NTT Docomo 123

Diunggah oleh

pranav.newtonDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

NTT Docomo 123

Diunggah oleh

pranav.newtonHak Cipta:

Format Tersedia

0

NTT DOCOMO

Global Expansion Strategy

Aakanksha Sharma

12DM-002

Ajinkya Vishwekar

12DM-016

Aravind Shenoy

12DM-036

Bharat Maheshwari

12FN-035

Pranav Patil

12DM-099

Surbhi Vijh

12FN-140

1

Sl.No Topic Page No

Executive Summary 4

1 NTT DOCOMO Company Profile 5

2 Japans Wireless Industry 6

2.1 Industry Analysis (2000) 6

3

NTT DoCoMos Strategy

9

3.1 Core Competencies for DoCoMo in Japan

9

3.2 NTT DoCoMos Global Expansion Strategy

9

3.3 Rolling Out a Global Strategy

10

4

Entry Strategy

11

4.1 Analytical Framework: Modes of Entry

11

4.2 Current Challenges

17

4.3 International Expansion

17

4.4 Global Expansion: Challenges

18

2

5

DoCoMo in US: Failure

19

6

DoCoMo in UK: Failure

21

7

DoCoMo Global Expansion: A good strategy?

22

8

DoCoMo in India: The Success Story

23

8.1 TATA TELECOM SERVICES LIMITED

23

8.2 TATA DoCoMo

23

8.3 Entry Strategy

24

8.4 Pricing

24

8.5 Differentiation

25

8.6 Positioning

25

8.7 Competition and Challenges

26

8.8 Marketing Strategy

26

8.9 Marketing Mix: 4Ps

27

3

9

Recommendations

30

10

Conclusions

32

4

Executive Summary

The report covers strategies employed by NTT DoCoMo for expanding into International

Markets. NTT DoCoMo is a Japan based mobile telecommunications company, spun off from

Nippon Telegraph and Telephone in 1991. It commands over half the market in its home

country Japan, having over 53 million subscribers. Looking to access other markets, NTT

DoCoMo looked to expand abroad, initiating tie-ups with European and American operators,

and also with those in Asian markets.

The report looks at the companys initial attempts at accessing the American and UK markets,

following what the group believes to be an Ethnocentric outlook. At this stage, the company

tried to capitalize on its mastery of a superior mobile communication technology. However,

faced with an unassailable lead by rival WAP technology being employed by competitors,

economic recession, less control over equity stakeholders these ventures failed.

However, when it came to Asian markets the companys strategy was closer to a more

Regiocentric approach, where it tried to establish Joint Ventures with equity stakes. This was

conditioned by government regulation, recognition of the competitive environment, and also

the need to hedge risks. Other significant factors were low technological advancement in the

telecom sectors of those countries, a more favorable competitive environment and a market

which was far from the level of saturation of other western markets . In particular, this report

examines NTT DoCoMos entry into the Indian market via a Joint Venture with Tata Teleservices

Limited, and attempts to adapt to local conditions by way of pricing, value added services,

promotion, and technology leadership measures.

It is worth noting that NTT DoCoMos strategy for Western nations also underwent a change

the company moved towards licensing in contrast to its earlier approach of establishing Joint

Ventures.

5

1. NTT DoCoMo - Company Profile

In 1959 Nippon Telegraph and Telephone (NTT) entered the telephone industry in Japan with

an offering of maritime telephone service. They added paging services in 1968, car telephone

services in 1986, and in-flight public telephone service in 1987. In 1991 NTT established a

separate company to provide wireless communication offerings, NTT Mobile Communications

Network, Inc. This new company was then spun off by NTT in 1992, ultimately resulting in one

of the biggest initial public offerings for the time in 1998, and is now 67.1% owned by NTT with

the balance of shares owned by public investors. By 1993 mobile subscribers surpassed the 5

million mark, and consumer growth has been dramatic with more than 20 million subscribers as

of 1998. NTT Mobile Communications Network, Inc. officially changed their name to NTT

DoCoMo in April of 2000 to adopt their widely recognized brand name.

DoCoMo is Japans largest mobile communication company, second in the world in subscribers,

behind Vodafone AirTouch. Today DoCoMo is the most valuable mobile communication

company in the world; the most valuable company in Japan, and has a market capitalization of

42% larger than its parent.

In 1999, DoCoMo launched i-mode (information-mode), the worlds most advanced wireless

Internet service. The outstanding feature of i-mode is that users are always connected to the

wireless web, and users can send simple text email messages, retrieve stock quotes, surf i-

modes portal sites with just a few clicks. This business model was first dismissed by

competitors as low quality with limited usage, but Japanese consumers seem to think otherwise

and are willing to sacrifice quality for convenience: 18,000 Japanese are signing up for i-mode

each day with total subscribers surpassing 20 million this year. At this rate, next year DoCoMo

will have more Internet subscribers than AOL.

6

2. Japans Wireless Industry

Although DoCoMo currently controls 57% of the Japanese market, this situation could change in

the near future. The Japanese government deregulated the wireless services market in 1994,

and as a result, many major global players have entered the Japanese market. British Cable &

Wireless recently bought DDI, the second largest mobile phone operator in Japan. Japan

Telecom, in which British Telecom and AT&T of the US together hold a 30% stake, and

Vodafone AirTouch are working together to compete with DoCoMo in the growing Japanese

market. Japan Telecom and Vodafone AirTouch are the two largest shareholders in each of the

country's nine regional mobile phone companies.

The global wireless communications industry has been characterized by rapid deregulation in

each country. This has been tied to a trend of various acquisitions and the emergence of global

players in various local markets. The following in-depth analysis of the Japanese wireless

communications industry is based on Porters Five Forces Model, and not only illustrates the

profitability and the changing face of the industry, but also gives insight to the key success

factors for DoCoMo in Japan.

2.1 Industry Analysis in 2000

1. Intensity of Competition

Currently, the mobile telephone industry in Japan is becoming more competitive as the demand

for wireless communications increase rapidly among consumers and wireless companies try to

compete for these new customers.

Market deregulation and the appearance of new entrants further intensify the rivalry.

Although there is a high concentration ratio between the top three companies, (C3 of 84% -

DoCoMo accounts for 57% market share), the emergence of international players like Vodafone

AirTouch, British Telecom and AT&T is putting pressure on domestic players to be competitively

efficient. The capital intensity required in the business has resulted in these companies owning

large specific assets. As a result, they are willing to fight fiercely to defend their investments

from competitors.

7

The remaining two cellular operators in Japan (DDI and IDO) merged their operations to push a

wireless web standard that differs from DoCoMos. Also, the Japanese government is going to

award three licenses for 3G wireless networks in the year 2001. This means that DoCoMo

would have to continue competing fiercely with other players for the licenses.

2. Presence of Substitute Products

Within the wireless industry, there are two competing technologies and standards (W-CDMA

i

and CDMA-2000

ii

) leading to a huge debate between the Americans and Europeans. DoCoMo is

currently rolling out its W-CDMA technology with the expectation of becoming the first 3G

network and gain first mover advantage especially in helping other countries wishing to build

their own 3G networks.

3. Buyer Power

Wireless consumers are fragmented with very weak market power, but because there are not

many dimensions wireless providers can compete in, competition is very keen as providers try

to differentiate their service in various packages and prices. Although companies are trying to

lock-in customers with different strategies, small differences in price and services could cause

customers to change providers.

