12 Abcefalphabet Song

Diunggah oleh

Wasiq RabbīJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

12 Abcefalphabet Song

Diunggah oleh

Wasiq RabbīHak Cipta:

Format Tersedia

The liquidity indicator approach uses financial ratios whose changes over time may reflect the

changing liquidity position of the financial institution. The ratios are used to estimate liquidity

needs and to monitor changes in liquidity position.

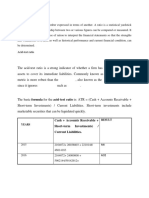

Cash Position Indicator

It shows the amount of cash and highly liquid assets which is the deposits that the bank holds at a

specific point in time as a ratio to the total assets that the bank holds. The formula for cash

position indicator is

Cash Position Indicator = (Cash+ Deposits)/ Total assets

Cash Position

Indicator

2008 2009 2010 2011 2012

Cash and Deposits 48,154,507,8

06

72,562,462,2

92

73,578,266,04

4

91,310,017,75

9

102,535,373,3

48

Total Assets 90,898,051,9

72

76,466,801,5

64

130,185,631,8

12

115,735,967,6

84

130,185,631,8

12

Cash Position

Indicator

0.529764 0.9489407 0.0.565179 0.78895 0.79

A greater proportion of cash means that a bank is in stronger position to handle immediate cash

needs. Individually, the bank experienced the lowest CPI in 2008 mainly because its growth in

total assets was greater than its growth in cash and deposits in that year. The banks CPI

experienced a fall in the years 10 while it picked up in 12 and 11. Overall, the banks CPI was

never below 0.529 in the past 5 years which means it had always been able to back more than

52% percent of its total assets with its cash flow which keeps the bank in a very liquid position.

Liquid Securities Indicator

This compares the most marketable securities the bank can hold with the overall size of its asset

portfolio. The formula for Liquid Securities Indicator is

Liquidity Position Indicator = Short term securities/ Total assets

Liquidity Position

Indicator

2008 2009 2010 2011 2012

Short Term Securities 89,192,805

2,281,793,1

08

1,673,817,749

5,552,363,63

9

4,897,126,471

Total Assets

90,898,051,9

72

76,466,801,

564

90,898,051,97

2

115,735,967,

684

130,185,631,8

12

Liquid Securities

Indicator

0.001 0.030 0.018 0.048 0.038

In general, The City Banks short term securities are a very small fraction of its Total assets

which says that in terms of short term securities, the bank is not in a liquid position. In 2012, it

had the highest amount of short term securities in all 5 years. This is also reflected in the

Liquidity Position Indicator which was the highest in 5 years in 2013.

Hot money ratio

This reflects whether the bank has balanced its borrowings in the money market with increases in

its money market assets that could be sold quickly to cover those money market liabilities. The

formula for hot money ratio is

Hot money ratio= Money market asset/Money market liability

2008 2009 2010 2011 2012

Hot Money Ratio

1.806315749

1.646915013 1.2404307 0.779670081 0.631679607

In the most recent year the bank had 63% of its money market liabilities backed by its money

market assets. The ratio is on a decreasing trend. 2008 saw the highest of its ratio with 180%

backed.

Anda mungkin juga menyukai

- Economics Project - Docx 2Dokumen7 halamanEconomics Project - Docx 2Gurpreet Singh100% (3)

- Financial Report Dutch LadyDokumen55 halamanFinancial Report Dutch Ladymed11dz87% (23)

- Study On The Factors Affecting Investors Decision in Investing in Equity Shares in IndiaDokumen104 halamanStudy On The Factors Affecting Investors Decision in Investing in Equity Shares in IndiaHridayanshu RastogiBelum ada peringkat

- Chapter 21 - Portfolio ManagementDokumen9 halamanChapter 21 - Portfolio ManagementOsama MuzamilBelum ada peringkat

- Performance Evaluation of AB BankDokumen28 halamanPerformance Evaluation of AB BankSaidurBelum ada peringkat

- Jatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghDokumen18 halamanJatin Johar Jitendra Kumar Tiwari Mahesh Singh Leena Bhatia Amit Kumar SinghJatin JoharBelum ada peringkat

