FDIProductive JBusRes Jul14

Diunggah oleh

Nguyễn Thanh TùngDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

FDIProductive JBusRes Jul14

Diunggah oleh

Nguyễn Thanh TùngHak Cipta:

Format Tersedia

Is foreign direct investment productive?

A case study of the regions

of Vietnam

Sajid Anwar

a,c,

, Lan Phi Nguyen

b,1

a

School of Business, University of the Sunshine Coast, Maroochydore, QLD 4558, Australia

b

Monetary Statistics and Forecasting, State Bank of Vietnam, Hanoi, Viet Nam

c

IGSB, University of South Australia, Adelaide, SA 5001, Australia

a b s t r a c t a r t i c l e i n f o

Article history:

Received 1 February 2013

Received in revised form 1 July 2013

Accepted 1 August 2013

Available online 27 September 2013

Keywords:

Foreign direct investment

Total factor productivity

Technological progress

Panel data analysis

Vietnam

By making use of a recently released dataset that covers a large number of manufacturing rms over the period

20002005, this paper examines the impact of foreign direct investment (FDI) and FDI generated spillovers on

total factor productivity (TFP) in eight regions of Vietnam. Unlike most existing studies, this paper focuses on

the impact of spillovers that take place through both horizontal and vertical linkages. The results presented in

this paper suggest that the impact of FDI spillovers onTFP varies considerably across regions. FDI spillovers generate

a strong positive impact on TFP through backward linkages only in Red River Delta, South Central Coast, South East

and Mekong River Delta while in other regions the impact is negative and mostly insignicant. The paper also

examines the impact of the absorptive capacity on TFP growth in each of the eight geographical regions.

2013 Elsevier Inc. All rights reserved.

1. Introduction

Economic reforms create international business opportunities. Due to

the rising cost of doing business in China, Vietnamhas become a popular

destination for foreign investment. A number of existing studies have

examined the impact of foreign direct investment (FDI) and FDI-related

spillover effects on rm productivity and export behavior in developed

as well as developing countries. This paper focuses on Vietnam, a country

that due to the rising cost of doing business in China is now attracting

signicant FDI. However, due to lack of appropriate data, so far, relatively

few studies have considered the case of Vietnam.

In recent years, the government of Vietnamhas started releasing rm

level data, including data onFDI inows that couldbe usedtoexamine the

impact of FDI-related spillover effects on rmperformance. Most existing

studies, for example Anwar andNguyen(2010a) andAthukorala andTien

(2012), focus only on the direct effect of FDI on rm performance in

Vietnam. In addition, the existing studies (such as Anwar and Nguyen,

2010b) are highly aggregated and hence do not present a clear picture

of the impact of FDI on different regions of Vietnam. An important role

of the government is to take steps to reduce regional economic disparity.

A region by region analysis of the impact of FDI-related spillover effects

(i.e., the indirect effect) on rm productivity can provide useful informa-

tion to domestic policy makers.

By making use of a rm level panel dataset, this paper empirically

examines the impact of FDI generated horizontal and vertical spillovers

on total factor productivity (TFP) of manufacturing rms located in all

eight regions of Vietnam.

The rest of this paper is structured as follows. Section 2 contains a

review of related studies. Section 3 includes a brief description of the

methodology. The empirical results are presented and discussed in

Section 4. Section 5 contains some concluding remarks.

2. Review of related studies

While a number of studies have examined the impact of FDI on rm

productivity and GDP growth, relatively few studies have explicitly

considered the impact of FDI-related spillover effects on productivity.

Liu (2002) and Liu and Wang (2003) consider the effect of FDI on tech-

nology transfer in China but they do not consider the impact of spillover

effects. Pan (2003) outlines source and host country factors that can

affect foreign direct investment in China. Bwalya (2006) examines the

nature of spillover from foreign to domestic rms by using rm level

data on Zambian manufacturing rms for the period 19931995.

Bwalya nds little evidence in support of technology spillovers from

foreign rms to local rms through horizontal channels, suggesting

that the productivity of local rms is negatively affected by the scale of

operation of foreign rms.

Stancik (2007) considers the effect of FDI on the growth rate of

sales of domestic rms in the Czech Republic by using rm level panel

data from1995 to 2003. Stancik focuses on the impact of FDI spillovers.

The empirical results suggest that the presence of foreign rms has

Journal of Business Research 67 (2014) 13761387

Corresponding author. Tel.: +61 7 5430 1222.

E-mail addresses: SAnwar@usc.edu.au (S. Anwar), nplan_dbtk@sbv.gov.vn

(L.P. Nguyen).

