Ar 2005-06

Diunggah oleh

jsrrohit0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

32 tayangan312 halamanJudul Asli

AR 2005-06

Hak Cipta

© © All Rights Reserved

Format Tersedia

RTF, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai RTF, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

32 tayangan312 halamanAr 2005-06

Diunggah oleh

jsrrohitHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai RTF, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 312

24

th

Annual Report

2005-06

Create a bold path,

Conquer the future

Rashtriya Ispat i!a" #i"ited

Visakhapatnam Steel Plant

(A Govt. of India Undertaking)

$li"pses of %on&ble 'ri"e (inister )r* (an"ohan +in!h,s -isit to RI# on 20th (ay, 2006*

.I+I/

.I+I/

Annual Report 2005-06

Rashtriya Ispat i!a" #td*

0/AR)

/1

)IR2C

3/R+

Chair"an-

4u"-

(ana!in!

)ire4tor

)ire4tor

51inan4e6

)ire4tor

5'ersonn

el6

)ire4tor

5Co""er

4ial6

)ire4tor

5/peratio

ns6

)ire4tors

Co"pany

+e4retary

Re!istere

d /ffi4e

0A72

R+

+tate

0an8 of

India

0an8 of

0aroda

Canara

0an8

9C/

0an8

Andhr

a

0an8

+tate

0an8

of

%yder

abad

Allaha

bad

0an8

Indian

/-ers

eas

0an8

%+0C

0an8

#td*

I)0I

0an8

#td*

Indian

0an8

Audit

ors

(:s

Rao ;

7u"a

r

Chart

ered

A44ou

ntants

.isa8

hapat

na"

Y. Siva

Sagar Rao

P.K.

Bishnoi

K.A.

Naidu

H.S.

Chhatwal

K.K. Rao

5upto

<=*0>*2006

6

P.K. Misra

5fro"

0=*0?*2006

on@ards6

A.K. Rath

J

.

P

.

S

i

n

g

h

5

u

p

t

o

2

<

*

0

=

*

2

0

0

6

6

D

r

.

S

.

N

.

D

a

s

h

5

u

p

t

o

0

6

*

0

4

*

2

0

0

6

6

G. Elias

5fro"

=<*04*200

6

on@ards6

R.S.S.L.N

.

Bhaskaru

du 5fro"

26*04*200

6

on@ards6

Dr. V.K.

Bhalla

5fro"

2A*06*200

6

on@ards6

J.S.

Mathur

5fro"

==*0>*

2006

on@ar

ds6

P.

Moha

n Rao

Ad

"in

istr

ati-

e

0uil

din

!,

.is

a8h

apa

tna

"

+te

el

'la

nt

.is

a8h

apa

tna

"

5<0

0<=

5An

dhr

a

'ra

des

h6

@ebsi

te B

@@@*

-iCa!

steel*

4o"

C/32

3+

Chair"an,s +tate"ent A

)ire4tors, Report

=

<

%i!hli!hts

<

?

Audited A44ounts

4

<

Auditor,s Report

>

0

Co""ents of C;A$

>

6

Re-ie@ of A44ounts by C;A$

>

?

4

Annual Report 2005-06

Foundation Stone Laying Ceremony for Expansion of RINL

from 3MT to 6.3MT p.a. of Liquid Steel

5

Rashtriya Ispat i!a" #td*

Glimpses of Honble Minister of State (Steel) Dr. Akhilesh Dass visit to Vizag Steel

India Steel Summit

5# to R6 +ri Ra" .ilas 'as@an, %on,ble 9nion (inister for +teel, +ri

R*+* 'andey, +e4retary 5+teel6 ; +ri D* +i-a +a!ar Rao, C(), RI#*

6

Annual Report 2005-06

Awards Galore

ational 2ner!y Conser-ation A@ard

0est Industrial 'rodu4ti-ity A@ard

0est C2/ A@ard

$olden 'ea4o48 A@ard for

2n-iron"ental (ana!e"ent

>

Rashtriya Ispat i!a" #td*

Glim

pses

of

Parli

ame

nt

Com

mitte

es

visit

to

Viza

g

Steel

?

Annual Report 2005-06

C%AIR(A,+ +3A32(23

It gives me great pleasure to

welcome you to this very special

24

th

Annual General Meeting of

your company, the first after its

declaration as a Mini Ratna

Company by the Honble

Minister for Steel, Chemicals

and Fertilizers, Government of

India on 20

th

May 2006.

Your company has moved ahead

with a strong performance and

well conceived strategies for

Expansion, Improved capacity

utilization and Corporate

transformation. The sustained performance of the company particularly during the last four years with its

relentless pursuit towards excellence enthuse over all confidence among all the stake holders. I feel proud to

quote the Honble Prime Minister on the momentous occasion of the Foundation stone laying ceremony on

the 20

th

May 2006 for the expansion of the plant from its present capacity of 3 Mt to 6.3 Mt liquid steel.

The turnaround of this steel plant is a land mark achievement. It shows that with hard work and

commitment, PSUs can perform well against competition. RINL has shown other PSUs the way forward. I

congratulate everyone associated with the remarkable turnaround. We rejoice in your success.

2005-06 : The record breaking year :

Our continued excellence and relentless endeavours backed by our sound work culture and dedicated work

force helped in registering the best ever sales turnover of Rs.8482 crs in the year 2005-06, the best since

inception. This is really noteworthy particularly given the steel market scenario in 2005-06 that witnessed

softening of the steel prices and hardening of the raw material inputs.

The Global Scenario :

The global steel scenario has stabilized by the end of 2005-06 and it is expected to grow steadily with

increased demand for steel from China and USA followed by India due to increase in infrastructural and

manufacturing activities. Apart from this, renewed business confidence from Europe and Asia has made

the economic scenario appear quite positive.

A

Rashtriya Ispat i!a" #td*

Indian Scenario :

The Indian economic scenario is robust at present backed by sustained manufacturing activity and focus on

Infrastructure development by the government. The GDP growth was around 8.4% (estimated) in 2005-06

against 7.5% in 2004-05. Growth prospects of the economy and business opportunities exude confidence and

there is over all optimism in all sectors paving way for investments by foreign institutional investors. This will

definitely help in augmenting the infrastructure sector which will enable handsome steel growth.

Indian Steel Sector :

The Indian Steel Sector has shown an accelerated growth rate of over 9% in the last five years and is all

set to grow further backed by strong economic growth. A National Steel Policy under the able stewardship

of the Honble Minister for Steel, Chemicals and Fertilizers has been evolved to facilitate smooth growth

of the steel industry. The long term goal of the National Steel Policy is to develop India as a modern and

efficient steel producer and achieve global competitiveness not only in terms of cost, quality and product

mix but also in terms of efficiency in productivity.

RINL - Bright Years ahead :

RINL, the emerging giant, has evolved both short term and long term strategies in line with the National

Steel Policy to convert the challenges into opportunities and propel the company to become a world class

integrated steel plant. The current expansion to double the capacity by 2008-09 is another step in its vision

to emerge as a world class company. The Corporate Plan 2020 is being worked out to capitalize on the

current opportunities and leverage the inherent strength, which will provide a blue print for growth of your

great company.

