Macro Notes Midterm 1

Diunggah oleh

Sahil Bambulkar0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

49 tayangan3 halamanRutgers University Intermediate Macroeconomics Exam 1 Professor: Tjang

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniRutgers University Intermediate Macroeconomics Exam 1 Professor: Tjang

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

49 tayangan3 halamanMacro Notes Midterm 1

Diunggah oleh

Sahil BambulkarRutgers University Intermediate Macroeconomics Exam 1 Professor: Tjang

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

Financial markets - markets in which funds are transferred from people who have an excess of available

funds to people who have a shortage.

Financial markets are important- Indeed, well-functioning financial markets are a key factor in producing

high economic growth, and poorly performing financial markets are one reason that many countries in

the world remain desperately poor. Activities in financial markets also have direct effects on personal

wealth, the behavior of businesses and consumers, and the cyclical performance of the economy.

A security (financial instrument) is a claim on the issuers future income or assets (any financial claim or

piece of property that is subject to ownership).

A bond is a debt security that promises to make payments periodically for a specified period of time.

Bond market is important because it enables corporations and govs to borrow to finance their

activities and is where interest rates are determined.

Interest Rate is the cost of borrowing or the price paid for the rental of funds (usually expressed as a

percentage of the rental of $100 per year). Many types of interest rates are found ex. Mortgage interest

rates, car loan rates, and interest rates on many different types of bonds.

Important for a lot of different reasons: high interest rates could deter you from buying a house

or a car because the cost of financing it would be high.

High interest rates could encourage you to save because you earn more interest income by

putting aside some of your earnings as savings.

Interest rates affect general health of the economy because they affect consumers/businesses

investment decisions ex. High interest rates might cause a business to postpone building a new building

Different interest rates tend to move in unison, economists frequently lump interest rates together and

refer to the interest rate

The Stock Market

A common stock represents a share of ownership in a corporation. It is a security that is a claim on the

earnings and assets of the corporation.

A way for corporations to raise funds to finanacie activitews.

Most widely followed financial market in almost every country that has one.

Called the market. Place where people get rich or poor quickly

Price of shares affect business investment decisions as it affects the amount of funds that can be raised

by selling newly issued stock to finance investment spending.

A higher price for a firms shares means that I can raise a larger amount of funds, to buy production or

equipment.

Financial system is complex, comprising of many different types of private setor, financial institutions,

including banks, insurance companies, mutual funds, finance companies and investment banks all of

which are heavily regulated by the government.

Financial intermediaries institutions that borrow funds from people who have saved and in turn make

loans to others.

Financial crises major disruptions in the financial markets that are characterized by sharp declines in

asset prices and the failures of many financial and non financial firms.

Banks and other financial institutions

Banks are financial institutions that accept deposits and make loans. Under the term banks are firms

such as commercial banks, savings and loan associations mututal savings banks and credit unions.

Financial intermediary.

Financial Innovation The development of new financial products and services can be an important

force for good by making financial systems more efficient. Improvements in information technology

have led to new financial products and the ability to deliver financial services electronically in what has

become known as e-finance.

Money, also called money supply is anything that is accepted in payment for goods or services or in

repayment of debts. Money is linked to the changes in economic variables that affect al of us and are

important to the health of the economy.

Aggregate output total production of goods and services

Unemployment rate percentage of the available labor force unemployed

Business cycle upward and downward movement of aggregate output produced by the economy is

affected by money.

When output is rising, it is easier to find a job output is falling it is harder to find a good job.

Recessions are periods of declining aggregate output.

Money growth has declined before almost every recession. Not every decline thoug .

Monetary theory, the theory that relates the quantity of money and the monetary policy to changes in

aggregate economic activity and inflation.

Money and Inflation

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- K-Electric SukukDokumen16 halamanK-Electric SukukAlaikaBelum ada peringkat

- Formats & Procedures for STP/EHTP UnitsDokumen16 halamanFormats & Procedures for STP/EHTP Unitsశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- The Concept of Free MarketDokumen6 halamanThe Concept of Free MarketDavidBelum ada peringkat

- Oasis Club MembershipDokumen2 halamanOasis Club Membershiprajasikander aliBelum ada peringkat

- Commercial Banking: Chapter ThreeDokumen39 halamanCommercial Banking: Chapter ThreeYoseph KassaBelum ada peringkat

- Chapter 13 - Managing Nondeposit LiabilitiesDokumen16 halamanChapter 13 - Managing Nondeposit LiabilitiesAhmed El KhateebBelum ada peringkat

- IATA TaxDokumen1.510 halamanIATA TaxMiguelRevera100% (1)

- Chapter 6 - Interest Rates and Bond Valuation Key ConceptsDokumen47 halamanChapter 6 - Interest Rates and Bond Valuation Key ConceptsCamille Santos50% (4)

- Abhishek Kumar Department of Management Studies Kumaun University, NainitalDokumen69 halamanAbhishek Kumar Department of Management Studies Kumaun University, NainitalAarav AroraBelum ada peringkat

- Onevanilla Prepaid Mastercard Balance - Onevanilla Visa Gift CardDokumen7 halamanOnevanilla Prepaid Mastercard Balance - Onevanilla Visa Gift Cardjames smithBelum ada peringkat

- Mafaza RulesDokumen12 halamanMafaza RulesdaniaeldamBelum ada peringkat

- 6tv 1 PDFDokumen10 halaman6tv 1 PDFSarwar MiyaBelum ada peringkat

- Legal NoticeDokumen1 halamanLegal NoticeMita BanerjeeBelum ada peringkat

- CXC It Sba 2015Dokumen6 halamanCXC It Sba 2015Wayne WrightBelum ada peringkat

- Intercontinental Bank Debunks Akingbola's Claims - 101010Dokumen2 halamanIntercontinental Bank Debunks Akingbola's Claims - 101010ProshareBelum ada peringkat

- Internship Report of NBPDokumen90 halamanInternship Report of NBPtarar58100% (1)

- Adb Loan Disbursement Handbook PDFDokumen140 halamanAdb Loan Disbursement Handbook PDFMunir AhmadBelum ada peringkat

- Cash and Cash Equivalents Sample ProblemsDokumen3 halamanCash and Cash Equivalents Sample ProblemsGee Lysa Pascua VilbarBelum ada peringkat

- Samba Financial GroupDokumen17 halamanSamba Financial GroupNoor Ul AinBelum ada peringkat

- International BankingDokumen55 halamanInternational BankingNipathBelaniBelum ada peringkat

- Components of Cash and Cash EquivalentsDokumen5 halamanComponents of Cash and Cash EquivalentsJomel BaptistaBelum ada peringkat

- MurabahahDokumen43 halamanMurabahahBoikobo MosekiBelum ada peringkat

- Disruptive TechnologyDokumen15 halamanDisruptive TechnologybinalamitBelum ada peringkat

- Chapter 5 Interest Rate Risk - The Repricing ModelDokumen19 halamanChapter 5 Interest Rate Risk - The Repricing ModelTiên CẩmBelum ada peringkat

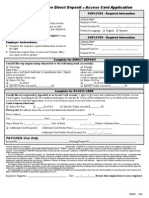

- Dir DepDokumen1 halamanDir Depfazlah8106Belum ada peringkat

- Indian Automotive Market - FrostDokumen5 halamanIndian Automotive Market - FrostdesijarmanBelum ada peringkat

- Simulated Document CheckDokumen6 halamanSimulated Document CheckAlok Pathak100% (1)

- pdfGenerateNewCustomer SAOAO1020618564Reciept SAOAO1020618564ResidentAccountOpenFormDokumen11 halamanpdfGenerateNewCustomer SAOAO1020618564Reciept SAOAO1020618564ResidentAccountOpenFormpavan reddyBelum ada peringkat

- Contact HBL for installment plans or visit websiteDokumen4 halamanContact HBL for installment plans or visit websiteKhizar HayatBelum ada peringkat

- Interest A Bane For SocietyDokumen4 halamanInterest A Bane For SocietyMohd Zubair AhmadBelum ada peringkat