4. Supplier Power

Suppliers in this industry are handset manufacturers, infrastructure providers, and technology

developers. Handset and infrastructure manufacturers do not have strong market power

because of the relative ease of market entry. For instance, most major electronics

manufacturers, such as Philips and Sony, are building handsets today. Recent international

agreements between major cellular phone manufacturers and mobile service providers have

also resulted in most handsets being compatible with different wireless services provided.

There are several competing wireless standards such as CDMA and GSM, which undermine the

bargaining power of technology developers. It is also noteworthy that wireless service

providers cannot switch from one technology provider to another without incurring high costs

in rebuilding infrastructure. To counter this, DoCoMo backward integrated by investing heavily

in R&D and developed its proprietary standard 2G (2

nd

Generation) PDC

iii

and 3G W-CDMA to

reduce reliance on technology providers.

8

5. Barriers to Entry

The threat of new entrants in this industry is moderate. Currently, there are just a few

important players. These players deter new entrants through ownership of patents and

licenses, network externalities, excess capacity, specificity of assets and high exit costs.

The main players in this industry own licenses to use the technologies for their networks. They

enjoy huge network externalities, which means that the more subscribers they have the more

people will want to belong to that specific network. Therefore new technologies have to be

compatible with the existing ones to find a niche in this market. These companies develop

excess capacity, which deters entrants due to the possibility of price wars. Additionally, the

specificity of the extremely expensive assets required in this industry make it difficult for new

players to enter the market, representing a real threat. Even with all the deterrents mentioned

above, payoffs are high enough to attract new entrants.

Based on our industry analysis, the wireless industry in Japan appears very profitable but

increasing competition could erode profit margins in the near future.

9

3. DoCoMos Strategy

3.1 Core Competencies for DoCoMo in Japan

The key success factors that allowed DoCoMo to secure its dominant position in the Japanese

market are its excellent management and marketing skills, investments in R&D and

relationships with manufacturers.

DoCoMo has built a very strong brand name projecting the image of a new, young and dynamic

company. It has challenged traditional Japanese management practice such as bringing in

people from outside the company to join the management team. It has also relied on various

types of external consulting to make internal management changes. These competencies in

management and marketing have created a strong image for DoCoMo within the new

generation of consumers in Japan, and as a result a high penetration rate in that demographic.

DoCoMo has also invested heavily in technology development. It has constantly improved

acquired technologies so it can sell them in other markets, thus establishing a platform for

themselves and developing competencies in technology. This has been a key strength for

DoCoMo to gain market share at home.

Finally, DoCoMos relationship with suppliers has been very effective in developing a strong

network with handset manufacturers like Motorola, Nokia and Ericsson. These companies sell

handsets marketed under the DoCoMo brand name so they benefit from DoCoMos exploding

pool of subscribers.

3.2 NTT DoCoMos Global Expansion Strategy

NTT DoCoMo seems to have the elements of a successful global player. First, it is in a promising

market. Furthermore, based in Japan, DoCoMo has the advantage over American and European

counterparts, like AT&T, Sprint and Vodafone AirTouch, of being closer to the 3.3 billion users

Asian market. In addition, DoCoMo is at the leading edge of technology and was the first

mobile operator to launch a 3

rd

Generation (3G) wireless network in 2001.

With its huge success at home, DoCoMo has been looking at ways to expand abroad. It wants

to market i-mode worldwide, but unlike its American and European counterparts, who have

been merging feverishly to enter new markets, DoCoMo believes friendly alliances will be more

10

effective, especially in the Asian market. DoCoMo has taken equity stakes in several Asian

companies and plans to woo Asian operators with funds and state-of-the-art technology. With

its newly developed 3G wireless networks, DoCoMo has negotiated additional joint

experimental projects with China, Malaysia, Singapore and South Korea.

Rivalry with competitors in the domestic market does not deter DoCoMo from cooperating with

them in foreign markets. Because DoCoMo is relatively new in the wireless market, it has

relatively limited experience in human resources, management, marketing and the

technological expertise necessary to deal in countries outside of Asia. Therefore, forming

strategic alliances with more experienced competitors helps DoCoMo market its technology

abroad and become a global player in the industry. DoCoMo is involved in several partnerships

and joint research efforts with domestic competitors, such as Vodafone AirTouch.

3.3 Rolling Out a Global Strategy

DoCoMo is making a bet in the international markets with W-CDMA technology. Expanding its

3G network throughout Asia, DoCoMo intends to gain first mover advantage and then leverage

its unique knowledge to compete in the global markets.

11

4. ENTRY STRATEGY

4.1 Analytical Framework: Modes of Entry

To analyze the strategic differentiation of major international Mobile Network Operators, we

identify four types of key strategies used to realize the motives/incentives.

1. Establishing an International Presence

A domestic MNO invests in a foreign MNO to expand its own market internationally as a growth

strategy. Most MNOs investing with this purpose try to obtain major stakes in foreign MNOs so

that the revenues generated from the foreign markets can be included in the overall revenues

12

reflected in their consolidated financial statements. Therefore, most MNOs that implement this

strategy are also the most actively involved in international business operations in order to

increase their overall revenues.

2. Creating Business Synergies

When international MNOs use this strategy, they focus on creating business synergies based on

economies of scale. This strategy also requires their active involvement in the international

business operations so the fact that operational cost savings can be achieved in their

international markets. Several forms of implementation of this strategy are listed here. An

MNO may pursue joint procurement of network equipment or handsets for its foreign markets.

Also, several MNOs may collaborate for the same purpose. An MNO may use an international

branding strategy to save on marketing expenses. Finally, some MNOs make strategic alliances

for roaming services. This strategy may be implemented with or without an equity investment

depending on the situation.

3. Generating Revenues through Exporting

When using this strategy, MNOs export services or technologies that have been proven to be

competitive in their own domestic markets to foreign markets. These services are in most cases

consultancy services, and MNOs transfer their own marketing and operational skills to other

foreign MNOs. The technologies are proprietary, such as wireless Internet platforms and

solutions and the MNOs receive royalties from their foreign MNOs through licensing

agreements. The objective of this strategy is to generate additional revenues by utilizing

existing competencies. Therefore, it requires relatively less involvement than the previously

mentioned strategies. Also, depending on the situation, this strategy may be implemented

with or without an equity investment.

4. Earning Capital Gains

A domestic MNO investing in a foreign MNO simply wishes to increase the amount of non-

operating profit that can be distributed in the form of dividends to shareholders. Therefore, the

role of an MNO in a specific foreign market is that of a financial investor, so this strategy

requires almost no involvement in the foreign MNOs business operations.

13

To achieve their goals in each of the four internationalization strategies mentioned above,

international MNOs use investment strategies based on the amount of equity participation

given their resources and the foreign market status.

To succeed, DoCoMo is implementing an internationalization strategy, and its most relevant key

factors are:

1. building friendly alliances and acquisitions

2. developing a sliver strategy focused on providing wireless services without owning the

infrastructure

3. expanding its technologies throughout Asia and the rest of the world

1. Friendly Alliances & Acquisitions

DoCoMo is committed to a strategy of geographic expansion through friendly alliances, joint

ventures and acquiring small stakes of small local companies in the rest of Asia. Traditionally

the telecommunications industry has been state-owned and it is only during the last decade

14

that there has been significant privatization and deregulation in this sector. Hence, most

governments are still deeply involved in the industry because they perceive these investments

as strategic national assets that should not be owned by foreign investors. In light of the recent

uproar about Chinas ban of CCF (Chinese-Chinese-Foreign) structures, DoCoMos strategy

allows market entry into such countries.

