Making Sense of Market Intelligence

Diunggah oleh

Aida ArguetaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Making Sense of Market Intelligence

Diunggah oleh

Aida ArguetaHak Cipta:

Format Tersedia

Making Sense of Market Intelligence

prepared by:

December 2009

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence i

12.09 v9.0

Table of Contents

Executive Summary ................................................................................................................................. 1

Why Market Intelligence? ......................................................................................................................... 1

Market Intelligence vs. Market Research ................................................................................................... 2

The Market Intelligence Concept: Defined ................................................................................................. 2

Focus Areas: The Three Pillars of Market Intelligence............................................................................. 3

Ongoing Activity vs. Ad hoc Analysis ..................................................................................................... 4

Situational Drivers for Market Intelligence ................................................................................................. 4

Hurdles and Impediments to Adopting a Comprehensive Market Intelligence Process................................... 5

We know what to do, we just need to do it better ............................................................................ 5

Inertia ................................................................................................................................................ 5

Sacred Cows ....................................................................................................................................... 5

Status Quo .......................................................................................................................................... 5

Tactically Oriented ............................................................................................................................... 5

Methods and the Need for a Dashboard ................................................................................................. 6

Market Intelligence Components: The Three Pillars of Market Intelligence ................................................... 6

Customer Focus: The Holy Grail of Market Intelligence ........................................................................ 6

Customer Focus: Voice of the Customer ................................................................................................ 7

Competitive Environment Focus: What You Dont Know CAN hurt you! ................................................... 8

Market or Industry Focus: Big Picture Trends that Shape the Landscape ................................................. 8

Feeding the Planning Cycle ....................................................................................................................... 9

Best Practice ..................................................................................................................................... 10

Enhanced Level ................................................................................................................................. 10

Base Level ......................................................................................................................................... 10

Customer Insight ............................................................................................................................... 10

Competitive Focus ............................................................................................................................. 10

Market Perspective ............................................................................................................................ 10

Summary and Conclusion ....................................................................................................................... 11

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 1

12.09 v9.0

Greater confidence in decision making: Why high performing companies are using market

intelligence to support strategic planning and marketing.

Executive Summary

Making critical decisions without sufficient information is a typical problem companies face. While

information is unlimited, time and budgets are not. Busy executives are accustomed to making difficult

decisions based on imperfect information. However, in todays climate, executives are far more

accountable to stakeholders than in the pastthey cannot afford to be wrong about major decisions that

put significant assets at risk.

Typical among these critical business decisions are those that deal with launching a new product line or

entering a new market. Historically, companies have engaged market research to address these needs.

However, for companies in the business to business (B2B) sector, fast moving trends require a dynamic

rather than static view of the marketmarket intelligence rather than market research.

So what is market intelligence, exactly, and why should you care? This paper answers these questions in

context of what it means for companies pursuing best-in-class business processes. We go beyond the

why and explore the what and how of this evolving discipline.

Why Market Intelligence?

The reality is thisif youre not doing it, youre in big trouble!

~Principal, Strategy Consulting Firm

B2B company executives must not only generate winning ideas on

how their organizations can grow by developing new products and

markets, they are also accountable for performance once plans are

put into place. One key success variable is refining growth plans on

actual market realities.

Plans are usually based upon some combination of knowledge, data,

gut instincts, and experience. Whatever formula or approach you use,

one thing is clear: in todays business environment, you cant afford to

be wrong about market assumptions. This need for higher confidence

in critical business decisions and for specific market insight is the

principal reason high performing companies use market intelligence to

support their marketing strategies.

Business organizations vary widely in their sophistication in terms of assessing market factors. Obviously,

universal constraints prevail: time and budgets are limited. Yet the pivotal issue that arises is how much

quality market information and insight is sufficient to support strategic business decisions. Its worth

reviewing commonly mentioned reasons of why activities that provide exceptional insight are neither

given priority nor practiced in a large number of B2B companies. Among them:

The pivotal issue that

arises is how much

quality market

information and

insight is sufficient to

support strategic

business decisions.

