Corsera Quiz 2

Diunggah oleh

Subodh MayekarDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Corsera Quiz 2

Diunggah oleh

Subodh MayekarHak Cipta:

Format Tersedia

Which of the following is NOT an advantage of the clearinghouse system relative to a bilateral system of

bank payments?

Clearinghouses do not permit negative balances intraday

Negative balances are the source of the relative elasticity of a credit payments system

Which of the following is NOT an accurate description of dealers in the Fed Funds market?

Dealers match buyers and sellers without taking positions on their own balance sheets

Brokers, not dealers, match buyers and sellers without taking positions on their own balance sheets

Which of the following statements about bank payment systems is NOT true?

When a bank borrows in the Fed Funds markets, the balance sheet of the Fed expands

Fed Funds are interbank credit, not Fed credit

A customer of Bank A orders payment to a customer of Bank B, but Bank A does not have sufficient

reserves on hand to make the payment. Which of the following methods would NOT be used to make

the payment?

Issuing bank notes : which Bank B refuses to accept as payment

Which of the following is a property of Fed Funds?

Promise to pay reserves

Which of the following statements is NOT true about the operation of the bank clearinghouse

association under the national banking system (before the Fed)?

The clearinghouse was unable to provide elasticity for its members during a crisis

Clearinghouse certificates provided elasticity, but only for members, and their legal status was shaky

Anda mungkin juga menyukai

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDokumen68 halamanCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarBelum ada peringkat

- Edited 1 QuestionnareDokumen7 halamanEdited 1 Questionnarehar2012Belum ada peringkat

- Banking Solutions A Transition From Manual System To CBSDokumen13 halamanBanking Solutions A Transition From Manual System To CBSPravah ShuklaBelum ada peringkat

- Camel RatingsDokumen19 halamanCamel RatingsVikas R GaddaleBelum ada peringkat

- Credit AppraisalDokumen12 halamanCredit AppraisalAishwarya KrishnanBelum ada peringkat

- The Factors Affecting The Adoption of Online Banking Services by Civil Servants in CameroonDokumen8 halamanThe Factors Affecting The Adoption of Online Banking Services by Civil Servants in CameroonInternational Journal of Innovative Science and Research Technology100% (1)

- Letter of Credit Appraisal NoteDokumen8 halamanLetter of Credit Appraisal NoteNimitt ChoudharyBelum ada peringkat

- FedaiDokumen3 halamanFedaiSourav AdiBelum ada peringkat

- BASEL I, II, III-uDokumen43 halamanBASEL I, II, III-uMomil FatimaBelum ada peringkat

- Balance Sheet of Axis BankDokumen8 halamanBalance Sheet of Axis BankKushal GuptaBelum ada peringkat

- India Credit Card ReportDokumen12 halamanIndia Credit Card ReportmalvikasinghalBelum ada peringkat

- Eom Ii - Test - 15-08-2021Dokumen21 halamanEom Ii - Test - 15-08-2021Bithal PrasadBelum ada peringkat

- BFM Module C Chapter 18 Part IiDokumen10 halamanBFM Module C Chapter 18 Part IifolinesBelum ada peringkat

- SLBK604 Credit Mgmt.Dokumen4 halamanSLBK604 Credit Mgmt.Prateek Gupta0% (1)

- Credit Appraisal Process GRP 10Dokumen18 halamanCredit Appraisal Process GRP 10Priya JagtapBelum ada peringkat

- RETAIL SOLUTIONS - MODULE - 1 - INTRODUCTION (1) Soundarya KolaDokumen3 halamanRETAIL SOLUTIONS - MODULE - 1 - INTRODUCTION (1) Soundarya Kolaaryan singh67% (3)

- Management of Non-Performing Assets in Public Sector Banks: Evidence From IndiaDokumen11 halamanManagement of Non-Performing Assets in Public Sector Banks: Evidence From IndiaNavneet GurjurBelum ada peringkat

- Promotion Study Material PDFDokumen271 halamanPromotion Study Material PDFsunil25150% (2)

- Credit Management in Banks - BasicsDokumen35 halamanCredit Management in Banks - BasicsMuralidharprasad AyaluruBelum ada peringkat

