Finacc Quiz 1

Diunggah oleh

Jonas Mondala100%(1)100% menganggap dokumen ini bermanfaat (1 suara)

117 tayangan8 halamanCash items are unrestricted if they are any of the following except a. Could be withdrawn immediately b. Available for the acquisition of current assets c. Available for payment of current obligations d. Available for acquisition of land e. Temporary investments in equity shares f. Redeemable preference shares of ABC Corporation acquired on September 15, 2012 and with redemption date of January 15, 2013.

Deskripsi Asli:

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniCash items are unrestricted if they are any of the following except a. Could be withdrawn immediately b. Available for the acquisition of current assets c. Available for payment of current obligations d. Available for acquisition of land e. Temporary investments in equity shares f. Redeemable preference shares of ABC Corporation acquired on September 15, 2012 and with redemption date of January 15, 2013.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

100%(1)100% menganggap dokumen ini bermanfaat (1 suara)

117 tayangan8 halamanFinacc Quiz 1

Diunggah oleh

Jonas MondalaCash items are unrestricted if they are any of the following except a. Could be withdrawn immediately b. Available for the acquisition of current assets c. Available for payment of current obligations d. Available for acquisition of land e. Temporary investments in equity shares f. Redeemable preference shares of ABC Corporation acquired on September 15, 2012 and with redemption date of January 15, 2013.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 8

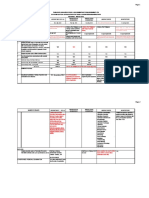

NAME:__________________________________ SECTION:__________________________________

ANSWER SHEET Quiz 1

I. THEORIES (1.5 POINTS EACH) II. PROBLEMS (2.5 POINTS EACH)

1. D 1. 11 610

2. A 2. 3 390

3. C 3. 190 shortage

4. D 4. 430 000

5. C 5. 350 000

6. C 6. 11 350

7. D 7. 836 350

8. A 8. 836 350

9. C 9. 196 425

10. D 10. 194 900

11. C 11. 196 050/196 075

12. B 12. 152 075/152 100

13. B 13. 165 350

14. C 14. 152 450

15. A 15. 63 820

16. A 16. 12 450

17. A 17. 242 450

18. A 18. 545 000

19. B 19. 65 800

20. D 20. 19 500

21. 531 000

22. 460 100

23. 233 800

24. 304 700

25. 216 000

26. 2 510

27. 71 500

28. 441 010

I. Multiple Choice Theory: Select the best answer for each numbered item. Use capital letters only: (20 items @ 1.5%

each) (30%)

1. Cash items are unrestricted if they are any of the following except

a. Could be withdrawn immediately

b. Available for the acquisition of current assets

c. Available for the payment of current obligations

d. Available for the acquisition of land

2. Which of the following instruments qualify to be classified as cash equivalents (the company adopts the policy of

treating debt instruments with maturity of not more than 90 days from the date of acquisition as cash equivalent)

a. Treasury bills purchased on December 15, 2012 and maturing on March 15, 2013

b. Treasury bills purchased on August 15, 2012 and maturing on January 15, 2013

c. Temporary investments in equity shares

d. Redeemable preference shares of ABC Corporation acquired on September 15, 2012 and with redemption date

of January 15, 2013

3. The following are indicators of good cash management except

a. Sufficient cash is maintained for use in current operations

b. Sufficient cash is available for payment of current obligations as they fall due

c. The company has excessive cash balance

d. Resources of the company are converted into productive resources to generate more inflow of resources

4. The following statements about voucher system of accounting are true except

a. A system used to control cash disbursements of the company

b. All disbursements of the company must be supported by a voucher approved by a responsible officer of the

company

c. All payments are entered first in the voucher register, and actual payments are recorded in the check register

d. All of the foregoing statements are false

5. The following are sound practices of cash control except

a. Segregation of the custodial and the recording functions

b. Imprest system of accounting must be in place

c. All payments must be supported by petty cash vouchers

d. Periodic preparation of bank reconciliation statement

6. Under the imprest fund system of accounting for petty cash, the following statements are true except

a. When the petty cash fund runs low, a check is drawn for an amount that will increase the amount of bills and

coins on hand to its original amount

b. If the fund is found to be inadequate to meet the companys needs, the petty cash fund balance is increased

c. If the total of bills and coins counted and expense vouchers is more than the original balance of the petty cash

fund at year-end, cash short and over is debited

d. If the end of the accounting period does not coincide with the replenishment date, petty cash fund is adjusted to

bring the petty cash fund balance to the actual amount of cash items on hand in the petty cash fund