DoCoMo prefers not to manage its international operations. Its strategy is to expand 3G W-

CDMA technology throughout Asia and the rest of the world through joint ventures and

alliances, even if buying a small portion of the company is necessary. As DoCoMo CEO

Tachikawa, former Sloan MBA student says in an interview with Business Week, We would like

to see our next generation standard adopted globally without a hitch. To make it possible, we

are ready to offer the necessary support. It could be in terms of technology, staff or money.

Thus DoCoMo gives financial and technical support to these local operators, to expand its 3G

W-CDMA technology and extract rents through consulting fees and other technology transfer

charges.

Recently, DoCoMo has engaged in several projects of this kind. DoCoMo started a joint venture

with S.K. Telecom to develop the infrastructure for a 3G network in Korea. It also bought 19%

of Hutchinson Telephone Company Limited, a Hong Kong cellular phone operator, and is

providing technical support for the development of their 3G infrastructure. Moreover,

Hutchinson has big investments in the Singapore telecom industry, and through this acquisition

DoCoMo is able to reach even farther markets.

In Europe, DoCoMo joined development forces with French Telecom, Deutsche Telecom and

Italia Telecom. In order to develop positive network externalities through expanding its

operations overseas, DoCoMo also joined its R&D forces with industry leaders as Nokia and

Ericsson. Mr. Oya adds, We could get support from Europe in the 3G standardization and it

was a large step toward a single global standard this is largely due to the support of Ericsson

and Nokia. Our role in the 3G system now is to get support from Asian countries the main

reason for our investments is not just to expect direct revenue but also to gain support for our

3G standard and expand our alliance for our 3G system.

By leaving a big portion of its overseas ventures to local investors, DoCoMo has hedged the

intrinsic risk of infrastructure investments. It retains local managers, their business networks

and government connections, as these connections represent assets that will protect DoCoMo

15

from problems of foreign ownership of infrastructure. Moreover, DoCoMo is less exposed to

expropriation risks because it is not only in the business of transferring technology to local

mobile operators abroad, but also receives royalties for its patents on W-CDMA technology.

2. Sliver Global Strategy

DoCoMo is a rather vertically integrated corporation in Japan. It owns all the infrastructure of

its wireless network (having inherited much of it from NTT), and is also a wireless service

provider (i-mode). However, in expanding abroad especially Asia, DoCoMo has adopted an

asset-light sliver strategy by focusing on its competitive advantage in leading edge W-CDMA

technology. Currently, only a few companies own the patents for the two contending 3G

protocols W-CDMA and CDMA-2000; in fact, Qualcomm and DoCoMo wholly own the patents

for W-CDMA.

3. Expansion of technology

Currently there is no uniform wireless standard in the world. Asia, Europe and the United

States adopted incompatible transmission protocols in the 2G wireless network. As a result,

consumers from the United States could not use their cellular phones in Europe or Asia, and

vice versa. Also, wireless service companies have difficulties competing in foreign markets

because of the differences in the protocols hence forcing them to license both competing

technologies. In contrast, the wireless web market is much less segmented. Information about

the different wireless transmission and web standards is summarized in the table below.

Japan US Asia Europe

Current 2G

wireless

transmission

protocol

PDC CDMA Mostly GSM

iv

GSM

Current 2G

wireless web

protocol

DoCoMo: i-mode

Others: WAP

WAP

v

WAP WAP

16

Next

generation 3G

wireless

protocol

W-CDMA

CDMA-

2000

W-CDMA W-CDMA

Next

generation 3G

wireless web

protocol

DoCoMo: WAP or

i-mode

Others: WAP

WAP WAP WAP

As a result of the current segmentation in 2G wireless transmission protocols, DoCoMo has

been prevented from even entering the Asian market because it is using an entirely different

standard, namely PDC. Tomoyuki Oya, a DoCoMo employee in R&D comments, At the early

stage of PDC in early 1990s, DoCoMo focused only on the domestic market because we were

quite busy competing with domestic competitors. When DoCoMo recognized that global

penetration of the system is necessary for manufacturers to have a large market share, all the

Asian countries had already decided to choose GSM system. That is why DoCoMo is working

hard to become a leader in developing the 3G W-CDMA technology and expanding it to other

markets.

Some companies like Ericsson are working on developing both 3G W-CDMA and CDMA-2000

technologies since a universal standard has not yet been decided on by the International

Telecommunications Union (ITU). DoCoMo, on the other hand, is betting on the W-CDMA

technology, believing that it is superior. Since Europe and Asia seem inclined to adopt the W-

CDMA standard, DoCoMo is helping wireless service providers in these regions to adopt the

technology. Last year a W-CDMA experiment was successfully tested in Hong Kong in

cooperation with Hutchinson Telecom and in South Korea in cooperation with SK Telecom.

Wireless web service is different. DoCoMo holds proprietary knowledge of the i-mode

technology, but the rest of the world, and other Japanese providers, are adopting the WAP

standard even though i-mode is superior to WAP because it allows users to be connected

permanently and is consistent with the standard compact HTML gaining access to a larger

subset of the World Wide Web.

17

4.2 Current Challenges

After huge local success, DoCoMo now faces new challenges in becoming a major player in the

global telecom industry. Today DoCoMo is developing joint ventures and acquiring companies

in Asia, in Europe and in the United States. It is also rolling out its 3G wireless network based

on W-CDMA, while the rest of the world still debates technology standards.

Increasing rivalry may reduce the attractiveness of the profitable wireless industry in the short

term. However, multinational telecommunications corporations, which are becoming

DoCoMos domestic competitors, may represent its best allies in pursuit of global expansion.

The future of DoCoMo abroad depends on its ability to leverage these alliances and its core

competencies in marketing, management, R&D, and good supplier relations which have been

responsible for its success in Japan.

Given the risks involved in investing in telecommunications infrastructure in foreign countries,

DoCoMo has chosen an asset-light sliver strategy, focusing on providing technology without

ownership. This is done through friendly joint ventures and acquisition of small stakes in local

operators with the purpose of expanding its technology worldwide and becoming the

technological leader. DoCoMo seems to be doing well in this respect as its 3G W-CDMA

technology gradually gains wider acceptance among other countries. However, expanding i-

mode, a revolutionary idea and currently the best wireless web option available, to the rest of

the world seems difficult because WAP has become almost a universal standard.

Although DoCoMo is a young and inexperienced player, it is implementing a rather aggressive

international strategy. If W-CDMA is adopted as a global standard for 3G wireless networks,

then DoCoMo will clearly emerge as the world technological leader. On the other hand, if the

ITU decides to push CDMA-2000 as the universal standard, DoCoMo would suffer major

setbacks in its development plans abroad and its future could be threatened.

4.3 International Expansion

To extend i-mode and 3G services outside Japan, DoCoMo focused on acquiring stakes in

various cellular countries around the world. Commenting on this, Natsuno Takeshi, Executive

Director of DoCoMo said DoCoMo alone is very sure of the potential of 3G, because we have

already experienced the explosive success of the data business. Our overseas business is to

18

offer our know-how. We cannot give it away free, but we can make a minority investment in

interested partners. I think it is a perfect strategy. DoCoMo invested in foreign mobile

providers who were aiming to deploy the next generation technology. In May 2000, it bought a

15 percent stake in Dutch KPN mobile to set up Europes rst i-mode service and in December

2000, completed the acquisition of a 16 percent stake in AT&T for $9.8 billion, planning to

establish the rst 3G network in the U.S. in 20032004. DoCoMo also invested in Hutchison in

HongKong, KG Telecom in Taiwan, and Tele Sudeste in Brazil. In exchange, these carriers agreed

to roll out i-mode and DoCoMos version of 3G mobile technology. Through these investments,

DoCoMo improved its access to Asia as well as the European and American markets. Its

network of international investments was intended to leverage DoCoMos know-how from the

advanced Japanese market. It planned to offer i-mode-type services based on 2.5G to be

followed by 3G products and services, which would be well developed in Japan by that time.

