Commodity Report by Ways2Capital 21 July 2014

Diunggah oleh

Ways2Capital0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan9 halamanWays2Capital is a major investigating body in the world capital market. It analyses capital transactions and investment trends. We basically aim to guide and suggest the most beneficial deal for the traders and investors all over the universe, fluctuations in the capital market influence trade and investment and everything which involves money.

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniWays2Capital is a major investigating body in the world capital market. It analyses capital transactions and investment trends. We basically aim to guide and suggest the most beneficial deal for the traders and investors all over the universe, fluctuations in the capital market influence trade and investment and everything which involves money.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan9 halamanCommodity Report by Ways2Capital 21 July 2014

Diunggah oleh

Ways2CapitalWays2Capital is a major investigating body in the world capital market. It analyses capital transactions and investment trends. We basically aim to guide and suggest the most beneficial deal for the traders and investors all over the universe, fluctuations in the capital market influence trade and investment and everything which involves money.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 9

Web: www.ways2capital.com | Mail: info@ways2capital.

com | Call: 0731-655125

COMMODITY WEEKLY REPORT

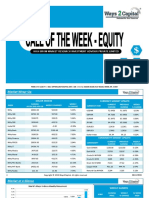

NCDEX DAILY AND WEEKLY LEVELS

DALLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

SYOREFIDR 20-AUG-14 702.10 693.50 684.60 681.20 675.50 672.30 666.80 657.10 648.90

SYBEANIDR 20-OCT-14 3939 3867 3803 3773 3739 3709 3675 3611 3547

RMSEED 20-AUG-14 3699 3672 3645 3634 3618 3607 3591 3564 3537

JEERAUNJHA 20-AUG-14 12071 11951 11831 11758 11711 11638 11591 11470 11351

DHANIYA 20-AUG-14 12486 12301 12116 12048 11931 11863 11746 11561 11376

CASTORSEED 20-AUG-14 4412 4328 4244 4199 4160 4115 4076 3992 3908

WEEKLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

SYOREFIDR 20-AUG-14 732.50 712.60 692.60 685.10 672.90 665.90 652.40 632.70 612.50

SYBEANIDR 20-OCT-14 4054 3944 3834 3789 3724 3679 3614 3504 3394

RMSEED 20-AUG-14 3820 3750 3681 3652 3611 3582 3541 3471 3401

JEERAUNJHA 20-AUG-14 12668 12353 12038 11861 11723 11546 11408 11093 10778

DHANIYA 20-AUG-14 13110 12725 13340 12160 11955 11775 11570 11185 10800

CASTORSEED 20-AUG-14 4998 4735 4472 4313 4209 4050 3964 3683 3420

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

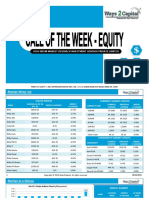

MCX DAILY AND WEEKLY LEVELS

DALLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

CRUDE OIL 21-JULY- 6424 6357 6290 6249 6223 6182 6156 6089 6022

GOLD 5- AUG-14 28815 28553 28291 28142 28029 27880 27767 27505 27243

LEAD 31-JULY- 135.50 134.05 132.50 131.80 131.05 130.30 129.50 128.05 126.85

NATURAL 28-JULY- 250 246 242 240 238 236 234 230 226

NICKEL 31-JULY- 1263 1219 1176 1149 1132 1105 1088 1045 1001

SILVER 5-SEPT-14 47517 46707 45897 45414 45087 44604 44277 43467 42657

ZINC 31-JULY- 142.20 140.85 139.50 138.85 138.15 137.50 136.80 135.45 134.10

WEEKLY EXPIRY R4 R3 R2 R1 PP S1 S2 S3 S4

ALUMINIUM 31-JULY- 130.90 126.55 112.20 120.45 117.85 116.10 113.50 109.15 104.80

COPPER 29-AUG- 466 453 441 434 429 421 417 404 392

CRUDE OIL 21-JULY- 7035 6739 6443 6326 6147 6030 5851 5555 5259

GOLD 5- AUG-14 30409 29604 28799 28396 27994 27591 27189 26384 25579

LEAD 31-JULY- 139 137 134 132 131 129 128 125 122

NATURAL 28-JULY- 287 272 257 247 242 232 226 211 196

NICKEL 31-JULY- 1304 1248 1192 1157 1136 1101 1080 1024 968

SILVER 5-SEPT-14 49491 48011 46531 45731 45051 44251 43571 42091 40611

ZINC 31-JULY- 143.20 141.55 139.90 139.05 138.25 137.40 136.60 134.95 133.30

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

MCX - WEEKLY NEWS LETTERS

Important News

US Building Permits was at 0.96 million in the last month.

