Issues of Fiqh Relating To IB (UMT Sample)

Diunggah oleh

AbdulAzeem0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan4 halamanFiqh helps a lot for in area in which Islamic financial institutions should focus because it is vital to ensure the acceptance and marketability of the Islamic financial products. The subject shall contribute to the understanding, advancement and acceleration of the process of Islamic financial product development from the Shariah aspect. Students are required to read assigned material before coming to class. The instructor will assess student's level of preparation by raising questions on the assigned topics.

Deskripsi Asli:

Judul Asli

Issues of Fiqh Relating to IB (UMT Sample)

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniFiqh helps a lot for in area in which Islamic financial institutions should focus because it is vital to ensure the acceptance and marketability of the Islamic financial products. The subject shall contribute to the understanding, advancement and acceleration of the process of Islamic financial product development from the Shariah aspect. Students are required to read assigned material before coming to class. The instructor will assess student's level of preparation by raising questions on the assigned topics.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

28 tayangan4 halamanIssues of Fiqh Relating To IB (UMT Sample)

Diunggah oleh

AbdulAzeemFiqh helps a lot for in area in which Islamic financial institutions should focus because it is vital to ensure the acceptance and marketability of the Islamic financial products. The subject shall contribute to the understanding, advancement and acceleration of the process of Islamic financial product development from the Shariah aspect. Students are required to read assigned material before coming to class. The instructor will assess student's level of preparation by raising questions on the assigned topics.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

Course Outline Page 1

University of Management and Technology

Course Outline

Course Code: IB - 615 Course Title: Issues of Fiqh Relating to Islamic Banking

Program

MS Islamic Banking and finance (MS IBF)

Credit Hours

03

Duration

15 weeks (15 sessions)

Prerequisites

N/A

Resource Person

Dr. Khaliq Ur Rehman

Counseling Timing

(Room# )

Contact

Chairman/Director signature.

Deans signature Date.

Course Outline Page 2

Learning Objective:

Shariah has opened the doors of creativity and innovation broadly to Muslim Ummah to

develop their economic activities in fulfilling their needs under the light of divine guidance.

One of the natures of Fiqh discipline is the availability of several opinions of Islamic jurists

pertaining to an issue. This nature is seen as an advantage rather than as an obstacle. In the

real world practice, it means that the Islamic banking could choose any juristic opinion to

manage its affairs. However the selection of juristic opinion should take into consideration

the juristic standing of the customers. Fiqh helps a lot for in area in which Islamic financial

institutions should focus because it is vital to ensure the acceptance and marketability of

the Islamic financial products. With this understanding in mind, it can be derived that

understanding the Fiqh is imperative and the area of Islamic banking and finance.

The subject shall contribute to the understanding, advancement and acceleration of the

process of Islamic financial product development from the Shariah aspect, as it is the most

imperative tool for the Islamic financial institutions to meet their increasing concern about

profitability, liquidity, assets value, risk management as well as product acceptability. It

could also help the practitioners to come up with more preferable financial products to

both customers and players.

Learning Methodology:

Class preparation and participation:

Students are required to read assigned material before coming to class. The instructor will assess

students level of preparation by raising questions on the assigned topics.

Examinations:

As per the University policy.

Assignments and Presentations:

All assignments for formal evaluation must be typed and submitted by the specified due dates.

Topics of assignments would be assigned by the course instructor from the given topics. Each

student will be required to make fifteen minutes class presentation on the topic assigned.

Class Attendance:

Attendance policy of the university would be strictly followed.

Course Outline Page 3

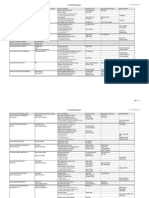

Grade Evaluation Criteria

Following is the criteria for the distribution of marks to evaluate final grade in

a semester.

Marks Evaluation Marks in percentage

Quizzes 15

Assignments 15

Mid Term 25

Attendance & Class Participation 10

Term Project 00

Presentations 00

Final exam 35

Total 100

Recommended Text Books/Readings:

1. Islamic Banking, Dr. Muhammad Imran Ashref Usmani, Darul-shaat Karachi

2. An Introduction to Islamic Finance, Mufti Taqi Usmani, Darul-shaat Karachi

3. Islamic Law of Contracts and Business Transactions, Dr. M. Tahir Mansoor, Sharia

Accademy-iiui

4. IIU

5.

6.

7.

8.

9.

