Kanda Paper

Diunggah oleh

jodaobiuanDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Kanda Paper

Diunggah oleh

jodaobiuanHak Cipta:

Format Tersedia

Scope of I nsurance Premium for Residential Houses against

Seismic Risk in J apan

J . Kanda

a)

and K. Nishijima

b)

a) University of Tokyo, J apan kandaj@k.u-tokyo.ac.jp

b) ETH, Switzerland

ABSTRACT

The premium for seismic insurance of houses in J apan is basically controlled by the

government. Since individual structural capacities of houses are not sufficiently taken

into account for the premium rating, the premium is fairly high in comparison with the

existing risk. The present study compares the current seismic insurance premium and

the expected seismic loss considering several levels of damages with damage cost

statistics available from the Hyogoken-Numbu Earthquake for eight sites in J apan.

The regional variation indicates the strong influences of the seismic hazard

characteristics. The differentiation of premium considering the structural capacity is

strongly recommended for improving the application ratio of seismic insurance.

KEYWORDS

Seismic insurance, I nsurance premium, Seismic hazard, residential houses, Damage

statistics, Fragility function, Loss function

I NTRODUCTI ON

I n J apan the seismic insurance for houses is re-insured by the government and the

premium is basically controlled by the government. The seismic insurance is a part of

the fire insurance as a special contract. The application rate for the seismic contract

has increased since the Hyogoken-Numbu Earthquake 1995 and is approximately 35%

at present. The premium was calculated from the average damages estimated from

the past earthquakes during 500 years. Since 1995 the seismic insurance has been

discussed in many occasions. The seismic hazard was reviewed and the insurance

premium has been amended by reflecting the seismic risk. The premium in a higher

zone is approximately three times that in a l ower zone. On the other hand the

premium for houses is not differentiated according to structural capacity differences.

The tendency of relations between significant parameters in the loss function and

reasonable insurance premium for houses is discussed by considering the seismic risk

for individual houses based on expected annual portfolio loss.

We focus only on the Earthquake insurance premium for new houses properly built of

steel structure and reinforced structure, because the main topic in this paper is to

discuss on the consistency between the insurance premium at present and the statistics

estimated from engineering experience such as expected loss or probable maximum loss

based on damage statistics available.

ESTI MATED LOSS FUNCTI ON

The loss function can be estimated from the fragility functions proposed from

damages by the Hyogoken-Nambu Earthquake. Murao and Yamazaki, 2000 showed

typical fragility models for buildings with different constructions. These fragility

functions can be applied to ordinary existing houses, while houses built according to the

current Building Standard Law are estimated to have significantly higher capacity.

Some houses with base isolation systems will have even higher capacity. Since

sufficient information is not available for these houses, parameters in loss functions are

somehow assumed based on the damages caused by Hyogoken-Nambu Earthquake.

Fragi l i ty curve is assumed to be expressed in the following log-normal probability

form with parameters in Table 1.

ln

( )

i

V

Damageratio

=

( 1)

where V is the input earthquake ground motion on surface in velocity (cm/s), is

the normal distribution function, and i represents the damage state. These values are

obtained after Hyogoken-Nambu earthquake for houses with grade 1, which is the basic

performance grade as specified by the Law for Quality Assurance of Performance of

Houses. The repair cost in Table 1 i s obtained al so from the Hyogoken-Numbu

Earthquake as surveyed by Kanda and Hirakawa, 1998 .

Seismic performance for newly built houses in J apan can be categorized into three

grades as the regulation specifies. Grade 1 is the ordinary level satisfying the criteria

specified in the seismic regulation according to the Building Standard Law, Grade 2 is

the level where 1.25 times seismic load of the regulation is applied and Grade 3 is the

level where 1.5 times is applied.

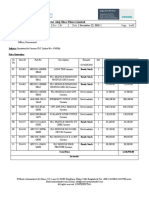

Table 1 Parameters for log-normal fragility curve

Damage state i

Repair cost (%)

Slight ln50 0.4 -

Minor ln100 0.4 10

Moderate ln150 0.4 15

Severe ln200 0.4 30

Collapse ln250 0.4 100

According to the conventional contract of the earthquake insurance, the insurance is

paid when the following criteria are met,

I f the monetary loss of elements of the relevant structure falls between 3 % and

20 %, or the house is affected by flood above floor level, 5 % of insured value is paid.

