ORM in Banks and Financials Institutions

Diunggah oleh

raul.rivera0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

90 tayangan16 halamanOperational risk losses have often led to the downfall of financial institutions. The regulators of financial companies and banks are demanding a far greater level of insight and awareness by directors about the risks they manage. This has led to an increased emphasis on having a sound operational risk management practice in place, especially when dealing with internal capital assessment and allocation process.

Deskripsi Asli:

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniOperational risk losses have often led to the downfall of financial institutions. The regulators of financial companies and banks are demanding a far greater level of insight and awareness by directors about the risks they manage. This has led to an increased emphasis on having a sound operational risk management practice in place, especially when dealing with internal capital assessment and allocation process.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

90 tayangan16 halamanORM in Banks and Financials Institutions

Diunggah oleh

raul.riveraOperational risk losses have often led to the downfall of financial institutions. The regulators of financial companies and banks are demanding a far greater level of insight and awareness by directors about the risks they manage. This has led to an increased emphasis on having a sound operational risk management practice in place, especially when dealing with internal capital assessment and allocation process.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 16

MetricStream

Operational Risk Management (ORM)

Roadmap to Advanced Measurement Approach (AMA)

and Better Business Performance

in Banks and Financial Institutions

Solution Brief

Governance, Risk, Compliance and Quality Management Solutions

Table of Contents

Operational Risk: Changing Face of Compliance

Challenges in Managing Operational Risk

Building an Operational Risk Framework

Business Benefits: Moving Beyond Compliance

MetricStream Solution for ORM

Roadmap to Advanced Measurement Approaches (AMA)

References

2

4

6

8

9

12

12

Op Op Op Op Oper er er er era aa aational R tional R tional R tional R tional Ri sk: i sk: i sk: i sk: i sk: C CC CChanging F hanging F hanging F hanging F hanging Fac ac ac ac ace of C e of C e of C e of C e of Complianc omplianc omplianc omplianc ompliance ee ee

2

Banks and financial institutions are undergoing a sea change and today face an environment marked by

growing consolidation, rising customer expectations, increasing regulatory requirements, proliferating

financial engineering, uprising technological innovation and mounting competition. This has increased the

probability of failure or mistakes from the operations point of view resulting in increased focus on manag-

ing operational risks.

Operational risk losses have often led to the downfall of financial institutions, with more than 100 reported

losses exceeding US$100 million in the recent years. The regulators of financial companies and banks are

demanding a far greater level of insight and awareness by directors about the risks they manage, and the

effectiveness of the controls they have in place to reduce or mitigate these risks. Further, compliance regula-

tions, like Basel II and SOX, mandate a focus on operational risks, forcing financial organizations to identify,

measure, evaluate, control and manage this ubiquitous risk. This has led to an increased emphasis on the

importance of having a sound operational risk management (ORM) practice in place, especially when deal-

ing with internal capital assessment and allocation process. This makes ORM one of the most complex and

fastest growing risk disciplines in financial institutions.

Alan Greenspan, Chairman of the Federal Reserve American Bankers Association, during Annual

Convention on October 5, 2004 held, It would be a mistake to conclude that the only way to succeed in

banking is through ever-greater size and diversity. Indeed, better risk management may be the only truly

necessary element of success in banking.

Old perceptions and behaviors toward risk are changing. ORM

is acquiring new credibility as a roadmap to add value to the

business; and is garnering new attention from regulators and

key stakeholders.

A recent Chartis Research's

1

report on ORM systems, suggests

that the worldwide financial services ORM market will con-

tinue to grow, reaching a total value of $1.55 billion by 2011.

This indicates a growing concern among banks and financial

institutions for managing their operational risk. The report has

three main findings:

Basel II and Operational Risk: Basel II and Operational Risk: Basel II and Operational Risk: Basel II and Operational Risk: Basel II and Operational Risk:

Operational risk is as old as the

banking industry itself and yet the

industry has only recently arrived at a

definition of what it is. Operational

risk is defined by the Basel Commit-

tee on Banking Supervision (2006) as:

the risk of loss resulting from inad-

equate or failed internal processes,

people and systems or from external

events. This definition includes legal

risk but excludes strategic and

reputational risk.

Many US and European financial institutions continue to

replace their first generation ORM systems - largely due to

inflexible and rigid product design and the ongoing

evolvement of ORM methodologies.

Some market segments, such as emerging regions (e.g.

Middle-East, Asia-Pacific, South America), and vertical

sectors (e.g. insurance, asset management) have begun investing in formal and sophisticated ORM

systems.

Average investment in ORM projects is increasing, as more and more financial institutions are focusing on

ORM's strategic business benefits

Additionally, the report claims financial institutions working on the demand side of the market are re-

examining their approach, culture and systems for managing operational risk.