Course Outline Page 4

Calendar of Course contents to be covered during semester

Course Code: IB - 615 Course Title: Issues of Fiqh Relating to Islamic Banking

Week Course Contents

Reference Chapter(s)

1 Brief Introduction to Fiqh

Fiqh usool-ul-fiqh and qamaidul fiqh

2 Temperament of fiqh

3 Objectives of fiqh

4 Difference of opinion in fiqh matters and its reasons.

5 Legal Capacity

6 Primary and Secondary Sources

7

CONTRACT

1. Sahih Valid

2. Fasid Vaidable

3. Batil Vaid

4. Islamic Law of Options (Khiyaraat)

5. Pledge (Rahn)

8 MIDTERM EXAM

9 GROUP PRESENTATIONS

10 Islamic Modes of Financing

11 Islamic Modes of Financing

12 Islamic Modes of Financing

13 Insurance and Takaful

14 Islamic Investments

1. Investment Funds

2. Limited Liability

15 REVISION and PRESENTATIONS

Anda mungkin juga menyukai

- 1st Semester - Financial Accounting Mid TermDokumen1 halaman1st Semester - Financial Accounting Mid TermAbdulAzeemBelum ada peringkat

- Fishing Industry: Introduction, Aquaculture, Uses, Types, Methods, and Areas of FishingDokumen68 halamanFishing Industry: Introduction, Aquaculture, Uses, Types, Methods, and Areas of FishingAbdulAzeemBelum ada peringkat

- Bba 3 Semester Financial Management OutlineDokumen5 halamanBba 3 Semester Financial Management OutlineAbdulAzeemBelum ada peringkat

- 7th - Corporate FinanceDokumen2 halaman7th - Corporate FinanceAbdulAzeemBelum ada peringkat

- Short term decision making test solution analyzedDokumen1 halamanShort term decision making test solution analyzedAbdulAzeemBelum ada peringkat

- 2020 - Managerial Acquisitiveness and Corporate Tax AvoidanceDokumen28 halaman2020 - Managerial Acquisitiveness and Corporate Tax AvoidanceAbdulAzeemBelum ada peringkat

- Institute of Cost and Management Accountants of Pakistan Fall 2012 ExamsDokumen4 halamanInstitute of Cost and Management Accountants of Pakistan Fall 2012 Examsmagnetbox8Belum ada peringkat

- 1st - Financial AccountingDokumen2 halaman1st - Financial AccountingAbdulAzeemBelum ada peringkat

- 201302a PDFDokumen7 halaman201302a PDFAbdul BasitBelum ada peringkat

- Nber Working Paper SeriesDokumen32 halamanNber Working Paper SeriesApriana RahmawatiBelum ada peringkat

- 2019 - Corporate Tax Avoidance - Is Tax Transparency The SolutionDokumen20 halaman2019 - Corporate Tax Avoidance - Is Tax Transparency The SolutionAbdulAzeemBelum ada peringkat

- Short Term Decision Making: Question No. 1Dokumen2 halamanShort Term Decision Making: Question No. 1AbdulAzeemBelum ada peringkat

- IAPM-Feb.2013 Investment Analysis and Portfolio Management examDokumen4 halamanIAPM-Feb.2013 Investment Analysis and Portfolio Management examAbdulAzeemBelum ada peringkat

- 2020 - Directors With Foreign ExperienceDokumen28 halaman2020 - Directors With Foreign ExperienceAbdulAzeemBelum ada peringkat

- w10471 PDFDokumen41 halamanw10471 PDFAlineRieBelum ada peringkat

- Guide Creating A Posting File Batch and Journals 1.0Dokumen13 halamanGuide Creating A Posting File Batch and Journals 1.0AbdulAzeemBelum ada peringkat

- Investment Interest FactorsDokumen16 halamanInvestment Interest FactorsAbdulAzeemBelum ada peringkat

- Chand Bagh School: Pakistan Studies DepartmentDokumen11 halamanChand Bagh School: Pakistan Studies DepartmentAbdulAzeemBelum ada peringkat

- P5 Home Country Tax System 308 CitationsDokumen31 halamanP5 Home Country Tax System 308 CitationsAbdulAzeemBelum ada peringkat

- 2017 - Determinants of Profit Reinvestment Undertaken by SMEs in The Small Island Countries - Base ArticleDokumen36 halaman2017 - Determinants of Profit Reinvestment Undertaken by SMEs in The Small Island Countries - Base ArticleAbdulAzeemBelum ada peringkat

- Short Term Decision Making: Question No. 1Dokumen2 halamanShort Term Decision Making: Question No. 1AbdulAzeemBelum ada peringkat

- Short Term Decision Making: Question No. 1Dokumen2 halamanShort Term Decision Making: Question No. 1AbdulAzeemBelum ada peringkat

- Determinants of Tax Avoidance Evidence On Profit Tax Paying Companies in RomaniaDokumen24 halamanDeterminants of Tax Avoidance Evidence On Profit Tax Paying Companies in RomaniaAbdulAzeemBelum ada peringkat

- Relegiousity and Tax Avoidance - 196 CitationDokumen32 halamanRelegiousity and Tax Avoidance - 196 CitationAbdulAzeemBelum ada peringkat

- Long-Run Corporate Tax Avoidance: Prevalence and CharacteristicsDokumen48 halamanLong-Run Corporate Tax Avoidance: Prevalence and CharacteristicsAbdulAzeemBelum ada peringkat

- 2015 - Determinant of Tax EvasionDokumen21 halaman2015 - Determinant of Tax EvasionAbdulAzeemBelum ada peringkat

- Nber Working Paper SeriesDokumen32 halamanNber Working Paper SeriesApriana RahmawatiBelum ada peringkat

