IPO, Minhaj & Kishore Trainee

Diunggah oleh

Payal ChauhanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

IPO, Minhaj & Kishore Trainee

Diunggah oleh

Payal ChauhanHak Cipta:

Format Tersedia

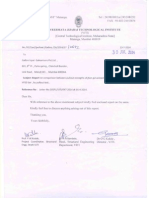

REPORT

ON

INITIAL PUBLIC OFFER (IPO)

SUBMITTED TO: SUBMITTED BY:

MR.ANIL GHAI (AGM) KISHORE YEOLEKAR

MINHAJ SHER KHAN

In this report you can understand/cover the following main points:

To understand what is an IPO.

To understand why company go for public.

To understand the different types of issues.

To understand the initial eligibility criteria for IPO.

To understand the intermediaries involves in the IPO process.

To understand the various initial IPO process.

Chapter-1

This chapter gives an idea about the IPO and company raises money to fund their

activities.

OVERVIEW ABOUT IPO

The IPO Companies In India Are Growing Every Year. Several Companies Are

Launching IPO For Raising Money To Fund Their Growth Plans. The Past Few

Years Have Witnessed The Growth In The IPO Companies In India. The Main

Purpose Of The Initial Public Offering (IPO) Is To Launch The Issue Of Equity

Shares To The Public At A Fixed Price Band. With The Rapid Economic Growth

Of The Country And Several Changes In The Policy Structure, The Capital Market

Was Completely Transformed. The IPO Has Helped The Companies To Churn Out

Money And Utilize It In Developmental Projects And Ventures Such Infrastructure

Based Projects, Output Expansion Programs, Acquisitions And Mergers, Etc.The

Central Government Agency, Which Regulates The IPO Companies,The Securities

Exchange Board Of India (SEBI).

WHAT IS AN IPO

An Initial Public Offering, Or IPO, Is The First Sale Of Stock By A Company To

The Public. A Company Can Rise Money By Issuing Either Debt Or Equity. If The

Company Has Never Issued Equity To The Public, It's Known As An IPO.

Companies fall into Two Broad Categories:--Private and Public.

A Privately Held Company Has Fewer Shareholders And Its Owners Don't Have

To Disclose Much Information About The Company. Anybody Can Go Out And

Incorporate A Company: Just Put In Some Money, File The Right Legal

Documents And Follow The Reporting Rules Of Your Jurisdiction. Most Small

Businesses Are Privately Held But large companies can be private too

it usually isn't possible to buy shares in a private company. You can approach the

owners about investing, but they're not obligated to sell you anything. Public

companies, on the other hand, have sold at least a portion of themselves to the

public and trade on a stock exchange. This is why doing an IPO is also referred to

as "going public." Public companies have thousands of shareholders and are

subject to strict rules and regulations. They must have a board of directors and they

must report financial information every quarter. In the United States, public

companies report to the Securities and Exchange Commission (SEC). In other

countries, public companies are overseen by governing bodies similar to the SEC.

From an investor's standpoint, the most exciting thing about a public company is

that the stock is traded in the open market, like any other commodity. If you have

the cash, you can invest. The CEO could hate your guts, but there's nothing he or

she could do to stop you from buying stock.

Chapter-2

WHY COMPANY GO FOR PUBLIC

After reading about IPO, now you should be able to understand why companies go

for public

The increase in the capital:

An IPO allows a company to raise funds for utilizing in various corporate

operational purposes like acquisitions, mergers, working capital, research and

development, expanding plant and equipment and marketing.

Liquidity:

The shares once traded have an assigned market value and can be resold. This is

extremely helpful as the company provides the employees with stock incentive

packages and the investors are provided with the option of trading their shares for a

price.

Valuation:

The public trading of the shares determines a value for the company and sets a

standard. This works in favour of the company as it is helpful in case the company

is looking for acquisition or merger. It also provides the share holders of the

company with the present value of the shares.

Increased wealth:

The founders of the companies have an affinity towards IPO as it can increase the

wealth of the company, without dividing the authority as in case of partnership.

MAJOR IPOS IN INDIA

Chapter-3

ELIGIBILITY CRITERIA FOR IPO

After reading the above chapter, you should be able to understand, what the

eligibility criteria of companies for issuing IPO in case of large cap company and

small cap company or both.

The following eligibility criteria have been prescribed for the companies seeking

permission to get listed on the stock exchange.

The companies are classified into two categories: Large Cap and Small Cap. A

company is treated as a large cap company if the issue size is greater than or equal

to Rs 10 crore and Market capitalization of not less than Rs 25 crore.

A) In case of Large Cap Companies

The minimum post-issue paid-up capital of the applicant company shall be Rs.

3 crore.

