FII Versus FDI

Diunggah oleh

Micah Thomas0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan2 halamanVis a vis analysis of FDI and FII

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniVis a vis analysis of FDI and FII

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

11 tayangan2 halamanFII Versus FDI

Diunggah oleh

Micah ThomasVis a vis analysis of FDI and FII

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

One minister holding finance and commerce portfolios could create new synergy

17 Jun, 2014, 05.24AM IST

By Manoj Pant

The new government seems to have hit the ground running. One of the issues in the new "cluster" approach to

ministries is to combine the portfolios of commerce and finance under one minister holding independent charge

of the first while sharing junior responsibility in the ministry of finance. This is supposed to create " synergy" in the

case of overlapping functions.

In this article, I will argue that this could be a worthwhile objective, especially in the context of trade and foreign

direct investment (FDI). As I will argue, some administrative reorganisation seems to be merited given the nature

of both trade and FDI flows.

While the term "trade" is easily understood, there seems to be some confusion about what is FDI. The definitional

issues are not inconsequential. Here is where the synergies are useful. FDI refers to financial flows from an

enterprise in one country to another "related" enterprise in another country.

The crucial issue is to distinguish FDI from other financial flows between unrelated entities. This is now what we

call FIIs in India and portfolio investment in general.

This was clearly recognised in the Industrial Policy of 1991, which stated that FDI is to be preferred to other forms

of financial capital flows. The logic was that FDI flows are more stable and not related to short-term swings in

interest rates or growth rates. So, one distinction is clearly drawn: FDI and foreign institutional investment (FII)

are two different entities altogether.

Why does this matter? For one, measures to attract FII and FDI are radically different. While FII flows are actually

determined by intercountry differences in interest or exchange rates, this is clearly not true of FDI. Second,

recognising the relation of FDI flows to production capacities, most direct tax treaties between countries give a

favourable treatment regarding the withholding tax rates applied on dividends or royalty payments among

"related" companies.

Clarity Before Vision

Yet, it has taken the ministry of finance a long time to define FDI flows. Recently, there seems to have been

some clarity when FDI flows were to be those where the investing company owns at least 10% of the equity of

the recipient company.

Second, an issue not really appreciated so far is that trade and FDI are really two sides of the same coin. So, FDI

is simply another way of engaging in trade. An entity in one country can engage with another country

through trade, that is, export or import. However, where there is a strong technology component, FDI is

the preferred form of engagement. In fact, about 60% of world trade is between "related" companies.

As world trade is increasingly in inputs and intermediate goods, this intra-firm trade is now the dominant form. So,

FDI simply combines the three elements of trade in goods, trade in services for instance, managerial services

and international technology flows. In fact, there is a near-perfect correlation between the bilateral FDI of

countries and their total trade.

Closer home, China's trade is almost completely driven by FDI-dominated firms. The phenomena of Indian

pharmaceutical and software companies acquiring companies in Europe and elsewhere (through FDI)

coincides with the high export growth in these sectors. More generally, it is impossible to trade

internationally without being part of the world "supply chains" that are linked by FDI between firms some

of which are actually quite small.

Yet, in India, there is a bureaucratic separation of FDI and trade. While the ministry of finance determines the

definition of FDI, the policies and control of FDI are with the department of industrial policy and promotion (Dipp),

which is a department in the ministry of commerce and industry.

Left Hand, Meet Right Hand

On the other hand, trade policy and so on is the preserve of the trade policy division of the commerce ministry.

So, while one wing liberalises trade, the other makes FDI policy more restrictive, thus negating all export efforts.

At the same time, wrangling over the definition of FDI in the ministry of finance leads to incoherent investment

climate for foreign investors.

Tech-Driven Trade

Similarly, while some technology dominated exports may need firms with high investment capacities, such

investment has to go through the route of the Foreign Investment Promotion Board (FIPB) that itself requires

consultations among an even large set of departments.

Today, trade is determined more by technology than by the traditional access to cheap labour and other inputs.

The emerging globalisation of production makes it imperative to be part of these international "supply chains".

The recent reorganisation in the ministry of finance and commerce must respond to this by creating a separate

wing that deals simultaneously with the issues of taxation of FDI and trade and FDI policies. World trade is on the

upswing. Let us not miss the boat again.