3

There are two main drivers for this development. First, there is a growing acknowledgement from banks that

a consistent and effective operational risk management framework can help them achieve organizational

objectives and superior performance. For example, by including a well-constructed operational risk process

in the entire value chain, a bank can help ensure that the risks inherent in those activities are understood and

addressed. In many instances an early involvement of operational risk management can increase the devel-

opment speed of new initiatives. The second key development is the launch of the Basel II Capital Accord

(the New Accord) by the Basel Committee for Banking Supervision, which requires banks to set aside regula-

tory capital for operational riskan important development that has affected most financial services institu-

tions worldwide. One of the major improvements in Basel II is that it ensures closer linkages between capital

requirements and the ways banks manage their actual risk. As summed up by one of the U.S. regulators, The

advanced approaches of Basel II represent a sea change in how banks determine their minimum level of required

capital for regulatory purposes. It intends to better align regulatory capital with inherent risks and banks' internal

economic capital.

The advanced approach for measurement of operational risk requires economic capital to be calculated

based on banks own operational risk management & measurement technique. It is imperative to strengthen

the soundness and stability of operational risk management practice by employing Advanced Measurement

Approach (AMA), in order to ensure that it does not become a significant source of competitive inequity over

rival banks & financial institutes. Further, AMA fosters risk sensitive environment and promotes efficiency in

managing risk. The road ahead should lead to Advanced Measurement Approach (AMA) as described under

Basel II accord.

Passive

Banks

Active

Banks

Avanced

Measurement

Approch

Standardized

Approch

Basic

Indicator

Approch

Low

Risk Sensitivity

High

High

Low

Capital Charge

Figure 1: Operational Risk Management Approaches

To comply with the accord, banks are making significant

investments to improve their internal risk processes, data

infrastructure, and analytical capabilities. Firms focused on

competing effectively are already incorporating many ele-

ments of the Basel II requirements into their risk and capital

management practices, as a blueprint of improved growth and

profitability.

As a result, Basel II compliance programs offer a rare opportu-

nity to rethink the way banks approach risk measurement and

management, and to look again how risk measures can be

integrated with each other and with managements approach

to running the business. Susan Schmidt Bies

2

, one of the U.S.

regulators, stressed, The emphasis in the new Accord on im-

proved data standards should not be interpreted solely as a re-

quirement to determine regulatory capital standards, but rather as

a foundation for risk management practices that will strengthen

the value of the banking franchise.

Although Basel II compliance opens up many strategic oppor-

tunities to leverage improved data standards and risk manage-

ment practices, it also offers many implementation challenges.

The next section highlights the major challenges in success-

fully implementing ORM.

Challenges of Managing Operational Risk Challenges of Managing Operational Risk Challenges of Managing Operational Risk Challenges of Managing Operational Risk Challenges of Managing Operational Risk

The discipline of operational risk is at a crossroads. Despite the industry's efforts to control operational risk,

institutions still have much work to do. Risk Managers are grappling with questions like, How does the

discipline add value to my organization?; What does the advanced measurement approachs (AMA) model-

ing techniques say about the operational risks my firm is facing? or What is the strategic role of operational

risk that my firm should adopt?. Lets take a look at some of the unique challenges that ORM brings:

4

An Ernst and Young's Global Basel

Survey in 2006 indicates that senior

banking executives are beginning to

appreciate the long term business

impacts of Basel II on their organiza-

tions and banking industry as a

whole. It suggests a realization that

Basel II adoption is a growing im-

perative in order to succeed in the

competitive race. About 89% of the

participants in the survey believed

that the banks with robust risk infra-

structures will have competitive

advantage over others.

Reference:

http://www.ey.com/Global/Assets.nsf/

International/Basel_II_Survey_

Report_2006/$file/EY_GFSRM_Basel_

II_Survey2006.pdf

Rising Costs of Compliance: Rising Costs of Compliance: Rising Costs of Compliance: Rising Costs of Compliance: Rising Costs of Compliance: Development of an ORM model as part of a regulatory and economic

capital framework is complex and takes time. There is a general agreement that the major ORM

challenge is the escalating cost of compliance.

Access to Appropriate Information and Reporting: Access to Appropriate Information and Reporting: Access to Appropriate Information and Reporting: Access to Appropriate Information and Reporting: Access to Appropriate Information and Reporting: Effective management of operational risk requires

diverse information from a variety of sourcesincluding, for example, risk reports, risk and control

profiles, operational risk incidents, key risk indicators, risk heat maps, and rules and definitions for

regulatory capital and economic capital reporting.

Development of Loss Databases: Development of Loss Databases: Development of Loss Databases: Development of Loss Databases: Development of Loss Databases: A well-structured operational risk framework requires development of

business-line databases to capture loss events attributable to various categories of operational risk. Basel

II specifically requires a minimum of three years of data for initial implementation and ultimately five

years for the Advanced Measurement Approaches (AMA). The need for historical data (including external

data) has been a cause of concern for many enterprises.

