Acct 4342-s14 Financial Schedules-Students

Diunggah oleh

api-2411641260 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

44 tayangan27 halamanJudul Asli

acct 4342-s14 financial schedules-students

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLSX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

44 tayangan27 halamanAcct 4342-s14 Financial Schedules-Students

Diunggah oleh

api-241164126Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 27

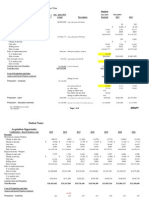

Account Description Debit Credit

1100 Cash - Operating Account 147,109.83

1110 Cash - Payroll 10.00

1130 Petty Cash -

1200 Accounts Receivable 133,000.00

1205 Allowance for Doubtful Accounts 2,660.00

1230 Interest Receivable -

1240 Notes Receivable 73,093.35

1300 Inventory 91,000.00

1410 Prepaid Insurance 16,500.00

1500 Fixed Assets - Furniture & Fixtures 273,500.00

1505 Accumulated Depreciation-Fixed Assets 37,787.50

2100 Accounts Payable 40,900.00

2150 Federal Withholding Payable -

2160 FICA Payable -

2165 Medicare payable -

2170 FUTA Payable -

2180 TX state SUTA payable -

2190 Interest Payable 7,800.00

2200 Federal Income Tax Payable -

2220 Current N/P to banks 39,603.65

2700 Notes Payable to Banks 94,334.80

2710 Other Liabilities 65,000.00

3100 Common Stock 5,000.00

3120 Additional Paid-In Capital-Common Stock 495,000.00

3200 Retained Earnings 59,340.08

4100 Sales 565,000.00

4180 Sales Discount 720.00

4190 Sales Returns 3,000.00

4500 Cost of Goods Sold 338,760.00

4700 Shrinkage and Waste 3,000.00

4800 Freight and Handling 5,000.00

5100 Accounting Fees 17,000.00

5200 Advertising Expense 4,500.00

5300 Bad Debts Expense 660.00

5400 Bank Fees 360.00

5600 Depreciation Expense 22,287.50

5700 Dues & Subscription 500.00

5800 Employee Benefits 1,500.00

5900 Insurance 1,000.00

6000 Legal Fees 9,000.00

6100 Life Insurance - Administration 500.00

6250 Postage -

6300 Rent Expense 27,000.00

6400 Repairs & Maintenance Expense 1,545.00

6500 Salaries and Wages 206,400.00

6600 Supplies -

6700 Telephone & Utilities 5,655.00

8000 Taxes - Federal Income -

8100 Taxes - FUTA Expense 168.00

8200 Taxes - FICA Expense 12,796.80

8250 Taxes - Medicare Expense 2,992.80

8400 Taxes - SUTA Expense 1,026.00

9000 Interest Expense 13,216.75

9100 Interest Income 375.00

9200 Miscellaneous Income/Expense -

1,412,801.03 1,412,801.03

-

Pre-Adjustment Trial Balance

December 31, 2013

234952399.xlsx.ms_office Adjusted Trial Balance

4100 Sales 565,000.00

4180 Sales Discount 720.00

4190 Sales Returns 3,000.00

4500 Cost of Goods Sold 338,760.00

4700 Shrinkage and Waste -

4800 Freight and Handling 5,000.00

5100 Accounting Fees 17,000.00

5200 Advertising Expense -

5300 Bad Debts Expense 660.00

5400 Bank Fees 360.00

5600 Depreciation Expense 22,287.50

5700 Dues & Subscription 500.00

5800 Employee Benefits 1,500.00

5900 Insurance -

6000 Legal Fees 9,000.00

6100 Life Insurance - Administration -

6250 Postage -

6300 Rent Expense 27,000.00

6400 Repairs & Maintenance Expense 1,545.00

6500 Salaries and Wages 206,400.00

6600 Supplies -

6700 Telephone & Utilities 5,655.00

8000 Taxes - Federal Income -

8100 Taxes - FUTA Expense 168.00

8200 Taxes - FICA Expense 12,796.80

8250 Taxes - Medicare Expense 2,992.80

8400 Taxes - SUTA Expense 1,026.00

9000 Interest Expense 13,216.75

9100 Interest Income -

9200 Miscellaneous Income/Expense -

Net Income (104,587.85)

