I Introduction To Banking

Diunggah oleh

behappy_aklprasadJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

I Introduction To Banking

Diunggah oleh

behappy_aklprasadHak Cipta:

Format Tersedia

1.

1. I Introduction to Banking

2. II Introduction to Retail Banking

3. III Banking Terminology

4. IV CASA

5. V Time Deposits

6. VI Loans

7. VII Remittances

8. VIII Non-Branch Delivery Channels

9. IX Audit and Supervision

10. X Software Expectations

11. XI Wrap-Up

2. Introduction to Banking

3. Banks

1. Role of Intermediary

2. Banks and Banking Functions

3. Competitors to Banks

4. Disintermediation

5. Changing Role of Banks

6. Towards a Financial Supermarket...

4. What is Banking

1. Borrowing and safe keeping of money

2. Lending of money

3. Transmitting of money

4. Exchanging of money

5. Exchange of financial information

5. BANKING FRAMEWORK

1. Retail Banking

1. CASA, Deposits, Loans, Credit Cards, FX, Remittances, Securitization

2. Corporate Banking

1. Trade Finance, Project Finance, Bills, LCs, Guarantees, Syndicated Financing

3. Investment Banking

1. FX, Money Markets, Securities, Leasing, Factoring

6.

1. Private Banking Trusts, Portfolio Management

2. Fiduciary Services

1. Pensions, Custody Services, Will & Estate Management

3. Other services Correspondent Banking, Safe deposit Vaults, Insurance, Travel, Bill Payment, Tax

Counselling

BANKING FRAMEWORK-2

7. Retail VS Wholesale Banking

1. Retail Banking Wholesale Banking

2. Focus On Individual Customers Focus On Large Corporate Entities

3. Wide Branch Network Limited Branch Networking

4. Variety Of Services Available Focus On Smaller Customer Base

8. Money Multiplier Effect

1. Money supply creation by Banks

2. Need to regulate and control

3. Methodology of regulation

9. Customer and the Bank

1. Who is a Customer

2. Customer Confidentiality

3. Ownership of Accounts

4. Precaution against Conversion and Frauds

5. Legal Responsibility to prevent Money Laundering Breaking countrys Laws

10. Bank-Client Relationship

1. Good Faith

2. Bankers General Right of Lien

3. Rights of Set -Off

4. Estoppel

5. Confidentiality

6. Disclosure Under Laws of the Land

7. Full Disclosure of Terms and Conditions of Relationship

8. Can bank Discriminate between Customers in Treatment?

11. Interest

1. Accrual

2. Capitalization

3. Accrual Frequency

4. Capitalization Frequency

5. Interest Methods

1. Monthly Minimum, Daily Balance, Average Balance,...

6. Interest Basis

1. 30/360, Actual/Actual, Actual/360,...

7. Withholding tax, Interest tax deduction

12.

1. Bank Accounting Peculiarities

2. Window Dressing

3. Income Recognition

4. NPA Classification

5. International Accountancy Rules

6. Capital Adequacy

7. Deposit Risk Cover Protection

Banks Books of Accounts

13. General Ledger

1. General Ledger and Subsidiary Ledger

2. Central Bank Reporting

3. Multi-Currency Treatment

4. Treatment of Inter-Branch Transactions

5. Treatment of Suspense Accounts, Entries

6. External General Ledger

14. Lending of Money

1. Statutory controls on lending

2. Principles of sound lending

3. Purposes

4. Periods

5. Types of lending

6. Security for advances

15. Principles of Sound Lending

1. Borrower

1. Character

2. Capital

3. Capability

2. Bank

1. Safety of funds

2. Spread of risk

3. Liquidity of funds

4. Profitability

3. Viability of the scheme

16. Traditional Banking...

1. Competition, Disintermediation and Diminishing Spreads

2. Movement towards Fee-income

3. Technology Driving Banking, Banking Driving Technology

4. Market Place crowded, Mixed, Technology-driven

17. Types of lending

1. Fund based

1. Term Loans

2. Cash Credit / Overdraft

3. Purchase & Discount of Bills (inland & foreign)

2. Non Fund based

1. Letters of credit

2. Guarantee

3. Bills Co-acceptance

18. Term Loans

1. Fixed Amount

2. For purchase of fixed assets

3. Payable

1. in suitable installments

2. in lump sum (principal + interest)