5

Lack of Systematic Measurement of Operational Risk: Lack of Systematic Measurement of Operational Risk: Lack of Systematic Measurement of Operational Risk: Lack of Systematic Measurement of Operational Risk: Lack of Systematic Measurement of Operational Risk: Many enterprises hold that their institutions are

measuring operational risk. However, very few of them have been able to complete the Basel II

quantification requirements, or are yet to formalize the measurement process around the Basel II

framework.

Implemen Implemen Implemen Implemen Implementing ORM sy ting ORM sy ting ORM sy ting ORM sy ting ORM syst st st st stems: ems: ems: ems: ems: Amid regulatory efforts to re-vamp the industrys immunity to operational

risk, and its implications on efficient financial intermediation, many organizations are looking to go

beyond traditional siloed approaches and implement a consolidated ORM framework across entire

value chain. Development of an ORM model as part of a regulatory and economic capital framework,

however, is complex and takes time. Some banks may either still be struggling with the requirements of

the "Sound Practices for ORM" BIS paper, which spells out how to introduce ORM principles, or may not

yet have in place the required governance or framework. Factors like lack of understanding of upcoming

technology regarding operational risk management, failure to get the top management to focus on the

benefits of the program, improved productivity and quality, as well as on loss reduction, and lack of

meaningful and timely data across business unit and product lines make the implementation of an ORM

system all the more formidable.

T TT TTone a one a one a one a one at the t the t the t the t the T TT TTop: op: op: op: op: Effective risk management program starts with The Tone at the Top- driven by the top

management and adhered by the bottom line. However, if banks top leaders perceive operational risk

management solely as a regulatory mandate, rather than as an important means of enhancing

competitiveness and performance, they may tend to be less supportive of such efforts. Management and

the board must understand the importance of operational risk, demonstrate their support for its

management, and designate an appropriate managing entity and framework - one that is part of the

banks overall corporate governance framework.

By adopting an integrated operational risk framework, companies can ensure that all operational risks

management initiatives are sustained and are aligned with the corporate strategy. Next section throws light

on essentials of an ideal operational risk framework.

Review of management

and measurement pro-

cesses by internal/external

audit

I dent i f y Ri sks I dent i f y Ri sks I dent i f y Ri sks I dent i f y Ri sks I dent i f y Ri sks

Risk Management Cycle Risk Management Cycle Risk Management Cycle Risk Management Cycle Risk Management Cycle

Analysis of

workflows and

processes

List risks and

causes

Assess the Ri sk Assess the Ri sk Assess the Ri sk Assess the Ri sk Assess the Ri sk

Sel ect r i sk Sel ect r i sk Sel ect r i sk Sel ect r i sk Sel ect r i sk

control measures control measures control measures control measures control measures

I mpl ement ri sk I mpl ement ri sk I mpl ement ri sk I mpl ement ri sk I mpl ement ri sk

control s control s control s control s control s

Moni tor and Moni tor and Moni tor and Moni tor and Moni tor and

Revi ew Revi ew Revi ew Revi ew Revi ew

Assess risk

severity

Assess risk

probability

Identify control

choices

Determine

priorities

Make control

decisions

Establish

authority and

responsibility

Define

structure

Define

processes and

procedures

Define

monitoring

Infrastructure

Monitor

process

Review

processes

R i s k R i s k R i s k R i s k R i s k

Management Management Management Management Management

Obj ect i ves Obj ect i ves Obj ect i ves Obj ect i ves Obj ect i ves

Operational risk management is at the core of a bank's opera-

tions - integrating risk management practices into processes,

systems and culture. As a pro-active partner to senior manage-

ment, ORM's value lies in supporting and challenging them to

align the business control environment with the bank's strat-

egy by measuring and mitigating risk exposure, contributing

to optimal return for stakeholders. For instance, HSBC

3

has

invested heavily in understanding customer behavior through

new systems initially designed for fraud detection, which is

now being leveraged beyond compliance to address more

effective customer service.

The ORM group of an organization keeps its people up-to-date

on problems that have happened to other financial institu-

tions, allowing it to take a more proactive approach. "Our goal

is for employees to look at ORM as a business stakeholder and a

shareholder, involving them on all levels and bring stability into

their jobs," said senior vice president of Operational and Com-

pliance Risk Management Group. A noted financial services

company, on the other hand, incorporates its ORM approach as

an extension of its business line and not a separate entity. The

company has implemented an operational risk umbrella that

encompasses all aspects of potential risks - bank protection,

fraud prevention, key risk indicators, capture of operational

loss data, business line risk oversight and new products and

initiatives for data security. Its Chief Risk officer quotes, "We

utilize our ORM practices to gain respect and appreciation of all

our business lines by really understanding their issues, and being

part of the overall solution."