1

Tel.: +84 91 775 1123.

0148-2963/$ see front matter 2013 Elsevier Inc. All rights reserved.

http://dx.doi.org/10.1016/j.jbusres.2013.08.015

Contents lists available at ScienceDirect

Journal of Business Research

adversely affected most domestic rms in the CzechRepublic, especially

in upstream sectors.

Bitzer, Geishecker, and Grg (2008) use industry level data for 17 Or-

ganisation for Economic Cooperation and Development (OECD) countries

to investigate the importance of horizontal and vertical spillovers. Their

empirical work shows that spillovers through vertical backward linkages

between multinationals and domestic rms exist in all 17 countries. They

also found evidence to support the existence of positive spillover effects

from horizontal FDI. Using annual data on 44 host countries over the pe-

riod 19832003, Beugelsdijk, Smeets, and Zwinkels (2008) argue that FDI

generatedhorizontal andvertical effects have a signicant positive impact

on host developed countries but those benets to host developing coun-

tries are insignicant. Liu (2008) examines the effect of technology trans-

fer arising from FDI in the Chinese manufacturing sector, nding that

spillovers through backward and forward linkages have a positive effect

onproductivity of domestic rms andbackwardlinkages are the most im-

portant channel through which technology spills over fromforeign to do-

mestic rms. Using an event history technique, Lin (2010), focuses on the

determinants of Taiwanese investment in Chinas IT industry. Du,

Harrison, and Jefferson (2012) examine the impact of FDI-related hori-

zontal and vertical spillovers on the productivity of Chinese manufactur-

ing rms. They nd that horizontal spillovers have a weak effect on

productivity but the impact of vertical spillovers is statistically signicant.

In summary, the empirical evidence regarding the impact of FDI gen-

erated spillovers on host economies is mixed (see Table 1, which includes

only some of the recent studies). A review of earlier studies can be found

in Meyer and Sinani (2009), Table 1. Some existing studies suggest that

the impact of FDI generated spillover effects also depends on the absorp-

tive capacity of host countries. This means that the impact of FDI spillovers

on host countries can vary from country to country and from industry to

industry.

2.1. FDI in Vietnam

Due to lack of data, only a few studies attempt to investigate the

impact of FDI on Vietnam. These studies consider a number of issues.

For example, Jenkins (2006) considers the direct effect of FDI on employ-

ment growth in Vietnam(especially in early years), nding only a limited

positive effect. Athukorala and Tien (2012) suggest that, in recent years,

FDI inows have played an important role, not only in providing invest-

ment capital but also in stimulating export growth. Le (2005) examines

the effect of FDI on labor productivity of 29 Vietnamese manufacturing

industries over the period 19952002. Le found FDI's effect on productiv-

ity to be positive. Nguyen and Nguyen (2007) used rm-level data to in-

vestigate the effect of FDI spillovers. They conclude that FDI has resulted

in improved labor productivity. Nguyen et al. (2008) used rm level

data to investigate the effect of FDI-related horizontal, backward and

forward spillover effects in Vietnam's manufacturing and services sec-

tors. However, they do not consider the effect of FDI-related spillovers

on TFP growth. The same applies to the work of Athukorala and Tien

(2012). Anwar and Nguyen (2010a) found that a two-way mutually

reinforcing relationship between output growth and FDI growth

exists in Vietnam. However, TFP is a better measure of productivity

(Lipsey & Carlaw, 2004). Other studies on Vietnam include Binh and

Haughton (2002), Giroud (2007), Anwar and Nguyen (2010b, 2011a,

2011b), and Nguyen and Sun (2012). These studies have focused on

the impact of FDI on trade and export performance. Unlike the existing

studies, this paper focuses on the impact of indirect effect of FDI on all

eight regions of Vietnam and TFP is used as a measure of productivity.

FDI in Vietnam concentrates mostly in the key economic regions,

namely Red River Delta, North East, South East, and Mekong River Delta,

while remote regions receive only a small fraction of FDI (see Table 2).

Table 2 shows that differences between regional economic growth

rates and per-capita income across regions are signicant. In 2005, the

per-capita income in South East was more than twice the national aver-

age. The per-capita income in Red River Delta was the same as the na-

tional average, but income in North West was approximately 40% of

the national average (see Table 2). These differences can inuence the

magnitude of FDI-relatedhorizontal and vertical spillovers. Accordingly,

a region-wise analysis can present a better picture of the benets from

FDI (Table 3).

