GR No. 78133

Diunggah oleh

Elle0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

173 tayangan1 halamanpartnership

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inipartnership

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

173 tayangan1 halamanGR No. 78133

Diunggah oleh

Ellepartnership

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

G.R. No.

78133 October 18, 1988

MARIANO P. PASCUAL and RENATO P. DRAGON, petitioners,

vs.

THE COMMISSIONER OF INTERNAL REVENUE and COURT OF TAX APPEALS, respondents.

FACTS:

1965. Petitioners bought 2 parcels of land from Santiago Bernardino et al.

1966. Bought another three the following year from Juan Roque.

1968. First two sold to Marenir Devt. Corp. (P165, 224.70)

1970. Last three sold Erlinda Reyes and Maria Samson (P60, 000.00).

Net profit realized.

Capital gains taxes paid by availing tax amnesties.

PROBLEM:

Petitioners assessed and required to pay deficiency corporate income taxes (P107, 101.70) for 1968 and 1970.

Allegedly:

Formed an unregistered partnership or joint venture taxable as a corporation

(as distinguished from profits derived from the partnership subject to individual income tax).

Availment of tax amnesty relieved petitioners of individual income tax liabilities but not tax liability of the unregistered partnership.

ISSUE:

WON the transaction is deemed a partnership or a co-ownership subject to tax.

EVANGELISTA CASE:

Petitioners borrowed a sum of money from their father which together with their own personal funds they used in buying several

real properties. They appointed their brother to manage their properties with full power to lease, collect, rent, issue receipts, etc.

They had the real properties rented or leased to various tenants for several years and they gained net profits from the rental

income. Thus, the Collector of Internal Revenue demanded the payment of income tax on a corporation, among others, from them.

HELD:

The transaction is deemed a co-ownership. There is no evidence that petitioners entered into an agreement to contribute money,

property or industry to a common fund, and that they intended to divide the profits among themselves. The transactions were

isolated. The character of habituality peculiar to business transactions for the purpose of gain was not present.

Co-ownership or co-possession does not itself establish a partnership, whether such co-owners or co-possessors do or do not

share any profits made by the use of the property.

The sharing of gross returns does not of itself establish a partnership, whether or not the persons sharing them have a joint or

common right or interest in any property from which the returns are derived. This only means that, aside from the circumstance of

profit, the presence of other elements constituting partnership is necessary, such as the clear intent to form a partnership, the

existence of a juridical personality different from that of the individual partners, and the freedom to transfer or assign any interest in

the property by one with the consent of the others.

Persons who contribute property or funds for a common enterprise and agree to share the gross returns of that enterprise in

proportion to their contribution, but who severally retain the title to their respective contribution, are not thereby rendered partners.

There is clear evidence of co-ownership between the petitioners. They shared in the gross profits as co-owners and paid their

capital gains taxes on their net profits and availed of the tax amnesty thereby.

And even assuming for the sake of argument that such unregistered partnership appears to have been formed, since there is no

such existing unregistered partnership with a distinct personality nor with assets that can be held liable for said deficiency corporate

income tax, then petitioners can be held individually liable as partners for this unpaid obligation of the partnership p. However, as

petitioners have availed of the benefits of tax amnesty as individual taxpayers in these transactions, they are thereby relieved of any

further tax liability arising therefrom.

Anda mungkin juga menyukai

- Pascual vs. CIR Case DigestDokumen5 halamanPascual vs. CIR Case DigestGuiller C. MagsumbolBelum ada peringkat

- Case Digest Part 2Dokumen2 halamanCase Digest Part 2Clarise Satentes AquinoBelum ada peringkat

- Lecture Notes On PartnershipDokumen2 halamanLecture Notes On PartnershipSakuraCardCaptor100% (1)

- Nitto V NLRCDokumen4 halamanNitto V NLRCDino AbieraBelum ada peringkat

- Prime Vs LazatinDokumen8 halamanPrime Vs LazatinMaceda KadatuanBelum ada peringkat

- Prop Cases - OwnershipDokumen6 halamanProp Cases - OwnershipRonnie James ValenciaBelum ada peringkat