DoCoMo was aiming to establish its WCDMA technology as the de-facto world-wide standard

for 3G mobile phones. However, its global aspirations soon ended due to the downturn in the

global telecommunications market.

4.4 Global Expansion: Challenges

In scal year 2001, DoCoMo was forced to write off almost 1 trillion yen due to the decline in

the value of its investments in various foreign wireless companies. The gross impairment

charges were 664.5 billion yen for AT&T Wireless Service, Inc., 320.5 billion yen for KPN Mobile

N.V., 36.5 billion yen for KG Telecommunications Co., Ltd., and 56.4 billion yen for Hutchison 3G

UK Holdings Ltd. In mid 2002, it was reported that DoCoMo was facing problems in convincing

its partner wireless companies to adopt its technology. These companies were reluctant to

spend huge amounts upgrading their networks, as they feared DoCoMos products and services

might not attract customers in their countries. They had already spent billions of dollars in

acquiring 3G licenses and did not have the nancing to set up and operate 3G networks. As a

result, a number of leading telecom companies in Europe and the U.S. decided to delay their 3G

roll out plans, which were initially projected for 2002 and early 2003.

19

5. DoCoMo in US: Failure

in December 2000, completed the acquisition of a 16 percent stake in AT&T for $9.8 billion,

planning to establish the rst 3G network in the U.S. in 20032004.

The various reason of failure could be:

I-mode: At the time of the acquisition of AT&T, Japan and Europe had already begun

migrating to the 3G networks whereas in the U.S. there were many full second-generation

network coverage and some 2.5G providers. Although the limited 2.5G data transmission

speed did not support advanced multimedia services, it provided the basic content that

satised customers. This was, however, not sufficient to be marketed as i-mode under

DoCoMos standards. The preferred protocol for mobile information services in the U.S. was

wireless application protocol (WAP), which allowed users to connect to the Internet and

advanced telephony services. It required the use of wireless markup language (WML) to

create content (Internet sites). WAP is an open standard, not controlled by a single vendor.

But its widespread adoption was uncertain due to its technical limitations. In contrast,

DoCoMo used its own protocol for i-mode in combination with its proprietary c-HTML

language. Switching to i-mode would thus be more expensive. Although most carriers had

introduced mobile Internet access based on the WAP protocol, similar capabilities were also

offered by providers of mobile e-mail services, such as Blackberry, and of wireless personal

digital assistants (PDAs). The distinction between cellular phones and PDAs were beginning

to blur as new cellular handsets incorporated PDA functionality and wireless PDAs were

voice enabled. Furthermore, the U.S. market was different from the Japanese market in

terms of fragmentation and a widely dispersed population. The intense competition in the

U.S. market had led to at rate calling plans, so there was little incentive for mobile carriers

to increase network usage. In addition, U.S. prices were often set too high to encourage

frequent use of additional services.

DoCoMo and Cingular Wireless are negotiating to introduce i-mode and 3G services to

Cingulars customers in the U.S. They aim to reach an accord in 2005. DoCoMo also announced

that it will soon set up a $100 million venture fund in the U.S. to invest in start-up companies

that develop advanced mobile communication technologies. After the company failed in its

20

overseas investments, it decided that smaller investments in promising venture companies

would be a better option. Investment in stakes of U.S. ventures will also shorten DoCoMos own

development cycle, lower R&D costs, and widen its opportunities.

21

6. DoCoMo in UK: Failure

In July 2000, DoCoMo bought 20% stake in Hutchison 3G UK Holdings Ltd. Although DoCoMos

technology was far superior to WAP, which European operators had been successfully

marketing to their customers, very few users signed up for i-mode. Mobile Internet services

were not as popular in Europe as they were in Asia and after studying the UK market, 3UK

decided against deploying i-mode. The local operators in Europe were also facing problems in

launching i-mode compatible technology in place of the standard WAP technology. In May

2004, DoCoMo announced that it had terminated its investment in Hutchison 3G UK holdings,

which operates 3UK. Some other reasons that contributed to the failure were the launching of

i-mode service during a recession, poor quality of i-mode enabled handsets, and the

opportunity for WAP to bounce back. Many consumers considered i-mode as an interim

technology that would soon be superseded by 3G. As John Tysoe, mobile-industry analyst at

WestLB Panmure in London pointed out, It will be tough to persuade people to get an i-mode

handset when so much has been said about 3G. Investors wanted DoCoMo to rethink its

overseas adventures.

In November 2004, DoCoMo signed an agreement with mm02plc under which the European

mobile operator will provide i-mode services to its 22 million customers in the UK, Germany,

and Ireland. O2 U.K and O2 Ireland will exclusively use i-mode brand and technology in their

markets. In Germany, O2 will launch services based on i-mode technology but under its own

brand.

22

7. DoCoMo Global Expansion: A good strategy?

It is questionable whether DoCoMo saw its business as a global business or rather a multi-local

business. DoCoMo focused on acquisitions to expand its business without truly analyzing the

synergy effect from these deals. According to nancial theory, mergers and acquisitions will

generate economic gain only if there is a synergy effect or if two rms are worth more together

than apart. An analyst from Dresdner Kleinwort Wasserstein, pointed out that there was no

additional gain for DoCoMo by acquiring stake in AT&T Wireless. However, some analysts also

say that DoCoMo was a latecomer in the U.S. market and partnerships with most carriers were

foreclosed to it. DoCoMo selected AT&T wireless largely because of AT&Ts national footprint

and because AT&T agreed to deploy i-mode and implement DoCoMos WCDMA standard by the

end of 2003. Furthermore, despite regulatory changes, economics of the mobile industry has

remained primarily national in nature and it is better to be a market leader in one country

rather than a follower in many countries. In general, a broader geographic scope and higher

subscribers than that of other companies is the true benet for the leader. Although DoCoMo

was the leader in Japan, this was not true for Europe or North America. To be successful in

international market by way of merger and acquisition synergies, DoCoMo should have been

more serious about gaining management control. Although it accumulated direct or indirect

shares in nine mobile operators during the telecom bubble period, it was the major player only

in KPN Mobile in Netherlands and Hutchison in HongKong, which were minority geographic

markets. The rest of the investments were not successful for being a market leader. AT&T

Wireless was the No. 3 player in the U.S., KG Telecom was No. 4 in Taiwan, and Hutchison was

No. 5 in U.K. Since DoCoMo was the minority shareholder, it had very little or no management

control. DoCoMo argued that the objective of global business expansion was to generate

royalties from its i-mode business model for mobile Internet services in joint ventures with

newly acquired partners and to increase the adoption of DoCoMos 3G mobile technology

standard. In Japan, DoCoMo was able to dominate the entire value chain by specifying

standards for handset manufacturers and regulating the content from content providers.

