15 AF 503 SFM - Ans

Diunggah oleh

Haseeb Ullah Khan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan9 halamansfm

Judul Asli

15-AF-503-SFM_ans

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inisfm

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

13 tayangan9 halaman15 AF 503 SFM - Ans

Diunggah oleh

Haseeb Ullah Khansfm

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 9

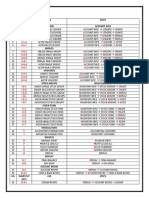

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 1 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

Q. 1 (a) Attending six (6) training courses per year:

Rs. 000

Year

Travel and

Accommodation

Course

Costs

Total Cash

Flows

Discount

Factor

Present

Value

1 15,660 2,115 17,775 0.877 15,589 1

2 16,443 2,168 18,611 0.769 14,312 1

3 17,265 2,222 19,487 0.675 13,154 1

4 18,128 2,278 20,406 0.592 12,080 1

5 19,035 2,335 21,369 0.519 11,091 1

66,225

Workings:

Travel and accommodation:

Rs. 000

Year-1 26,100 x 100 scholars x 6 courses 15,660

Year-2 15,660 (1.05) 16,443

Year-3 16,443 (1.05) 17,265

Year-4 17,265 (1.05) 18,128

Year-5 18,128 (1.05) 19,035 2

Course cost:

Rs. 000

Year-1 352,500 x 6 courses 2,115

Year-2 2,115 (1.025) 2,168

Year-3 2,168 (1.025) 2,222

Year-4 2,222 (1.025) 2,278

Year-5 2,278 (1.025) 2,335 2

Proposed e-learning solution:

Rs. 000

Year 0 1 2 3 4 5

Hardware 45,000 (1,500)

Software 1,050 1,050 1,050 1,050 1,050

Technical manager 900 954 1,011.24 1,071.91 1,136.23 1

Camera and sound 720 720 763.20 808.99 857.53 1

Trainers and course material 360 381.60 404.50 428.77 454.49 1

Broadband connection 900 855 812.25 771.64 733.06 1

46,050 3,930 3,960.60 4,041.19 4,131.31 1,681.31 1

Discount factor 1.000 0.877 0.769 0.675 0.592 0.519

Present value 46,050 3,446.61 3,045.70 2,727.80 2,445.74 872.60 1

Total present value = Rs. 58,588,446

The e-learning system is recommended since it has the lowest present value. 1

Notes:

Depreciation is not a relevant cost and should not be included in the analysis.

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 2 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

(b) Three alternative current assets financing policies:

(1) A moderate approach:

Here, the current asset financing involves matching the maturities of assets and

liabilities, so that temporary current assets are financed with short-term non

spontaneous debt and permanent current assets are financed with long-term debt or

equity, plus spontaneous debt. 1

(2) Aggressive approach:

Under this approach, some permanent current assets, and perhaps even some fixed

assets, are financed with short-term debt. 1

(3) A conservative approach:

Would be to use long-term capital to finance all permanent assets and some of the

temporary current assets. 1

(c) Good Health Ltd.

Alternative Balance Sheets

Rs. 000

Restricted (40%) Moderate (50%) Relaxed (60%)

Current assets 2,400 3,000 3,600 1

Fixed assets 1,200 1,200 1,200 1

Total assets 3,600 4,200 4,800 1

Debt 1,800 2,100 2,400 1

Equity 1,800 2,100 2,400 1

Total liabilities and equity 3,600 4,200 4,800 1

OR 2 + 2 + 2 = 6

Good Health Ltd.

