Application of Decision Sciences To Solve Business Problems - Marketelligent

Diunggah oleh

MarketelligentJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Application of Decision Sciences To Solve Business Problems - Marketelligent

Diunggah oleh

MarketelligentHak Cipta:

Format Tersedia

Application of Decision Sciences

to Solve Business Problems

Retail Industry

Analytics

for Retail

Merchandising

Store-layout Planning

Effective macro space planning is critical for consumers to have a favourable perception about the stores

environment and to increase sales throughput. Store layout planning shows the size and location of each

department, permanent structures, fixture locations, merchandizing and overall aesthetics in order to

maximise revenue, increase consumer footfalls and conversion rates.

Store layout includes category space allocations and adjacencies in order to optimize overall sales and

footfalls.

It helps in answering business questions like:

Which departments will produce the highest traffic? Which departments should be placed adjacent?

Where different departments should be spaced to facilitate the deepest penetration and widest

dispersion of consumer flow throughout the store?

Where different categories should be placed so as to have maximumimpact on consumers?

Where the seasonal items should be placed?

House Hold Laundry

Party Needs

Toiletries

Crisps & Snacks

Confectionery

Pet Foods

Beverages Cookies

Stationary

Magazines

Cereals

Milk Juices

Cosmetics

Cakes

Soft Drinks

Bakery Items

Fish & Meat Grocery

Sauce Pickle Canned-Soup Canned-Vegetables

Baskets

B

a

s

k

e

t

s

Beer Stacks

Chilled Beers & Wines

Red & White Wines Beers & Cigars

D

a

i

r

y

P

r

o

d

u

c

t

s

F

r

o

z

e

n

F

o

o

d

RTE Food

Vegetables Fruits

Entr

anc

e

Stairs

C

o

u

n

t

e

r

1

C

o

u

n

t

e

r

2

C

o

u

n

t

e

r

3

Store layout designed for a leading supermarket

Merchandising

Assortment Optimization and Planogramming

Different products and SKUs within a category are assorted based on their profit and revenue contribution

and local consumer preferences. It can be assorted for a store cluster or localized at an individual store level.

Dividing the products intocore/destination (drive the store sales), complementary/accessory (add-on items

for core products), secondary items (not core, but have the potential to develop over time) and impulse

itemsalso serves as the basis for assortment.

Once the right assortment has been decided for each category, the next logical step is placing them in the

most effective manner on the shelf. Planogramming is a widely used technique for the same. It enables the

retailers to stock the product, at the right place, at the right time, with the right facing to attract the

consumers and prompt them to buy.

Category1

Category2

Category3

Category4

Category5

Category6

Category7

Shelf space allocation for categories based on incremental revenue per unit space

1

2

3

5

6

4

X

Y

MINIMUM MAXIMUM

Marginal Space Allocated (%)

M

a

r

g

i

n

a

l

S

a

l

e

s

(

%

t

o

t

h

e

A

v

g

.

S

a

l

e

s

Supply Chain

Sales Forecasting

A good demand forecast helps improve sales volume, cash flow and hence the profitability, by optimizing

inventory and by minimizing out-of-stock. Besides considering historical data, external factors like changing

trends and consumer preferences, seasonal impact and promotion influences on demand, price changes,

different store formats and channels are also considered for more accurate forecasts. Sales forecast in retail

is very essential for:

Stock replenishment by categories and SKUs

Predicting excess and stock-outs at SKU level and hence minimizing costs

Designing store promotion activities and optimizing resource allocation for the same

Capitalizing on peak sales weeks: Accurate forecasting ensures right product mix to take full advantage of

operational capacity and peak market demands

Statistical techniques (like Moving averages, Holt Winters, Regression, ARIMA, etc.) are employed to project

future demand on a category and SKU level, based on historical data.

0.0

1.0

2.0

3.0

4.0

5.0 Actual Sales Forecasted Sales Base Line Sales

M

i

l

l

i

o

n

c

a

s

e

s

s

o

l

d

Supply Chain

Lead time : It is the time lag between

when the order is placed and the point at

which the stocks are available; A lead

time of 4 days implies that there should

always be stock for 4 days supply to avoid

stock-out scenario

Safety stock is the buffer quantity to

cover any unplanned excess requirement

taking into account delivery delays

Reorder point is the minimum level of

stock at which procurement should be

triggered and quantity of warehouse

stock should never go below this point

If the quantity of warehouse stock is less

than re-order point, there is shortfall

Stock

Time Release date

Safety

Stock

Reorder point

Availability date

Lot size

Replenishment

lead time

Inventory Management

Optimal inventory management is an indispensable function to ensure un-interrupted product supply to

meet the consumer demand. Stock out analysis on a category and SKU level helps in:

Optimizing inventory and service levels by streamlining ordering processes

Minimizing stock out which leads to loss of sales

Handling overstock which results in increased inventory handling costs and cost to liquidate the excess

inventory

Maximizing warehouse space utilization

Designing store promotion activities and optimizing resource allocation

Concepts of lead-time and re-order point are utilized for inventory planning. Lead time is the time lag at

which order is placed to the point at which stocks are available. The buffer quantity to cover any unplanned

excess requirement, taking into account delivery delays, is referred to as safety stock. Providing for safety

stock, on top of lead time demand, will give the re-order point, which is the minimal level of stock at which

procurement should be triggered. Warehouse stock should never go below the re-order point. Re-order point

will assist in deciding what would be the optimal order quantity and when to place an order.

Supply Chain

Vendor Management

For the efficient and smooth functioning of a retail store, various departments have to work in tandem.