Sanctions on Russias biggest oil company boosted crude oil prices.

Euro Zone CPI unchanged at 0.5 percent in the month of June.

Renewed Ukraine concerns spurred safe haven status of gold.

US Philly Fed Manufacturing Index gained to 23.9-mark in July.

Indian Currency

The Indian Rupee traded on a flat note and depreciated for fourth consecutive days and fell

around 0.1 percent in yesterdays trading session. The currency depreciated on the back of

dollar demand from state run banks for oil and defense related payments. Further, rise in oil

prices after new sanctions imposed by the US on Russia exerted downside pressure on the

currency. Unfavorable trade balance data in prior trading session lead to concerns over the

financial stability of the country and acted as a negative factor.

Precious Metals

Spot gold prices gained by around 1.4 percent on Thursday as investors sought shelter in the

precious metal on fears of further turmoil after news that a Malaysian passenger jetliner had

been downed in Ukraine. Earlier, safe-haven bids had already boosted bullion prices on new

U.S. and European Union sanctions on Russia, fresh on the heels of news that a Ukrainian

fighter plane had been shot down over eastern Ukraine. Gold rallied $20 per ounce in about 40

minutes and the S&P 500 equities index tumbled after the Malaysian airliner was brought down

over eastern Ukraine, killing all 295 people aboard and sharply raising the stakes in a conflict

between Kiev and pro-Moscow rebels in which Russia and the West back opposing sides.

Before the Malaysian jetliner news, precious metal prices were higher on U.S. President Barack

Obama's move to impose sanctions on some of Russia's biggest companies for the first time over

Moscow's failure to curb violence in Ukraine.

On the MCX, gold prices rose by around 1.8 percent taking cues from strong international

markets and closed at Rs.28199/10gms.

On an next trading session basis, we expect gold and silver prices to trade on a positive note on

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

escalation of tensions in the Ukrainian peninsula and fresh round of sanctions imposed by US

on Russia. Housing data released last night did not come as per expectations appealing bullions

safe haven

appeal in turn acting as a positive factor for prices.

On the MCX, gold and silver prices are expected to trade on a positive note taking cues from

strong international markets.

Base Metals

Base metals on the LME largely gained on Thursday as the manufacturing data from the US

turned out to be positive despite expectations of it slowing down. Aluminum prices rose to a

16-month high yesterday as LME inventories slump to the lowest in 22 months.

However, sharp gains were capped on the back of unfavorable housing data from the US. Also,

concerns regarding the health of construction sector in China after Huntington Road & Bridge

Group warned that it might not be able to repay a $65 million debt due next week exerted

downside pressure on prices.

In the Indian markets, all the base metals traded on a positive note taking cues from

international markets.

Energy

Oil prices gained on Thursday, extending their rebound from a weeks-long decline as new U.S.

sanctions announced on Wednesday took aim at some of Russia's biggest companies for the first

time, including Rosneft, the largest oil producer. Gains accelerated over the afternoon as news

spread of a Malaysian airliner crash in eastern Ukraine, where government forces are fighting

pro-Moscow rebels. U.S. Vice President Joseph Biden said the jet was "blown out of the sky" and

Ukraine accused "terrorists" of shooting it down. On the MCX, crude oil prices rose by around

2.2 percent and closed at Rs.6221/bbl.

Natural gas prices on the NYMEX declined by more than 3 percent on moderating climate in the

US and inventory additions in storage more than the market expectations. Utilities have added

107Bcf of gas in the previous week as against previous addition of 93Bcf acting as a negative

factor for prices.

On the MCX, NG prices declined by more than 4 percent on weakness in international markets

and closed at Rs.238.60/Mmbtu.

On next trading session basis, we expect crude oil prices to trade on a positive note continuing

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

its gains from the previous session. Escalating tensions in Ukraine coupled with additional

sanctions imposed on Russia by the US will push crude prices higher.

Besides, incremental demand for crude in the US is visible in draw down in inventories for

continuous two weeks in a row is acting as a positive factor. On the MCX, crude prices are

expected to trade on a positive note taking cues from strong international markets.

