Chapter 15 Solutions

Diunggah oleh

happysparky0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

437 tayangan6 halamanAdvanced Accounting 10th Edition, Partnerships: Formation, Operation, and Changes in Membership

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAdvanced Accounting 10th Edition, Partnerships: Formation, Operation, and Changes in Membership

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

437 tayangan6 halamanChapter 15 Solutions

Diunggah oleh

happysparkyAdvanced Accounting 10th Edition, Partnerships: Formation, Operation, and Changes in Membership

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 6

Chapter 15 - Partnerships: Formation, Operation, and Changes in Membership

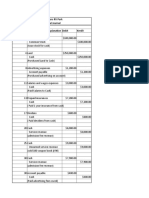

P15-17 Partnership Formation, Operation, and Changes in Ownership

a. Entries to record the formation of the partnership and the events that occurred

during 20X7:

Cash 110,000

Inventory 80,000

Land 130,000

Equipment 100,000

Mortgage payable 50,000

Installment Note Payable 20,000

J ordan, Capital ($60,000+$80,000 +$100,000

- $20,000)

220,000

ONeal, Capital

($50,000 +$130,000 - $50,000) 130,000

(1) Inventory 30,000

Cash 24,000

Accounts Payable 6,000

(2) Mortgage Payable 5,000

Interest Expense 2,000

Cash 7,000

(3) Installment Note Payable 3,500

Interest Expense 2,000

Cash 5,500

(4) Accounts Receivable 21,000

Cash 134,000

Sales 155,000

(5) Selling and General Expenses 34,000

Cash 27,800

Accrued Expenses Payable 6,200

(5) Depreciation Expense 6,000

Accumulated Depreciation 6,000

(6) J ordan, Drawing ($200 x 52) 10,400

ONeal, Drawing 10,400

Cash 20,800

(8) Sales 155,000

Income Summary 155,000

(7) Cost of Goods Sold 90,000

Inventory 90,000

$90,000 =$80,000 beginning inventory +30,000 purchases - 20,000

ending inventory

15-1

Chapter 15 - Partnerships: Formation, Operation, and Changes in Membership

P15-17 (continued)

(8) Income Summary 134,000

Cost of Goods Sold 90,000

Selling and General Expenses 34,000

Depreciation Expense 6,000

Interest Expense 4,000

(8) Income Summary 21,000

J ordan, Capital 10,500

ONeal, Capital 10,500

(8) J ordan, Capital 10,400

ONeal, Capital 10,400

J ordan, Drawing 10,400

ONeal, Drawing 10,400

Schedule to allocate partnership net income for 20X7:

J ordan

ONeal Total

Profit percentage 60% 40% 100%

Beginning capital balance $220,000 $130,000 $350,000

Net income ($155,000 revenue

- $134,000 expenses) $ 21,000

Interest on beginning capital balances (3%) $ 6,600 $ 3,900 (10,500)

$ 10,500

Salaries 12,000 12,000 (24,000)

$(13,500)

Residual deficit (8,100) (5,400) 13,500

Total $ 10,500 $ 10,500 $ -0-

b. J ordan ONeal Partnership

Income Statement

For the Year Ended December 31, 20X7

Sales $155,000

Less: Cost of Goods Sold:

Inventory, J anuary 1 $ 80,000

Purchases 30,000

Goods Available for Sale $110,000

Less: Inventory, December 31 (20,000) (90,000)

Gross Profit $ 65,000

Less: Selling and General Expenses $ 34,000

Depreciation Expense 6,000 (40,000)

Operating Income $ 25,000

Nonoperating Expense Interest (4,000)

Net Income $ 21,000

15-2

Chapter 15 - Partnerships: Formation, Operation, and Changes in Membership

P15-17 (continued)

c. J ordan ONeal Partnership

Balance Sheet

At December 31, 20X7

Assets

Cash $158,900

Accounts Receivable 21,000

Inventory 20,000

Land 130,000

Equipment (net) 94,000

Total Assets $423,900

Liabilities and Capital

Liabilities:

Accounts Payable $ 6,000

Accrued Expenses Payable 6,200

Installment Note Payable 16,500

Mortgage Payable 45,000

Total Liabilities $ 73,700

Capital:

