharsh guptaBelum ada peringkat

- Inventory Control Practice Problems (To Be Submitted As Assignment On or Before 02-12-2019)Dokumen2 halamanInventory Control Practice Problems (To Be Submitted As Assignment On or Before 02-12-2019)syedqutub16Belum ada peringkat

- 361 Chapter 18 MC SolutionsDokumen25 halaman361 Chapter 18 MC SolutionsMariechi Binuya100% (1)

- Transmission Line Acceptance ProjectDokumen7 halamanTransmission Line Acceptance Projectnikhil ingoleBelum ada peringkat

- Elliot Lake Community ProfileDokumen10 halamanElliot Lake Community ProfileElliot Lake Centre for DevelopmentBelum ada peringkat

- Case Study Beach FoodsDokumen2 halamanCase Study Beach FoodsUmar KhattakBelum ada peringkat

- Attachment Test 8Dokumen54 halamanAttachment Test 8piyushkumar151Belum ada peringkat

- 1Dokumen131 halaman1Jitendra KumarBelum ada peringkat

- End Term ACF 2021 Set 2Dokumen2 halamanEnd Term ACF 2021 Set 2pranita mundraBelum ada peringkat

- Portfolio ModelsDokumen38 halamanPortfolio ModelsAsiha GujarBelum ada peringkat

- Ijfs 07 00018 With CoverDokumen14 halamanIjfs 07 00018 With CoverSultonmurod ZokhidovBelum ada peringkat

- Introduction to Financial Institutions: An OverviewDokumen16 halamanIntroduction to Financial Institutions: An OverviewsleshiBelum ada peringkat

- Foreign Exchange Market-An Analysis of Movement of USD Against INRDokumen3 halamanForeign Exchange Market-An Analysis of Movement of USD Against INRMallikarjun Rao0% (1)

- Chapter 11 Relevant Costs For Non Routine Decision MakingDokumen24 halamanChapter 11 Relevant Costs For Non Routine Decision MakingCristine Jane Moreno Camba50% (2)

- Contractual ProcedureDokumen44 halamanContractual Proceduredasun100% (7)

- Foundation Course in Managerial Economics: DR Barnali Nag IIT Kharagpur Lecture 25: MonopolyDokumen19 halamanFoundation Course in Managerial Economics: DR Barnali Nag IIT Kharagpur Lecture 25: MonopolyDebesh GhoshBelum ada peringkat

- Basics of Demand and SupplyDokumen29 halamanBasics of Demand and SupplyNuahs Magahat100% (2)

- Valuation of EquityDokumen40 halamanValuation of EquityPRIYA KUMARIBelum ada peringkat

- Symphony Theatre: Indian Institute of Management Ahmedabad IIMA/F&A0126Dokumen3 halamanSymphony Theatre: Indian Institute of Management Ahmedabad IIMA/F&A0126xssfsdfsfBelum ada peringkat

- Ic38 Q&a-2Dokumen29 halamanIc38 Q&a-2Anonymous O82vX350% (2)

- Weekly Market Report 15-10-2023 (IND)Dokumen8 halamanWeekly Market Report 15-10-2023 (IND)wibage9267Belum ada peringkat

- CSEC Economics June 2008 P1Dokumen11 halamanCSEC Economics June 2008 P1Sachin BahadoorsinghBelum ada peringkat

- Geisst Monopolies in America PDFDokumen368 halamanGeisst Monopolies in America PDFmhtsospap100% (1)

- PBSA Portugal InformationDokumen4 halamanPBSA Portugal InformationHua YunBelum ada peringkat

- Cost12eppt 18Dokumen29 halamanCost12eppt 18Maika J. PudaderaBelum ada peringkat

- Forex Currency Correlation Indicator - What It Is and How It Works - 1610129024373Dokumen9 halamanForex Currency Correlation Indicator - What It Is and How It Works - 1610129024373SamsonBelum ada peringkat

- Belliss Morcom Industrial Brochure ENDokumen5 halamanBelliss Morcom Industrial Brochure ENAlectroBelum ada peringkat

- MB0039 SLM Unit 11Dokumen18 halamanMB0039 SLM Unit 11Kamal RaiBelum ada peringkat

- Hotel Asset Management GuidefDokumen12 halamanHotel Asset Management GuidefLaurentiuBelum ada peringkat

- Demand AnalysisDokumen65 halamanDemand AnalysisJoshua Stalin SelvarajBelum ada peringkat