NCDEX - WEEKLY NEWS LETTERS

MANSOON WATCH

Monsoon covers entire IndiaIMD

The Rainfall deficiency falls to 36% from 42%

Agri counters trade with high volatile as moderate corrections seen over revival of Monsoon.

SETELITE IMAGE OF INDIAN WHETHER CONDITION AS ON 11/07/2014 9.45 A.M.

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

CHANA

After the recent fall in rates for Chana, prices bounced back as demand rose in the mandis.

Some more recovery is likely for the counter even as improved Monsoon reports could also

keep the uptrend limited. The demand that had picked up over last few days slowed down at

these higher levels as traders wait for dips before initiating fresh demand in the mandis. An

already weak Monsoon seen so far has been supporting the overall market sentiment for the

commodity. Re-peated efforts by the Govt to keep tab on hoardersmainly for essen-tial Food

items are however keeping the uptrend limited also.

Monsoon progress for next few days remains critical. Sowing of Kharif Pulses are likely to get

adversely affected if delayed and below normal Monsoon is maintained. Drought like

conditions and heat wave delaying sowing of most crops, monsoon rains were 42% below

normal till date

As per latest reports of sowing of kharif crops, kharif sowing area has crossed 182.40 lakh

hectare. It is reported that as on 4.7.2014, rice has been sown/transplanted in 45.12 lakh ha,

pulses in 7.50 lakh

On International front, Australian Chana production reportedly has fallen by 23%. A fall in

Dollar vs Re has kept the import cost of Pulses from Myanmar, Australia and Cana-da low

resulting in further weaken-ing of market sentiments.

SOYABEAN / REFI.SOYA

Refined soy oil continued the bullish tone on steady demand from traders and stockiests amid

low supplies. US markets firmed up on some support from Chinese de-mand at these low levels

coupled with geo political tension in Ukraine borders.

The soy oil remained under pres-sure due to excess supplies from imports. As per Solvent

Extractors Association of India (SEA) data bank, there has been a significant increase in

imports of Soy oil, sunflower oil & Rape oil and drop in imports of Palm oil, for last seven

months of edible oil marketing year (Nov - Oct Global production of 10 major oilseeds is

forecast to climb 3 percent in 2014-15 on a bigger soybean harvest, lifting stocks to a record by

the end of the next sea-son.

Soybean markets remained firm on demand from crushers and meal exporters picking up in

mandis across MP & Mahrashtra. The supplies are slow as suppliers are expecting a rally in

prices in the coming season.

As per per the latest date released by the Ministry of Agriculture, the oilseed sowing is around

14.49 lakh hectares down from a bumper sowing of 110.27 lakh hectares last year during the

same period.

Soybean production may jump to 301.9 million tons from 284.11 million tons. Brazils harvest

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

may climb to 90 million tons from 86.5 million and Argentina may gather 56 million tons from

55 million a year earlier. The inventories will be at a record 85.31 million tons.

CUMIN SEED (JEERA)

Jeera trades with extreme high volatility as the initial upside move-ment is followed by profit

booking by day end. Good Export demand however keeps sentiments firm for the commodity.

Arrival remained moderate. But an expected pick up in exports in coming weeks, supported by

a firmness in Dollar vs Re could support the prices. Downtrend from these levels seem limited.

Jeera rates are fetching premium w.r.t. International markets. Low stocks in global trade and

political unrest in Turkey and Syria have pushed export demand to India. India will remain the

primary export-er for this commodity as of now.

Cumin seed or jeera production in India is expected to rise to 6.5-7 million bags of 55 kg each

in the year 2014, from 4.5-5 million bags a year earlier, due to an expanded area under

cultivation and favoura-ble weather conditions.

Rape/mustard Seed

Rmseed picked up after a days weakness due to firm demand from meal exporters and crushers

in northern belts. The arrivals are in the range of 60,00080,000 bags of 85 Kg each.

Rajasthan government has lowered the VAT on rapeseed from 5 to 3 %. As per SEA of India,

the sowing area is estimated to be around 71.38 lakh ha higher by 3.89 lakh ha compared to

last year and production around 72.25 lakh MT.