- Current Ratio Year LiabilitiesDokumen14 halamanCurrent Ratio Year LiabilitiesVaibhavSonawaneBelum ada peringkat

- Ratio Analysis Bank AL Habib Ltd.Dokumen23 halamanRatio Analysis Bank AL Habib Ltd.Hussain M Raza33% (3)

- Unit TrustDokumen23 halamanUnit TrustqairunnisaBelum ada peringkat

- Ratio Analysis: Liquidity RatiosDokumen7 halamanRatio Analysis: Liquidity RatiosAneeka NiazBelum ada peringkat

- Advance Analysis of Financial Statement AssignmentDokumen17 halamanAdvance Analysis of Financial Statement AssignmentWaqas Ur RehmanBelum ada peringkat

- Prime Bank LTD Ratio AnalysisDokumen30 halamanPrime Bank LTD Ratio Analysisrafey201Belum ada peringkat

- Financial Intermediation: ANK ReditDokumen25 halamanFinancial Intermediation: ANK ReditPraveen Reddy PenumalluBelum ada peringkat

- Financial Analysis of GSK Consumer HealthcareDokumen36 halamanFinancial Analysis of GSK Consumer Healthcareadnan424100% (1)

- Assignment: Fin 441 Bank ManagementDokumen11 halamanAssignment: Fin 441 Bank ManagementNazir Ahmed ZihadBelum ada peringkat

- Financial Analysis of Tesco PLCDokumen7 halamanFinancial Analysis of Tesco PLCSyed Toseef Ali100% (1)

- Financial Ratio AnalysisDokumen5 halamanFinancial Ratio AnalysisIrin HaBelum ada peringkat

- A Study On Liquidity Management-Prime Bank LimitedDokumen14 halamanA Study On Liquidity Management-Prime Bank LimitedselimduBelum ada peringkat

- Chapter No 08 CAMEL Framework: Capital Adequacy-CDokumen10 halamanChapter No 08 CAMEL Framework: Capital Adequacy-CMuneeb AmanBelum ada peringkat

- Project Report On: By-Deepak Verma Amrit Kumar Shubham Gupta PriyaDokumen12 halamanProject Report On: By-Deepak Verma Amrit Kumar Shubham Gupta PriyaDeepzz SanguineBelum ada peringkat

- Balance SheetDokumen6 halamanBalance Sheet012345asBelum ada peringkat

- Videocon Financial AnalysisDokumen9 halamanVideocon Financial AnalysisDiv KabraBelum ada peringkat

- MSF 506-Final DocumentDokumen22 halamanMSF 506-Final Documentrdixit2Belum ada peringkat

- Company ProfileDokumen21 halamanCompany ProfilezahidBelum ada peringkat

- PNB Analysis 2012Dokumen14 halamanPNB Analysis 2012Niraj SharmaBelum ada peringkat

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Dokumen40 halamanStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamBelum ada peringkat

- Square Pharmaceuticals-Financial AnalysisDokumen17 halamanSquare Pharmaceuticals-Financial AnalysisShahid MahmudBelum ada peringkat

- Ratio AnalysisDokumen13 halamanRatio AnalysisBharatsinh SarvaiyaBelum ada peringkat

- Ratio Analysis of Dutch-Bangla Bank LTD (Based On FY 2009-13)Dokumen22 halamanRatio Analysis of Dutch-Bangla Bank LTD (Based On FY 2009-13)Yeasir MalikBelum ada peringkat

- The First Voluntary Bank Merger Announced On 06 Dec. 2011: Banking NoteDokumen5 halamanThe First Voluntary Bank Merger Announced On 06 Dec. 2011: Banking NoteThuy Duong PhamBelum ada peringkat

- CamelDokumen43 halamanCamelsuyashbhatt1980100% (1)

- Financial Statement Case StudyDokumen11 halamanFinancial Statement Case StudyGayle Tadler50% (2)

- Data Analysis & InterpretationDokumen47 halamanData Analysis & InterpretationsangfroidashBelum ada peringkat

