Techne Corporation (TECH) - Good Risk/Reward Proposition

Diunggah oleh

sommer_ronald5741Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Techne Corporation (TECH) - Good Risk/Reward Proposition

Diunggah oleh

sommer_ronald5741Hak Cipta:

Format Tersedia

Measured Approach

TECHE CORPORATION (NASDAQ:TECH) Data as of: 11/20/2009

Industry: Biotechnology & Drugs

Current Data

Current Price $67.12 PEG 1.4

Market Cap ($M) 2499.98 EPS TTM ($) $2.76

Shares Outstanding (M) 37.2450 P/E TTM 24.3

Institutional Holdings % 78.6 EPS Estimated 2010 ($) $2.97

Insider Holdings % 6.8 P/Estimated EPS 22.6

Beta 0.70 MA Value ($) $89.72

Latest Quarter Reported 09/30/2009 Dividend Yield % 1.5

Techne Corporation (TECH) is a mid-cap biotechnology company that offers a good

risk/reward profile. It is engaged in the development and manufacture of biotechnology

products and hematology calibrators and controls. The company appears to be richly

priced as compared to its competitors. However, we think this is a hidden gem.

The company's strengths include a strong financial position with no long-term debt and

cash in excess of current liabilities, expanding profit margins and outstanding return on

equity.

Quick Facts

The results are in for the first quarter and Techne reported a decline in net earnings of

6.4% to $26.8 million ($0.72 per diluted share). In the prior year quarter, the company

reported net income of $28.6 million or $0.74 per diluted share. Consolidated net sales

for the quarter were $66.5 million, a 4.0% decrease from $69.32 million in the year-ago

quarter. Four analysts estimated revenues of $66.70 million for the quarter.

TECH announced that its Board of Directors has decided to pay a dividend of $0.26 per

share for the quarter ended September 30, 2009. The quarterly dividend will be payable

November 23, 2009 to all common shareholders of record on November 9, 2009. Future

cash dividends will be considered by the Board of Directors on a quarterly basis.

From the company’s FY2009 10K:

“TECHNE’s sales and earnings again reached record levels in fiscal 2009, despite difficult

world economic conditions. Regardless of the economic environment, our long-term

investment in the people, equipment and facilities that generate new product

development continues to be the primary driver of our business, as it has for many

years.

Here are some of the highlights of our fiscal 2009 performance:

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

• Net earnings were $105.2 million or $2.78 per diluted share, an EPS increase of 5.3%,

as compared with net earnings of $103.6 million, or $2.64 per diluted share in fiscal

2008. Foreign currency fluctuations negatively affected net earnings by $4.5 million (12

cents per share), resulting from strength in the U.S. dollar vs. the euro and British pound

sterling. Net earnings were also affected by lower investment yields that reduced

interest income by $4.6 million (9 cents per share after tax).

• Net sales increased 2.5% to $264.0 million, compared with sales of $257.4 million, in

Fiscal 2008. Organic revenue growth, net of foreign currency exchange rate changes,

was

5.9% vs. 12.3% last year.

• Gross margins for fiscal 2009 were 79.0%, down from 79.5% last year, primarily due to

currency impacts; operating margin was 57.1%, up from 56.1%; and return on sales was

39.9%, down from 40.2% due to the severe decline in interest income.

• Return on average invested capital (ROIC) was 22.3% in fiscal 2009, generating more

than 11% of economic value for our shareholders, when compared with TECHNE’s cost

of capital of approximately 11%.

• Return on average equity was also 22.3% (the same as ROIC since we have no debt)

and return on average assets was 21.5% for the year.

• Net cash provided by operations was $111.3 million and we returned $118.8 million

to shareholders during the year; $28.2 million in dividends and $90.6 million through

purchases of 1.4 million shares of our common stock at an average purchase price of

$63.82 per share. We closed the year with $264.8 million in cash and available-for-sale

investments.

• We introduced 1,419 new products during fiscal 2009, bringing our product total to

nearly 14,000 products. Revenues from these new products amounted to $3.4 million in

their first year, representing greater than expected first year sales.

Our Biotechnology segment, which represented 65.9% of TECHNE revenues in fiscal

2009, grew 5.0% for the year vs. 13.0% in fiscal 2008, reflecting the pronounced

slowdown in the world economy. In that regard, key customer segment revenue growth

rates were: Bio/Pharmaceutical 4.7%, International Distributors 6.2% and the Academic

market 3.9%. R&D Systems Europe (R&D Europe), which represented 27.5% of TECHNE’s

US dollar revenues in fiscal 2009, declined 4.2% during the year, as the result of

currency translations, primarily the euro and the British pound sterling, both of which

weakened significantly versus the US dollar in fiscal 2009. Organically, excluding

currency effects, R&D Europe grew 7.2% for the year, compared with 12.2% in fiscal

2008. Thus far, biotechnology research in both European academic institutions and

bio/pharmaceutical companies has been less severely impacted by the world recession

than comparable institutions in the United States.”

