Accounting HW1

Diunggah oleh

Kartik BhamidipatiHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounting HW1

Diunggah oleh

Kartik BhamidipatiHak Cipta:

Format Tersedia

1-3A Kartik Bhamidipati

Income Statement

Revenues

Service Revenue 7,500 $

Expenses

Advertising expense 400 $

Supplies Expense 1000

Maintenance and Repairs Expense 600

Utilities Expense 300

Salaries and wages expense 1400

Total Expenses 3700

Net Income 3,800 $

Retained Earnings Statement

RE, June 1 - $

Add: Net Income 3800

Less: Dividends 1400

2400

Balance Sheet

Assets

Cash 4,600 $

Accounts Recievable 4000

Supplies 2400

Equipment 26000

37000

Liabilities

Notes Payable 12,000 $

Accounts Payable 500

12500

Shareholder's Equity

Retained Earnings 2,400 $

Common Stock 22,100

24500

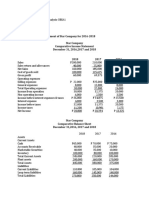

P1-3B

1-3A

Income Statement

Revenues

Service Revenue 10,400 $

Expenses

Advertising expense 800 $

Maintenance and Repairs Expense 2900

Insurance Expense 400

Salaries and wages expense 2000

Total Expenses 6,100 $

Net Income 4,300 $

Retained Earnings Statement

RE, June 1 - $

Add: Net Income 4,300 $

Less: Dividends 1700

2,600 $

Balance Sheet

Assets

Cash 15,800 $

Accounts Recievable 6200

Equipment 56000

78,000 $

Liabilities

Notes Payable 28,000 $

Accounts Payable 2400

30,400 $

Shareholder's Equity

Retained Earnings 2,600 $

Common Stock 45,000

47,600 $

P1-4B

Statement of Cash Flows

Cash Flow from Operating Activities

Cash received from customers 172,000 $

Cash paid to suppliers (154,000) $

Net cash from operating 18,000 $

Cash flow from Investing Activities

Cash paid to purchase equipment (30,000) $

Net cash from investing (30,000) $

Cash flow from Financing Activities

Cash received from bonds payable 40,000 $

Cash dividends paid (6,000) $

Net cash from financing 34,000 $

Cash at end of year 22,000 $

E2-7

a) EPS= (Net Income- Preferred Div)/Average # of Shares outstanding

In 2007, EPS was 0.783

In 2008, EPS was 1.012

b) Profitability seemed to have increased

c) Common stock dividends would not affect calculation, preferred stock div. would lower EPS

P2-5A

a) Working Capital (CA-CL) 263,400 $

Current Ratio (CA/CL) 2.347315

FCF 67800

Debt/Total Assets 0.382421

EPS 3.062

b) Liquidity increased, Solvency Increased and Profitability Decreased

P2-6A 2011 2012

a) EPS 2 2.1212121

b) Working Capital (CA-CL) 85000 113000

c) Current Ratio (CA/CL) 2.214285714 2.5066667

d) Debt/Total Assets 0.233577 0.203947

e) FCF 3000 17000

f) Profitability increase, liquidity increase and solvency increase

P2-2B

Income Statement

Revenues

Service Revenue 53,000 $

Expenses

Insurance Expense 1,800 $

Depreciation Expense 4300

Maintenance and Repairs Expense 2600

Utilities Expense 2100

Salaries and wages expense 36000

Total Expenses 46,800 $

Net Income 6,200 $

Retained Earnings Statement

RE, June 1 14,000.00 $

Add: Net Income 6,200 $

Less: Dividends 2600

17,600.00 $

Balance Sheet

Assets

Cash 5,100 $

Accounts Recievable 4900

Prepaid Insurance 1400

Equipment 31000

Accumulated Depreciation (8,600) $

33,800 $

Liabilities

Salaries and Wages Payable 2,000 $

Accounts Payable 8200

10,200 $

Shareholder's Equity

Retained Earnings 17,600 $

Common Stock 6,000

23,600 $

Anda mungkin juga menyukai

- Product SpecificationsDokumen1 halamanProduct SpecificationsKartik BhamidipatiBelum ada peringkat

- PBMC Isolation ProtocolDokumen1 halamanPBMC Isolation ProtocolKartik BhamidipatiBelum ada peringkat

- Spectrum Presents Ty Travis Scott and Topaz JonesDokumen1 halamanSpectrum Presents Ty Travis Scott and Topaz JonesKartik BhamidipatiBelum ada peringkat