Tax rate 35%

Income Tax -

Account Description Debit Credit

1100 Cash - Operating Account 147,139.83

1110 Cash - Payroll 10.00

1130 Petty Cash -

1200 Accounts Receivable 133,000.00

1205 Allowance for Doubtful Accounts 2,000.00

1230 Interest Receivable -

1240 Notes Receivable 72,718.35

1300 Inventory 94,000.00

1410 Prepaid Insurance 18,000.00

1500 Fixed Assets - Furniture & Fixtures 265,500.00 x

1505 Accumulated Depreciation-Fixed Assets 37,787.50

2100 Accounts Payable 38,900.00

2150 Federal Withholding Payable -

2160 FICA Payable -

2165 Medicare payable -

2170 FUTA Payable -

2180 TX state SUTA payable -

2190 Interest Payable -

2200 Federal Income Tax Payable -

2220 Current N/P to banks 43,660.19 We use both of these accounts

2700 Notes Payable to Banks 90,278.26 133,938.45

2710 Other Liabilities 65,000.00

3100 Common Stock 5,000.00

3120 Additional Paid-In Capital-Common Stock 495,000.00

3200 Retained Earnings 59,340.08

4100 Sales 565,000.00

4180 Sales Discount 720.00

4190 Sales Returns 3,000.00

4500 Cost of Goods Sold 338,760.00

4700 Shrinkage and Waste -

4800 Freight and Handling 5,000.00

5100 Accounting Fees 25,000.00

5200 Advertising Expense 2,500.00

5300 Bad Debts Expense -

5400 Bank Fees -

5600 Depreciation Expense 39,817.50

5700 Dues & Subscription 500.00

5800 Employee Benefits 1,500.00

5900 Insurance -

6000 Legal Fees 9,000.00

6100 Life Insurance - Administration -

6250 Postage -

6300 Rent Expense 27,000.00

6400 Repairs & Maintenance Expense 1,545.00

6500 Salaries and Wages 189,200.00

6600 Supplies -

6700 Telephone & Utilities 5,655.00

8000 Taxes - Federal Income -

8100 Taxes - FUTA Expense 1,234.40

8200 Taxes - FICA Expense 11,730.40

8250 Taxes - Medicare Expense 2,992.80

8400 Taxes - SUTA Expense 1,026.00

9000 Interest Expense 5,416.75

9100 Interest Income -

9200 Miscellaneous Income/Expense -

1,401,966.03 1,401,966.03

-

Pre-Adjustment Trial Balance

December 31, 2013

234952399.xlsx.ms_office Trial Balance

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 372,107.33 372,107.33

12 30 CD 367,529.15 4,578.18

12 30 CR 142,561.65 147,139.83

12 31 Bank Fees-December GJ13 30 147,109.83

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 10.00 10.00

12 30 PR 13,779.20 13,769.20

12 30 CD 13,779.20 10.00

Account not used -

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 137,000.00 137,000.00

12 30 SJ 137,000.00 274,000.00

12 30 CR 141,000.00 133,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 2,000.00 2,000.00

Dec 31 Adjustment to Bad Debt- 2c GJ4 660.00 2,660.00

Cash - Operating Account

Account 1100

General Ledger

Account 1110

Cash - Payroll

Account 1130

Account 1200

Accounts Receivable

Account 1205

Allowance for Doubtful Accounts

234952399.xlsx.ms_office; General Ledger - Students Page 4 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 Record interest owed-2d GJ5 375.00 375.00

12 31 Record interest payment-2d GJ6 375.00 -

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 1 CD 75,000.00 75,000.00

12 31 CR 2,281.65 72,718.35

12 31 Adjustment for interest-2d GJ6 375.00 73,093.35

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 37,000.00 37,000.00

12 30 SJ 78,000.00 41,000.00

12 30 PJ 135,000.00 94,000.00

12 31 2e- Shrinkage and waste GJ7 3,000.00 91,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 CD 18,000.00 18,000.00

12 31 Expensing 1/12- 2f GJ8 1,500.00 16,500.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 265,500.00 265,500.00

Dec 30 Item 40-2g GJ11 8,000.00 273,500.00

Account 1240

Notes Receivable

Account 1300

Inventory

Interest Receivable

Account 1230

Account 1410

Prepaid Insurance

Account 1500

Fixed Assets - Furniture and Fixtures

234952399.xlsx.ms_office; General Ledger - Students Page 5 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 15,500.00 15,500.00

12 30 GJ2 22,287.50 37,787.50

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 110,000.00 110,000.00

12 30 PR 375.00 110,375.00

12 30 PJ 173,900.00 284,275.00

12 30 CD 245,375.00 38,900.00

12 31 Adjustment to VA01-2h GJ9 2,000.00 40,900.00

ACCOUNT NOT ACTIVE

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 PR 1,730.00 1,730.00

12 30 CD 1,730.00 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 PR 1,066.40 1,066.40

12 30 CD 1,066.40 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 PR 249.40 249.40

12 30 CD 249.40 0.00

Account 1505

Accumulated Depreciation Fixed Assets

Account 2150

Federal Withholding Payable

Account 2100

Accounts Payable

Account 2140

Account 2160

FICA Payable

Account 2165

Medicare Payable

234952399.xlsx.ms_office; General Ledger - Students Page 6 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 Interest on line of credit GJ15 7,800.00 7,800.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 Income tax 2013 GJ16 -