The broad hypotheses tested in the following section include (1) the

impact of FDI and FDI-related spillovers on productivity of domestic

rms varies across the regions of Vietnam and (2) absorptive capacity

(as measured by human capital, technology gap with foreign rms and

the level of nancial development) enhances the FDI spillover effects

across the regions of Vietnam.

Table 1

FDI and economic performance A summary of some recent studies.

Bwalya (2006) 19931995 Zambia Panel data FDI spillovers through horizontal channels have a positive impact on rm output.

Abu-Bader and Abu-Qarn

(2008)

19602001 Egypt Time series There is a bi-directional relationship between nancial development and economic growth.

Alvarez and Lopez (2008) 19901999 Chile Panel data Exporting leads to positive spillover effects.

Beugelsdijk et al. (2008) 19942003 44 countries Panel data Vertical FDI has a stronger positive impact on productivity.

Bitzer et al. (2008) 19892003 17 OECD Countries Panel data FDI linked backward spillovers have a positive impact on productivity.

Liu (2008) China 19951999 Panel data FDI can have a negative impact on productivity in the short term but its impact on long term

productivity is positive.

Barbosa and Eiriz (2009) Portugal 19941999 Panel data FDI spillovers do not have a signicant impact on rm productivity.

Suyanto et al. (2009) Indonesia 19882000 Panel data FDI and FDI-related spillovers have a positive impact on productivity.

Anwar and Nguyen (2010) 19902007 Vietnam Panel data There is a bi-directional relationship between FDI and economic growth.

Wang (2010) 19731991 Canada Panel data FDI generates strong positive impact on productivity.

Anwar and Nguyen (2011a) 2004 Vietnam Cross section data FDI has contributed to increase in net exports in the post Asian crisis period.

Anwar and Nguyen (2011b) 20002007 Vietnam Panel data FDI spillovers can have positive impact on export performance of domestic rms.

Nguyen and Sun (2012) 20032004 Vietnam Panel data FDI spillovers improve rm export performance.

Athukorala and Tien (2012) 20002005 Vietnam Time series data FDI has a positive impact on real output.

Du et al. (2012) 19982007 China Panel data FDI benets local rms through both vertical and horizontal linkages.

Fernandes and Paunov (2012) 19922004 Chile Panel data FDI has a positive impact on productivity of rms in both manufacturing and services sectors.

Table 2

FDI in regions of Vietnam (1988 to 2005).

Source: GSO (2013).

Regions of Vietnam Number of

FDI projects

FDI in million

US dollars at

constant prices

FDI projects

in percentage

of the total

Red River Delta 1239 14884.3 20.10

North East 291 1945.5 4.72

North West 23 100.6 0.37

North Central Coast 90 1368.8 1.46

South Central Coast 280 3476.3 4.54

Central Highlands 94 1001.1 1.52

South East 3831 32380.5 62.15

Mekong River Delta 268 1812.9 4.34

1377 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

3. The model and data

The empirical model used in this paper is developed in two stages.

Stage one species a standard CobbDouglas model that can be used

to estimate TFP of each region. TFP is the dependent variable, whereas

FDI-related spillovers are the independent variables. While the focus

of the empirical exercise is on the impact of FDI-related spillovers on

TFP, in stage two, we also identify a number of control variables that

can affect TFP. The inclusion of the control variables in our regression

equation serves to reduce the severity of omitted variable bias, which

can reduce the reliability of the estimated results.

Accordingly, stage two, in order to correctly estimate the impact

of FDI-related spillovers on TFP, species an empirical model where

FDI-related spillovers and other variables appear as independent

variables. As all identied independent variables cannot be directly

measured, following the existing literature, we use several proxies.

Similar proxies are widely used in the existing literature (for example

see Wang, 2010).

In order to focus on the impact of FDI-related spillover effects on

productivity and economic growth, in stage one, we remove the impact

of growth in capital and labor on regional production growth, which in-

volves calculation of TFP. In stage one, TFP of Vietnamese rms in

manufacturing industries in all eight regions of Vietnam is estimated

by means of the following production function.

Y

ijt

A

ijt

K

ijt

L

ijt

1

where Y

ijt

is the real output of domestic rmi inindustry j inperiodt; K

ijt

is the real book value of xed assets of rmi (following Blomstrmand

Sjoholm, 1999, the book value is used as a proxy for capital stock); L

ijt

is

the number of workers employedby rmi; A

ijt

is TFP of rmi inindustry

j in period t; and and respectively are the production elasticities of

capital and labor.