J ordan, Capital $220,100

ONeal, Capital 130,100

Total Capital 350,200

Total Liabilities and Capital $423,900

d. Hill's investment into the partnership $ 99,800

Prior partners' capital 350,200

Total capital of the new partnership $450,000

Hill's capital credit (0.20 x $450,000) $ 90,000

Bonus allocated to J ordan and ONeal in the

ratio 60:40 $ 9,800

J anuary 1, 20X8 journal entry:

Cash 99,800

J ordan, Capital (0.60 x $9,800) 5,880

ONeal, Capital (0.40 x $9,800) 3,920

Hill, Capital 90,000

15-3

Chapter 15 - Partnerships: Formation, Operation, and Changes in Membership

P15-19 Formation of a Partnership and Allocation of Profit and Loss

Part I:

Haskins and Sells Partnership

Balance Sheet

At J anuary 2, 20X3

Assets

Current assets:

Cash $ 55,000

Temporary Investments 81,500

Trade Accounts Receivable $70,000

Less: Allowance for uncollectible accounts (4,500) 65,500

Note Receivable 50,000

Inventories 62,500

Total Current Assets $314,500

Property, Plant, and Equipment:

Building (less accumulated depreciation of $230,000) 370,000

Intangible Assets:

Customer Lists 60,000

Total Assets $744,500

Liabilities and Partnership Capital:

Current Liabilities:

Current Portion of Mortgage Payable $ 25,000

Long-term Liabilities:

Mortgage Payable, less current portion 150,000

Partnership Capital:

Haskins, Capital $327,000

Sells, Capital 242,500 569,500

Total Liabilities and Partnership Capital $744,500

15-4

Chapter 15 - Partnerships: Formation, Operation, and Changes in Membership

P15-19 (continued)

Part II:

a. Haskins and Sells Partnership

Income Statement

For the Year Ended December 31, 20X3

Revenues $ 650,000

Less: Cost of Goods Sold (320,000)

Gross Profit $ 330,000

Operating Expenses:

Selling, General, and Administrative Expenses (70,000)

Net Income $ 260,000

Note that salaries paid to partners and the bonus paid to Haskins are distributions of

partnership net income and are not expenses of the partnership.

b. Description Haskins Sells Total

10% bonus to Haskins $ 26,000 $ 26,000

Salaries to each partner 90,000 $ 70,000 160,000

Residual net income: $74,000 14,800 59,200 74,000

Total $130,800 $129,200 $260,000

Capital

c. Description Haskins Sells Total

Capital balances, J anuary 3, 20X3 $327,000 $242,500 $569,500

Add: Net income for 20X3 130,800 129,200 260,000

Withdrawals made during the year* (110,000) (80,000) (190,000)

Capital balances at December 31, 20X3 $347,800 $291,700 $639,500

*Note that the salaries were also withdrawn during the year, so Haskins total withdrawals

are $110,000 ($100,000 salary+$10,000) and Sells were $80,000 ($75,000 salary +

$5,000).

d. To find out what partnership net income would have to be for each partner to receive

the same amount of income, determine the amount of income difference that would go to

each partner for each additional dollar of partnership net income. To illustrate, assume

that partnership net income was $261,000 instead of $260,000. How would this

incremental $1,000 affect the distribution of net income? To find out the answer to this

question, see the computation below.

Description Haskins Sells Total

Bonus to Haskins $ 26,100 $ 26,100

Salaries to each partner 90,000 $ 70,000 160,000

Remainder to each partner ($74,900) 14,980 59,920 74,900

Total $131,080 $129,920 $261,000

The increase of $1,000 in partnership net income resulted in a $280 increase in Haskins

share of net income and a $720 increase in Sells share of net income. Another way to

look at this is that for a $1,000 increase in partnership net income, Sells will receive $440

more, or 44% more, than Haskins ($720 minus $280 =$440 divided by $1,000).

15-5

Chapter 15 - Partnerships: Formation, Operation, and Changes in Membership

Take this information and use it to answer the question. At partnership net income of

$260,000, Haskins will receive $1,600 more net income than Sells ($130,800 minus

$129,200). Take the difference between these two incomes and divide it by 0.44. Dividing

$1,600 by 0.44 equals $3,636. Add this amount to $260,000 to get $263,636, the amount

of partnership net income that would result in each partner receiving the same amount of

net income.