Mostly these day to day operations are outsourced to vendors. Constant monitoring and evaluation of

vendors is necessary to maintain the smooth functioning of different departments. It enables to control

costs, drive service excellence and mitigate risks to gain increased value fromtheir vendor by:

Minimizing potential business disruption

Avoiding deal and delivery failure

Ensuring more-sustainable multi-sourcing, while driving most value fromthe vendors

Improving operational efficiencies, control costs and planning of workforce

Partner Strategic Fit Brand Equity Financial Health

Ability to

operationalize

Final Score Status

Vendor 1 9 8 10 7.4 8.75 Pass

Vendor 3 10 9 8 7.4 9.00 Pass

Vendor 3 10 7 6 7.4 7.50 Pass

Vendor 4 10 10 8 10.0 9.50 Underleveraged

Vendor 5 9 7 8 7.4 7.75 Pass

Vendor 6 2 7 6 8.2 5.50 Risky

Vendor Filtration Methodology & Process Flow

It includes vendor identification,

recruitment, monitoring, tracking and

evaluating the vendors on certain KPIs like:

Pricing: Competitive pricing

(comparable to other vendors), stability

(low variance), advance notice of price

changes

Quality: Compliance with purchase

order, conformity to specifications,

reliability (rate of product failures),

durability, support, warranty

Delivery: Time, quantity, lead time,

packaging, emergency delivery,

technical support

Marketing

Loyalty Analytics

In todays competitive business scenario with consumers having a multitude of options, their preferences &

buying patterns have been constantly evolving. It is necessary for retailers to gain insights into changing

consumer trends & accordingly tailor their offerings.

CRM analytics helps analyse consumers transactional and others behavioural patterns to facilitate optimal

decisions regarding marketing strategies.

It helps the business to:

Identify consumer segments based on demographic, psychographic and purchase behaviour. Design

customized product offerings and marketing strategies relevant for each of these consumer segments.

Track these segments over time to study how the industry is evolving.

Closely track and maintain constant touch-point with your most profitable & loyal consumer segments.

Identify any signs of attrition in advance and accordingly formulate the right retention strategy

Formulate cross-selling and up-selling strategies by analysing product affinities & associations. Identify

the consumer segments which can be targeted for the same. This helps in increasing overall revenue

contribution from the same customer base.

They are frequent

visitors and prefer

brewed coffee

They visit mostly

during weekends, to

sip their coffee over an

enjoyable experience

of a football game or a

live concert

These consumer have

no set routines, and

visit during lunch

hours on weekdays,

and prefer not to be

disturbed over their

discussion. Cappuccino

is their preferred drink

They come generally

for the desserts &

smoothies, visit usually

during evening hours

Coffee Junkies

Entertainment

Seekers

Business over

Coffee

The Sweet Tooth

16,000 consumers

(37.2%) - $178

12,000 consumers

(28%) - $60

8,000 consumers

(18.6%) - $125

7,000 consumers

(16.2%) - $29

M T W T F S S M T W T F S S M T W T F S S M T W T F S S

Mor Aft Eve Mor Aft Eve Mor Aft Eve Mor Aft Eve

Consumer segments for a leading organized retail caf chain

Marketing

Pricing Analysis

Pricing strategies are crafted to meet two key objectives: profit and revenue maximization. It helps in

identifying the best pricing strategy for a retailer. Price optimization enables retailers evaluate cost,

assortment, margin targets and promotions. It employs predictive modeling techniques for:

Evaluating price elasticity for their private labels and deciding the optimal price points

Identifying price gaps/thresholds to decide the optimal price points and associated discounts for

different brands and SKUs while maximizing category sales

Determining base, promotion, markdown and discount prices

Identify price thresholds by brands Optimum price corridor for retailers own label

53.2

44.0

30.4

20.4

19.1

18.3

0

10

20

30

40

50

60

70

0

5

10

15

20

25

30

35

$0.90

to

$0.98

$0.99 $1.00

to

$1.08

$1.09 $1.10

to

$1.18

$1.19 $1.20

to

$1.28

$1.29 $1.30

to

$1.38

$1.39 $1.40

to

$1.48

$1.49

% ACV Brand A sales rate

0

10

20

30

40

50

60

70

80

90

100

110

120

W

k

- 1

( ' 0

9

)

W

k

- 4

( ' 0

9

)

W

k

- 7

( ' 0

9

)

W

k

- 1

0

( ' 0

9

)

W

k

- 1

3

( ' 0

9

)

W

k

- 1

6

( ' 0

9

)

W

k

- 1

9

( ' 0

9

)

W

k

- 2

2

( ' 0

9

)

W

k

- 2

5

( ' 0

9

)

W

k

- 2

8

( ' 0

9

)

W

k

- 3

1

( ' 0

9

)

W

k

- 3

4

( ' 0

9

)

W

k

- 3

7

( ' 0

9

)

W

k

- 4

0

( ' 0

9

)

W

k

- 4

3

( ' 0

9

)

W

k

- 4

6

( ' 0

9

)

W

k

- 4

9

( ' 0

9

)

W

k

- 5

2

( ' 0

9

)

W

k

- 3

( ' 1

0

)

W

k

- 6

( ' 1

0

)

W

k

- 9

( ' 1

0

)

W

k

- 1

2

( ' 1

0

)

W

k

- 1

5

( ' 1

0

)

W

k

- 1

8

( ' 1

0

)

W

k

- 2

1

( ' 1

0

)

W

k

- 2

4

( ' 1

0

)

W

k

- 2

7

( ' 1

0

)

W

k

- 3

0

( ' 1

0

)

W

k

- 3

3

( ' 1

0

)

W

k

- 3

6

( ' 1

0

)

W

k

- 3

9

( ' 1

0

)

W

k

- 4

2

( ' 1

0

)

W

k

- 4

5

( ' 1

0

)

W

k

- 4

8

( ' 1

0

)

W

k

- 5

1

( ' 1

0

)

W

k

- 2

( ' 1

1

)

W

k

- 5

( ' 1

1

)

W

k

- 8

( ' 1

1

)

W

k

- 1

1

( ' 1

1

)

W

k

- 1

4

( ' 1

1

)

W

k

- 1

7

( ' 1

1

)

W

k

- 2

0

( ' 1

1

)

W

k

- 2

3

( ' 1

1

)

W

k

- 2

6

( ' 1

1

)

W

k

- 2

9

( ' 1

1

)

W

k

- 3

2

( ' 1

1

)

W

k

- 3

5

( ' 1

1

)

W

k

- 3

8

( ' 1

1

)

W

k

- 4

1

( ' 1

1

)

W

k

- 4

4

( ' 1

1

)

W

k

- 4

7

( ' 1

1

)

W

k

- 5

0

( ' 1

1

)

Price index vs. competition Volume share

Optimum price corridor

Marketing

Consumer & Trade Promotions

Trade promotions and consumer promotions refer to different marketing activities implemented in the store,

to increase footfalls and to drive sales and profit. The most commonly implemented programs are features,

in-store displays, TPRs (temporary price reductions), couponing and loyalty reward programs.

Advanced econometric modeling techniques are used to help stores refine their promotion strategies, to

understand the lift generated by various promotional programs for different categories and the associated

ROI. This information is then used by marketers to:

Optimally allocate budget among different promotion vehiclesfeatures, displays, TPRs and couponing

while increasing category sales and maximizing ROI

Optimally allocate budget for different brands as per their revenue and profit contribution

Design programs specific to a category instead of following one-size fits all approach

0%

10%

20%

30%

40%

50%

60%

70%

80%

0% 5% 10% 15% 20% 25% 30% 35% 40% 45%

TPR Only

Feature Only

Display Only

Feature & Display

I

m

p

a

c

t

o

n

V

o

l

u

m

e

S

h

a

r

e

Level of Discount

0%

5%

10%

15%

20%

25%

30%

TPR Feature Display Feature & Display

R

O

I

Promotion program Spends

Elasticity curve to quantify the sales impact for each promotion Evaluate ROI from different promotion programs

Streaming Sales Data

fed weekly or monthly

as is available

Promotion Calendar fed

into the system

periodically

Marketelligent

PRISM

Display

Feature

Consumer

TPR

Decomposed Lift ()

Marketing

Real-time evaluation of promotions

Marketelligent has developed an in-house proprietary tool called PRISM, for continuous monitoring and

evaluation of trade and consumer promotions on a real time basis, using the test-control approach.

Identifying the control samples for each of the test group takes most of the time and effort. PRISM

minimizes the time required for the same and identifies the control samples on a real time basis, based on

historical sales trends and outlet demographics.

PRISM uses sales in test and control outlets, to calculate the lift factor for each or combinations of trade

promotion programs. Based on the lift factor, incremental sales and ROI are calculated for each activity. The

effectiveness of promotions can be compared at different levels channels, categories, brands and markets.

Marketing

Market Mix Modeling

Usually for marketing, retailers utilize radio, magazines, newspapers and outdoor for creating awareness.

Market mix modeling helps managers develop an optimal media investment strategy that provides the

required sales lift and also maximises the returns on investment by media vehicle.

The model aids in:

Establishing key relationships between sales and marketing driver inputs

Quantifying impact of each marketing driver on sales

Optimizing allocation spends across media vehicles to maximise sales

Calculating saturation spends for each media vehicle based on diminishing returns

Evaluating decay impact, if any, for each of the media vehicles (also called ad-stock)

Decompose sales into baseline and incremental Evaluate ROI from each media vehicle

R

O

I

i

n

c

r

e

m

e

n

t

a

l

v

o

l

u

m

e

S

p

e

n

d

s

i

n

U

S

D

J

a

n

0

9

F

e

b

0

9

M

a

r

0

9

A

p

r

0

9

M

a

y

0

9

J

u

n

0

9

J

u

l

0

9

A

u

g

0

9

S

e

p

0

9

O

c

t

0

9

N

o

v

0

9

D

e

c

0

9

J

a

n

1

0

F

e

b

1

0

M

a

r

1

0

A

p

r

1

0

M

a

y

1

0

J

u

n

1

0

J

u

l

1

0

A

u

g

1

0

S

e

p

1

0

O

c

t

1

0

N

o

v

1

0

D

e

c

1

0

0

100

200

300

400

500

600

700

800

900

0

2

4

6

8

10

12

14

16

18

20

2%

4%

6%

8%

10%

12%

14%

Total Spends Radio spend Newspaper spend Outdoor spend

Baseline sales Online incr. sales TV incr. sales Daily incr. sales

Online spend TV spend Dailies spend

R

O

I

Marketing

Market Basket Analysis

Market basket analysis is done to evaluate consumers purchasing behaviour and to identify the different

items bought together in the same shopping session. It uses stores transactional data and is leveraged for

creating cross-selling opportunities for furthering sales.

It aids retailers in:

Product placements--Which products should be placed next to each other

Customizing layouts, assortments and pricing, to the local demographic

Affinity promotion--Designing more profitable and effective consumer promotions like couponing based

on associated products

Increase the profit fromsales of complementary products, which do not sell by themselves

Stimulate trials and increase consumer awareness during launch of new products and variants

Handling excess stock by designing offers among associated products

Support, Confidence and Lift are used to identify the combination of products consumers buy together most

often.