7. In a reconciliation statement that attempts to bring the unadjusted book balance of cash to the unadjusted bank

balance of cash, the following statements are true except

a. Outstanding checks is added

b. Deposit in transit is deducted

c. Proceeds of note collected by the bank is added

d. Bank service charge is added

8. In a reconciliation statement that attempts to bring the unadjusted bank balance of cash to the unadjusted book

balance of cash, the following are added except

a. Proceeds of bank loan

b. Bank service charge

c. Erroneous bank charge

d. Overstatement of receipt by the depositor

9. In a reconciliation statement that brings unadjusted book balance of cash to its correct cash balance, the following

items are deducted except

a. Bank service charge

b. A check issued to a supplier on account for P475 was recorded in the cash disbursements book by the depositor

as P457

c. A customers check for P7,500 from a customer on account was recorded in the cash receipts books by the

depositor as P5,700

d. A check in payment of cash purchase for P4,500 was not recorded in the cash disbursements book for the month

10. In a four column bank reconciliation that attempts to bring the unadjusted book and bank balances to correct book

and bank balances of cash, which of the following statements is false?

a. Deposit in transit for the current month is added to the bank receipts as well as to the current month bank

balance

b. Outstanding checks as of the previous month is deducted from the bank disbursements for the current month as

well as from the previous month bank balance of cash

c. A cash receipt for the current month that is not reflected in the bank balance of cash for the current month is

added to the bank receipt for the current month as well as to the bank balance of cash for the current month

d. A customers check that was returned due to insufficiency of fund for the current month and re-deposited in the

same month is added to the book disbursement for the current month and deducted from the book balance of

cash for the current month (no entry was made by the depositor for the return and redeposit)

11. The following statements are true about compensating balances except

a. If not legally restricted is reported as part of the regular cash account

b. If legally restricted is shown separately from the regular cash account as cash held as compensating balance

under current assets section of the statement of financial position provided the corresponding loan is short-term

c. If legally restricted is shown separately from the regular cash account as cash held as compensating balance

either in the current or non-current assets section of the statement of financial position regardless of the term

of the loan

d. Is the amount of deposit maintained in the current account to support the loan obtained from the bank by the

depositor

12. Which of the following statements is true regarding bank overdraft?

a. Is reported as a current liability even though there is another account in the same bank that reports a positive

balance and that the right of offset exists

b. Is netted against another account in the same bank with positive balance (the right of offset exists) and the net

positive balance is reported as cash

c. Is netted against another cash in bank account in another bank and the net positive balance is reported as part

of cash

d. All of the foregoing statements are true

13. Which of the following is cash for financial reporting purposes?

a. Customers post-dated checks received on or before reporting date

b. Companys post-dated checks issued on or before reporting date and recorded as disbursements at year-end

c. Companys undelivered checks at year-end but not recorded as disbursements at year-end

d. Customers no sufficient fund checks

14. Unadjusted book balance of cash is less than the correct cash balance of cash due to the following except

a. Proceeds of note collected by the bank

b. A customers check for P540 was recorded by the depositor in the cash receipts book as P450

c. A check issued to a supplier on account for P760 was recorded in the cash disbursements book as P670

d. Interest earned

15. Unadjusted bank balance of cash is more than the correct cash balance of cash due to the following except?

a. Deposit in transit

b. Outstanding checks

c. Erroneous bank credit

d. A customers deposit for P450 was recorded by the bank as P540

16. The following are deducted from the bank balance of cash in order to arrive at the correct cash balance for financial

reporting purposes except

a. Deposit in transit

b. Outstanding checks

c. Erroneous bank credit

d. A customers deposit for P275 was recorded by the bank as P725

17. Which of the following reconciling items would affect the book balance of cash but not the bank balance of cash?

a. Proceeds of bank loan obtained from the bank

b. Outstanding checks

c. Deposit in transit

d. Erroneous bank charge

18. Book receipts for the current month amounted to P425,000 including note collected by the bank as of the previous

month of P5,400. A customers check for P540 was recorded by the depositor as P450 for the current month. If the

previous and current month deposit in transit are P12,500 and P25,000, respectively, how much is the bank receipts

for the current month?