ACCOUNT NOT IN USE

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 43,660.19 43,660.19

12 31 Correction for interest-2j GJ14 4,056.54 39,603.65

TX State SUTA Payable

Account 2190

Interest Payable

Account 2200

Federal Income Tax Payable

Account 2210

Account 2220

Current NP to Banks

Account 2180

Account 2170

FUTA Payable

234952399.xlsx.ms_office; General Ledger - Students Page 7 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 93,516.51 93,516.51

12 30 CD 3,238.25 90,278.26

12 31 Correction for interest-2j GJ14 4,056.54 94,334.80

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 65,000.00 65,000.00

65,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 5,000.00 5,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 495,000.00 495,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 59,340.08 59,340.08

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 425,000.00 425,000.00

12 30 SJ 140,000.00 565,000.00

Retained Earnings

Account 4100

Sales

Account 2700

Notes Payable to Banks

Account 2710

Other Liabilities

Account 3100

Common Stock

Account 3120

Additional Paid-In Capital - CS

Account 3200

234952399.xlsx.ms_office; General Ledger - Students Page 8 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward

12 30 CR 720.00 720.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward

12 30 SJ 3,000.00 3,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 260,760.00 260,760.00

12 30 SJ 78,000.00 338,760.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward

12 31 Shrinkage and Waste-2e GJ7 3,000.00 3,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 CD 5,000.00 5,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 PJ 8,000.00 8,000.00

12 31 PJ 17,000.00 25,000.00

12 31 Adjustment to fixed asset GJ11 8,000.00 17,000.00

Account 4700

Shrinkage and Waste

Account 4800

Freight and Handling

Account 5100

Accounting Fees

Account 4180

Sales Discount

Account 4190

Sales Returns

Account 4500

Cost of Goods Sold

234952399.xlsx.ms_office; General Ledger - Students Page 9 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 PJ 2,500.00 2,500.00

12 31 Adjustment to VA01 GJ9 2,000.00 4,500.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Dec 31 Adjustment for Allow. Doubtful 2c GJ4 660.00 660.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 Correction GJ1- 1c GJ3 330.00 330.00

12 31 Bank fees- December GJ13 30.00 360.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 330.00 330.00

12 30 PR 17,200.00 17,530.00

12 30 GJ2 22,287.50 39,817.50

12 31 Correct GJ1- 1c GJ3 330.00 39,487.50

12 31 Correct for payroll-2i GJ12 17,200.00 22,287.50

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 15 PJ 500.00 500.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 1,375.00 1,375.00

12 30 CD 125.00 1,500.00

Bad Debts Expense

Account 5400

Bank Fees

Account 5600

Depreciation Expense

Account 5700

Dues & Subscription

Account 5800

Employee Benefits

Account 5200

Advertising Expense

Account 5300

234952399.xlsx.ms_office; General Ledger - Students Page 10 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 Prepaid-2f GJ8 1,000.00 1,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 30 PJ 9,000.00 9,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Dec 31 Record expense-2f GJ8 500.00 500.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 24,750.00 24,750.00

12 30 CD 2,250.00 27,000.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 15 PJ 1,545.00 1,545.00

Insurance

Account 6000

Legal Fees

Account 5900

Repairs & Maintenance Expense

Account 6100

Life Insurance - Administration

Account 6250

Postage

Account 6300

Rent Expense

Account 6400

234952399.xlsx.ms_office; General Ledger - Students Page 11 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 189,200.00 189,200.00

12 31 December payroll- 2i GJ12 17,200.00 206,400.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 5,300.00 5,300.00

12 15 PJ 355.00 5,655.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 2013 income tax GJ16 - 0.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 168.00 168.00

12 30 CD 1,066.40 1,234.40

12 31 Adjustment to tax expense GJ10 1,066.40 168.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 11,730.40 11,730.40

12 31 Adjustment to tax expense GJ10 1,066.40 12,796.80

Account 6500

Salaries and Wages

Taxes - Federal Income

Account 8100

Taxes - FUTA Expense

Account 8200

Taxes - FICA Expense

Account 6600

Supplies

Account 6700

Telephone & Utilities

Account 8000

234952399.xlsx.ms_office; General Ledger - Students Page 12 of 27

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 2,743.40 2,743.40

12 30 CD 249.40 2,992.80

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 1,026.00 1,026.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward GJ1 5,016.65 5,016.65

12 30 CD 400.10 5,416.75

12 31 Interest for bank credit GJ15 7,800.00 13,216.75

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

12 31 Payment for N/R-2d GJ5 375.00 375.00

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 0.00

Miscellaneous Income/Expense

Taxes - SUTA Expense

Account 9000

Interest Expense

Account 9100

Interest Income

Account 8250

Taxes - Medicare Expense

Account 8300

Account 8400

Account 9200

Account Not in Use

234952399.xlsx.ms_office; General Ledger - Students Page 13 of 27

Account Receivable Subsidiary Ledger

Accounts Receivable Account 1200

C 10

Customer 10 Credit Terms: 2/10, Net 30

Credit Limit: $25,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward (from November) 20,000.00