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 2

12.09 v9.0

Staff: Often not dedicated or available to manage these activities (considered interruptions)

Skill set: Not geared to provide staff with the capability of knowing what to do and how to do it

Focus: There is so much to know and too much available information; its easy to get sidetracked

with nice-to-know rather than need-to-know

Insight: Key insights required to truly understand customers and competitors are difficult to get

Culture: Good research requires not only objectivity, but devils advocacy as wellrequires

corporate culture that supports constructive doubt provided by, perhaps, junior staff members

Market Intelligence vs. Market Research

You really want to arrive at knowledge. Information is

adequate, but, remember, data is just one level above

noise. ~Marketing Consultant and Author

How does market intelligence differ from traditional market

research? Overall, market intelligence is best thought of as

an enhanced level of market researcha broader, more

inclusive view of every aspect of the marketplace with

market research as an important component. When used by

marketing executives, market intelligence lends itself to

strategic decision making where market research tends to

provide tactical support for specific marketing goals and

objectives.

Simply stated, research is what you do (gather data and analyze); insight and knowledge is what you

gain and actions result. Market intelligence is actionable insight used to drive successful decision making.

Traditionally, we think of market research as the vehicle that develops and delivers information and

insight to the marketing process. Yet many disciplines that make up traditional market research processes

evolved out of consumer packaged goods industries and, therefore, fit imperfectly into the B2B world.

Consumer-oriented demographics linked to buyer behavior fall short in terms of decision support for

B2Bs, especially where new technology is concerned. The question becomes, what specific processes best

support formation of critical management insights that allow for confident and reliable decision making in

the B2B world?

The Market Intelligence Concept: Defined

The CEO may think he or she knows what the issues are, but the customer is saying something

completely different. ~Principal, Business Advisory Firm

The term market intelligence is frequently used in relation to decision support for B2Bs. However, like a

lot of jargon, it can mean a lot of things, depending on who is using it. A quick Internet search

demonstrates the vagueness of its meaning: A Google search on market intelligence leads to vertical

market or technology category coverage, industry news, database products, and financial market focus.

Many disciplines that make up

traditional market research

process evolved out of

consumer packaged goods

industries and, therefore, fit

imperfectly into the B2B world.

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 3

12.09 v9.0

According to a First Resource survey of 16 marketing executives across industries, market intelligence is

best defined as:

A process, not a product

Both quantitative and qualitative

Dynamic, not static

An ongoing activity, not a one-time snapshot

Multifacetedconsiders customers, influencers,

industry watchers, and channel players

Cross-functionalit brings together

perspectives often siloed by different

groups (sales and marketing)

A subset of Business Intelligence (BI) that

focuses on external market data

Market intelligence is decision-centric: gathering relevant information from a wide variety of strategically

chosen sources. The key benefit? A reliable and all-encompassing backdrop for confident decision making

and answers to these fundamental questions:

What do we need to know?

What do we want to know?

What decisions will we be able to confidently make as a result?

Can we afford not to know?

While the body of knowledge that comes from this process may in fact confirm initial assumptions and

gut level instincts, the ongoing practice of using market intelligence provides value in its objectivity, while

truly allowing for surprising results that can alter the companys critical marketing strategies and tactics.

At the very least, initial assumptions may be confirmed, disputed, or simply refined by the weight of the

analysis that stems from the process.

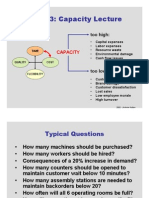

Focus Areas: The Three Pillars of Market Intelligence

Typically, market intelligence information is required in three primary areas of focus:

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 4

12.09 v9.0

Each focus provides a different perspective and insight that supports decision making. Synergistically, its

best to have all three. The whole is greater than the sum of the parts in that, when considered

collectively, decision making encompasses a far greater understanding of all aspects of the market.

Ongoing Activity vs. Ad-hoc Analysis

Unlike rifle-shot market research efforts, market intelligence spins a web of understanding that goes

beyond mere data points; rather, it lends itself to support a comprehensive analysis of a specific decision

or business case. Usually, market intelligence defines a series of topics to be monitored continuously as

the market evolves and unfolds. Specific processes, which only occur once or provide a static, snapshot

view, may be implemented by using an ad hoc analysis. However, the very heart and soul of market

intelligence is a dynamic, or an ongoing effort to better understand customers needs and requirements

and their perceptions of your organizations offerings and brand strength relative to those needs.

The ongoing monitoring approach requires... While the ad hoc approach is...

Commitment to the processbelief in its strategic

importance

Leadershipa willingness to be surprised by the facts

Resource allocation (tools and budgets); like any

program, it needs support to be successful

An internal distribution methodleverage the value by

sharing results

An intelligence cultureone that encourages paying

attention and taking risks (of possibly being wrong)

Event driven

Decision focused

Of lower-level rigor

Frequently designed to support

projects already in process

All approaches must translate into actionable insights and knowledge used to feed the planning process

and deliver value through measurable results. According to a First Resource survey of marketing

executives, market intelligence best practice calls for an ongoing process supplemented by the use of

specific ad hoc projects as needed.

Situational Drivers for Market Intelligence

Usually, its desperation that triggers the need.

~VP-Marketing, Healthcare Industry

Often, pain points or major impending events fuel initial thrusts to launch some form of research or

intelligence-gathering process, such as a perceived external threat or a sense of desperation in meeting

an objective. A competitive surprise or a sudden, unexplained gap in sales performance are common

examples. Additionally, specific event-driven needs born from an internal decision to pursue initiatives

also drive the need for market intelligence:

Re-branding efforts

New product or line extensions

Territory expansions

Transactions (M & A)

New applications for existing products

and services

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 5

12.09 v9.0

Irrespective of whether initial market intelligence processes are based on external threats or perceptions

of new opportunities, a solid first step in data gathering and knowledge building can lead to a broader

adoption of these practices. The result? A strong value proposition for ongoing analyses.

Hurdles and Impediments to Adopting a Comprehensive Market Intelligence Process

Some organizations may not be able to digest the data, even if it is available.

~Principal, Strategy Firm

We know what to do; we just need to do it better

Many companies struggle to incorporate knowledge gained from

market facts into a high-level marketing strategy. Frequently, the

impediment is rooted in the belief that management already has the

answers. The prevailing view is that execution is the only thing

holding back better performance.

Inertia

Many mid-market companies struggle to take action at alland may

be mired in a status-quo mentality. Managers in enterprise level

companies are often cautious about unsettling implications; they

simply dont want to rock the boat. In any size company resource

constraints make the creation of a strong market intelligence program

appear as a luxury.

Sacred Cows

Company culture must support constructive doubtsacred cows are not conducive to the market

intelligence process. Success trumps all impedimentslike admitting you are on the wrong track. A

collaborative culture where information, insight, and resources emerge from the silos is the best fit for

market intelligence.

Status Quo

Strong top leadership willing to question, rethink, and base decisions on knowledge rather than

conjecturewilling to rock the boat while providing the ability to stay the courseis a success driver in a

comprehensive market intelligence process.

Tactically Oriented

Market-driven and strategically oriented companies see the value of market intelligence in making

decisions to keep them ahead of the pack. This is particularly true in technology industries, where

product cycles have shrunk and the competition is fierce. Securing a leg up through market intelligence

can make a difference between gaining or losing marketshare by anticipating rather than reacting to

competitor moves.

Securing a leg up

through market

intelligence can make a

difference in gaining or

losing market share by

anticipating rather

than reacting to

competitor moves.

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 6

12.09 v9.0

Methods and the Need for a Dashboard

They think they know, but they just dont have the metrics to support it.

~Vice President-Marketing, Public Company

Metrics are important. While a comprehensive discussion of quantitative methods is not warranted here,

it is important to apply accepted market research standards such addressing statistical significance and

good sampling technique. When using published reports, note their research methodology and dates of

publication, and recognize built-in bias by asking: Why was the study conducted and who financed it?

Published industry size and trend data are often biased and oblique to the data sought, even if produced

by reputable sources, such as the government or an industry trade group.

A full-time staff managing these functions can help contain costs and provide immediacy for on-demand

reporting. It can also monitor, screen, and disseminate relevant news feeds on competitors or regulatory

trends and oversee customer feedback programs.

Business intelligence processes such as data mining complement market intelligence processes. The

overall idea is to define key intelligence requirements then determine which internal and external data

sources feed each one.

Outsourced research should fill gaps, seek answers to questions unavailable from internal data gathering

methods, and provide these advantages:

Objectivity

Better access to competitors

Ability to discuss sensitive topics with customers (of the company and competitors)

Professionalism

Ability to meet aggressive deadlines

Reporting format should provide executives with an intelligence dashboard for viewing market variables

in a dynamic environment. Off-the-shelf or customized software solutions support the need to aggregate

data and insight for custom, real-time reports. Whatever method is used, the benefit of being able to

easily access data and analysis across the organization cannot be overstated.

Market Intelligence Components: The Three Pillars of Market Intelligence

Customer Focus: The Holy Grail of Market Intelligence

Zeroing in on what customers truly want and need is the most important purpose of any market

intelligence undertaking. How customers behave can drive all facets of the organizations marketing

planning process.

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 7

12.09 v9.0

The often smaller number of customers in B2B, whose issues and

values may vary significantly, suggests using a methodology that

skews toward qualitative vs. quantitative techniques. As in any good

research effort, one must match the technique to the answers

sought.

Customer Focus: Voice of the Customer

Customer interviews can tell how customers perceive you, their

needs, and receptivity to your solution(s):

Current pain pointsbothersome issues ideally addressed

with seamless solutions

Trust in your organization and general attitudes toward your policies, products, and services

Legacy solutions you are replacing and experiences of your conversion process

Belief in your brand and whether you are stretching it too far beyond your existing reputation

How your solution will be used and whether it dovetails with existing products and systems

The complexity of their decision-making processes; how do decisions really get made?

Willingness to champion your solution in their organization

Customer interviews can also help answer questions about market segmentation:

Determine which customers have similar needs, wants, and characteristics

What it will take to have continued success in various segments

What customer changes have occurred that may devalue a targeted segment

What specific competitors are doing to capture market share and which ones are showing

weakness that can be exploited

Every customer entity is different, but in-depth interviews with a relatively small number of buying

influences help discern patterns to extrapolate and plan an appropriate sales and marketing strategy. In

the end, you develop a small number of archetypes for how various players influence a decision, such as:

Financial

Technical

Legal

Operations

Marketing and Sales

Engineering and Product Development

Key Value Elements

Measuring customer satisfaction

real-time helps to avoid painful

loss of loyalty

Win-loss input can feed competitor

analysis

Ongoing customer panels can be

a great source of innovative ideas

and a quick reality check on

company-driven product notions

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 8

12.09 v9.0

Competitive Environment Focus: What You Dont Know CA hurt you!

It is impossible to thoroughly develop a differentiation strategy

without understanding the competitive landscape and customer

perceptions toward your competitors. You must know what they

are:

Doing and planning now

Capable of doing now and inclined to do in the future

You must also know the affinity your customers have for loyalty,

switching to another vendor, or doing business with multiple

vendors. Here, the same elements that are important to know

about your own customers must be part of your competitive

market intelligence analysis. How well does the competition stack up and, more importantly, what are the

best opportunities for greater differentiation? Finally, how can you instill loyalty to defend against

customer attrition?

It is also useful to distinguish between competitor intelligence and product intelligence. Competitor

intelligence assesses company-level elements such as service delivery, sales and marketing capabilities,

corporate messaging, branding, finances, etc. Comparing yourself at this level drives your competitive

strategy and differentiation for being the low cost producer, best service provider, etc.; and feeds

strategy and planning, such as a SWOT analysis. Comparing yourself at the product level, by contrast,

drives differentiation in product line benefits (features): pricing, positioning, product line extensions, etc.

Market or Industry Focus: Big Picture Trends that Shape the

Landscape

Here is where you answer the question: If a thorough effort to

understand the customer is in place, what other market

information do we need? Customers rarely have a forward view

of technology trends or any of the macro forces that impact any

particular industry category. So, moving beyond your customers

perspectives, here is a list of sources for other perspectives that

will allow you to monitor overall market or industry activity:

Regulators and watchdog

agencies

Professional groups and

societies

Standards setting entities

Public opinion

Pundit services (Gartner,

IDC, etc.)

Distributors

Reps

Integrators and VARs

OEM

Trade Press

o Bias brand attitude

o Open to

o Inclined toward

o Relationship with

Key Value Elements

Avoid being blindsided by a

sudden competitive move

Provide frontline sales force

with solid tools to sell head-to-

head against competitors

Feed critical insight to the

strategic planning function

Key Value Elements

Greatest strategic value occurs

when intelligence is mined from

all three arenas

When artfully mined, company

can get great analyst insight

without significant cost

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 9

12.09 v9.0

Feeding the Planning Cycle

What good is the map if you dont know WHERE you want to go?

~Principal, Strategy Firm

Creating interval market snapshots provides a fully integrated and compelling view of all three

components customer, competitor, and marketthat allows for higher level insight to feed the planning

process.

In reality, strategic planning often starts with current-year planning templates that often lead to tweak-

ing. Building the plan with updated market assumptions helps avoid compromise to the resulting strategic

plan. Minimally, the plan should explicitly state underlying market assumptions. Ideally, it should include

evidence that assumptions have been validated, along with their source and confidence levels.

Sales forecasts by product line, rep, and territory based upon hunches are problematic if they are simply

an arbitrary percentage change from the current years number. If you can determine net new salesthe

amount of sales or market share being taken from each competitorand explain why and how they came

to be, with the support of customer and market intelligence, sales forecasting becomes more reliable.

The use of a SWOT analysis tool combined with a solid market snapshot can feed the planning cycle prior

to allocation of budgets and directives. The essential components for meaningful and action-oriented

planning must factor intelligence gained from all three phases of research. The following table

summarizes market intelligence practices and might serve as a checklist or scorecard as you seek best

practice in this discipline.

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 10

12.09 v9.0

Market Intelligence (MI) Performance Levels

Best Practice:

Well Supported, Ongoing MI Program

Ongoing monitoring of key

intelligence topics

Broad internal awareness of

MI goals, values, and

strategic importance

Customer insight fuels

product innovation and

refinement

Enhanced Level:

Routine Use of Ad Hoc MI Projects

Impending events trigger

quest for intelligence

Value added approach that

blends staff and outsource

providers appropriately

Results are shared broadly

throughout the organization

Base Level:

Company Culture and Values

Base level ethic: winning

trumps being right

Management willing to listen

to, accept, and act on well-

supported analysis that may

be counterintuitive

Management supportive of

staff intelligence collection

and a devils advocate

culture

In its highest form, market intelligence embraces an ongoing and carefully scheduled effort to meet

planning process needs, supplemented with additional ad hoc efforts as the need arises. Best practice

allows for both as represented in the checklist on the following page.

Key Recommended Activities: Checklist

Customer Insight

Mine insight from active customer-touch programs using either an ad hoc or ongoing approach

Mine insight from failed prospectswould-be customers who, after careful consideration,

chose to do business with a competitor (sometimes referred to as Win-Loss Analysis)

Provide frontline employees with easy methods to direct customer feedback to management

for immediate analysis

Competitive Focus

Maintain an up-to-date grid that compares product and service offerings with that of key

competitors

Conduct forward-looking analysis to update theories or predictions on how each customer

might be planning to change and grow in ways that could mean loss of market share to your

company

Market Perspective

Track major trends that can impact your business

Stay current with analysis by professional industry watchers

Maintain a constant relationship with independent market influencers (analysts, trade press,

trade associations, watchdogs, regulators)

Making Sense of Market Intelligence

First Resource, Inc. Making Sense of Market Intelligence 11

12.09 v9.0

Summary and Conclusion

I wish it were ongoing usually its not.

~VP- Marketing, Software Firm

Market intelligence is simple in concept but powerful in effect: it helps B2B enterprises keep a leg up on

the competition. Although challenging to implement at the best practice levels, even base-level

implementation has measurable value in that it leads to a more robust decision-making process.

At its base level, market intelligence is comprised of data collection activity, analytical tools, and the

discipline to integrate resulting knowledge gained into the planning cycle. At the best practice level, its

practice enjoys a corporate culture where unbiased and honest assessment of customer perceptions,

competitive offerings, and market trends allow for actionable insights that drive critical business

decisions. In all, market intelligence practices provide these benefits:

Increased confidence in decision making

A planning cycle fed with actionable knowledge

Top-down value of marketing insights derived from the process

A cultural shift to an organization that truly listens

A focus on customer insight and market trends that allow you to be more responsive

A marketing strategy reliant on actual intelligence, not speculation

Measurable outcomes that help sell the resulting strategy to other stakeholders

An actual method that assigns accountability

For companies that make the commitment to both the practices and supporting culture, results will lead

to greater confidence in decisions and bolster the firms competitive edge.

First Resource provides practical and actionable market analysis that professionals want and need

before implementing strategic plans. The perspective, insight, and analysis provided by First Resource is

critical to the development of successful growth strategies. Whether the result is to consider, confirm, or

refine developing action plans, First Resource provides the confidence needed to move forward

because companies simply cannot afford to be wrong about market assumptions.

Denver, CO . 303.750.1950 . 877.800.6471 . www.1st-resource.com

Anda mungkin juga menyukai

- Market IntelligenceDokumen16 halamanMarket IntelligencePopa AlinaBelum ada peringkat

- Market Research NotesDokumen2 halamanMarket Research NotesNitin Gopal Gupta100% (1)

- Application of Marketing ResearchDokumen7 halamanApplication of Marketing ResearchkanishkBelum ada peringkat

- Knowledge ManagementDokumen67 halamanKnowledge ManagementKarthik AnandBelum ada peringkat

- An AssignmentDokumen6 halamanAn AssignmentasrajibBelum ada peringkat

- The Impact of Small and Medium Scale Industries On The Economic Growth of Nigeria (1986 - 2010)Dokumen82 halamanThe Impact of Small and Medium Scale Industries On The Economic Growth of Nigeria (1986 - 2010)Tytler Samuel Abiodun OlayinkaBelum ada peringkat

- CLC_18DMA02 Team Research MethodsDokumen4 halamanCLC_18DMA02 Team Research MethodsTường ViBelum ada peringkat

- Definition of Competitive IntelligenceDokumen3 halamanDefinition of Competitive IntelligenceSAYMON ISABELO SARMIENTOBelum ada peringkat

- Case Study BDODokumen2 halamanCase Study BDOSaumya GoelBelum ada peringkat

- Marketing IntelligenceDokumen13 halamanMarketing IntelligenceSwapno Sarit PandaBelum ada peringkat

- E Commerce and E BusinessDokumen3 halamanE Commerce and E BusinessSonamBelum ada peringkat

- Definition of StatisticsDokumen3 halamanDefinition of StatisticsHaseeb WaheedBelum ada peringkat

- Creating Customer Value, Satisfaction & LoyaltyDokumen26 halamanCreating Customer Value, Satisfaction & Loyaltydrlov_20037767Belum ada peringkat

- Return On Assets RatioDokumen21 halamanReturn On Assets RatioKaviya KaviBelum ada peringkat

- National Fresh Produce Markets COBPDokumen21 halamanNational Fresh Produce Markets COBPDane McDonaldBelum ada peringkat

- Market IntelligenceDokumen11 halamanMarket IntelligenceNisha MalikBelum ada peringkat

- Marketing StrategiesDokumen3 halamanMarketing StrategiesJoshua TobiBelum ada peringkat

- Module 4 Corporate ValuationDokumen6 halamanModule 4 Corporate ValuationYounus ahmedBelum ada peringkat

- Assessing Global Markets Through Cultural DynamicsDokumen5 halamanAssessing Global Markets Through Cultural DynamicsJM GinoBelum ada peringkat

- Business Ethics & Corporate Governance - Assignment1Dokumen13 halamanBusiness Ethics & Corporate Governance - Assignment1AnjaliBelum ada peringkat

- Marketing EnviDokumen18 halamanMarketing EnviRrnkp GalzBelum ada peringkat

- Conjoint AnalysisDokumen4 halamanConjoint AnalysisdeepakBelum ada peringkat

- Future Trends of Marketing Research Approach - An OverviewDokumen21 halamanFuture Trends of Marketing Research Approach - An OverviewSarang RokadeBelum ada peringkat

- Calculating ROI On BPMDokumen2 halamanCalculating ROI On BPMStephan De Bruyn100% (1)

- CH01 - Introduction To Operations Management Rev.01Dokumen44 halamanCH01 - Introduction To Operations Management Rev.01Izzaty Riang RiaBelum ada peringkat

- Marketing MixDokumen11 halamanMarketing Mixketan chavanBelum ada peringkat

- Chapter 4 Marketing Research2Dokumen17 halamanChapter 4 Marketing Research2gracia_belindaBelum ada peringkat

- Beximco Pharma :MKISDokumen10 halamanBeximco Pharma :MKISshahin317Belum ada peringkat

- Channel ManagementDokumen8 halamanChannel Managementsajid bhattiBelum ada peringkat

- Mtic NotesDokumen50 halamanMtic NotesAnshita GargBelum ada peringkat

- Operations Management 2023Dokumen8 halamanOperations Management 2023Mouphtaou YarouBelum ada peringkat

- Why Do Projects Fail Reasons and Recommendations For Success PDFDokumen3 halamanWhy Do Projects Fail Reasons and Recommendations For Success PDFAlok BhardwajBelum ada peringkat

- Foundation of IMCDokumen32 halamanFoundation of IMCsanjay_pimBelum ada peringkat

- Cage ModelDokumen25 halamanCage ModelLaura GómezBelum ada peringkat

- Business Buyer BehaviorDokumen3 halamanBusiness Buyer BehaviorAntony JoseBelum ada peringkat

- Customer Value, Satisfaction and Loyalty at UberDokumen3 halamanCustomer Value, Satisfaction and Loyalty at UberAmar narayanBelum ada peringkat

- Strategy & Process AnalysisDokumen13 halamanStrategy & Process AnalysisGrishma BarotBelum ada peringkat

- Cost Accounting Vs Financial AccountingDokumen2 halamanCost Accounting Vs Financial AccountingSagar NareshBelum ada peringkat

- Marketing Strategies For Frozen Fish Exporters in BangladeshDokumen8 halamanMarketing Strategies For Frozen Fish Exporters in BangladeshDoc JoeyBelum ada peringkat

- MDI Marketing Compendium 2018Dokumen22 halamanMDI Marketing Compendium 2018Subhendu PradhanBelum ada peringkat

- Media Planning and Strategy Guide for Event ManagementDokumen5 halamanMedia Planning and Strategy Guide for Event Managementharishk2060Belum ada peringkat

- Integrated Marketing Communications Unit One NotesDokumen6 halamanIntegrated Marketing Communications Unit One NotesMohd SabirBelum ada peringkat

- Ratio Analysis Project Shankar - NewDokumen15 halamanRatio Analysis Project Shankar - NewShubham SinghalBelum ada peringkat

- Chapter+13+Summary MKT MGTDokumen12 halamanChapter+13+Summary MKT MGTFerdous MostofaBelum ada peringkat

- Components of An ERPDokumen8 halamanComponents of An ERPemBelum ada peringkat

- McKinsey & Company - Achieving Customer Management Excellence in EMsDokumen6 halamanMcKinsey & Company - Achieving Customer Management Excellence in EMsShravan MentaBelum ada peringkat

- Dells Just in Time Inventory Management SystemDokumen19 halamanDells Just in Time Inventory Management SystemThu HươngBelum ada peringkat

- Marketing Concepts Explained in DetailDokumen284 halamanMarketing Concepts Explained in Detailmohseen619Belum ada peringkat

- Strategic Marketing Plan. Sonex CookwareDokumen29 halamanStrategic Marketing Plan. Sonex Cookwareqasim mehmud100% (1)

- PPTDokumen25 halamanPPTSatish ChauhanBelum ada peringkat

- PEST Analysis: Identify External Factors Impacting Your BusinessDokumen6 halamanPEST Analysis: Identify External Factors Impacting Your Businessramcis c.cabanoBelum ada peringkat

- Green Marketing in India Challenges andDokumen13 halamanGreen Marketing in India Challenges andAmirul FathiBelum ada peringkat

- Nature of Innovation - How Organizational Culture Impacts Creativity & New IdeasDokumen10 halamanNature of Innovation - How Organizational Culture Impacts Creativity & New IdeashuixintehBelum ada peringkat

- Enterprise Risk Management Methods in 40 CharactersDokumen12 halamanEnterprise Risk Management Methods in 40 CharactersRao ArsalanBelum ada peringkat

- Efficient Market HypothesisDokumen6 halamanEfficient Market HypothesisLeon ΛοιζουBelum ada peringkat

- Note On Competitor AnalysisDokumen4 halamanNote On Competitor AnalysisSubhadeep PaulBelum ada peringkat

- Marketing AuditDokumen14 halamanMarketing Auditsajid bhattiBelum ada peringkat

- Role of Correlation in Business and Day To Day LifeDokumen6 halamanRole of Correlation in Business and Day To Day LifeEditor IJTSRDBelum ada peringkat

- Growth Strategy Process Flow A Complete Guide - 2020 EditionDari EverandGrowth Strategy Process Flow A Complete Guide - 2020 EditionBelum ada peringkat

- Chap 05Dokumen50 halamanChap 05Aida ArguetaBelum ada peringkat

- UK KPI GuideDokumen28 halamanUK KPI Guidemaryanne23Belum ada peringkat

- Small Stores in Big Cities The Future of Retailing in RussiaDokumen4 halamanSmall Stores in Big Cities The Future of Retailing in RussiaAida ArguetaBelum ada peringkat

- B 77 Bench MarkingDokumen6 halamanB 77 Bench MarkingJorsant EdBelum ada peringkat

- Diffserv Bandwidth Brokers As Mini-MarketsDokumen6 halamanDiffserv Bandwidth Brokers As Mini-MarketsAida ArguetaBelum ada peringkat

- 03 CapacidadDokumen22 halaman03 CapacidadAida ArguetaBelum ada peringkat

- Death by PowerpointDokumen61 halamanDeath by Powerpointspn100% (6)

- Note Buad836 Mod1 Yj7myoyoou5ym38Dokumen150 halamanNote Buad836 Mod1 Yj7myoyoou5ym38Adetunji TaiwoBelum ada peringkat

- Sales PlanningDokumen11 halamanSales PlanningMohit Singh BishtBelum ada peringkat

- ICWAI Syllabus 2002 Complete For Foundation, Inter and FinalDokumen19 halamanICWAI Syllabus 2002 Complete For Foundation, Inter and FinalsuccessgurusBelum ada peringkat

- Strategic Management (Group 5 Assignment) PDFDokumen8 halamanStrategic Management (Group 5 Assignment) PDFDesu Mekonnen100% (4)

- POLICE ORGANIZATION AND ADMINISTRATION ReviewerDokumen35 halamanPOLICE ORGANIZATION AND ADMINISTRATION ReviewerVincentBelum ada peringkat

- IT Risk Assessment QuestionnaireDokumen7 halamanIT Risk Assessment QuestionnaireRodney LabayBelum ada peringkat

- Midterm ExamDokumen5 halamanMidterm ExamRoberto Velasco MabulacBelum ada peringkat

- Functional Area 01 Strategic Global Human ResourcesDokumen20 halamanFunctional Area 01 Strategic Global Human ResourcesvinnshineBelum ada peringkat

- Chapter 2 Company and Marketing Strategy Partnering To Build Customer RelationshipsDokumen32 halamanChapter 2 Company and Marketing Strategy Partnering To Build Customer RelationshipsWaqar HussainBelum ada peringkat

- 2010 Business English Review Test Q1Dokumen7 halaman2010 Business English Review Test Q1Kasia KulkaBelum ada peringkat

- BSBMGT402 Implement Operational Plan KM2Dokumen17 halamanBSBMGT402 Implement Operational Plan KM2cplerk78% (9)

- PMI Módulo 4 - Revisión de Intentos 3Dokumen20 halamanPMI Módulo 4 - Revisión de Intentos 3Nataly Cruz ColoniaBelum ada peringkat

- ECG FinalDokumen35 halamanECG Finalwinnar37Belum ada peringkat

- Strategic PlanningDokumen58 halamanStrategic PlanningP12T50% (2)

- Principles of Management MCQ Questions and Answers Part - 1 - SAR PublisherDokumen1 halamanPrinciples of Management MCQ Questions and Answers Part - 1 - SAR PublisherTRICKS MASTERBelum ada peringkat

- 8516Dokumen8 halaman8516Mudassar SaqiBelum ada peringkat

- 4Dokumen11 halaman4Terry YaniBelum ada peringkat

- Strategic Plan Fy22 24Dokumen22 halamanStrategic Plan Fy22 24annaBelum ada peringkat

- Entrepreneurship Midterm Exam Senior High School DepartmentDokumen3 halamanEntrepreneurship Midterm Exam Senior High School DepartmentRay Faustino50% (2)

- Org Week 5Dokumen7 halamanOrg Week 5Arlyn Jane Catienza PradoBelum ada peringkat

- BASIC MARKETING: A Marketing Strategy Planning Approach by JR., William Perreault, Joseph Cannon and E. Jerome McCarthy - 19e, TEST BANK 0078028981Dokumen141 halamanBASIC MARKETING: A Marketing Strategy Planning Approach by JR., William Perreault, Joseph Cannon and E. Jerome McCarthy - 19e, TEST BANK 0078028981jksnmmmBelum ada peringkat

- 2022.08 Competency Exam - PD - Partner ProposalDokumen4 halaman2022.08 Competency Exam - PD - Partner ProposalagentbflyBelum ada peringkat

- Insurance Regulatory AuthorityDokumen51 halamanInsurance Regulatory AuthorityĦøşęħ ÖżįlBelum ada peringkat

- Intel Case Studt 10 11Dokumen13 halamanIntel Case Studt 10 11iroshaBelum ada peringkat

- CrossIndustry v721 Vs v611Dokumen1.046 halamanCrossIndustry v721 Vs v611Jasqim HasriBelum ada peringkat

- Leading The Process of Crafting and Executing StrategyDokumen27 halamanLeading The Process of Crafting and Executing StrategySifat Shahriar ShakilBelum ada peringkat

- Business PlanningDokumen4 halamanBusiness PlanningSalar CheemaBelum ada peringkat

- 20 Questions Directors of Not-For-Profit Organizations Should Ask About Strategy and Planning PDFDokumen36 halaman20 Questions Directors of Not-For-Profit Organizations Should Ask About Strategy and Planning PDFHC1990Belum ada peringkat

- Kotler 13 Tif 02Dokumen29 halamanKotler 13 Tif 02Hum92reBelum ada peringkat

- Academic AffairsDokumen41 halamanAcademic AffairsKakeembo NasiifuBelum ada peringkat