ANALYSIS OF THE BALANCE SHEET

The schedule below shows the year-end balance sheets for the years between June 30,

2005 and June 30, 2009 and for the twelve month period ending September 30, 2009.

Accounts receivable and inventory comprise approximately 16 percent of the business’s

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

current assets. Cash and short-term investments comprise approximately 81 percent of

current assets. The amount of current assets has been steadily increasing throughout

the period shown.

Fixed assets (net property, plant and equipment) include all of the company’s

production machinery and equipment. As of September 30, 2009, they made up

approximately 48 percent of the company’s non-current assets. Other non-current

assets include long-term investments (36 percent of non-current assets) and

goodwill/intangibles (14 percent of non-current assets.)

Overall, the business’s total assets have increased approximately 65 percent during the

period June 30, 2005 to September 30, 2009. The increase in total assets has been due

primarily to increases in cash and short-term investments.

Current liabilities are comprised about equally of accounts payable and other current

liabilities. Total current liabilities are $16.0 million, as of September 30, 2009.

As the business’s earnings steadily increased, so did its equity. The company nearly

doubled its booked equity during the period presented below.

Balance Sheet

(Amounts in Millions)

TTM FYE FYE FYE FYE FYE

Assets 09/30/09 06/30/09 06/30/08 06/30/07 06/30/06 06/30/05

Cash 174.80 160.90 167.00 135.50 89.60 80.30

ST Investments 52.50 41.90 39.40 29.30 19.20 16.80

Accounts Receivable 31.70 31.20 33.30 31.00 25.10 23.70

Inventory 12.50 11.30 9.50 8.80 9.00 7.80

Other Current Assets 10.40 10.20 9.20 8.30 6.90 6.40

Total Current Assets 281.90 255.50 258.40 212.80 149.80 135.00

Net Property, Plant & Equip. 98.80 100.10 101.70 91.50 88.80 89.00

LT Investments 74.40 84.00 112.10 115.60 94.90 50.00

Goodwill/Intangibles 27.80 28.10 29.00 30.20 32.00 14.10

Other LT Assets 4.10 4.40 6.00 4.70 5.00 7.10

Total Assets 487.00 472.00 507.40 454.80 370.50 295.30

Liabilities

Accounts Payable 8.00 7.50 6.10 6.90 5.50 4.10

Short Term Debt 0.00 0.00 0.00 0.00 1.20 1.20

Other Current Liabilities 8.10 8.10 14.10 10.30 11.30 8.70

Total Current Liabilities 16.00 15.50 20.20 17.20 18.00 14.00

LT Debt 0.00 0.00 0.00 0.00 12.20 13.40

Other LT Liabilities 0.00 0.00 0.00 0.00 0.00 0.00

Total Liabilities 16.00 15.50 20.20 17.20 30.20 27.40

Preferred Stock 0.00 0.00 0.00 0.00 0.00 0.00

Common Stock Equity 471.00 456.50 487.10 437.70 340.30 267.90

Total Liabilities & Equity 487.00 472.00 507.30 454.90 370.50 295.30

Book Value Per Share 12.65 12.08 12.45 11.11 8.71 6.64

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

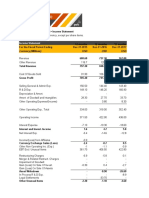

ANALYSIS OF THE INCOME STATEMENT

As part of my analysis, I have analyzed the business’s income statements for the years

ending June 30, 2005 through June 30, 2009 and for the twelve month period ending

September 30, 2009.

Revenues have increased from $178.7 million to $261.2 million during the period under

study. Throughout this period, the gross profit percentage has remained remarkably

stable, and high, ranging from 77.4 percent to 79.4 percent. The result is a 45 percent

increase in gross margin dollars for the twelve month period ending September 30, 2009

as compared for the FYE June 30, 2005.

Operating expenses have averaged approximately 43 percent of revenues during the

reporting period. Operating expenses are stable in relation to revenues.

Because the company has had basically the same cost structure throughout the

reporting period, as revenues increased by 46 percent, pre-tax earnings have increased

approximately 52 percent.