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

This Document has been prepared by Ways2Capital (A Division of High Brow Market Research

Investment Advisory Pvt Ltd). The information, analysis and estimates contained herein are

based on Ways2Capital Equity/Commodities Research assessment and have been obtained from

sources believed to be reliable. This document is meant for the use of the intended recipient

only. This document, at best, represents Ways2Capital Equity/Commodities Research opinion

and is meant for general information only. Ways2Capital Equity/Commodities Research, its

directors, officers or employees shall not in any way to be responsible for the contents stated

herein. Ways2Capital Equity/Commodities Research expressly disclaims any and all liabilities

that may arise from information, errors or omissions in this connection. This document is not to

be considered as an offer to sell or a solicitation to buy any securities or commodities.

All information, levels & recommendations provided above are given on the basis of technical &

fundamental research done by the panel of expert of Ways2Capital but we do not accept any

liability for errors of opinion. People surfing through the website have right to opt the product

services of their own choices.

Any investment in commodity market bears risk, company will not be liable for any loss done

on these recommendations. These levels do not necessarily indicate future price moment.

Company holds the right to alter the information without any further notice. Any browsing

through website means acceptance of disclaimer.

Web: www.ways2capital.com! | Mail: info@ways2capital.com! | Call: 0731-655125

Anda mungkin juga menyukai

- MAS FORMULASDokumen22 halamanMAS FORMULASJezreel Pamintuan100% (1)

- The Oil Card: Global Economic Warfare in the 21st CenturyDari EverandThe Oil Card: Global Economic Warfare in the 21st CenturyBelum ada peringkat

- FOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungeDari EverandFOCUS REPORT: U.S. Shale Gale under Threat from Oil Price PlungePenilaian: 2 dari 5 bintang2/5 (1)

- Ib Business Management - Answers To 1.2c Activity - Types of OrganisationDokumen6 halamanIb Business Management - Answers To 1.2c Activity - Types of Organisationroberto100% (1)

- Chapter 6 - Bond ValuationDokumen52 halamanChapter 6 - Bond Valuationhafizxyz77% (13)

- Accounting Basics, Part 1: Accrual, Double-Entry, Debits & CreditsDokumen33 halamanAccounting Basics, Part 1: Accrual, Double-Entry, Debits & CreditsVinny Hungwe100% (1)

- Ethics and Corporate Social Responsibility in The Corporate World Are Very ImportantDokumen10 halamanEthics and Corporate Social Responsibility in The Corporate World Are Very ImportantSeroney JustineBelum ada peringkat

- Dividend Policy, Growth, and The Valuation of Shares M&M 1961Dokumen24 halamanDividend Policy, Growth, and The Valuation of Shares M&M 1961TarasBelum ada peringkat

- Commodity Weekly News by Trifid ResearchDokumen6 halamanCommodity Weekly News by Trifid ResearchSunil MalviyaBelum ada peringkat

- Daily Commodity Report As On: Thursday, June 30, 2011Dokumen16 halamanDaily Commodity Report As On: Thursday, June 30, 2011hiteshavachatBelum ada peringkat

- Commodity Weekly Technical Report 06 Jan To 10 Jan.Dokumen6 halamanCommodity Weekly Technical Report 06 Jan To 10 Jan.Sunil MalviyaBelum ada peringkat

- What's Happening, CommoditiesDokumen1 halamanWhat's Happening, CommoditiesWoo Yong ChoiBelum ada peringkat

- CommDokumen8 halamanCommKhem RajBelum ada peringkat

- Crude Oil: Weekly Report On Oil SuppliesDokumen2 halamanCrude Oil: Weekly Report On Oil SuppliesJitesh GuptaBelum ada peringkat

- Commodity Report by Ways2Capital 02 June 2014Dokumen12 halamanCommodity Report by Ways2Capital 02 June 2014Ways2CapitalBelum ada peringkat

- Commodity Report by Ways2Capital 03 March 2015Dokumen7 halamanCommodity Report by Ways2Capital 03 March 2015Ways2CapitalBelum ada peringkat

- Commodities Daily: US Natural Gas Price Climbs To 2 - Year HighDokumen6 halamanCommodities Daily: US Natural Gas Price Climbs To 2 - Year HighScoobydo1001Belum ada peringkat

- International Commodities Evening Update, May 21 2013Dokumen3 halamanInternational Commodities Evening Update, May 21 2013Angel BrokingBelum ada peringkat

- Commodity Report Ways2Capital 23 Feb 2015Dokumen13 halamanCommodity Report Ways2Capital 23 Feb 2015Ways2CapitalBelum ada peringkat