23

8.1 TATA TELECOM SERVICES LIMITED

Despite being a late entrant, Tata Indicom, TTSL's CDMA brand, had already established its

presence and was the fastest-growing pan-India operator. Incorporated in 1996, Tata

Teleservices Limited was the pioneer of the CDMA 1x technology platform in India. In 2008-09,

Tata Teleservices Limited, along with Tata Teleservices (Maharashtra) Ltd, served over 37

million customers in more than 320,000 towns and villages across the country offering a wide

range of telephony services including Mobile Services, Wireless Desktop Phones, Public Booth

Telephony and Wire line Services.

8.2 TATA DOCOMO

Tata DoCoMo is Tata Teleservices Limited's (TTSL) telecom service on the GSM platform arising

out of the Tata Group's strategic alliance with Japanese telecom major NTT DOCOMO in

November 2008.

Tata Teleservices received a pan-India license to operate GSM telecom services, under the

brand Tata DoCoMo and was also allotted spectrum in 18 telecom Circles. The company rolled

out GSM services in 14 of Indias 22 telecom Circles in a quick span of under six months.

Currently, it has rolled out services in all the 18 Circles that it received spectrum in from the

Government of India-Tamil Nadu, Kerala, Orissa, Karnataka, Andhra Pradesh, Maharashtra,

Mumbai, Madhya Pradesh-Chhattisgarh, Haryana-Punjab, Kolkata, Rest of West Bengal,

Jharkhand, Bihar, UP (East), UP (West), Gujarat, Himachal Pradesh and Rajasthan.

Tata DoCoMo has also set up a 'Business and Technology Cooperation Committee, comprising

of senior personnel from both companies. The committee is responsible for identification of the

key areas where the two companies will work together. DOCOMO, the worlds leading mobile

operator will work closely with Tata Teleservices Limited management and provide know- how

on helping the company develop its GSM business.

On November 5, 2010, Tata DoCoMo became the first private sector telecom firm (third overall)

to launch 3G services in India, with a 20 city launch. The joint venture between Tata

Teleservices and Japanese telecom major NTT DoCoMo officially began rollouts with a plan to

invest $2 billion for its pan-India GSM services.

24

The launch of the Tata DoCoMo brand marked a significant milestone in Indian telecom

landscape, as it redefined the very face of telecoms in India, being the first to pioneer the per-

second tariff option-part of its Pay for What You Use pricing paradigm.

Tata DOCOMO also became the first Indian private operator to launch 3G services in India, with

its recent launch in all the nine telecom Circles where it bagged the 3G license. In association

with its partner NTT DOCOMO, the Company finds itself suitably positioned to leverage this

first-mover advantage. With 3G, Tata DOCOMO stands to redefine the very face of telecoms in

India.

8.3 Entry Strategy

Country-wide TATA DOCOMO service rollout is set to be completed this year itself. Best

coverage was ensured in every state of India at the time of launch. It started its rollout from

Southern India and continued to other parts of India. The launch was supported with DIVE-IN

stores. The stores have a unique concept that offer a relaxing and interactive environment for

consumers and are aimed at inspiring and educating them on the benefits of mobility. These

stores are perfectly placed to execute aggressive sales promotion of the new brand and to

connect with customers.

TATA required technology expertise as Indian market is expanding and also with latest

technology infusion, they required expertise to keep pace with other players. DoCoMo also

injected $2.3 billion into Tata Teleservices. They were first to launch 3G services only because of

DoCoMos help DoCoMo has technology and is looking for partners from quite a long time to

enter India JV best option as Indian telecom laws are quite strict and also cap n FDI also a

problem And India still provides a big market. Looking to raise stake in JV from 26% to gain

more chances of earnings. Tata being a value oriented player works well with DoCoMos values.

8.4 Pricing

Indian Telecom space was Disrupted by Tata DoCoMo when they came out with a 1 paisa per

second tariff. Wikipedia defines disruptive innovation as an innovation that improves a product

or service in ways that the market does not expect, typically by being lower priced or designed

for a different set of consumers.

25

We have earlier seen how Reliance India Mobile changed the mobile industry by coming up

with the lowest tariff in the beginning of this decade. The call charges were around Rs 2-3 per

minute and because of Reliance this was brought down to around Re 1 per minute.

Tata DoCoMo was the next one to employ disruptive innovation in the Indian mobile industry.

Currently the game is not played on the price front but Value added services front, which is

evident from the advertisements of Airtel (Madhavan and VidyaBalan) and Vodafone (Zoozoos)

in the past.

If Aircel is redefining how telecom operators approach value added services and GPRS in India,

TataDoCoMo is doing its bit to change billing practices.

TATA DOCOMO is the pioneer of PAY- FOR-WHAT-YOU -USE. A joint venture of Tata

Teleservices (TTSL) and Japans leading mobile operator NTT, DOCOMO took the right steps to

penetrate into the overly crowded Indian telecom market. The first step was of knowing their

target audience well and hence emerged plans like per second charging scheme for calls and

per character charging scheme for SMSs, with Rs 95 for unlimited GPRS. The innovative concept

was mixed with perfect marketing to win over other players.

8.5 Differentiation

It used tariff plans to differentiate itself from other major players like Vodafone, Airtel and Idea

in the GSM category. It has cheaper rates than any other CDMA service provider and the added

advantage is that unlike CDMA, a different handset is not required. Pulse rate of per second,

where all other services used one minute gave TATA DOCOMO the first mover advantage.

Also, services offered were customised as per subscribers. TATA DOCOMO has unveiled a

portfolio of Value-Added Services that has reinvented mobile telephony in India. It offers

products and services like diet SMS, Free VoiceMail, Timed SMS Service, Missed Call Alerts, Call-

me Tunes, etc. All of them are customized to liberate and refresh the subscribers.

8.6 Positioning

TATA DOCOMO has positioned itself as a value for money brand. The first move on this front

was to cut through the clutter and redefine the entire pricing paradigm. In the clutter of

26

confusing service providers, TATA DOCOMO is positioned as the countrys most transparent,

innovative and liberating telecom brand.

Tata DoCoMo appears to be banking heavily on its tariff plans the company offers a 1 second

pulse instead of the usual 1 minute pulse that other telecom operators were offering. This

means that consumers are charged on a per second basis, instead of a per minute basis, and

end up saving money on unused seconds. A nifty little application How much can you really

save on DoCoMos website explains how this works. Rs. 0.01/second is a marked change from

the Re 1/min and Rs. 0.49 /min charges that usually apply. Now while this plan might sound

unique, it isnt that it hasnt been tried before: back in 2004, Tata Indicom had launched 1

second pulse plans, which going by their current plans, appears to have been shelved. At

present, Tata DoCoMo has launched voice portals, 24-hourmusic, cricket commentary and voice

chat, apart from offering free Missed Call Alerts and Voicemail. Interestingly, voice based

services are also being priced with a per-second-pulse: 24 hour music and voice chat are priced

at Rs.0.02/second. Caller Tune search service Genie is also being priced at Rs. 0.02/second.

This is a marked change, again, from the per minute pricing, and can offer consumers cheaper

options

8.7 Competition and Challenges

Other players in market have stolen the success formula of TATA DOCOMO. Vodafone, Airtel,

Loop, Aircel and others have introduced 1 sec pulse. But TATA DOCOMO still has the edge over

competitors.

As they are in the GROWING phase of product life cycle, their innovative rates planning is

keeping them ahead of the crowd. The customization provided in VAS is still a novel concept in

the market. But to sustain the lead they have acquired, they need to innovate continuously.

