DUBAI JITTER ACROSS COUNTRIES AND INVESTMENT AVEVNUES - What, Why, How and Whats Next

Diunggah oleh

vinittulsyanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

DUBAI JITTER ACROSS COUNTRIES AND INVESTMENT AVEVNUES - What, Why, How and Whats Next

Diunggah oleh

vinittulsyanHak Cipta:

Format Tersedia

1 Dubai Fears – Collateral Damage… A catalyst for Market Re-Pricing – Time to Move On…

Dubai Fears – Collateral Damage...

A Catalyst for Market Re-Pricing

Time to Move On…

Collateral Damage across countries with all investment avenues Oil, gold, currencies

(except USD due to flight to safety), metals, equities, REITs etc

28th November, 2009

Global markets hit by fear about Dubai crisis

Oil falls below US$ 74 amid Dubai debt default fears

Dubai fears hammers Asian Banks and builders

YEN surges to 14 year high against US$

A catalyst for market pricing: Something had to come; some trigger had to come to

pull the market down, and it came but in my opinion this is not a beginning of a crisis,

but a kind of after adjusted effect to the crisis which was there before March 2009.

Vinit Tulsyan http://vinittulsyan.wordpress.com

2 Dubai Fears – Collateral Damage… A catalyst for Market Re-Pricing – Time to Move On…

Basically in my opinion markets across countries and investment avenues has started

to feel uncomfortable to this huge liquidity which has made its ways to all asset

classes across all emerging markets.

Now is the time when the investors will start looking at fundamentals, which in my

opinion will push the market higher

One thing this crisis has further ensured that all the debate going on about

withdrawing stimulus (mainly in emerging markets will take a pause for not,

pushing equities even higher)

In my opinion, going forward (may be beginning of next year), INFLATION remains

the biggest risk to our Indian market, and I firmly believe ‘INFLATION’ has the ability

to kill any bull market rally in equities (which currently is undergoing). Inflation is a

dangerous word and with the ease Central Bank of India induced liquidity (in all

forms i.e., Fiscal or Monetary) following world economic crisis, am sure the pace of

withdrawing these will not be similar to the face at which these were induced, but

still with the kind of expectation about INFLATION, market participants are having, I

feel this will prove to be a dampener in equity market rally going forward (not

now).

What happened?

On Wednesday, 25 November,

the government of Dubai said

that its investment holding

company, Dubai World, which

owns a vast portfolio of

businesses worldwide, is being

"restructured" with immediate

28th November, 2009

effect. The objective of the

restructuring is to "address

financial obligations" and

"ensure the continuity" of the company's operations. The government also announced that

it will ask all creditors of Dubai World to agree to a debt "standstill" during the restructuring

and to extend maturities to "at least 30 May." The announcement is not a default yet

because payment is only due on 14 December 2009 of a bond held by one of Dubai World's

Vinit Tulsyan http://vinittulsyan.wordpress.com

3 Dubai Fears – Collateral Damage… A catalyst for Market Re-Pricing – Time to Move On…

subsidiaries (see below). But, the announcement has already led to a rise in CDS spreads and

resulted in multiple-notch downgrades overnight of several Dubai-based entities by S&P's

and Moody's. (Source – UBS)

Snapshot of the United Arab Emirates; The story is not going to go away easily

small countries combined together and immediately…

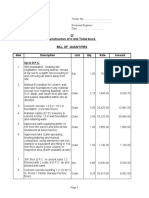

Dubai World (debt maturity schedule)

Entity Maturity Date In Billion

Nakheel 14-Dec-09 $3.5

Limitless 21-Mar-10 $1.2

Nakheel 13-May-10 $1.0

Dubai World 19-May-10 $2.1

Nakheel 11-Jan-11 $1.2

Dubai World 19-Jun-11 $2.4

Palm District Cooling 20-Jul-11 $0.5

Port, Free Zone World 29-Sep-11 $1.0

Dubai Drydocks 11-Oct-11 $1.7

Total $14.6

Source: CNBC

The story is not going to go away easily and immediately… Do not know from where the

next bomb would be dropped?