- KAZMIDokumen3 halamanKAZMISanaBelum ada peringkat

- Credit Monitoring Caselets by Baroda Academy Ahmedabad - Print - QuizizzDokumen9 halamanCredit Monitoring Caselets by Baroda Academy Ahmedabad - Print - QuizizzShilpa JhaBelum ada peringkat

- Ans:ss Prospective Borrower: An Individual, Organization or Company Having Requirement of Additional Fund ForDokumen3 halamanAns:ss Prospective Borrower: An Individual, Organization or Company Having Requirement of Additional Fund ForMd AlimBelum ada peringkat

- Agenda 15 - Transaction Limits in CBS System For Different Types of TransactionsDokumen13 halamanAgenda 15 - Transaction Limits in CBS System For Different Types of TransactionsJay MeskaBelum ada peringkat

- Chapter 06Dokumen25 halamanChapter 06Farjana Hossain DharaBelum ada peringkat

- 262086378-Internship-Report-on-Loans-and-Advances-of-Pubali-Bank-Limited 01 PDFDokumen109 halaman262086378-Internship-Report-on-Loans-and-Advances-of-Pubali-Bank-Limited 01 PDFaal linconBelum ada peringkat

- BPCL Balance SheetDokumen2 halamanBPCL Balance SheetTaksh DhamiBelum ada peringkat

- Mobile Banking QuestionnaireDokumen3 halamanMobile Banking QuestionnaireObk AkashBelum ada peringkat

- Credit RiskDokumen26 halamanCredit RiskSecret PsychologyBelum ada peringkat

- Classification N ProvisionDokumen37 halamanClassification N ProvisionNur AlahiBelum ada peringkat

- Overview of Lending Activity: by Dr. Ashok K. DubeyDokumen19 halamanOverview of Lending Activity: by Dr. Ashok K. DubeySmitha R AcharyaBelum ada peringkat

- Material 2008 BDokumen227 halamanMaterial 2008 BshikumamaBelum ada peringkat

- Non - Performing Assests (Npa'S)Dokumen12 halamanNon - Performing Assests (Npa'S)Suhit SarodeBelum ada peringkat

- Syllabus Banking Diploma, IBB 5Dokumen2 halamanSyllabus Banking Diploma, IBB 5sohanantashaBelum ada peringkat

- An - Analytical - Study - of - Determinants - of - Non-Performing LoanDokumen14 halamanAn - Analytical - Study - of - Determinants - of - Non-Performing LoanSpade AceBelum ada peringkat

- Commercial Credit Information Report (CCR) - GuideDokumen22 halamanCommercial Credit Information Report (CCR) - Guidecyber ageBelum ada peringkat

- Assessment of Working Capital Finance 95MIKGBVDokumen31 halamanAssessment of Working Capital Finance 95MIKGBVpankaj_xaviers100% (1)

- Andhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsDokumen9 halamanAndhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsSivaramakrishna NeelamBelum ada peringkat

- Short Answer Questions For Financial ManagementDokumen2 halamanShort Answer Questions For Financial ManagementPrakash Sharma100% (1)

- Assessment of Working CapitalDokumen43 halamanAssessment of Working CapitalAshutosh VermaBelum ada peringkat

- Non-Banking Finance Companies (NBFCS) : Vivek Sharma Instructor Indian Financial SystemDokumen24 halamanNon-Banking Finance Companies (NBFCS) : Vivek Sharma Instructor Indian Financial Systemviveksharma51Belum ada peringkat

- Promn Exam MCQs 23-01-2022 - 5470497Dokumen17 halamanPromn Exam MCQs 23-01-2022 - 5470497Ghanshyam KumarBelum ada peringkat

- Gist of Important RBI CircularsDokumen9 halamanGist of Important RBI CircularsrajvkramBelum ada peringkat

- Asset Liability Management QuestionnaireDokumen9 halamanAsset Liability Management QuestionnairePriya MhatreBelum ada peringkat

- ABC Analysis For Final Subjects PDFDokumen15 halamanABC Analysis For Final Subjects PDFCA Test Series100% (1)

- Asset Monitoring CbsDokumen14 halamanAsset Monitoring CbsSankara NarayananBelum ada peringkat