15-6

Anda mungkin juga menyukai

- Chap 12 SolutionDokumen15 halamanChap 12 SolutionMarium Raza0% (1)

- Chapter 3 DiscussionsDokumen22 halamanChapter 3 Discussionsの変化 ナザレBelum ada peringkat

- Accounting 2301 (Chapter 1-4)Dokumen3 halamanAccounting 2301 (Chapter 1-4)Fabian NonesBelum ada peringkat

- Ch08 Harrison 8e GE SM (Revised)Dokumen102 halamanCh08 Harrison 8e GE SM (Revised)Muh BilalBelum ada peringkat

- CityDokumen8 halamanCitylaale djaanBelum ada peringkat

- Agro Chem, Inc.Dokumen32 halamanAgro Chem, Inc.Camryn Bintz50% (2)

- FM Aaj KaDokumen15 halamanFM Aaj Kakaranzen50% (2)

- IRR and NPVDokumen21 halamanIRR and NPVAbdul Qayyum100% (1)

- XYTECH, Inc.Dokumen12 halamanXYTECH, Inc.P3 PowersBelum ada peringkat

- Business Accounting (LO 03,4,5) - Alternative AssessmentDokumen7 halamanBusiness Accounting (LO 03,4,5) - Alternative Assessmentpiumi100% (1)

- 39.1 SolutionDokumen5 halaman39.1 SolutionJeanelle ColaireBelum ada peringkat

- Acct4342 Xero Part2Dokumen29 halamanAcct4342 Xero Part2api-280107742Belum ada peringkat

- Income Statement SimDokumen5 halamanIncome Statement Simjustwon100% (1)

- Chapter 6 Solutions 2241Dokumen22 halamanChapter 6 Solutions 2241JamesBelum ada peringkat

- Problem Set 2 SolutionDokumen10 halamanProblem Set 2 SolutionLawly GinBelum ada peringkat

- Do You Think It Was Important For Michael To Stipulate That He Wanted A Business That HeDokumen17 halamanDo You Think It Was Important For Michael To Stipulate That He Wanted A Business That Hemiss_hazel85100% (1)

- CLP v2.0 - Session 8 Transformation in ChristDokumen7 halamanCLP v2.0 - Session 8 Transformation in Christarcee alcedo100% (2)

- Xytech IncDokumen12 halamanXytech IncApoorv SinghalBelum ada peringkat

- CF 12th Edition Chapter 02Dokumen38 halamanCF 12th Edition Chapter 02Ashekin MahadiBelum ada peringkat

- Chapter 03 Ratio AnalysisDokumen46 halamanChapter 03 Ratio AnalysisMustakim Bin Aziz 1610534630Belum ada peringkat

- 17 Answers To All ProblemsDokumen25 halaman17 Answers To All ProblemsRaşitÖnerBelum ada peringkat

- Chapter 01Dokumen2 halamanChapter 01badunktuaBelum ada peringkat

- Tutor 6Dokumen26 halamanTutor 6MERINABelum ada peringkat

- MCD2010 - T8 SolutionsDokumen9 halamanMCD2010 - T8 SolutionsJasonBelum ada peringkat

- BonusesDokumen1 halamanBonusesKayla SheltonBelum ada peringkat

- Case 20: The Walt Disney Company: Strategic ManagementDokumen31 halamanCase 20: The Walt Disney Company: Strategic ManagementAYU SINAGABelum ada peringkat

- Beefeaters RV Park General Journal Date Account Titles and Explanation Debit KreditDokumen1 halamanBeefeaters RV Park General Journal Date Account Titles and Explanation Debit Kredityogi fetriansyahBelum ada peringkat

- Cash Flow Excercise Questions-Set-2Dokumen2 halamanCash Flow Excercise Questions-Set-2AgABelum ada peringkat

- Chapter 14. Tool Kit For Distributions To Shareholders: Dividends and RepurchasesDokumen9 halamanChapter 14. Tool Kit For Distributions To Shareholders: Dividends and RepurchasesHenry RizqyBelum ada peringkat

- IFRS Chapter 10 The Consolidated Income StatementDokumen34 halamanIFRS Chapter 10 The Consolidated Income StatementJuBin DeliwalaBelum ada peringkat

- Real Options and Capital Budgeting (I Wish I Had A Crystal Ball)Dokumen4 halamanReal Options and Capital Budgeting (I Wish I Had A Crystal Ball)Ian S. DaosBelum ada peringkat

- Case 5-32&33Dokumen4 halamanCase 5-32&33Majde Qasem100% (1)

- Potato BestDokumen42 halamanPotato BestkornelusBelum ada peringkat

- Bài Tập 2-27 - Nhóm8LớpKN007Dokumen6 halamanBài Tập 2-27 - Nhóm8LớpKN007nguyenhongBelum ada peringkat

