Anti Dumping Duty Notifications (Customs) No.25/2014 Dated 9th June, 2014

Diunggah oleh

stephin k jJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Anti Dumping Duty Notifications (Customs) No.25/2014 Dated 9th June, 2014

Diunggah oleh

stephin k jHak Cipta:

Format Tersedia

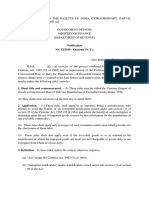

[TO BE PUBLISHED IN PART II SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF

INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. 25/2014-Customs (ADD)

New Delhi, the 09

th

June, 2014

G.S.R. (E). Whereas, the designated authority, vide notification No. 15/11/2012-

DGAD, dated the 18

th

September, 2012, published in Part I, Section 1 of the Gazette of India,

Extraordinary, dated the 18

th

September, 2012, had initiated a review in the matter of

continuation of anti-dumping on imports of Presensitised Positive Offset Aluminium Plates

(thickness ranging from 0.15 mm to 0.40 mm with a variation of 0.03 mm on either side)

(hereinafter referred to as the subject goods) falling under Chapter 37, 76 or 84 of the First

Schedule to the Customs Tariff Act 1975, (51 of 1975) (hereinafter referred to as the said

Customs Tariff Act), originating in, or exported from, the Peoples Republic of China

(hereinafter referred to as the subject country), imposed vide notification of Government of

India, in the Ministry of Finance (Department of Revenue), No. 108/2007-Customs, dated the

25

th

September, 2007, published in Part II, Section 3, Sub-section (i) of the Gazette of India,

Extraordinary, vide G.S.R. No. 627 (E), dated the 25

th

September, 2007.

And whereas, the Central Government had extended the anti-dumping duty on the subject

goods, originating in, or exported from, the subject country up to and inclusive of the 23

rd

September, 2013 vide notification of the Government of India, in the Ministry of Finance

(Department of Revenue), No. 44/2012 Customs (ADD) dated the 25

th

September, 2012,

published in Part II, Section 3, Sub-section (i) of the Gazette of India, Extraordinary, vide G.S.R

No. 715(E), dated the 25

th

September, 2012.

And whereas, in the matter of review of anti-dumping on import of the subject goods,

originating in, or exported from the subject country, the designated authority vide its final

findings, No. 15/11/2012-DGAD, dated the 10

th

March, 2014, published in the Gazette of India,

Extraordinary, Part I, Section 1, dated the 10

th

March, 2014, has come to the conclusion that

(i) There has been continued dumping of the subject goods from subject country and

the dumping is likely to continue and intensify if anti-dumping duty is allowed to

cease;

(ii) The subject goods are entering the Indian market at dumped prices from the

subject country and the dumping margin is substantial causing injury to the

domestic industry;

(iii) The injury to the domestic industry is likely to continue in the event of withdrawal

of anti-dumping duty from the subject country;

(iv) The anti-dumping duty is required to be extended and revised,

and has recommended continued imposition of the anti-dumping duty against the subject goods,

originating in, or exported from the subject country.

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of section

9A of the said Act read with Rules 18 and 23 of the Customs Tariff (Identification, Assessment

and Collection of Anti-dumping Duty on Dumped Articles and for Determination of Injury)

Rules, 1995, the Central Government, after considering the aforesaid final findings of the

designated authority, hereby imposes on the subject goods, the description of which is specified

in column (3) of the Table below, falling under Chapter of the First Schedule to the Customs

Tariff Act as specified in the corresponding entry in column (2), the specification of which is

specified in column (4) of the said Table, originating in the country as specified in the

corresponding entry in column (5), and produced by the producers as specified in the

corresponding entry in column (7), and exported from the country specified in the corresponding

entry in column (6) , by the exporters as specified in the corresponding entry in column (8) and

imported into India, an anti-dumping duty at a rate which is equal to the amount specified in the

corresponding entry in column (9), in the currency as specified in the corresponding entry in

column (11) and as per unit of measurement as specified in the corresponding entry in column

(10) of the said Table.

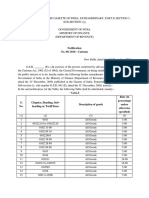

Table

S

N

o

Chapter Description

of

Goods

Specification Country

of Origin

Country of

Exports

Producer Exporter Duty

Amount

Unit Currency

(1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11)

1.

37, 76 or

84

Pre-

sensitised

Positive

Offset

Aluminium

Plates

Thickness ranging

from 0.15 mm to

0.40 mm with a

variation of 0.03

mm on either side

Peoples

Republic of

China

Peoples

Republic of

China

Any Any 0.22

Per

Kg

USD

2.

37, 76 or

84

Pre-

sensitised

Positive

Offset

Aluminium

Plates

Thickness ranging

from 0.15 mm to

0.40 mm with a

variation of 0.03

mm on either side

Peoples

Republic of

China

Any other

than

Peoples

Republic of

China

Any Any 0.22

Per

Kg

USD

3.

37, 76 or

84

Pre-

sensitised

Positive

Offset

Aluminium

Plates

Thickness ranging

from 0.15 mm to

0.40 mm with a

variation of 0.03

mm on either side

Any other

than

Peoples

Republic of

China

Peoples

Republic of

China

Any Any 0.22

Per

Kg

USD

2. The anti-dumping duty imposed shall be levied for a period of five years (unless revoked,

superseded or amended earlier) from the date of publication of this notification in the Official

Gazette and shall be payable in Indian currency.