4. Usually Secured

19. Cash Credits & Overdrafts

1. Running accounts

2. Drawings fluctuate within a pre-determined band

3. As many drawals as necessary

4. Interest charged on daily balances

5. Cash credit : Usually secured

6. Overdraft : Could be secured or unsecured

20. Bills : Purchase & Discount BILLS INLAND FOREIGN DEMAND USANCE DOCUMENTARY CLEAN

21. Types of Bills

1. Demand Bills

1. Payable on demand or At sight or

2. On presentment or

3. No time for payment specified

2. Usance Bills

1. Payable on the expiry of a certain period after date or sight

22. Types of Bills

1. Clean Bill

1. Unaccompanied by any other allied documents

2. eg : Cheques, Warrants

3. Trade bills without the relative document evidencing dispatch of goods

4. Unsecured. Can be Sight or usance

2. Documentary Bill

1. Accompanied by document of title to goods

2. Secured/Unsecured: Secured/Unsecured

23. Advantages of Bill Business

1. Definite date of repayment

2. Re-discounting facilities

3. Stability of value

4. High profitability

5. Greater legal protection

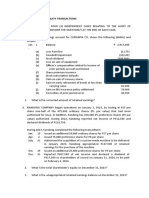

24. Bill Transactions

1. Collection

2. Purchase & Discount

3. Negotiation

25. Letters of Credit

1. Issuing bank undertakes to make payment to the beneficiary of the LC against presentation of

specified documents

2. Beneficiary is assured of payment

3. No immediate outflow of funds

4. Parties to a credit

1. Applicant (buyer)

2. Beneficiary (seller)

3. Issuing bank

26. Guarantees

1. To perform the promise or discharge the liability of a third party in case of his default

2. Three parties

1. Guarantor / Surety (banker)

2. Principal Debtor (on whose behalf)

3. Principal Creditor (in whose favour)

3. Financial Guarantee

4. Performance Guarantee

5. Deferred payment guarantee

6. No immediate outflow of funds

27. Related Services

1. Merchant banking

2. Counselling corporate clients on

1. Capital structure

2. Form of capital to be raised

3. Terms & conditions of the issue

4. Under writing of the issue

5. Timing of the issue

6. Preparation of the prospectus

7. Raising of long term loans

28. Related Services (contd...)

1. Trustee, executor, & admin services

2. To handle

1. Investments / estates / properties

2. Distribution after death

3. To act as guardian of a minors property

4. To administer public trusts

29.

1. Factoring

2. Factor maintains the trade debts of the client company

1. Maintains sales ledger

2. Issues invoices

3. Collects payments

3. Credit protection

1. Factor assumes responsibility for trade debts, due to the client company

4. Factor advances a proportion of the trade debts immediately and the balance on maturity of the

debts

1. Improves client's liquidity

Related Services

30. Clearing House Operations

1. Outward clearing

2. Inward clearing

3. Returns- outward clearing

4. Returns- Inward clearing

5. Re-presentations

6. Time factor

7. Reconciliation

31. Automated Clearing House

1. Electronic clearing

2. Paperless transfers of funds

3. Settlement

32. Foreign Exchange

1. FX Market

2. Exchange rates

3. Risks

4. Revaluation

5. Mark to the market

6. Risk management

33. Legal aspects in Banking

1. Customer

2. Types of legal relationships

3. Duties and obligations

4. Rights and remedies

5. Confidentiality

6. Law relating to Limitations

7. Disclosure regulations in Accounts

34. Law and Banking

1. Application of Law

2. Jurisdiction

3. Civil laws

4. Criminal laws

5. Law of limitation

35. Supervision of Banks

1. Central Bank of the country

2. Degrees of supervision

3. Modes of Supervision

4. Audit and self-regulation

5. Importance of proper supervision

6. Cross-country regulation of Banks

Anda mungkin juga menyukai

- Financial Unorthodoxy: Practicable Views on Money, Banking and InvestingDari EverandFinancial Unorthodoxy: Practicable Views on Money, Banking and InvestingBelum ada peringkat

- Islamic Banking And Finance for Beginners!Dari EverandIslamic Banking And Finance for Beginners!Penilaian: 2 dari 5 bintang2/5 (1)

- An Overview of Banks & Their Services: M. Morshed 1Dokumen15 halamanAn Overview of Banks & Their Services: M. Morshed 1Rawkill 2000Belum ada peringkat

- Syllabus: I - Overview of Indian Banking SectorDokumen98 halamanSyllabus: I - Overview of Indian Banking SectorNikhil JainBelum ada peringkat

- Deposit ProductsDokumen5 halamanDeposit ProductsLycka MarceloBelum ada peringkat

- Bank Management Summary - Chapter OneDokumen6 halamanBank Management Summary - Chapter Oneabshir sugoowBelum ada peringkat

- Essential Points To Solve Case StudiesDokumen6 halamanEssential Points To Solve Case StudiesAaryan KarthikeyBelum ada peringkat

- Financial Markets Reporting 1Dokumen2 halamanFinancial Markets Reporting 1Kat De lumenBelum ada peringkat

- Macroeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions Manual Full DownloadDokumen18 halamanMacroeconomics Canada in The Global Environment Canadian 9th Edition Parkin Solutions Manual Full Downloadlisawilliamsqcojzynfrw100% (37)

- Role of Banking in The Modern EconomyDokumen18 halamanRole of Banking in The Modern Economybackupsanthosh21 dataBelum ada peringkat

- Chapter 01: An Overview of Bank and Their ServicesDokumen15 halamanChapter 01: An Overview of Bank and Their ServicesTahmid Sadat100% (1)

- Lecture 1 - Introduction To BankingDokumen23 halamanLecture 1 - Introduction To BankingLeyli MelikovaBelum ada peringkat

- Chapter #1: Essence of Banking: 3) Financial System: ElementsDokumen7 halamanChapter #1: Essence of Banking: 3) Financial System: ElementsPedro ArteagaBelum ada peringkat

- Global Finance 1Dokumen6 halamanGlobal Finance 1JASMINE FAITH MEBATOBelum ada peringkat

- Commercial Lending GADokumen81 halamanCommercial Lending GAhtc2011100% (1)

- Banking & Insurance NotesDokumen26 halamanBanking & Insurance NotesMinatoBelum ada peringkat

- Money and Banking-WPS OfficeDokumen8 halamanMoney and Banking-WPS Officemuskansajid517Belum ada peringkat

- Raja ProjectDokumen108 halamanRaja ProjectDeepak AkojuBelum ada peringkat

- Intro To Traditional Financial ServicesDokumen10 halamanIntro To Traditional Financial Servicesmoinavrang123Belum ada peringkat

- Saran Full ProjectDokumen39 halamanSaran Full Projecttn63 villanBelum ada peringkat

- (S) Chapter 2&3Dokumen5 halaman(S) Chapter 2&3Vilma TayumBelum ada peringkat

- Banking and Ins PDFDokumen94 halamanBanking and Ins PDFsakshiBelum ada peringkat

- Axis Bank ProjectDokumen48 halamanAxis Bank Projectsohail shaikhBelum ada peringkat

- Final Project of Banking and Financial MarketsDokumen32 halamanFinal Project of Banking and Financial MarketsNaveed KhokharBelum ada peringkat

- Ba 1731-Corporate Finance: Unit-IDokumen14 halamanBa 1731-Corporate Finance: Unit-IKennedy NongmeikapamBelum ada peringkat

- BBFH407 - Assignment 1Dokumen7 halamanBBFH407 - Assignment 1Simba MashiriBelum ada peringkat

- Unit 1 Structure of Banking in IndiaDokumen31 halamanUnit 1 Structure of Banking in IndiaArjun NayakBelum ada peringkat

- Unit 1 Trade and Supporting Services BankingDokumen9 halamanUnit 1 Trade and Supporting Services BankingSimra RiyazBelum ada peringkat

- Financial ServicesDokumen120 halamanFinancial ServicesBhargaviBelum ada peringkat

- Financial Markets and InstitutionsDokumen40 halamanFinancial Markets and InstitutionsAnZeerBelum ada peringkat

- CHAP - 01 - An Overview of Banking SectorDokumen70 halamanCHAP - 01 - An Overview of Banking SectorKaBelum ada peringkat

- Functions of Commercial BanksDokumen12 halamanFunctions of Commercial Banks9639166250Belum ada peringkat

- Letter of CreditDokumen19 halamanLetter of CreditAmarjeet Singh0% (1)

- Banking and Insurance For SlideshowDokumen100 halamanBanking and Insurance For SlideshowB I N O D ツBelum ada peringkat

- AnglaisDokumen4 halamanAnglaisWissal ChafiBelum ada peringkat

- BankingDokumen19 halamanBankingTipu SultanBelum ada peringkat

- Principles of Business The Nature of A Business - Money & Inflation Ref#-01/04-09/15Dokumen3 halamanPrinciples of Business The Nature of A Business - Money & Inflation Ref#-01/04-09/15Shaira mohammedBelum ada peringkat

- Financial Institutions DefinitionDokumen3 halamanFinancial Institutions DefinitionRabaa DooriiBelum ada peringkat