- ACCT 4342-F13 Final AIS Project Spreadsheet (Printable 2)Dokumen30 halamanACCT 4342-F13 Final AIS Project Spreadsheet (Printable 2)chrismg89Belum ada peringkat

- Final Exam On Accounting For Decision MakingDokumen17 halamanFinal Exam On Accounting For Decision MakingSivasakti MarimuthuBelum ada peringkat

- CH 1 AmericoDokumen10 halamanCH 1 Americojordi92500Belum ada peringkat

- Challenge Exercise 2 (9 - 10)Dokumen3 halamanChallenge Exercise 2 (9 - 10)Kevin ChandraBelum ada peringkat

- Cash Flow Analysis: Selected Item 2019 ($M) 2018 ($M) 2017 ($M) 2016 ($M)Dokumen7 halamanCash Flow Analysis: Selected Item 2019 ($M) 2018 ($M) 2017 ($M) 2016 ($M)fintech100% (1)

- CH 06Dokumen67 halamanCH 06AnkitBelum ada peringkat

- Cash Flow Statement and Financial Ratio AssignDokumen4 halamanCash Flow Statement and Financial Ratio AssignChristian TanBelum ada peringkat

- Operating Profit - 200 2500 2500 2500 2500Dokumen4 halamanOperating Profit - 200 2500 2500 2500 2500Archana J RetinueBelum ada peringkat

- Chapter 2: Measuring National Output and National Income: Macro Economics Numerical Problem Solving ExercisesDokumen11 halamanChapter 2: Measuring National Output and National Income: Macro Economics Numerical Problem Solving Exercisesahmed housniBelum ada peringkat

- Case StudyDokumen5 halamanCase Studyphượng nguyễn thị minhBelum ada peringkat

- McPhee Distillers Statements v03 CPDokumen13 halamanMcPhee Distillers Statements v03 CPcmag10Belum ada peringkat

- Beefeater RV Park General Journal Apr-31 Date Account Titles and Explanation Debit CreditDokumen2 halamanBeefeater RV Park General Journal Apr-31 Date Account Titles and Explanation Debit Credityogi fetriansyahBelum ada peringkat

- FIN1161 - Introduction To Finance For Business - Report 2Dokumen6 halamanFIN1161 - Introduction To Finance For Business - Report 2thunlagbd230128Belum ada peringkat

- Hhtfa8e ch01 SMDokumen83 halamanHhtfa8e ch01 SMkbrooks323Belum ada peringkat

- Exercise 14Dokumen11 halamanExercise 14dwitaBelum ada peringkat

- Tutorial 6Dokumen4 halamanTutorial 6Muntasir AhmmedBelum ada peringkat

- MASTERDokumen10 halamanMASTERNour SawaftaBelum ada peringkat

- Balance Sheet of Tech MahindraDokumen3 halamanBalance Sheet of Tech MahindraPRAVEEN KUMAR M 18MBR070Belum ada peringkat

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDokumen4 halamanCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalBelum ada peringkat

- Maria HernandezDokumen8 halamanMaria HernandezAimane BeggarBelum ada peringkat

- ME Mod B 2016 - DeM3 - HomeworkDokumen11 halamanME Mod B 2016 - DeM3 - HomeworkBauyrzhan KobadilovBelum ada peringkat

- Assignment 01 Financial StatementsDokumen5 halamanAssignment 01 Financial StatementsAzra MakasBelum ada peringkat

- FM09-CH 24Dokumen16 halamanFM09-CH 24namitabijweBelum ada peringkat

- Marion Boats Case Solution CompressDokumen16 halamanMarion Boats Case Solution CompressashishBelum ada peringkat

- Actg 1Dokumen12 halamanActg 1oconn1Belum ada peringkat

- Solution To Chapter 15Dokumen9 halamanSolution To Chapter 15Ismail WardhanaBelum ada peringkat

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- Ryterna Modul Architectural Challenge 2021Dokumen11 halamanRyterna Modul Architectural Challenge 2021Pham QuangdieuBelum ada peringkat

- BPHC HRSA-23-025 (H8H) FY 2023 Ending HIV Epidemic - FinalDokumen44 halamanBPHC HRSA-23-025 (H8H) FY 2023 Ending HIV Epidemic - FinalTuhin DeyBelum ada peringkat