- Weekly MCX Newsletter by Theequicom 30-DecemberDokumen12 halamanWeekly MCX Newsletter by Theequicom 30-Decembertheequicom1Belum ada peringkat

- Commodity - Report - Daily 16 May 2013Dokumen6 halamanCommodity - Report - Daily 16 May 2013researchviaBelum ada peringkat

- Weekly Newsletter 20 JuneDokumen6 halamanWeekly Newsletter 20 JuneDebjit AdakBelum ada peringkat

- Newsletter MC XDokumen6 halamanNewsletter MC XNehaSharmaBelum ada peringkat

- Weekly Commodity Market Data 30 May To 3rd JuneDokumen6 halamanWeekly Commodity Market Data 30 May To 3rd JuneRahul SolankiBelum ada peringkat

- Russian Oil - UralsDokumen1 halamanRussian Oil - UralsKhalidBelum ada peringkat

- International Commodities Evening Update August 27 2013Dokumen3 halamanInternational Commodities Evening Update August 27 2013Angel Broking100% (1)

- Commodity Weekly Market News 07 April To 11 AprilDokumen6 halamanCommodity Weekly Market News 07 April To 11 AprilSunil MalviyaBelum ada peringkat

- Daily MCX Newsletter 03-OCT-2013Dokumen10 halamanDaily MCX Newsletter 03-OCT-2013api-230785654Belum ada peringkat

- International Commodities Evening Update December 11 2013Dokumen3 halamanInternational Commodities Evening Update December 11 2013angelbrokingBelum ada peringkat

- Commodity - Report - Daily 13 May 2013Dokumen6 halamanCommodity - Report - Daily 13 May 2013researchviaBelum ada peringkat

- OPEC and Russia Aim To Raise Oil Prices With Supply Cut - The New York TimesDokumen5 halamanOPEC and Russia Aim To Raise Oil Prices With Supply Cut - The New York TimesozzzzzBelum ada peringkat

- Consolidated Report - 4 Weeks Trading (Systems & Brent)Dokumen6 halamanConsolidated Report - 4 Weeks Trading (Systems & Brent)Fatima MirBelum ada peringkat

- Weekly Commodity Market Report 8 To 11 MARDokumen6 halamanWeekly Commodity Market Report 8 To 11 MARRahul SolankiBelum ada peringkat

- Natural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GasDokumen10 halamanNatural Gas/ Power News: Shale's Bounty Goes Beyond Oil and GaschoiceenergyBelum ada peringkat

- Daily Report: 13 NOVEMBER. 2013Dokumen7 halamanDaily Report: 13 NOVEMBER. 2013api-212478941Belum ada peringkat

- Inside Commodities: Chart of The Day Today'S MarketsDokumen6 halamanInside Commodities: Chart of The Day Today'S MarketsNancy WebbBelum ada peringkat

- International Commodities Evening Update, June 17 2013Dokumen3 halamanInternational Commodities Evening Update, June 17 2013Angel BrokingBelum ada peringkat

- International Commodities Evening Update, June 10 2013Dokumen3 halamanInternational Commodities Evening Update, June 10 2013Angel BrokingBelum ada peringkat

- CDM ADokumen2 halamanCDM ANikunj AgarwalBelum ada peringkat

- Commodity - Report - Daily 09 May 2013Dokumen6 halamanCommodity - Report - Daily 09 May 2013researchviaBelum ada peringkat

- Weekly Report of Commodity 30 NovDokumen6 halamanWeekly Report of Commodity 30 NovRahul SolankiBelum ada peringkat

- Support and Resistance 26.11.2015...Dokumen1 halamanSupport and Resistance 26.11.2015...ekarupBelum ada peringkat

- International Commodities Evening Update, May 24 2013Dokumen3 halamanInternational Commodities Evening Update, May 24 2013Angel BrokingBelum ada peringkat

- Commodity - Report - Daily 08 May 2013Dokumen6 halamanCommodity - Report - Daily 08 May 2013researchviaBelum ada peringkat

- Commodity - Report - Daily 29 May 2013Dokumen6 halamanCommodity - Report - Daily 29 May 2013researchviaBelum ada peringkat

- International Commodities Evening Update, July 23 2013Dokumen3 halamanInternational Commodities Evening Update, July 23 2013Angel BrokingBelum ada peringkat

- RodaineDokumen2 halamanRodainejohnbertlacastesantosBelum ada peringkat

- International Commodities Evening Update July 18 2013Dokumen3 halamanInternational Commodities Evening Update July 18 2013Angel BrokingBelum ada peringkat

- Ups and downs of oil prices: Will prices continue to fallDokumen18 halamanUps and downs of oil prices: Will prices continue to fallmuki10Belum ada peringkat

- Weekly Commodity Market Updates 4 To 8 Apr 16Dokumen6 halamanWeekly Commodity Market Updates 4 To 8 Apr 16Rahul SolankiBelum ada peringkat

- International Commodities Evening Update, June 26 2013Dokumen3 halamanInternational Commodities Evening Update, June 26 2013Angel BrokingBelum ada peringkat

- IJNRD2204035Dokumen7 halamanIJNRD2204035Sameer RajBelum ada peringkat

- International Commodities Evening Update, May 22 2013Dokumen3 halamanInternational Commodities Evening Update, May 22 2013Angel BrokingBelum ada peringkat

- Zaner Daily Energy Complex Commentary Nov.29.2018.Dokumen7 halamanZaner Daily Energy Complex Commentary Nov.29.2018.thunderdomeBelum ada peringkat

- Daily Commodity Report 25 Nov 2013 by EPIC RESEARCHDokumen7 halamanDaily Commodity Report 25 Nov 2013 by EPIC RESEARCHNidhi JainBelum ada peringkat

- Daily MCX NewsletterDokumen9 halamanDaily MCX Newsletterapi-230785654Belum ada peringkat

- International Commodities Evening Update November 23Dokumen3 halamanInternational Commodities Evening Update November 23Angel BrokingBelum ada peringkat

- International Commodities Evening Update, May 23 2013Dokumen3 halamanInternational Commodities Evening Update, May 23 2013Angel BrokingBelum ada peringkat

- International Commodities Evening Update, May 20 2013Dokumen3 halamanInternational Commodities Evening Update, May 20 2013Angel BrokingBelum ada peringkat

- Daily Metals and Energy Report, August 16 2013Dokumen6 halamanDaily Metals and Energy Report, August 16 2013Angel BrokingBelum ada peringkat

- Commodity Report DailyDokumen6 halamanCommodity Report DailyresearchviaBelum ada peringkat

- Energy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdayDokumen9 halamanEnergy Data Highlights: NYMEX January Gas Futures Contract Falls 2.6 Cents Midday TuesdaychoiceenergyBelum ada peringkat

- International Commodities Evening Update, July 10 2013Dokumen3 halamanInternational Commodities Evening Update, July 10 2013Angel BrokingBelum ada peringkat

- Oil futures rise as API data shows sharp drop in U.S. crude stocksDokumen8 halamanOil futures rise as API data shows sharp drop in U.S. crude stocksMuhammad SulemanBelum ada peringkat

- International Commodities Evening Update, June 24 2013Dokumen3 halamanInternational Commodities Evening Update, June 24 2013Angel BrokingBelum ada peringkat

- Country ReviewRussia: A CountryWatch PublicationDari EverandCountry ReviewRussia: A CountryWatch PublicationBelum ada peringkat

- Commodity Research Report 21 January 2019 Ways2CapitalDokumen13 halamanCommodity Research Report 21 January 2019 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 06 March 2019 Ways2CapitalDokumen13 halamanCommodity Research Report 06 March 2019 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 21 January 2019 Ways2CapitalDokumen17 halamanEquity Research Report 21 January 2019 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 12 March 2019 Ways2CapitalDokumen13 halamanCommodity Research Report 12 March 2019 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 11 December 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 11 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 26 December 2018 Ways2CapitalDokumen17 halamanEquity Research Report 26 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 26 December 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 26 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 18 September 2018 Ways2CapitalDokumen17 halamanEquity Research Report 18 September 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 31 December 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 31 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 18 December 2018 Ways2CapitalDokumen17 halamanEquity Research Report 18 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 18 December 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 18 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 03 December 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 03 December 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 20 November 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 20 November 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 27 November 2018 Ways2CapitalDokumen17 halamanEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 27november 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 27november 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 16 October 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 16 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 06 November 2018 Ways2CapitalDokumen17 halamanEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 13 November 2018 Ways2CapitalDokumen17 halamanEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 13 November 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 13 November 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 23 October 2018 Ways2CapitalDokumen17 halamanEquity Research Report 23 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 16 October 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 16 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 06 November 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 06 November 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 30 October 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 30 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 23 October 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 23 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 30 October 2018 Ways2CapitalDokumen17 halamanEquity Research Report 30 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 16 October 2018 Ways2CapitalDokumen17 halamanEquity Research Report 16 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Equity Research Report 09 October 2018 Ways2CapitalDokumen17 halamanEquity Research Report 09 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- Commodity Research Report 09 October 2018 Ways2CapitalDokumen13 halamanCommodity Research Report 09 October 2018 Ways2CapitalWays2CapitalBelum ada peringkat