- Chapter Two Financial Institutions and Their Operations LectureDokumen147 halamanChapter Two Financial Institutions and Their Operations LectureAbdiBelum ada peringkat

- FMO Unit 1Dokumen8 halamanFMO Unit 1aakashsankhla33Belum ada peringkat

- Cifa Financial Institutions and Markets PDFDokumen104 halamanCifa Financial Institutions and Markets PDFMswakubaffBelum ada peringkat

- The Commercial Letter of Credit Final NA TALAGADokumen27 halamanThe Commercial Letter of Credit Final NA TALAGAMaricar SalameñaBelum ada peringkat

- Introduction To Money and The Financial System: Matt Ysrael P. Vicedo Instructor Department of ManagementDokumen18 halamanIntroduction To Money and The Financial System: Matt Ysrael P. Vicedo Instructor Department of Managementjoan magpuriBelum ada peringkat

- Financial MarketDokumen11 halamanFinancial MarketRetemoi CookBelum ada peringkat

- © FINANCE TRAINER International Introduction To Bank Management / Page 1 of 25Dokumen25 halaman© FINANCE TRAINER International Introduction To Bank Management / Page 1 of 25imic_2007Belum ada peringkat

- 2024 Module GFEBDokumen57 halaman2024 Module GFEBJesalie BatacBelum ada peringkat

- Financial Markets Sample Course OutlineDokumen4 halamanFinancial Markets Sample Course OutlineAbbey NavidadBelum ada peringkat

- 9197 FIM Assignment Money Market Instruments in BangladeshDokumen17 halaman9197 FIM Assignment Money Market Instruments in BangladeshTahsin RahmanBelum ada peringkat

- Marketing of Banking ServicesDokumen97 halamanMarketing of Banking ServicesAvtaar Singh100% (1)

- Deposit Poicy 2018 20 25082020Dokumen27 halamanDeposit Poicy 2018 20 25082020NK PKBelum ada peringkat

- Saran Full ProjectDokumen26 halamanSaran Full Projecttn63 villanBelum ada peringkat

- Banking NotesDokumen23 halamanBanking Notesgopan009Belum ada peringkat

- Module 3 Banker & CustomerDokumen33 halamanModule 3 Banker & CustomerSumiya YousefBelum ada peringkat

- Letter of CreditDokumen7 halamanLetter of CreditAnam AshfaqBelum ada peringkat

- Bank Accounts and DepositsDokumen45 halamanBank Accounts and Depositsmirna tayehBelum ada peringkat

- PFIN 6th Edition Billingsley Solutions Manual 1Dokumen36 halamanPFIN 6th Edition Billingsley Solutions Manual 1rebeccabuckwecfyrisgj100% (29)

- International Banking Final AssginmentDokumen83 halamanInternational Banking Final Assginmentlephankythu.workBelum ada peringkat

- CH 01Dokumen24 halamanCH 01তৌহিদুর রহমান শাওনBelum ada peringkat

- Objectives: at The End of The Session You Will Be Able ToDokumen70 halamanObjectives: at The End of The Session You Will Be Able ToManoj Narayan KatkarBelum ada peringkat

- Monetary and Financial Economic: 2 Année de La Grande Ecole de L'institut de RabatDokumen23 halamanMonetary and Financial Economic: 2 Année de La Grande Ecole de L'institut de RabatIsmaîl TemsamaniBelum ada peringkat

- Guide For Designing Cyber Security ExercisesDokumen6 halamanGuide For Designing Cyber Security Exercisesbehappy_aklprasadBelum ada peringkat

- Financial Cyber CrimeDokumen10 halamanFinancial Cyber Crimebehappy_aklprasadBelum ada peringkat

- Prospectus For Online Certificate, Diploma and Degree Programmes - 2013 - 2014Dokumen33 halamanProspectus For Online Certificate, Diploma and Degree Programmes - 2013 - 2014behappy_aklprasadBelum ada peringkat

- Prospectus For Online Certificate, Diploma and Degree Programmes - 2013 - 2014Dokumen33 halamanProspectus For Online Certificate, Diploma and Degree Programmes - 2013 - 2014behappy_aklprasadBelum ada peringkat

- Ilfse Ts CorporateDokumen83 halamanIlfse Ts Corporatebehappy_aklprasadBelum ada peringkat

- Objectives of CRM: Relationship and The Main Objectives To Implement CRM in The Business Strategy AreDokumen2 halamanObjectives of CRM: Relationship and The Main Objectives To Implement CRM in The Business Strategy Arebehappy_aklprasadBelum ada peringkat

- 4 THDokumen1 halaman4 THbehappy_aklprasadBelum ada peringkat

- Demonetisation: A Project OnDokumen52 halamanDemonetisation: A Project OnSwarnajeet GaekwadBelum ada peringkat

- A Study On The Financial Performance of Canara BankDokumen7 halamanA Study On The Financial Performance of Canara BankAruna ABelum ada peringkat

- The Architectural Review - 09 2019Dokumen124 halamanThe Architectural Review - 09 2019Pepo Girones Masanet100% (1)

- Intermediate Accounting - Investment Property (Pas 40)Dokumen2 halamanIntermediate Accounting - Investment Property (Pas 40)22100629Belum ada peringkat

- Act Broadband AprilDokumen2 halamanAct Broadband AprilAshaBelum ada peringkat

- Aviva India LTD.: Background Factors For SuccessDokumen4 halamanAviva India LTD.: Background Factors For SuccessAtul KatochBelum ada peringkat

- FIN531 Investment Analysis: Faculty of BusinessDokumen85 halamanFIN531 Investment Analysis: Faculty of Businessusername6969100% (1)

- F Wall Street PDFDokumen2 halamanF Wall Street PDFGuyBelum ada peringkat

- Vision of Microfinance in IndiaDokumen28 halamanVision of Microfinance in Indiashiva1720Belum ada peringkat

- Sample of Bank Comfort LetterDokumen2 halamanSample of Bank Comfort LetterShakeshakes89% (9)

- Equity Exercises 1Dokumen3 halamanEquity Exercises 1alcazar rtuBelum ada peringkat

- Key Principles of Micro FinanceDokumen7 halamanKey Principles of Micro FinanceAniruddha Patil100% (1)

- Government of Kerala: Rs. Rs. RsDokumen25 halamanGovernment of Kerala: Rs. Rs. RsmuhammedBelum ada peringkat

- Siquaf Trade Paparan PDFDokumen31 halamanSiquaf Trade Paparan PDFsiquaf15Belum ada peringkat

- From Inception of Operations To December 31 2008 Blaise PascalDokumen1 halamanFrom Inception of Operations To December 31 2008 Blaise PascalM Bilal SaleemBelum ada peringkat

- Chapter 1 Afar (Bus Com)Dokumen24 halamanChapter 1 Afar (Bus Com)jajajaredredBelum ada peringkat

- 23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Dokumen55 halaman23.+Other+Percentage+Tax-REVISED+2023-classroom+discussion - Students 2Aristeia NotesBelum ada peringkat

- Infra SectorDokumen89 halamanInfra SectorTina PhilipBelum ada peringkat

- MMT and Its CritiquesDokumen10 halamanMMT and Its CritiquestymoigneeBelum ada peringkat

- Lecture Sheet 07Dokumen10 halamanLecture Sheet 07Rj Aritro SahaBelum ada peringkat

- 1st Quiz AUD ProblemsDokumen1 halaman1st Quiz AUD ProblemsGletzmar IgcasamaBelum ada peringkat

- Substation Tender DocumentDokumen97 halamanSubstation Tender DocumentthibinBelum ada peringkat

- NEGO 103 Case DigestsDokumen34 halamanNEGO 103 Case DigestskbongcoBelum ada peringkat

- Ugba 101b Test 2 2008Dokumen12 halamanUgba 101b Test 2 2008Minji KimBelum ada peringkat

- CitiGroup 2002Dokumen34 halamanCitiGroup 2002Coco CiaoBelum ada peringkat

- Introduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011Dokumen5 halamanIntroduction To Financial Accounting: Suggested Answers Foundation Examinations - Spring 2011adnanBelum ada peringkat

- GLC Legal Profession Accounts and Records Regulations Consolidated 2017Dokumen20 halamanGLC Legal Profession Accounts and Records Regulations Consolidated 2017tajhtechzBelum ada peringkat

- Holydays Homework EcoDokumen3 halamanHolydays Homework EcoAkshita ChauhanBelum ada peringkat

- KPMG Flash News Draft Guidelines For Core Investment CompaniesDokumen5 halamanKPMG Flash News Draft Guidelines For Core Investment CompaniesmurthyeBelum ada peringkat

- Group 8 - Final Report - Mutual Funds in VietnamDokumen18 halamanGroup 8 - Final Report - Mutual Funds in VietnamNguyễn Thuỳ DungBelum ada peringkat