- SBL by Sir Ashraf RehmanDokumen1 halamanSBL by Sir Ashraf RehmanAbdulAzeemBelum ada peringkat

- w10471 PDFDokumen41 halamanw10471 PDFAlineRieBelum ada peringkat

- Course Content Schedule For SBL by Sir Muhammad Ashraf RehmanDokumen8 halamanCourse Content Schedule For SBL by Sir Muhammad Ashraf RehmanAbdulAzeemBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Lucia Paras v. Kimwa Construction aggregates supply contract disputeDokumen3 halamanLucia Paras v. Kimwa Construction aggregates supply contract disputeMichelleBelum ada peringkat

- Sango bh.0Dokumen11 halamanSango bh.0rayyanrashid.neBelum ada peringkat

- Animal Farm EssayDokumen2 halamanAnimal Farm EssayJaroslav Evry BoudaBelum ada peringkat

- CIR v. Standard Chartered BankDokumen11 halamanCIR v. Standard Chartered Bankf919Belum ada peringkat

- Final-G9-WEEK-8 FOR TEACHERDokumen24 halamanFinal-G9-WEEK-8 FOR TEACHERAngelica Cumapon EsmeresBelum ada peringkat

- ECB ManagersDokumen3 halamanECB Managersnikitas666Belum ada peringkat

- Globalization Has Renovated The Globe From A Collection of Separate Communities InteractingDokumen11 halamanGlobalization Has Renovated The Globe From A Collection of Separate Communities InteractingVya Lyane Espero CabadingBelum ada peringkat

- Ent (Feasibility Analysis)Dokumen6 halamanEnt (Feasibility Analysis)Jeeshan IdrisiBelum ada peringkat

- US DOJ Letter PhotographyDokumen11 halamanUS DOJ Letter PhotographyAvi S. AdelmanBelum ada peringkat

- Marketbeats Indonesia Jakarta Landed Residential H2 2022Dokumen4 halamanMarketbeats Indonesia Jakarta Landed Residential H2 2022SteveBelum ada peringkat

- Rig Com StationDokumen4 halamanRig Com StationCristof Naek Halomoan TobingBelum ada peringkat

- JK Pay SysDokumen3 halamanJK Pay SysMir Mudasir RehmanBelum ada peringkat

- List of 104 amendments to the Indian ConstitutionDokumen12 halamanList of 104 amendments to the Indian Constitutiondxrcfg nm100% (1)

- Jo Roby Statement of HarmDokumen13 halamanJo Roby Statement of HarmMichael_Lee_RobertsBelum ada peringkat

- RoHs Certificate - Stainless Steel Flat ProductsDokumen1 halamanRoHs Certificate - Stainless Steel Flat ProductsVictor camacho100% (1)

- Lin CodeDokumen26 halamanLin CodeKyline Genevieve ParkBelum ada peringkat

- Ella Baila Sola Eslabon Armado Peso PlumaDokumen5 halamanElla Baila Sola Eslabon Armado Peso Plumagaramond656Belum ada peringkat

- Letter of AgreementDokumen5 halamanLetter of AgreementIndra YurmanBelum ada peringkat

- Persuasive SpeechDokumen5 halamanPersuasive Speechapi-255025847Belum ada peringkat

- Chapter 7 - Construction ContractsDokumen17 halamanChapter 7 - Construction ContractsMikael James VillanuevaBelum ada peringkat

- Lecture 6Dokumen5 halamanLecture 6euniceBelum ada peringkat

- Basic Amc AcDokumen12 halamanBasic Amc AcSATNAM SINGH LAMBABelum ada peringkat

- Stonehell Dungeon 1 Down Night Haunted Halls (LL)Dokumen138 halamanStonehell Dungeon 1 Down Night Haunted Halls (LL)some dude100% (9)

- Tosun, 1999 - Towards A Typology of Community Participation in The Tourism Devt ProcessDokumen23 halamanTosun, 1999 - Towards A Typology of Community Participation in The Tourism Devt ProcessHarold Kim JoaquinBelum ada peringkat

- Forensic and Investigative Accounting Module 1Dokumen18 halamanForensic and Investigative Accounting Module 1Jhelson SoaresBelum ada peringkat

- CIAC Jurisdiction Over Construction DisputeDokumen3 halamanCIAC Jurisdiction Over Construction DisputeRoland Joseph MendozaBelum ada peringkat

- Term 2 - PPT On Sheikh Zayed and UaeDokumen13 halamanTerm 2 - PPT On Sheikh Zayed and UaeSreeshn BhaskaranBelum ada peringkat

- Disclaimer Regarding Hotel, Restaurant, Airlines Company and Theme ParkDokumen9 halamanDisclaimer Regarding Hotel, Restaurant, Airlines Company and Theme Parkmd rimonBelum ada peringkat

- Shri Mata Vaishno Devi Shrine Board - Poojan Parchi Services 2Dokumen1 halamanShri Mata Vaishno Devi Shrine Board - Poojan Parchi Services 2Shreyash mathurBelum ada peringkat

- Far270 February 22 FaDokumen8 halamanFar270 February 22 FarumaisyaBelum ada peringkat