- Strategic Management AnswerDokumen7 halamanStrategic Management AnswerJuna Majistad CrismundoBelum ada peringkat

- Kanchipuram Silk SareesDokumen12 halamanKanchipuram Silk SareesChandni Agarwal Dixit100% (2)

- Washingtons PresidencyDokumen27 halamanWashingtons PresidencyoscaryligiaBelum ada peringkat

- Chap 0023Dokumen26 halamanChap 0023yousef olabiBelum ada peringkat

- Safe Disposal of Hazardous Wastes Vol IDokumen290 halamanSafe Disposal of Hazardous Wastes Vol IRodrigo BartoloBelum ada peringkat

- The Six Day War: Astoneshing Warfear?Dokumen3 halamanThe Six Day War: Astoneshing Warfear?Ruben MunteanuBelum ada peringkat

- Chapter 3. Different Kinds of ObligationDokumen17 halamanChapter 3. Different Kinds of ObligationTASNIM MUSABelum ada peringkat

- 154 - 2 - Passive Voice ExercisesDokumen9 halaman154 - 2 - Passive Voice ExercisesSerbescuBelum ada peringkat

- Athletics Federation of India: Men & U23 Men U20 MenDokumen3 halamanAthletics Federation of India: Men & U23 Men U20 Menl3spawlBelum ada peringkat

- Herb and Spice History PDFDokumen2 halamanHerb and Spice History PDFHarumi0% (1)

- Industry ProfileDokumen16 halamanIndustry Profileactive1cafeBelum ada peringkat

- Transfer: One Page Guide: Ear P Ourself and Hole Eartedly Mbrace TheDokumen1 halamanTransfer: One Page Guide: Ear P Ourself and Hole Eartedly Mbrace TheRAHUL VIMALBelum ada peringkat

- An Introduction To The "Mantra Śãstra": By: S.E. Gop ĀlāchārluDokumen25 halamanAn Introduction To The "Mantra Śãstra": By: S.E. Gop ĀlāchārluKuldeep SharmaBelum ada peringkat

- Amelia David Chelsea Cruz Ellaine Garcia Rica Mae Magdato Shephiela Mae Enriquez Jamaica Bartolay Jerie Mae de Castro Meryl Manabat Riejel Duran Alexis ConcensinoDokumen9 halamanAmelia David Chelsea Cruz Ellaine Garcia Rica Mae Magdato Shephiela Mae Enriquez Jamaica Bartolay Jerie Mae de Castro Meryl Manabat Riejel Duran Alexis ConcensinoRadleigh MercadejasBelum ada peringkat

- Customer Information Update FormDokumen1 halamanCustomer Information Update FormmikeBelum ada peringkat

- The City Bride (1696) or The Merry Cuckold by Harris, JosephDokumen66 halamanThe City Bride (1696) or The Merry Cuckold by Harris, JosephGutenberg.org100% (2)

- Purging CostSavingsDokumen2 halamanPurging CostSavingscanakyuzBelum ada peringkat

- Elizabeth Stevens ResumeDokumen3 halamanElizabeth Stevens Resumeapi-296217953Belum ada peringkat

- 02-7 QCS 2014Dokumen5 halaman02-7 QCS 2014Raja Ahmed Hassan0% (1)

- Meaningful Use: Implications For Adoption of Health Information Technology (HIT) Tamela D. Yount HAIN 670 10/17/2010Dokumen10 halamanMeaningful Use: Implications For Adoption of Health Information Technology (HIT) Tamela D. Yount HAIN 670 10/17/2010Tammy Yount Di PoppanteBelum ada peringkat

- Terence Fretheim - The Exaggerated God of JonahDokumen11 halamanTerence Fretheim - The Exaggerated God of JonahChris Schelin100% (1)

- Contrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesDokumen2 halamanContrast and Compare Napoleon (Animal Farm) and Big Brother (1984) Characters in George Orwell's MasterpiecesTogay Balik100% (1)

- 12 Business Combination Pt2 PDFDokumen1 halaman12 Business Combination Pt2 PDFRiselle Ann SanchezBelum ada peringkat

- APLN - Audit Report 2018Dokumen133 halamanAPLN - Audit Report 2018Dini DesvarhozaBelum ada peringkat

- English File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)Dokumen2 halamanEnglish File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)dzinedvisionBelum ada peringkat

- Suffixes in Hebrew: Gender and NumberDokumen11 halamanSuffixes in Hebrew: Gender and Numberyuri bryanBelum ada peringkat