The minimum issue size shall be Rs. 10 crore; and

The minimum market capitalization of the Company shall be Rs. 25 crore

(market capitalization shall be calculated by multiplying the post-issue paid-up

number of equity shares with the issue price).

Authorized capital is the amount for which a company has got the authorization

from the regulatory body to raise through the issue. A company may or may not

want to raise the full amount of authorized capital. Issue size is the amount that a

company wants to raise funds through the issue. Its always less than or equal to

authorized capital.

Part payment facility may be available for the investors who want to subscribe to

an issue. Post-issue paid-up capital is the value of subscriptions (including

promoters holding) paid at the end of issue date. This will be less than issue size if

the total subscriptions are less than the offered shares or when there is part

payment facility available for the issue.

Market capitalization is the product of number of shares outstanding (including

promoters holding) and the market price. In an IPO before the first day of listing

the market price is the issue price.

B) In respect of Small Cap Companies

The minimum post-issue paid-up capital of the Company shall be Rs. 3 crore

The minimum issue size shall be Rs. 3 crore

The minimum market capitalization of the Company shall be Rs. 5 crore

(market capitalization shall be calculated by multiplying the post-issue paid-up

number of equity shares with the issue price)

The minimum income/turnover of the Company shall be Rs. 3 crore in each of

the preceding three 12-months period

The minimum number of public shareholders after the issue shall be 1000.

A due diligence study may be conducted by an independent team of Chartered

Accountants or Merchant Bankers (Investment Bankers) appointed by BSE, the

cost of which will be borne by the company. The requirement of a due diligence

study may be waived if a financial institution or a scheduled commercial bank

has appraised the project in the preceding 12 months.

In addition to this, the issuer company should have a post issue net worth (equity

capital + free reserves excluding revaluation reserve) of Rs 20 crore.

c) For all companies

In respect of the requirement of paid-up capital and market capitalization, the

issuers shall be required to include in the disclaimer clause forming a part of the

offer document that in the event of the market capitalization (product of issue

price and the post issue number of shares) requirement of BSE not being met,

the securities of the issuer would not be listed on BSE.

The applicant, promoters and/or group companies, shall not be in default in

compliance of the listing agreement.

The above eligibility criteria would be in addition to the conditions prescribed

under SEBI (Disclosure and Investor Protection) Guidelines, 2000.

D) Minimum Public Shareholding

If the issuers post issue market capitalization is more than Rs 4000 crore then

issuers can consider an IPO size of 10% of post issue capital

Every listed company should maintain public shareholding of at least 25%.

Issuers diluting less than 25% via the IPO are required to comply with

minimum public shareholding of 25% within three years of the rate of the IPO

listing.

Under the listing agreement, compliance with the minimum public shareholding

can be carried out via an offer for sale through stock exchange mechanism, an

institutional placement program or a follow on public offerings.

However, if issuers post market issue market capitalization is less than Rs 4000

crore, then IPO size of at least 25% of post issue capital is required.

PSUs are required to maintain minimum public shareholding of 10% instead of

25% required by other companies.

Chapter-4

INTERMEDIARIES INVOLVE IN IPO PROCESS

After reading the above chapter, you should be able to understand, what are the

intermediaries involve in IPO process.

INTERMIDIARIES

IN IPO PROCESS ROLE

BOOK RUNNING LEAD

MANAGERS (BRLM'S)

OVERALL ISSUE MANAGEMENT

MARKETING,

PRICING,

CO-ORDINATION EXECUTION,

FILLINGS WITH THE SEBI

DOMESTIC LEGAL COUNSEIS

(FOR UNDERWRITER +

ISSUER)

ADVERTISING ON STRUCTURE,

DUE DILIGENCE,

DOCUMENTATION/DRAFTING,

REVIEWING AGREEMENT BETWEEN ISSUER,BRLM'S AND

OTHER INTERMEDIARIES,

PROVIDING LEGAL OPINION

INTERNATIONAL LEGAL

COUNSEL

DUE DILIGENCE,

NEGOTIATION OF COMFORT LETTERS WITH AUDITORS,

DRAFTING OF SPECIFIC SECTION(INDUSTRY, BUSINESS,

RISK FACTORS, MD&A),

DRAFTING INTERNATIONAL WRAP AND PROVIDING LEGAL

OPINIONS,

ADVICE ON COMPLIANCE WITH INTERNATIONAL

REGULATIONS, PUBLICITY AND ROADSHOWS PROCESS,

SELLING RESTRICTION, RESEARCH GUIDLINES, PFIC/

INVESTMENT COMPANY ACT

AUDITORS REVIEW OF FINANCIAL STATEMENTS, COMFORT LETTERS

REGISTRAR

COLLECTION OF ISSUE SUBSRIPTION DETAIL,

RECONCILIATION,

ALLOTMENT,

SHAREHOLDER REFUNDS,

LIAISON-DESPATCH,

HANDLING QUERIES AND REQUESTS ETC.

MONITORING AGENCY

REPORTING ON USAGE OF PROCEEDS FOR ANY ISSUE

AABOVE RS.500 CRORE

ESCROW BANK

COLLECTION AND REFUND AIDING IN THE COLLECTION OF

BIDS

SYNDICATE BANK AIDING IN THE COLLECTION OF BIDS

IPO GRADING AGENCY ASSIGNING A RATING FOR THE ISSUE

ADVERTISING/ PR AGENCY

STATUTORY AND ANOTHER ADVERTISEMENTS,

MONITORING PUBLICITY IN ACCORDANCE WITH THE ICDR

PRINTER

PRITING OF OFFER DOCUMENTS, FORMS ETC.,

Chapter-5

TYPES OF ISSUES

After reading the above chapter, you should be able to understand what are the

issues raises to the public in the primary market.

Corporate may raise capital in the primary market by way of an initial public offer,

rights issue or private placement. An Initial Public Offer (IPO) is the selling of

securities to the public in the primary market. This Initial Public Offering can be

made through the fixed price method, book building method or a combination of

both.

FIXED PRICE ISSUES

Price at which the securities are offered and would be allotted is made known in

advance to the investors. Demand for the securities offered is known only after the

closure of the issue. 100 % advance payment is required to be made by the

investors at the time of application. 50 % of the shares offered are reserved for

applications below Rs. 1 lakh and the balance for higher amount applications.

BOOK BUILDING ISSUES

A 20 % price band is offered by the issuer within which investors are allowed to

bid and the final price is determined by the issuer only after closure of the bidding.

Demand for the securities offered, and at various prices, is available on a real time

basis on the BSE website during the bidding period. 10 % advance payment is

required to be made by the QIBs along with the application, while other categories

of investors have to pay 100 % advance along with the application. 50 % of shares

offered are reserved for QIBS, 35 % for small investors and the balance for all

other investors.

Chapter-6

PREPARING A COMPANY FOR AN IPO

After reading the above chapter, you should be able to understand how companies

preparing for an IPO and what are the crucial mediators in the IPO process.

Appointment of Underwriter

The Underwriter Is Appointed Who Commit To Shoulder The Liability And

Subscribe To The Shortfall In Case The Issue Is Under-Subscribed. For This

Commitment They Are Entitled To A Maximum Commission Of 2.5 % On The

Amount Underwritten.

Appointment of Registrars

Registrars Process The Application Forms, Tabulate The Amounts Collected

during The Issue And Initiate The Allotment Procedures. Appointment Of The

Brokers To The Issue Recognized Members Of The Stock Exchanges Are

Appointed As Brokers To The Issue For Marketing The Issue. They Are Eligible

For A Maximum Brokerage Of 1.5%.

Appointment Of Lawyers

Lawyers Are Appointed By Company To Ensure That All The Agreements

They Enter Are As Per The Rules And Regulation.

Draft Prospectus

A Draft Prospectus Is Prepared Giving Out Details Of The Company,

Promoters Background, Management, Terms Of The Issue, Project Details,

Modes Of Financing, Past Financial Performance, Projected Profitability And

Others, The Lead Manager Has To Verify And Certify The Facts Stated In The

Draft Prospectus And Ensure That The Company Is Not Making Any False

Claims. Which Is To Be Filed With SEBI 21 Days before IPO, SEBI Gives Its

Observation And Recommends Necessary Changes.

Chapter-7

Going forward from this chapter, you can understand the initial filling of

prospectus, statutory announcement, process of applications, allotments of

shares and how the issues are listed in the stock exchanges.

FILING OF PROSPECTUS WITH THE REGISTRAR OF

COMPANIES

The Prospectus Along With The Copies Of The Agreements Entered Into With

The Lead Manager, Underwriters, Bankers, Registrars And Brokers To The Issue

Is Filed With The Registrar Of Companies Of The State Where The Registered

Office Of The Company Is Located.

Printing and Dispatch Of Application Forms:

The Prospectus And Application Forms Are Printed And Dispatched To All The

Merchant Bankers, Underwriters, And Brokers To The Issue.

Filing Of the Initial Listing Application:

A Letter Is Sent To The Stock Exchanges Where The Issue Is Proposed To Be

Listed Giving The Details And Stating The Intent; Of Getting The Shares Listed

On The Exchange. The Initial Listing Application Has To Be Sent With A Fee Of

Rs. 7,500/-.