- Principles and Practices of Banking - JAIIB: Timing: 3 HoursDokumen20 halamanPrinciples and Practices of Banking - JAIIB: Timing: 3 HoursMallikarjuna RaoBelum ada peringkat

- Cbs HandoutDokumen126 halamanCbs HandoutsudhaaBelum ada peringkat

- A Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDokumen5 halamanA Study On Management of Non Performing Assets in District Central Cooperative Bank PDFDevikaBelum ada peringkat

- Jaiib Questions Accounting & Finance Module D - Cont... : InvestmentsDokumen4 halamanJaiib Questions Accounting & Finance Module D - Cont... : InvestmentsBiswajit DasBelum ada peringkat

- Mcqs Based On Bank'S Circulars During July, 2021Dokumen8 halamanMcqs Based On Bank'S Circulars During July, 2021Shilpa JhaBelum ada peringkat

- Answer of Bank QuestionsDokumen2 halamanAnswer of Bank Questionsabu hanifBelum ada peringkat

- AOADokumen15 halamanAOAhappydaysshree2291Belum ada peringkat

- SME Business Division: Question BankDokumen26 halamanSME Business Division: Question BankKawoser AhammadBelum ada peringkat

- Case 2-1 - Solution: Estimated Time To Complete This Case Is Two HoursDokumen10 halamanCase 2-1 - Solution: Estimated Time To Complete This Case Is Two HoursLavanya TadepalliBelum ada peringkat

- Finance Mid TermDokumen4 halamanFinance Mid TermbloodinawineglasBelum ada peringkat

- Project by BrincyDokumen64 halamanProject by BrincyJeeva VargheseBelum ada peringkat

- CAIIB Question - TreasuryDokumen12 halamanCAIIB Question - TreasuryDiwakar PasrichaBelum ada peringkat

- Post Shipment FinanceDokumen5 halamanPost Shipment FinanceJc Duke M EliyasarBelum ada peringkat

- Money CreationDokumen4 halamanMoney Creationt7qkd7hv6wBelum ada peringkat

- Test Your Understanding of Material For The FinalDokumen10 halamanTest Your Understanding of Material For The FinalDegoBelum ada peringkat

- Ethical Issues in The Financial Services IndustryDokumen23 halamanEthical Issues in The Financial Services IndustrySubodh Mayekar50% (2)

- Interest Rate SwapsDokumen19 halamanInterest Rate SwapsSubodh MayekarBelum ada peringkat

- Project TopicsDokumen4 halamanProject TopicsSubodh MayekarBelum ada peringkat

- NTELOSDokumen2 halamanNTELOSSubodh MayekarBelum ada peringkat

- Coursera Quiz 4Dokumen2 halamanCoursera Quiz 4Subodh Mayekar0% (3)

- Financial CrisisDokumen70 halamanFinancial CrisisSubodh MayekarBelum ada peringkat

- Best 3D MoviesDokumen1 halamanBest 3D MoviesSubodh MayekarBelum ada peringkat

- Ok Lets Start.Dokumen3 halamanOk Lets Start.Subodh MayekarBelum ada peringkat

- Business PlanDokumen31 halamanBusiness Planriz2010Belum ada peringkat

- Business PlanDokumen24 halamanBusiness PlanHarshi Aggarwal80% (5)

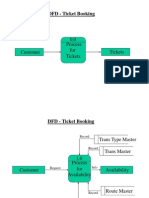

- DFD - Ticket Booking: Process For Tickets 0.0 TicketsDokumen4 halamanDFD - Ticket Booking: Process For Tickets 0.0 TicketsSubodh MayekarBelum ada peringkat

- Transport Master: Rate Minor UOM STRT Pos Dest SRT Time Rech Time TRP Type IDDokumen7 halamanTransport Master: Rate Minor UOM STRT Pos Dest SRT Time Rech Time TRP Type IDSubodh MayekarBelum ada peringkat

- Project Report On Human Resource PlanningDokumen4 halamanProject Report On Human Resource PlanningSubodh Mayekar100% (1)

- CRB ScamDokumen8 halamanCRB ScamSubodh MayekarBelum ada peringkat

- DFD - Transport MaintenanceDokumen3 halamanDFD - Transport MaintenanceSubodh MayekarBelum ada peringkat