8.8 Marketing Strategy

Segments for TATA DOCOMO are not restricted to any particular age, sex or mood; it includes

all Indians who have the potential to use a mobile phone. Tata DoCoMo appears to be banking

heavily on its tariff plans, the company is offering a 1 second pulse instead of the usual 1

minute pulse that other telecom operators are offering. This means that consumers are

27

charged on a per second basis, instead of a per minute basis, and end up saving money on

unused seconds. A nifty little application How much can you really save on DoCoMos website

explains how this works. Rs. 0.01/second is a marked change from the Re 1/min and Rs.

0.49/min charges that usually applies.

8.9 Marketing Mix: 4PS

Product

TATADOCOMO has good range of services. Tata DoCoMo provides both postpaid and prepaid

services. Tata DoCoMo has good quality network which provides clarity in voice.

Price

TATADOCOMO has 1paisa /sec it is applicable for both prepaid and postpaid. A fifty little

application How much can you really save on DoCoMos website explains how this works. Rs.

0.01/second is a marked change from the Re 1/min and Rs. 0.49/min charges that usually

applies.

Now while this plan might sound unique, it isnt that it hasnt been tried before back in 2004,

Tata Indicom had launched 1 second pulse plans, which going by their current plans, appears to

have been shelved.

The pay per second model has really paid off well for the latest entrant in the Indian GSM

space, Tata DoCoMo. The new pricing strategy from Tata DoCoMo has changed the rules of the

GSM game, which is dominated by AirTel and Vodafone. Mobile pricing innovation Tata

DoCoMo now charges per website for Mobile Browsing!

The new pay-per-website offering however, takes it to a complete different level and unheard

of pricing strategy. This is a very thoughtful strategy and something which has potential to

growth rapidly. Tata DoCoMo pricing strategy.

We have been quite impressed the way Tata DoCoMo have gone about their innovative pricing

models as well as marketing strategies.

28

Per Character SMS Pricing: On 8th September 2009, the GSM branch of the Indian carrier

Tata introduced a novel pricing strategy for text messaging. Under the brand Diet-SMS, Tata-

DOCOMO bills its customers by-the-character, rather than on a per message basis.

It is a very attractive marketing scheme, since many wireless subscribers, almost by habit, tend

to pepper their text messages with abbreviations and acronyms.

Under the new plan, Tata-DoCoMo charges one paisa per character. For example, a text

which reads tnx (for thank-you) is charged at 3paise instead of the normal SMS charge.

Tata DoCoMo has gathered significant market share, owing to its pricing strategies. Existing

mobile operators are matching the price and the clear winners are the subscribers since all the

competition is sending the prices downhill.

Place

Good range of channels of distribution: As Tata already exists in this field of

telecommunications as Tata Indicom. It has wide range of channels of distribution to sell

TATADOCOMO services.

Promotion

Advertising: TATADOCOMO following different style of advertising pattern in TV and

newspapers. Due to that reason it was reaching public very fast. The company has carried out a

few adverts that highlight the brand's unique features and some other topical advertising

during Ganesh Chaturthi and Diwali. The latest from the GSM provider is the 'Friendship

Express' TVC. The ad opens inside train, where everyone is doing their own thing. A couple of

the travelers don't like the solemn mood and start humming the DoCoMo tune. Slowly and

steadily, others pitch in and soon most of the train is singing along. The ad ends with the super,

'Why walk alone when we can dance together'.

Cutting through the clutter that the Indian telecom landscape finds itself in with customers

forced to jostle with confusing and complicated products, services and tariff plans Tata

DOCOMO is Doing the New again, with the launch of its new brand campaign, aptly titled

Keep It Simple. Tata DOCOMOs unique Keep It Simple Campaign is in a form of a stand-up

29

comedy show with many episodes, which aired during the course of this IPL season. It focuses

largely on how Tata DOCOMO simplifies the telecom experience, and hence the consumers

life, by providing differentiated products and services. Each individual advertisement starts by

illustrating a complexity in the category, and presents the Tata DOCOMO product and/or

service as a means of simplifying things. This campaign is simple, captures the various moods of

Ranbir depicting those of Tata DOCOMO.

DOCOMO has invested heavily into outdoor, print and television media. But the fact that they

are open to the idea of using social media marketing is in itself laudable. TATA DOCOMO has

understood the Indian fondness for E-MEDIA and has used social sites like Twitter and

Facebook. This demonstrates their social marketing approach.

The theme of marketing being used by the brand gives a trigger to forget the old ways and do

the new. The launch of DOCOMO was carried forward with the association of the brand with

the thought do. Such theme connects with everyone in diverse segments. Also the fact that

they achieved this feat without any celebrity endorsement is laudable. Recently, it has struck a

deal with Neo Cricket as season partners and is promoting itself heavily during the ongoing

India vs. Sri Lanka test series.

The print advertisements are customized as per the states. Different states with respective

culture, dances etc. are shown with TATA DOCOMO highlighted on the ads. The TATA DOCOMO

signature tone is being liked and recognized by the Indian public in general; especially the

advertisement with Friendship Express is gaining popularity. To complete the promotion

strategy the website for TATA DOCOMO has all the elements to engross the GEN-X. Currently

they have the Animator Ahoy contest to engross the visitors.

30

9. Recommendations

Producer Network Alliance

While Tata DoCoMo currently provide its own mobile sets, an alliance with mobile handset

producers like Nokia (which has a 70 percent plus market share) and Samsung should help in

attracting a greater number of customers.

Products and Services

Given that the Indian market is fundamentally heterogeneous, DOCOMO will need to adapt its

services to cater to both urban and rural customers. This may be done by providing multi-

lingual interfaces and devices which cater to both markets.

Promotion

The company should consider better utilization of its presence on social media by allowing

marketers to interact with consumers, influencers. It can consider hiring celebrities as brand

ambassadors who can communicate to consumers on social networks. This aspect seems to be

neglected in their current promotion strategy.

Channels

The company should consider adopting a multi channel sales strategy to penetrate the market

quickly by offering cell phones online and through non-Tata owned consumer electronic outlets

for urban customers. In Rural markets deploying mobile sales vans and establishing local,

village-based networks to take advantage of personal relationships an account for the

influencers in any particular area.

Pricing

For the urban market which is more likely to spend on smartphones and utilize 3G enabled

services using the same, the company can consider offering service bundles or contracts

incentivizing the acquisition of phones as well as subscription to Tata DoCoMo services. In this

context, it can consider the system of contracts followed by telecom providers in the US.

31

In rural or low income market it will have to increase volumes by offering family and friend

deals in services and if necessary will have to be prepared to lose money in selling low-end

instruments in exchange for service contracts. While the latter is contrary to current customer

behaviour its a needed shift if the goal is to own a strong subscriber base in the short-term and

grow ARPU in the long-term.

32

10. Conclusions

After analysis and interpretation of the data it can be concluded that Tata Docomo is

providing a broad range of schemes ranging from international calling to hello tunes. This is the

critical factor in attracting different types of customers and is resulting in a rapid increase in the

number of customers for Tata Docomo.

Tata Docomo has emerged as a giant killer due to their tariff plans and heading towards the

position of dominator. This is largely because tariff charges introduced by the Tata Docomo are

found to be cheaper than other services. However, Tata Docomo is providing some unique

features and services like pay per second, SMS per character, pay per site plans that are making

them being different from their competitors and giving them it an advantage.

At this stage, awareness of the Tata Docomo is spreading widely among people due to their

promotional activities. Buyers are now insisting for cheaper plans or threatening to opt out.