CONFIDENCE Product 1 Product 2 Product 3 Product 4 Product 5 Product 6 Product 7 Product8

Product 1 100% 25% 9% 6% 18% 2% 28% 31%

Product 2 42% 100% 7% 8% 22% 6% 29% 22%

Product 3 31% 16% 100% 5% 10% 4% 18% 17%

Product 4 35% 29% 8% 100% 28% 7% 26% 12%

Product 5 47% 35% 8% 12% 100% 3% 37% 24%

Product 6 37% 66% 18% 19% 21% 100% 25% 21%

Product 7 45% 28% 8% 7% 23% 2% 100% 25%

Product 8 57% 24% 9% 3% 17% 2% 29% 100%

Probability that Product 8 is purchased given that Product 1 is bought is 31%

Probability that Product 1 is purchased given that Product 8

is bought is 57%

Increasing sales by creating cross-selling opportunities using MBA

Fraud detection & Loss prevention

Fraud and shrinkage is one of the most common challenges faced by retailers resulting in financial and

consumer trust loss. It can originate with consumers, employees, or external sources. Different types of fraud

include credit-card fault, fraudulent merchandise returns and shrinkage due to shoplifting, embezzlement

and human error.

Predictive modeling helps in identifying unusual patterns of purchase and product movements that can help

detect fraud and shrinkage. It also helps narrow down the categories and sale seasons that are most

sensitive to fraudulent behaviour. The retailer can then take extra precautions to safeguard against loss

among these sensitive categories and shopping periods.

Fraud Multiplier by Industry

Store

Operations

0 5

1.9

2.0

2.0

2.2

2.3

2.3

2.3

2.6

2.8

2.9

3.1

3.3

3.4

2.3

0 1 1 2 2 3 3 4 4 5 5

Housingwares/Home Furniture

Automotive/Motor Vechile and Parts

Telecommunications or data service

Flowers/Gifts/Jewelry

Sporting Goods

Computer/Electronics/Software

Books/CDs/Videos/DVDs/Music

Textiles/Apparel/Clothing

Drug/Health & Beauty

Office Supplies

General Merchandise Stores

Hardware/Home Improvement

Toys/Hobbies

Total

Fraud Multiplier

Category Sales Reporting & Analysis

Constant tracking of sales and regular reporting helps the sales force analyse category sales so that they can

have an action plan before the next sales cycle starts. Also, it serves as the base for formulating sales

strategies.

It helps in:

Identifying which categories, products and SKUs are selling the most in the store

Analysing consumer preferences and buying patterns in the store

Evaluating growth potential for product portfolio (categories, brands and SKUs)

Planning and managing store promotions

Evaluating the performance of the store by categories and SKUs on a regular basis

Enabling root-cause analysis in case of sales/profit decline: help identify the epicentre and rectify the

same

-1%

2%

4%

-5%

1%

-1%

8%

-8%

1%

-1%

6%

-5%

10%

18%

22%

50%

Color cosmetics

Skin Care

Personal Care

Hair Care

Current Month

Market Share

YTD Market

Share Change

YOY Market

Share Change

3 month MOM

Market Share Change

55%

0.1%

0.3% 0.4% 1.0%

3.2%

50%

12%

32%

52%

YTD'11 Company1 Company2 Company3 Company4 Company5 YTD'12

Narrowing down on share loss within Hair Care category

52%

4.1%

1.1%

0.3%

8.7%

48%

30%

45%

60%

YTD'11 Brand1 Brand2 Brand3 Brand4 YTD'12

Further narrowing down on the brand(s) causing the share loss

Store

Operations

Workforce Analytics

Sales force, for a retailer is an equally important asset as the product that they sell. A good, experienced

sales force yields higher consumer satisfaction and hence increased sales. It is therefore critical to optimize

the employee recruitment, training and supervising process. Retailers can use analytics to increase

productivity and can help enable an effective and sustainable retail workforce.

The advantages of work force analytics include:

Acquisition of talent- identifying the most effective employee attributes

Skill set mapping- placing employees in the ideal role based on their capabilities

Talent building- recognizing employee training needs in key skills and ensuring all employees meet store

standards

Improve scheduling effectiveness- based on predictions of when and where consumers are most likely to

shop, analytics can help schedule the most-productive employees appropriately

Retention- by understanding the key risk factors that drive attrition, employers can preemptively

mitigate these risks.

Improve safety- detect the underlying causes to workplace accidents and rectify

Store

Operations

Tracking work-force effectiveness & its impact on revenue

Opening of newstores

Site selection is crucial to a retailer and identifying the ideal location to open a new store has to be a

strategic decision.

Integrating census data, which provides population and income data, along with survey data, providing

demographic, psychographic and competitor store data, and financial data will give the retailer a better

understanding on areas with the greatest potential. With this information, a strategic model can be built,

which can help determine the best sites and best strategy for that area.

This process helps retailers identify:

The ideal location for the stores

The type of store format that is needed in a specific instance

Whether to remodel or not

What merchandising approach to adopt

Strategy &

Planning

Identifying the optimum location for a retailer

Tracking Overall Performance

Retailers need to get a birds eye view on changing business conditions and emerging trends, and growth

potential based on the sales and profits earned from their stores and categories. Accordingly they can adjust

plans and forecasts to meet the new challenges and opportunities.

This requires a close monitoring and tracking process of the sales and financial measure of the overall market

and then correlating it with the individual store performance.

It helps retailers:

Analyse market trends and buying patterns in the retail industry and identify the gaps and opportunities

Evaluate and benchmark store performance on key metrics like traffic counts, conversion rate, sales per

square feet and sales per employee

Track sales activity for all outlets by region/sub-region/category

Identify profitable categories in various regions

Monitoring & tracking performance across outlets

Strategy &

Planning

Sales Performance:

Store Clustering

Retailers need to customize their product and service offering to meet the taste and preferences to diverse

cultural and demographic consumer segments. Implementing strategies at an outlet level will be

operationally difficult to manage, while an overall promotional campaign and strategy for all outlets, despite

being operationally more feasible will not be able to meet localized consumer needs. To counter this issue,

retailers need to identify stores that exhibit similar demographics, locational proximity, personal income and

shopping behaviours of local consumers and device a localized approach to run their marketing activities.