Statutory Announcement:

An Abridged Version Of The Prospectus And; The Issue Start And Close Dates

Are Published In Major English; Dailies And Vernacular Newspapers.

Processing Of Applications:

After The Close Of The Public Issue All The Application Forms Are Scrutinized,

Tabulated And Then Shares Are Allotted Against These Application Establishing

The Liability Of The Underwriter: In Case The Issue Is Not Fully Subscribed To,

Then The Liability For The Subscription Falls On The Underwriters Who Have To

Subscribe To The Shortfall.

Allotment Of Shares

The Registrar Finalizes The List Of Eligible Allottees After Deleting The Invalid

Applications And Ensures That The Corporate Action For Crediting Of Shares To

The Demat Accounts Of The Applicants Is Done And The Dispatch Of Refund

Orders To Those Applicable Are Sent. The Lead Manager Coordinates With The

Registrar To Ensure Follow Up So That That The Flow Of Applications From

Collecting Bank Branches, Processing Of The Applications And Other Matters Till

The Basis Of Allotment Is Finalized.

LISTING OF THE ISSUE

The shares after having been allotted have to be listed compulsorily on the l stock

exchange and optionally at the other stock exchanges.

Escrow Account:

An escrow account is a designated account, the funds in which can be utilized

only for a specified purpose. In other words, the bankers to the issue keep the funds

in the escrow account on behalf of the bidders. These funds are not available to the

company till the issue is completed and allocation is made.

Category of bidders

Retail Individual Investor : means an investor who applies or bids for

securities of or for face value of not more than Rs 50,000/-

Non-Qualified Institutional Buyer: Any investor who bids for an

amount above Rs 50,000 and does not fall in the QIB category.

Qualified Institutional Buyer: Qualified Institutional Buyer(QIB) shall

mean: a. public financial institution as defined in section 4A of the

Companies Act, 1956; b. scheduled commercial banks; c. mutual funds; d.

foreign institutional investor registered with SEBI; Contd.

QIBs-category

QIBs-category E: multilateral and bilateral development financial

institutions.

QIBs-category F: venture capital funds registered with SEBI.

QIBs-category G: foreign Venture capital investors registered with SEBI.

State Industrial Development Corporations.

QIBs-category I: insurance Companies registered with the Insurance

Regulatory and Development Authority.

QIBs-category J: provident Funds with minimum corpus of Rs. 25 crore.

QIBs-category K: pension Funds with minimum corpus of Rs. 25 crore.

Chapter-8

After reading the significant part of IPO, now you can understand the final

important steps of an IPO.

IPO PROCESS

Timeline and bid period

Determination of price band

Book building process

Determination of issue price

Allocation to classes of investors

Withdrawal of issue

Allocation, allotment & settlement

NSE

The National Stock Exchange (NSE) is India's leading stock exchange covering

various cities and towns across the country. NSE was set up by leading institutions

to provide a modern, fully automated screen-based trading system with national

reach. The Exchange has brought about unparalleled transparency, speed &

efficiency, safety and market integrity. It has set up facilities that serve as a model

for the securities industry in terms of systems, practices and procedures.

NSE has played a catalytic role in reforming the Indian securities market in terms

of microstructure, market practices and trading volumes. The market today uses

state-of-art information technology to provide an efficient and transparent trading,

clearing and settlement mechanism, and has witnessed several innovations in

products & services viz. demutualisation of stock exchange governance, screen

based trading, compression of settlement cycles, dematerialisation and electronic

transfer of securities, securities lending and borrowing, professionalisation of

trading members, fine-tuned risk management systems, emergence of clearing

corporations to assume counterparty risks, market of debt and derivative

instruments and intensive use of information technology.

Our Products

Capital market

Equities

Indices

Mutual Funds

Exchange Traded

Funds

Initial Public

Offerings

Security Lending

and Borrowing

Scheme

Derivatives

Equity

Derivatives

Currency

Derivatives

Interest Rate

Futures

Debt

Retail Debt

Market

Wholesale Debt

Market

Corporate Bonds

Equities

The securities market has two interdependent and inseparable segments, the

new issues (primary) market and the stock (secondary) market. The primary

market provides the channel for creation and sale of new securities, while

the secondary market deals in securities previously issued. The Stock market

or Equities market is where listed securities are traded in the secondary

market. Currently more than 1300 securities are available for trading on the

Exchange.

Indices

A stock market index is a measure of the relative value of a group of stocks in

numerical terms. As the stocks within an index change value, the index value

changes. An index is important to measure the performance of investments

against a relevant market index.