W orld's Biggest Debtor Nations

Country GDP (2008) Gross External Debt (US$) External Debt (GDP%) External Debt /Capita

United States $14.26 trillion 13.4 tn. (2009 Q2) 94.3% $43,793

Hungary $196.6 billion 207.9 bn. (2009 Q1) 105.7% $20,990

Australlia $800.2 billion 891.3 bn. (2009 Q2) 111.3% $41,916

Italy $1.823 trillion 2.3 tn. (2009 Q1) 126.7% $39,741

Greece $343 billion 552.8 bn. (2009 Q2) 161.1% $51,483

Spain $1.403 trillion 2.4 tn. (2009 Q2) 171.7% $59,457

Germ any $2.918 trillion 5.2 tn. (2009 Q2) 178.5% $63,263

Finland $193.5 billion 364.9 bn. (2009 Q2) 188.5% $69,491

Sweden $344.3 billion 669.1 bn. (2009 Q2) 194.3% $73,854

Norway $275.4 billion 548.1 bn. (2009 Q2) 199.0% $117,604

Hong Kong $306.6 billion 631.1 bn. (2009 Q2) 205.8% $89,457

28th November, 2009

Portugal $236.5 billion 507.0 bn. (2009 Q2) 214.4% $47,348

France $2.128 trillion 5.2 tn. (2009 Q2) 236.0% $78,387

Austria $329.5 billion 832.4 bn. (2009 Q2) 252.6% $101,387

Denm ark $203.6 billion 607.4 bn. (2009 Q2) 298.3% $110,422

Belgium $389.0 billion 1.2 tn. (2009 Q1) 320.2% $119,681

Netherlands $672.0 billion 2.4 tn. (2009 Q2) 365.0% $146,703

United Kingdom $2.226 trillion 9.1 tn. (2009 Q2) 408.3% $148,702

Switzerland $316.7 billion 1.3 tn. (2009 Q2) 422.7% $176,045

Ireland $188.4 billion 2.4 tn. (2009 Q2) 1267.0% $567,805

Source: CNBC (http://www.cnbc.com/id/30308959/)

Vinit Tulsyan http://vinittulsyan.wordpress.com

4 Dubai Fears – Collateral Damage… A catalyst for Market Re-Pricing – Time to Move On…

Global Islamic Bond Issuance Investment/Loan scattered across banks

Largest Foreing Banks invested in UAE (Loan 2008)

Sr. No. Bank In Billion

1 HSBC $17.0

2 Standard Chartered $7.8

3 Barclays $3.6

4 Royal Bank of Scotland $2.2

5 Arab Bank $2.1

6 CITI Group $1.9

7 Bank of Baroda (India) $1.8

8 Bank Saderat Iran $1.7

9 BNP Paribas $1.7

10 Lloyds Banking Group $1.6

Total 41.43

Source: CNBC

Source: CNBC, Deallogic

Markets to become more global (closely following each other)

My conviction over no countries being de-

ChangeinSovereignCDSLevelsinlast2days

coupled (barring USA, which provides the

Country Current WED. Close

direction to world markets rather than

AbuDabhi 185.0 138.8

following them) in today’s’ world gets

Dubai 675.0 435.0

stronger following this DUBAI CRISIS. And Lavita 616.3 500.0

this leaves emerging markets in more of Ukraine 29.4 28.5

weaker spot. Every time debate grows over Source: CNBC- Note: CDS- CreditDefaultSwap

emerging markets leading the global

markets out of the global economic/financial meltdown, some events arises, which takes a

toll on this debate.

Though INDIA & CHINA is to a larger extent insulated from these events, but this globalized

world does not leave any one and this is evident from the financial markets crash over the 28th November, 2009

last two days i.e., Chinese main index Shanghai Composite down over 6% and India’s NIFTY

down better than 3%.