What elements should a financial institution consider when

developing an analytical framework for operational risk?

There is no one-size-fits-all approach to ORM as every enterprise follows a framework that is specific to its

own internal operating environment. When inquired about the standard ORM framework, a risk expert notes,

There is no "standard" standard. Ultimately, the Operational risk framework should not merely be Basel-compli-

ant; it should also provide the bank with mechanisms for improving overall risk culture and behavior towards

operational risk management. Understanding our risks should lead to better decision making and reflect in our

performance. A robust operational risk management framework is made up of the following core compo-

nents:

B BB BBuilding an Op uilding an Op uilding an Op uilding an Op uilding an Oper er er er era aa aational R tional R tional R tional R tional Risk F isk F isk F isk F isk Fr rr rrame ame ame ame amew ww wwor or or or ork kk kk

6

An award winning Banking Group

states that it is focused on the regular

monitoring of its operational risk

profiles and material exposures to

operational losses- with senior

management supporting the proac-

tive management of operational

risks. Its Operational Risk Manage-

ment department (ORM)

Carries out risk-audit activities,

assessments of operational risks

and prepares recommendations

for risk mitigation.

Implements a number of tools

recommended by the Basel Com-

mittee including: internal loss

collection and reporting, key risk

indicators, external loss data

collection; and control and risk

self-assessments.

Analyzes new products and intra-

bank regulations.

Holds comprehensive insurance

policy, which is designed with

ORM participation.

The group has received the Opera-

tional Risk Achievement Award for

two consecutive years.

7

Governance: Governance: Governance: Governance: Governance: It is the process by which the Board of Directors defines key objectives for the bank and

oversees progress towards achieving those objectives. It defines overall operational risk culture in

organization, and sets the tone as to how a bank implements and executes its operational risk

management strategy. A successfully executed risk strategy often results in risk being firmly embedded

in the vision, strategies, tools, and tactics of the organization. Governance sets the precedence for

Strategy, Structure and Execution.

S SS SStr tr tr tr tra aa aat tt tteg eg eg eg egy yy yy: :: :: A banks strategy for operational risk drives the other components within the management

framework and provides clear guidance on risk appetite or tolerance, policies, and processes for day-to-

day risk management.

Appetite and Policy: Appetite and Policy: Appetite and Policy: Appetite and Policy: Appetite and Policy: An ideal risk management process ensures that organizational behavior is

driven by its risk appetite. Adopting an operational risk strategy aligned to risk appetite, leads to

informed business and investment decisions.

C C C C Clear D lear D lear D lear D lear Definition & C efinition & C efinition & C efinition & C efinition & Communic ommunic ommunic ommunic ommunica aa aation of P tion of P tion of P tion of P tion of Polic olic olic olic olicy yy yy: :: :: An organizations top management must identify,

assess, decide, implement, audit and supervise their strategic risks. There should be a strategic policy

at the board level to focus on managing risk at all levels and conscious efforts should be made to

ensure that these policies are communicated at all levels and across entire value chain.

Periodic Evaluations Based on Internal & External Changes: Periodic Evaluations Based on Internal & External Changes: Periodic Evaluations Based on Internal & External Changes: Periodic Evaluations Based on Internal & External Changes: Periodic Evaluations Based on Internal & External Changes: An ideal risk management process

puts improvement of risk performance on a competitive level with other important mission

concerns periodically evaluating the ORM performance goals in the light of internal and external

factors. Depending upon the criticality of internal operating environment and key external factors,

organization must review the strategic policies inside out.

Governance

Control and self

Assessment

Key Risk

Indicators (KRIs)

Loss Data -

Internal and

External

Issue

Management

Figure 2: Operational Risk Management Framework

8

S SS SStr tr tr tr truc uc uc uc uctur tur tur tur ture: e: e: e: e: When designing the operational risk management structure, the banks overall risk scenario

should serve as a guideline. This includes initiatives like laying down a hierarchical structure that

leverages current risk processes, developing risk measurement models to assess regulatory and

economic capital,and allocating economic capital vis--vis the actual risk confronted. Centralized

aggregation of operational risk information collected via various self assessments across the

organization, further, provides useful insight for the desired hierarchial structure. The implementation of

these concepts allows risk to be handled consistently throughout the organization.