Mutual funds

Security Lending and Borrowing Scheme (SLBS)

Short Selling means selling of a stock that the seller does not own at the time of

trade. Short selling can be done by borrowing the stock through Clearing

Corporation/Clearing House of a stock exchange which is registered as Approved

Intermediaries (AIs). Short selling can be done by retail as well as institutional

investors. The Securities Lending and Borrowing mechanism allows short sellers

to borrow securities for making delivery.

Equity derivative

Equity derivative is a class of derivatives whose value is at least partly derived

from one or more underlying equity securities. Options and futures are by far the

most common equity derivatives. This section provides you with an insight into the

daily activities of the equity derivatives market segment on NSE. 2 major products

under Equity derivatives are Futures and Options, which are available on Indices

and Stocks.

Retail debt market

NSE has introduced a trading facility through which retail investors can buy and

sell government securities from different locations in the country through

registered NSE brokers and their sub brokers in the same manner as they have been

buying and selling equities. This market is known as "Retail Debt Market" of NSE.

Wholesale Debt Market

The Wholesale Debt Market segment deals in fixed income securities and is fast

gaining ground in an environment that has largely focussed on equities. The

segment commenced operations on June 30, 1994. This provided the first formal

screen based trading facility for the debt market in the country.

CAPITAL MARKET (EQUITIES) SEGMENT

1 Settlement Guarantee Fund 31-MAR-2011 5,100.35 crores

2 Investor Protection Fund 28-FEB-2011 311.04 crores

3 Number of securities available for trading 31-JAN-2012 3,041

4 Record number of trades 19-MAY-2009 1,12,60,392

5 Record daily turnover (quantity) 19-MAY-2009 19,225.95 lakhs

6 Record daily turnover (value) 19-MAY-2009 40,151.91 crores

7 Record market capitalisation 05-NOV-2010 75,60,607 crores

8 Record value of S&P CNX Nifty Index 08-JAN-2008 6,357.10

9 Record value of CNX Nifty Junior Index 04-JAN-2008 13,209.35

CLEARING & SETTLEMENT

1 Record Pay-in/Pay-out (Rolling Settlement):

Funds Pay-in/Pay-out (N2007200) 23-OCT-2007* 4,567.70 crores

Securities Pay-in/Pay-out (Value) (N2009088) 21-MAY-2009* 9,523.33 crores

Securities Pay-in/Pay-out (Quantity) (N2009088) 21-MAY-2009* 4,385.75 lakhs

*Settlement Date

DERIVATIVES (F&O) SEGMENT

1 Settlement Guarantee Fund 31-MAR-2011 29,759.79 crores

2 Investor Protection Fund 28-FEB-2011 57.18 crores

3 Record daily turnover (value) 24-FEB-2011

2,77,277.49

crores

4 Record number of trades 24-FEB-2011 30,29,676

CURRENCY DERIVATIVES SEGMENT

1 Record daily turnover (value) 24-SEP-2010 22,124.90 crores

2 Record number of trades 19-APR-2011 93,581

3 Record number of contracts 20-APR-2010 48,84,935

4 Investor Protection Fund 28-FEB-2011 0.05 crores

WHOLESALE DEBT SEGMENT

1 Number of securities available for trading 31-JAN-2012 5,003

2 Record daily turnover (value) 25-AUG-2003 13,911.57 crores

NSE PRODUCT SUITE

SLBM

RETAIL

DEBT MKT

JPY INR

GBR INR

EUR INR

USD INR

CURRENCY

DERIVATIVES

INTREST

RATE

FUTURE

LIQUID

EQUITY

GOLG

ETF

CORPORA

TE BONDS

WHOLE

SALE

DEBT MKT

INDEX

INDEX

STOCK

DERIVA-

-TIVES

STOCK

OPTION

FUTURE

CASH

MUTUAL

FUND

SERVICE

ETF

EQUITI

ES

CDS &

IRF

WDM

WDM

RETAIL

DEBT

MKT

CORPOR-

-ATE

BONDS

WHOLE

SALE

DEBT

MKT

CURRE-

-NCY

DERIVATI

VES

GBR

INR

EUR

INR

USD

INR

TOTAL LISTED COMPANIES IN NATIONAL STOCK EXCHANGE AS

ON JANUARY 2012

BSE:

BSE Limited is the oldest stock exchange in Asia What is now popularly known as

the BSE was established as "The Native Share & Stock Brokers' Association" in

1875.

Over the past 135 years, BSE has facilitated the growth of the Indian corporate

sector by providing it with an efficient capital raising platform.