a. P407,190

b. P407,010

c. P432,190

d. P432,010

19. Bank disbursements for the current month amounted to P725,000 including bank service charge for the current

month of P1,500. The erroneous bank credit of the previous month amounting to P4,500 was corrected by the bank

in the current month. If the book disbursements for the current month is P724,000, how much is the previous

month outstanding checks if outstanding checks of the current month amounted to P42,500?

a. P46,500

b. P37,500

c. P47,500

d. P38,500

20. Seldom does the book balance of cash is in agreement with the bank balance of cash due to any of the following

except

a. Deposit in transit

b. Outstanding checks

c. Bank charges and credits recognized by the bank during the month

d. Bank secrecy requirements

II. Problems: Answer the requirements for each numbered items. (28 items @ 2.5% each) (70%)

A. Upon examination of the petty cash fund of Kpops Company on January 3, 2012, the following items were found:

Bills and coins counted

1pc @ 1,000

4pcs @ 500

5pcs @ 100

3pcs @ 20

10pcs @5

Check payable to petty custodian representing her salary 5,250

Check payable to an employee dated January 15, 2013 1,300

Certified check of comptroller 2,500

IOUs of employees not supported by petty cash vouchers 1,050

Petty cash vouchers not yet replenished

PCV # 345 dated December 14, 2012 for postage stamps 350

PCV # 346 dated December 23, 2012 for supplies 500

PCV # 347 dated January 3, 2013 for freight 250 1,100

Unused supplies 200

Currency in an envelope marked collections for Christmas gift for company

president with employees name attached (content intact) 5,000

The petty cash fund was established for an amount of P15,000.

Q1. The correct petty cash fund balance to be reported in the current assets section of the statement of financial

position at December 31, 2012.

Q2. Net adjustment to the petty cash fund balance at year-end.

Q3. Cash shortage or overage. Indicate whether shortage or overage.

B. Won Companys general ledger showed a balance of P1,602,500 in its Cash account on December 31, 2012 which

consisted of the following items: (The company adopts the policy of classifying as cash equivalents investment

instruments with maturity of not more than 90 days)

Checking account with Security Bank, General Account P475,000

Checking account with Security Bank, Payroll Account, overdraft (25,000)

Certificate of deposit with BPI, term 180 days placed on December 1, 2012 125,000

Checking account with BPI 350,000

Sinking fund cash 250,000

Savings account with May Bank (closed) 120,000

Petty cash fund 25,000

Two year treasury bonds issued on March 1, 2011 but acquired on March 1, 2012

and maturing on February 28, 2013 75,000

Cash surrender value of life insurance contracts 22,500

Travel advances of salesmen 20,000

Undeposited receipts 45,000

Customers checks dated January 20, 2013 15,000

Customers checks dated December 12, 2012 but returned due to insufficiency of fund 5,000

Savings deposit with BDO earmarked for the acquisition of equipment which is expected

To be disbursed in March, 2013 100,000

Total P1,602,500

The following information were gathered at year-end that pertains to the above:

a. Included among the checks drawn against Security Bank general account during December and recorded also in

December are:

Check # 1245 written for P12,500 payable to ABC Trading was delivered on January 5, 2013

Check # 1320 written for P24,000 payable to Dac Trading was certified by the bank but this check

remained outstanding at reporting date.

Check # 2100 written for p7,500 payable to Rev Trading dated January 26, 2013

Included among the December receipts recorded in the Security Bank general account are as follows:

Customers checks for P15,000 dated January 30, 2013

Customers check for P25,000 dated December 14, 2012 but returned by the bank due to insufficiency of

fund

Money orders for P1,000

Travellers check for $2,000 converted to peso value of P84,000

b. The company has an overdraft line with Security Bank hence the right of offset exists.

c. Included in the checking account with BPI is compensating balances amounting to P150,000 against long-term

borrowing. The compensating balances are not legally restricted.

d. Petty cash fund consists of currencies and coins of P11,350; unreplenished vouchers for expenses, P10,200; cash

advances of employees, P3,450.

Q4. Correct cash balance of the checking account with Security Bank at December 31, 2012

Q5. Correct cash balance of the checking account with BPI at December 31, 2012

Q6. Correct petty cash fund balance at December 31, 2012

Q7. Correct cash balance at December 31, 2012

Q8. Correct cash and cash equivalents at December 31, 2012

C. The bank statement of Bib Corporation for June, 2012 showed an ending balance of P210, 350. Deposit in transit for

June was P15,300 while outstanding checks for June amounted to P30,750. During the month of June, the bank

charged back NSF checks in the amount of P15,250 but of this amount P3,250 was redeposited in June and cleared

the bank also in June. The depositor made no entry for the return and for the redeposit of the checks. On June 12,

the bank collected on behalf of the depositor cash proceeds of note left for collection including interest of P100 for

P5,100 but the bank charged the depositor service charge for this service of P25.

June receipt amounting to P5,400 was entered in the cash receipts book by the depositor as P4,500 in error while

June disbursements amounting to P2,700 was entered in the cash disbursements book as P7,200 in error.

The May bank reconciliation shows deposit in transit of P30,000, outstanding checks of P37,500 and an erroneous

bank credit of P5,400. All items that were outstanding as of May 31 cleared the bank including the erroneous bank

credit.

Q9. Unadjusted cash balance per book for June

Q10. Correct cash balance for June

Q11. If bank receipts for June is P220,000, how much is book receipts for June?

Q12. If bank disbursements for June is P175,000, how much is book disbursements for June?

Q13. Based on the assumed amount of receipts and disbursements per bank in Q11 and Q12, how much is the

unadjusted balance per bank for May?

Q14. Based on your answer in Q13, how much is the unadjusted cash balance per book for May?

D. At April 30, 2012, book debits and book credits per general ledger Cash in Bank of Tinamaan Company are P345,000

and P225,000, respectively. Included in the book debits for April is proceeds of note collected by the bank in March

amounting to P5,500. The bank statement for the same month indicates bank credits of P355,000 and bank debits of

P195,000. Included in the bank credits for April is erroneous bank credit for P4,500 while the bank debits for the

same month includes service charge of P750.

Customers check deposit for April for P3,750 was recorded by the bank as P3,570.

The March 31, 2012 bank reconciliation showed deposits in transit of P75,000. Outstanding check at April 30, 2012

were P45,000.

A check written in April for P7,500 was recorded by the depositor as P5,700.

Q15. Deposit in transit, April 30

Q16. Outstanding checks, March 31

E. Xfactor Enterprise is making a four column bank reconciliation at August 31 from the following data:

July 31 August 31

Balance per book ? P308,300

Balance per bank P275,000 333,700

Book receipts 531,900

Bank receipts ?

Book disbursements 466,050

Bank disbursements 486,300

Deposit in transit 30,000 ?

Outstanding checks ? 45,000

Erroneous bank credit corrected in the following month 5,400 3,500

Bank service charge 750 1,500

NSF checks 2,500 1,200

Customers check deposit for July for P2,850 was recorded by the

depositor as P8,250 in error*

Cash deposit for August for P4,500 was recorded by the depositor

as P5,400 in error*

*corrected in the following month

Q17. Unadjusted cash balance per book for July

Q18. Bank receipts for August

Q19. Outstanding checks for July

Q20. Deposit in transit for August

Q21. Corrected cash receipts for August

Q22. Corrected cash disbursements for August

Q23. Corrected cash balance for July

Q24. Corrected cash balance for August

F. The statement of financial position of Weh Company shows cash of P860,000. The following items were found to

comprise the total amount:

Checking account balance in Metrobank per bank statement

(outstanding checks of P34,000; deposit in transit of P25,000;

service charge, P1500; NSF checks, P2,450) P225,000

Petty cash fund (currencies and coins, P2,510; expense receipts, P2,100;

IOUs, P380) 5,000

Undeposited collections (of which P5,000 is in money orders, P3,000 in travellers

check and postdated checks of customers for P3,500) 75,000

Bond sinking fund cash 125,000

Treasury bills with original maturity of 6 months and acquired 2 months prior to

maturity 50,000

Postdated checks received from customers at reporting date 25,000

Trust fund account, 30 days term 100,000

Travel advances 5,000

Savings account restricted for the payment of long term obligations 250,000

Total P860,000

Q25. Correct cash balance of the checking account with Metrobank

Q26. Correct petty cash fund balance

Q27. What amount of the undeposited collections is to be reported as cash?

Q28. Correct cash and cash equivalents

Anda mungkin juga menyukai

- 01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Dokumen4 halaman01 - TFAR2301 - Cash and Cash Equivalents - January 16 (With Answers)Bea GarciaBelum ada peringkat

- Reviewer - Cash & Cash EquivalentsDokumen5 halamanReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- 1201 Cash QuestionsDokumen12 halaman1201 Cash QuestionsAngel Mae YapBelum ada peringkat

- FINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSDokumen9 halamanFINANCIAL ACCOUNTING 1 CASH AND CASH EQUIVALENTSPau Santos76% (29)

- 112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashDokumen7 halaman112 Practice Material: Cash, Cash Equivalents, Bank Reconciliation Petty CashKairo ZeviusBelum ada peringkat

- ProbsDokumen27 halamanProbsDante Jr. Dela Cruz50% (2)

- (Cash and Cash Equivalents Drills) Acc.106Dokumen18 halaman(Cash and Cash Equivalents Drills) Acc.106Boys ShipperBelum ada peringkat

- Theory of Accounts Cash and Cash EquivalentsDokumen9 halamanTheory of Accounts Cash and Cash Equivalentsida_takahashi43% (14)

- Q1 SMEsDokumen6 halamanQ1 SMEsJennifer RasonabeBelum ada peringkat

- Theories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionDokumen15 halamanTheories - Cash & Cash Equivalents: Identify The Choice That Best Completes The Statement or Answers The QuestionRyan PatitoBelum ada peringkat

- Pq-Cash and Cash EquivalentsDokumen3 halamanPq-Cash and Cash EquivalentsJanella PatriziaBelum ada peringkat

- 1st Long Exam (Summer 2022) WITHOUT ANSWERDokumen10 halaman1st Long Exam (Summer 2022) WITHOUT ANSWERDaphnie Kitch CatotalBelum ada peringkat

- Problem Solving (With Answers)Dokumen12 halamanProblem Solving (With Answers)sunflower100% (1)

- Bank Reconciliation and Cash Accounts QuizDokumen3 halamanBank Reconciliation and Cash Accounts QuizMarizMatampaleBelum ada peringkat

- ACCTG102 MidtermQ1 CashDokumen13 halamanACCTG102 MidtermQ1 CashRose Marie93% (15)

- Theories Cash and Cash EquivalentsDokumen9 halamanTheories Cash and Cash EquivalentsJavadd KilamBelum ada peringkat

- FAR-Cash & Cash Equivalents Theory-MCDokumen5 halamanFAR-Cash & Cash Equivalents Theory-MCOlive Grace CaniedoBelum ada peringkat

- Cash and Cash EqDokumen18 halamanCash and Cash EqElaine YapBelum ada peringkat

- Deptals 2Dokumen6 halamanDeptals 2jenylyn acostaBelum ada peringkat

- Quiz 2 Cash To ARDokumen4 halamanQuiz 2 Cash To ARGraziela MercadoBelum ada peringkat

- A. TheoryDokumen10 halamanA. TheoryROMULO CUBID100% (1)

- Cash and Cash Equivalents ExamDokumen7 halamanCash and Cash Equivalents ExamRudydanvinz BernardoBelum ada peringkat

- Copy of AllreviewerDokumen127 halamanCopy of AllreviewerRoyu BreakerBelum ada peringkat

- SolutionsDokumen25 halamanSolutionsDante Jr. Dela Cruz100% (1)

- Financial Accounting 1Dokumen35 halamanFinancial Accounting 1Bunbun 221Belum ada peringkat

- ACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Dokumen10 halamanACEINT1 Intermediate Accounting 1 Midterm Exam AY 2021-2022Marriel Fate Cullano0% (1)

- Assessment Test 2nd Cash&RecDokumen6 halamanAssessment Test 2nd Cash&RecMellowBelum ada peringkat

- P1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFDokumen10 halamanP1 & TOA Quizzer (UE) (Cash & Cash Equivalents) PDFrandy0% (1)

- Mock Exam Guide for Junior Philippine AccountantsDokumen5 halamanMock Exam Guide for Junior Philippine AccountantsRonnie PahilagaoBelum ada peringkat

- BA 114.1 - Quiz 1 SamplexDokumen12 halamanBA 114.1 - Quiz 1 SamplexPamela May NavarreteBelum ada peringkat

- ACEINT1 Intermediate Accounting 1 Midterm ExamDokumen9 halamanACEINT1 Intermediate Accounting 1 Midterm ExamMarriel Fate CullanoBelum ada peringkat

- Financial Accounting Exam ReviewDokumen15 halamanFinancial Accounting Exam ReviewChjxksjsgskBelum ada peringkat

- Theories and Problem Solving AKDokumen19 halamanTheories and Problem Solving AKJob CastonesBelum ada peringkat

- TOA 01 CASH AND CASH EQUIVALENTS W SOL PDFDokumen5 halamanTOA 01 CASH AND CASH EQUIVALENTS W SOL PDFJerelyn DaneBelum ada peringkat

- Simulates Midterm Exam. IntAcc1 PDFDokumen11 halamanSimulates Midterm Exam. IntAcc1 PDFA NuelaBelum ada peringkat

- Quiz On Audit of CashDokumen11 halamanQuiz On Audit of CashY JBelum ada peringkat

- National College of Business and Arts 1st Preboard Accounting ReviewDokumen7 halamanNational College of Business and Arts 1st Preboard Accounting ReviewTherese AcostaBelum ada peringkat

- Quiz On Cash Ga TheoriesDokumen5 halamanQuiz On Cash Ga TheoriesgarciarhodjeannemarthaBelum ada peringkat

- Test Bank Far 3 CparDokumen24 halamanTest Bank Far 3 CparBromanineBelum ada peringkat

- Multiple Choice Theories Part IDokumen13 halamanMultiple Choice Theories Part IKevin T. Onaro100% (1)

- Test Bank For Intermediate Accounting 17th Edition Stice DownloadDokumen68 halamanTest Bank For Intermediate Accounting 17th Edition Stice Downloadjasondaviskpegzdosmt100% (27)

- Cash and Cash Equivalents, Bank Reconciliation, and Proof of CashDokumen8 halamanCash and Cash Equivalents, Bank Reconciliation, and Proof of CashMichaelBelum ada peringkat

- THEORIESOFACCOUNTSDokumen3 halamanTHEORIESOFACCOUNTSMounicha AmbayecBelum ada peringkat

- OLERIANA_QUIZ1_CCEDokumen11 halamanOLERIANA_QUIZ1_CCERyzza OlerianaBelum ada peringkat

- IA1 - 1st Mock Quiz (With Suggested Answers)Dokumen6 halamanIA1 - 1st Mock Quiz (With Suggested Answers)Rogienel ReyesBelum ada peringkat

- 11 ACCT 1AB CashDokumen17 halaman11 ACCT 1AB CashJustLike JeloBelum ada peringkat

- Polytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsDokumen15 halamanPolytechnic University of The Philippines College of Accountancy Junior Philippine Institute of AccountantsYassi CurtisBelum ada peringkat

- Handout - CashDokumen17 halamanHandout - CashPenelope PalconBelum ada peringkat

- 2 - Cash and Cash EquivalentsDokumen5 halaman2 - Cash and Cash EquivalentsandreamrieBelum ada peringkat

- FARAP-4501 (Cash and Cash Equivalents)Dokumen10 halamanFARAP-4501 (Cash and Cash Equivalents)Marya NvlzBelum ada peringkat

- C&CEDokumen11 halamanC&CEAnne VinuyaBelum ada peringkat

- BAC 213 Financial Accounting Part 1 ReviewDokumen13 halamanBAC 213 Financial Accounting Part 1 ReviewRafael Capunpon Vallejos100% (1)

- Acctg 100C 01Dokumen6 halamanAcctg 100C 01Jose Magallanes100% (1)

- Audit of Cash and Cash EquivalentsDokumen2 halamanAudit of Cash and Cash EquivalentsWawex Davis100% (1)

- CASH & CASH EQU-WPS OfficeDokumen12 halamanCASH & CASH EQU-WPS OfficeVincent MuegueBelum ada peringkat

- Theories IA1Dokumen4 halamanTheories IA1Lester SanchezBelum ada peringkat

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Dari EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Dari EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Penilaian: 4.5 dari 5 bintang4.5/5 (5)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Dari EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- Press ReleaaaaaaseDokumen2 halamanPress ReleaaaaaaseJonas MondalaBelum ada peringkat

- Sec 35 of NIRCDokumen1 halamanSec 35 of NIRCjonas_1229Belum ada peringkat

- Transportation ExpensesDokumen9 halamanTransportation ExpensesJonas MondalaBelum ada peringkat

- Get A Grip, Get A Life, and Et Over ItDokumen1 halamanGet A Grip, Get A Life, and Et Over ItJonas MondalaBelum ada peringkat

- Itinerary PDFDokumen5 halamanItinerary PDFJonas MondalaBelum ada peringkat

- Kimi No NawaDokumen1 halamanKimi No NawaJonas MondalaBelum ada peringkat

- Sample BitchDokumen1 halamanSample BitchJonas MondalaBelum ada peringkat

- 30 Increment 52week Money ChallengeDokumen2 halaman30 Increment 52week Money ChallengeCaitlin BacallanBelum ada peringkat

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Grab Receipt ADR-2335218-2-036Dokumen1 halamanGrab Receipt ADR-2335218-2-036Jonas MondalaBelum ada peringkat

- Rupaul WinnersDokumen1 halamanRupaul WinnersJonas MondalaBelum ada peringkat

- Date Time Charge CodeDokumen2 halamanDate Time Charge CodeJonas MondalaBelum ada peringkat

- XXXXXXXDokumen17 halamanXXXXXXXJonas MondalaBelum ada peringkat

- Love Will Find A Way Chords TabDokumen2 halamanLove Will Find A Way Chords TabJonas MondalaBelum ada peringkat

- Session 5 Capital BudgetingDokumen6 halamanSession 5 Capital BudgetingKevin PhamBelum ada peringkat

- CVDokumen5 halamanCVMuhammad AdityaBelum ada peringkat

- WORKING CAPITAL MANAGEMENT ADVISORY SERVICESDokumen9 halamanWORKING CAPITAL MANAGEMENT ADVISORY SERVICESJonas Mondala80% (5)

- Battle of The Voices Season 3 Blind AuditioneesDokumen1 halamanBattle of The Voices Season 3 Blind AuditioneesJonas MondalaBelum ada peringkat

- MANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSDokumen7 halamanMANAGEMENT ADVISORY SERVICES QUANTITATIVE METHODSJonas MondalaBelum ada peringkat

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- PRC List of RequirementsDokumen24 halamanPRC List of RequirementscharmainegoBelum ada peringkat

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Chapter 15 Problems UHFM 7th EditionDokumen13 halamanChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Resume Mondala JonathanDokumen5 halamanResume Mondala JonathanJonas MondalaBelum ada peringkat

- CCH Axcess Paperless and Data Rich White PaperDokumen6 halamanCCH Axcess Paperless and Data Rich White PaperJonas MondalaBelum ada peringkat

- Rachelle Pomperada Ramos #2675 A. Bautista St. Punta Sta. Ana, ManilaDokumen2 halamanRachelle Pomperada Ramos #2675 A. Bautista St. Punta Sta. Ana, ManilaJonas MondalaBelum ada peringkat

- Income Statement For MeatDokumen36 halamanIncome Statement For MeatJonas MondalaBelum ada peringkat

- XXXXXXXDokumen17 halamanXXXXXXXJonas MondalaBelum ada peringkat

- Thomasian Resume FormatDokumen5 halamanThomasian Resume FormatJonas MondalaBelum ada peringkat

- Letter For WalwalanDokumen1 halamanLetter For WalwalanJonas MondalaBelum ada peringkat