Execution: Execution: Execution: Execution: Execution: Once operational risk management structure have been established by an organization

adequate procedures should be designed and implemented to ensure execution of and compliance

with these policies at business line level. The first step includes identification and assessment of

operational risk inherent in day-to-day processes of the bank. After assessment of inherent risk, target

tolerance limit of risk should be established. This is commonly accomplished by calculating the

probability/ likelihood of materialization of risk, by considering the drivers or causes of the risk together

with the assessment of its impact. The results of the risk assessment and quantification process enables

management to compare the risks with its operational risk strategy and policies, identify those risk

exposures that are unacceptable to the institution or are outside the institutions risk appetite, and select

and prioritise appropriate mechanisms for mitigation. Finally appropriate risk mitigation and internal

controls procedures are established by the business units such that residual risk is mitigated to the

acceptable level. Regular reviews must be carried out, to analyse the control environment and test the

effectiveness of implemented controls, thereby ensuring business operations are conducted within

acceptable risk limits. Further, it is essential that the top management ensures consistent monitoring and

controlling of operational risk, and that risk information is received by the appropriate people, on timely

basis, in the form and format that will aid in the monitoring and control. Operational risk metrics or Key

Risk Indicators (KRIs) are established to ensure timely warning is received prior to the occurance of an

event. Key to effective KRIs lies in setting threshold at the acceptable level of risk. Execution and

implementation of Operational Risk framework is key to setting up effective Operational Risk

environment ensuring that business is conducted within appropriate risk tolerance limit.

Business Benefits: Moving Beyond Compliance Business Benefits: Moving Beyond Compliance Business Benefits: Moving Beyond Compliance Business Benefits: Moving Beyond Compliance Business Benefits: Moving Beyond Compliance

As ORM efforts mature, and gain both the support and the confidence of management, they are becoming

increasingly valuable to the business. Perceived initially to support regulatory requirements, these efforts can

be leveraged and aligned with business performance management. To be successful, however, such align-

ment must be based on a clear vision of the potential benefits. Few of the benefits are discussed below:

Identified and assessed key operational risk exposures: Identified and assessed key operational risk exposures: Identified and assessed key operational risk exposures: Identified and assessed key operational risk exposures: Identified and assessed key operational risk exposures: ORM enables an organization to identify

measure, monitor and control its inherent risk exposures of the business at all levels. Elements like Risk

Assessment, Event Management, and Key Risk Indicator play an important role; enabling the

organization to evaluate the risk controls, based on the identified inherent risk, and to measure the

residual risk which remains after the implementation of controls.

Clarified personal accountabilities, roles and responsibilities for managing operational risks: Clarified personal accountabilities, roles and responsibilities for managing operational risks: Clarified personal accountabilities, roles and responsibilities for managing operational risks: Clarified personal accountabilities, roles and responsibilities for managing operational risks: Clarified personal accountabilities, roles and responsibilities for managing operational risks: Clear

cut specification of roles and responsibilities of personnel regarding risk profile is an imperative part of

implementing an integrated ORM framework. It not only streamlines the risk management process, but

also allows risk managers to better incorporate accountability into the work culture of the organization.

E EE EEv vv vvolv olv olv olv olved and enabled efficien ed and enabled efficien ed and enabled efficien ed and enabled efficien ed and enabled efficient allo t allo t allo t allo t alloc cc cca aa aation of op tion of op tion of op tion of op tion of oper er er er era aa aational r tional r tional r tional r tional risk c isk c isk c isk c isk capital: apital: apital: apital: apital: With streamlined risk

management process, efficient allocation and utilization of operational risk capital can be ensured.

7

Consistent and timely operational risk management information and reporting capabilities: Consistent and timely operational risk management information and reporting capabilities: Consistent and timely operational risk management information and reporting capabilities: Consistent and timely operational risk management information and reporting capabilities: Consistent and timely operational risk management information and reporting capabilities:

Through the development of a well-tailored risk management strategy, a robust ORM system supports

features like role-based dashboards, control diagrams and scorecards that provide visibility into the

ongoing risk management efforts and bring high-risk areas into focus.

Sustained risk-smart workforce and environment: Sustained risk-smart workforce and environment: Sustained risk-smart workforce and environment: Sustained risk-smart workforce and environment: Sustained risk-smart workforce and environment: Application of an ORM framework, in conjunction

with related risk management activities, will support cultural shift to a risk-smart workforce and

environment in the organization. An essential element of a risk-smart environment is that it ensures that

the organization has the capacity and tools to be innovative while recognizing and respecting the need

to be prudent in protecting its interest.

Ensured continuous risk management learning: Ensured continuous risk management learning: Ensured continuous risk management learning: Ensured continuous risk management learning: Ensured continuous risk management learning: Most business units today acknowledge that

continuous learning is fundamental to more informed and proactive decision-making; and a successful

learning organization must align itself to the businesses it supports. To ensure continuous risk

management learning, these business units are sharing their experience and best risk management

practices - internally and across organizations. This supports innovation, capacity building and

continuous improvement, and fosters an environment that motivates people to learn.

However, successfully navigating the road from compliance to value creation can be daunting without a

roadmap and a clear vision. By taking a holistic approach to ORM organizations can significantly lower its

risk profile and contribute to its responsiveness in the marketplace - thereby delivering strategic and opera-

tional benefits.