Today, BSE is the world's number 1 exchange in the world in terms of the number

of listed companies (over 4900). It is the world's 5th most active in terms of

40

105

257

276

442

545

772

932

1227

1506

1816

2288

2669

5115

0 1000 2000 3000 4000 5000 6000

BERMUDA ST EX

BUENOS AIRES ST EX

LIMA ST EXC

COLOMBO ST EX

INDONESIA ST EX

THE ST EX OF THAILAND

SINGAPORE EX

SHANGHAI EX

OSAKA ST EX

HONG KONG ST EX

KOREA EX

TOKYO ST EX GROUP

NASDAQ OMX

BOMBAY ST EX

TOTAL LISTED COMPANIES AS ON JANUARY

2012

TOTAL

LISTED

COMPA

NIES AS

ON

JANUAR

Y 2012

number of transactions handled through its electronic trading system. And it is in

the top ten of global exchanges in terms of the market capitalization of its listed

companies (as of December 31, 2009). The companies listed on BSE command a

total market capitalization of USD Trillion 1.28 as of Feb, 2010

BSE is the first exchange in India and the second in the world to obtain an ISO

9001:2000 certification. It is also the first Exchange in the country and second in

the world to receive Information Security Management System Standard BS 7799-

2-2002 certification for its BSE On-Line trading System (BOLT). Presently, we are

ISO 27001:2005 certified, which is a ISO version of BS 7799 for Information

Security.

The BSE Index, SENSEX, is India's first and most popular Stock Market

benchmark index. Exchange traded funds (ETF) on SENSEX, are listed on BSE

and in Hong Kong. Futures and options on the index are also traded at BSE

BSE continues to innovate:

Became the first national exchange to launch its website in Gujarati and

Hindi and now Marathi

Purchased of Marketplace Technologies in 2009 to enhance the in-house

technology development capabilities of the BSE and allow faster time-to-

market for new products

Launched a reporting platform for corporate bonds christened the ICDM or

Indian Corporate Debt Market

Acquired a 15% stake in United Stock Exchange (USE) to drive the

development and growth of the currency and interest rate derivatives

markets

Launched 'BSE StAR MF' Mutual fund trading platform, which enables

exchange members to use its existing infrastructure for transaction in MF

schemes.

BSE now offers AMFI Certification for Mutual Fund Advisors through BSE

Training Institute (BTI)

Co-location facilities for Algorithmic trading

BSE also successfully launched the BSE IPO index and PSU website

BSE revamped its website with wide range of new features like 'Live

streaming quotes for SENSEX companies', 'Advanced Stock Reach',

'SENSEX View', 'Market Galaxy', and 'Members'

Launched 'BSE SENSEX MOBILE STREAMER

PRODUCT INFORMATION

Market Data-Equity

1. Level 1 Data contains the following information:

i. BSE Scrip Code

ii. Open, High, Low and Last Traded Price

iii. Best Bid / Offer with Volume

iv. Traded Volume

v. Close and Last Traded Quantity (only for live feed)

2. Level 2 Data contains the following information in addition to the level 1

data:

i. Weighted Average Price

ii. Upper Circuit Limit and Lower Circuit Limit

iii. Turnover Value, Number of Trades, Trend

iv. Total Buy Quantity and Total Sell Quantity

Indices

Broad Market Indices Sectoral Indices Dollar Linked Indices

SENSEX BSE Auto DOLLEX 30

BSE 100 BSE Bankex DOLLEX 100

BSE 200 BSE Capital Goods DOLLEX 200

BSE 500 BSE Consumer Durables

BSE Mid Cap Index BSE FMCG

BSE Small Cap Index BSE Healthcare

BSE IT

BSE Metal

BSE Oil & Gas

BSE Power

BSE PSU

BSE Realty

BSE TEC k

Market Data: Derivatives

There is a rekindled interest in the BSE F&O segment, which is now reporting a

daily turnover of nearly Rs. 10,000 million. Presently, the BSE F&O segment

covers 88 scrips. It also includes 7 Indices including our flagship product

Market Data: Corporate Bonds

BSE, in consultation with SEBI, has developed an Internet-based reporting

platform - the Indian Corporate Debt Market (ICDM) for reporting of all corporate

deals done in respect of corporate bonds that are listed on any stock exchange in

the country, This is presently limited to corporate bonds that are in demat form and

the trade value is over Rs. 1 lakh. ICDM is presently being used by over 120

participants. The data includes basic information about traded bonds and also the

latest traded price, latest traded quantity, weighted average price, weighted average

yield, cumulative trading value etc.

Book Building Data-Public Offerings

Book Building has emerged as the most preferred option for the corporates to raise

money from the public.

BSE provides an online Book Building facility in which bids are entered through

the large network of BSE Brokers across the country.

The Book Building process generates significant data on the bids:

- Number of shares bid for

- Price point at which the bids have been placed

- Type of bidder

This information provides a guide for the investors about the status of the bidding

i.e. the level of investor interest in the public offering and the pricing points at

which the bids are active, and to then take a decision on how much to bid and at

what price.

BSE provides this bidding data, updated every 5 minutes, through its real time

Data Feed network.

(BSE also makes available the prospectus of every public issue for download,

before the commencement of the bidding process.)

Anda mungkin juga menyukai

- Kotak Mahindra Bank Silk Programme Is Dedicated To The Woman of SubstanceDokumen11 halamanKotak Mahindra Bank Silk Programme Is Dedicated To The Woman of SubstancePayal ChauhanBelum ada peringkat

- CSR Aditya Birla GroupDokumen9 halamanCSR Aditya Birla GroupPayal ChauhanBelum ada peringkat

- Smart Choices, Greener CommuteDokumen12 halamanSmart Choices, Greener CommutePayal ChauhanBelum ada peringkat

- Mid Term ReviewDokumen11 halamanMid Term ReviewPayal ChauhanBelum ada peringkat

- Profit and Loss Statement: Net Sales Less Cost of Goods Sold Gross Margin Operating ExpensesDokumen1 halamanProfit and Loss Statement: Net Sales Less Cost of Goods Sold Gross Margin Operating ExpensesShahid AslamBelum ada peringkat

- Data Interpretation & Sufficiency by Haripal RawatDokumen148 halamanData Interpretation & Sufficiency by Haripal RawatPayal ChauhanBelum ada peringkat

- Vjti Pull Out Test ReportDokumen2 halamanVjti Pull Out Test ReportPayal ChauhanBelum ada peringkat

- Review Paper On Carpooling Using Android Operating System-A Step Towards Green EnvironmentDokumen4 halamanReview Paper On Carpooling Using Android Operating System-A Step Towards Green EnvironmentPayal ChauhanBelum ada peringkat

- Kone CaseDokumen1 halamanKone CasePayal ChauhanBelum ada peringkat

- MoS Application ExercisesDokumen4 halamanMoS Application ExercisesPayal ChauhanBelum ada peringkat

- Eva TutorialDokumen15 halamanEva TutorialPayal ChauhanBelum ada peringkat

- Disney PixarDokumen3 halamanDisney PixarPayal Chauhan100% (1)

- Kone CaseDokumen1 halamanKone CasePayal ChauhanBelum ada peringkat

- CB Lecture I Section ADokumen30 halamanCB Lecture I Section APayal ChauhanBelum ada peringkat

- Lal Bahadur Shastri Institute of Management, Delhi: Time-Table PGDM (General) Tri-I Wef 21 July 2014Dokumen1 halamanLal Bahadur Shastri Institute of Management, Delhi: Time-Table PGDM (General) Tri-I Wef 21 July 2014Payal ChauhanBelum ada peringkat

- UploadDokumen1 halamanUploadPayal ChauhanBelum ada peringkat

- Synopsis of End Term ProjectDokumen5 halamanSynopsis of End Term ProjectPayal ChauhanBelum ada peringkat

- Chapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldDokumen25 halamanChapter 3: Valuation of Bonds and Shares Problem 1: 0 INT YieldPayal ChauhanBelum ada peringkat

- DFS Manual Deef FreezeDokumen28 halamanDFS Manual Deef FreezeRic S. MalongaBelum ada peringkat

- Disney PixarDokumen3 halamanDisney PixarPayal Chauhan100% (1)

- Cover LetterDokumen1 halamanCover LetterPayal ChauhanBelum ada peringkat

- Lal Bahadur Shastri Institute of Management, Delhi: Trimester-IV Room # Is SpecifiedDokumen2 halamanLal Bahadur Shastri Institute of Management, Delhi: Trimester-IV Room # Is SpecifiedRohit JainBelum ada peringkat

- Fresher Format Sample ResumeDokumen2 halamanFresher Format Sample ResumePayal ChauhanBelum ada peringkat

- Bloodshed Dev-C++ Is Distributed Under The GNU General Public License.Dokumen7 halamanBloodshed Dev-C++ Is Distributed Under The GNU General Public License.onaibaf13Belum ada peringkat

- Bharat NirmanDokumen1 halamanBharat NirmanPayal ChauhanBelum ada peringkat

- Rbi.gradeb.phase1.2013.Rbi.vze.ComDokumen7 halamanRbi.gradeb.phase1.2013.Rbi.vze.ComAakash KaushalBelum ada peringkat

- ArticlesDokumen15 halamanArticlesPayal ChauhanBelum ada peringkat

- List of Important Tables: S. NO. Description Table NoDokumen1 halamanList of Important Tables: S. NO. Description Table NoPayal ChauhanBelum ada peringkat

- Economics Chapter 1Dokumen16 halamanEconomics Chapter 1pace_saBelum ada peringkat