Income Statement

Amounts in Millions

TTM FYE FYE FYE FYE FYE

09/30/09 06/30/09 06/30/08 06/30/07 06/30/06 06/30/05

Sales 261.20 264.00 257.40 223.50 202.60 178.70

Cost of Goods Sold 55.30 55.50 52.90 46.70 45.70 36.80

Gross Income 205.90 208.50 204.50 176.80 156.90 141.90

Depreciation & Amortization 0.80 1.00 1.10 1.60 2.00 1.20

Research/Development 23.80 23.60 22.40 20.10 18.80 18.40

Interest Expense 0.00 0.00 0.00 0.00 0.00 0.80

Unusual Expenses/(Income) 0.00 0.00 0.40 0.00 0.00 0.00

Total Operating Expenses 112.40 113.20 113.50 90.90 89.40 77.60

Operating Income 148.70 150.80 143.90 132.60 113.20 101.10

Interest Expense - Non-Op. 0.00 0.00 0.00 1.10 1.00 0.00

Other Expenses/(Income) (3.30) (4.60) (9.90) 2.60 1.00 1.20

Pretax Income 152.10 155.40 153.80 128.90 111.20 99.90

Income Taxes 48.70 50.10 50.30 43.80 37.80 33.80

Income After Taxes 103.40 105.20 103.60 85.10 73.40 66.10

Adjustments to Income 0.00 0.00 0.00 0.00 0.00 0.00

Income for Primary EPS 103.40 105.20 103.60 85.10 73.40 66.10

Nonrecurring Items 0.00 0.00 0.00 0.00 0.00 0.00

Net Income 103.40 105.20 103.60 85.10 73.40 66.10

EPS Basic 2.76 2.78 2.65 2.16 1.88 1.64

EPS Diluted 2.76 2.78 2.64 2.15 1.85 1.62

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

INDUSTRY COMPARATIVE ANALYSIS

The following schedule presents a comparative ratio analysis of TECH and the industry

median for the Biotechnology & Drug industry. Four categories of ratios (profitability,

liquidity, debt management and asset management) have been used to compare the

operating results of the subject company with that of the industry median.

Gross profit margin reflects the pricing decisions of a company as well as the costs of the

materials needed to produce their product(s) or service(s). It is the ratio of the gross

income of a company (sales less cost of goods sold) to its sales for the same period. The

greater this margin is and the more stable it is over time, the greater the company’s

expected profitability.

The average operating margin ratio examines the relationship between sales and

management-controllable costs before interest, taxes, and non-operating expenses. The

operating margin is the ratio of operating income (sales less operating expenses) to

sales for the same period. You ideally would like to see a high operating margin that is

steady over time.

Return on equity (book value) examines the financial structure of a firm and its impact

on earnings. Return on equity indicates how much common shareholders earned on

their investment. The level of debt or leverage on the balance sheet has a significant

impact on return on equity during good and bad years. Large differences between

return on assets and return on equity should alert investors to examine closely the

liquidity and financial risk of the company.

The current ratio compares the level of the firm’s most liquid assets—current assets—

against that of its shortest maturity obligations—current liabilities. A high current ratio

indicates a high level of liquidity and, consequently, less risk of immediate financial

trouble. However, too high a current ratio may point to unnecessary investment in

current assets, or an inability on the company’s part to collect accounts receivable, or an

inflated inventory. Circumstances such as these ultimately have a negative impact on

earnings. On the other hand, too low a current ratio implies illiquidity and the potential

for the company to be unable to meet current liabilities in the event of random shocks,

such as strikes, that temporarily reduce the inflow of cash. It is computed by dividing

short-term assets by short-term liabilities for the same period.

Sometimes referred to as the interest coverage ratio, times interest earned is the

traditional measure of a company’s ability to meet its interest payments. It indicates

how well a company is able to generate earnings to pay interest on its debt. The larger

and more stable the ratio, the lower the risk of the company defaulting. In addition, the

higher the ratio, the more flexibility a company has in being able to meet its financial

obligations and have money left over for dividends, expansion, etc. Interest on debt

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

obligations must be paid, regardless of a company’s future potential. Failure to do so

will result in default if the lender is not willing to restructure debt obligations. As this

ratio falls, the risk of a company defaulting on its debt obligations increases. A ratio of

less than one indicates that company’s current earnings are not high enough to meet

their current debt obligations, meaning they will need to liquidate assets to make up the

shortfall or find additional funding.

The ratio of total liabilities to total assets is also referred to as the debt to total assets

ratio, measures the percentage of assets financed by all forms of debt—both current

and long term. The higher the percentage and the greater the potential variability of

earnings translates into a greater potential for the firm to default on its debt obligations.

Long-term debt as a percentage of total capital is a popular measure of a company’s

financial leverage. It compares the level of long-term debt carried by a company to all

sources of long-term financing—long-term debt and stockholder’s equity. A high ratio

indicates high risk. However, just because this ratio is low does not necessarily mean risk

is low. You need to examine the level of current liabilities; if current liabilities are such

that the company cannot meet these obligations, it runs the risk of defaulting, thus

increasing its risk. Long-term debts are liabilities due in a year or more.