MetricStream Solution for ORM MetricStream Solution for ORM MetricStream Solution for ORM MetricStream Solution for ORM MetricStream Solution for ORM

MetricStream offers industrys most advanced and comprehensive solution designed to meet Operational

Risk needs of banks & financial services. The solution is based on an integrated Enterprise Compliance Plat-

form (ECP) for successfully managing risk and meeting regulatory requirments while lowering the associated

costs that can otherwise be substantial. ECP, a proven infrastructure for building risk and compliance applica-

tion, provides core modules and services to automate and streamline Opertaional Risk processes.

MetricStream uniquely combines software and content to deliver ORM solutions. Its embedded best practices

content helps define the scope of processes and sub-processes for which risk management needs to be

Expected loss is the amount a business should budget to cover its annual cost of operational failure while

unexpected loss is the amount the business ought to reserve as capital.

Expected

loss

Unexpected loss Tail Events

Amount of loss

9

10

performed and guides development of control and test libraries. It brings together all risk management

related data - a reusable library of risks and their corresponding controls and assessments, results from indi-

vidual assessments, key risk indicators, events such as losses and near-misses, issues and remediation plans -

in a single solution. It also provides other intelligent and content driven features such access to training

content from an expert community from within the solutions and integration of business processes with

regulatory notifications and industry alerts. Key components of MetricStream solution for ORM would in-

clude:

R RR RRisk A isk A isk A isk A isk Analy naly naly naly nalysis and R sis and R sis and R sis and R sis and Risk S isk S isk S isk S isk Self A elf A elf A elf A elf Assessmen ssessmen ssessmen ssessmen ssessment: t: t: t: t: The

MetricStream solution for ORM provides a centralized

risk framework to document all risks faced by an

organization. It supports risk assessment and

computations based on configurable methodologies

and algorithms giving an insight into organizations risk

profile enabling the risk managers to prioritize their

response strategies for optimal risk/reward outcomes.

Risk Control Self Assessment (RCSA) forms a core part of

the MetricStream solution. MetricStream's risk self-

assessment capabilities enable organizations to

document and evaluate their risk frameworks, including

processes, risks, events, key risk indicators (KRI) and

controls. Executive-level dashboard and reports provide

visibility into the risk analysis, highlighting key risk

metrics and policy compliance. Business process

automation capabilities provide for real-time event

escalation, automated risk processes and streamlined

remediation of issues and action items.

Control Design and Assessments: Control Design and Assessments: Control Design and Assessments: Control Design and Assessments: Control Design and Assessments: Once the key risks are

identified and prioritized, MetricStream leverages the

operational risk framework to enable companies to

define a set of controls that mitigate those risks. The

solution also allows associated policy and procedure

documents to be attached for reference. The system

supports assessments based on predefined criteria and

checklists and has a mechanism for scoring, tabulating

and reporting results. The repository of all assessments

with an easy search capability ensures that the users can

check to see if a specific control was tested, access the

assessment results and confirm whether it requires a

remedial action plan.

L LL LLoss oss oss oss oss T TT TTr rr rrack ack ack ack acking and K ing and K ing and K ing and K ing and Ke ee eey R y R y R y R y Risk Indic isk Indic isk Indic isk Indic isk Indica aa aat tt ttors (KRI ors (KRI ors (KRI ors (KRI ors (KRIs): s): s): s): s): With loss

event tracking, risk managers can track loss incidents and

near misses, record amounts, and determine root causes

and ownership. MetricStream provides statistical and

trend analysis capabilities and enables end-users to track

remedies and action plans. Key risk indicators (KRIs)

11

provide capabilities for tracking risk metrics and thresholds, with automated notification when

thresholds are breached. MetricStream provides facilities for both manual and automatic data inputs

from internal and external data sources.

Issue Management and Remediation: Issue Management and Remediation: Issue Management and Remediation: Issue Management and Remediation: Issue Management and Remediation: For issues arising from the assessment and auditing processes or

from any other external events such as loss-events, scenario analysis or near-misses', the MetricStream

solution provides seamless issue management and remediation management capabilities. Once issues

are identified, documented and prioritized, a systematic mechanism of investigation and remediation is

set off by the underlying workflow and collaboration engine. The solution supports triggering automatic

alerts and notifications to appropriate personnel for task assignments for investigation and remedial

action.

Internal Audit: Internal Audit: Internal Audit: Internal Audit: Internal Audit: MetricStream solution provides seamless integration with internal audit management

for streamlining the auditing process in the organization. It provides the flexibility to manage a wide

range of audit-related activities, data and processes to support risk management. It supports all types of

audits, including internal audit, operational audit, finanacial statement audit, IT audits and quality audits.

