Business Finances A Level

Diunggah oleh

KarenChoiDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Business Finances A Level

Diunggah oleh

KarenChoiHak Cipta:

Format Tersedia

Finance why do we need finances?

1. Start up capital

2. Working capital for day to day operation

3. Expansion of business; need money to buy capitals

4. Buy out another firm

5. Contingencies: recessions, fires, etc.

6. Pay for R&D

Working capital is current assets minus current liabilities. It is money used to finance for

day to day operation such as rent, salaries, paying for raw material etc.

How much working capital is needed?

- We need enough so business dont become illiquid

- We cannot have to much or else opportunity cost will be too high

- We need more working capital if we give out lots of credit for sales, we need less if

we receive credit more than we owe to creditors

Working Capital cycle: buy supplies on credit ->sell on credit ->receive money >money to

buy supplies/pay suppliers

The longer the working cycle takes to complete the more working capital will be needed.

Managing Working Capital: dangers from both too much or too little working capital.

4 main components of the cycle:

1. Debtors (Customers) :

- Give shorter credit terms, debt factoring, not credit to new customers, only credit to

credit worthy customer, offer discounts to those pay early

Capital expenditure:

Money to buy or upgrade physical assets that last more than 1 year; require long term

source of finance

Revenue expenditure:

Money used in day to day operation which is paid for by working capital; money that is

used to generate revenue; short term source

2. Creditors (Suppliers) :

- Negotiate longer terms, delay payment, pay for more on credit

3. Stock (Product)

- Use JIT stock ordering with accurate demand forecast, more efficient stock control

preferably using computer to keep sales record, stock level, and reorder when

needed, keep less stock

4. Cash (Money) :

- Use cash flow forecast, sell unused assets, buy less capital and invest less

Sources of finance:

Internal External

1. Retained earnings 1. ST/LT bank loans, debentures

2. Owners investment 2. Bank overdraft

3. Sale of shares or new partnership 3. Grants

4. Sale of unused assets

5. Sale and leaseback of assets

6. Reduction in working capital

Evaluation of internal sources of finances:

This type of capital has no direct cost to the business.

Although, if the assets are leased back once sold, there will be leasing charges.

Why do we use published accounts?

To knows its financial position as at the end of the year. E.g.: How much does the

business owe?

To know the result of its business operation. E.g.: It has made profit or loss.

To help it make business decision.

To compare the results of the business operation.

Internal External

1. Business managers: measure

performance, help make decisions, set

targets

1. Customers: safe to buy from bus,

purchase of after sale service

2. Employees: job security, demand for

higher wages

2. Community: to see whether business

expands or not, income

3. Owner/shareholder 3. Government: calculate tax, whether in

danger of closing down, abiding

accounting laws

4. Banks: can pay back loans or not

5. Investors: assess potential profitability

and outlook

6. Creditors: should supply on credit or

not

Limitation Of Published Accounts

All stakeholders have a use for the published accounts of the business.

The companies will only release the absolute minimum of accounting information as laid

down by company law.

Company directors obviously wish to avoid sensitive information falling into the hands of

competitors or pressure groups.

Data that does not have to be published in a companys annual report & accounts

include:

a) Details of sales & profitability of each goods & services.

b) The R&D plans of the business.

c) The future plans for expansion & rationalization of the business.

d) The performance of each department.

e) Evidence of the companys impact on the environment & the local community.

f) future budgets or plans.

Are Published Accounts Really Accurate?

Stakeholders are often concerned about the accuracy of the published accounts.

No company can publish accounts that it knows to be illegally misleading.

There are many instances when in compiling accounts it is necessary to use judgement &

estimations.

These judgements can often lead to a difference of opinion between accountants. E.g.:

Over the precise value of goods (stocks) or the value of other assets.