Cluster analysis uses loyalty card transaction data and survey data to identify similar stores that form a

cluster based on shopper demographic data and their shopping patterns. The retailer is then able to tailor

specific promotional campaigns, assortment, planogramming, pricing and promotion strategies, store

formats, layouts for servicing each of the identified clusters. This garners the retailer better returns on their

strategies since it is more focused to shopper needs and increases consumer satisfaction due to the

personalized approach.

Store clusters for a leading mass retailer in the US

Strategy &

Planning

Strategy &

Planning

Key Value ItemAnalysis

A few SKUs have a disproportionate impact on consumer price-value perception and can cause consumers to

switch stores when those SKUs are not priced appropriately. These price sensitive items are known as Key

Value Items, or KVIs. A retailer can use this knowledge to have a significant control over the items perceived

price image and thus regulate the stores image by carefully fixing the everyday pricing and the promotional

pricing.

Key Value Item Analysis blends behavioral data (sales, household penetration, purchase frequency) and

attitudinal data (consumer awareness of product, accurate price recall, price differential across similar

retailers). The KVIs are identified across categories based on revenue coverage, price sensitivity, sales

volume, and the role and prevalence of the item in the market basket.

By managing true KVIs through aggressive pricing, promotions, wide range availability and correct placement,

retailers will be able to:

Influence consumers overall perception of the store

Drive sales and footfalls

Gain market share

Factors

determining

a KVI

Sales

Volume

Price

Sensitivity

Revenue

coverage

S

a

l e

Price

Role & Presence

in Market Basket

Price differential

across retailers

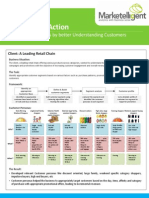

Business Situation:

The client, a leading retail chain offering various products across categories, wanted to understand its customers to better plan customized

campaigns and promotions with the objective of increasing customer engagement and overall revenues.

The Task:

Identify appropriate customer segments based on various factors such as purchase patterns, promotion response and demographics of the

customers.

Framework:

Customer Personas:

Analytics in Action

Increasing Revenues by better Understanding Customers

Client: A Leading Retail Chain

Define & Build

customer segments

Segment analysis Customer profile

Identified an appropriate

customer base based on the #

of visits and days on books

Built customer segments using

clustering algorithms after

treating the outliers

Analyzed the segments and

identified the customer

personas in each segment

Got a detailed profile of

customer in a segment to

target for promotion

Who?

What?

When?

70% sales

from FMCG &

Staples

Early morning

Weekend

Early Morning

Weekend Shoppers

Large family

High visits

60% sales

from FMCG &

Staples.

Multi-

category

shopping

Afternoon to

Evening

High sales, large

family shoppers

Salaried

staples

shoppers

70% sales

from Staples

Shops in rice,

oil, pulses and

flour

Morning to

Afternoon

1

st

10 days

Salaried, Health

conscious,

staples shoppers

Salaried

Large family

50% sales-

staples, 30%-

FMCG.

Multi-

category

shopping

Morning to

Afternoon

Weekend 1

st

10 days

Salaried, large family,

weekend shoppers

Low visits

Low sales and

high margin

45% sales

from Apparels

Shops in

Mens casual

and formal,

ethnic wear

Morning to

Afternoon

Weekend

Weekend, apparel buying

shoppers

Single family

with kids

Health

conscious

70% sales-

FMCG

High

proportion of

baby care and

health SKUs

Morning to

Afternoon

single/small family

shoppers

Discount

seekers

50% sales

from Home

needs.

Shops in

utensils, bed

and luggage

Afternoon to

Evening

Weekend

Discount seekers

70% sales

from Staples

& FMCG

Evening

Evening shoppers

The Result:

Developed relevant Customer personas like discount oriented, large family, weekend specific category shoppers,

impulsive buyers, high end buyers, etc

Customer personas helped the business to appropriately target customers based on the day, time, affinity and category

of purchase with appropriate promotional offers, leading to incremental revenues

Identify an

appropriate

Customer Base

Small to

Medium size

families

Large families

shops mostly

in FMCG and

Staples

Business Situation:

The client, a B2B US-based retailer with presence in North America, Australia, Europe and Middle East noticed a significant increase in % Bad

Debt for new prospect acquisitions; from 5.1% of total prospect sales in 2007 to 8.8% in 2011. Business wanted to manage this without

compromising on lost sales.

The Task:

Design, develop and implement a robust predictive strategy that will help in quantifying the forward-looking risk at a Prospect-level. This will

be a quantifiable and reliable benchmark for the business to leverage and decision whether to extend credit, go for credit card pre-payment,

or completely avoid a particular prospect.

Analytical Framework:

Developed a Risk or Q-Score using firmographics and transaction information on prospects acquired between 2007 2011. Upon

implementation, each Prospect had a risk score between 1 and 10; with 1 being the most risky prospects; and 10 being the least risky

Prospects.

The Result:

Based on validation results; the predictive model was able to significantly separate prospects who paid and who defaulted

Prospects with Q-score = 1, 2, 3 are high risk prospects. These prospects on average have 2.2X default rate as prospects with score = 4 to

10

Recommendations implemented by the business: Review of all orders > $100 for Q-score < 4 and Prepayment for all orders > $200 for Q-

score < 4

Overall Bad debt decreased by 32% in the subsequent year

Analytics in Action

Prospect Acquisitions: Lowering Bad Debt by 32%

Client: A leading US-based Retailer to Small & Medium Enterprises

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

1 2 3 4 5 6 7 8 9 10

%

B

a

d

P

r

o

s

p

e

c

t

s

Q-Score

Model

Random

Model Results

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

1 2 3 4 5 6 7 8 9 10

%

B

a

d

P

r

o

s

p

e

c

t

s

Q-Score

Model

Random

Validation Results

Defining

Modelling

universe

Risk Tables

Variable

selection and

Model

development

Build Model,

assigning Q-

scores

Prospects segments with limited data and

low bad debts ignored (these segments

were treated separately)