(level 1)

I f the monetary loss of elements of the relevant structure falls between 20 % and

50 %, or 20 % to 70% of total floor is lost due to fire, tsunami, or flood, 50 % of

insured value is paid. (level 2)

I f the monetary loss of elements of the relevant structure exceeds 50 %, or 70 % or

more of total floor is lost due to fire, tsunami, or flood, 100 % of insured value is

paid. (level 3)

Compared with the loss due to the direct damage from earthquake motion, the

probability that the house is damaged by fire, tsunami, or flood is so much smaller that

only damage due directly to the earthquake motion is considered hereafter.

I n order to estimate some statistics of earthquake insurance, we need to relate the

criteria of earthquake insurance to damage state of structure in Table 1. I t seems

rational to relate as level 1 to the slight and minor damage, level 2 to the severe and

moderate damage, level 3 to the collapse. As a consequence, the insured loss,

i

L , where

i indicates the damage level, is obtained as the sum of the following,

1

ln ln50 ln ln150

0.05

0.4 0.4

V V

L

=

( 2a)

2

ln ln150 ln ln250

0.5

0.4 0.4

V V

L

=

( 2b)

3

ln ln250

1

0.4

V

L

=

( 2c)

Figure 1 shows the diagram of damage ratio for each stage of loss level. These loss

functions can be interpreted as the ones for portfolio. The original fragility curve

represents the average loss ratio so that the local loss ratios may differ from average

loss ratio. However, when portfolio loss is considered, the loss ratio can be rationally

assumed to converge to average loss ratio by the law of large number. The portfolio

loss can be used for insurance premium calculation. From this reason, thereafter we

adopt the above loss functions as the ones for portfolio in a deterministic manner.

SEI SMI C HAZARD ESTI MATI ON

For illustrative purposes, 8 major cities in J apan are selected, i.e. Sapporo, Sendai,

Tokyo, Nagoya, Osaka, Hiroshima, Takamatsu, and Kitakyushu as shown in Figure 2.

Seismic hazard analysis is conducted utilizing data and procedures proposed by Ochi et

al 2002. Fi gure 3 shows earthquake hazard at each city. Major acti ve faul ts are

considered with respective occurrence probability according to a report provided by the

Ministry of Education, Culture, Sports, Science and Technology, 2001 and the

Gutenberg-Richer relationship for the earthquake occurrence is adopted where active

fault information is not available based on the past earthquake statistics. Soil

amplification factor at each site is assumed to be 2.0, which is a reference value for a

relatively firm soil condition.

Hazard values at Osaka, Nagoya and Takamatsu are relatively high as shown in

Figure 2 as the consequence of To-kai and To-nankai Earthquakes with their fairly high

occurrence probabilities. The uncertainty of attenuation formula used in the study is

assumed as 0.5 in terms of the logarithmic standard deviation. Although this value is

consistent to the statistics available for many earthquakes, it could be considered to be

extremely high when the fault source model can be estimated and soil characteristics

and path information are provided. The combination of high occurrence probability

and high uncertainty of attenuation formula cause significantly high hazard results and

could lead to the conservative loss estimation. Thi s conservatism may be eliminated

by applying scenario earthquakes to probabilistic hazard estimation such as proposed

by Kanda et al, 2004.

I NSURANCE PREMI UM AND EXPECTED LOSS

Table 2 shows basic insurance premium for each site for a house of reinforced concrete

or steel structure. Even higher premium is determined f or wooden houses. The

seismic activity is considered based on the hazard evaluation and premium is

differentiated for sites as listed in Table 2.

Table 2 Annual basic premium for RC or S

Sapporo Sendai Tokyo Nagoya Osaka Hiroshima Takamatsu Kitakyushu

Premium

(%)

0.05 0.07 0.175 0.135 0.135 0.05 0.05 0.05

Figure 4 shows the comparison between the present insurance premiums at each site

and the mean insured loss estimated from engineering calculation. I f a house is

categorized to grade 1, 2 or 3, the insurance premium is reduced by 10 %, 20 %, 30 %

respectively. The above mentioned fragility curve corresponds to the one for grade 1.

From the engineering point of view it can be assumed that the resistance of the house

with grade 2, 3 is stronger in terms of seismic load considered by 25 %, 50 % than the

above mentioned fragility curve. Therefore the fragility curves for houses with grade 2,

3 are obtained by shifting the original fragility curves accordingly and so are insured

loss functions.