- HBR Bhag VisionDokumen4 halamanHBR Bhag VisionChristopher CorgiatBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Corporate Formation and Shareholders' EquityDokumen16 halamanCorporate Formation and Shareholders' EquityJulius B. OpriasaBelum ada peringkat

- International Certificate in Wealth and Investment Management Ed1Dokumen356 halamanInternational Certificate in Wealth and Investment Management Ed1nuwany2kBelum ada peringkat

- 23 MergersDokumen44 halaman23 MergerssiaapaBelum ada peringkat

- A Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010Dokumen81 halamanA Comparative Analysis of Theperformance o FAfrican Capital Market Volume 2 2010NiladriAcholBelum ada peringkat

- Seminar Reaction Paper SampleDokumen3 halamanSeminar Reaction Paper SampleJonathan Andrew Pepito100% (1)

- Econ PPT ReportDokumen12 halamanEcon PPT ReportLouise Phillip Labing-isaBelum ada peringkat

- The Only Technical Analysis Book You Will Ever NeedDokumen143 halamanThe Only Technical Analysis Book You Will Ever Needasadmurodov00100% (3)

- The MarketEdge Way 2nd EdDokumen66 halamanThe MarketEdge Way 2nd EdMarkBelum ada peringkat

- Bajaj-Auto 25042023174456 CoveringletteragmDokumen2 halamanBajaj-Auto 25042023174456 CoveringletteragmsantoshBelum ada peringkat

- A Basic Trading Course & Advance Concepts & Tools - Alma MirandaDokumen145 halamanA Basic Trading Course & Advance Concepts & Tools - Alma Mirandaidiotfellow100% (1)

- 193 Uday Kumar - Online Trading-AngelDokumen62 halaman193 Uday Kumar - Online Trading-AngelMohmmedKhayyumBelum ada peringkat

- Case Study On HDFC and Icici Demate AccountDokumen3 halamanCase Study On HDFC and Icici Demate Accountnishu_dhiman1350% (2)

- Adhish Sir'S Classes 1: Chapter - Cost of CapitalDokumen8 halamanAdhish Sir'S Classes 1: Chapter - Cost of CapitaladhishcaBelum ada peringkat

- Chapter 01 - 2019Dokumen20 halamanChapter 01 - 2019Kristen KooBelum ada peringkat

- Phân Tích Tài Chính Pepsi Vs Coca-ColaDokumen49 halamanPhân Tích Tài Chính Pepsi Vs Coca-ColaLập PhanBelum ada peringkat

- Value Investing and Accrual Investing: Kolagani HarichandanaDokumen9 halamanValue Investing and Accrual Investing: Kolagani HarichandanaHari ChandanaBelum ada peringkat

- Discover Funds To Grow My Wealth 23 Jan 2024 1554Dokumen6 halamanDiscover Funds To Grow My Wealth 23 Jan 2024 1554sowntharyagbmBelum ada peringkat

- Risk Management in Future ContractsDokumen4 halamanRisk Management in Future Contractsareesakhtar100% (1)

- 08 - Chapter 1Dokumen31 halaman08 - Chapter 1Blanche DmelloBelum ada peringkat

- Greed & FearDokumen10 halamanGreed & Fearmegadeath100% (1)

- Bikol Reporter December 13 - 19, 2015 IssueDokumen8 halamanBikol Reporter December 13 - 19, 2015 IssueBikol ReporterBelum ada peringkat

- Chapter - 1: 1.1 OverviewDokumen33 halamanChapter - 1: 1.1 OverviewAshish KotianBelum ada peringkat

- Jagsonpal OpennofferDokumen56 halamanJagsonpal OpennofferMannu SinghBelum ada peringkat

- Paper 11Dokumen51 halamanPaper 11eshwarsapBelum ada peringkat

- Muf InvestDokumen15 halamanMuf InvestZubia JabeenBelum ada peringkat

- Final Internship Report PDFDokumen46 halamanFinal Internship Report PDFsonuBelum ada peringkat

- Information On Consolidated BakeriesDokumen17 halamanInformation On Consolidated BakeriesMecheal ThomasBelum ada peringkat

- NFO Bandhan Nifty Alpha50 Index FundDokumen28 halamanNFO Bandhan Nifty Alpha50 Index Fundpwrsys18Belum ada peringkat

- Charles P. Jones, Investments: Analysis and Management, 12 Edition, John Wiley & SonsDokumen23 halamanCharles P. Jones, Investments: Analysis and Management, 12 Edition, John Wiley & SonsJc TambauanBelum ada peringkat

- The History of Corporate Governance: Brian R. CheffinsDokumen38 halamanThe History of Corporate Governance: Brian R. CheffinsArshad ShaikhBelum ada peringkat