Strategic Initiatives :

Raw material security has become the prime concern and various strategies have been drawn to acquire

captive mines both within the country as well as abroad through joint ventures and acquisitions. An

exclusive group is working in this direction and joint ventures with NMDC and MOIL are the results of

such efforts. Our continued efforts for captive mines has resulted in the allocation of Mahal Coking Coal

Block with an estimated reserve of 258 Million Tonnes.

To strengthen our brand leadership in the market and improve process optimization, concerted efforts are

being put to provide more value to the customers at a price that is competitive and attractive. Therefore,

an exclusive R&D Department has been formed to focus on value advantage and cost optimization.

To further enhance the operational efficiencies, Enterprise Resource Planning is given due priority and a

cross functional team has been set up to ensure its implementation at the earliest.

=0

Annual Report 2005-06

On the energy front, in line with the vision of our Honble President Dr Abdul Kalam ji, renewable energy

and generation of bio-diesel has been given due attention and action plans have been drawn to substitute

5% of the energy requirement through renewable energy. A Renewable Energy Policy has been drawn

committing our efforts towards augmenting Renewable Energy.

Human Resources Development :

Today RINL stands tall among its competitors with an unmatched quality leadership. This is phenomenal,

given the high levels of capacity utilization of about 125%. The Labour Productivity of 282 t/man year is

the best in the steel industry of the country. This would not have been possible but for the committed and

dedicated team of our employees and their passion to excel. Their excellence is best exemplified by your

company winning almost one fifth of the Vishwakarma Rashtriya Puraskars at the National level. The

company therefore puts concerted efforts to sharpen the innovative and creative skills of the employees for

building upon the existing competencies and also for creating new areas of excellence. The HRM practices

are directed to motivate them and ensure their readiness to face the emerging challenges and the upswing

in the companys business.

Corporate Social Responsibility (CSR) :

As a responsible corporate citizen your company has initiated voluntary measures addressing the social

and environmental concerns of the stake holders. A comprehensive CSR Policy has been evolved. CSR is

viewed as a key business process to ensure peripheral development and for promoting the cultural

efflorescence of the society around. A number of welfare and development projects have been taken up and

a lot more have been planned to promote all round development of the society.

Continued Excellence :

The first quarter of the second fiscal has started on a bright note with the sales registering a growth of

30%. The Expansion programme has been given continued fillip and all efforts are being put for

completing the expansion by 2008-09 as promised to the government. A High Power Steering Committee is

formed to monitor the progress periodically. The task is quite daunting and therefore the need for speedy

implementation has been given specific focus through empowerment and refinement of processes and

systems. I am confident with the resources and competencies available, the RINL collective will leave no

stone unturned in accomplishing its objective.

Laurels :

The performance of your company has been well recognized and has been bestowed with a number of

accolades in various spheres of our activities. Some of them are :

1- The National Energy Conservation Award for the sixth time in succession

2- The ICWAI Award for Excellence in Cost Management

3- Commendation Certificate for Strong Commitment in HR Excellence from CII

==

Rashtriya Ispat i!a" #td*

1- The INSAAN Award for Organisational Excellence

2- The QCFI Award for the best QC implementation

3- Golden Peacock Award for Environment Management

4- The CII Award for Excellence in Water Management

5- The Viswakarma Rashtriya Puraskars (6 out of 28 awards at the National Level)

The Future :

With the kick starting of the second phase of RINL, your company has now embarked in chalking out the

growth path for future. As mentioned earlier, the Corporate Plan 2020 is under preparation to leverage the

inherent strengths and create more value to the stake holders. As the steel industry becomes more and

more technology driven, the need for intensifying the R&D activities has become more imperative and due

care is taken to strengthen this area further. The integration of the existing assets with the emerging

technologies and diversification of activities in line with the market needs are the broad areas of focus in

the Corporate Plan to be released shortly.

Acknowledgements :

The journey of RINL as a Mini Ratna Company has just started and with a committed and competent team,

your company is poised to create more wealth and greater value for the shareholders. During the current

fiscal year, as the Company enters into its Silver Jubilee year, I am sure it will take on its stride the

challenges to convert them into profitable avenues to place it on a higher orbit of growth and excellence to

acquire the NAVRATNA status in the coming years.

The sustained excellence of your company could be achieved with the commitment and contribution from

the entire RINL collective and support from various other corners, the Valued Customers, Suppliers, the

Statutory Auditors, C&AG, Financial Institutions, Banks, Officers Association and the Unions. I take this

opportunity to thank the Honble Minister of Steel, Chemicals & Fertilizers, the Honble Minister of State

for Steel, the Secretary and officials of the Ministry of Steel, Government of India for their unstinted

support. I would also like to acknowledge the support extended by the Honble Chief Minister of Andhra

Pradesh and officials of the State Government. I am thankful to the assistance rendered by other

Ministries/ Departments of the Government of India and the Government of Andhra Pradesh. I am grateful

to the entire Board of Directors for their guidance and support. I thank each and every employee of the

Company for their dedicated efforts and hard work in keeping the Companys flag flying high at all times.

( Y Siva Sagar Rao )

Place : Visakhapatnam

Date : 25

th

September, 2006

=2

Annual Report 2005-06

)IR2C3/R+, R2'/R3

To

The Members,

Rashtriya Ispat Nigam Ltd,

Visakhapatnam.

On behalf of the Board of

Directors of the Company, I

have great pleasure in

presenting the 24th Annual

Report of the Company

together with the Audited

Accounts for the year ended

31st March, 2006.

It is a matter of immense

satisfaction for me and the

entire VSP collective that as

your Company enters the Silver

Jubilee year of its existence, it

has posted a sterling

performance encompassing all

facets of corporate excellence.

For the past twenty four years,

your company has focused on

its core competencies without

any diversions. It has put in all

out efforts for excellence in

almost all fields of its

functioning and in spite of

various adverse factors and

situations over the last twenty

four years, the Company

ultimately emerged as a profit

making company wiping out all

its accumulated losses and

setting industry standards in

many technical parameters

benchmarking with the best in

the world of Steel industry.

2005-06 : AN YEAR OF

SUSTAINED GROWTH

The year 2005-06 has been a

significant one for

the Steel industry in

general with the

world steel

production

registering a 6%

growth. On the

domestic front, the

industry has grown

by over 16%, a

remarkable

achievement

indeed. This only

supports the growth

anticipated in the

National Steel

Policy symbolizing

robust economic

growth. During the

year, RINL on its

part achieved a

capacity utilization

of 120% of its rated

capacity and

registered a 2%

growth in Saleable

Steel production.

The total sales

turnover has

improved by 3.68%.

Majority of the Units

have achieved a

rare distinction of

highest ever

production since

inception. The

turnover touched an

all time high since

inception. The year

shall also be

reckoned as a

landmark and

memorable one for

RINL, because it

could secure the

final approval

/clearance of the

Government of

India in a record time of 10

months for its Expansion

Project from 3Mt to 6.3 Mt of

Liquid Steel i.e. almost

doubling its rated capacities

thus paving way for a

sustainable growth path in

coming years as well.

FINANCIAL REVIEW

The Financial year 2005-06

was an eventful year for RINL.

It has created Record Turnover

of over Rs.8,482 crores. For

the fifth consecutive year it

earned Net Profit and for the

year it is Rs.1,252 crores after

taxes. This is apart from

payment of (a) Income Tax of

Rs.500 crores towards

Corporate Tax, (b) over

Rs.1000 crores towards Excise

Duty and (c) over

24th AGM held at

Vizag on 25th

September, 2006.

=<

Rashtriya Ispat i!a" #td*

Rs.250

crores by

way of

Sales

Tax to

different

State

Governm

ents.

With the

current

year's

net

profit, all

the

accumul

ated

losses of

the

company

since its

inception

have

been

fully

wiped

out. With

this,

RINL

became

a real

profit

making

company

and it

has,

therefore

, been

classified

as a

MINIRAT

NA

CATEGO

RY-I

PSE by

Govt. of

India vide

Ministry of

Steel's

letter

No.1(9)20

04-VSP

dated 25th

May, 2006.

It is indeed

a great

journey

from a

time when

the

company

has

reported to

BIFR its

erosion of

Net Worth

and now

conferred

with

MINIRATN

A status.

The

Company

was

conferred

National

Award for

Excellency

in Cost

Reduction

instituted

by the

Institute of

Cost and

Works

Accountan

ts of India

(ICWAI) for

the year

2005 in

recognition

of its

efforts for

effective

implement

ation of

Cost and

Manageme

nt

Accounting

tools,

quality of

cost

accounting

records,

optimum

utilization

of

resources,

waste

manageme

nt, etc. by

the

Ministry of

Company

Affairs,

Governme

nt of India.

This is one

more

feather in

the cap of

RINL. The

Finance

and

Accounts

Departmen

t of the

Company

secured

the ISO

9001

Certificate,

which is

unique in

Public

Sector

Steel

Plants in

the

Country.

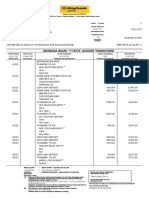

The summary of Financial performance is as

follows:

Rs. In

Crores

Description 2005-06

2004-

05

Turnover (Gross) 8482.44 8181.34

Total Income 7761.59 7646.15

Total expenditure 5392.54 4375.16

Gross margin 2369.04 3270.99

Interest charges 31.24 11.11

Cash Profit 2337.80 3259.88

Depreciation 448.29 447.25

Profit before exceptional

items 1889.51 2812.63

Depreciation of earlier

years - 558.87

Profit before tax 1889.51 2253.76

Provision for tax

Current Tax 474.97 87.18

Fringe benefit Tax 3.94 -

Deferred Tax 158.23 158.49

Net Profit 1252.37 2008.09

Accumulated loss (-) / profit

(+)

(+)

346.38

(-)

905.99

Boar

d

Meeti

ng

held

at

Vizag

on

31st

Augu

st,

2006.

=4

Annual Report 2005-06

SALE

S

AND

MAR

KETI

NG

REVI

EW

Marke

ting

Perfor

manc

e

durin

g

April

2005 -

March

2006

As

agains

t the

MOU

target

of Rs.

8793

Crs.

for the

year

2005-

06,

VSP

achiev

ed a

sales

realisa

tion of

Rs.

8482

Crs.,

thus

registe

ring a

fulfilm

ent of

96%

and a

growth of

4% over

the sales

turnover

of Rs.

8181

Crs. in

2004-05.

The

Sales

turn over

of

Rs.8482

Crs. of

2005-06

were the

best ever

since

inception

. And this

could be

possible

against

the

backdrop

of

sluggish

market

condition

s right

througho

ut the

year

which

has

brought

price line

under

tremend

ous

pressure

for any

year.

Domesti

c sales

turnover

of Rs.

8040

Crs. in

2005-06

was also

the best

ever till

date.

Sales

performa

nce w.r.t.

MOU

Target

2005-

06 :

Volume in '000 t

ITEM

2005-

Target Actual

Domestic

Pig Iron 383

Steel 3078

Export

Pig Iron 33

Steel 47

Total

Pig Iron

41

6

Steel

31

25

Value in

Rs.Crs.

Domestic

*

864

3 8039.9

Export 150

Total

87

93

* Domestic

includes

Iron, Steel

& By

Products

The

reven

ue

gener

ation

increa

sed

with

higher

sales

realiza

tion

value

as

well

as the

increa

sed

sale of

value

added

produ

cts.

Sale

of

value

added

produ

cts

grew

by 5

% in

2005-

06 as

compa

red to

2004-

05.

Total

sales

in

Steel

volum

e

during

2005-

06

registe

red

record

sales of

3.3

million

tons

(since

inception

) with a

6%

growth

over

previous

year.

Domesti

c steel

volume

of 3.10

million

tons

recordin

g a

growth of

1% over

2004-05

(3.06

million

tons).

To

further

strength

en the

Exports,

2.02 lakh

tonnes of

steel

was

exported

during

the year

to the

countries

viz.

Banglad

esh,

Myanmar

, Nepal,

Sri

Lanka,

Thailand

and USA

being

our

strategic

markets,

compare

d to 0.56

lakh tons

last year.

Sales of

By-

Products

during

the year

was Rs

150 Crs.

registerin

g a

growth of

5% over

2004-05

(Rs.142

Crs.).

This

includes

exports

of 6.95

lakh tons

of Blast

furnace

slag to

Banglad

esh,

Malaysia

and

USA.

Pig iron

recorded

sales of

3.07 lakh

tons in

Domesti

c market

during

2005-06

with a

growth of

156%

over

2004-

05

(1.20

lakh

tons).

The

focus

during

the

year

was

on the

develo

pment

of

actual

user

base

in

domes

tic

marke

t.

Aroun

d 60%

of the

steel

was

suppli

ed to

the

actual

user

segme

nt in

2005-

06.

As a

step

toward

s

increa

sing

custo

mer

satisfa

ction

levels,

settleme

nt of

customer

quality

complain

ts

through

e-system

has been

develope

d and

impleme

nted on

VSP's

intranet.

This will

eliminate

Wire Rod Coils in process

=5

Rashtriya Ispat i!a" #td*

delay in processing of quality complaints and provide

an efficient mechanism for settlement of quality

complaints.

SALES TURNOVER DURING THE LAST 3

YEARS:

MATERIALS MANAGEMENT REVIEW

During the year 2005-06, the required materials were

made available in time with no disruption of

Production.

Long Term Agreements were entered into for Hard

Coking Coal, Soft Coking Coal, Coke, Iron Ore Lumps

and Fines and MOUs were signed for MCC, Boiler

Coal, Aluminium Coils & Ingots and Steel Items, in

order to curtail price fluctuations in a highly volatile

market and to control the scarcity of material.

Coking Coal block at Mahal, Dhanbad (Dist), Jaria Coal

Field has been allotted to RINL and further studies are

underway. A High Level Delegation visited Canada,

Columbia, USA & Australia to explore the possibility of

acquiring Coking Coal Mines and submitted it's report.

MOU was entered with NMDC for a Joint Venture for Iron

Ore Pellet/Sponge Iron Plant in Chattisgarh.

3 Year Contracts were entered into for Special

Refractory Items. Also Rate Contracts were entered/

continued for various spares and consumables.

Coke Oven Battery Coke Ovens - By Product Plant

=6

Annual Report 2005-06

5S

was

imple

mente

d in

almost

all

areas

of

Stores

for

better

house

keepin

g and

servic

e. A

20 T

Gantry

crane,

lying

idle for

almost

two

decad

es,

was

made

operat

ive

throug

h in-

house

efforts.

The

invent

ory of

Stores

and

Spare

s at

cost

as on

31.03.

2006

was

Rs.

294.72

crores

(provisio

nal) and

was Rs.

290.83

crores as

on

31.3.200

5. While

adding

In-

transit/un

der

inspectio

n items

and

reducing

obsolesc

ence and

non-

moving

items,

the level

of

Inventory

was

brought

down

from

Rs.279.2

6 crores

in 2004-

05 to

Rs.273.5

4 crores

in 2005-

06.

During

the

period

under

consider

ation,

project

inventory

of Coke

Oven

Battery

IV has

gone up

from

Rs.16.12

crores to

Rs.32.81

crores

The

Internal

procure

ment

Leadtime

stood at

84 days

and the

Total

Leadtime

at 206

days.

Initiative

s like Six

Sigma,

simplifica

tion of

Purchas

e

Procedur

es, Total

Logistics

Manage

ment

etc.,

were

taken to

reduce

the

Procure

ment

Leadtime

.

The total

earnings

during

the year

2005-06

stood

at

Rs.102

58.57

lakhs

with

earnin

gs

from

Dispos

al - Rs.

947.76

lakhs;

Cenvat

- Rs.

8217.4

6

lakhs;

Early

despat

ch of

vessel

s-

Rs.108

2.83

lakhs;

Charte

r

agenc

y - Rs.

65.74

lakhs;

Custo

ms

agenc

y-

Rs.6.8

2

lakhs.

Saving

s

throug

h

negoti

ations

was

Rs.

8.51

Crores

.

In order

to

improve

the

existing

online

MIS

system

and to

make it

more

effective,

a

Committ

ee was

formed

on Data

Ware

Housing.

The

recomm

endation

s of the

Committ

ee were

approve

d and

modules

are

being

tested.

MIS

System

for port

operatio

ns and

Major

Raw

material

order

placeme

nt were

made

online.

P

R

O

D

U

C

T

I

O

N

R

E

V

I

E

W

A

N

D

T

E

C

H

N

O

E

C

O

N

O

M

I

C

F

A

C

T

O

R

S

Rated

capaci

ty of

the

Plant

has

been

surpas

sed

for the

fifth

conse

cutive

year.

VSP

contin

ued to

honou

r the

commi

tments

made

in the

MOU

for the

year

05-06

entere

d into

with the

Governm

ent of

India in

almost

all shops

by

registerin

g more

than

100%

fulfillmen

t in Oven

Pushing

(104%),

Bars Mill

products

(108%),

Wire

Rods

(113%),

MMSM

products

(116%),

Billets

(103%),

Saleable

Steel

(104%),

Liquid

Steel

(103%),

Hotmetal

(104%)

and

Sinter

(104%).

Highlight

s on

Producti

on front

are

briefly

stated

below:

1 Prod

uctio

n of

2.97

3 Mt

Finis

hed

Steel

with

3%

growt

h

over

last

year.

2 Valu

e

adde

d

prod

uctio

n of

8,89,

112 t

is the

highe

st

with

1%

growt

h

over

04-

05.

3 High

est

no.

of

Iron

and

Steel

rakes

(859

rakes

in a

year,

102

rakes

in a

mont

h)

dispa

tched

sin

ce

inc

ep

tio

n.

4 Hi

gh

est

no

.

of

Ro

ad

ve

hic

les

dis

pa

tch

ed

in

a

m

on

th

(1

07

76

in

M

ar

ch

06

)

5 La

bo

ur

pr

od

uct

ivit

y

of

28

2

t/

m

an

-yr

[6%

growt

h

over

last

year

(265t

/man

-yr)]

is the

best

so

far.

Co

nv

ert

er

Co

nti

nu

ous

Cas

tin

g

=>

Rashtriya Ispat i!a" #td*

1 Gros

s

Wate

r

cons

umpt

ion

of

2.56

cum/

t LS

(8%

redu

ction

over

last

year)

is the

best

so

far.

2 Gros

s

Pow

er

cons

umpt

ion

of

457

Kwh/

t LS

is the

lowe

st so

far.

3 Lowe

st

Semi

s of

8.13

% in

Sale

able

Steel

so

far.

4 Highes

t BF

Produ

ctivity

(w.r.t.

Workin

g

Volum

e) 2.07

t/day

COST

REDUCTI

ON

MEASUR

ES

1) Maximi

zing

the

utilizati

on of

waste

produc

ts like:

1) LD

Sla

g

us

ed

in

SP,

BF

an

d

SM

S

to

rep

lac

e

lim

est

on

e

to

the

ext

ent

of

78,

52

3 t.

2) Scr

ap

to

the

ext

ent

of

6,7

69t

wa

s

rec

lai

me

d

fro

m

ma

int

en

an

ce

act

iviti

es

an

d

us

ed

in

SM

S.

2) Separa

te

Calcini

ng of

lime

and

dolomit

e and

using

the flux

separa

tely in

the

conv

erter

s has

redu

ced

the

cons

umpt

ion

of

flux

per

tonn

e of

Liqui

d

Steel

drast

ically

from

52.7

kg to

45

kg.

In

addition

to the

techno-

economi

c

paramet

ers being

focused

and

monitore

d by

Works

Division,

the other

functiona

l areas

like

Finance,

Materials

Manage

ment

and

Marketin

g have

also

adopted

various

measures

in order to

achieve

cost

reduction

in freight,

transportat

ion and

handling

charges in

respect of

both

inward and

outward

movement

of

materials

including

export as

well as

reduction

in interest

expenses.

RAW

MATERIA

LS /

CAPTIVE

MINES

The

performan

ce of

Jaggayyap

eta

Limestone

Mine for

the year

2005-06

was

excellent

with all

time

production

record of

4,10,325

tonnes and

dispatch

record of

4,03,611

tonnes of

limestone.

The %

growth in

respect of

JLM

production

was 7.74%

and

dispatch

was

12.31% as

compared

to 2004-

05.

The

performan

ce of

Madharam

Dolomite

Mine for

the year

2005-06

was also

excellent

with all

time

productio

n record

of

6,80,293

tonnes

and

dispatch

record of

6,48,185

tonnes of

dolomite.

The %

growth in

respect

of MDM

productio

n was

9.65%

and

dispatch

was

6.65%

as

compare

d to

2004-05.

The

productio

n of

mangan

ese at

Garbha

m

Mangan

ese Mine

was

13,467

tons and

dispatch

was

12,989

tons.

Producti

on

achieved

was

70.14% of

the

budget.

The usage

of sand

was

reduced

and

achieved

46.00% of

sand from

Nellimarla

Sand Mine

and

Sarepalli

Sand

Mine,

which was

opened on

16.12.200

4.

The

Karajada

Sand Mine

at

Vamshadh

ara river in

Srikakulam

district will

be

operated

during

2006-07. It

is

proposed

to operate

a Quartz

Mine

during this

financial

year 2006-

07 at

Kintada

Village, K

Kotapadu

Mandal,

Visakhapat

nam

district to

maintain

uniformity

in quality

of quartz

and

reduce

usage of

sand.

The

Company

has

submitted

5 mining

lease

applications for iron ore deposit in the State

of

Oriss

a

(4415.8807

ha.), two applications in the

state

of

Blast

Furna

ce

=?

Annual Report 2005-06

Chhatt

isgarh

(4606.

34

ha.)

and

two

applic

ations

in the

State

of

Andhr

a

Prade

sh

(1384.

27

ha).

These

applic

ations

are

pendin

g with

respec

tive

State

Gover

nment

s and

the

same

is

being

follow

ed up

with

Ministr

y of

Mines

throug

h

Ministr

y of

Steel.

ACQUI

SITION

OF

COAL

MINES

IN

INDIA

AND

ABROA

D

Governm

ent of

India

allotted

"Mahal

Block"

(Medium

Coking

Coal) to

RINL/VS

P. Work

Order is

issued

for "Pre-

Feasibilit

y Study"

to

Central

Mining

Plan and

Design

Institute

Ltd

(CMPDIL

),

Ranchi.

RINL/VS

P applied

for

Tenughat

Jhirkhi

Coking

Coal

Block to

the

Ministry

of Coal

and also

applied

for three

Non-

coking

coal

blocks in

Khamma

m

District

to the

Ministry

of Coal.

Ministry

of Coal

forwarde

d it to the

Ministry

of Steel

for their

comment

s.

"Express

ion of

interest

for

acquisiti

on of

Hard

Coking

Coal

Mines

abroad"

was

placed in

VSP's

website.

Respons

es from

Australia

, USA

and

Canada

have

been

received

and the

Evaluatio

n

Proce

ss is

contin

uing

for

selecti

ng

suitabl

e mine

for

Joint

Ventur

e.

Consu

ltant is

propo

sed to

be

appoin

ted by

the

Comp

any

for

further

evalua

tion of

the

propo

sals.

SMS

LIMEST

ONE

JOINT

VENTU

RES

RINL

received

proposal

s and

samples

from

different

agencies

of Oman,

Malaysia

,

Thailand

and

Philippin

es. So

far no

agency

is

finalized

for Joint

Venture

with

RINL/VS

P due to

non-

matching

of

required

specifica

tion. The

processi

ng is

continuin

g for

selecting

suitable

Mine for

Joint

Venture.

SAFET

Y,

ENVIR

ONMEN

T &

HEALT

H

CARE :

Safety

Visakhap

atnam

Steel

Plant is

the first

integrate

d steel

plant to

be

certified

for

"Occupat

ional

Health &

Safety

Manage

ment

System"

as per

British

Standard

s

Institute

specifica

tion in

the year

2002

and re-

certified

again in

the year

2005.

Two

Surveilla

nce

Audits

were

conducte

d in the

year

2005-06.

Continuo

us efforts

in

imple

menta

tion of

safety

standa

rds,

monito

ring of

hazar

ds in

the

activiti

es had

helped

in

achiev

ing a

10.67

%

reducti

on of

report

able

accide

nts.

HIGH

LIGH

TS

AND

ACHI

EVE

MEN

TS :

1 "Z

er

o

Ac

cid

en

t"

wa

s

ac

hie

ve

d

in

17

de

part

ment

s viz.

ACV

S,

CED,

CSD,

Cant

eens,

EnM

D,

ETL,

L&H,

OHS

RC,

PPM,

PEM,

PD,

RMD

,

StED

,

Syst

ems,

TEL

ECO

M,

TS,

and

T&D

C.

RI

NL

sig

ns

M

OU

wit

h

M

OI

L

Saf

ety

at

wo

rkp

lac

e

=A

Rashtriya Ispat i!a" #td*

1 10.6

7%

redu

ction

of

Rep

ortab

le

accid

ents

was

achi

eved

durin

g the

year

2005

-06.

2 First

and

Seco

nd

Surv

eillan

ce

Audit

s of

OHS

AS-

1800

1

were

succ

essfu

lly

com

plete

d

and

well

appr

eciat

ed

by

the

exter

nal

auditor

s.

3 Interna

l

Safety

Audits

were

conduc

ted in

respec

t of 16

depart

ments.

4 Two

plant

level

Mock

Drills

were

conduc

ted to

check

the

emerg

ency

prepar

edness

and

respon

se of

various

agenci

es.

5 Nation

al

Safety

Day

was

celebr

ated

on 4th

March,

2006

and in

that

connec

tion

various

compe

titions

such

as

Quiz,

Essay,

Debate

,

Poster

etc.

were

conduc

ted.

Safety

Playlet

and

First

Aid

Compe

titions

were

also

held.

6 Inter-

depart

mental

Safety

Perfor

mance

and

House

Keepin

g

Comp

etition

s were

condu

cted.

VSP won

the

Leadershi

p and

Excellence

Award for

the efforts

in Safety,

Health

and

Environ

ment in

the

competiti

on

organize

d by CII,

Southern

Region.

OTHER

IMPOR

TANT

ACTIVI

TIES

1 VSP

impa

rted

refre

sher

Safet

y

Train

ing

to

abou

t

5000

regul

ar

empl

oyee

s

and

Safet

y

Indu

ction

traini

ng

and

Job

Spec

ific

Train

ing

was

given

to all

contra

ctor

employ

ees.

2 Control

Measur

es for

Hazard

Identifi

cation

and

Risk

Assess

ment

were

implem

ented

and

monitor

ed.

Measu

rable

targets

were

set in

respec

t of

Safety

and

Occup

ational

Health

for

each

depart

ment

and

corres

pondin

g

manag

ement

progra

ms

had

been

prepar

ed and

monito

red for

achievi

ng the

objecti

ves.

1 On site

emerg

ency

plan

and

Safety

Report

were

update

d.

2 One

trainin

g

Progr

am

was

orga

nized

for

the

Centr

al

Safet

y

Com

mitte

e

mem

bers,

inclu

ding

a

plant

visit

to

NTP

C

Simh

adri.

Depa

rtme

ntal

Safet

y

Com

mitte

e

meeti

ngs

were

held

in

every

mont

h in

vario

us

depa

rtme

nts.

ENVIR

ONMEN

T

MANAGE

MENT

REVIEW

The

commitme

nt of VSP

managem

ent for

preservatio

n of the

environme

nt as an

integral

part of its

products

and

services

has always

remained

a guiding

principle of

its

business

strategy.