Alternative Income Statements

Rs. 000

Restricted Moderate Relaxed

Sales 6,000 6,000 6,000

EBIT 900 900 900 1

Interest (10%) 180 210 240 1

Earnings before taxes 720 690 660 1

Taxes (40%) 288 276 264 1

Net income 432 414 396 1

ROE

432

1,800

414

2,100

396

2,400

24.0% 19.7% 16.5%

1

OR 2 + 2 + 2 = 6

(d) The NPVs, are calculated as follows:

For Model-S:

Rupees

Year Cash Flow Discount Factor @ 10% PV

0 (200,000) 1.000 (200,000)

1 2 120,000 1.736 208,320

NPV 8,320 1

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 3 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

For Model-L:

Rupees

Year Cash Flow Discount Factor @ 10% PV

0 (200,000) 1.000 (200,000)

1 4 67,000 3.170 212,390

NPV 12,390 1

However, if we make our decision based on the raw NPVs, we would be biasing the

decision against the shorter model. Since the models are expected to be replicated,

repeated after 2 years as under:

Rupees

Year Cash Flow PV Factors @ 10% PV

0 (200,000) 1.000 (200,000)

1 120,000 0.909 109,080

2 (200,000) + 120,000 0.826 (66,080)

3 120,000 0.751 90,120

4 120,000 0.683 81,960

NPV 15,080

Thus, when compared over a 4-year common life, Model-S has the higher NPV, hence it

should be chosen.

(e) If the cost of Model-S is expected to increase, the replication model is not identical to the

original, and we would put the cash flows on a time line as follows:

Rupees

Year Cash Flow PV Factors @ 10% PV

0 (200,000) 1.000 (200,000)

1 2 120,000 1.736 208,320

2 (210,000) 0.826 (173,460)

3 4 120,000 1.434 172,080

Common life NPV 6,940

Common life NPVS = 6,940

With this change, the common life NPV of Model-S is less than that for Model-L, and

hence Model-L should be chosen. 1

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 4 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

Q. 2 (a) Gearing and interest cover ratios:

Prior charge capital

Gearing =

Shareholders funds

500

2015 =

893.6

= 56.0%

500

2016 =

875.8

= 57.1%

500

2017 =

863.8

= 57.9%

These are slightly below the covenant level of 60% and therefore appear acceptable.

However, it would only take a fall of Rs.5 million per annum in shareholder funds for

gearing to rise to an unacceptable level.

Interest cover:

Rs. in million

Interest on debentures (14% x 300 m) 42

Interest on bank loans (10% x 200 m) 20

Total interest 62

232

2015 =

62

= 3.74 times

200

2016 =

62

= 3.23 times

216

2017 =

62

= 3.48 times

The covenant for EBIT/ total interest is 3.5 times so interest cover falls below acceptable

limits in 2016 and 2017.

There is a significant risk that XYZ will breach the debenture covenants so urgent

action is required to obtain alternative finance or restructure the business to

improve gearing and interest cover.

(b) Cost of debt for existing debenture:

Rs. 000

Year

Cash

Flow

Discount

Factor @ 3%

PV

Discount

Factor @ 6%

PV

0 Market value (240.00) 1.000 (240.00) 1.000 (240.00) 1

1 4 Interest (after tax) 18.20 3.717 67.65 3.465 63.06 1

4 Capital repayment 200.00 0.888 177.60 0.792 158.40 1

5.25 (18.54)

After tax cost of debt = 3% +

18.54 5.25

5.25

!

(3%)

= 3% +

23.79

5.25

(3%)

= 3% + 0.66% = 3.66% 1

= 3.66%

Pre-tax cost of debt =

0.35 - 1

3.66

= 5.63% 1

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 5 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

Cost of debt for a 10% pre-tax bank loan:

Rs. 000

Year

Cash

Flow

Discount

Factor @ 6%

PV

Discount

Factor @ 8%

PV

0 Loan (240.00) 1.000 (240.00) 1.000 (240.00) 1

1 4 *Interest (after tax) 15.60 3.465 54.05 3.312 51.67 1

4 Loan repayment 240.00 0.792 190.08 0.735 176.4 1

4.13 (11.93)

*240 x 0.10 = 24 (1-0.35) = 15.6

After tax cost of loan = 6% +

11.93 4.13

4.13

!

(2%)

= 6% +

16.06

4.13

(2%)

= 6% + 0.5% = 6.5% 1

Pre-tax cost of loan =

0.35 - 1

6.5

=

0.65

6.5

= 10.0%

Decision:

The debenture is therefore cheaper than the proposed replacement bank loan.