Long-term debt as a percentage of total common equity indicates what proportion of

the firm’s capital is derived from debt as compared to equity. A higher percentage of

debt compared to equity increases the volatility of earnings as well as the probability

that the firm will not be able to make its interest payments and default on its debt.

Long-term debts are liabilities due in a year or more.

The accounts receivable turnover measures the effectiveness of the firm’s credit policies

and helps indicate the level of investment in receivables needed to maintain the level of

sales. It tells us how many times each period the company collects or turns into cash its

accounts receivable. The higher the turnover ratio, the shorter the time between the

credit sale and cash collection. A decline in receivables turnover over time is a red flag of

possible reduced demand for the firm’s products, an indication that the company is not

doing as good a job collecting its receivables, or that the company is improperly booking

credit sales in order to boost its revenues.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

COMPARATIVE RATIOS

TTM FYE FYE FYE FYE FYE

Profitability 09/30/09 06/30/09 06/30/08 06/30/07 06/30/06 06/30/05

Gross Profit Margin % 78.80 79.00 79.40 79.10 77.40 79.40

Industry Median 51.00 52.80 55.70 53.10 54.10 54.20

Operating Margin % 57.00 57.10 55.90 59.30 55.90 56.60

Industry Median (41.20) (36.00) (39.80) (55.40) (62.70) (68.80)

Net Profit Margin % 39.60 39.80 40.20 38.10 36.20 37.00

Industry Median (38.00) (38.80) (37.40) (50.20) (59.30) (65.80)

Return on Equity % 23.30 22.30 22.40 21.90 24.10 23.40

Industry Median (13.70) (25.80) (28.40) (26.80) (30.00) (26.00)

Return on Assets % 22.50 21.50 21.50 20.60 22.00 21.30

Industry Median (52.40) (49.00) (42.50) (42.20) (38.00) (39.70)

Liquidity

Quick Ratio (X) 16.80 15.80 12.30 11.90 7.80 9.10

Industry Median 1.80 2.20 3.00 3.30 3.30 3.80

Current Ratio (X) 17.60 16.50 12.80 12.40 8.30 9.60

Industry Median 2.10 2.40 3.30 3.50 3.50 3.90

Payout Ratio (X) 36.20 27.00 0.00 0.00 0.00 0.00

Industry Median 0.00 0.00 0.00 0.00 0.00 0.00

Times Interest Earned (X) na na na 118.20 112.20 125.90

Industry Median (5.30) (6.30) (7.30) (8.40) (6.20) (8.10)

Debt Management

Total Liabilities to Total Assets % 3.30 3.30 4.00 3.80 8.20 9.30

Industry Median 51.40 47.10 38.80 37.00 35.70 30.70

Long-Term Debt to Capital % 0.00 0.00 0.00 0.00 3.50 4.80

Industry Median 0.40 0.90 0.30 0.30 0.90 0.50

Long-Term Debt to Equity % 0.00 0.00 0.00 0.00 3.60 5.00

Industry Median 0.00 0.00 0.00 0.00 0.00 0.00

Asset Management

Receivables Turnover (X) 8.20 8.20 8.00 8.00 8.30 8.00

Industry Median 6.10 6.10 5.70 5.30 5.50 5.60

Inventory Turnover (X) 5.00 5.30 5.80 5.20 5.40 4.80

Industry Median 3.00 3.00 3.00 3.00 2.90 2.90

Asset Turnover (X) 0.60 0.50 0.50 0.50 0.60 0.60

Industry Median 0.50 0.40 0.20 0.20 0.20 0.20

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

VALUATION CONCLUSIONS

We place a target price of $89.72 on the common shares of Techne Corporation. We

recognize this implies very high multiples to forecasted earnings and sales. However, we

feel this target is justified. Though future earnings are supposed to be the chief

determinant of value, we take into consideration a number of other factors. These

factors are considered in determining a capitalization rate.

We consider the long-term prospects of a company. We do not know what the future

will be but there are disconnects between the value of individual companies and an

industry. In the case of Techne, we believe the company’s ability to sustain margins

superior to the industry is a contributing factor to justifying premium multiples.

The role of management is one of those qualitative factors that are difficult to measure.

However, if past is prologue, then a company’s past performance provides some

indication of what we can expect in the future. Techne has consistently reported

growing profits and free cash flow.

There is something to be said for a company that is financially strong and has a sound

capital structure. Stock of a company with a lot of surplus cash and nothing ahead of the

common is clearly a better purchase than another one with the same per share earnings

but large bank loans and senior securities.