Being an

ISO-14001

certified

company

since May

2001, VSP

has

expressly

included

social and

environme

ntal

responsibil

ity in its

corporate

objective

which is

regularly

reviewed

and

improved.

MAJOR

ENVIRO

NMENTA

L

PROJEC

TS

UNDER

IMPLEM

ENTATIO

N

All

statutory

requiremen

ts are

fulfilled and

over a

dozen

projects to

improve

the

environme

ntal

standards

further in

VSP are

under

implementa

tion at an

estimated

cost of over

Rs.263

Crores.

This is an

enough

evidence

on the part

of VSP that

it giving

priority to

people

before

Wor

ksho

p for

Chil

dren

on

Edu

catio

n

Park

in

Tow

nshi

p

20

Annual Report 2005-06

profits

. The

major

projec

ts

under

imple

menta

tion

includ

e the

followi

ng :

VSP

CERT

IFIED

TO

ISO

1400

1 :

2004

VSP

was

first

certifi

ed to

ISO

14001

: 1996

in

May

2001

and

recerti

fied

on

15.12.

2004.

Howe

ver,

the

stand

ard

was

upgra

ded to

ISO

14001 :

2004

and VSP

took

rapid

strides to

comply

with the

new

standard

. VSP

was

audited

for its

EMS

from 6th

to 8th

February

2006

and

having

complied

with all

the new

requirem

ents,

VSP has

been

certified

by M/s

BVQI for

certificati

on to

ISO

14001 :

2004.

S

l

. Projects under

N

o

. implementation

1 Pulverised coal dust

injection in BF - 1 , 2

2

High temperature

membrane

bag filters in CRMP :

FK - 1, 2, 3, 4

3 Replace compressors

working on 'ODS' with

non-ODS

(R - 22 / R - 134a) :

a) 2 chillers of CWP -

4

b) 4 chillers of CWP-3

4

Dry fly ash handling,

storage

and delivery system

5

a) Continuous on-line

stack

monitoring systems

(10 nos.)

b) Continuous on-line

stack

monitoring stations

(10 nos.)

HEAL

TH

CAR

E

Comp

uteriza

tion of

Visakh

a

Steel

Gener

al

Hospit

al

servic

es

was

compl

eted

succe

ssfully

and

broug

ht into

usage

for all

Out-

Patien

t

activiti

es

startin

g from

Regist

ration,

Consu

ltation,

Clinica

l

Labor

atory,

Radiol

ogical

Investi

gation

s,

Retrie

val of

Investiga

tion

Reports

and

Dispensi

ng of

Drugs

from the

Dispensa

ry

through

Online

(Comput

erized

Operatio

nal

Activities

) from

21st

January,

2006.

The

Second

Phase of

Compute

rization is

under

process

and

efforts

have

been

initiated

for

obtaining

ISO

Certificati

on for

VSGH.

Impleme

ntation of

"5-S"

initially in

Medical

Stores,

Admn.

Office,

Operatio

n

Theatre

was

taken up

and

presently

they are

in "2-S"

& "3-S"

stage.

The total

no. of in-

Patients

treated

was

4,407

and total

no. of

out-

Patients

treated

was

4,72,436.

While

extendin

g

medical

care

round the

clock in

VSGH, to

have

expert

opinion

and

second

opinion

in certain

cases,

and

where

specialist

s do no

exist in

particular

discipline

s, visiting

consulta

nts

are

visitin

g

VSGH

from

Visakh

apatn

am

City

and

extend

ing

their

servic

es on

weekl

y

basis.

A

w

a

r

e

n

e

s

s

P

r

o

g

r

a

m

me

on

He

alth

Car

e

2=

Rashtriya Ispat i!a" #td*

With the

help of

social

service

associati

ons like

Lions

Club,

Rotary

Club,

free eye

camps

are

being

conducte

d in the

VSP's

peripher

al areas

and also

Steel

Doctors

Trust is

being

conducti

ng

general

cases.

In

addition

to all the

above

services,

to create

enthusia

sm and

awarene

ss

among

the VSP

employe

es and

other

Public in

and

around

Ukkunagar

am,

number of

other

programm

es like :

1 Condu

cting

statuto

ry

Health

checku

p to all

Emplo

yees

at

OHSR

C

2 Organi

zing

First

Aid

Trainin

g to

Execut

ives

and

Non-

executi

ves(92

87

emplo

yees

covere

d) at

OHSR

C

3 Apart

from

Patient

Care,

condu

cting

CMEs

-

Interna

l and

Extern

al for

updati

ng the

knowle

dge of

doctor

s

4 Weekl

y once

conduc

ting

the

De-

addicti

on

clinic

in

VSGH

Patients

awareness

programm

es were

also

conducted

periodicall

y.

An amount

of Rs.22

Lakhs was

realized by

the

treatment

of Non-

Entitled

Cases at

VSGH.

HUMAN

RESOUR

CE

MANAGE

MENT

REVIEW

The

Company

has long

drawn

plans

aimed at

individua

l and

overall

develop

ment of

its

Human

Resourc

es.

Towards

achievin

g

synergy

and

group

concept,

the HRD

focused

on many

skilled

training

program

mes for

enhance

ment of

manager

ial

compete

ncies.

THROU

GH

HRD

CENTR

E :

TRAININ

G

PROGR

AMMES

MOU

FULFIL

MENT

2005-

06

SNo Particulars Total

1.0 No. of Programmes

1.1.

1 Inhouse Programmes 106

1.1.

2 External Nominations 354

Grand Total 460

2.0 No. of Employees

2.1.

0 Executives

2.1.

1 Inhouse Programmes 2613

2.1.

2 External Nominations 1052

Sub-Total 3665

2.2.

0 Non-Executives

2.2.

1 Inhouse Programmes 769

2.2.

1 External Nominations 229

Sub-Total 998

Grand Total 4663

Employees

were

nominated

to

participate

in

programme

s at XLRI,

Jamshedp

ur; ASCI,

Hyderabad

; NITIE,

Mumbai;

IIM

Bangalore;

CII-Godrej

Insitute;

ESCI,

Hyderabad

etc.

Besides

these, a

unique

program

me titled

"Improvin

g

Effective

ness of

Stockyar

d

Sri KA Naidu,

Dire

ctor

(Pers

onne

l)

recei

ving

HR

Exce

llenc

e

Awar

d

22

Annual Report 2005-06

Opera

tions"

is

organi

zed

for

perso

nnel

under

directo

rate of

Comm

ercial

who

are

conne

cted

with

stocky

ard

operat

ions.

An

expert

faculty

Shri J

Charlu

from

Banga

lore

who

served

as ED

(Mktg)

at

SAIL

and

JVSL

in the

past,

facilita

ted

the

tailor-

made

progra

mmes

during

October

'05 at

Chennai

and

Decemb

er '05 at

Mumbai.

The

program

me

design

includes

visit to

stockyar

d with

senior

manage

ment

member

s and

drawing

up

individua

l action

plans.

The

feedback

was

quite

encoura

ging.