(c) Issue Price of proposed rights issue:

Current number of shares =

10

400

= 40 million 1

Number of new shares to be issued =

4

40

= 10 million 1

Rs.200 million is needed so the

issue price

=

shares million 10

million 200 Rs.

= Rs.20 per share 1

Rupees

4 shares @ Rs.30 120

1 share @ Rs.20 20

140 1

Ex-right price (140 5) 28 1

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 6 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

Q. 3 (a) (i) Alpha Ltd.s cost of capital:

Since the profits and dividends are expected to remain constant the formula V

o

=

i

D

is

applicable. Where V

o

= ex div share price, d = dividend per share and i = cost of

ordinary share capital.

Annual profit = Rs. 5,000,000

.. Dividend per share =

1,000,000

5,000,000

= Rs.5 per share 1

Market price = Rs.30 per share cum div

Ex-dividend = Rs.30 Rs.5 = Rs.25 per share 1

Applying above formula = 25 =

i

5

Cost of equity (i) =

25

5

= 0.2 or 20% 1

(ii) Beta Ltd. Ordinary share capital:

Rupees

Annual profit 5,000,000

Less: Debenture interest 1,500,000

Available for dividends 3,500,000 1

.. Dividend per share 3.5 1

Applying above formula = 14 =

i

3.5

Cost of equity (i) =

14

3.5

= 0.25 or 25% 1

(iii) Beta Ltd. Weighted average cost of capital:

Market Value

Source

Rs. 000 Proportion

Cost of Capital

(%)

WACC (%)

Equity 14,000 0.528 25 13.20 1

Debentures 12,500 0.472 12 5.66 1

26,500 1.000 18.86

(iv) Summary of results:

Company Cost of Equity WACC

Alpha Ltd. 20% 20.00%

Beta Ltd. 25% 18.66%

(b) The difference in the cost of ordinary share capital must be entirely explained in terms of

the different gearing of the two companies. The effect of the higher gearing of Beta Ltd., is

to increase the level of financial risk and, therefore, decrease the relative attractiveness of

the ordinary shares. 1

This may be explained in terms of the objectives with which investors acquire and hold

ordinary shares. In the first place investors will seek to maximize their return. However, at

the same time investors are in general averse to risk and, therefore, will seek to minimize

the uncertainty inherent in those returns. Uncertainties may be explained in terms of the

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 7 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

variance of the returns about their expected values.

Because, investors are averse to such uncertainty, they will demand a higher rate of return

to compensate them for the higher level of uncertainty. This clearly explains why the cost

of equity of Beta Ltd., (25%) is higher than that of Alpha Ltd., (20%). 1

(c) Improve in annual income of Mr. Siddiqui:

(i) Present annual income = 100,000 x Rs.3.5 = Rs. 350,000

(ii) Market value of holding = 100,000 x Rs.14 = Rs.1,400,000

(iii) Amount to be borrowed: Mr Siddiquis level of risk will be unchanged if he employs

personal gearing to the same extent as Beta Ltd., i.e., so that debt is 47.2% of total

capital and own funds are in the ratio 12,500 : 14,000. Amount to be borrowed is,

therefore:

=

1,400

1,250

x 1,400,000 = Rs.1,250,000 1

(iv) Number of shares to be purchased:

Total capital available = 1,400,000 + 1,250,000 = Rs.2,650,000 1

Number of shares in Alpha Ltd., which can be purchased (ex div):

=

25

2,650,000

= 106,000 shares 1

(v) Annual income following the scheme:

Rupees

Dividend receipts 106,000 at Rs.5 530,000

Less: Interest at 12% on Rs.1,250,000 150,000

Net income 380,000 1

Mr. Siddiquis annual income would therefore increase by Rs.30,000 (380,000

350,000) or 8.6% [(

350,000

30,000

x 100)] as a result of the scheme.

1

Reservations:

(a) The level of gearing in Beta Ltd high. By adopting a similarly high personal level of

gearing Mr. Siddiqui is accepting a high risk from which he has no limited liability.