One measure of quality is a company’s ability to provide a safe dividend. Though Techne

only recently started paying a dividend, it is well covered by earnings. The current

dividend rate is about 1.5 percent.

Valuation Ratios

Current Industry

Company MA Value Median

Price Earnings 24.30 32.51 14.60

PE to Growth 1.40 2.22 0.70

Price to Book 5.30 7.09 2.70

Price to Sales 9.50 12.80 3.40

Price to Cash Flow 24.10 32.27 12.40

Price to Free Cash Flow 36.70 49.03 13.60

Disclosure: The author has no position in TECH.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Anda mungkin juga menyukai

- Amdocs LTDDokumen4 halamanAmdocs LTDsommer_ronald5741Belum ada peringkat

- Topic:-Evaluate The Financial Performance of Marks &spencer PLCDokumen27 halamanTopic:-Evaluate The Financial Performance of Marks &spencer PLCAnonymous ohYFoO4Belum ada peringkat

- Course Code: Fm60/ Financial - Class: FM 1A - SCHEDULE: MONDAY//5:30PM-8:30PM - Professor: Ms. Eunicel D. BalaneDokumen17 halamanCourse Code: Fm60/ Financial - Class: FM 1A - SCHEDULE: MONDAY//5:30PM-8:30PM - Professor: Ms. Eunicel D. BalaneMariece CapananBelum ada peringkat

- InfosysDokumen9 halamanInfosysvibhach1Belum ada peringkat

- Forest Laboratories, Inc.Dokumen4 halamanForest Laboratories, Inc.sommer_ronald5741Belum ada peringkat

- CHAPTER 4 Financials Velas Encendida Candles 3 12 19Dokumen18 halamanCHAPTER 4 Financials Velas Encendida Candles 3 12 19JenilynBelum ada peringkat

- Trading Information 2011 2010 2009 2008Dokumen10 halamanTrading Information 2011 2010 2009 2008Fadi MashharawiBelum ada peringkat

- Week 1 - Broadway ProformaDokumen34 halamanWeek 1 - Broadway ProformashivangiBelum ada peringkat

- CasesDokumen74 halamanCasesPollsBelum ada peringkat

- PWC Challenge 2020 Round 1 Cure& DatasetDokumen5 halamanPWC Challenge 2020 Round 1 Cure& Datasetsagar vaziraniBelum ada peringkat

- Illustration For Financial Analysis Using RatioDokumen2 halamanIllustration For Financial Analysis Using RatioamahaktBelum ada peringkat

- Financial Analysis For The Year Ended 2009Dokumen4 halamanFinancial Analysis For The Year Ended 2009Habiba KashifBelum ada peringkat

- Ca Final SFM List of Important Qa For May 2022Dokumen110 halamanCa Final SFM List of Important Qa For May 2022PapuBelum ada peringkat

- Toshiba: by Lenan Ye (Nancy) Yafang Xiong (Dori) Pam Berwick Ryan BinstockDokumen24 halamanToshiba: by Lenan Ye (Nancy) Yafang Xiong (Dori) Pam Berwick Ryan BinstockJonathan EscamillanBelum ada peringkat

- 6 Financial Statements ReviewDokumen21 halaman6 Financial Statements Reviewsanu sayedBelum ada peringkat

- Idea InnovationDokumen14 halamanIdea Innovationnilufar nourinBelum ada peringkat

- LBO - UncompletedDokumen10 halamanLBO - UncompletedRachel TangBelum ada peringkat

- 99 A Benzeer Tanha Funfin FinalsDokumen7 halaman99 A Benzeer Tanha Funfin FinalsBenzeer TanhaBelum ada peringkat

- UGBS Compiled Past Questions 4 PDFDokumen327 halamanUGBS Compiled Past Questions 4 PDFEbunBelum ada peringkat

- Year Sales Annual Growth Rate: Average CagrDokumen14 halamanYear Sales Annual Growth Rate: Average CagrmeaowBelum ada peringkat

- Case Ascend The Finnacle FinalRound 2ADokumen3 halamanCase Ascend The Finnacle FinalRound 2ASAHIL BERDEBelum ada peringkat

- Jollibee Foods Corporation Financial Data (2017)Dokumen10 halamanJollibee Foods Corporation Financial Data (2017)Sheila Mae AramanBelum ada peringkat

- Analysis of Fianacial Statements-NewDokumen26 halamanAnalysis of Fianacial Statements-NewTushar SinghBelum ada peringkat

- Session 3 - Class Exercise Krakatau Steel (A) - SolutionDokumen17 halamanSession 3 - Class Exercise Krakatau Steel (A) - SolutionM Agung PrabowoBelum ada peringkat