Common forms of window dressing accounts include:

a) Selling assets such as building.

b) Reducing the amount of depreciation of fixed assets.

c) Ignoring the fact that some customers (debtors) who have not paid for goods delivered.

d) Giving stock levels a higher value then they are worth.

e) Delaying paying bills or incurring expenses until after the accounts have been published.

For these reason, published accounts of companies need to viewed with caution by

stakeholders.

They are useful starting point for investigating the performance of a business.

Several branches of accounting:

a) Financial accountants

b) Management accountants

Financial accountants - Prepare the published accounts of a business & usually concerned

with the past. They need to know about accounting technique, company law, auditing

requirement & taxation law.

Management accountants - Prepare detailed & frequent information for internal use by

the managers of the business who need financial data to control the firm. Concerned with

the future. They need knowledge on accounting concepts & methods & they also require

training in economics & management science. They involved in decision making.

The Work Of Financial & Management Accountant

Financial Accounting

a) Collection of data on daily transactions.

b) Preparation of the published report & accounts of a business.

c) Information is used by external groups.

d) Accountants are bound by the rules & concepts of the accounting profession.

e) Accounts prepared once or twice a year.

f) Covers past periods of time.

Management accounting

a) Preparation of information for managers on any financial aspect of a business, its

departments & products.

b) Information is only made available to managers.

c) Accounting reports prepared as & when required by managers.

d) No set rules.

e) Cover past time periods, but can also can be concerned with the present or future.

Foundations Of Accounting - Accounting Concepts & Conventions

The Double-Entry Principle

Every time a business engages in a transaction. E.g.: Buying materials or selling goods, the

accounting records must include it.

Business accounts

1. Profit and loss account

2. Balance sheet

3. Cash flow statement

1. Profit and loss account

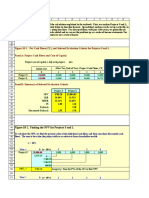

A forecasted income statement example.

Source: cie 2011 m/j paper 33

(A) Forecasted income statement

Forecasted income statement for fpc year ending 31 may 2012

Gross profit margin

=(revenue cost of

good )/revenue

72% = (56-cogs)/56

Cogs =15.68

(B) Usefulness of forecasted income statement

Forecasts of future profits and losses

Allow comparisons with budgets and past performances

Useful for decision making what if questions

Based on forecasts such as market research, past data etc. So considerable

inaccuracy

Ceo might be window dressed profits to push decision and optimize data

(C) Continue or not?

Clearly profitable = npm increase from 14% to 19.5 % which is 5.5 % increase

56% increase in net profit

Fpc = plc so should please shareholders demands for high dividends

Operation ends in a few years so pressure group will be pleased to know that

No?

Against mission statement

Pressure groups may reduce fpc reputation and sales which has long term

impact on profitability

Evaluation.

How powerful are pressure groups?

Can forest be sold to another business?

Will stockholders care about forest that much to cease operation

Business customers may not be driven by ethical thinking

A legit income statement: records revenue, cost, and profit over a given period.

3 parts: trading, profit and loss, and appropriation

Revenue

(sales)

0.80x50x1.15 =46+10=56

Cost of good

sold

15.68

Gross profit 40.32

Overhead

costs

29.4

Net profit 10.92

Income statement for abc for year ending in 21, june, 2014

Sales revenue Quantity sold x selling price

Cost of goods sold Opening stock +purchases closing stock

Gross profit Revenue cost of goods sold

Overheads

expenses

-utilities ,rent, admin cost, depreciation

Net profit Gross profit - overheads

Less tax paid Corporate taxes

Less dividend Share of profit in return for investing in

company

Retained earnings Whats left from deductions, usually used for

reinvestments (placed in capital employed

under shares in balance sheet)

Used to assess profitability of business in a given period

Help investors to decide whether to invest or not

Bank will use it to decide whether business is profitable enough to repay loans

Determine expected profit in the future (forecasted income statements)

2. Balance sheet: net worth of business in a given period

Balance sheet for year ended 31, december 2014

Current assets:

cash

inventory

accounts receivables

Total current assets

fixed assets

building

machinery

land

intangible assets: goodwills

Total fixed assets

Current liabilities:

short term loans

bank overdraft

trade payables

Total current liabilities

Long term loans

Total liabilities

Capital and reserves

shares capital

retained earnings

Total asset Total liabilities and capital employed

Where total assets and total capital employed is equal

1. Cash flow statements: shows inflows and outflows of cash in a given period

****important statement: inability to generate enough cash flow = liquidation

Purpose:

1. Show sources and uses of cash

2. Helps managers realize why a profitable business may be out of cash

Critics say:

1. Little info, no legal requirement to disclose it

2. Based on historical information, more useful if it is based on future predictions

Cash flow forecast:

A cash flow forecast is all expected receipts and payments of a cash in a month usually

produced for a 12 month period.

Why do business prepare cash flow forecasts?

1. To identify cash shortages and surplus (in example: march, april, june, august =

shortages) so that businesses know when they need to borrow money and how

much they need to borrow

2. Supporting document for when business wants to obtain a loan (shows prospects

of business and whether business have enough cash flow to pay interest)

3. Aid in planning: for finances, for marketing, hr etc.

4. Calculate variance between predicted figures and actual figures at the end of the

year to figure out what happened (perhaps there is a positive variance where

cash flow is better than expected or perhaps a negative variance)

Evaluation:

1. Forecast is not the most accurate because it is based on past data

2. Ignores external environment that brings unpredictable changes

Importance of cash

flow

A. Business will not be able to pay suppliers on time if lack cash

flow, sometimes supplier may stop supplying and/or bring

business to court and then firm can face liquidation

B. Wages and salaries need to be paid on time to reduce labour

turnover and demotivation

C. New capital equipment cannot be paid for which may reduce

efficiency of firm

D. Taxes might not be paid for

Why do we need to

manage it? Profit

vs. Cash

When we make a sale on credit, we count that as revenue but we

dont actually get the cash until a later time. We might be making a

profit, but much of it is made up by receivables. If our suppliers ask

us to pay them or our credit is up, then even if we are making profit,

we dont have the cash to pay our debts until a later date. Hence, a

profitable business can be insolvent.

Insolvency Company does not have enough assets to meet liabilities

Managing cash

flow

1. Size and timing of cash inflows (debtors management)

2. Size of timing of cash outflow (credit management)

3. Finances to cover for cash shortages

Control over cash

flow

1. Keep up to date business records

2. Plan ahead and produce accurate cash flow forecast

3. Operate a tighter credit control system to prevent late or bad

debts

Cash flow problems

1. Reduce or delay

capital spending

-no immediate negative effects

like with suppliers and

customers

-reduced efficiency, less

competitive with old equipment

2. Delay payment -no interest charge -supplier can refuse to delay

to suppliers payment

-worsen relationship with suppliers

3. Rent or lease

equipment rather

than outright buy

-reduce capital costs

-lease company responsible for

maintenance

-lease payments decrease long

term cash flow

-never own asset; wont increase

balance sheet value

4. Reduce debtor

period and insist

cash payment

-avoids fund being tied up

-reduce bad debts

-customers might not want to buy

anymore if no credit is offered

5. Debt factoring -release cash from debts

-risk of bad debts taken by

factoring company

-expensive, lost % of debt

-customer might not like dealing

with factoring company

6. Bank overdraft,

short term loans

-avoid conflict with supplier

and customer

-flexible form

-high interest

-overdraft might need to be repaid

at a very short time; business could

become insolvent

Costing Provide financial information on what to base decisions on, help to

identitfy profitable activities, avoid waste and provide information for

cost cutting

Classifying cost -some costs is hard to allocate as variable cost or fixed cost

-if we are producing multi-products in the same factory, is admin cost

a fixed cost for both? We will be double counting then.

Cost center Specific costs are allocated to a department or specific part of

business Ex. Large company splits itself into cost centers where cost

can be allocated

generate team spirit: sense of belonging to a group

each individual know that if they dont keep cost down,

company will trace it back to the cost center that is incurring

the most cost

identify cost generated by each department and firm can

decide whether it is using too much $$ then what it is making

Profit center Section of business which cost and revenue can be allocated

Ex. A Mcdonalds branch

-budget will be drawn up for revenue and cost (profit) of profit center

for forthcoming year

-allows power to be delegated to profit center managers to speed up

decision making

-profit and loss account can be a financial incentive for everyone in

the profit centre

-but makes it harder to coordinate all small branches from central

office

Unit cost Average cost of producing each unit of output

Total costs/number of units produced

Overheads/indirect

cost

1. Production: rent, depreciation of equipment

2. Selling and distribution: packing, salaries

3. Admins: office rent, clerical, management salaries

4. finance: interest on loans

Full/absorption

costing

Charge all the cost of producing that unit of output

Advantages easy to calculate and understand

use it for single product business

all costs are allocated

good bases for pricing decisions

Disadvantages no attempt to allocate overheads to cost center

costs figures may be misleading since its based on past data

average full cost only accurate if actual output = that used in

calculation

very time consuming, complex, expensive

Contribution Revenue direct costs (sales-variable costs)

Budgets: detailed financial plan for the future that is agreed in advance

Managers will not allocate resources without a plan to work towards. Budgeting then

becomes the plan.

Key Requirements:

1) Departments cannot make conflicting plans (Ex. Marketing wants to increase sales

by lowering price but production wants to cut costs by reducing output so to reduce

labour cost budget, HR wants to hire part times to reduce cost wont work out

for marketing if no one is producing)

2) Managers should be involved in budgeting to give them a sense of purpose and

they should be praised on meeting targets

Stages:

Stage 1: Determining most important organization objectives based on last years

performance, external environment and forecasts based on research

Stage 2: Identify factor that make business successful sales revenue

Stage 3: Sale budget is prepared

Stage 4: subsidiary budgets are prepared in sale budget: cash budget, admin budget,

materials budget, selling and distribution budget

Stage 5: Making sure budgets do not conflict with each other from all departments

Stage 6: Master budget prepared + budgeted profit and loss account + balance sheet

Stage 7: Budget approved by board: budgets will become organization plans for each

department and cost center

Setting Budgets:

1) Incremental budgets: use last years figure to use it as starting point; using raise

sales budget by a target amount while expecting cost to stay the same or lower to

put pressure on staff to be more productive

2) Zero Budgeting: start from 0 or a clean sheet and requires all budget holder to

justify their budgets; usually very time consuming

Advantages of setting budgets:

1) planning to translate objectives of firm and give sense of purpose to workforce

2) set targets to be achieved

3) Coordination and communication everyone work together to achieve targets

4) effective allocation of resources and that capital is fully employed

5) Allow for modification: if plan cannot be achieved then we need to modify it

6) Means to control income and expenditure, regulate spending and draw attention to

waste, inefficiency, losses

7) Emphasize responsibility of execs

8) Delegation of responsibility to subordinates and expect them to meet targets

Drawbacks:

1) Lead to resentments: fewer budgets than last year etc.

2) Inflexible budgets might make managers lose out on opportunities

3) if actual figures varies too much from budget then budget is useless

Budgets - Variance Analysis: At the end of the period, budgets and actual figures are

compared and the reason for difference or the variance is examined.

Variance analysis is seeing whether the same production and style can be achieved at

lower cost

- Differences from planned performance

- Assist in analyzing the causes of deviation from budget

- Reasons for deviation can be used to change future budget to make it more

accurate

Favorable variance: effect of increasing profit (Revenue higher than budgeter, cost lower

than planned)

Unfavorable/Adverse variance: reduces profit (cost is higher than planned)

Fixed Budget Example:

Actual Level: cost is reduced by $2000, that shows favorable variance but fixed budget is

misleading because output changed to 80 (20% below budgeted) so obviously cost

decreased.

Flexible Budget Example:

Flexible budgets show that at 80 units, direct material should be budgeted at $16000,

where the actual variance is adverse by $2000.

Why is profit less than budgeted?

1) Lower than expected prices thus reduces total revenue

2) Lower than expected # of customers which deviates from market research figures

3) Labour costs higher than budgeted

4) Overhead costs more than expected: higher admins and salaries

5) Promotion: less or more than expected

Evaluation of budgetary control: Is it worthwhile?

1) Detailed plan to allocate money and resources give focus and direction to all

departments

2) To know how much each cost center should spend and produce

3) To compare and measure performance between departments

4) To know and monitor progress

5) Gives responsibility to those who are budget holders = empowerment

Business Accounts Analysis: Accounting Ratios

The thing with business accounts is that if we wanted to use it to tell us about how the

business is doing or what the prospects of the business is, it is virtually useless if you just

look at the accounts for one year and try to expect some magical explanation to come up.

There are 2 ways to examine the performance of a business:

1. Comparing accounts of previous years

2. Using accounting ratios then comparing ratios from previous years

There are 5 ratios that we use to assess performance of the business.

Liquidity Profitability Efficiency Gearing Shareholders

1. Current Ratios

2. Acid test

Ratios

1. Gross profit

margin

2. Net profit

Margin

3. Return on

capital

employed

1. Inventory

turnover

2. Sales turnover

1. Gearing ratio

2. Interest cover

1. Earning per

share

2. Dividend yield

2. Dividend

cover

Liquidity Firms ability to pay short term debts or liabilities; concerned with

managing of working capital

1. Current

ratios

-This means for every $1 of debt,

Nairobi has $2 to pay for it (more

liquid position), and for Kingston,

for every $1 of debt, firm has $1

to pay for it

-higher is good but means

business has too much money

tied up in working capital = lost

opportunity cost

-banks, investors, suppliers might

be interested current ratio to see

whether business can repay short

term debts

2. Acid test

ratio

-Inventory is less liquid than cash

so this accounts for business

actual ability to repay debts

Improve

liquidity ratios

(working

capital)

1) better control over debts

2) offer discounts for early payment

3) reduce stock level to reduce storage cost and stock holding cost

4) increase credit terms, sale of asset to increase current assets, sale and

leaseback, loans

Profitability or

performance

Compare profits of the business with sales, assets, capital employed;

how successful business is at getting profit from sale; measure

performance of company

Affects profitability:

1. Changes in overhead costs.

2. Impact of competition.

3. Government policy.

4. Income - Nature of the product (Luxury or necessity)

5. Changes in the external environment.

6. Market segments being targeted.

7. Cost structure of the business.

1. Gross profit

margin (profit

before

overheards)

-measures how good business is at adding value

-owners, managers, employees, investors likely to be interested in this

-must take into account objectives to increase sales = lower price =

lower gross profit margin

-can reduce cost while maintaining revenue

-need to compare ratios in same industry because there is different

level of risk in different industries and gross margin will be different

Net Profit Margin

(NPM) compares

net profit with

sales turnover.

The profitability gap between these 2 businesses has narrowed. This

suggests that Nairobi has high overheads compared to sales.

Kingston could narrow the gap further by reducing expenses whilst

maintaining sales without an increase in overhead expenses.

A comparison of results with those of previous years would indicate

whether the performance & profitability of a company were improving

or worsening.

Return On

Capital Employed

higher the value of ratio = greater the return

compared both with other companies & previous year.

Increased by increasing the profitable, efficient use of the assets

owned by the business, which were purchased by the capital employed.

many different methods so cause discretion

Efficiency ratios Ability to use resources to make profit

Stock turnover

ratio

Number of times a business sells stock in a 12 month period

-the ratio shows the number of times a business sells its stock and

reorder the stock level

-higher means you generated more revenue

-means business is more efficient: perhaps use JIT

Debtors days ratio

(days sales in

receivables)

How long it takes to get money back from sales on credit

-means it take 109.5 days to collect debts on average for Nairobi

-shorter time to collect debt is good because money can go toward

working capital to pay debts

-take long time may mean that business risk being insolvent

Gearing ratio Measure of how much of the business is funded by interest bearing long

term debt

-highly geared over 50% means lot of business is funded by debt

-under 50% means business is unambitious and playing it safe

-shareholders might not get that much dividends since business needs

to pay interest first

-more risking more creditors as business become highly geared because

they run the risk of not being paid

-business might want to get finances from loans rather than from

stakeholders so they dont lose control

-low geared doesnt mean shareholder are going to get a lot of

dividends

Shareholders or

investment

Investors or shareholders use these to determine the worth of the

company and their shares; investing in a company can result in 2 kinds

ratios of gains: capital gains and dividend yields, these ratios analyze how

profitable an investment is in firm

Dividend yield

ratio

Dividend per share as a % of current share price

-measures rate of return a shareholder gets at current share price

-compare it with bank interest rates and dividend yields from other

companies

This means for every 3.00 you invest in Nairobi, you get 5% return

annually.

-need to be compared with previous years and other companies

Dividend cover Profit after tax/annual dividend

Measures how many times a companys dividend can be paid from net

profit

-the higher the ratio means the company couldve paid dividend x

times more had it paid out all of its profit after tax

-that means more of the profit is used from reinvesting into the business

Price/Earning

ratio (EPS)

Market price of shares as a proportion of earning per share; shows how

much investors are willing to pay for current earnings ( for every 0.30

cents earning, investors are willing to pay $1.50)

=market price per share/earning per share(profit after tax/number of

ordinary share)

Ex. Market price per share = $1.50, earning per share is 30 cents

$1.50/$.30=5

This means it will take 5 years to earn the cost of the share from

dividends

-Fluctuations of price in shares means price earning ratio need to

change constantly

Investment Appraisals: methods to assess the value of investment projects.

Necessary Information for investment appraisals:

1. Initial cost of investment like equipment and installations

2. Estimated life of project: how many years of returns

3. Residual value of investment: at the end of project, assets may be sold

4. Forecast of net cash flows of project: all investments require forecast but forecast may

not be accurate representation of future so some amount if risk is involved with every

project that needs to be taken into account

Definitions

Investment: an expenditure on capital goods, construction, inventory, or public sector

investment in hope to yield a return in the future.

Net Cash flows: inflows outflows of cash; revenue from investment less operating cost

1. Payback Method

Calculates length of time taken to recover original investment from a projects net cash

flow

Ex 1) A project costs $2 mil. And is expected to payback $500,000 per year, the payback

period will then be 4 years.

Ex 2)

Techniques:

1. Payback Period

2. Average rate of return

3. Net present value

4. Internal rate of return (IRR): determine whether an investment project is worthwhile

2(a) (II) Payback period

= cost of project/annual return

=15/4.4

=3.409 = 3 years and 4.91 months

Why do we calculate payback period?

1. Business may have borrowed $$ and longer payback might mean more interest is paid

2. Faster the payback, the faster capital can be made use of in other projects

3. Cash flows received in the future is lesser in value than cash flows today because of

inflation and returns from savings and other investments

4. Some managers want to reduce risk, longer to payback = more uncertainties

Benefits of Payback Period:

1. Quick and easy to calculate and easily understood

2. Useful for businesses where liquidity is important to overall profitability

3. Result can eliminate projects that take too long to pay back

4. Technology changes rapidly so we dont want long payback periods which creates the

uncertainty that product will be outdated very soon

Disadvantages:

1. Does not consider cash earned after payback and overall profitability of project

2. Sometimes, very profitable investments might be rejected just because it takes longer to

pay back

2. Average Rate of return (ARR): measures net return per annum as a % of initial spending

Steps:

1. Add up all positive cash flows = $2m + $2m + $2m + $3m = $9m

2. Subtract cost of investment = $9m - $5m = $4m

3. Divide by life span = $4m/4 years = $1m

4. Calculate the percentage return: $1m/$5m x 100 = 20%

Result means that over 5 years, business can expect 20% on investment per year. Result

can be compared to ARR of other projects; Criterion rate can be set to use to refuse

projects that give return less than the criterion rate.

Example:

Source: 2008 MJ Paper 2

D(I) ARR

=annual return/initial investment

=total inflow = 0.25x5 =1.25

=1.25-1 = 0.25/5 = 0.05 per year

=0.05/1 = 5%

Advantages:

1. Uses all the cash flow data and take into profitability of whole project

2. Result easily understood and compare with other projects

3. Accept or reject using criterion rate

Drawbacks:

1. Ignores how it takes for cost to be recovered. 2 projects can have similar ARR but

different payback times

2. Less likely to be accurate as all cash inflows are included, later cash flows are more

uncertain

3. Time value of money is ignored

Evaluating ARR:

1. Very widely used but it is better to use payback with it too

2. Results then allow consideration of both profits and cash flow timings

3. Net present Value: looks at size of cash inflow over life of capital as well as timing of

money

-cash is more valuable now than later

Equation: A/(1-r)^n

A= money

R= discount rate

N= # of years

This gives us the present value of the money that we predict will receive in the future with

cash flow forecasts

Ex. $300,000 investment, discount rate = 10%, cash inflow = $75,000 per year for 5 years

with residual value 10000 after 5 years. Find NPV of project.

Year Cash flow Present value

0 -300000 -300000

1 75000 71428.57

2 75000 68027.21

3 75000 68787.82

4 75000 61702.69

5 85000 66599.72

NPV = $332546.01-300000=32546.01

4. Internal rate of return: where NPV =0 by guessing and checking discount rates which is

super complicated anyways and much harder to do than the other methods

Qualitative Factors: investment is not just about making profit

1. Impact on environment and local community: bad publicity may dissuade managers

to not go ahead because of long term impact on sales and image

2. Some projects does not receive planning permission and pressure groups may try to

influence business decisions

3. Aims and objectives of business

4. Risks that managers are willing to take

Anda mungkin juga menyukai

- HksarDokumen8 halamanHksarKarenChoiBelum ada peringkat

- Negligent MisstatementsDokumen4 halamanNegligent MisstatementsKarenChoiBelum ada peringkat

- T6 - CertaintiesDokumen3 halamanT6 - CertaintiesKarenChoiBelum ada peringkat

- Defenses in NegligenceDokumen3 halamanDefenses in NegligenceKarenChoiBelum ada peringkat

- LW 2600 Lecture 2 - Facts & Law, Law ReportDokumen6 halamanLW 2600 Lecture 2 - Facts & Law, Law ReportKarenChoi100% (1)

- Edexcel As Biology Revision GuideDokumen108 halamanEdexcel As Biology Revision GuideMohamed Muawwiz Kamil95% (75)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Aqa Accn4 W Ms Jun12Dokumen15 halamanAqa Accn4 W Ms Jun12zahid_mahmood3811Belum ada peringkat

- BAF 202 Corporate Finance and Financial ModellingDokumen62 halamanBAF 202 Corporate Finance and Financial ModellingRhinosmikeBelum ada peringkat

- Invested Capital Profit Annual NET RORDokumen7 halamanInvested Capital Profit Annual NET RORAnjo VasquezBelum ada peringkat

- Mas 08 - Capital BudgetingDokumen7 halamanMas 08 - Capital BudgetingCarl Angelo Lopez100% (1)

- Zaire Electronics Can Make Either of PDFDokumen6 halamanZaire Electronics Can Make Either of PDFHafiz Reza100% (1)

- Chapter 15 TB Hilton PDFDokumen52 halamanChapter 15 TB Hilton PDFBOB MARLOWBelum ada peringkat

- ECO280 Chapter5Dokumen86 halamanECO280 Chapter5Orkun AkyolBelum ada peringkat

- Name - Akshay Surange Reg No - 19MCA10049 Software Project Management Assignment 1Dokumen5 halamanName - Akshay Surange Reg No - 19MCA10049 Software Project Management Assignment 1Akshay SurangeBelum ada peringkat

- Business Plan: University of Santo Tomas Senior High SchoolDokumen23 halamanBusiness Plan: University of Santo Tomas Senior High SchoolGina Camaya DatuBelum ada peringkat

- P4 Chapter 02 Investment AppraisalDokumen44 halamanP4 Chapter 02 Investment Appraisalasim tariqBelum ada peringkat

- Laundromat Business PlanDokumen40 halamanLaundromat Business PlanGaopotlake MokokongBelum ada peringkat

- PCDEP User GuideDokumen117 halamanPCDEP User GuideLuis MacedoBelum ada peringkat

- Ch10 Tool KitDokumen18 halamanCh10 Tool KitElias DEBSBelum ada peringkat

- Manajemen Ruang Lingkup ITDokumen49 halamanManajemen Ruang Lingkup ITSondang Rohmulia SinagaBelum ada peringkat

- FIN QUIZ Answer KeyDokumen6 halamanFIN QUIZ Answer KeyGrazielle DiazBelum ada peringkat

- PDE Lecture 3Dokumen48 halamanPDE Lecture 3fanusBelum ada peringkat

- Toaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRDokumen9 halamanToaz - Info Elec 1 Capital Budgeting Exercise Dec 6 2020 Bsa2 Answer Key PRJasper Gerald Q. OngBelum ada peringkat

- Financial Management 2iu3hudihDokumen10 halamanFinancial Management 2iu3hudihNageshwar singhBelum ada peringkat

- DCF N Non DCFDokumen36 halamanDCF N Non DCFNikita PorwalBelum ada peringkat

- Energystar: Building Upgrade ManualDokumen27 halamanEnergystar: Building Upgrade Manual88sanBelum ada peringkat

- Daserb Kangkong Chip BusinessDokumen13 halamanDaserb Kangkong Chip BusinessELAME BALABABelum ada peringkat

- Capital BudgetingDokumen120 halamanCapital BudgetingAnn Kristine Trinidad100% (1)

- Question Bank PM AtulDokumen8 halamanQuestion Bank PM AtulMY NAME IS NEERAJ..:):)Belum ada peringkat

- Bs204 Frequently Asked QuestionsDokumen13 halamanBs204 Frequently Asked QuestionsTakudzwa GwemeBelum ada peringkat

- Ch09 PPT Capital Budgeting TechniquesDokumen36 halamanCh09 PPT Capital Budgeting Techniquesmuhammadosama100% (2)

- IPCC Capital Budgeting and FFS ScannerDokumen27 halamanIPCC Capital Budgeting and FFS ScannerMadan SharmaBelum ada peringkat

- C2-Org StrategyProj select-ISB-elDokumen23 halamanC2-Org StrategyProj select-ISB-elNgoc Nguyen Thi MinhBelum ada peringkat

- KPIM05EFA Financial Analysis Coursework Divya Darshini 9654866Dokumen20 halamanKPIM05EFA Financial Analysis Coursework Divya Darshini 9654866P U Divya DarshiniBelum ada peringkat

- Course Name-Financial Management Course Code-MBA-205 Lecture No - Topic - Introduction To Capital Budgeting DateDokumen59 halamanCourse Name-Financial Management Course Code-MBA-205 Lecture No - Topic - Introduction To Capital Budgeting DatePubgnewstate keliyeBelum ada peringkat