Explanation. - For the purposes of this notification, - rate of exchange applicable for the

purposes of calculation of anti-dumping duty shall be the rate which is specified in the

notification of the Government of India in the Ministry of Finance (Department of Revenue),

issued from time to time, in exercise of the powers under sub-clause (i) of clause (a) of sub-

section (3) of section 14 of the Customs Act, 1962 (52 of 1962) and the relevant date for the

determination of the rate of exchange shall be the date of presentation of the bill of entry under

section 46 of the said Customs Act.

F No. 354/136/2007/TRU (Pt-I)

(Akshay Joshi)

Under Secretary to the Government of India.

Anda mungkin juga menyukai

- Customs Circular No.05/2015 Dated 9th February, 2016Dokumen21 halamanCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jBelum ada peringkat

- Customs Circular No. 25/2015 Dated 15th October, 2015Dokumen10 halamanCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jBelum ada peringkat

- Customs Circular No.04/2015 Dated 9th February, 2016Dokumen5 halamanCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jBelum ada peringkat

- Customs Circular No. 28/2015 Dated 23rd October, 2015Dokumen3 halamanCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jBelum ada peringkat

- Customs Circular No.03/2015 Dated 3rd February, 2016Dokumen4 halamanCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jBelum ada peringkat

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Dokumen34 halamanCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 20/2015 Dated 31st July 2015Dokumen15 halamanCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jBelum ada peringkat

- Customs Circular No. 27/2015 Dated 23rd October, 2015Dokumen13 halamanCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jBelum ada peringkat

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Dokumen2 halamanCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jBelum ada peringkat

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Dokumen26 halamanCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jBelum ada peringkat

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Dokumen1 halamanDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jBelum ada peringkat

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Dokumen5 halamanCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jBelum ada peringkat

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Dokumen60 halamanCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jBelum ada peringkat

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Dokumen22 halamanCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jBelum ada peringkat

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Dokumen3 halamanCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jBelum ada peringkat

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Dokumen38 halamanCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jBelum ada peringkat

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Dokumen15 halamanDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jBelum ada peringkat

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Dokumen3 halamanDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1091)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Cir Vs First Express PawnshopDokumen16 halamanCir Vs First Express Pawnshopjan panerioBelum ada peringkat

- Case StudyDokumen8 halamanCase StudyJenalyn OrtegaBelum ada peringkat

- Chap 019Dokumen45 halamanChap 019ducacapupuBelum ada peringkat

- Chapter 13 Motivation at WorkDokumen7 halamanChapter 13 Motivation at WorkVincent ChurchillBelum ada peringkat

- Vice President or Sales and MarketingDokumen4 halamanVice President or Sales and Marketingapi-76867294Belum ada peringkat

- Audit Plan and ProgramDokumen35 halamanAudit Plan and ProgramReginald ValenciaBelum ada peringkat

- A Simpler Way To Modernize Your Supply ChainDokumen23 halamanA Simpler Way To Modernize Your Supply ChainragerahulBelum ada peringkat

- ConstrainsDokumen2 halamanConstrainsRuvarasheBelum ada peringkat

- Comparative Analysis of Software Development Life Cycle Models (SDLC)Dokumen12 halamanComparative Analysis of Software Development Life Cycle Models (SDLC)Satendra KumarBelum ada peringkat

- Toaz - Info Email Oil Gas PRDokumen305 halamanToaz - Info Email Oil Gas PRnnadoziekenneth5Belum ada peringkat

- Iibf ExamDokumen13 halamanIibf ExamRahul MondalBelum ada peringkat

- Pradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeDokumen9 halamanPradhan Mantri Formalisation of Micro Food Processing Enterprise SchemeAlok GuptaBelum ada peringkat

- Senior Officer - Director, Office of Equal Employment OpportunityDokumen4 halamanSenior Officer - Director, Office of Equal Employment OpportunityMarshay HallBelum ada peringkat

- Winning Pips System.Dokumen9 halamanWinning Pips System.blonderekBelum ada peringkat

- Sep by IncometDokumen18 halamanSep by IncometYUVRAJ RAJBHARBelum ada peringkat

- SniperTradingSetups ManualDokumen63 halamanSniperTradingSetups ManualDavid SheehanBelum ada peringkat

- Marketing Literature ReviewDokumen17 halamanMarketing Literature ReviewUday bBelum ada peringkat

- MCS AssignmentDokumen28 halamanMCS Assignmenthaseeb_tankiwalaBelum ada peringkat

- s307 InglesDokumen176 halamans307 InglesAna M. RodriguezBelum ada peringkat

- Supply Chain Case StudyDokumen7 halamanSupply Chain Case StudyP Singh KarkiBelum ada peringkat

- Video Traffic Endgame PDFDokumen12 halamanVideo Traffic Endgame PDFDan KBelum ada peringkat

- MComDokumen32 halamanMComTuki DasBelum ada peringkat

- MIS Hotel ManagementDokumen27 halamanMIS Hotel Managementyogesh_sherla87% (15)

- IGL BillDokumen1 halamanIGL BillArun KumarBelum ada peringkat

- Cash Flow ProjectionDokumen8 halamanCash Flow ProjectionSuhailBelum ada peringkat

- Employee Recognition Preferences QuestionnaireDokumen4 halamanEmployee Recognition Preferences QuestionnaireMansi Jain100% (1)

- QCS 2014 S02 - 4Dokumen231 halamanQCS 2014 S02 - 4Sai Ram NadimuthuBelum ada peringkat

- Game TheoryDokumen32 halamanGame TheoryMemoona AmbreenBelum ada peringkat

- Cocacola TQM ProjectDokumen18 halamanCocacola TQM ProjectOmer Farooq92% (13)

- Assessing Financial Health (Part-A)Dokumen17 halamanAssessing Financial Health (Part-A)kohacBelum ada peringkat