- Isabela Sawmill Partnership Dissolution and Creditor ClaimsDokumen1 halamanIsabela Sawmill Partnership Dissolution and Creditor Claimsxx_stripped52Belum ada peringkat

- G.R. No. 97212Dokumen4 halamanG.R. No. 97212shezeharadeyahoocomBelum ada peringkat

- Corpo RecapDokumen8 halamanCorpo RecapErwin April MidsapakBelum ada peringkat

- 19-Mondano Vs Silvosa 97 Phil 143Dokumen3 halaman19-Mondano Vs Silvosa 97 Phil 143enan_intonBelum ada peringkat

- Negotiable Instruments RecitationDokumen10 halamanNegotiable Instruments RecitationMarkonitchee Semper FidelisBelum ada peringkat

- Guinggona v. City FiscalDokumen3 halamanGuinggona v. City Fiscal001nooneBelum ada peringkat

- Testate Estate of Lazaro MotaDokumen2 halamanTestate Estate of Lazaro Motakingley leanderBelum ada peringkat

- Manila Memorial Park Cemetery, Inc. v. LinsanganDokumen6 halamanManila Memorial Park Cemetery, Inc. v. Linsangancmv mendozaBelum ada peringkat

- Income Taxation (General Principles of Taxation)Dokumen10 halamanIncome Taxation (General Principles of Taxation)Isabelle HanBelum ada peringkat

- Celestino & Co. v. Collector, 99 Phil. 841 (1956)Dokumen3 halamanCelestino & Co. v. Collector, 99 Phil. 841 (1956)Winnie Ann Daquil Lomosad-MisagalBelum ada peringkat

- Notes 17 - Law On Sales Assignment of CreditsDokumen7 halamanNotes 17 - Law On Sales Assignment of CreditsChristine Daine BaccayBelum ada peringkat

- Agency, Trust & Partnership Reviewer - 1786-1814 (Cambri Notes)Dokumen6 halamanAgency, Trust & Partnership Reviewer - 1786-1814 (Cambri Notes)Arvin FigueroaBelum ada peringkat

- 51 Heirs of Cabal vs. CabalDokumen17 halaman51 Heirs of Cabal vs. CabalVianice BaroroBelum ada peringkat

- Common provisions for pledge and mortgageDokumen6 halamanCommon provisions for pledge and mortgagemarmiedyanBelum ada peringkat

- Leon Sibal, Plaintiff-Appellant v. Emiliano J. Valdez, Et. Al., Defendants-Appellee GR No. 26278, August 4, 1927 Johnson, J. Bai Malyanah A. SalmanDokumen1 halamanLeon Sibal, Plaintiff-Appellant v. Emiliano J. Valdez, Et. Al., Defendants-Appellee GR No. 26278, August 4, 1927 Johnson, J. Bai Malyanah A. Salmanbai malyanah a salmanBelum ada peringkat

- Nature of the attorney-client relationshipDokumen1 halamanNature of the attorney-client relationshipangelo doceoBelum ada peringkat

- AFISCO Insurance Corporation v. CA rules insurance pool formed a partnershipDokumen2 halamanAFISCO Insurance Corporation v. CA rules insurance pool formed a partnershiplealdeosa100% (2)

- Property - Case Digest - Co-OwnershipDokumen9 halamanProperty - Case Digest - Co-OwnershipGoodyBelum ada peringkat

- CID Vs JavierDokumen1 halamanCID Vs JavierEmil BautistaBelum ada peringkat

- Partnership I. Part CDokumen135 halamanPartnership I. Part CKristelle KuaBelum ada peringkat

- Isabelo Moran Jr. vs. Court of AppealsDokumen10 halamanIsabelo Moran Jr. vs. Court of AppealsMarianne Hope VillasBelum ada peringkat

- Lagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFDokumen22 halamanLagandaon vs. CA, 1998 - Relativity of Contracts - CTS - Buyers in GFhenzencameroBelum ada peringkat

- 24 Capitle V de GabanDokumen1 halaman24 Capitle V de GabanMark Anthony Javellana SicadBelum ada peringkat

- Agra Bar QuestionsDokumen3 halamanAgra Bar QuestionsRamon Rarama100% (1)

- Sec. 1601 To 1618 of NCCDokumen3 halamanSec. 1601 To 1618 of NCCGuiller C. MagsumbolBelum ada peringkat

- Law On Partnership-Limited PartnershipDokumen3 halamanLaw On Partnership-Limited PartnershipDea Lyn BaculaBelum ada peringkat

- Afisco Insurance Corp Vs CADokumen2 halamanAfisco Insurance Corp Vs CAEmi SicatBelum ada peringkat

- Campos Rueda Vs Pacific Comm. (1x5 5)Dokumen1 halamanCampos Rueda Vs Pacific Comm. (1x5 5)Angelic ArcherBelum ada peringkat

- 07 People v. GoDokumen1 halaman07 People v. GoAnonymous bOncqbp8yiBelum ada peringkat

- #5 Case Digests On Abatement of Nuisance and Basic Services and FacilitiesDokumen11 halaman#5 Case Digests On Abatement of Nuisance and Basic Services and FacilitiesRoy BacaniBelum ada peringkat

- Partnership Dissolution Ruled Unilateral by PartnerDokumen3 halamanPartnership Dissolution Ruled Unilateral by PartnerMaisie ZabalaBelum ada peringkat

- Beaumont v. PrietoDokumen22 halamanBeaumont v. PrietoJNMGBelum ada peringkat

- Litonjua Vs Litonjua Facts:: Quo Is Void or Legally Inexistent)Dokumen2 halamanLitonjua Vs Litonjua Facts:: Quo Is Void or Legally Inexistent)Ghreighz GalinatoBelum ada peringkat

- Credit TransDokumen3 halamanCredit Transalliah SolitaBelum ada peringkat

- 5 Cui Vs Arellano UniversityDokumen3 halaman5 Cui Vs Arellano UniversityGabriel DominguezBelum ada peringkat

- The Corporation Code of The PhilippinesDokumen5 halamanThe Corporation Code of The PhilippinesIbiang DeleozBelum ada peringkat

- Legal Ethics in Malaysian Legal EducationDokumen21 halamanLegal Ethics in Malaysian Legal EducationNur SyarahBelum ada peringkat

- Cagayan Vs Sandiko - DigestDokumen2 halamanCagayan Vs Sandiko - DigestNegou Xian TeBelum ada peringkat

- Ra 11232 RCCDokumen72 halamanRa 11232 RCCTugadiWayneBelum ada peringkat

- Agga Vs NLRCDokumen2 halamanAgga Vs NLRCFrizie Jane Sacasac MagbualBelum ada peringkat

- SC Affirms PhilGuarantee's Right to Reimbursement from DebtorDokumen4 halamanSC Affirms PhilGuarantee's Right to Reimbursement from DebtorKMBelum ada peringkat

- Green Asia v. CADokumen1 halamanGreen Asia v. CAAaron James PuasoBelum ada peringkat

- The Corporation Code of The Philippines (Final)Dokumen200 halamanThe Corporation Code of The Philippines (Final)sarahsheenBelum ada peringkat

- Bpi CaseDokumen2 halamanBpi Caseinna andresBelum ada peringkat

- 08 Briones-Vasquez Vs CADokumen13 halaman08 Briones-Vasquez Vs CAyassercarlomanBelum ada peringkat

- Joseph vs. Bautista PDFDokumen8 halamanJoseph vs. Bautista PDFApple Lentejas - QuevedoBelum ada peringkat

- Contract of AgencyDokumen18 halamanContract of AgencyJui ProvidoBelum ada peringkat

- #225 Borromeo V Descallar - NietoDokumen1 halaman#225 Borromeo V Descallar - NietoYanna Beatriz NietoBelum ada peringkat

- Union Bank Vs CaDokumen4 halamanUnion Bank Vs CaDianne YcoBelum ada peringkat

- Partnership. TSNDokumen25 halamanPartnership. TSNFaith Imee RobleBelum ada peringkat

- A. Scope & Nature of Employee's Right Constitutional Statutory Basis: C. Purpose of Exercise of Right: Two-FoldDokumen12 halamanA. Scope & Nature of Employee's Right Constitutional Statutory Basis: C. Purpose of Exercise of Right: Two-FoldKhukeiBelum ada peringkat