Table 3 shows the ratio of present premium, for each site and each grade, to expected

insured loss obtained by hazard anal yses and l oss functi ons. Resul ts of Tabl e 3

indicates that present insurance premium in Table 2 does not fully reflect the local

earthquake hazard, and what is more, the reduction of premiums by 20% or 30% for

grade 2 or 3 respectively does not compensate at all for strengthened resistance of

house.

Table 3 (insurance premium at present) / (expected insured loss)

Sapporo Sendai Tokyo Nagoya Osaka Hiroshima Takamatsu Kitakyushu

grade1 466.6 13.7 9.0 1.5 1.9 6.3 1.8 17.5

grade2 999.0 25.6 15.7 2.8 3.7 13.5 3.8 38.5

grade3 2054.4 42.0 25.4 4.0 5.0 16.5 4.7 44.8

Probable maximum loss (PML) curves for are shown in Figure 5. 90 percentile loss

estimation was used as i n the conventi onal PML estimation. 475 year is often

considered for PML as the return period for the maximum earthquake ground motion,

but the return period is treated as the variable in the figure to examine the tendency of

the return period of input motion on the probabilistic loss estimation. As the tendency

of the seismic activity differs from site to site, PML varies with the return period rather

differently.

I n sites where the slope shallow as in Tokyo or Nagoya in Figure 5, damages are

expected for relatively high frequency events which corresponds to the lower level

damages. Then this tendency can also pointed out in Figure 4, where the expected

level 1 damage is relatively high in Tokyo or Nagoya.

CONCLUSI ONS

Sei smi c i nsurance premi um for houses i s consi dered to be too hi gh i n J apan.

Although insurance companies explain that the premium is determined according to the

past earthquake damage statistics, the strength of present houses is not considered

sufficiently for the premium determination. The present study describes numerical

examples by showing the present premium and the expected loss, then the

inconsistency of the local hazard and also the individual strength of houses are

discussed.

ACKNOWLEDGEMENT

This project is partly supported by the grant from the J SPS for young scientists.

REFERENCES

Kanda, J . and Hirakawa, T. Failure cost estimation equivalent to multi-level limit state

failure, Structural Safety and Reliability, Balkema, pp295-300, 1998.

Kanda, J . et al., Probabilistic design earthquake ground motions considering scenario

earthquakes, Proc. 13

th

World Conf. Earthquake Eng., Vancouver, Paper No. 2120,

2004.

Ministry of Education, Culture, Sports, Science and Technology, Report on Survey of

Active Faults, 1997-2001. (in J apanese)

Murao, O. and Yamazaki, F. Development of fragility curves for buildings based on

damage survey data of a local government after the 1995 Hyogoiken-Numbu

Earthquake, J . Struct. Constr. Eng., A.I .J . No.527, pp189-196, 2000. (in J apanese)

Ochi, S., Sakamoto, S., Takada, T. and Kanda, J . An internet-based system for seismic

performance evaluation of existing buildings, 1

st

ASRANet I nternational Colloquium,

Glasgow, 2002.

Fi gure 1 Diagram of damage ratio for each level

Figure 2 Locations of 8 sites in J apan

Figure 3 Hazard curves at 8 sites

Figure 4 Comparison between present insurance premium and expected insured loss

from our analysis at each site

Figure 5 PML curve at each site

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Fem Seismic Shaking TableDokumen13 halamanFem Seismic Shaking TablejodaobiuanBelum ada peringkat

- Beam Theories The Difference Between Euler-Bernoulli and TimoschenkoDokumen8 halamanBeam Theories The Difference Between Euler-Bernoulli and TimoschenkoRenit Sam100% (1)

- Tunnels in Weak RockDokumen15 halamanTunnels in Weak RockSandeep AggarwalBelum ada peringkat

- Seismic Vulnerability of Deep Tunnels: Numerical Modeling For A Fully Nonlinear Dynamic AnalysisDokumen12 halamanSeismic Vulnerability of Deep Tunnels: Numerical Modeling For A Fully Nonlinear Dynamic AnalysisjodaobiuanBelum ada peringkat

- Quantification of Degree of Nonlinear Site Response: S. Noguchi and T. SasataniDokumen8 halamanQuantification of Degree of Nonlinear Site Response: S. Noguchi and T. SasatanijodaobiuanBelum ada peringkat

- Kanda PaperDokumen9 halamanKanda PaperjodaobiuanBelum ada peringkat

- A Methodology For The Geotechnical Design of Long High-Speed Rail Tunnels Under The Conditions of UncertaintyDokumen27 halamanA Methodology For The Geotechnical Design of Long High-Speed Rail Tunnels Under The Conditions of UncertaintyjodaobiuanBelum ada peringkat