Anda mungkin juga menyukai

- Virgin Mobiles Pricing StrategyDokumen5 halamanVirgin Mobiles Pricing StrategyMicah ThomasBelum ada peringkat

- Operations Strategy at GalanzDokumen12 halamanOperations Strategy at GalanzMicah Thomas100% (2)

- Flexibility: Calculation of Unused Debt CapacityDokumen2 halamanFlexibility: Calculation of Unused Debt CapacityMicah ThomasBelum ada peringkat

- Outlandish: Automotive - Future of MobilityDokumen46 halamanOutlandish: Automotive - Future of MobilityMicah ThomasBelum ada peringkat

- Socioeconomic IndiaDokumen15 halamanSocioeconomic IndiaMicah ThomasBelum ada peringkat

- Tata Business Excellence ModuleDokumen6 halamanTata Business Excellence ModuleMicah ThomasBelum ada peringkat

- PepsiCo Sales and Distribution Strategies AnalysisDokumen13 halamanPepsiCo Sales and Distribution Strategies AnalysisMicah ThomasBelum ada peringkat

- Outlandish: Automotive - Future of MobilityDokumen46 halamanOutlandish: Automotive - Future of MobilityMicah ThomasBelum ada peringkat

- Outlandish: Automotive - Future of MobilityDokumen46 halamanOutlandish: Automotive - Future of MobilityMicah ThomasBelum ada peringkat

- Salem Telephone Fixed and Variable Expenses BreakdownDokumen10 halamanSalem Telephone Fixed and Variable Expenses BreakdownMicah ThomasBelum ada peringkat

- ShenanigansDokumen15 halamanShenanigansMicah ThomasBelum ada peringkat

- Salem Telephone Fixed and Variable Expenses BreakdownDokumen10 halamanSalem Telephone Fixed and Variable Expenses BreakdownMicah ThomasBelum ada peringkat

- Wi-Fi Hostel ReportDokumen11 halamanWi-Fi Hostel ReportMicah ThomasBelum ada peringkat

- Salem Telephone Fixed Variable Expenses Break Even AnalysisDokumen10 halamanSalem Telephone Fixed Variable Expenses Break Even AnalysisMicah ThomasBelum ada peringkat

- MicrofinanceDokumen20 halamanMicrofinanceMicah ThomasBelum ada peringkat

- Financial Analysis of Power SectorDokumen32 halamanFinancial Analysis of Power SectorMicah ThomasBelum ada peringkat

- Implementation ChallengesDokumen2 halamanImplementation ChallengesMicah ThomasBelum ada peringkat

- National Food Security BillDokumen3 halamanNational Food Security BillRajarajanBelum ada peringkat

- Aviva India - Campus PresentationDokumen19 halamanAviva India - Campus PresentationMicah ThomasBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- DPB50123 HR Case Study 1Dokumen7 halamanDPB50123 HR Case Study 1Muhd AzriBelum ada peringkat

- Projector - Manual - 7075 Roockstone MiniDokumen20 halamanProjector - Manual - 7075 Roockstone Mininauta007Belum ada peringkat

- BPT Bulletproof Standards SmallDokumen1 halamanBPT Bulletproof Standards Smallalex oropezaBelum ada peringkat

- Cambridge IGCSE: 0450/22 Business StudiesDokumen12 halamanCambridge IGCSE: 0450/22 Business StudiesTshegofatso SaliBelum ada peringkat

- Supreme Court's Triple Talaq JudgmentDokumen395 halamanSupreme Court's Triple Talaq JudgmentThe Quint100% (1)

- Brandon Civil War Relic Show Vendor FormDokumen2 halamanBrandon Civil War Relic Show Vendor FormSCV Camp 265Belum ada peringkat

- Honda Cars ApplicationDokumen2 halamanHonda Cars ApplicationHonda Cars RizalBelum ada peringkat

- Digbeth Residents Association - ConstitutionDokumen3 halamanDigbeth Residents Association - ConstitutionNicky GetgoodBelum ada peringkat

- Revised Guidelines PD 851Dokumen4 halamanRevised Guidelines PD 851Abegail LeriosBelum ada peringkat

- Pieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Dokumen9 halamanPieterson v. INS, 364 F.3d 38, 1st Cir. (2004)Scribd Government DocsBelum ada peringkat

- Routing Slip: Document Tracking SystemDokumen8 halamanRouting Slip: Document Tracking SystemJeffrey Arligue ArroyoBelum ada peringkat

- Western Civilization A Brief History 9Th Edition Spielvogel Test Bank Full Chapter PDFDokumen43 halamanWestern Civilization A Brief History 9Th Edition Spielvogel Test Bank Full Chapter PDFSharonMartinezfdzp100% (7)

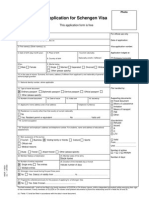

- Application For Schengen Visa: This Application Form Is FreeDokumen2 halamanApplication For Schengen Visa: This Application Form Is FreeMonirul IslamBelum ada peringkat

- QSPOT571423: Create Booking Within 24 HoursDokumen2 halamanQSPOT571423: Create Booking Within 24 HoursNaimesh TrivediBelum ada peringkat

- NSO Layered Service Architecture: Americas HeadquartersDokumen34 halamanNSO Layered Service Architecture: Americas HeadquartersAla JebnounBelum ada peringkat

- Oblicon SampleDokumen1 halamanOblicon SamplelazylawatudentBelum ada peringkat

- Faith Leaders Call For Quinlan's FiringDokumen7 halamanFaith Leaders Call For Quinlan's FiringThe Columbus DispatchBelum ada peringkat

- Political Science - The Leviathan EssayDokumen3 halamanPolitical Science - The Leviathan EssayMari ManagadzeBelum ada peringkat

- Zambia HIV/AIDS Data IntegrityDokumen1 halamanZambia HIV/AIDS Data IntegrityReal KezeeBelum ada peringkat

- Print: A4 Size Paper & Set The Page Orientation To PortraitDokumen1 halamanPrint: A4 Size Paper & Set The Page Orientation To Portraitnitik baisoya100% (2)

- International Law Obligation of States to Enact Legislation to Fulfill Treaty TermsDokumen17 halamanInternational Law Obligation of States to Enact Legislation to Fulfill Treaty TermsFbarrsBelum ada peringkat

- Florin Tamas 25.02.2019: Mitigation Questionnaire/Statement of TruthDokumen1 halamanFlorin Tamas 25.02.2019: Mitigation Questionnaire/Statement of TruthFlorin PetrişorBelum ada peringkat

- CAPISTRANO vs. LIMCUANDODokumen1 halamanCAPISTRANO vs. LIMCUANDOElaine Grace R. AntenorBelum ada peringkat

- Non-Negotiable Copy Mediterranean Shipping Company S.A.: 12-14, Chemin Rieu - CH - 1208 GENEVA, SwitzerlandDokumen1 halamanNon-Negotiable Copy Mediterranean Shipping Company S.A.: 12-14, Chemin Rieu - CH - 1208 GENEVA, SwitzerlandVictor Victor100% (2)

- Amalgmation, Absorbtion, External ReconstructionDokumen9 halamanAmalgmation, Absorbtion, External Reconstructionpijiyo78Belum ada peringkat

- 18th SCM New Points 1 JohxDokumen55 halaman18th SCM New Points 1 JohxAnujit Shweta KulshresthaBelum ada peringkat

- Bolton, Timothy - The Empire of Cnut The Great Conquest and The Consolidation of Power in Northern Europe in The Early Eleventh Century (Reup 6.21.10) PDFDokumen368 halamanBolton, Timothy - The Empire of Cnut The Great Conquest and The Consolidation of Power in Northern Europe in The Early Eleventh Century (Reup 6.21.10) PDFSolBelum ada peringkat

- Swot Analysis of IB in PakistanDokumen2 halamanSwot Analysis of IB in PakistanMubeen Zubair100% (2)

- BIZ ADMIN INDUSTRIAL TRAINING REPORTDokumen14 halamanBIZ ADMIN INDUSTRIAL TRAINING REPORTghostbirdBelum ada peringkat

- Heartbalm Statutes and Deceit Actions PDFDokumen29 halamanHeartbalm Statutes and Deceit Actions PDFJoahanna AcharonBelum ada peringkat