- AP Stat SummerDokumen6 halamanAP Stat SummerKartik BhamidipatiBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- A Project On "Financial Statement Analysis of .'': IMBA Program: Semester-I Batch: 2019-24Dokumen30 halamanA Project On "Financial Statement Analysis of .'': IMBA Program: Semester-I Batch: 2019-24mahawish kadriBelum ada peringkat

- 04 04 FIG Questions AnswersDokumen65 halaman04 04 FIG Questions AnswersAbcdef100% (2)

- Cost Accounting PresentationDokumen30 halamanCost Accounting PresentationPhilimon YambaleBelum ada peringkat

- Contents Table Supermarket Business Plan PDFDokumen4 halamanContents Table Supermarket Business Plan PDFkavenindiaBelum ada peringkat

- M120-Onen 429044Dokumen54 halamanM120-Onen 429044Sarah BalisacanBelum ada peringkat

- Finance For HRDokumen192 halamanFinance For HRHany HamdyBelum ada peringkat

- Cfas ReviewerDokumen6 halamanCfas Reviewerkeisha santosBelum ada peringkat

- Slide 1Dokumen1 halamanSlide 1Hazel CorralBelum ada peringkat

- SEM III - Advanced Accounting (EM)Dokumen4 halamanSEM III - Advanced Accounting (EM)Abdul MalikBelum ada peringkat

- 1 - RehashDokumen13 halaman1 - RehashCyra JimenezBelum ada peringkat

- Xparcoac Midterms ReviewerDokumen11 halamanXparcoac Midterms ReviewerKristine dela CruzBelum ada peringkat

- LCBB4001: Accounting FundamentalsDokumen43 halamanLCBB4001: Accounting FundamentalsНикола БъчваровBelum ada peringkat

- Income Statement: (Company Name)Dokumen3 halamanIncome Statement: (Company Name)ChristianBelum ada peringkat

- Ricardo Pangan CompanyDokumen38 halamanRicardo Pangan CompanyAndrea Tugot67% (15)

- Financial Ratios Analysis: Nestle VS Engro FoodsDokumen35 halamanFinancial Ratios Analysis: Nestle VS Engro FoodsAbhishek YadavBelum ada peringkat

- Circular No. 20 (Holiday Homework of Class Xii)Dokumen43 halamanCircular No. 20 (Holiday Homework of Class Xii)rishu ashiBelum ada peringkat

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Dokumen5 halamanComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellBelum ada peringkat

- Financial Information Memorandum GSPC Gas Company Limited: (Strictly Private & Confidential)Dokumen97 halamanFinancial Information Memorandum GSPC Gas Company Limited: (Strictly Private & Confidential)AbhishekKumarBelum ada peringkat

- Financial AccountingDokumen124 halamanFinancial AccountingShashi Ranjan100% (1)

- 1Dokumen40 halaman1Madhu Kiran DhondalayBelum ada peringkat

- Wang - Foerster - Tsagarelis - Are Cash Flows Better Stock Return Predictors Than ProfitsDokumen43 halamanWang - Foerster - Tsagarelis - Are Cash Flows Better Stock Return Predictors Than ProfitsvisotakyBelum ada peringkat

- Financial Statement of Analysis Horizontal and VerticalDokumen7 halamanFinancial Statement of Analysis Horizontal and VerticalALYSSA MARIE NAVARRABelum ada peringkat

- The Other Face of Managerial AccountingDokumen20 halamanThe Other Face of Managerial AccountingModar AlzaiemBelum ada peringkat

- Akun Pengantar Jurnal Ledger Neraca SaldoDokumen13 halamanAkun Pengantar Jurnal Ledger Neraca SaldoAdi Al HadiBelum ada peringkat

- Unit 4 NotesDokumen30 halamanUnit 4 Notesmukul dish ahirwarBelum ada peringkat

- Projecting Cash Flow and EarningsDokumen46 halamanProjecting Cash Flow and EarningsNaeemBelum ada peringkat

- Accountancy Department College of Business & AccountancyDokumen41 halamanAccountancy Department College of Business & AccountancyNhlakanipho NgobeseBelum ada peringkat

- FINANCIAL-STATEMENT - Business FinanceDokumen22 halamanFINANCIAL-STATEMENT - Business FinanceRhea Mae SumalpongBelum ada peringkat

- Acca SBR s21 NotesDokumen153 halamanAcca SBR s21 NotesCharul Chugh100% (1)

- MGT602 14finalterm MasterFileSubjectiveSolvedDokumen216 halamanMGT602 14finalterm MasterFileSubjectiveSolvednimra tariqBelum ada peringkat