Risk factors calculated for each prospect

variable such as location, transacted value,

organization size by prospect segment, etc

Variables (factors) with high information

value (IV) to risk identified; inter-correlated

factors discarded to include most relevant

factor in the model*

Q-score calculated based on model and

assigned to each prospect

V

a

l

i

d

a

t

i

o

n

a

n

d

M

o

d

e

l

r

e

f

i

n

e

m

e

n

t

%

P

r

o

s

p

e

c

t

s

w

h

o

d

e

f

a

u

l

t

e

d

%

P

r

o

s

p

e

c

t

s

w

h

o

d

e

f

a

u

l

t

e

d

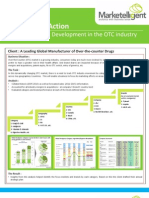

Business Situation :

US-based manufacturer of personalized gift items; with presence across North America, Australia, Europe and Middle East. They have over

3,000 skus on offer; across 8 product platforms and 13 countries. SKUs are supplied from Far East suppliers, with a 3-month lead time. And

almost 60% of Customers purchase gift items for immediate consumption; with the remaining having a deferred shipment date through out

the year. In addition, the manufacturer runs SKU-level promotions through-out the year, which result in SKU-specific demand. Critical to have

accurate sku-level demand forecast so that all orders are met; while maintaining optimal inventories.

The Task :

- Develop a framework and relevant forecasting models for improving the forecast process and accuracy.

- Obtain a robust and accurate SKU-level forecasting for each week over a year.

- Implement the predictive models so that forecasting is improved, inventory levels are optimal and customer satisfaction is improved.

Analytical Framework :

The solution was aimed at simplifying the process and improving the timeliness and accuracy of demand forecast:

1. Simplify and automate some of the current processes that were cumbersome and susceptible to human error.

2. Use statistical analysis to learn from historical trends, project future demand, and create an Early Warning System to predict weekly excess

and stock-outs at SKU level.

3. Improved the existing process of predicting repeat business using cannibalization models and also provided shipment profiles with insights

on patterns of how products shipped out to customers. This helped in placing timely and appropriate Purchase Orders with suppliers.

4. Provided dashboards for measuring forecast accuracy and also performance of shipments.

5. Adhoc analytics to support current forecasting, customer care and marketing decisions e.g. quantifying financial impact of late shipments

The Result :

Better sku-level forecasts and ability to react faster to products becoming hits.

Less obsolete inventory at the end of the year meant freeing up working capital and reducing waste. Lower stock-out rates also meant

better customer satisfaction in addition to revenue. Since repeat customers are their main focus, this factor is critical in preventing

unnecessary attrition.

More scientific approach to forecasting, thereby eliminating any bias in subjective forecasting logic.

Analytics in Action

Improve Demand Forecasts. Sales up by $ 3MM, stock-outs down

Client : A US-based Manufacturer of Customized Gifting Products

Forecast Variance

S

a

l e

s

g

r

o

w

t

h

(

P

Y

)

Over- forecasted

Growing

Under-forecasted

Growing

Under-forecasted

Declining

Over-forecasted

Declining

WC57001A, +, +

TD72601B, -, -

WC87901A, -, -

WC74846A, +, +

WC57001B, -, -

WC59401A, +, +

WC69501A, +, +

WC62545A, -, -

WC93001A, +, +

WA38001A, -, -

WC62545B, -, -

WC58802A, +, +

WC59004A, -, -

WC74846B, +, +

WC30146A, -, -

WD25646A, +, +

WC74903B, +, +

WD06001A, -, -

WC74903A, +, +

WC59401B, -, -

WC59004B, -, -

WC83504A, +, +

WD31503B, -, -

WC80446A, -, -

WC28801A, +, +

WC81001A, -, -

WC83945A, +, +

WC28301A, -, -

WC87901B, +, +

WA85401A, -, -

WC58802B, +, +

WC88102A, -, -

WD11202A, -, -

WC89803A, +, +

WC83945B, -, -

WD01993A, +, +

WC30146B, -, -

WD18006A, +, +

-5000

0

5000

10000

15000

20000

25000

30000

-40000

-30000

-20000

-10000

0

10000

20000

30000

40000

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43

MAPE - 23.47%

2UCL

3UCL

2LCL

3LCL

Variance

235386

359051

198157

211658.2184

196496.3737

0

50000

100000

150000

200000

250000

300000

350000

400000

1 2 3 4 5 6 7 8 9 10111213141516171819202122232425262728293031323334353637383940414243444546474849505152

Plan C

FY_2009

YTD_2010

Regression 1

Regression 2

forecast

Further, it was found that key style groups and colors remained consistent year-on-year

And that Customer repurchases on deleted style groups and colors were not significantly impacted the

following year

Recommendations made to rationalize marginal style groups and colors, leading to approximately 30% SKU

reduction and significant cost savings in business complexity and working capital.

5%

5% 5%

5%

11% 10% 8% 6%

11%

11%

11%

10%

10% 11% 11%

12%

26% 25% 26%

28%

30% 30% 31% 30%

0%

20%

40%

60%

80%

100%

2008-09 2009-10 2010-11 2011-12

13%

34%

64%

44%

15%

36%

57%

49%

0% 10% 20% 30% 40% 50% 60% 70%

Reactivation Continued SKUs Reactivation Discontinued SKUs

Customer

Segment1

Customer

Segment2

Customer

Segment3

Customer

Segment4

Business had over 5000 SKUs

across a few unique Product

Platforms. Each platform had

SKUs across many style groups

and colors.

Style groups and colors were

investigated for marginal

contributions to Revenues.