(b) Mr. Siddiqui may find it difficult to borrow such a large sum unless he provides

additional security. The cost may well be greater than the companys borrowing rate.

(c) Other investors may see the possibility of providing additional income by the same

process thus increasing the share price of Alpha Ltd., Mr. Siddiqui may therefore be

required to pay the higher price thus reducing his anticipated increase.

(d) Transaction costs have been ignored.

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 8 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

Q. 4 (a) The estimated required rate of return for the acquisition is:

Blue Ltd. = Rf + (Rm Rf)

= 0.09 + (0.14 0.09)(0.80) = 0.13 2

Using this rate to discount the net cash flows, we obtain:

Rupees

Years Net Cash Flow Present-Value Factor Present Value

1 5 100 3.5172 351,720 1

6 10 180 (5.4262 3.5172) 343,620 1

11 ! 260 [(1/0.13) 5.4262] 589,188 1

1,284,528 1

The maximum price that should be paid is Rs.1,284,528.

(b) To pay this price, the assumptions of the CAPM must hold. The company is being valued

according to its systematic risk only. The effect of the acquisition on the total risk of Blue

Ltd., Company is assumed not to be a factor of importance to investors. Additionally, we

assume that the measurement of beta is accurate and that the estimates of R

f

and R

m

are

reasonable. 1

Q. 5 (a) Replacement cost value:

Rupees

Owners Equity 908,200

Free hold land and buildings (1,000,000 651,600) 348,400 1

Furniture and fixtures (200,000 521,280) (321,280) 1

Motor vehicles (250,000 130,320) 119,680 1

Inventory and work in progress (1,100,000 1,031,800) 68,200 1

1,123,200

(b) Realisable value:

Rupees

Owners Equity 908,200

Free hold land and buildings (550,000 651,600) (101,600) 1

Furniture and fixtures (250,000 521,280) (271,280) 1

Motor vehicles (100,000 130,320) (30,320) 1

Inventory and work in progress (1,140,000 1,031,800) 108,200 1

Accounts receivable (1,490,000 x 0.02) (29,800) 1

583,400

(c) Looking at dividend growth over the past five years we have dividend of Rs.41,000 and

Rs.50,000 for year 2010 and 2014 respectively. If the annual growth rate in dividends is

g.

50,000

(1 + g)

4

=

41,000

= 1.2195

1 + g =

= 1.0508

g =

= 0.0508, say 5% 2

SUGGESTED ANSWERS EXTRA ATTEMPT, MAY 2014 EXAMINATIONS 9 of 9

STRATEGIC FINANCIAL MANAGEMENT SEMESTER-5

Marks

DISCLAIMER: The suggested answers provided on and made available through the Institutes website may only be referred, relied upon or treated as a guide and substitute for professional

advice. The Institute does not take any responsibility about the accuracy, completeness or currency of the information provided in the suggested answers. Therefore, the Institute is

not liable to attend or receive any comments, observations or critics related to the suggested answers.

Expected dividend

Market value ex-dividend =

0.12 g

50,000(1.05)

=

0.07

= Rs.750,000 2

(d) P/E ration model:

Comparable quoted companies to Friends Engineering Ltd have P/E ratios of about 10.

Friends Engineering Ltd is much smaller and being unquoted, its P/E ratio would be less

than 10, but how much less?

P/E ratio of 5, market value (104,400 x 5) 522,000

P/E ratio of 10 x 2/3, market value (104,400 x 10 x 2/3) 696,000

P/E ratio of 10, market value (104,400 x 10) 1,044,000 2

THE END

Anda mungkin juga menyukai

- 8 - (S5) SFM QPDokumen6 halaman8 - (S5) SFM QPHaseeb Ullah KhanBelum ada peringkat

- BrownDokumen1 halamanBrownvermondBelum ada peringkat

- BrownDokumen1 halamanBrownvermondBelum ada peringkat

- Repeated PPRA text documentDokumen104 halamanRepeated PPRA text documentImran MukhtarBelum ada peringkat

- Introduction To Microeconomics, E201Dokumen248 halamanIntroduction To Microeconomics, E201Al Beirão100% (6)

- Theory of Demand and SupplyDokumen97 halamanTheory of Demand and Supplyprabh17Belum ada peringkat

- Corporate Finance WACC With Answer PDFDokumen2 halamanCorporate Finance WACC With Answer PDFNurhafiz Morjidi100% (1)

- Auditing MCQs with AnswersDokumen45 halamanAuditing MCQs with AnswersHaseeb Ullah Khan100% (3)

- Theory of Demand and SupplyDokumen97 halamanTheory of Demand and Supplyprabh17Belum ada peringkat

- MCQ S Question Bank - AuditingDokumen22 halamanMCQ S Question Bank - Auditingabdul majid khawajaBelum ada peringkat

- New Chart of Accounts-29 October 2002Dokumen74 halamanNew Chart of Accounts-29 October 2002Haseeb Ullah KhanBelum ada peringkat

- Book 1Dokumen2 halamanBook 1Haseeb Ullah KhanBelum ada peringkat

- Theory of Demand and SupplyDokumen97 halamanTheory of Demand and Supplyprabh17Belum ada peringkat

- Theory of Demand and Supply: Chapter - 2Dokumen0 halamanTheory of Demand and Supply: Chapter - 2carolsaviapetersBelum ada peringkat

- CostofCapital IIDokumen30 halamanCostofCapital IIअंजनी श्रीवास्तवBelum ada peringkat

- Operational Risk Data SRMDokumen5 halamanOperational Risk Data SRMHaseeb Ullah KhanBelum ada peringkat

- 15 BAF 503 SFM - AnsDokumen10 halaman15 BAF 503 SFM - AnsHaseeb Ullah KhanBelum ada peringkat

- 15 Af 503 SFMDokumen6 halaman15 Af 503 SFMHaseeb Ullah KhanBelum ada peringkat

- Solutions To IAS 19: A-1 Statement of Financial Position Rs. (M) Rs. (M)Dokumen3 halamanSolutions To IAS 19: A-1 Statement of Financial Position Rs. (M) Rs. (M)Haseeb Ullah KhanBelum ada peringkat

- P2int 2008 Jun QDokumen6 halamanP2int 2008 Jun QShuja Muhammad LaghariBelum ada peringkat

- 10 AF 401 MA - AnsDokumen6 halaman10 AF 401 MA - AnsHaseeb Ullah KhanBelum ada peringkat

- ICMAP 2nd Comprehensive Exam Analysis of ABC Ltd and Divisional Transfer PricingDokumen3 halamanICMAP 2nd Comprehensive Exam Analysis of ABC Ltd and Divisional Transfer PricingSajid AliBelum ada peringkat

- Comp Exam1 05082k8Dokumen2 halamanComp Exam1 05082k8Shoaib AliBelum ada peringkat

- Employee Benefit Ias 29Dokumen18 halamanEmployee Benefit Ias 29Haseeb Ullah KhanBelum ada peringkat

- ACCADokumen12 halamanACCAAbdulHameedAdamBelum ada peringkat

- Investment DecisionsDokumen8 halamanInvestment DecisionsHaseeb Ullah KhanBelum ada peringkat

- Appendix B Cost of CapitalDokumen15 halamanAppendix B Cost of CapitalceojiBelum ada peringkat

- 56 Portfolio SummeryDokumen10 halaman56 Portfolio SummeryHaseeb Ullah KhanBelum ada peringkat

- s301 FaDokumen4 halamans301 FaHaseeb Ullah KhanBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- CH 03Dokumen65 halamanCH 03zubnareeBelum ada peringkat

- Pizza Hut Vs Domino PizzaDokumen2 halamanPizza Hut Vs Domino Pizzatarunthakur_dwBelum ada peringkat

- Exercise 2 - CVP Analysis Part 1Dokumen5 halamanExercise 2 - CVP Analysis Part 1Vincent PanisalesBelum ada peringkat

- BrochureDokumen5 halamanBrochureSumay Kumar FBelum ada peringkat

- Car Wash Business PlanDokumen13 halamanCar Wash Business PlanOlumide Akinz100% (2)

- Lecture Notes IMC Unit IDokumen4 halamanLecture Notes IMC Unit Ivikas__cc100% (1)

- Clarkson Lumber SolutionDokumen9 halamanClarkson Lumber SolutionDiego F. Guty JadueBelum ada peringkat

- I W e T e I M P: Aidil Hanafi Amirrudin, Nur Syuhadah Kamaruddin, Nurshahirah Salehuddin, Suraiya IbrahimDokumen15 halamanI W e T e I M P: Aidil Hanafi Amirrudin, Nur Syuhadah Kamaruddin, Nurshahirah Salehuddin, Suraiya IbrahimJoselyn CerveraBelum ada peringkat

- EbayDokumen81 halamanEbayJohnny ChanBelum ada peringkat

- Tally Shortcut Keys GuideDokumen2 halamanTally Shortcut Keys Guideradha ramaswamyBelum ada peringkat

- Motivation Letter For MechatronicsDokumen1 halamanMotivation Letter For MechatronicsMuhammad Zaka Ud Din60% (5)

- Chapter 2 Financial AnalysisDokumen26 halamanChapter 2 Financial AnalysisCarl JovianBelum ada peringkat

- SS 08 Quiz 1 - AnswersDokumen82 halamanSS 08 Quiz 1 - AnswersVan Le Ha100% (3)

- Genjrl 1Dokumen1 halamanGenjrl 1Tiara AjaBelum ada peringkat

- VWAPBandsDokumen5 halamanVWAPBandsdefgiaBelum ada peringkat

- SOSTAC E-Marketing Plan For B2B CompanyDokumen2 halamanSOSTAC E-Marketing Plan For B2B CompanyPerry SmithBelum ada peringkat

- Private Equity in AustraliaDokumen5 halamanPrivate Equity in AustraliaWinnifred AntoinetteBelum ada peringkat

- Chapter 7 International StrategyDokumen16 halamanChapter 7 International StrategyTamara PutriBelum ada peringkat

- 7 C'S of Marketing Communication: Amitabha Gupta Swami Vivekananda UniversityDokumen10 halaman7 C'S of Marketing Communication: Amitabha Gupta Swami Vivekananda UniversityAmitabha GuptaBelum ada peringkat

- How To Define A Chart of Accounts in Oracle Apps R12: Month End ProcessDokumen18 halamanHow To Define A Chart of Accounts in Oracle Apps R12: Month End ProcessCGBelum ada peringkat

- B ProposalDokumen19 halamanB ProposalberisomorketaBelum ada peringkat

- CEO & President with Growth ExperienceDokumen1 halamanCEO & President with Growth ExperienceMultiservicios RapaloBelum ada peringkat

- Havells India LTDDokumen7 halamanHavells India LTDshalabhs4uBelum ada peringkat

- 201 Final Fall 2013 V1aDokumen11 halaman201 Final Fall 2013 V1aJiedan HuangBelum ada peringkat

- Exposure To Currency Risk Definition and Measurement PDFDokumen2 halamanExposure To Currency Risk Definition and Measurement PDFTaraBelum ada peringkat

- S.No Issues Under Consideration Desired Information Available Information Gap Possible Sources of InformationDokumen1 halamanS.No Issues Under Consideration Desired Information Available Information Gap Possible Sources of InformationSUALI RAVEENDRA NAIKBelum ada peringkat

- Practical No 3Dokumen4 halamanPractical No 3skjlf sljdfBelum ada peringkat

- ISO Quant and ISO CostDokumen14 halamanISO Quant and ISO CostMahesh Surve100% (1)

- Seven Essential COmponents To A Marketting PlanDokumen1 halamanSeven Essential COmponents To A Marketting PlanGeneTearBodgesBelum ada peringkat

- DBL Annual Report 2021 - Final PDFDokumen326 halamanDBL Annual Report 2021 - Final PDFShamim BaadshahBelum ada peringkat