ORGAN

ISATIO

N

DEVEL

OPMEN

T

EMPLO

YEES

SATISF

ACTIO

N

SURVE

Y

Followin

g the

documen

ted

approac

h of

taking

external

consulta

nt's help

to

conduct

a survey

after

every

two

years,

work

order

has been

placed

on M/s

AcNielse

n

ORGMA

RG, New

Delhi,

after

assessin

g the

capabiliti

es of

leading

agencies

in the

country.

The

results of

survey

analysis

pertainin

g to

critical

paramet

ers like

work

content,

hygiene

factors,

welfare,

motiva

tion,

leader

ship

etc.,

are

expect

ed to

come

by

close

of the

secon

d

quarte

r 06-

07.

Organi

sation

climat

e

survey

was

condu

cted in

the

Plant

intern

ally

and

analys

is was

made

for

submit

ting

the

same

for HR

excell

ence

award.

INTE

RNAL

COM

MUNI

CATI

ON

Launche

d novel

informal

monthly

interactio

n

sessions

of our

employe

es with

our CMD

starting

with

maiden

sessions

of "Dil Ki

Baat" for

senior

officers

and

"Chairma

n Tho

Mata" for

non-

executiv

es.

There

was

encoura

ging

feedback

.

IMPLE

MENTA

TION

OF SIX

SIGMA

As an

ongoing

process

towards

business

excellen

ce, Six

Sigma

concept

was

introduce

d in VSP.

During

February

2005,

M/s

Omnex

Consulta

nts,

Chennai

have

been

entruste

d with

the job of

impleme

nting Six

Sigma

concept

to

improv

e the

perfor

mance

.

Specifi

c

project

s on

Quality

,

perfor

mance

, cost-

reducti

on,

waste

elimin

ation

would

be

taken

up by

the

teams

under

the

superv

ision

of M/s

Omne

x

Consu

ltants

for

breakt

hroug

h

improv

ement

in the

above

areas.

An

appre

ciation

progra

mme

was

held in

March

05 for

Top/

Senior

manage

ment

team by

the

consulta

nts. 65

projects

have

been

identified

in Works

and Non-

works

areas

involving

a

potential

savings

of Rs.42

crores to

the

Compan

y. The

projects

are

being

continuo

usly

monitore

d by the

Champio

ns. It is

expected

that this

initiative

will move

from its

present

nascent

stage to

cover

many

more

aspects

of the

processe

s once

training

and

compete

ncies are

built up.

T

H

R

O

U

G

H

T

R

AI

NI

N

G

&

D

E

V

E

L

O

P

M

E

N

T

C

E

N

T

R

E:

EMPLO

YEES

DEVEL

OPMEN

T

PROGR

AMMES

:

1.

Tr

ain

ing

pr

og

ra

m

m

es

co

nd

uct

ed

co

ve

rin

g

a

tot

al

nu

m

be

r

of

44

,4

88

e

m

plo

ye

es,

wh

ich

inc

lud

es

e

m

plo

ye

es

co

ve

re

d

by

T&D

C

(29,8

92

num

bers)

,

HRD,

Safet

y

Dept.

and

CISF

Fire

Wing

thus

La

un

chi

ng

of

R

IN

AD

S

In

au

gu

rat

ion

of

Jas

hu

va

par

k

at

To

wn

shi

p

by

CMD-RINL

2<

Rashtriya Ispat i!a"

#td*

ach

ievi

ng

11.

46

ma

n

day

s of

trai

nin

g

per

em

plo

yee

per

yea

r.

2. Thr

ust

is

giv

en

to

dep

art

me

ntal

refr

esh

er

pro

gra

mm

es

cov

erin

g

ove

r

10,

000

em

ploy

ees

whic

h is

100

%

grow

th

over

last

year.

On

the

Job

Trai

ning

cove

red

700

3

empl

oyee

s. 24

SOP

s

and

192

SMP

s

were

tran

slate

d

into

Telu

gu.

3. A

Com

pete

ncy

Map

ping

Mod

el

has

bee

n

deve

lope

d

and

exec

uted

in

Sint

er

Plan

t

cove

ring

Char

gem

an

to E-

4

level

.

4. With

rega

rd to

quali

ty of

traini

ng,

in

reac

tion

level

feed

back

87.1

2%

parti

cipa

nts

rate

d>4

on a

5-

point

scal

e, in

lear

ning

lev

el

84

%

part

icip

ant

s

sco

red

>60

%

mar

ks

in

pos

t

trai

nin

g

test

s,

in

app

lica

tion

lev

el

fee

d

bac

k,

con

troll

ing

offi

cer

s

rate

d

>3.

5

for

81

%

part

icip

ant

s

on a

5-

point

scal

e.

5. 365

empl

oyee

s

were

train

ed

on

Criti

cal

Equi

pme

nt

Trai

ning

and

200

empl

oyee

s

were

train

ed

on

Criti

cal

Activ

ities

traini

ng

(to

take

care

of

the

critic

al

cont

ract

ual

jobs)

.

6. Trad

e

Test

s

were

cond

ucte

d for

168

9

empl

oyee

s for

the

Inter

Clus

ter

pro

moti

ons

in

differ

ent

Wor

ks

and

Non-

work

s

Dep

artm

ents.

7. Trai

ning

Wee

k

was

cele

brat

ed

from

20-

3-

200

6 to

25-

3-

200

6

and

priz

es

wer

e

dist

ribu

ted

duri

ng

the

val

edi

ctor

y

ses

sio

n.

8. "Ukk

u

Pari

chay

am",

a

book

on

Stee

l

maki

ng in

Telu

gu

has

been

revie

wed,

edite

d

and

ed

and

was

relea

sed

durin

g the

Trai

ning

Wee

k

Vale

dicto

ry

Func

tion.

9. The

Trai

ning

Port

al

was

inau

gura

ted

durin

g the

Trai

ning

Wee

k

Vale

dicto

ry

Sess

ion.

10. Refu

rbish

ing

of

T&D

C

audit

oriu

m

and

Conf

eren

ce

Hall

has

been

done

.

New

clas

s

roo

m

furnit

ure

proc

ured

.

Thre

e

clas

s

roo

ms

were

air

cond

ition

ed.

4

LC

D

proj

ect

ors

pro

cur

ed

and

fixe

d in

the

clas

s

roo

ms.

The

am

bie

nce

of

Trai

nee

s

Hos

tel

and

T&

DC

can

tee

n

wer

e

imp

rov

ed.

11. Aud

itori

um

facil

ities

and

nec

ess

ary

hel

p

exte

nded

in

orga

nizin

g

and

cond

uctin

g 35

prog

ram

mes

inclu

ding

VRU

DDH

I

sum

mit,

IRE

FCO

N-

2006

,

WIP

S

funct

ions

etc.

12. 186

QC

Proj

ects

have

been

sub

mitte

d to

MS

Dep

artm

ent

agai

nst a

targ

et of

18

QCs

durin

g the

year.

13. 208

sugg

estio

ns

gene

rate

d in

T&D

C

agai

nst

the

targ

et of

130

durin

g the

year.