- NYSF Practice TemplateDokumen22 halamanNYSF Practice TemplaterapsjadeBelum ada peringkat

- Fatima FertilizersDokumen18 halamanFatima FertilizersBarira AkhtarBelum ada peringkat

- Bajaj Bal SheetDokumen3 halamanBajaj Bal SheetSukshith ShettyBelum ada peringkat

- FM Handout 5Dokumen32 halamanFM Handout 5Rofiq VedcBelum ada peringkat

- Financial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsDokumen7 halamanFinancial Accounting Assignment - II: Ayush India Ltd. Revenue ModelsnikunjBelum ada peringkat

- Trading Information 2011 2010 2009 2008Dokumen10 halamanTrading Information 2011 2010 2009 2008Fadi MashharawiBelum ada peringkat

- Income Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisDokumen1 halamanIncome Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisSandy SinghBelum ada peringkat

- Practice Questions (L5)Dokumen34 halamanPractice Questions (L5)simraBelum ada peringkat

- Practice Questions (L4)Dokumen58 halamanPractice Questions (L4)simraBelum ada peringkat

- Capital StructureDokumen17 halamanCapital StructuresaifBelum ada peringkat

- Financial Goal PlanningDokumen10 halamanFinancial Goal Planningsharvari kadamBelum ada peringkat

- Financial Forecasting In-Class ExamplesDokumen3 halamanFinancial Forecasting In-Class ExamplesRobert IronsBelum ada peringkat

- Financial Plan: Important AssumptionsDokumen15 halamanFinancial Plan: Important AssumptionsjehooniesunshineBelum ada peringkat

- Financial Statement Analysis FormulasDokumen10 halamanFinancial Statement Analysis FormulasKarl LuzungBelum ada peringkat

- Puma R To L 2020 Master 3 PublishDokumen8 halamanPuma R To L 2020 Master 3 PublishIulii IuliikkBelum ada peringkat

- Tuck Industrie Version1.0Dokumen14 halamanTuck Industrie Version1.0Kamolwan StonnisgulBelum ada peringkat

- Trading Information 2011 2010 2009 2008Dokumen10 halamanTrading Information 2011 2010 2009 2008Fadi MashharawiBelum ada peringkat

- 5-Year Financial Plan - Manufacturing 1Dokumen8 halaman5-Year Financial Plan - Manufacturing 1tulalit008Belum ada peringkat

- FSA - Additional HandoutDokumen6 halamanFSA - Additional HandoutApoorva SharmaBelum ada peringkat

- Intoduction: - Tata Steel Formerly Known As TISCO and Tata Iron and Steel CompanyDokumen7 halamanIntoduction: - Tata Steel Formerly Known As TISCO and Tata Iron and Steel Companyaamit87Belum ada peringkat

- PART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%Dokumen5 halamanPART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%jaBelum ada peringkat

- Fina 004Dokumen4 halamanFina 004Mike RajasBelum ada peringkat

- AIR T AnalysisDokumen5 halamanAIR T Analysissommer_ronald5741Belum ada peringkat

- Chapter 1. Exhibits y AnexosDokumen16 halamanChapter 1. Exhibits y AnexosJulio Arroyo GilBelum ada peringkat

- ABC Company, Inc. Recapitalization AnalysisDokumen10 halamanABC Company, Inc. Recapitalization AnalysisMarcBelum ada peringkat

- Week 1 - Landmark ProformaDokumen26 halamanWeek 1 - Landmark ProformashivangiBelum ada peringkat

- Financial Analysis of P & GDokumen25 halamanFinancial Analysis of P & Ghitesh_mahajan_3Belum ada peringkat

- Trial 1 - DominionDokumen17 halamanTrial 1 - Dominionelenasalvazia9Belum ada peringkat

- Assignment 3-Cap Budget-Cap Structure-Val-Student Version SP 2024Dokumen15 halamanAssignment 3-Cap Budget-Cap Structure-Val-Student Version SP 2024salehaiman2019Belum ada peringkat

- Worldscope Full Company Report Acc LimitedDokumen20 halamanWorldscope Full Company Report Acc LimitedAnkit LunawatBelum ada peringkat

- Financial Model SolvedDokumen29 halamanFinancial Model SolvedSaad KhanBelum ada peringkat

- ' Ìi'Êü Ì Êì Iê'I Êûiàã Ê Vê V Ýê À Ê Ê ' Ì Àê / Êài Ûiêì Ãê Ì Vi) Êû Ã Ì/ÊDokumen8 halaman' Ìi'Êü Ì Êì Iê'I Êûiàã Ê Vê V Ýê À Ê Ê ' Ì Àê / Êài Ûiêì Ãê Ì Vi) Êû Ã Ì/ÊArpit MaheshwariBelum ada peringkat