- University of The CordillerasDokumen6 halamanUniversity of The CordillerasBrix ChagsBelum ada peringkat

- Asset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M3 CLEAN NewDokumen47 halamanAsset-V1 IMF+FMAx+2T2017+type@asset+block@FMAx M3 CLEAN NewkingjaspeBelum ada peringkat

- 5 Stages of Startup FundingDokumen1 halaman5 Stages of Startup FundingSachin Khurana0% (1)

- 1 Annex I. Imprimatur Investment Agreement: Example Offer Letter, Key Terms and Outline ProcessDokumen5 halaman1 Annex I. Imprimatur Investment Agreement: Example Offer Letter, Key Terms and Outline ProcessAfandie Van WhyBelum ada peringkat

- The Sahara ScamDokumen12 halamanThe Sahara ScamBrahmanand ShetBelum ada peringkat

- Core Complexities Bharat SyntheticsDokumen4 halamanCore Complexities Bharat SyntheticsRohit SharmaBelum ada peringkat

- Kaveri Seed Company: IPO Fact SheetDokumen4 halamanKaveri Seed Company: IPO Fact Sheetrahulrai001Belum ada peringkat

- CASE - Berjaya V MConceptDokumen27 halamanCASE - Berjaya V MConceptIqram MeonBelum ada peringkat

- International Corporate Finance 10 Edition: by Jeff MaduraDokumen20 halamanInternational Corporate Finance 10 Edition: by Jeff MaduraNatashaAimilBelum ada peringkat

- The Artisan - Northland Wealth Management - Summer 2017Dokumen8 halamanThe Artisan - Northland Wealth Management - Summer 2017Victor KBelum ada peringkat

- Ace 6 PDFDokumen4 halamanAce 6 PDFCharles John CatanBelum ada peringkat

- An Economic Analysis of Financial StructureDokumen15 halamanAn Economic Analysis of Financial Structurevetushi123Belum ada peringkat

- Dipifr Int 2010 Dec A PDFDokumen11 halamanDipifr Int 2010 Dec A PDFPiyal HossainBelum ada peringkat

- Chapter 3 - National Income EquilibriumDokumen42 halamanChapter 3 - National Income EquilibriumRia AthirahBelum ada peringkat

- Local Voice Summer/Fall 2018Dokumen32 halamanLocal Voice Summer/Fall 2018MoveUP, the Movement of United ProfessionalsBelum ada peringkat

- 7IFDokumen2 halaman7IFKumaraswamy HgmBelum ada peringkat

- SMCH 18 BeamsDokumen19 halamanSMCH 18 BeamsAtika DaretyBelum ada peringkat

- Capm ModelDokumen12 halamanCapm ModelBittoo SinghBelum ada peringkat

- Introduction to the BFSI Sector: Banking, Financial Services and InsuranceDokumen2 halamanIntroduction to the BFSI Sector: Banking, Financial Services and InsuranceGopal Gidwani0% (1)

- Benchmarking Best Practice in Asset Management: Participant Organisations and RepresentativesDokumen32 halamanBenchmarking Best Practice in Asset Management: Participant Organisations and RepresentativesSushmit SharmaBelum ada peringkat

- Amit Ojt ReportDokumen40 halamanAmit Ojt ReportAnu ThakurBelum ada peringkat

- Deconstructing Robert Kiyosaki 344comments: 82shareDokumen33 halamanDeconstructing Robert Kiyosaki 344comments: 82shareRichard RodriguezBelum ada peringkat

- Financial Plan Assignments 7apr05Dokumen23 halamanFinancial Plan Assignments 7apr05Pavan Kumar MylavaramBelum ada peringkat

- The Future of Performance ManagementDokumen66 halamanThe Future of Performance ManagementRavindra DeyBelum ada peringkat