This surely bodes well for Tata Docomos prospects.

So far as NTT Docomo is concerned, a change in from the earlier Ethnocentric strategy for

Internationalization, to Regiocentric has brought about positive results as can be seen from

the failure of its early US and UK ventures and the success of its Indian venture.

.

33

Anda mungkin juga menyukai

- LLC Operating AgreementDokumen18 halamanLLC Operating Agreementjwalker6492283% (6)

- Fans & Blowers-Calculation of PowerDokumen20 halamanFans & Blowers-Calculation of PowerPramod B.Wankhade92% (24)

- Fans & Blowers-Calculation of PowerDokumen20 halamanFans & Blowers-Calculation of PowerPramod B.Wankhade92% (24)

- Cellular Technologies for Emerging Markets: 2G, 3G and BeyondDari EverandCellular Technologies for Emerging Markets: 2G, 3G and BeyondBelum ada peringkat

- Trust Receipt Law NotesDokumen8 halamanTrust Receipt Law NotesValentine MoralesBelum ada peringkat

- Original PDF Global Problems and The Culture of Capitalism Books A La Carte 7th EditionDokumen61 halamanOriginal PDF Global Problems and The Culture of Capitalism Books A La Carte 7th Editioncarla.campbell348100% (41)

- Disrupting MobilityDokumen346 halamanDisrupting MobilityMickey100% (1)

- Age of Mobile Data: The Wireless Journey To All Data 4G NetworksDari EverandAge of Mobile Data: The Wireless Journey To All Data 4G NetworksPenilaian: 4.5 dari 5 bintang4.5/5 (5)

- Project Report-Reliance Communications-Customer SatisfactionDokumen57 halamanProject Report-Reliance Communications-Customer Satisfactionyash mittal82% (49)

- NTT Docomo Case StudyDokumen4 halamanNTT Docomo Case StudyLy Nguyen LeBelum ada peringkat

- Vodafone's Global Reach and Investments in NetworksDokumen3 halamanVodafone's Global Reach and Investments in Networksagarwaldia28100% (1)

- The Academy of Economic Studies Entrepreneurship and Business Administration - English TeachingDokumen32 halamanThe Academy of Economic Studies Entrepreneurship and Business Administration - English TeachingElena Nichifor33% (3)

- NBCC Heights - Brochure PDFDokumen12 halamanNBCC Heights - Brochure PDFAr. Yudhveer SinghBelum ada peringkat

- TELECOM ORGANIZATIONS ADAPT IN A POST-COVID-19 REALITYDari EverandTELECOM ORGANIZATIONS ADAPT IN A POST-COVID-19 REALITYBelum ada peringkat

- Vodafone's International Expansion and Acquisition StrategyDokumen9 halamanVodafone's International Expansion and Acquisition StrategyBezawit TesfayeBelum ada peringkat

- Marketing EngineeringDokumen6 halamanMarketing Engineeringpranav.newtonBelum ada peringkat

- An Analysis On DoComoDokumen12 halamanAn Analysis On DoComodisha_11_89Belum ada peringkat

- Japanese Mobile Market Dominated by NTT DocomoDokumen13 halamanJapanese Mobile Market Dominated by NTT DocomoRaj PaulBelum ada peringkat

- Business Strategy Case Study - DoCoMoDokumen18 halamanBusiness Strategy Case Study - DoCoMoRobinHood TiwariBelum ada peringkat

- Docomo-Japanese Wireless Tel LeaderDokumen16 halamanDocomo-Japanese Wireless Tel Leaderbil2009Belum ada peringkat

- DoCoMo's Losses and Strategy Shift to 3GDokumen12 halamanDoCoMo's Losses and Strategy Shift to 3GSudhanshu AnandBelum ada peringkat

- Final PPT DoCoMoDokumen23 halamanFinal PPT DoCoMoNirmal100% (2)

- NTT DOCOMO - Technology Strategy AnalysisDokumen7 halamanNTT DOCOMO - Technology Strategy AnalysisMadhuranath RBelum ada peringkat

- Presentation On Case Study ofDokumen23 halamanPresentation On Case Study ofankit boxerBelum ada peringkat

- Docomo - The Japanese Wireless Telecom Leader: Pakistan Water and Power Development Authority (Wapda)Dokumen12 halamanDocomo - The Japanese Wireless Telecom Leader: Pakistan Water and Power Development Authority (Wapda)wajeeha javedBelum ada peringkat

- Do ComoDokumen3 halamanDo ComoVibhuti DabrālBelum ada peringkat

- Welcome P: Resented by Abhishek SandeepDokumen28 halamanWelcome P: Resented by Abhishek SandeepnvabhishekBelum ada peringkat

- NTT DoCoMo i-mode: How it created value through innovation and partnershipsDokumen8 halamanNTT DoCoMo i-mode: How it created value through innovation and partnershipsHimanshu SuriBelum ada peringkat

- Docomo's Strategic Shift to Profitability After 3G FailureDokumen14 halamanDocomo's Strategic Shift to Profitability After 3G FailureSandesh S GadkarBelum ada peringkat

- Analysis of NTT DocomoDokumen3 halamanAnalysis of NTT Docomosandeep4u60Belum ada peringkat

- DocomoDokumen13 halamanDocomodisha_11_89Belum ada peringkat

- NTT DocomoDokumen2 halamanNTT Docomo2203854Belum ada peringkat

- NTT Docomo - Tata M&a Case StudyDokumen14 halamanNTT Docomo - Tata M&a Case StudyUjjawal AgrawalBelum ada peringkat

- Summer Project Progress Report No. 1 "Telecom Industry Analysis of Vodafone Company"Dokumen15 halamanSummer Project Progress Report No. 1 "Telecom Industry Analysis of Vodafone Company"muskan aggarwalBelum ada peringkat

- Docomo FeliCaDokumen14 halamanDocomo FeliCaShiva Kumar 91Belum ada peringkat

- VodafoneDokumen28 halamanVodafoneNavaneet Yadav100% (1)

- VodafoneDokumen2 halamanVodafoneFaiz Ahmed100% (1)

- HRM RelianceDokumen78 halamanHRM Reliancemanwanimuki12Belum ada peringkat

- Customer Satisfaction On JioDokumen75 halamanCustomer Satisfaction On JioPrince Kumar0% (1)

- Main Project of NokiaDokumen37 halamanMain Project of NokiaAnkur JaiswalBelum ada peringkat

- Softbank EaccessDokumen8 halamanSoftbank EaccessAmbar Tri BawonoBelum ada peringkat

- Introduction to India's Telecom Industry and Major PlayersDokumen51 halamanIntroduction to India's Telecom Industry and Major PlayersshusssssssssBelum ada peringkat

- Vodafone Complete ProjectDokumen51 halamanVodafone Complete ProjectUmesh KhandareBelum ada peringkat

- Japan's Telecom Market StructureDokumen4 halamanJapan's Telecom Market StructureSantiagoLaverdeBelum ada peringkat

- World Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving TwoDokumen52 halamanWorld Telecom Industry Is An Uprising Industry, Proceeding Towards A Goal of Achieving Twomanwanimuki12Belum ada peringkat

- Five Force Analysis of Japan's Telecom Industry at i-mode LaunchDokumen4 halamanFive Force Analysis of Japan's Telecom Industry at i-mode Launchnitishhere100% (2)

- Vodafone Project DeepsDokumen48 halamanVodafone Project DeepsSingh SurendraBelum ada peringkat