Advanced capabilities like built-in remediation workflows, time tracking, email-based notifications and

alerts and offline functionality for conducting at remote field sites allow organizations to implement the

industry best practices for efficient audit execution and ensure integration of the audit process with the

risk and compliance management system.

R RR RRep ep ep ep epor or or or orts and D ts and D ts and D ts and D ts and Dashb ashb ashb ashb ashboar oar oar oar oards: ds: ds: ds: ds: The solution has the ability to track risk profiles, control ownership,

assessment plans, remediation status, etc. on graphical charts that can be accessed globally and display

real-time information. Ability to drill-down provides an easy way to access the data at finer levels of

detail. In addition to pre-configured standard risk reports, the system provides flexibility by enabling

stakeholders to configure ad-hoc or scheduled reports to view metrics on a variety of parameters such as

by process, by business units, by status, etc. Quarterly and monthly trending analysis along with the

ability to drill-down into each report and dashboard to see the underlying details enables risk managers

and process owners to stay in constant touch with the ground reality and progress on risk management

programs. Automated alerts for events such as exceptions and failures eliminate any surprises and make

the process predictable.

12

Roadmap to Advanced Measurement Approaches (AMA) Roadmap to Advanced Measurement Approaches (AMA) Roadmap to Advanced Measurement Approaches (AMA) Roadmap to Advanced Measurement Approaches (AMA) Roadmap to Advanced Measurement Approaches (AMA)

MetricStream ORM solution provides a platform for organizations to develop an integrated ORM approach

which can help them qualify for Basel II AMA approach. Solution implements strategies, methodologies and

risk reporting functionality to identify, measure, monitor, control and mitigate operational risk. It ensures that

the organizations internal systems and controls are credible and appropriate, well reasoned and well

documented, transparent and accessible, and are capable of being validated by internal and external

auditors. Moreover, it provides capability to ensure that the risk management practices are embedded across

the entire value chain.

The figure below maps MetricStream solution to the qualifying criteria for AMA.

Reference Reference Reference Reference Reference

1. Operational Risk Management Systems 2008 - Navigating through a fragmented market

http://www.chartis-research.com/assets/RR08011.pdf

2. Remarks by Governor Susan Schmidt Bies: At the International Center for Business Information's Risk

Management Conference: Basel Summit, Geneva, Switzerland

http://www.federalreserve.gov/boarddocs/speeches/2005/20051206/default.htm

3. http://www.opriskandcompliance.com/public/showPage.html?page=480328

Systematic tracking of 35

years of historic loss data

Sound Operational Risk

Management System

Measurement integrated in

day-to-day risk manage-

ment

Review of management

and measurement pro-

cesses by internal/external

audit

Figure 3: Roadmap to Advanced Measurement Approaches by MetricStream Figure 3: Roadmap to Advanced Measurement Approaches by MetricStream Figure 3: Roadmap to Advanced Measurement Approaches by MetricStream Figure 3: Roadmap to Advanced Measurement Approaches by MetricStream Figure 3: Roadmap to Advanced Measurement Approaches by MetricStream

Risk & Control Self Assessment (RCSA)

Key Risk Indicators (KRI)

Loss Event Database

External Loss Data interface

Integrated RCSA & Loss Event Data

Internal Audit

Dashboards & Reports

Qualifying Criteria Qualifying Criteria Qualifying Criteria Qualifying Criteria Qualifying Criteria MetricStream solution capability MetricStream solution capability MetricStream solution capability MetricStream solution capability MetricStream solution capability

19

About MetricStream About MetricStream About MetricStream About MetricStream About MetricStream

MetricStream is a market leader in Enterprise-wide Gover-

nance, Risk, Compliance (GRC) and Quality Solutions for global

corporations. MetricStream solutions are used by leading

corporations such as Pfizer, Philips, American Airlines, NASDAQ,

SanDisk, BP, Entergy, Subway, Fairchild Semiconductor, Hitachi

and TaylorMade-Adidas Golf in diverse industries such as

Pharmaceuticals, Medical Devices, High Tech Manufacturing,

Food & Beverage, Energy and Financial Services to manage

their quality processes, regulatory and industry-mandated

compliance and corporate governance initiatives, as well as by

over a million compliance professionals worldwide via the

ComplianceOnline.com portal.

MetricStream, Inc. MetricStream, Inc. MetricStream, Inc. MetricStream, Inc. MetricStream, Inc.

2600 E. Bayshore Road

Palo Alto, CA 94303

Phone: 650-620-2900

Fax: 650-632-1953

info@metricstream.com

Copyright 2010 MetricStream. All rights reserved.