The Potential Risk (Commercial RE) BUT am confident that there is nothing material in it…

After the financial crisis following CDS bubble in housing market and then subsequent

downturn in all parts of economy, many have been raising fear since last few months that

Vinit Tulsyan http://vinittulsyan.wordpress.com

5 Dubai Fears – Collateral Damage… A catalyst for Market Re-Pricing – Time to Move On…

though housing market might have bottomed out in US, employment beginning to

stabilize (as reflected through jobless claims – a more leading indicator), decent reporting

by retail companies, a revival in technology sector with tech companies leading this revival,

increased M&A activities etc., one area which market participant feel is still not out of

woods is “COMMERCIAL REAL ESTATE”, and the next downturn will be led by a bust in

commercial market. Though I feel (am not an expert on commercial real estate either in

US, Europe, Middle East or emerging markets), if any bust kind of scenario had to happen,

which could have a ripple effect across markets and investment avenues for a longer

period of time, it would have happened during Oct’08 – Mar-09 (the worst time for

economies, companies, financial markets across globe), when things were just not UGLY

but turned UGLIEST. My view is more based on the PSYCHOLOGICAL aspect because of the

fact that things were just too bad during those six months, when liquidity was not there,

people were trying to find a faulty point out of any good news coming to markets. I just do

not think that things can worsen any where closer to the levels prevailing during those

times.

Markets finding optimism within Dubai pessimism

October 2009 – March 2010 (the worst ever period for all investment avenues, countries,

corporate world around the globe) is over, and during these period, thing were just not

ugly but turn ugliest where everyone tried to first find the bad news out of any good news,

which came during these period.

Now things have drastically turned and “OPTIMISM” is the word which has taken the

centre-stage, and now everyone is trying to find good stuff out of this bad news, which is:

This amount of total Dubai debt component is just miniscule (from a broader

28th November, 2009

perspective)

This debt exposure are scattered across banks with European banks leading the pack,

so there is no chance of any major financial institution going bust due to this crisis.

Abu Dabhi will come to Dubai rescue as it has done a number of times in the past,

though this time around Abu Dabhi is scouting for a hard bargain and one in my

Vinit Tulsyan http://vinittulsyan.wordpress.com

6 Dubai Fears – Collateral Damage… A catalyst for Market Re-Pricing – Time to Move On…

opinion this time it will just not be routine rescue but a lot of collateral will be

exchanged for this rescue.

Going Forward…

I believe markets would forget this story in a day or two and this story will again be in focus

around 14th December 2009, when a US$ 3.5 billion payout is due from NAKHEEL. Now is the

time, in which I believe that no country or major financial institution (TOO BIG TO FAIL,

though the debate on too big to fail will continue) is going to go bust, and even if there are

symptoms of these, a larger concentrated and coordinated move will be taken by respective

countries. This belief stems from my confidence that no country and political party would

just want to spoil the credibility (due to PESSIMISM turning in OPTIMISM since the crisis

occurred) they have been have to gather. And they know that any event of such kind could

well have a catastrophic effect across financial markets and the credibility or the optimism

which was built over last 1 year would not even take seconds/hours to fade away.

I remain confident that Markets (EQUITIES, OIL, COMMODITIES, and GOLD) would be higher

than today’s level by the time December is over and we start New Year on the back of

starting of capital expenditure cycle by corporate world around the globe. As inventories

goes down, new capacity additions takes place, employment number starts looking better,

retail consumptions returns to normalcy, all these will support the financial market around

the globe.

Though the same cannot hold true for USD, which in my opinion will continue its slide but

the slide would be drastic against other major currencies i.e., POUND, EURO, YEN etc. due to

the similar deficit situation prevailing in European Zone, Japan as it is in USA. One thing I am

absolutely confident about the DOLLAR will depreciate drastically against CHINESE YUAN (if

china allows its currency to be re-valued) due to not so bad fiscal imbalance in China. In

Indian context, Indian Rupee might appreciate but not by a large magnitude due to larger

28th November, 2009

fiscal imbalances in INDIA (in comparison to CHINA).

