Category: B Intelligence Report: (Department of Commercial Taxes)

Diunggah oleh

SeemaNaik0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan2 halamanReport Green City

Judul Asli

Report Green City

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniReport Green City

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan2 halamanCategory: B Intelligence Report: (Department of Commercial Taxes)

Diunggah oleh

SeemaNaikReport Green City

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

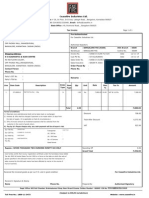

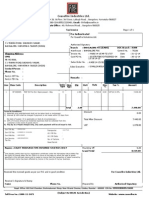

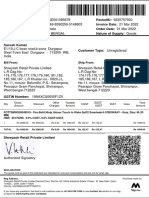

GOVERNMENT OF KARNATAKA

(Department of Commercial Taxes)

NO.ADCOM/ENF/SZ/AC-V/INS-21/13-14 Office of the Addl. Commissioner

of

Commercial Taxes (Enforcement),

South Zone, V.T.K.II, 6th Floor, 80

Feet Road, Near National Games

Housing Complex, Vivek Nagar Post,

Koramangala, Bangalore.47.

Dated 29-01-2014

CATEGORY: B

INTELLIGENCE REPORT

1 Name and address of the

dealer

M/s.Green City Super Market

No. 90 33

rd

Main Road,Near Frank

School,J.P. Nagar 6

th

Phase, Bangalore.

2 Additional places inspected Nil

3 TIN 29610472018 COT

Assignment No. 7022880

4 Date of inspection 07-12-2013

5 Nature of business Kirana, spices and general goods

6 Books of accounts produced

for verification

Purchase and sales register, Purchase and

sales invoices, VAT returns

7 Books of accounts seized Nil

8 Period to which the report is

related

13-14 under KVAT Act

9 Name & designation of the

Inspecting Officer

Sri M.B.Harishbabu

ACCT(Enf)-V, SZ, Bangalore.

10 Name & designation of the

person in charge

Sri Vajeer, partner

BRIEF DETAILS OF THE INSPECTION:

The placeof business of the above dealer was inspected by the on 07-12-

2013. At the time of inspection Sri Vajeer partner of the concern was present,

produced the books of accounts and attended to the entire inspection

proceedings.

Contd.2/-

Following a complaint to e-Grahak that M/s

Green City Super Market, that the said dealer is not issuing sale bills, a test

purchase was conducted on 07-12-2013. Soaps, biscuits,and tooth paste was

purchased for Rs. 186/- and the dealer did not issue sale bill. Therefore the

premises was inspected

The dealer is a small time provisions dealer in food grains,

soaps, oil, toilet articles etc. He is a registered dealer under KVAT holding

the above TIN. He has opted for composition tax u/s 15 paying tax at 1% as

a retailer.The dealee has not maintained stock or other registers. The offence

for non-issue of sale bill was penalized in a sum of Rs. 2000/- collected vide

Rt. No. 0328306 dated 7-12-2013.

The goods are purchased locally. The stock held in

the premises is about Rs. 2,00,000/- Since the books of account are not

maintained, the offence under section 74 was penalized with Rs. 5000/-

collected vide receipt No0328307 dated 7-12-2013. In view of the fact of

non-issue of sale bills and the amount of stock held the turnover being

declared appears to be less. Therefore the dealer agreed to declare more

turnover by about Rs. 8,00,000/- at 1% and discharged the liability of Rs.

8000/- vide 592408 dated 28-12-2013 to LVO .

I am forwarding herewith the above information to utilise the said

information while concluding the /re-assessment of the dealer. The result of

action taken may please be intimated to this office for records.

Receipt of this report may please be acknowledged.

Asst. Commissioner of Commercial Taxes

(Enforcement)-5 South Zone.,Bangalore.

To

The Joint Commissioner of

Commercial Taxes(Admn.)

Divisional Vat Office-3

Bangalore.

Copy to the LVO 090 for information.

Anda mungkin juga menyukai

- June 2009 PRC Room Assignment (Manila Examinees)Dokumen1.712 halamanJune 2009 PRC Room Assignment (Manila Examinees)lylesantos84% (25)

- Report Lal MachineryDokumen2 halamanReport Lal MachinerySeemaNaikBelum ada peringkat

- Category: B Intelligence Report: (Department of Commercial Taxes)Dokumen2 halamanCategory: B Intelligence Report: (Department of Commercial Taxes)SeemaNaikBelum ada peringkat

- Report Vastimal BanajiDokumen3 halamanReport Vastimal BanajiSeemaNaikBelum ada peringkat

- Ceasefire Industries LTD.: Terms & ConditionsDokumen1 halamanCeasefire Industries LTD.: Terms & ConditionsPrashBelum ada peringkat

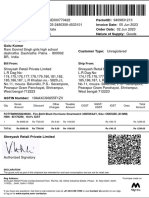

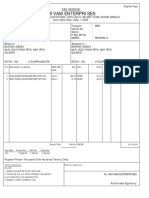

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen2 halamanBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPadma GouteBelum ada peringkat

- 187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Dokumen7 halaman187 State of Karnataka V Ecom Gill Coffee Trading PVT LTD 13 Mar 2023 463904Nithyananda N LBelum ada peringkat

- DCIT v. Punjab Retail - ITAT IndoreDokumen17 halamanDCIT v. Punjab Retail - ITAT IndorekalravBelum ada peringkat

- Government crackdown on tax evasion by real estate firmDokumen6 halamanGovernment crackdown on tax evasion by real estate firmSeemaNaikBelum ada peringkat

- CESTAT sets aside service tax demand on fees paid to State Excise departmentDokumen5 halamanCESTAT sets aside service tax demand on fees paid to State Excise departmentAsma HussainBelum ada peringkat

- Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen1 halamanQty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDEEPAK CHANDELBelum ada peringkat

- 2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioDokumen7 halaman2023 153 Taxmann Com 686 Punjab Haryana 01 03 2023 Mahavir Rice Mills Vs CommissioThe Chartered Professional NewsletterBelum ada peringkat

- Neeraj Jawla & Associates: Chartered AccountantsDokumen2 halamanNeeraj Jawla & Associates: Chartered AccountantsSandeep TyagiBelum ada peringkat

- 75d5968 4608HTML000002Dokumen6 halaman75d5968 4608HTML000002DIpakBelum ada peringkat

- Proforma Invoice: Ceasefire Industries LTDDokumen1 halamanProforma Invoice: Ceasefire Industries LTDPrashBelum ada peringkat

- It The Above Said Firm Assessed in This Period, Then IgnoredDokumen1 halamanIt The Above Said Firm Assessed in This Period, Then IgnoredSurinder VermaBelum ada peringkat

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen2 halamanBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total Amountfaizan ganiBelum ada peringkat

- Jwalamala JewellersDokumen9 halamanJwalamala Jewellersbharath289Belum ada peringkat

- HDFC Bank statement summary for Munish SharmaDokumen6 halamanHDFC Bank statement summary for Munish SharmaHena SharmaBelum ada peringkat

- Court of Tax Appeals: Fabon-VictorinoDokumen65 halamanCourt of Tax Appeals: Fabon-VictorinoJoefrey UyBelum ada peringkat

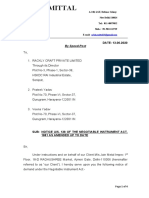

- RCPL Notice 138 Rohit BalaniDokumen2 halamanRCPL Notice 138 Rohit BalaniShreypratap SinghBelum ada peringkat

- MTN PDF 1Dokumen1 halamanMTN PDF 1Martin KyuksBelum ada peringkat

- MTNDokumen1 halamanMTNICloud Remove0% (2)

- SO Ramleela Ground 2018Dokumen9 halamanSO Ramleela Ground 2018Subhas MishraBelum ada peringkat

- Legal Notice - Rackly Craft PVT - LTDDokumen4 halamanLegal Notice - Rackly Craft PVT - LTDUtkarsh KhandelwalBelum ada peringkat

- RCPL Notice 138 Rohit Balani 2Dokumen2 halamanRCPL Notice 138 Rohit Balani 2Shreypratap SinghBelum ada peringkat