- Torts Barredo Vs Garcia and AlmarioDokumen25 halamanTorts Barredo Vs Garcia and AlmarioRaisa BarramedaBelum ada peringkat

- 7.) Pascual and Dragon V CIRDokumen2 halaman7.) Pascual and Dragon V CIRRusty SeymourBelum ada peringkat

- Pascual V CIRDokumen4 halamanPascual V CIRFlorence UdaBelum ada peringkat

- Chapter I InsuranceDokumen2 halamanChapter I InsuranceElleBelum ada peringkat

- Chapter I InsuranceDokumen2 halamanChapter I InsuranceElleBelum ada peringkat

- Codal Corporation Code General ProvisionsDokumen2 halamanCodal Corporation Code General ProvisionscharizzzzzeBelum ada peringkat

- Sunga vs. ChuaDokumen1 halamanSunga vs. ChuaElleBelum ada peringkat

- GR No. 78133Dokumen1 halamanGR No. 78133ElleBelum ada peringkat

- Co-Ownership Not Subject to Income Tax for Resale of Real PropertyDokumen1 halamanCo-Ownership Not Subject to Income Tax for Resale of Real PropertyElleBelum ada peringkat

- Co-Ownership Not Subject to Income Tax for Resale of Real PropertyDokumen1 halamanCo-Ownership Not Subject to Income Tax for Resale of Real PropertyElleBelum ada peringkat

- G.R. No. 143340Dokumen1 halamanG.R. No. 143340ElleBelum ada peringkat

- Estanislao vs. CA G.R. No. L-49982 April 27, 1988Dokumen1 halamanEstanislao vs. CA G.R. No. L-49982 April 27, 1988ElleBelum ada peringkat

- Mendiola vs. CA G.R. 159333 July 31, 2006Dokumen2 halamanMendiola vs. CA G.R. 159333 July 31, 2006Elle75% (4)

- Heirs of Jose Lim Partnership DisputeDokumen2 halamanHeirs of Jose Lim Partnership DisputeElleBelum ada peringkat

- Estanislao vs. CA G.R. No. L-49982 April 27, 1988Dokumen1 halamanEstanislao vs. CA G.R. No. L-49982 April 27, 1988ElleBelum ada peringkat

- Mendiola vs. CA G.R. 159333 July 31, 2006Dokumen2 halamanMendiola vs. CA G.R. 159333 July 31, 2006Elle75% (4)

- GR No. 126881Dokumen2 halamanGR No. 126881ElleBelum ada peringkat

- Are Women More Likely To Be Credit Constrained? Evidence From Low-Income Urban Households in The Philippines by Hazel Jean L. MalapitDokumen37 halamanAre Women More Likely To Be Credit Constrained? Evidence From Low-Income Urban Households in The Philippines by Hazel Jean L. MalapitElleBelum ada peringkat

- Are Women More Likely To Be Credit Constrained? Evidence From Low-Income Urban Households in The Philippines by Hazel Jean L. MalapitDokumen37 halamanAre Women More Likely To Be Credit Constrained? Evidence From Low-Income Urban Households in The Philippines by Hazel Jean L. MalapitElleBelum ada peringkat

- Critical Thinking Rrl1Dokumen19 halamanCritical Thinking Rrl1CHow GatchallanBelum ada peringkat

- Child-Adoption MatchingDokumen49 halamanChild-Adoption MatchingElleBelum ada peringkat

- 4 10 Ra 3765Dokumen3 halaman4 10 Ra 3765Stewart Paul TorreBelum ada peringkat

- Privilege&Property DeazleyDokumen454 halamanPrivilege&Property DeazleyElleBelum ada peringkat

- Itemized DeductionsDokumen23 halamanItemized DeductionsAbhishek JaiswalBelum ada peringkat

- CashDokumen3 halamanCashDahirBelum ada peringkat

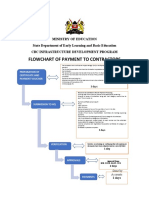

- Process of Payment To ContractorsDokumen1 halamanProcess of Payment To ContractorsBasil MalakiBelum ada peringkat