For More Information

about MetricStream GRC and Quality

Management Solutions

please visit www.metricstream.com

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- 5 Series LLC Strategies EbookDokumen11 halaman5 Series LLC Strategies EbookjuniormintsBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- IAS 2 InventoriesDokumen10 halamanIAS 2 InventoriesOtun AdedamolaBelum ada peringkat

- Airthread Connections Work Sheet SelfDokumen65 halamanAirthread Connections Work Sheet SelfkjhathiBelum ada peringkat

- Financial Inclusion in AfricaDokumen148 halamanFinancial Inclusion in AfricakimringineBelum ada peringkat

- Economics Handout Public Debt: The Debt Stock Net Budget DeficitDokumen6 halamanEconomics Handout Public Debt: The Debt Stock Net Budget DeficitOnella GrantBelum ada peringkat

- The Effect of Dollarization On EconomicDokumen61 halamanThe Effect of Dollarization On Economicnely bebe100% (1)

- KelloggsDokumen4 halamanKelloggshasan_waqar2004Belum ada peringkat

- Corporate Tax Return Checklist-Fillable-1Dokumen3 halamanCorporate Tax Return Checklist-Fillable-1ShujaRehmanBelum ada peringkat

- Nigerian Stock Exchange and Economic DevelopmentDokumen14 halamanNigerian Stock Exchange and Economic DevelopmentAbdulhameed BabalolaBelum ada peringkat

- Awfis DRHPDokumen484 halamanAwfis DRHPrahuluecBelum ada peringkat

- Cash Flow Statement: (Cheat Sheet)Dokumen5 halamanCash Flow Statement: (Cheat Sheet)LinyVatBelum ada peringkat

- Advance Financadvance Financial Accounting and Reportingweek 1 AfarDokumen22 halamanAdvance Financadvance Financial Accounting and Reportingweek 1 AfarCale HenituseBelum ada peringkat

- Consolidation: Wholly Owned Subsidiaries: PresenterDokumen36 halamanConsolidation: Wholly Owned Subsidiaries: PresenterSunila DeviBelum ada peringkat

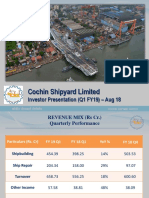

- CSL Investor Presentation Aug 18Dokumen21 halamanCSL Investor Presentation Aug 18gopalptkssBelum ada peringkat

- NPV Irr Payback & Pi As Well From The Very BasicsDokumen37 halamanNPV Irr Payback & Pi As Well From The Very BasicsZab JaanBelum ada peringkat

- Advance Test Schedule CS Executive Dec-23Dokumen22 halamanAdvance Test Schedule CS Executive Dec-23Gungun ChetaniBelum ada peringkat

- 47 Electricity Accounting Theory ProblemsDokumen5 halaman47 Electricity Accounting Theory Problemsbala_ae100% (1)

- Bulaong Extension, General Santos City 9500: Gensantos Foundation College, IncDokumen9 halamanBulaong Extension, General Santos City 9500: Gensantos Foundation College, IncCristine YamutaBelum ada peringkat

- The Case of Bernard MadoffDokumen10 halamanThe Case of Bernard Madoffmanzanojade1985Belum ada peringkat

- Shareholders' Equity - : Measure of The Consideration ReceivedDokumen3 halamanShareholders' Equity - : Measure of The Consideration ReceivedChinchin Ilagan DatayloBelum ada peringkat

- Customer Relationship Marketing: Building Customer Relationships For Enduring Profits in A Wired EconomyDokumen36 halamanCustomer Relationship Marketing: Building Customer Relationships For Enduring Profits in A Wired Economylidia_pozoBelum ada peringkat

- TENTH Lord in Your KundliDokumen4 halamanTENTH Lord in Your KundliAmit LambaBelum ada peringkat

- Docket #0909 Date Filed: 11/26/2012Dokumen88 halamanDocket #0909 Date Filed: 11/26/2012VivienneBarthaBelum ada peringkat

- Alvarez Vs Guingona G.R. No. 118303 - January 31, 1996 - HERMOSISIMA, JR., J.Dokumen1 halamanAlvarez Vs Guingona G.R. No. 118303 - January 31, 1996 - HERMOSISIMA, JR., J.Keisha Mariah Catabay LauiganBelum ada peringkat

- Multiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionsDokumen8 halamanMultiple Choice. Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionsRandy ManzanoBelum ada peringkat

- FMA - Tutorial 8 - Capital BudgetingDokumen4 halamanFMA - Tutorial 8 - Capital BudgetingPhuong VuongBelum ada peringkat

- Current Affairs December 2016 EbookDokumen261 halamanCurrent Affairs December 2016 Ebooksaurabh887Belum ada peringkat

- S.I and C.IDokumen16 halamanS.I and C.IMumtazAhmad100% (1)

- 2012 PROP 6600 Outline (Draft2)Dokumen7 halaman2012 PROP 6600 Outline (Draft2)bert1423Belum ada peringkat

- Market Outlook: Dealer's DiaryDokumen16 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat