210427429-Nego - pdf12345 (Dragged) 20

Diunggah oleh

Christian Lemuel Tangunan Tan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

17 tayangan1 halamanvgvnnv

Judul Asli

210427429-Nego.pdf12345 (dragged) 20

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inivgvnnv

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

17 tayangan1 halaman210427429-Nego - pdf12345 (Dragged) 20

Diunggah oleh

Christian Lemuel Tangunan Tanvgvnnv

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

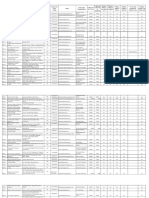

NEGOTIABLE INSTRUMENTS NOTES

BASED ON AGBAYANIS BOOK AND ATTY. MERCADOS LECTURES

Page 97 of 190

BY: MA. ANGELA LEONOR C. AGUINALDO

ATENEO LAW 2D BATCH 2010

Sec. 71. Presentment where instrument is not payable on demand

and where payable on demand. - Where the instrument is not

payable on demand, presentment must be made on the day it falls

due. Where it is payable on demand, presentment must be made

within a reasonable time after its issue, except that in the case of a

bill of exchange, presentment for payment will be sufficient if made

within a reasonable time after the last negotiation thereof.

WHEN PAYABLE AT A FIXED OR DETERMINABLE FUTURE TIME

The presentment must be made at the date of maturity

WHEN PAYABLE ON DEMAND IN CASE OF NOTES

The time for presentment depends upon whether the instrument is a

bill or a note

If it is a note, it must be presented for payment within reasonable time

for issue

If it is a bill, it must be presented for payment within reasonable time

from last negotiation and not for issue, as in the case of notes

CASE DIGESTS: SECTION 71

132 FAR EAST REALTY INVESTMENT V. CA

166 SCRA 256

FACTS:

Private respondents approached petitioner and asked the latter to extend

to them an accommodation loan. They proposed to pay with interest.

They even gave a check, signed by Tat, drawn against Chinabank, and

signed at the back by the private respondents. They said that they will

change the check with cash after one month and if not, the check could be

presented for payment and it would be paid. The loan was actually

extended but when the check was presented for payment, it was

dishonoredthe account on which it is drawn has long been closed. The

trial courts held in favor of petitioner but this was reversed by the appellate

court by ruling that the check has passed through other hands before

reaching the petitioner and the said check wasnt presented within

reasonable time and after its issuance.

HELD:

Where the instrument is not payable on demand, presentment must be

made on the day it falls due. Where it is payable on demand, presentment

must be made within a reasonable time after issue, except that in case of a

bill of exchange, presentment for payment is sufficient if made within

reasonable time after the last negotiation thereof.

Notice may be given as soon as instrument has been dishonored and

unless delay is excused must be given within the time fixed by law.

In this case, presentment and notice of dishonor were not made within

reasonable time.

September 1960date when the check was drawn

March 1964presented to drawee bank

April 1968notice of dishonor

133 REPUBLIC V. PNB

3 SCRA 851

FACTS:

The government filed a complaint for escheat of certain unclaimed bank

deposits balances pursuant to a law, which provides that unclaimed

balancescredits, money, bullion, security or other evidence of

indebtedness of any kind, and interest with banksshall be deposited with

the government if it remains to be unclaimed within a period of 10 years of

more.

One of the banks against the complaint has been filed is First National City

Bank. Although it concedes that the government had the right to claim the

unclaimed deposit balances, it seeks to exclude some which, according to

it, are not within the purview of credits and deposits as defined in law. the

trial court held in favor of the bank, excluding from the claim the

managers checks and other demand drafts.

HELD:

Credit is a sum credited on the books of a company to a person who

appears to be entitled to it. it presupposes a creditor-debtor relationship

and may be said to imply ability, by reason of property or estates, to make

a promised payment. It is correlative to indebtedness, and that which is

due to any person, as distinguished to that which he owes.

Do demand drafts and telegraphic orders come within the purview of

credits or deposits employed in the law?

Since the demand drafts herein involved have not been presented either

for acceptance or payment, the inevitable consequence is that the bank

never had the chance of accepting or receiving them. Verily, the bank

never became a debtor of the payee concerned and as such the aforesaid

Anda mungkin juga menyukai

- TheDokumen1 halamanTheChristian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 25Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 25Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 8Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 8Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 5Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 5Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 8Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 8Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 4Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 4Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 6Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 6Christian Lemuel Tangunan TanBelum ada peringkat

- Negotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 162 of 190Dokumen1 halamanNegotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 162 of 190Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 7Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 7Christian Lemuel Tangunan TanBelum ada peringkat

- Negotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 183 of 190Dokumen1 halamanNegotiable Instruments Notes Based On Agbayani'S Book and Atty. Mercado'S Lectures Page 183 of 190Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 7Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 7Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 7Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 7Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 2Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 2Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 3Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 3Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 31Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 31Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 33Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 33Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 30Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 30Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 1Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 1Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 28Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 28Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 27Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 27Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 22Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 22Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 26Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 26Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 19Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 19Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 25Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 25Christian Lemuel Tangunan TanBelum ada peringkat

- Negotiable Instruments NotesDokumen1 halamanNegotiable Instruments NotesChristian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 16Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 16Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 24Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 24Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 18Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 18Christian Lemuel Tangunan TanBelum ada peringkat

- 210427429-Nego - pdf12345 (Dragged) 17Dokumen1 halaman210427429-Nego - pdf12345 (Dragged) 17Christian Lemuel Tangunan TanBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Sample Exam 1Dokumen11 halamanSample Exam 1habiba_il786Belum ada peringkat

- 10 Unusual Facts About James Lord Pierpont The Man Behind Jingle BellsDokumen4 halaman10 Unusual Facts About James Lord Pierpont The Man Behind Jingle BellsLuke HanscomBelum ada peringkat

- St. John's E.M High School: Class: IVDokumen5 halamanSt. John's E.M High School: Class: IVsagarBelum ada peringkat

- Nellore - Redbus Ticket PDFDokumen2 halamanNellore - Redbus Ticket PDFwaseemBelum ada peringkat

- Third Reich Occult and Heinrich Himmlers Ahnenerbe (Runes, NDokumen5 halamanThird Reich Occult and Heinrich Himmlers Ahnenerbe (Runes, Napi-37134210% (2)

- Chapter II. Types of Cargo Ships Перевод ТекстаDokumen3 halamanChapter II. Types of Cargo Ships Перевод ТекстаНаталья ЛандикBelum ada peringkat

- Fixtures National Secondary School Football Boys Championship 2023Dokumen9 halamanFixtures National Secondary School Football Boys Championship 2023Stamina DaddyBelum ada peringkat

- R.a.7438 Rights Under Custodial InvestigationDokumen3 halamanR.a.7438 Rights Under Custodial InvestigationLeon Odarniem Saniraf EtelpBelum ada peringkat

- Michael Rubens BloombergDokumen3 halamanMichael Rubens BloombergMarina Selezneva100% (1)

- "Illegal Number Games" Is Any Form of Illegal Gambling Activity Which UsesDokumen4 halaman"Illegal Number Games" Is Any Form of Illegal Gambling Activity Which Usesmaria luzBelum ada peringkat

- Conflicts of Law ChartDokumen8 halamanConflicts of Law ChartJoAnne Yaptinchay ClaudioBelum ada peringkat

- Marital issues and succession rights questionsDokumen2 halamanMarital issues and succession rights questionsTovy BordadoBelum ada peringkat

- Paguio vs. NLRCDokumen3 halamanPaguio vs. NLRCPilyang Sweet100% (4)

- Pune GeographyDokumen39 halamanPune GeographynaniBelum ada peringkat

- Public International Law - OutlineDokumen5 halamanPublic International Law - OutlineLJ W SantosBelum ada peringkat

- SWS V ComelecDokumen1 halamanSWS V ComelecnabingBelum ada peringkat

- Amniocentesis Procedure OverviewDokumen6 halamanAmniocentesis Procedure OverviewYenny YuliantiBelum ada peringkat

- Philippine Deposit Insurance Corporation Act: By: PONCE, Enrico and VALMORES, Gay ValerieDokumen7 halamanPhilippine Deposit Insurance Corporation Act: By: PONCE, Enrico and VALMORES, Gay ValerieAngel Alejo AcobaBelum ada peringkat

- Bangladesh War of Independence LectureDokumen42 halamanBangladesh War of Independence LectureAlam joviBelum ada peringkat

- Sight Word Story With All The 220 Basic Dolch Words (The Best Thing in The World)Dokumen4 halamanSight Word Story With All The 220 Basic Dolch Words (The Best Thing in The World)Eric Alden ApoleBelum ada peringkat

- Prospectiva - First Year in Office - Julio.2023Dokumen25 halamanProspectiva - First Year in Office - Julio.2023lapatillaBelum ada peringkat

- Letter of Quarantine of EmployeesDokumen3 halamanLetter of Quarantine of EmployeesSample BakeshopBelum ada peringkat

- Music Essay Final DraftDokumen4 halamanMusic Essay Final Draftapi-312578543Belum ada peringkat

- PropertyDokumen84 halamanPropertyNeo KigzBelum ada peringkat

- The Bishop's kindness and generosity testedDokumen9 halamanThe Bishop's kindness and generosity testedGangadhar MamadapurBelum ada peringkat

- En A Paper On Hadiths of Month of MuharramDokumen12 halamanEn A Paper On Hadiths of Month of MuharramHelmon ChanBelum ada peringkat

- Patliputra University PatnaDokumen3 halamanPatliputra University PatnaAvinash KumarBelum ada peringkat

- Citizen's Surety v. Melencio HerreraDokumen1 halamanCitizen's Surety v. Melencio HerreraVanya Klarika NuqueBelum ada peringkat

- Comprehension Dangerous MosquitoesDokumen1 halamanComprehension Dangerous MosquitoeskiluBelum ada peringkat

- P Series Volume 67 Additional ListDokumen2 halamanP Series Volume 67 Additional ListKuhramaBelum ada peringkat