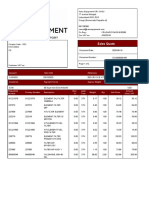

- In Voice 6561987Dokumen1 halamanIn Voice 6561987Chakradhar PonnuruBelum ada peringkat

- FNSTPB412 AE Sk2of4 Appx FrasersElectricalEmployeeDataDokumen34 halamanFNSTPB412 AE Sk2of4 Appx FrasersElectricalEmployeeDataChoo Li ZiBelum ada peringkat

- Duty Credit Scrip: Sahil Chhabra - 39ADokumen8 halamanDuty Credit Scrip: Sahil Chhabra - 39AsahilchhabraBelum ada peringkat

- My Payslip 31 MAR 23Dokumen1 halamanMy Payslip 31 MAR 23educatingmary226Belum ada peringkat

- De 4Dokumen4 halamanDe 4fschalkBelum ada peringkat

- Income Tax Calculation 2019 20Dokumen760 halamanIncome Tax Calculation 2019 20Dsp VarmaBelum ada peringkat

- Solution Aassignments CH 13Dokumen2 halamanSolution Aassignments CH 13RuturajPatilBelum ada peringkat

- This Study Resource Was: AnswerDokumen2 halamanThis Study Resource Was: AnswermerryBelum ada peringkat

- 14 - Tax Planning Under Income Tax LawsDokumen35 halaman14 - Tax Planning Under Income Tax Lawsrohanfyaz00Belum ada peringkat

- Ratios and Proportions Unit PlanDokumen4 halamanRatios and Proportions Unit Planapi-377808688Belum ada peringkat

- Return Saifee Hsopital TrustDokumen6 halamanReturn Saifee Hsopital TrustAnonymous u6Zg0QhBelum ada peringkat

- Act 5Dokumen1 halamanAct 5Unknowingly AnonymousBelum ada peringkat

- Export of Service Rules, 2005Dokumen2 halamanExport of Service Rules, 2005mads70Belum ada peringkat

- 2307 TemplateDokumen4 halaman2307 TemplateMarianneRoseBrusolaBelum ada peringkat

- Cir vs. Aichi Forging G.R. No. 184823Dokumen14 halamanCir vs. Aichi Forging G.R. No. 184823Eiv AfirudesBelum ada peringkat

- Tax Return Engagement LetterDokumen2 halamanTax Return Engagement LetterAshru AshrafBelum ada peringkat

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokumen1 halamanTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sajine DBelum ada peringkat

- Kanu Equipment DRC SASU Sales Quote for KIS KANDUDokumen2 halamanKanu Equipment DRC SASU Sales Quote for KIS KANDUkandukissBelum ada peringkat

- AC405 Assignment R185840RDokumen3 halamanAC405 Assignment R185840RDiatomspinalcordBelum ada peringkat

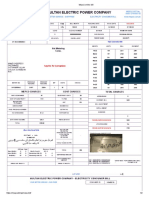

- Bill Feb 23 1Dokumen2 halamanBill Feb 23 1Irfan JillaniBelum ada peringkat

- Cases 1 and 2 - TaxDokumen4 halamanCases 1 and 2 - TaxRevina EstradaBelum ada peringkat

- Invoice: Inclusive All TaxesDokumen2 halamanInvoice: Inclusive All TaxesVAV PPPBelum ada peringkat

- Text Book Multiple Choice Quiz AnswersDokumen128 halamanText Book Multiple Choice Quiz Answersbinod gaire0% (1)

- Kotak Securities Payslip for August 2020Dokumen1 halamanKotak Securities Payslip for August 2020Aakash PrajapatiBelum ada peringkat

- Edy Transport Limited invoices Steel Trans Ltd £7,260 for deliveriesDokumen21 halamanEdy Transport Limited invoices Steel Trans Ltd £7,260 for deliveriesDon SniperBelum ada peringkat

- Tax WorldwideDokumen449 halamanTax WorldwidebreeH20Belum ada peringkat

- Adjusting Entries FR UTB Fill in The Blanks N Effects of OmissionsDokumen31 halamanAdjusting Entries FR UTB Fill in The Blanks N Effects of Omissionsjadetablan30Belum ada peringkat