12 10 CR 20,000.00 -

12 20 SJ 8,000.00 8,000.00

C 20

Customer 20 Credit Terms: 2/10, Net 30

Credit Limit: $50,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward (from October) 45,000.00

12 15 CR 25,000.00 20,000.00

12 28 Inv 1205 SJ 24,000.00 44,000.00

12 30 CM 01 SJ 3,000.00 41,000.00

C 30

Customer 30 Credit Terms: 2/10, Net 30

Credit Limit: $75,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward (from November) 60,000.00

12 3 CR 60,000.00 -

12 5 Inv 1202 SJ 48,000.00 48,000.00

C40

Customer 40 Credit Terms: 3/10, Net 30

Credit Limit: $45,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward (from November) 12,000.00

12 2 Inv 1201 SJ 24,000.00 36,000.00

12 5 Open Balance CR 36,000.00 -

12 10 Inv 1203 SJ 36,000.00 36,000.00

234952399.xlsx.ms_office; Subsidiary Ledger-AR

Inventory Subsidiary Ledger

Inventory Account 1300

I 10

Item 10 Preferred Vendor: Vendor 30

Current Cost: $1,000 Retail Sales Price: $2,000 (Price Increase from $1,500)

Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 5,000.00 5.00

12 3 PJ 10,000.00 15,000.00 10.00 15.00

12 20 SJ 4,000.00 11,000.00 4.00 11.00

I 20

Item 20 Preferred Vendor: Vendor 30

Current Cost: $1,500 Retail Sales Price: $3,000 (Price Increase from $2,000)

Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 6,000.00 4.00

12 3 PJ 15,000.00 21,000.00 10.00 14.00

12 10 SJ 18,000.00 3,000.00 12.00 2.00

12 31 Shrinkage and Waste-2e GJ7 3,000.00 - 2.00 -

I 30

Item 30 Preferred Vendor: Vendor 30

Current Cost: $2,000 Retail Sales Price: $4,000 (Price Increase from $3,000)

Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 14,000.00 7.00

12 3 PJ 10,000.00 24,000.00 5.00 12.00

12 28 SJ 12,000.00 12,000.00 6.00 6.00

12 31 Correction for sale- 2e SJ 12,000.00 $ - $ 6.00 -

I 40

Item 40 Preferred Vendor: Vendor 30

Current Cost: $4,000 Retail Sales Price: $6,000 (Price Increase from $5,000)

Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 12,000.00 3.00

12 3 PJ 40,000.00 52,000.00 10.00 13.00

12 5 SJ 32,000.00 20,000.00 8.00 5.00

12 6 PJ 60,000.00 80,000.00 15.00 20.00

Stock Item

Quantity

Stock Item

Stock Item

Quantity

Quantity

Stock Item

Quantity

234952399.xlsx.ms_office; Subsidiary Ledger-Inventory

Fixed Asset Subsidiary Ledger

Fixed Assets - Furnitures and Fixtures Account 1500

Item 10 F10

Purchase Date: March 1, 2012 Depreciation Method: Straight Line Annual Depreciation 18,000.00 $

Disposal Date: n/a Salvage Value: 20,000.00 $ Useful Life 10 Years

Vendor: Vendor 20 Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 200,000.00 15,000.00 15,000.00

12 30 GJ 18,000.00 33,000.00

Item 20 F20

Purchase Date: November 2, 2012 Depreciation Method: Straight Line Annual Depreciation 3,000.00 $

Disposal Date: n/a Salvage Value: 500.00 $ Useful Life 5 Years

Vendor: Vendor 20 Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 15,500.00 500.00 500.00

12 30 GJ 3,000.00 3,500.00

Item 30 F30

Purchase Date: October 1, 2013 Depreciation Method: Straight Line Annual Depreciation 4,500.00

Disposal Date: n/a Salvage Value: 5000 Useful Life 10 Years Accumulated Depreciation

Vendor: Vendor 20 Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 50,000.00

12 30 GJ 1,125.00 1,125.00

Item 40 F40

Purchase Date: December 2, 2013 Depreciation Method: Straight Line Annual Depreciation 1,950.00

Disposal Date: n/a Salvage Value: 200 Useful Life 4 Years Accumulated Depreciation

Vendor: Vendor 20 Ref Debit Credit Debit Balance Credit Balance Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward

12 30 PJ 8,000.00 8,000.00

12 30 GJ 162.50 162.50

Accumulated Depreciation

Accumulated Depreciation

234952399.xlsx.ms_office; Subsidiary Ledger-Fixed Assets

Account Payable Subsidiary Ledger

Accounts Payable Account 2100

V10

Vendor 10 Credit Terms: Net 30 days

Medical Insurance Vendor Credit Limit: $5,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward -

12 30 PR 375.00 375.00

12 30 CD 375.00 -

V20

Vendor 20 Credit Terms: 2/10, Net 30

Fixed Asset Vendor Credit Limit: $150,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward

12 2 PJ 8,000.00 8,000.00

V30

Vendor 30 Credit Terms: 2/10, Net 30

Inventory Vendor Credit Limit: $150,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward 110,000.00

12 1 CD 110,000.00 -

12 3 PJ 75,000.00 75,000.00

12 6 PJ 60,000.00 135,000.00

12 15 CD 135,000.00 -

V40

Vendor 40 Credit Terms: 2/10, Net 30

General Supplies & Misc. Vendors Credit Limit: $75,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward -

12 15 Repair Bill V 810 PJ 1,545.00 1,545.00

12 15 Dues V 907 PJ 500.00 2,045.00

12 30 Advertising Bill VA01 PJ 2,500.00 4,545.00

12 31 Adjustment to bill VA01 GJ9 2,000.00 6,545.00

234952399.xlsx.ms_office; Subsidiary Ledger-AP Page 17 of 27

Account Payable Subsidiary Ledger

Accounts Payable Account 2100

V50

Vendor 50 Credit Terms: Net 30

Accounting Vendor Credit Limit: $75,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward -

12 30 Accounting Bill V 222 PJ 17,000.00 17,000.00

V60

Vendor 60 Credit Terms: Net 30

Legal Vendor Credit Limit: $75,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward -

12 30 Legal Bill V723 PJ 9,000.00 9,000.00

V70

Vendor 70 Credit Terms: Net 30

Telephone and Utilities Vendor Credit Limit: $75,000

Ref Debit Credit Debit Balance Credit Balance

Dec 1 Balance Forward -

12 15 Utilities Bill V654 PJ 355.00 355.00

234952399.xlsx.ms_office; Subsidiary Ledger-AP Page 18 of 27

Salaries and Wages Subsidiary Ledger

Salaries and Wages Account 6500

Salaried: $3,200 per month; Firm pays 25% of medical insurance P10

W-4 Filed, Married, 0 $236.00 / period 0.062 0.0145 $105/period

Ref Gross Federal W/H Social Security Medicare

Medical

Insurance Net Pay Check #

Dec 1 Balance Forward PR 35,200.00 2,596.00 2,182.40 510.40 1,155.00 28,756.20

12 30 PR 3,200.00 236.00 198.40 46.40 105.00 2,614.20 1045

2013 Total 38,400.00 2,832.00 2,380.80 556.80 1,260.00 31,370.40

Zero Balance Check: 38400-2832-2380.8-556.8-1260-31370.40

Salaried: $3,500 per month; Firm pays 25% of medical insurance P20

W-4 Filed, Married, 2 $217.00 / period 0.062 0.0145 $105

Ref Gross Federal W/H Social Security Medicare

Medical

Insurance Net Pay Check #

Dec 1 Balance Forward PR 38,500.00 2,387.00 2,387.00 558.25 1,155.00 32,012.75

12 30 PR 3,500.00 217.00 217.00 50.75 105.00 2,910.25 1046

2013 Total 42,000.00 2,604.00 2,604.00 609.00 1,260.00 34,923.00

Zero Balance Check: +42000-2604-2604-609-1260-34923

Salaried: $5,000 per month; Firm pays 25% of medical insurance P30

W-4 Filed, Single 0 $851.00 / period 0.062 0.0145 $60

Ref Gross Federal W/H Social Security Medicare

Medical

Insurance Net Pay Check #

Dec 1 Balance Forward PR 55,000.00 9,361.00 3,410.00 797.50 660.00 40,771.50

12 30 PR 5,000.00 851.00 310.00 72.50 60.00 3,706.50 1047

2013 Total 60,000.00 10,212.00 3,720.00 870.00 720.00 44,478.00

Zero Balance Check: 60000-10212-3720-870-720-44478

Salaried: $5,500 per month; Firm pays 25% of medical insurance P40

W-4 Filed, Married 4 $426.00 / period 0.062 0.0145 $105

Ref Gross Federal W/H Social Security Medicare

Medical

Insurance Net Pay Check #

Dec 1 Balance Forward PR 60,500.00 4,686.00 3,751.00 877.25 1,155.00 50,030.75

12 30 PR 5,500.00 426.00 341.00 79.75 105.00 4,548.25 1048

2013 Total 66,000.00 5,112.00 4,092.00 957.00 1,260.00 54,579.00

Zero Balance Check: 66000-5122-4092-957-1260-54579

Employee 10

Employee 20

Employee 30

Employee 40

234952399.xlsx.ms_office; Subsidiary Ledger - Wages&Sal

GL Acct# Explanation

Posted

Ref Debit Credit

GJ1

1100 Cash - Operating Account 372,107.33

1110 Cash - Payroll 10.00

1200 Accounts Receivable 137,000.00

1205 Allowance for Doubtful Accounts 2,000.00

1300 Inventory 37,000.00

1500 Fixed Assets - Furniture and Fixtures 265,500.00

1505 Accumulated Depreciation-Fixed Assets 15,500.00

2100 Accounts Payable 110,000.00

2220 Current N/P to banks 43,660.19

2700 Notes Payable to Banks 93,516.51

2710 Other Liabilities 65,000.00

3100 Common Stock 5,000.00

3120 Additional Paid-In Capital-Common Stock 495,000.00

3200 Retained Earnings 59,340.08

4100 Sales 425,000.00

4500 Cost of Goods Sold 260,760.00

5600 Bank Fees 330.00

5800 Employee Benefits 1,375.00

6300 Rent Expense 24,750.00

6500 Salaries and Wages 189,200.00

6700 Telephone & Utilities 5,300.00

8100 Taxes - FUTA Expense 168.00

8200 Taxes - FICA Expense 11,730.40

8250 Taxes - Medicare Expense 2,743.40

8400 Taxes - SUTA Expense 1,026.00

9000 Interest Expense 5,016.65

109,520 1,314,016.78 1,314,016.78

To input beginning balances. Input by GL Clerk

GJ2

12 30 5600 Depreciation Expense 22,287.50

1505 Accumulated Depreciation 22,287.50

22,287.50 22,287.50

7,105

To record annual Depreciation Expense per Fixed Asset Subledger

GJ3

12 31 5400 Bank Fees 330

12 31 5600 Depreciation Expense 330

Correcting GJ1- 1c

GJ4

12 31 5300 Bad Debt Expense 660

12 31 1205 Allowance for Doubtful Accounts 660

Adjustment to AFDA- 2c

GJ5

12 31 1230 Interest Receivable 375.00

12 31 9100 Interest Income 375.00

GJ6

12 31 1240 Notes Receivable 375.00 $

12 31 1230 Interest Receivable 375.00 $

GJ7

12 31 4700 Shrinkage and Waste 3,000.00 $

12 31 1300 Inventory 3,000.00 $

GJ8- 2f

Date

General Journal

Hash

Total

234952399.xlsx.ms_office; General Journal Page 20 of 27

GL Acct# Explanation

Posted

Ref Debit Credit Date

General Journal

12 31 5900 Insurance 1,000.00 $

12 31 6100 Life Insurance- Administration 500.00 $

12 31 1410 Prepaid insurance 1,500.00 $

GJ9-2h

12 31 5200 Advertising Exp 2,000.00 $

`12 31 2100 A/P 2,000.00 $

GJ10

12 31 8200 FICA tax exp. 1,066.40 $

12 31 8100 FUTA tax exp. 1,066.40 $

GJ11

12 31 1500 Fixed Assets 8,000.00 $

12 31 5100 Accounting Fees 8,000.00 $

GJ12

12 31 6500 Salaries and Wages 17,200.00 $

12 31 5600 Depreciation expense 17,200.00 $

GJ13

12 31 5400 Bank Fees 30.00 $

12 31 1100 Cash 30.00 $

December Bank Fees

GJ14- 2j

12 31 2220 Current NP 4,056.54

12 31 2700 N/P to Banks 4,056.54

Account for interest in payments- 2j

GJ15

12 31 9000 Interest expense 7,800.00

12 31 2190 Interest Payable 7,800.00

46392.94 46392.94

234952399.xlsx.ms_office; General Journal Page 21 of 27

GL Acct# Explanation

Posted

Ref Debit Credit Date

General Journal

234952399.xlsx.ms_office; General Journal Page 22 of 27

Payroll Journal

DEBIT

Employee

Name

Posted

Ref Gross Pay

Federal

Withholding

FICA

(6.2%)

Medicare

Withheld

(1.45%)

Medical

Insurance

$80 Single

$140 Married

Firm pays 25% Net Pay Check No.

Acct # 6500 2150 2160 2165 2100 1110

EMPLOYEE:

12 30 Employee 10 3,200.00 236.00 198.40 46.40 105.00 2,614.20 1045

12 30 Employee 20 3,500.00 217.00 217.00 50.75 105.00 2,910.25 1046

12 30 Employee 30 5,000.00 851.00 310.00 72.50 60.00 3,706.50 1047

12 30 Employee 40 5,500.00 426.00 341.00 79.75 105.00 4,548.25 1048

Total 17,200.00 1,730.00 1,066.40 249.40 375.00 13,779.20

Zero Balance Check:

Posted to

Subledger V10

0=17,200-1,730-1,066.40-249.4-375-13,779.20

Date

CREDIT

234952399.xlsx.ms_office; Payroll Journal

Cash Receipts Journal

Description Cash Sales Discount

1100 4180

A/R

Subsidiary

Acct Amount

Posted

Ref GL Acct # Amount

Posted

Ref

12 3 Customer 30 60,000.00 C30 60,000.00

12 5 Customer 40 35,280.00 720.00 C40 36,000.00

12 10 Customer 10 20,000.00 C10 20,000.00

12 15 Customer 20 25,000.00 C20 25,000.00

12 31 Note Payment 2,281.65 1240 2,281.65

Total 142,561.65 720.00 141,000.00 2,281.65

Zero Balance Check:

0 = 142,561.65+720-141,000-2281.65

CREDIT

Date

DEBIT

Accounts Receivable 1200 Other Account

234952399.xlsx.ms_office; Cash Receipts Journal

Sales Journal

Description

Invoice/

Credit Memo

#

A/R

Subsidiary

Acct

Posted

Ref

Accounts

Receivable Sales Return COGS

Inventory

Subsidiary

Acct

Posted

Ref Inventory Sales

1200 4190 4500 1300 4100

12 2 Customer 40 1201 C40 24,000.00 12,000.00 I30 12,000.00 24,000.00

12 5 Customer 30 1202 C30 48,000.00 32,000.00 I40 32,000.00 48,000.00

12 10 Customer 40 1203 C40 36,000.00 18,000.00 I20 18,000.00 36,000.00

12 20 Customer 10 1204 C10 8,000.00 4,000.00 I10 4,000.00 8,000.00

12 28 Customer 20 1205 C20 24,000.00 12,000.00 I30 12,000.00 24,000.00

12 30 Customer 20 CM01 C20 (3,000.00) 3,000.00

Total 137,000.00 3,000.00 78,000.00 78,000.00 140,000.00

Zero Balance Check:

137,000+3,000-140,000 = 0

78,000-78,000 = 0

CREDIT

Date

DEBIT

234952399.xlsx.ms_office; Sales Journal

Purchases Journal

Vendor

Vendor

Invoice #

Inventory

1300 GL Acct # Amount

Posted

Ref

A/P Subs.

Acct # Amount

Posted

Ref

12 2 Vendor 20 - Fixed Asset V123 1500 8,000.00 V20 8,000.00

12 3 Vendor 30 V456 75,000.00 V30 75,000.00

10 Units - Item 10, 10 Units - Item 20, 5 Units-Item 30, 10 Units item 40

12 6 Vendor 30 V457 60,000.00 V30 60,000.00

15 Units - Item 40

12 15 Repair Bill V810 6400 1,545.00 V40 1,545.00

12 15 Dues V907 5700 500.00 V40 500.00

12 15 Phone Bill V654 6700 355.00 V70 355.00

12 30 Accounting Bill V222 5100 17,000.00 V50 17,000.00

12 30 Advertising Bill VA01 5200 2,500.00 V40 2,500.00

12 30 Legal Bill V723 6000 9,000.00 V60 9,000.00

Total 135,000.00 38,900.00 173,900.00

Zero Balance Check:

0=135,000+38,900-173,900

Date

DEBIT

Other Acct

CREDIT

ACCOUNTS PAYABLE - 2100

234952399.xlsx.ms_office; Purchases Journal

Cash Disbursement Journal

CREDIT

Check # Description

Cash

1100

A/P Subs.

Acct # Amount

Posted

Ref GL Acct # Amount

Posted

Ref GL Acct # Amount

Posted

Ref

12 1 2010 Vendor 30 110,000.00 V30 110,000.00

12 1 2011 Loan (Promissory Note) 75,000.00 1240 75,000.00

12 5 2012 Insurance (Life, General) 18,000.00 1410 18,000.00

12 15 2013 Vendor 30 135,000.00 V30 135,000.00

12 30 2014 Freight Bill 5,000.00 4800 5,000.00

12 30 2015 Rent 2,250.00 6300 2,250.00

12 30 n/a Transfer to Payroll 13,779.20 1110 13,779.20

12 30 2016 Federal Withholding 1,730.00 2150 1,730.00

12 30 2017 FICA 2,132.80 2160 1,066.40 8200 1,066.40

12 30 2018 Medicare 498.80 2165 249.40 8250 249.40

12 30 2019 Medical Insurance 500.00 V10 375.00 5800 125.00

12 30 2020 First Bank (Note Payable) 3,638.35 2700 3,238.25 9000 400.10

367,529.15 245,375.00 120,438.25 1,715.90

Zero Balance Check:

0=367,529.15-245,375-120,438.25-1715.90

Date

DEBIT

Other Accounts Other Accounts ACCOUNTS PAYABLE - 2100

234952399.xlsx.ms_office; Cash Disbursement Journal

Anda mungkin juga menyukai

- Tiffee Brian Accounting ResumeDokumen1 halamanTiffee Brian Accounting Resumeapi-241164126Belum ada peringkat

- Marketing PowerpointDokumen21 halamanMarketing Powerpointapi-241164462Belum ada peringkat