- Quiz 3 Cap Budgeting Cap Structure Valuation Expanded Student VersionDokumen21 halamanQuiz 3 Cap Budgeting Cap Structure Valuation Expanded Student Versionsalehaiman2019Belum ada peringkat

- Guide to Management Accounting CCC for managers 2020 EditionDari EverandGuide to Management Accounting CCC for managers 2020 EditionBelum ada peringkat

- The Best in Coal SummaryDokumen1 halamanThe Best in Coal Summarysommer_ronald5741Belum ada peringkat

- Semiconductor Automated Test Equipment SummaryDokumen1 halamanSemiconductor Automated Test Equipment Summarysommer_ronald5741Belum ada peringkat

- Semiconductor Automated Test Equipment SummaryDokumen1 halamanSemiconductor Automated Test Equipment Summarysommer_ronald5741Belum ada peringkat

- Paper & Paper Products Industry SummaryDokumen1 halamanPaper & Paper Products Industry Summarysommer_ronald5741Belum ada peringkat

- DIY InvestingDokumen2 halamanDIY Investingsommer_ronald5741Belum ada peringkat

- Starting Lineup For 2011Dokumen3 halamanStarting Lineup For 2011sommer_ronald5741Belum ada peringkat

- Global Telecom Opportunities SummaryDokumen1 halamanGlobal Telecom Opportunities Summarysommer_ronald5741Belum ada peringkat

- LubrizolDokumen2 halamanLubrizolsommer_ronald5741Belum ada peringkat

- ComTech Telecom SummaryDokumen3 halamanComTech Telecom Summarysommer_ronald5741Belum ada peringkat

- A Small Cap Healthcare PickDokumen1 halamanA Small Cap Healthcare Picksommer_ronald5741Belum ada peringkat

- Brinker International: Challenge For Casual DiningDokumen2 halamanBrinker International: Challenge For Casual Diningsommer_ronald5741Belum ada peringkat

- The Long Term Case For HumanaDokumen2 halamanThe Long Term Case For Humanasommer_ronald5741Belum ada peringkat

- 2010 Win Some Lose SomeDokumen2 halaman2010 Win Some Lose Somesommer_ronald5741Belum ada peringkat

- Inter Digital ProfileDokumen2 halamanInter Digital Profilesommer_ronald5741Belum ada peringkat

- Dialing For Dollars in ArgentinaDokumen2 halamanDialing For Dollars in Argentinasommer_ronald5741Belum ada peringkat

- Tractor SupplyDokumen2 halamanTractor Supplysommer_ronald5741Belum ada peringkat

- GT SolarDokumen2 halamanGT Solarsommer_ronald5741Belum ada peringkat

- Core Laboratories: An Oil Patch OpportunityDokumen3 halamanCore Laboratories: An Oil Patch Opportunitysommer_ronald5741Belum ada peringkat

- Hawkins IncDokumen2 halamanHawkins Incsommer_ronald5741Belum ada peringkat

- DIY For Cars - Advance Auto Parts Inc.Dokumen3 halamanDIY For Cars - Advance Auto Parts Inc.sommer_ronald5741Belum ada peringkat

- Navigate With GarminDokumen2 halamanNavigate With Garminsommer_ronald5741Belum ada peringkat

- Astrazeneca SummaryDokumen1 halamanAstrazeneca Summarysommer_ronald5741Belum ada peringkat

- The Game Is Not Over For GameStop Corp.Dokumen4 halamanThe Game Is Not Over For GameStop Corp.sommer_ronald5741Belum ada peringkat

- Sorl Auto Parts Inc. - No Stopping HereDokumen2 halamanSorl Auto Parts Inc. - No Stopping Heresommer_ronald5741Belum ada peringkat

- Oracle Corporation: The Road To RecoveryDokumen7 halamanOracle Corporation: The Road To Recoverysommer_ronald5741Belum ada peringkat

- Profit From Western DigitalDokumen3 halamanProfit From Western Digitalsommer_ronald57410% (1)

- Endo Pharmaceuticals - Steady GrowthDokumen3 halamanEndo Pharmaceuticals - Steady Growthsommer_ronald5741Belum ada peringkat

- In Hog Heaven With Hormel FoodsDokumen3 halamanIn Hog Heaven With Hormel Foodssommer_ronald5741Belum ada peringkat

- Fuqi International: Finding Gold in ChinaDokumen3 halamanFuqi International: Finding Gold in Chinasommer_ronald5741Belum ada peringkat

- Stryker Corporation: Opportunity or Trap?Dokumen6 halamanStryker Corporation: Opportunity or Trap?sommer_ronald5741100% (1)