- Quantification of Degree of Nonlinear Site Response: S. Noguchi and T. SasataniDokumen8 halamanQuantification of Degree of Nonlinear Site Response: S. Noguchi and T. SasatanijodaobiuanBelum ada peringkat

- For Accuracy and Safety: Globally ApprovedDokumen4 halamanFor Accuracy and Safety: Globally ApprovedPedro LopesBelum ada peringkat

- Chakir Sara 2019Dokumen25 halamanChakir Sara 2019hiba toubaliBelum ada peringkat

- Banking Ombudsman 58Dokumen4 halamanBanking Ombudsman 58Sahil GauravBelum ada peringkat

- Hitachi Vehicle CardDokumen44 halamanHitachi Vehicle CardKieran RyanBelum ada peringkat

- Pyramid Type Plate Bending MachineDokumen10 halamanPyramid Type Plate Bending MachineAswin JosephBelum ada peringkat

- Sony x300 ManualDokumen8 halamanSony x300 ManualMarcosCanforaBelum ada peringkat

- Industrial ReportDokumen52 halamanIndustrial ReportSiddharthBelum ada peringkat

- G.Devendiran: Career ObjectiveDokumen2 halamanG.Devendiran: Career ObjectiveSadha SivamBelum ada peringkat

- Fundasurv 215 Plate 1mDokumen3 halamanFundasurv 215 Plate 1mKeith AtencioBelum ada peringkat

- Leveriza Heights SubdivisionDokumen4 halamanLeveriza Heights SubdivisionTabordan AlmaeBelum ada peringkat

- PDFDokumen653 halamanPDFconstantinBelum ada peringkat

- Pam8610 PDFDokumen15 halamanPam8610 PDFRaka Satria PradanaBelum ada peringkat

- Problem Solving No. 123Dokumen5 halamanProblem Solving No. 123Christy Joy BarboBelum ada peringkat

- Aristotle - OCR - AS Revision NotesDokumen3 halamanAristotle - OCR - AS Revision NotesAmelia Dovelle0% (1)

- Cash Flow July 2021Dokumen25 halamanCash Flow July 2021pratima jadhavBelum ada peringkat

- VOTOL EMController Manual V2.0Dokumen18 halamanVOTOL EMController Manual V2.0Nandi F. ReyhanBelum ada peringkat

- Javascript Notes For ProfessionalsDokumen490 halamanJavascript Notes For ProfessionalsDragos Stefan NeaguBelum ada peringkat

- ME-6501Computer Aided Design (CAD) WITH QB - BY Civildatas - Com 1Dokumen85 halamanME-6501Computer Aided Design (CAD) WITH QB - BY Civildatas - Com 1Nathar ShaBelum ada peringkat

- Digital Systems Project: IITB CPUDokumen7 halamanDigital Systems Project: IITB CPUAnoushka DeyBelum ada peringkat

- Anker Soundcore Mini, Super-Portable Bluetooth SpeakerDokumen4 halamanAnker Soundcore Mini, Super-Portable Bluetooth SpeakerM.SaadBelum ada peringkat

- LC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Dokumen2 halamanLC For Akij Biax Films Limited: CO2012102 0 December 22, 2020Mahadi Hassan ShemulBelum ada peringkat

- BDokumen28 halamanBLubaBelum ada peringkat

- Categorical SyllogismDokumen3 halamanCategorical SyllogismYan Lean DollisonBelum ada peringkat

- File RecordsDokumen161 halamanFile RecordsAtharva Thite100% (2)

- Atmel 46003 SE M90E32AS DatasheetDokumen84 halamanAtmel 46003 SE M90E32AS DatasheetNagarajBelum ada peringkat

- 5.1 Behaviour of Water in Rocks and SoilsDokumen5 halaman5.1 Behaviour of Water in Rocks and SoilsHernandez, Mark Jyssie M.Belum ada peringkat

- ISO Position ToleranceDokumen15 halamanISO Position ToleranceНиколай КалугинBelum ada peringkat

- Stress Management HandoutsDokumen3 halamanStress Management HandoutsUsha SharmaBelum ada peringkat

- How To Install Metal LathDokumen2 halamanHow To Install Metal LathKfir BenishtiBelum ada peringkat

- Life and Works of Jose Rizal Modified ModuleDokumen96 halamanLife and Works of Jose Rizal Modified ModuleRamos, Queencie R.Belum ada peringkat