It was found that only a few

key style groups and colors

accounted for over 90% of

revenues

Client : A leading B2B Retailer of Personalized Gift Products

Blue

Gunmetal

Red

Black

Burgundy

Green

Rest

Analytics in Action

Effective SKU Management

MANAGEMENT TEAM

GLOBAL EXPERIENCE.

PROVEN RESULTS.

Roy K. Cherian

CEO

Roy has over 20 years of rich experience in marketing, advertising and media

in organizations like Nestle India, United Breweries, FCB and Feedback

Ventures. He holds an MBA fromIIMAhmedabad.

Anunay Gupta, PhD

COO &Head of Analytics

Anunay has over 15 years of experience, with a significant portion focused

on Analytics in Consumer Finance. In his last assignment at Citigroup, he was

responsible for all Decision Management functions for the US Cards

portfolio of Citigroup, covering approx $150B in assets. Anunay holds an

MBA in Finance fromNYU Stern School of Business.

Kakul Paul

Business Head, CPG & Retail

Kakul has over 8 years of experience within the CPG industry. She was

previously part of the Analytics practice as WNS, leading analytic initiatives

for top Fortune 50 clients globally. She has extensive experience in what

drives Consumer purchase behavior, market mix modeling, pricing &

promotion analytics, etc. Kakul has an MBA fromIIMAhmedabad.

ADVANCED ANALYTICAL SOLUTIONS

MARKETELLIGENT, INC.

80 Broad Street, 5th Floor, New York, NY 10004

1.212.837.7827 (o) 1.208.439.5551 (fax) info@marketelligent.com

CONTACT

www.marketelligent.com

Industry Business Focus Tools and Techniques

Consumer Finance Investment Optimization SAS, SPSS, R, VBA

Credit Cards Revenue Maximization Cluster analysis

Loans and Mortgages Cost and Process Efficiencies Factor analysis

Retail Banking & Insurance Forecasting Structural Equation Modeling

Wealth Management Predictive Modeling Conjoint analysis

Consumer Goods and Retail Risk Management Perceptual maps

CPG & Retail Pricing Optimization Neural Networks

Consumer Durables Customer Segmentation Chaid / CART

Manufacturing and Supply Chain Drivers Analysis Genetic Algorithms

High Tech OEMs Supply Chain Management Support Vector Machines

Automotive Sentiment Analysis

Logistics & Distribution

YOUR PARTNER FOR

DATA ANALYTI CS SERVI CES

Greg Ferdinand

EVP, Business Development

Greg has over 20 years of experience in global marketing, strategic planning,

business development and analytics at Dell, Capital One and AT&T. He has

successfully developed and embedded analytic-driven programs into a

variety of go-to-market, customer and operational functions. Greg holds an

MBA fromNYU Stern School of Business

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- ICI PakistanDokumen29 halamanICI PakistanMuhammad Hassaan Ali100% (4)

- 19 ConceptsandTheories CashflowForecasting OkDokumen9 halaman19 ConceptsandTheories CashflowForecasting OkPrecious J Alolod ImportanteBelum ada peringkat

- Sap Hana Real Time Enterprise Stories PDFDokumen94 halamanSap Hana Real Time Enterprise Stories PDFAditya Budhi DharmaBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A B2B Retailer Increase Its Lead VelocityDokumen2 halamanAnalytics in Action - How Marketelligent Helped A B2B Retailer Increase Its Lead VelocityMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sMarketelligentBelum ada peringkat

- (Operations Management) - McDonald's AnalysisDokumen36 halaman(Operations Management) - McDonald's AnalysisVineet Harit100% (2)

- Decline Curve Analysis For Oil Production ForecastingDokumen73 halamanDecline Curve Analysis For Oil Production Forecastingmohamed saadBelum ada peringkat

- Case Study #2: Growing PainsDokumen13 halamanCase Study #2: Growing PainsTricia Ann Jungco Maquirang100% (1)

- Multi Agent ApplicationsDokumen384 halamanMulti Agent ApplicationsJhonBelum ada peringkat

- Statistical Techniques For Management Decision MakingDokumen4 halamanStatistical Techniques For Management Decision MakingDrRitesh Patel67% (3)

- COMM 225 MCQ Theory QuestionsDokumen17 halamanCOMM 225 MCQ Theory QuestionsTeja100% (2)

- Front OfficeDokumen27 halamanFront Officeakshay chauhanBelum ada peringkat

- Application of Decision Sciences To Solve Business Problems - MarketelligentDokumen17 halamanApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentBelum ada peringkat

- Order of Magnitude Forecast - How Marketelligent Helped A Leading OTC Company Launch New Products in Emerging MarketsDokumen2 halamanOrder of Magnitude Forecast - How Marketelligent Helped A Leading OTC Company Launch New Products in Emerging MarketsMarketelligent100% (1)

- Application of Decision Sciences To Solve Business Problems - MarketelligentDokumen14 halamanApplication of Decision Sciences To Solve Business Problems - MarketelligentMarketelligentBelum ada peringkat

- Application of Business Sciences To Solve Business Problems - MarketelligentDokumen17 halamanApplication of Business Sciences To Solve Business Problems - MarketelligentMarketelligentBelum ada peringkat

- Automotive Capabilities - MarketelligentDokumen17 halamanAutomotive Capabilities - MarketelligentMarketelligentBelum ada peringkat