- Ims Pharma Generic v5Dokumen14 halamanIms Pharma Generic v5api-241164126Belum ada peringkat

- Acqusition AnalysisDokumen8 halamanAcqusition Analysisapi-241164126Belum ada peringkat

- Oil: Costs Are High and Rising! Summary:: Tiffee, Brian Econ 2302.65 Professor Sawyer June 16, 2013Dokumen2 halamanOil: Costs Are High and Rising! Summary:: Tiffee, Brian Econ 2302.65 Professor Sawyer June 16, 2013api-241164126Belum ada peringkat

- Marketing Final PaperDokumen11 halamanMarketing Final Paperapi-241164462Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Trust Deed FormatDokumen6 halamanTrust Deed Formatchandraadv100% (4)

- Corporate Law Firm Headquartered in Lahore PakistanDokumen6 halamanCorporate Law Firm Headquartered in Lahore PakistanRana EhsanBelum ada peringkat

- DSLSBill PDFDokumen1 halamanDSLSBill PDFUdit jainBelum ada peringkat

- Renunciation of POA PowersDokumen2 halamanRenunciation of POA PowersJatin SharanBelum ada peringkat

- SCM Batch B - Group 3 - Madura Accessories LTDDokumen35 halamanSCM Batch B - Group 3 - Madura Accessories LTDSHILPA GOPINATHAN100% (1)

- Answer Sheet: Mindanao State UniversityDokumen14 halamanAnswer Sheet: Mindanao State UniversityNermeen C. AlapaBelum ada peringkat

- Fical PolicyDokumen51 halamanFical Policyrasel_203883Belum ada peringkat

- Ac 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesDokumen53 halamanAc 518 Hand-Outs Government Accounting and Auditing TNCR: The National Government of The PhilippinesHarley Gumapon100% (1)

- Engineering EconomyDokumen18 halamanEngineering EconomyWesam abo HalimehBelum ada peringkat

- Inner Circle Trader - Sniper Course, Escape & EvasionDokumen3 halamanInner Circle Trader - Sniper Course, Escape & EvasionKute HendrickBelum ada peringkat

- Event Contract - TemplateDokumen17 halamanEvent Contract - Templatenoel damotBelum ada peringkat

- Revivalofairindia 1pp02Dokumen10 halamanRevivalofairindia 1pp02Quirking QuarkBelum ada peringkat

- Rural DevelopmentDokumen55 halamanRural DevelopmentmeenatchiBelum ada peringkat

- Sept 18 LtaDokumen1 halamanSept 18 LtaSidharth SBelum ada peringkat

- KKR Annual Review 2008Dokumen77 halamanKKR Annual Review 2008AsiaBuyoutsBelum ada peringkat

- The Effect of Financial Constraints, Investment Opportunity Set, and Financial Reporting Aggressiveness On Tax AggressivenessDokumen16 halamanThe Effect of Financial Constraints, Investment Opportunity Set, and Financial Reporting Aggressiveness On Tax AggressivenessmuchlisBelum ada peringkat

- Case Study: Buffett Invests in Nebraska Furniture MartDokumen8 halamanCase Study: Buffett Invests in Nebraska Furniture MartceojiBelum ada peringkat

- Inventory Management and Cash BudgetDokumen3 halamanInventory Management and Cash BudgetRashi MehtaBelum ada peringkat

- Residual Income Model ExplainedDokumen12 halamanResidual Income Model ExplainedKanav GuptaBelum ada peringkat

- Mitigating Control: 1. General InformationDokumen2 halamanMitigating Control: 1. General InformationRavi KumarBelum ada peringkat

- Pro FormaDokumen8 halamanPro FormaZhiXBelum ada peringkat

- FIN3102 Fall14 Investments SyllabusDokumen5 halamanFIN3102 Fall14 Investments SyllabuscoffeedanceBelum ada peringkat

- Real Estate Economics PDFDokumen88 halamanReal Estate Economics PDFTekeba BirhaneBelum ada peringkat

- Earnings Deductions: Eicher Motors LimitedDokumen1 halamanEarnings Deductions: Eicher Motors LimitedBarath BiberBelum ada peringkat

- Problem 16.2 Nikken Microsystems (B)Dokumen2 halamanProblem 16.2 Nikken Microsystems (B)Julie SpringBelum ada peringkat

- Group 3 CostingDokumen68 halamanGroup 3 CostingPY SorianoBelum ada peringkat

- SBD HPPWD Final2016Dokumen108 halamanSBD HPPWD Final2016KULDEEP KAPOORBelum ada peringkat

- Control Design Effectiveness Quality Review ChecklistDokumen6 halamanControl Design Effectiveness Quality Review ChecklistRodney LabayBelum ada peringkat

- AF The World of AccountingDokumen11 halamanAF The World of AccountingEduardo Enriquez0% (1)