- Financial Institution AssignmentDokumen10 halamanFinancial Institution AssignmentDina AlfawalBelum ada peringkat

- Cash Flow and Ratio AnalysisDokumen7 halamanCash Flow and Ratio AnalysisShalal Bin YousufBelum ada peringkat

- AXIS Bank AnalysisDokumen44 halamanAXIS Bank AnalysisArup SarkarBelum ada peringkat

- Ratio Analysis of Sainsbury PLCDokumen4 halamanRatio Analysis of Sainsbury PLCshuvossBelum ada peringkat

- Productwise Business Volume TrendDokumen7 halamanProductwise Business Volume TrendbibekBelum ada peringkat

- Financial Statement Analysis - Pantaloon Retail IndiaDokumen7 halamanFinancial Statement Analysis - Pantaloon Retail IndiaSupriyaThengdiBelum ada peringkat

- Financial Statement Analysis - HulDokumen15 halamanFinancial Statement Analysis - HulNupur SinghalBelum ada peringkat

- Summary Report OF Dena Bank: Prepared ByDokumen6 halamanSummary Report OF Dena Bank: Prepared BySahil ShahBelum ada peringkat

- Untitled DocumentDokumen4 halamanUntitled DocumentTran Duc Tuan QP2569Belum ada peringkat

- Series 1: 1. Profit Margin RatioDokumen10 halamanSeries 1: 1. Profit Margin RatioPooja WadhwaniBelum ada peringkat

- Data Analysis and InterpretationDokumen15 halamanData Analysis and InterpretationMukesh KarunakaranBelum ada peringkat

- Profitability AnalysisDokumen9 halamanProfitability AnalysisAnkit TyagiBelum ada peringkat

- Ratio Analysis of HDFC FINALDokumen10 halamanRatio Analysis of HDFC FINALJAYKISHAN JOSHI100% (2)

- Ratio Analysis ITCDokumen15 halamanRatio Analysis ITCVivek MaheshwaryBelum ada peringkat

- 1) Ratio Calculations: (1) CurrentDokumen13 halaman1) Ratio Calculations: (1) CurrentRahul KumarBelum ada peringkat

- Banking Sector (Afifc)Dokumen12 halamanBanking Sector (Afifc)Punam PandeyBelum ada peringkat

- Ratio Analysis of TAJGVK Hotels and Resort - Group4Dokumen32 halamanRatio Analysis of TAJGVK Hotels and Resort - Group4Shuvam DotelBelum ada peringkat

- Habib Metropolitan Bank Banking Project: Submitted To: Submitted byDokumen22 halamanHabib Metropolitan Bank Banking Project: Submitted To: Submitted byHaseeb ParachaBelum ada peringkat

- Sample - Team ProjectDokumen10 halamanSample - Team ProjectDiyaBelum ada peringkat

- AmgenDokumen15 halamanAmgenDavid Rivera0% (1)

- Ratio Analysis of Pepsi Co.Dokumen88 halamanRatio Analysis of Pepsi Co.ZAS100% (2)

- A Fundamental Analysis of The PerformanceDokumen10 halamanA Fundamental Analysis of The PerformanceVictor DasBelum ada peringkat

- Financial Ratio AnalysisDokumen26 halamanFinancial Ratio AnalysisMujtaba HassanBelum ada peringkat

- Working Capital & Dividend PolicyDokumen9 halamanWorking Capital & Dividend PolicyLipi Singal0% (1)

- Financial Ratio AnalysisDokumen16 halamanFinancial Ratio AnalysisjesuelBelum ada peringkat

- Valuation: Future Growth and Cash FlowsDokumen12 halamanValuation: Future Growth and Cash FlowsAnshik BansalBelum ada peringkat

- Balance Sheet - in Rs. Cr.Dokumen9 halamanBalance Sheet - in Rs. Cr.Ashwin KumarBelum ada peringkat

- Ratio AnalysisDokumen8 halamanRatio AnalysisikramBelum ada peringkat

- Applied Corporate Finance. What is a Company worth?Dari EverandApplied Corporate Finance. What is a Company worth?Penilaian: 3 dari 5 bintang3/5 (2)