- Marketelligent Capabilities & Offerings For Sales AnalyticsDokumen10 halamanMarketelligent Capabilities & Offerings For Sales AnalyticsMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped Increase Customer Engagement Via Targeted Cross-SellDokumen2 halamanAnalytics in Action - How Marketelligent Helped Increase Customer Engagement Via Targeted Cross-SellMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Petroleum Retailer Identify 'At Risk' CustomersDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Petroleum Retailer Identify 'At Risk' CustomersMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Hair Care Manufacturer Re-Design Its Product Communication StrategiesDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Hair Care Manufacturer Re-Design Its Product Communication StrategiesMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped An Online Remittance Firm Identify Risky TransactionsDokumen2 halamanAnalytics in Action - How Marketelligent Helped An Online Remittance Firm Identify Risky TransactionsMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Retailer Increase RevenuesDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Retailer Increase RevenuesMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Quick Service Restaurant Chain Identify Customer Pain PointsDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Quick Service Restaurant Chain Identify Customer Pain PointsMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A US Manufacturer Improve Demand ForecastsDokumen2 halamanAnalytics in Action - How Marketelligent Helped A US Manufacturer Improve Demand ForecastsMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Publishing House Identify Its Social InfluencersDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Publishing House Identify Its Social InfluencersMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueDokumen2 halamanAnalytics in Action - How Marketelligent Helped A CPG Company Boost Store Order ValueMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A CPG Company Optimize Its Media PlanningDokumen2 halamanAnalytics in Action - How Marketelligent Helped A CPG Company Optimize Its Media PlanningMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Beverage Manufacturer Better Its Production PlanningMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A B2B Retailer Minimize Bad DebtsDokumen2 halamanAnalytics in Action - How Marketelligent Helped A B2B Retailer Minimize Bad DebtsMarketelligentBelum ada peringkat

- Application of Decision Sciences To Solve Business Problems in The Consumer Packaged Goods (CPG) IndustryDokumen24 halamanApplication of Decision Sciences To Solve Business Problems in The Consumer Packaged Goods (CPG) IndustryMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Bank Validate A Predictive ModelDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Bank Validate A Predictive ModelMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Technology Firm Prioritize Business PartnershipsDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Technology Firm Prioritize Business PartnershipsMarketelligentBelum ada peringkat

- Trade Promotion Optimization - MarketelligentDokumen12 halamanTrade Promotion Optimization - MarketelligentMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Leading Alcobev Manufacturer Forecast SalesDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Leading Alcobev Manufacturer Forecast SalesMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Retailer Rationalize SKU'sMarketelligent100% (1)

- Analytics in Action - How Marketelligent Helped An Insurance Provider Optimize Acquisition InvestmentsDokumen2 halamanAnalytics in Action - How Marketelligent Helped An Insurance Provider Optimize Acquisition InvestmentsMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Manufacturer Optimize Trade Promotion SpendsDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Manufacturer Optimize Trade Promotion SpendsMarketelligentBelum ada peringkat

- Analytics in Action - How Marketelligent Helped A Leading OTC Manufacturer Track Market DevelopmentDokumen2 halamanAnalytics in Action - How Marketelligent Helped A Leading OTC Manufacturer Track Market DevelopmentMarketelligent100% (1)

- Sales Forecast: Dr. Shivakant UpadhyayaDokumen20 halamanSales Forecast: Dr. Shivakant UpadhyayajyotiBelum ada peringkat

- Research 2013 Black Swan PresentationDokumen33 halamanResearch 2013 Black Swan PresentationMAK1013Belum ada peringkat

- Ch.1 Load Forecasting 1Dokumen9 halamanCh.1 Load Forecasting 1Yogesh DabholeBelum ada peringkat

- Contoh Soal Generator DC Penguat Seri Dan ParalelDokumen38 halamanContoh Soal Generator DC Penguat Seri Dan ParalelBagoes Fudzian PrimaBelum ada peringkat

- HRM NotesDokumen49 halamanHRM Notesvenkatesan thilagarBelum ada peringkat

- INFORMS Job Task Analysis 2012 2019Dokumen16 halamanINFORMS Job Task Analysis 2012 2019Francisco GalindoBelum ada peringkat

- 2.4 Budgets and ForecastsDokumen29 halaman2.4 Budgets and ForecastsharikatejaBelum ada peringkat

- Water Supply ExcersiseDokumen12 halamanWater Supply ExcersisemenyiluBelum ada peringkat

- Stochastic Modelling 2000-2004Dokumen189 halamanStochastic Modelling 2000-2004Brian KufahakutizwiBelum ada peringkat

- Boston 2020 Multifamily Investment Forecast ReportDokumen1 halamanBoston 2020 Multifamily Investment Forecast ReportKevin ParkerBelum ada peringkat

- HRP and Job AnalysisDokumen24 halamanHRP and Job Analysisgeachew mihiretuBelum ada peringkat

- Demand Forecasting: Concept, Significance, Objectives and FactorsDokumen24 halamanDemand Forecasting: Concept, Significance, Objectives and FactorsXinger XingerBelum ada peringkat

- Introduction To Sales & Distribution ManagementDokumen76 halamanIntroduction To Sales & Distribution ManagementDr. Milind Narayan DatarBelum ada peringkat

- Eea Unit-1 Lecture NotesDokumen19 halamanEea Unit-1 Lecture NotesAnand MelamBelum ada peringkat

- Group 4 - Forecast Time Series Data - Toyota VietnamDokumen15 halamanGroup 4 - Forecast Time Series Data - Toyota VietnamHoa ThyBelum ada peringkat

- Chapter 1 - Production PlanningDokumen63 halamanChapter 1 - Production PlanningManish Gandhi100% (1)

- Alternative Methodology To Avoid Convergence Problems Caused For WELDRAW KeywordDokumen3 halamanAlternative Methodology To Avoid Convergence Problems Caused For WELDRAW Keywordmanish.7417Belum ada peringkat

- Supply Chain Management & Logistics (SCML) : Department of Operation ManagementDokumen58 halamanSupply Chain Management & Logistics (SCML) : Department of Operation ManagementSiddharth MohapatraBelum ada peringkat

- Unit 2Dokumen69 halamanUnit 2Jeya PrakashBelum ada peringkat

- Egyanam AMDOCS SPLUNK-ML PPTDokumen19 halamanEgyanam AMDOCS SPLUNK-ML PPTMaheshBelum ada peringkat