- Cip 2.0Dokumen1 halamanCip 2.0JitendraBhartiBelum ada peringkat

- Mortgage Markets Chapter 11 Multiple Choice QuestionsDokumen9 halamanMortgage Markets Chapter 11 Multiple Choice QuestionsSoraLeeBelum ada peringkat

- Rating 101Dokumen2 halamanRating 101AmitBelum ada peringkat

- Academic Field Trip Plan BDokumen2 halamanAcademic Field Trip Plan BRachelleBelum ada peringkat

- Audit Plan Tests Financial StatementsDokumen27 halamanAudit Plan Tests Financial StatementsAbdul Malik FajriBelum ada peringkat

- NH7003167061226.INDIA CustomerVoucherDokumen3 halamanNH7003167061226.INDIA CustomerVoucherAshok BansalBelum ada peringkat

- BudgetDokumen59 halamanBudgetKiritBelum ada peringkat

- Accounting Information System ReviewDokumen5 halamanAccounting Information System ReviewALMA MORENABelum ada peringkat

- Ts 101671v031201pDokumen161 halamanTs 101671v031201pSalvatore TrainaBelum ada peringkat

- Review QuickBooks Online Assessment AnswersDokumen18 halamanReview QuickBooks Online Assessment AnswersYanah Flojo88% (8)

- Logistics vs. Supply Chain ManagementDokumen23 halamanLogistics vs. Supply Chain ManagementÁnh NguyễnBelum ada peringkat

- Zakiyyah Logan Joins PrivatePlus MortgageDokumen2 halamanZakiyyah Logan Joins PrivatePlus MortgagePR.comBelum ada peringkat

- DocDokumen8 halamanDocJAY AUBREY PINEDABelum ada peringkat

- Practie Homework CH 9 (25ed) Updated NovDokumen3 halamanPractie Homework CH 9 (25ed) Updated NovThomas TermoteBelum ada peringkat

- FWC Stadium Requirements Handbook-V1.0 - LaidoutDokumen1.310 halamanFWC Stadium Requirements Handbook-V1.0 - LaidoutRodrigo SimoninBelum ada peringkat

- Electronic Commerce SystemsDokumen48 halamanElectronic Commerce SystemsYasir HasnainBelum ada peringkat

- DDDDDokumen2 halamanDDDDMuhammad AmjadBelum ada peringkat

- ISA 700 705 706 Audit Report UpdatedDokumen28 halamanISA 700 705 706 Audit Report UpdatedAshraf Uz ZamanBelum ada peringkat

- AddValue Safari BGANDokumen2 halamanAddValue Safari BGANMinh Tran VanBelum ada peringkat

- An Overview of Digitization in Indian Banking Sector: Anthony Rahul Golden SDokumen4 halamanAn Overview of Digitization in Indian Banking Sector: Anthony Rahul Golden SSoumya Ranjan SutarBelum ada peringkat

- Relaxation in ASLAAS Card UpdatesDokumen3 halamanRelaxation in ASLAAS Card UpdatesNarayanaBelum ada peringkat

- ChaseDokumen6 halamanChasepeter hammerBelum ada peringkat

- Mani Finances - Personal Loan and Business LoanDokumen1 halamanMani Finances - Personal Loan and Business Loanvigneshwaran ArumugamBelum ada peringkat

- Objectives and Sample QuestionnaireDokumen4 halamanObjectives and Sample QuestionnaireShamel MundethBelum ada peringkat

- Chapter 7 Warehouse Operations & ManagementDokumen69 halamanChapter 7 Warehouse Operations & ManagementKhánh Đoan Lê Đình100% (1)

- CH 4Dokumen34 halamanCH 4አርቲስቶቹ Artistochu animation sitcom by habeshan memeBelum ada peringkat

- Wells Fargo Way2Save Checking: Important Account InformationDokumen5 halamanWells Fargo Way2Save Checking: Important Account InformationBernadette B. Reyes0% (1)

- Apply for IndusInd Bank Credit CardDokumen2 halamanApply for IndusInd Bank Credit CardPrashant TambeBelum ada peringkat

- Big BazaarDokumen19 halamanBig BazaarAlok RanjanBelum ada peringkat

- Delivery ChallanDokumen1 halamanDelivery ChallanAl-Amin Packaging Ind.Belum ada peringkat