- Evolution of Telecom Industry The 19 CenturyDokumen6 halamanEvolution of Telecom Industry The 19 CenturyJoseph KuncheriaBelum ada peringkat

- Evolution of India's Telecom IndustryDokumen6 halamanEvolution of India's Telecom IndustryJoseph KuncheriaBelum ada peringkat

- Batch 39 - Exam PaperDokumen11 halamanBatch 39 - Exam Papervihangasenevirathna1997Belum ada peringkat

- Case 1: LecturersDokumen6 halamanCase 1: LecturersЖаннаBelum ada peringkat

- Index: Executive Summary 2Dokumen60 halamanIndex: Executive Summary 2imadBelum ada peringkat

- Introduction To Telecom IndustryDokumen8 halamanIntroduction To Telecom Industryshabad_sharma564Belum ada peringkat

- Do ComoDokumen1 halamanDo ComoRahul RajBelum ada peringkat

- Topic: Motorola - A Comprehensive Review in India Subject: International BusinessDokumen14 halamanTopic: Motorola - A Comprehensive Review in India Subject: International BusinessJahnavi ChowdaryBelum ada peringkat

- Namit Saxena-IDENTIFYING THE TELECOMDokumen54 halamanNamit Saxena-IDENTIFYING THE TELECOMkarannarula87Belum ada peringkat

- India: Mobile Handset Market inDokumen15 halamanIndia: Mobile Handset Market inShannon GarciaBelum ada peringkat

- BSNL Telecom Sector Report AnalysisDokumen21 halamanBSNL Telecom Sector Report AnalysisTajudheen TajBelum ada peringkat

- NTT DoCoMo Case: Managing Customer Migration and Marketing FocusDokumen4 halamanNTT DoCoMo Case: Managing Customer Migration and Marketing FocusKuntalDekaBaruah100% (1)

- KPMG Accounting and Auditing Update October 2010Dokumen32 halamanKPMG Accounting and Auditing Update October 2010Rahul Govind DwivediBelum ada peringkat

- Comsumer Behaviour Project ReportDokumen39 halamanComsumer Behaviour Project ReportAbhijeet VatsBelum ada peringkat

- Papers on the field: Telecommunication Economic, Business, Regulation & PolicyDari EverandPapers on the field: Telecommunication Economic, Business, Regulation & PolicyBelum ada peringkat

- Case UnderstandingDokumen5 halamanCase Understandingpranav.newtonBelum ada peringkat

- DSE Training ModuleDokumen1 halamanDSE Training Modulepranav.newtonBelum ada peringkat

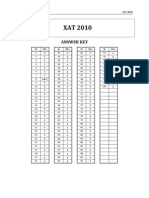

- Answer Key Xat 2010Dokumen1 halamanAnswer Key Xat 2010pranav.newtonBelum ada peringkat

- Lectures RevisedDokumen2 halamanLectures Revisedpranav.newtonBelum ada peringkat

- Leave Application FormDokumen1 halamanLeave Application Formpranav.newtonBelum ada peringkat

- Financial Ratios & Hospital ManagementDokumen3 halamanFinancial Ratios & Hospital Managementpranav.newtonBelum ada peringkat

- Insights On Mobile Consumption From Nielsen ResearchDokumen21 halamanInsights On Mobile Consumption From Nielsen ResearchSumit RoyBelum ada peringkat

- CAT 2007 SolutionsDokumen30 halamanCAT 2007 SolutionsBHUSHAN100% (2)

- Lectures RevisedDokumen2 halamanLectures Revisedpranav.newtonBelum ada peringkat

- KPMG ReportDokumen16 halamanKPMG ReportPavan GuntupalliBelum ada peringkat

- Imt FeeDokumen4 halamanImt Feepranav.newtonBelum ada peringkat

- You Have Your LebanonDokumen2 halamanYou Have Your Lebanonpranav.newtonBelum ada peringkat

- Final MinorDokumen5 halamanFinal Minorpranav.newtonBelum ada peringkat

- Formation and Running of SAEINDIA Student ChaptersDokumen15 halamanFormation and Running of SAEINDIA Student Chapterspranav.newtonBelum ada peringkat

- MogheDokumen3 halamanMoghepranav.newtonBelum ada peringkat

- PresentationDokumen11 halamanPresentationpranav.newtonBelum ada peringkat

- EH101 Course InformationDokumen1 halamanEH101 Course InformationCharles Bromley-DavenportBelum ada peringkat

- Coffe Production in Colombia PDFDokumen4 halamanCoffe Production in Colombia PDFJuanes RestrepoBelum ada peringkat

- Part 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetDokumen50 halamanPart 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetMary Rose De TorresBelum ada peringkat

- AssignmentDokumen8 halamanAssignmentnaabbasiBelum ada peringkat

- Distress For Rent ActDokumen20 halamanDistress For Rent Actjaffar s mBelum ada peringkat

- PresentationDokumen21 halamanPresentationFaisal MahamudBelum ada peringkat

- IPO Fact Sheet - Accordia Golf Trust 140723Dokumen4 halamanIPO Fact Sheet - Accordia Golf Trust 140723Invest StockBelum ada peringkat

- Geography Repeated Topics CSSDokumen12 halamanGeography Repeated Topics CSSAslam RehmanBelum ada peringkat

- Annual Report 2019 Final TCM 83-498650 PDFDokumen153 halamanAnnual Report 2019 Final TCM 83-498650 PDFzain ansariBelum ada peringkat

- HUL EthicsDokumen29 halamanHUL EthicsRimci KalyanBelum ada peringkat

- 16MEJUDokumen4 halaman16MEJUPhyo Wai LinnBelum ada peringkat

- Marketing Plan - NikeDokumen32 halamanMarketing Plan - NikeHendra WijayaBelum ada peringkat

- Capital Market InstrumentsDokumen6 halamanCapital Market Instrumentsgeet_rawat36Belum ada peringkat

- Research Article StudyDokumen2 halamanResearch Article StudyRica Mae DacoyloBelum ada peringkat

- Chapter 21 AppDokumen2 halamanChapter 21 AppMaria TeresaBelum ada peringkat

- RS Cashless India Projuct PDFDokumen90 halamanRS Cashless India Projuct PDFRAJE100% (1)

- IAS 2 InventoriesDokumen13 halamanIAS 2 InventoriesFritz MainarBelum ada peringkat

- TSSD-EFIS02-001 DILP CHECKLIST OF PRE-DOCS Rev05 Eff71521Dokumen2 halamanTSSD-EFIS02-001 DILP CHECKLIST OF PRE-DOCS Rev05 Eff71521NeQuie TripBelum ada peringkat

- Legal NoticeDokumen7 halamanLegal NoticeRishyak BanavaraBelum ada peringkat

- 12-11-2022 To 18-11-2022Dokumen74 halaman12-11-2022 To 18-11-2022umerBelum ada peringkat

- Exchange RatesDokumen11 halamanExchange RatesElizavetaBelum ada peringkat

- Balance StatementDokumen5 halamanBalance Statementmichael anthonyBelum ada peringkat

- Tour Guiding Introduction to the Tourism IndustryDokumen13 halamanTour Guiding Introduction to the Tourism Industryqueenie esguerraBelum ada peringkat

- DonaldDokumen26 halamanDonaldAnonymous V2Tf1cBelum ada peringkat

- Zesco Solar Gyser ProjectDokumen23 halamanZesco Solar Gyser ProjectGulbanu KarimovaBelum ada peringkat