- 7 Investment PolicyDokumen87 halaman7 Investment PolicyShaurya Singh100% (1)

- Characteristics of Financial Instruments and A Description of RiskDokumen14 halamanCharacteristics of Financial Instruments and A Description of RiskRidwan MohsinBelum ada peringkat

- Bajaj Allianz: Future GainDokumen17 halamanBajaj Allianz: Future GainPawan KumarBelum ada peringkat

- Banking ConceptsDokumen383 halamanBanking Conceptspurinaresh85Belum ada peringkat

- SAILDokumen16 halamanSAILAman Bachhraj0% (1)

- Ratio AnalysisDokumen69 halamanRatio AnalysisAniqa AshrafBelum ada peringkat

- Risk & Return NCFMDokumen41 halamanRisk & Return NCFMworld4meBelum ada peringkat

- Final ProjectDokumen59 halamanFinal ProjectshelarnamdevBelum ada peringkat

- MAS 12 Working Capital Management MAS 12 Working Capital ManagementDokumen11 halamanMAS 12 Working Capital Management MAS 12 Working Capital ManagementiBEAYBelum ada peringkat

- Impact of Mergers and Acquisition To Bank Performance by Mira SakhaDokumen48 halamanImpact of Mergers and Acquisition To Bank Performance by Mira SakhaAnkit ShresthaBelum ada peringkat

- Nepal Auditing Practice StatementsDokumen94 halamanNepal Auditing Practice StatementsSuneelBelum ada peringkat

- Risk Spectrum For BanksDokumen5 halamanRisk Spectrum For BanksLý Minh TânBelum ada peringkat

- AuGD Compendium Report On PCJ and Petrojam Limited PDFDokumen114 halamanAuGD Compendium Report On PCJ and Petrojam Limited PDFgabyyyyyyBelum ada peringkat

- Mint Money 1 For WEBDokumen17 halamanMint Money 1 For WEBRoshan KumarBelum ada peringkat

- Financial Instruments, Financial Markets, and Financial InstitutionsDokumen58 halamanFinancial Instruments, Financial Markets, and Financial InstitutionsMike AntolinoBelum ada peringkat

- BFMDokumen17 halamanBFMsaurabhasdfBelum ada peringkat

- Icici Prudential Value Discovery FunbDokumen145 halamanIcici Prudential Value Discovery FunbAnuj RanaBelum ada peringkat

- Fauji Fertilizer Co (1) - LTD Aruba KhanDokumen33 halamanFauji Fertilizer Co (1) - LTD Aruba KhanYasir Ahmed Farhan50% (2)

- Chapter 8 - Money Market and Capital MarketDokumen24 halamanChapter 8 - Money Market and Capital MarketMerge MergeBelum ada peringkat

- Investment Strategy For Indian Markets Post-CovidDokumen21 halamanInvestment Strategy For Indian Markets Post-CovidJcoveBelum ada peringkat

- Urp GFM 01 Global Financial Markets StructureDokumen61 halamanUrp GFM 01 Global Financial Markets StructureWhiny CustodioBelum ada peringkat

- FIM Past ExamDokumen6 halamanFIM Past Examemre kutayBelum ada peringkat

- Commercial Bank Examination Manual PDFDokumen1.818 halamanCommercial Bank Examination Manual PDFJoshua Sygnal GutierrezBelum ada peringkat

- DocumentDokumen16 halamanDocumentyared girmaBelum ada peringkat

- Mini Project WorkDokumen6 halamanMini Project WorkVengatesh SBelum ada peringkat

- Janata BankDokumen89 halamanJanata BankabirBelum ada peringkat

- Working Capital Management: A Comparative Study of The Coca-Cola Company and PepsicoDokumen22 halamanWorking Capital Management: A Comparative Study of The Coca-Cola Company and PepsicoIshu SinhaBelum ada peringkat

- Stock Market and Economic Growth in Eastern Europe: Maria A. Prats and Beatriz SandovalDokumen34 halamanStock Market and Economic Growth in Eastern Europe: Maria A. Prats and Beatriz SandovalJorkosBelum ada peringkat