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreDokumen6 halamanAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- Third Party Declaration FormatDokumen1 halamanThird Party Declaration FormatDalip MahapatraBelum ada peringkat

- Employees OrientationDokumen26 halamanEmployees OrientationRojila luitelBelum ada peringkat

- Banglore Hotel Bill - 08 JAN 2023Dokumen1 halamanBanglore Hotel Bill - 08 JAN 2023Devendar UradiBelum ada peringkat

- CorpFin C07Dokumen106 halamanCorpFin C07Huy PanhaBelum ada peringkat

- Solution - Interest Rate RiskDokumen8 halamanSolution - Interest Rate RiskTuan Tran VanBelum ada peringkat

- Prachi Navghare, 29 ValuationDokumen14 halamanPrachi Navghare, 29 ValuationPrachi NavghareBelum ada peringkat

- Finincal Statment (Feburary)Dokumen3 halamanFinincal Statment (Feburary)Murad MuradBelum ada peringkat

- Bernard W. Dempsey (1903-1960) - Interest and Usury. With An Introduction by Joseph A. Schumpeter (1948)Dokumen242 halamanBernard W. Dempsey (1903-1960) - Interest and Usury. With An Introduction by Joseph A. Schumpeter (1948)Miles Dei100% (1)

- Credit Repair WorkbookDokumen13 halamanCredit Repair WorkbookEmmanuel MartinezBelum ada peringkat

- Commerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsDokumen6 halamanCommerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsVishakha VishwakarmaBelum ada peringkat

- RbiDokumen23 halamanRbiAnkitha TheresBelum ada peringkat

- Bitcoin Unconfirmed TransactionsDokumen2 halamanBitcoin Unconfirmed Transactionsseyed Ali SafaviBelum ada peringkat

- PAN Card ApplicationDokumen2 halamanPAN Card ApplicationKishore PotnuruBelum ada peringkat

- Overcoming Challenges in An Unrecognized EconomyDokumen8 halamanOvercoming Challenges in An Unrecognized Economyamira yonisBelum ada peringkat

- Wa0053.Dokumen1 halamanWa0053.millasayba1 SaybaBelum ada peringkat

- How Much Is 100 Us in Jamaica - Google SearchDokumen1 halamanHow Much Is 100 Us in Jamaica - Google SearchMoya QueenBelum ada peringkat

- Fourth Quarter - Module 5 Week 5Dokumen11 halamanFourth Quarter - Module 5 Week 5Marco UmbalBelum ada peringkat

- Surat Peoples Cooperative Bank LTDDokumen108 halamanSurat Peoples Cooperative Bank LTDbrmehta06Belum ada peringkat

- Finance 16UCF519-FINANCIAL-MANAGEMENTDokumen23 halamanFinance 16UCF519-FINANCIAL-MANAGEMENTHuzaifa Aman AzizBelum ada peringkat

- GMT Academy - Fund Accounting CourseDokumen10 halamanGMT Academy - Fund Accounting CourseShivarathri SathwikBelum ada peringkat

- Transcript 1820115Dokumen2 halamanTranscript 1820115Wasifa Tahsin AraniBelum ada peringkat

- Third Quarter 2010 GTAA EquitiesDokumen70 halamanThird Quarter 2010 GTAA EquitiesZerohedge100% (1)

- Indirect Tax Meaning - Merits and Demerits of Indirect Taxes PDFDokumen9 halamanIndirect Tax Meaning - Merits and Demerits of Indirect Taxes PDFumeshBelum ada peringkat

- Markets With Frictions: Banks: Guido MenzioDokumen36 halamanMarkets With Frictions: Banks: Guido MenzioDaniel GavidiaBelum ada peringkat

- Narayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, HyderbadDokumen65 halamanNarayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, Hyderbadsaryumba5538Belum ada peringkat

- Nguyen Khuong Duy (9958142) - Offer Letter (BP217 - S2 2022)Dokumen7 halamanNguyen Khuong Duy (9958142) - Offer Letter (BP217 - S2 2022)duyBelum ada peringkat

- BPC Report - The - Open - Banking - Revolution - NeedsDokumen14 halamanBPC Report - The - Open - Banking - Revolution - NeedshojunxiongBelum ada peringkat

- Economics-And-Finance-Video-Quiz-Questions 1Dokumen3 halamanEconomics-And-Finance-Video-Quiz-Questions 1api-550118775Belum ada peringkat

- TAX399 - 2024 - Chapter 3-6 - RevisionDokumen54 halamanTAX399 - 2024 - Chapter 3-6 - Revisionobenakemtiku15Belum ada peringkat