Thanking You,

Warm Personal Regards,

Vinit Tulsyan

http://vinittulsyan.wordpress.com/

Vinit Tulsyan http://vinittulsyan.wordpress.com

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- SWOT AnalysisDokumen6 halamanSWOT AnalysisSSPK_92Belum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- 1.2 The Main Components of Computer SystemsDokumen11 halaman1.2 The Main Components of Computer SystemsAdithya ShettyBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Qa-St User and Service ManualDokumen46 halamanQa-St User and Service ManualNelson Hurtado LopezBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- WhatsNew 2019 enDokumen48 halamanWhatsNew 2019 enAdrian Martin BarrionuevoBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Dokumen6 halamanType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- LISTA Nascar 2014Dokumen42 halamanLISTA Nascar 2014osmarxsBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Giuliani Letter To Sen. GrahamDokumen4 halamanGiuliani Letter To Sen. GrahamFox News83% (12)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Typical World Coordinates Are: Pos X-Axis Right Pos Y-Axis Back Pos Z-Axis UpDokumen2 halamanTypical World Coordinates Are: Pos X-Axis Right Pos Y-Axis Back Pos Z-Axis UpSabrinadeFeraBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Supply Chain Risk Management: Resilience and Business ContinuityDokumen27 halamanSupply Chain Risk Management: Resilience and Business ContinuityHope VillonBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Dokumen6 halamanPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanBelum ada peringkat

- Effect of Internet Use To Academic PerformaceDokumen4 halamanEffect of Internet Use To Academic PerformaceLeonard R. RodrigoBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Questionnaire: ON Measures For Employee Welfare in HCL InfosystemsDokumen3 halamanQuestionnaire: ON Measures For Employee Welfare in HCL Infosystemsseelam manoj sai kumarBelum ada peringkat

- MNO Manuale Centrifughe IngleseDokumen52 halamanMNO Manuale Centrifughe IngleseChrist Rodney MAKANABelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Tecplot 360 2013 Scripting ManualDokumen306 halamanTecplot 360 2013 Scripting ManualThomas KinseyBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- SDM Case AssignmentDokumen15 halamanSDM Case Assignmentcharith sai t 122013601002Belum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- SKF LGMT-2 Data SheetDokumen2 halamanSKF LGMT-2 Data SheetRahul SharmaBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Colibri - DEMSU P01 PDFDokumen15 halamanColibri - DEMSU P01 PDFRahul Solanki100% (4)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Government of India Act 1858Dokumen3 halamanGovernment of India Act 1858AlexitoBelum ada peringkat

- Sappi Mccoy 75 Selections From The AIGA ArchivesDokumen105 halamanSappi Mccoy 75 Selections From The AIGA ArchivesSappiETCBelum ada peringkat

- Solutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1Dokumen16 halamanSolutions To Questions - Chapter 6 Mortgages: Additional Concepts, Analysis, and Applications Question 6-1--bolabolaBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rundown Rakernas & Seminar PABMI - Final-1Dokumen6 halamanRundown Rakernas & Seminar PABMI - Final-1MarthinBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Annotated Portfolio - Wired EyeDokumen26 halamanAnnotated Portfolio - Wired Eyeanu1905Belum ada peringkat

- R 18 Model B Installation of TC Auxiliary Lights and WingletsDokumen29 halamanR 18 Model B Installation of TC Auxiliary Lights and WingletsAlejandro RodríguezBelum ada peringkat

- HW4 Fa17Dokumen4 halamanHW4 Fa17mikeiscool133Belum ada peringkat

- The April Fair in Seville: Word FormationDokumen2 halamanThe April Fair in Seville: Word FormationДархан МакыжанBelum ada peringkat

- 1 s2.0 S0304389421026054 MainDokumen24 halaman1 s2.0 S0304389421026054 MainFarah TalibBelum ada peringkat

- Triplex (Triple Full Free Panoramic) Mast (5M15D To 5M35D) : Structure and FunctionDokumen2 halamanTriplex (Triple Full Free Panoramic) Mast (5M15D To 5M35D) : Structure and FunctionMaz Ariez EkaBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Nguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceDokumen14 halamanNguyen Dang Bao Tran - s3801633 - Assignment 1 Business Report - BAFI3184 Business FinanceNgọc MaiBelum ada peringkat

- Computer System Sevicing NC Ii: SectorDokumen44 halamanComputer System Sevicing NC Ii: SectorJess QuizzaganBelum ada peringkat

- Elb v2 ApiDokumen180 halamanElb v2 ApikhalandharBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)