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen2 halamanBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountRitik MaheshwariBelum ada peringkat

- Hap Company Details Bad DebtsDokumen26 halamanHap Company Details Bad DebtsSeema ganganiaBelum ada peringkat

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen1 halamanBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountRalu SinghBelum ada peringkat

- InvoiceDokumen1 halamanInvoiceashok1653636Belum ada peringkat

- InvoiceDokumen1 halamanInvoiceHitesh GuptaBelum ada peringkat

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen3 halamanBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountA&P ConsultancyBelum ada peringkat

- Highlander Hoodie9489474556Dokumen2 halamanHighlander Hoodie9489474556organcorpBelum ada peringkat

- Highlander Hoodie9489474556Dokumen2 halamanHighlander Hoodie9489474556organcorpBelum ada peringkat

- itemInvoiceDownload-1Dokumen2 halamanitemInvoiceDownload-1kumaealok759Belum ada peringkat

- FL0148130333 PDFDokumen1 halamanFL0148130333 PDFPavan ArigiBelum ada peringkat

- The Central Sales Tax Form "C"Dokumen2 halamanThe Central Sales Tax Form "C"Rahul SinghBelum ada peringkat

- ZREDDokumen2 halamanZREDSantoshBelum ada peringkat

- Project On Net Banking2019253469858476625Dokumen2 halamanProject On Net Banking2019253469858476625Arsh RajBelum ada peringkat

- NAA HEARING ON ANTI-PROFITEERING COMPLAINTDokumen12 halamanNAA HEARING ON ANTI-PROFITEERING COMPLAINTkalyan sundarBelum ada peringkat

- SKSE Securities LimitedDokumen2 halamanSKSE Securities LimitedsunitdaveBelum ada peringkat

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokumen1 halamanTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)SethuramanBelum ada peringkat

- Adobe Scan 10 Jun 2022Dokumen2 halamanAdobe Scan 10 Jun 2022Palwasha GulBelum ada peringkat

- 23 March 2022 One PlusDokumen1 halaman23 March 2022 One PlusVikas VermaBelum ada peringkat

- RECTIFICATION - ENG Power No Mistake Aishwaryam Garden Plot No.7Dokumen2 halamanRECTIFICATION - ENG Power No Mistake Aishwaryam Garden Plot No.7Gokulakrishnan SelvarajanBelum ada peringkat

- Bom 487Dokumen1 halamanBom 487Roop HariaBelum ada peringkat

- Tax InvoiceDokumen1 halamanTax InvoiceBhavesh GuptaBelum ada peringkat

- Tax Invoice Eureka Forbes Limited: Original For RecipientDokumen1 halamanTax Invoice Eureka Forbes Limited: Original For Recipientnilotpal borahBelum ada peringkat

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokumen2 halamanBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountPrashank SaxenaBelum ada peringkat

- Shivam EntDokumen21 halamanShivam EntJatin GulsatyaBelum ada peringkat

- Edgetech 1Dokumen35 halamanEdgetech 1abhaytalentcornerBelum ada peringkat

- Invoice (3) (Dokumen1 halamanInvoice (3) (shivamdhuriya278Belum ada peringkat

- RDSO-STORES-PO-TRIBO METER-03012024Dokumen2 halamanRDSO-STORES-PO-TRIBO METER-03012024Karthikeyan RajamanickamBelum ada peringkat

- Ceasefire Industries LTD.: Terms & ConditionsDokumen1 halamanCeasefire Industries LTD.: Terms & ConditionsPrashBelum ada peringkat

- Makati City Government's Assessment of Local Taxes on Mactel Corporation DisputedDokumen15 halamanMakati City Government's Assessment of Local Taxes on Mactel Corporation DisputedCesar ValeraBelum ada peringkat

- UygygDokumen5 halamanUygygsachin sahuBelum ada peringkat

- Tax Invoice for Smartwatch PurchaseDokumen1 halamanTax Invoice for Smartwatch PurchaseIndrajit RanaBelum ada peringkat

- Invoice 1Dokumen1 halamanInvoice 1Anupam PriyamBelum ada peringkat

- SonyInvoice PDFDokumen3 halamanSonyInvoice PDFAnonymous RX8b0jBTDBelum ada peringkat

- 15846Dokumen4 halaman15846SeemaNaikBelum ada peringkat

- GST ImplementationDokumen3 halamanGST ImplementationSeemaNaikBelum ada peringkat

- Aam Admi Under GSTDokumen5 halamanAam Admi Under GSTSeemaNaikBelum ada peringkat

- Compliance ResponseDokumen1 halamanCompliance ResponseSeemaNaikBelum ada peringkat

- JULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallyDokumen8 halamanJULY 14, 2010: by Pritam Mahure, CA A Business Group Venturing in Different Business Segments UsuallySeemaNaikBelum ada peringkat

- GST4Dokumen4 halamanGST4SeemaNaikBelum ada peringkat

- Place of Supply Under GST RegimeDokumen3 halamanPlace of Supply Under GST RegimeSeemaNaikBelum ada peringkat

- NoticeDokumen2 halamanNoticeSeemaNaikBelum ada peringkat

- Tax Notification SummaryDokumen24 halamanTax Notification SummarySeemaNaikBelum ada peringkat

- GST3Dokumen4 halamanGST3SeemaNaikBelum ada peringkat

- Implement GST by April 1Dokumen4 halamanImplement GST by April 1SeemaNaikBelum ada peringkat

- FM may consider extending GST credit benefit to individuals tooDokumen7 halamanFM may consider extending GST credit benefit to individuals tooSeemaNaikBelum ada peringkat

- Integrated GSTDokumen5 halamanIntegrated GSTSeemaNaikBelum ada peringkat

- IGSTDokumen6 halamanIGSTSeemaNaikBelum ada peringkat

- GST2Dokumen2 halamanGST2SeemaNaikBelum ada peringkat

- GST1Dokumen4 halamanGST1SeemaNaikBelum ada peringkat

- Finance Commission Task Force Report On GSTDokumen3 halamanFinance Commission Task Force Report On GSTSeemaNaikBelum ada peringkat

- GSTDokumen7 halamanGSTSeemaNaikBelum ada peringkat

- Finance Commission Group Wants Five GST ExemptionsDokumen2 halamanFinance Commission Group Wants Five GST ExemptionsSeemaNaikBelum ada peringkat

- Discussion Paper On GSTDokumen19 halamanDiscussion Paper On GSTSeemaNaikBelum ada peringkat

- FM Pitches in For Dual Rates For GSTDokumen8 halamanFM Pitches in For Dual Rates For GSTSeemaNaikBelum ada peringkat

- Goods and Services TaxDokumen15 halamanGoods and Services TaxSeemaNaikBelum ada peringkat

- Empowered Committee of FM 091109 GST First DraftDokumen59 halamanEmpowered Committee of FM 091109 GST First DraftrdpathBelum ada peringkat

- Discussion Paper On GSTDokumen19 halamanDiscussion Paper On GSTSeemaNaikBelum ada peringkat

- VJ Shroff & Co Circular on First GST Discussion PaperDokumen3 halamanVJ Shroff & Co Circular on First GST Discussion PaperSeemaNaikBelum ada peringkat

- Comments of The Department of RevenueDokumen8 halamanComments of The Department of RevenueSeemaNaikBelum ada peringkat

- Centre Prepares ForDokumen3 halamanCentre Prepares ForSeemaNaikBelum ada peringkat

- Budget 2010Dokumen2 halamanBudget 2010SeemaNaikBelum ada peringkat

- By Steven D' Souza, Former IRS & Management Consultant Dear Finance MinisterDokumen5 halamanBy Steven D' Souza, Former IRS & Management Consultant Dear Finance MinisterSeemaNaikBelum ada peringkat

- Budget - 2010Dokumen6 halamanBudget - 2010SeemaNaikBelum ada peringkat

- Avoiding The Common Causes of Project Failure: Take Actions To Ensure Project SuccessDokumen26 halamanAvoiding The Common Causes of Project Failure: Take Actions To Ensure Project SuccessAli MohsinBelum ada peringkat

- BS English Mumbai 09-02-2023Dokumen27 halamanBS English Mumbai 09-02-2023ChandreshDharDubeyBelum ada peringkat

- CDPI Call Letter FormatDokumen4 halamanCDPI Call Letter FormatAniket BhattBelum ada peringkat

- Accreditation To LTODokumen1 halamanAccreditation To LTONoe S. Elizaga Jr.Belum ada peringkat

- "Naked Economics" Study GuideDokumen2 halaman"Naked Economics" Study GuideROBERTO TARUDBelum ada peringkat

- City of Marshalville Financial Report June 30, 2023Dokumen60 halamanCity of Marshalville Financial Report June 30, 2023Alexandria Dorsey100% (1)

- Financial Management ExplainedDokumen2 halamanFinancial Management ExplainedSERNADA, SHENA M.Belum ada peringkat

- Law On Partnership and Corporation Study GuideDokumen110 halamanLaw On Partnership and Corporation Study GuideYour Public ProfileBelum ada peringkat

- Coc MechanicalDokumen1 halamanCoc Mechanicalrolando dionisioBelum ada peringkat

- Manotok Brothers Inc. v. CADokumen2 halamanManotok Brothers Inc. v. CAdelayinggratificationBelum ada peringkat

- Member's Data Form (MDF) Print (No912253051110Dokumen2 halamanMember's Data Form (MDF) Print (No912253051110Andrei Estibal King85% (13)

- Priya Rathore Offer LetterDokumen2 halamanPriya Rathore Offer Lettervaishnavikesharwani234Belum ada peringkat

- Kindergarten Module 9 Week 9Dokumen14 halamanKindergarten Module 9 Week 9Febie CerveraBelum ada peringkat

- GST06 CertificateDokumen3 halamanGST06 CertificateHarikrishan BhattBelum ada peringkat

- Cornerstones of Cost Management 3rd Edition Hansen Test BankDokumen26 halamanCornerstones of Cost Management 3rd Edition Hansen Test BankKristieKelleyenfm100% (66)

- Dick's Lumber - FaridehDokumen322 halamanDick's Lumber - FaridehEbrahimi Accounting Services LTD.Belum ada peringkat

- Agreement Draft For Sub ContractDokumen6 halamanAgreement Draft For Sub ContractBittudubey officialBelum ada peringkat

- Participants 15Dokumen12 halamanParticipants 15Rebecca CunninghamBelum ada peringkat

- Dear Delegate: Ref: Joining Instructions For SIA HABC Level 2 Award in Door Supervision (DS) / Security Guarding (SG)Dokumen5 halamanDear Delegate: Ref: Joining Instructions For SIA HABC Level 2 Award in Door Supervision (DS) / Security Guarding (SG)api-40598803Belum ada peringkat

- 4-Sales - Invoice-Cash SaleDokumen1 halaman4-Sales - Invoice-Cash Salenaamm7570% (1)

- OD426863892903857100Dokumen1 halamanOD426863892903857100SethuBelum ada peringkat

- National Treasury Invites Bids for Consultancy and IT ProjectsDokumen2 halamanNational Treasury Invites Bids for Consultancy and IT Projectssharif sayyid al mahdalyBelum ada peringkat

- Tax Invoice: Paypal Payments Private LimitedDokumen1 halamanTax Invoice: Paypal Payments Private LimitedLekshmi2014Belum ada peringkat

- Short Code Allocation ProcedureDokumen3 halamanShort Code Allocation ProcedureMohsin KhanBelum ada peringkat

- Nominated Sub Contractor & Supplier PDFDokumen20 halamanNominated Sub Contractor & Supplier PDFnurhanis nadhirah binti ramli100% (2)

- 2020HK in BriefDokumen29 halaman2020HK in Briefxenow46438Belum ada peringkat

- National Economic Research and Business Assistance Center NEDokumen46 halamanNational Economic Research and Business Assistance Center NEWilliamBelum ada peringkat

- Veterans Management Service V USDA Forest ServiceDokumen11 halamanVeterans Management Service V USDA Forest ServiceShelby DeweyBelum ada peringkat

- Concept of Offer and Acceptance in Law of ContractDokumen4 halamanConcept of Offer and Acceptance in Law of ContractSimon JnrBelum ada peringkat