John Eklund's Responses

Diunggah oleh

The News-Herald0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan2 halamanHere is an e-mail sent by state Sen. John Eklund to the News-Herald in response to statements from a few public officials and two state Representatives that homeowners are taking on an unfair share of the property tax burden.

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHere is an e-mail sent by state Sen. John Eklund to the News-Herald in response to statements from a few public officials and two state Representatives that homeowners are taking on an unfair share of the property tax burden.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan2 halamanJohn Eklund's Responses

Diunggah oleh

The News-HeraldHere is an e-mail sent by state Sen. John Eklund to the News-Herald in response to statements from a few public officials and two state Representatives that homeowners are taking on an unfair share of the property tax burden.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

Property Tax Rollback Info

Eklund, John <JEklund@calfee.com> Wed, Jun 18, 2014 at 5:15 PM

To: Simon Husted <shusted@news-herald.com>

Simon -

Ive had a chance to briefly review the summary of the ETPI study and offer the following:

1. Plainly, at least some portion of the changes in sources of property taxes in Ohio over time has

been the relatively modest increases in business real property values (compared to residential real

property values). I suspect this is, as much as anything, a reflection of what a crummy business

climate Ohio had created for itself over the years.

2. No doubt the elimination of the Tangible Personal Property Tax (TPP), has also impacted the

changes in sources of property taxes, but bear the following in mind:

a. The decision to phase out the TPP (and the schedule on which to do it) was made in the

126th General Assembly (2005). School Districts have had that long to plan and prepare for the

eventuality. And, the law provided that districts would be held harmless for any lost revenue from

the phase out for a period of time, and then the hold harmless would be phased out. The phase-out

of the hold harmless provision was supposed to start in 2011, but the 128th General Assembly

(2009-2010) postponed that for another two years (on its way to digging Ohio a structural budget

hole of about 8 BILLION dollars). In short, we are finally arriving (albeit late) where everyone has

known we were heading for the last 10 years or so.

b. Notwithstanding all this, State sources of school revenue for 2015 will exceed 2010

levels, including the almost .5 billion dollars in stimulus money that the prior administration threw

at education knowing it was only one-time money. For FY 2015, State General Revenue Fund and

Lottery Profit spending for primary and secondary education will exceed FY 2010 funding levels by

$1.3 billion, or 17.8 percent. Even including one time federal-stimulus funding, TPP/KwH

reimbursements, and property tax relief, FY 2015 funding levels will exceed FY 2010 funding levels

by $317.8 million, or 3.3 percent.

c. Remember, in the same HB 66 that set elimination of the TPP in motion, Ohio adopted the

Commercial Activity Tax - a tax on businesses. That money not only has been used for the Local

Government and School District property tax replacement funds, part of it also goes into the general

revenue fund and helps fuel the increases in State resources for K-12 education.

3. Business Real Estate, moreover, has seen average millage rates increase by 43.4% compared to

an average millage increase on residential realty of 19.47%.

My conclusion: Any shift in the property tax mix of funding for schools is old news and not that

important (except to the extent it is coming out of the pockets of Ohioans - which makes it

important to all of us). More importantly, to set up the shift as being away from business property

and on to residential property is misleading - while business personal property taxes may be less of a

share of school funding, other business taxes were designed to replace the TPP, and they have been

doing a swell job of it - by ignoring this important fact, the study presents less than half the picture.

Eklund

Anda mungkin juga menyukai

- News-Herald Print Specs Ad SizesDokumen2 halamanNews-Herald Print Specs Ad SizesThe News-Herald0% (4)

- Damus Habeas Corpus PetitionDokumen21 halamanDamus Habeas Corpus PetitionThe News-HeraldBelum ada peringkat

- Port Authority Letters of Interest To Replace McMahonDokumen14 halamanPort Authority Letters of Interest To Replace McMahonThe News-HeraldBelum ada peringkat

- Lake County Opioid Caseload 2013-PresentDokumen2 halamanLake County Opioid Caseload 2013-PresentThe News-HeraldBelum ada peringkat

- Better Flip Request For Interested BiddersDokumen1 halamanBetter Flip Request For Interested BiddersThe News-HeraldBelum ada peringkat

- Willoughby Hills Ordinance 2018-11Dokumen2 halamanWilloughby Hills Ordinance 2018-11The News-HeraldBelum ada peringkat

- Harbor Crest Childcare Academy Pao 7084Dokumen6 halamanHarbor Crest Childcare Academy Pao 7084The News-HeraldBelum ada peringkat

- 1740 N. Ridge Rd. Painesville Township Lease BrochureDokumen4 halaman1740 N. Ridge Rd. Painesville Township Lease BrochureThe News-HeraldBelum ada peringkat

- ASHLAWN - Complaint Against City of Painesville (FILED)Dokumen28 halamanASHLAWN - Complaint Against City of Painesville (FILED)The News-HeraldBelum ada peringkat

- Comprehensive Plan For Lake CountyDokumen3 halamanComprehensive Plan For Lake CountyThe News-HeraldBelum ada peringkat

- Lake County 2018 BudgetDokumen74 halamanLake County 2018 BudgetThe News-HeraldBelum ada peringkat

- Available Ad SizesDokumen2 halamanAvailable Ad SizesThe Morning Journal0% (1)

- First Energy Resolution 2.7.18Dokumen2 halamanFirst Energy Resolution 2.7.18The News-HeraldBelum ada peringkat

- Willoughby Hills Ordinance 2009-10Dokumen2 halamanWilloughby Hills Ordinance 2009-10The News-HeraldBelum ada peringkat

- Willoughby Hills Ordinance No. 2017-75Dokumen3 halamanWilloughby Hills Ordinance No. 2017-75The News-HeraldBelum ada peringkat

- Wright v. City of EuclidDokumen18 halamanWright v. City of EuclidsandydocsBelum ada peringkat

- Yolimar Tirado Motion To DismissDokumen8 halamanYolimar Tirado Motion To DismissThe News-HeraldBelum ada peringkat

- Quilts 2018 WinnersDokumen3 halamanQuilts 2018 WinnersThe News-HeraldBelum ada peringkat

- Richard Hubbard III Motion To DismissDokumen7 halamanRichard Hubbard III Motion To DismissThe News-HeraldBelum ada peringkat

- Amiott Disciplinary Charges Finding 8-18-17Dokumen5 halamanAmiott Disciplinary Charges Finding 8-18-17The News-HeraldBelum ada peringkat

- Jack Thompson TestimonyDokumen3 halamanJack Thompson TestimonyThe News-HeraldBelum ada peringkat

- 2016 Lake County Accidental Overdose Death ReportDokumen4 halaman2016 Lake County Accidental Overdose Death ReportThe News-HeraldBelum ada peringkat

- New Mentor Feral Cat LegislationDokumen7 halamanNew Mentor Feral Cat LegislationThe News-HeraldBelum ada peringkat

- Feral Cat Ordinance 2017 (v3)Dokumen5 halamanFeral Cat Ordinance 2017 (v3)Anonymous h4rj255ABelum ada peringkat

- Willoughby Officer-Involved Shooting BCI Investigative SynopsisDokumen36 halamanWilloughby Officer-Involved Shooting BCI Investigative SynopsisThe News-HeraldBelum ada peringkat

- NH Engagement Form PDFDokumen1 halamanNH Engagement Form PDFThe News-HeraldBelum ada peringkat

- Lake County CCW Stats Since Law StartedDokumen14 halamanLake County CCW Stats Since Law StartedThe News-HeraldBelum ada peringkat

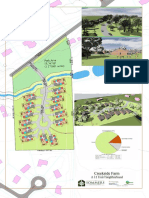

- Creekside Farm SubdivisionDokumen1 halamanCreekside Farm SubdivisionThe News-HeraldBelum ada peringkat

- NH Anniversary Form PDFDokumen1 halamanNH Anniversary Form PDFThe News-HeraldBelum ada peringkat

- NH Wedding Form PDFDokumen1 halamanNH Wedding Form PDFThe News-HeraldBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Q1 Tle 4 (Ict)Dokumen34 halamanQ1 Tle 4 (Ict)Jake Role GusiBelum ada peringkat

- Moral Character ViolationsDokumen2 halamanMoral Character ViolationsAnne SchindlerBelum ada peringkat

- Lesson Plan 7 Tabata TrainingDokumen4 halamanLesson Plan 7 Tabata Trainingapi-392909015100% (1)

- High-pressure dryers for PET bottle production and industrial applicationsDokumen3 halamanHigh-pressure dryers for PET bottle production and industrial applicationsAnonymous 6VCG1YRdBelum ada peringkat

- Scaffolding Control & MeasuresDokumen3 halamanScaffolding Control & Measuresviswamanoj100% (1)

- TSS-TS-TATA 2.95 D: For Field Service OnlyDokumen2 halamanTSS-TS-TATA 2.95 D: For Field Service OnlyBest Auto TechBelum ada peringkat

- A. Kumar Aswamy Job Offer LetterDokumen1 halamanA. Kumar Aswamy Job Offer LetterHimanshu PatelBelum ada peringkat

- Frank Wood S Business Accounting 1Dokumen13 halamanFrank Wood S Business Accounting 1Kofi AsaaseBelum ada peringkat

- Retail Management PPT1Dokumen14 halamanRetail Management PPT1Srilekha GubbalaBelum ada peringkat

- Rockwool 159: 2.2 Insulation ProductsDokumen1 halamanRockwool 159: 2.2 Insulation ProductsZouhair AIT-OMARBelum ada peringkat

- Solution Manual of Physics by Arthur BeiserDokumen145 halamanSolution Manual of Physics by Arthur BeiserManuull71% (49)

- Ethamem-G1: Turn-Key Distillery Plant Enhancement With High Efficiency and Low Opex Ethamem TechonologyDokumen25 halamanEthamem-G1: Turn-Key Distillery Plant Enhancement With High Efficiency and Low Opex Ethamem TechonologyNikhilBelum ada peringkat

- EEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanDokumen3 halamanEEDMATH1 - Teaching Mathematics in The Primary Grades Beed 2E Learning Activity PlanBELJUNE MARK GALANANBelum ada peringkat

- 2024 - Chung 2024 Flexible Working and Gender Equality R2 CleanDokumen123 halaman2024 - Chung 2024 Flexible Working and Gender Equality R2 CleanmariaBelum ada peringkat

- UNICESS KR Consmetics Maeteria Nunssupjara 01apr23Dokumen44 halamanUNICESS KR Consmetics Maeteria Nunssupjara 01apr23ZB ChuaBelum ada peringkat

- Puskesmas Dua Puluh Tiga Ilir Publishes Vaccination Ticket ListDokumen98 halamanPuskesmas Dua Puluh Tiga Ilir Publishes Vaccination Ticket ListLaboratorium PKM 23 IlirBelum ada peringkat

- PHAR342 Answer Key 5Dokumen4 halamanPHAR342 Answer Key 5hanif pangestuBelum ada peringkat

- Emission of Volatile Organic Compounds (Vocs) From Dispersion and Cementitious Waterproofing ProductsDokumen16 halamanEmission of Volatile Organic Compounds (Vocs) From Dispersion and Cementitious Waterproofing ProductsKrishna KusumaBelum ada peringkat

- Workplace Hazard Analysis ProcedureDokumen12 halamanWorkplace Hazard Analysis ProcedureKent Nabz60% (5)

- Ic Audio Mantao TEA2261Dokumen34 halamanIc Audio Mantao TEA2261EarnestBelum ada peringkat

- Apc 8x Install Config Guide - rn0 - LT - enDokumen162 halamanApc 8x Install Config Guide - rn0 - LT - enOney Enrique Mendez MercadoBelum ada peringkat

- Chemical and Physical Properties of Refined Petroleum ProductsDokumen36 halamanChemical and Physical Properties of Refined Petroleum Productskanakarao1Belum ada peringkat

- Measure BlowingDokumen52 halamanMeasure BlowingLos Ángeles Customs GarageBelum ada peringkat

- Pulsar2 User Manual - ENDokumen83 halamanPulsar2 User Manual - ENJanette SouzaBelum ada peringkat

- Infinite & Finite Slope1Dokumen38 halamanInfinite & Finite Slope1CHUKKALA LEELA RAVALIBelum ada peringkat

- Practice of Epidemiology Performance of Floating Absolute RisksDokumen4 halamanPractice of Epidemiology Performance of Floating Absolute RisksShreyaswi M KarthikBelum ada peringkat

- Thee Correlational Study of Possittive Emotionons and Coping Strategies For Academic Stress Among CASS Studentts - updaTEDDokumen23 halamanThee Correlational Study of Possittive Emotionons and Coping Strategies For Academic Stress Among CASS Studentts - updaTEDJuliet AcelBelum ada peringkat

- 8-26-16 Police ReportDokumen14 halaman8-26-16 Police ReportNoah StubbsBelum ada peringkat

- RTG E-One - Manual de Manutenção 41300-41303 (EN)Dokumen328 halamanRTG E-One - Manual de Manutenção 41300-41303 (EN)Conrado Soares100% (1)

- Biology (Paper I)Dokumen6 halamanBiology (Paper I)AH 78Belum ada peringkat