OTHER

INITIAT

IVES :

1) FRE

SHE

RS

TRA

ININ

G:

141

M.T(

T)s,

10

M.Ts

(Fin)

and

2 Jr.

Trai

nees

were

give

n

Indu

ction

Trai

ning

and

pos

ted

for

on

the

job

trai

nin

g.

Fou

nda

tion

Sto

ne

Lay

ing

for

Exp

ansi

on

by

Ho

nbl

e

Pri

me

Min

iste

r of

Indi

a

24

Annual Report 2005-06

2) C

O

M

P

R

E

H

E

N

SI

V

E

M

A

N

A

G

E

RI

AL

C

O

U

R

S

E

F

O

R

JO

s

an

d

JS

Os

:

34

,

19

8

an

d

19

2

ca

nd

idate

s

have

atten

ded

Phas

e-I,

Phas

e-II &

Phas

e-III

progr

amm

es

resp

ectiv

ely

(alto

geth

er

424

inclu

ding

outst

ation

candi

date

s).

3) APP

REN

TICE

SHIP

TRAI

NIN

G:

For

the

first

time,

VSP

host

ed

the

Cent

ralise

d

walk-

in-

inter

view

s for

selec

tion

of

vario

us

appr

entic

es

from

differ

ent

orga

nizati

ons

in

liaiso

n

with

the

appr

entic

eship

auth

oritie

s.

77

Trad

e

Appr

entic

es,

153

Grad

uate

Appr

entic

es

and

138

Tech

nicia

n

Appr

entic

es

,

87

Te

ch

nic

ia

n

(V

oc

ati

on

al)

Ap

pr

en

tic

es

we

re

giv

en

tra

ini

ng

.

4) VA

CA

TI

O

N

AL

T

R

AI

NI

N

G,

C

O

LL

A

B

O

RA

TI

V

E

T

RAIN

ING

AND

GUI

DED

VISI

TS

TO

THE

PLA

NT:

As

part

of

socia

l

oblig

ation

,

VSP

has

been

exte

ndin

g

traini

ng/pr

oject

work

facilit

ies to

stud

ents

of

educ

ation

al

instit

ution

s.

3021

stud

ents

were

given

traini

ng.

5) TRAI

NIN

G

FOR

OTH

ER

ORG

ANIS

ATIO

NS:

24

office

rs

from

JSW

L,

Bella

ry

and

07

office

rs

from

JSPL

,

Raig

arh

were

given

traini

ng in

Sinte

r

Plant

and

Blast

Furn

ace

resp

ectiv

ely.

6) FOR

EIGN

TRAI

NIN

G: 25

office

rs, 8

non-

exec

utive

s

an

d

01

fro

m

M

O

S

we

re

se

nt

on

Fo

rei

gn

tra

ini

ng

/

bu

sin

es

s

vis

its

to

diff

er

en

t

co

un

tri

es

.

7) LIBR

ARY:

919

book

s,

3113

journ

als,

16 e-

journ

als,

126

India

n

and

Inter

natio

nal

Stan

dard

s

were

proc

ured.

227

Man

age

ment

and

Tech

nical

Articl

es, 3

Nos.

of

Libra

ry

bullet

ins

were

circul

ated

to

senio

r

exec

utive

s and

Direc

tors.

Centr

alize

d Air

Cond

ition

with

false

ceilin

g has

been

done

.

8) RE

VE

NU

E

GE

NE

RA

TIO

N :

a) Training charges received

from (JSWL, JSPL etc.)

b) Amount received for

utilization of facilities at

T&DC and Hostel and

Vacational Training

Total

PERSO

NNEL

DEPAR

TMENT

1. MAN

POW

ER :

Durin

g the

perio

d

from

01-

04-

2005

to

31

-

03

-

20

06

th

er

e

wa

s a

ne

t

de

cr

ea

se

in

th

e

m

an

po

we

r

by

39

i.e.

fro

m

16

,6

13

as

on

01

-

04

-

20

05

to

16

,5

74

as

on

31

-

03-

2006

.

As

on

31-

03-

2006

, the

num

ber

of

Displ

aced

Pers

ons

on

the

rolls

of

VSP

was

5,57

1.

E

mp

loy

ee

dev

elo

pm

ent

pro

gra

m

me

in

pro

gre

ss..

Co

rpo

rat

e

So

cia

l

Re

spo

nsi

bili

ty

Rashtriya Ispat i!a" #td*

2. R

E

P

R

E

S

E

N

T

A

T

I

O

N

O

F

S

C

H

E

D

U

L

E

D

C

A

S

T

E

S

A

N

D

S

C

H

E

D

U

L

E

D

T

R

IB

ES

:

I. The

group-

wise

repres

entatio

n of

SCs

and

STs in

the

Compa

ny as

on 31-

03-

2006 is

as

follows

:

GROU

P TOTAL

STRENGTH

A

B

C

D

D"

(Sweep

ers) 16574

II.

POSTS

FILLED

BY

RECRUIT

MENT :

Class

of Total

posts no. of

vacanci

es

filled

(1) (2) (3) (4)

(5

)

A 177 31 36 25

2

7

B - - - - -

C 1 - - - -

D 1 - - - -

3.

WELFA

RE

ACTIVI

TIES

A)

Welfare

of SCs

& STs:

1) Thre

e

parks

in the

Steel

Town

ship

have

been

name

d

after

Dr. B

R

Amb

edkar

,

Babu

Jagje

evan

Ram

and

Ekala

vya

and a

separ

ate

Librar

y-

cum-

Read

ing

Roo

m

was

name

d

after

Dr B

R

Ambed

kar.

2) Jayant

hi

Celebr

ations

of Dr.

Babu

Jagjee

van

Ram

and

Bharat

Ratna

Dr. B R

Ambed

kar

were

observ

ed by

garlan

ding

functio

ns

followe

d by

comm

emorat

ion

meetin

gs,

which

were

organi

zed at

Babu

Jagjee

van

Ram

Childre

n's

Park,

Sector-

5 on

05.04.

2005

and at

Dr.

Ambed

kar

Park,

Sector-

6 on

14.04.

2005

respec

tively.

3) A

Sports

and

Cultura

l

Festiva

l was

organi

zed

during

the

month

of April

2005

at

CWC,

Ukkun

agara

m in

connec

tion

with

Bharat

Ratna

Dr. B R

Ambed

kar

Jayant

hi

Celebr

ations.

4) In

connec

tion

with

Vardha

nthi

Cerem

ony of

Bhar

at

Ratn

a Dr.

B R

Amb

edkar

,

Garla

nding

Func

tion

was

orga

nized

on

06.1

2.20

05 at

Dr.

Amb

edka

r

Park,

Sect

or-6.

5) RINL

/VSP

has

incre

ased

the

num

ber

of

Scho

larshi

ps

from

3

Nos.

to 6

Nos.

per

year

exclu

sivel

y for

the

childre

n of

SC/ST

employ

ees

from

the

acade

mic

year

2005-

06.

Under

this

Schola

rship

Schem

e, 2

Schola

rships

of

Rs.1,5

00/ -

(Rupe

es One

Thous

and

and

Five

Hundr

ed

only)

per

month

and 2