TFP (in log form) can be calculated by rewriting Eq. (1) as follows:

ln A

ijt

ln Y

ijt

ln K

ijt

ln L

ijt

: 2

In stage two, the impact of FDI spillovers and other control variables

(i.e., absorptive capacity) on TFP is evaluated by estimating Eq. (3) as

follows:

ln A

ijt

a

0

a

1

ln H

ijt

a

2

S

ijt

a

3

C

jt

a

4

T

ijt

a

5

F

ijt

a

6

H FDI

jt

a

7

B FDI

jt

a

8

F FDI

jt

c

ijt

3

where H is human capital of rm i in industry j in period t, which is

approximated by real expenditure on education and training; S

ijt

is

sales of each of the domestic rms relative to the total industry sales

in period t; C

jt

is the Herndahl index, which is a measure of the size

of rms within industry j; T

ijt

is the technology gap which is measured

by the difference in average productivity of domestic and foreign rms

in percentage terms in the same industry; F

ijt

is the level of nancial

development within industry j, which is measured by working capital

as a percentage of total assets; H _ FDI

jt

,B _ FDI

jt

and F _ FDI

jt

respective-

ly are measures of horizontal, backward-vertical and forward-vertical

FDI spillovers.

By making use of the existing literature, (for example Grima, Grg &

Pisu, 2008 and Wang, 2010), FDI spillovers are measured as follows:

The horizontal spillover in industry i at time t, say H_FDI

it

, is calculat-

ed as the proportion of output accounted for by foreign rms in that

industry.

The vertical backward spillover in industry i at time t is computed as

follows:

B FDI

it

X

ki

ki

H FDI

ki

4

where

ki

is the proportion of industry i's output supplied to in-

dustry k. It is assumed that the greater the proportion of output

supplied to an industry with foreign multinational presence, the

greater the degree of linkages between foreign and domestic

rms.

The vertical forward spillover in industry i at time t is calculated

as follows:

F FDI

it

X

ki

ki

H FDI

ki

5

where

ki

represents the proportion of industry k's output sup-

plied to industry i. This measure captures the extent of forward

linkages between domestic rms in downstream and foreign

rms in upstream industries. The values of and are obtained

from the Inputoutput Tables of Vietnam published by the Gen-

eral Statistic Ofce of Vietnam (GSO).

The Herndahl index, which is a measure of concentration in an in-

dustry j, is dened as follows:

HERF

jt

X

n

i1

x

ijt

X

jt

!

2

i 1; 2; ; n

where x

ijt

is the sales of rm i in industry j; X

jt

denotes the total sales of

industry j at time t.

An increase in the Herndahl index reects a decline in compe-

tition, which negatively affects TFP growth. An increase in technol-

ogy gap is expected to decrease TFP growth, whereas the effect of

nancial development on TFP growth is likely to be positive. TFP

growth is expected to be positively related to the stock of human

capital. An increase in sales is expected to increase TFP. Finally,

the impact of FDI-related spillovers on TFP growth can be either

positive or negative.

The empirical analysis is conductedby means of rmlevel panel data

for 23 manufacturing industries over the period 20002005. Most of the

data are collected from GSO. The number of rms per year varies from

Table 3

Gross regional product per capita in US dollars.

Source: GSO (2013); and authors estimates.

2000 2001 2002 2003 2004 2005

Red River Delta 342 361 399 453 531 615

North East 201 214 234 264 309 352

North West 155 162 177 191 226 262

North Central Coast 200 208 228 252 293 336

South Central Coast 275 289 321 355 418 501

Central Highlands 197 193 211 235 276 332

South East 866 902 963 1156 1388 1632

Mekong River Delta 309 316 355 393 452 517

National Average 363 379 414 477 563 657

Table 4

Number of manufacturing rms in regions of Vietnam (20002005).

Source: GSO (2013).

2000 2001 2002 2003 2004 2005

Red River Delta 2425 2894 3855 4071 4584 5280

North East 534 636 848 980 1469 1890

North West 66 73 94 137 170 210

North Central Coast 444 541 710 775 806 938

South Central Coast 616 756 907 1032 1057 1757

Central Highlands 232 259 309 361 408 496

South East 3672 4456 5792 6487 7965 9457

Mekong River Delta 3672 4456 5792 6487 6965 7450

Total 11,661 14,071 18,307 20,330 23,424 27,478

1378 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

approximately 11,661 rms in 2000 to 27,478 rms in 2005 (see

Table 4). This paper utilizes this dataset as it provides all information

needed for the study. Due to condentiality considerations, rm level

data is released with a lag. All nominal variables are measured in 1994

prices.

4. Empirical results and analysis

In stage one, using rm level panel data, we estimate TFP for each of

the eight geographical regions of Vietnam. These regions are Red River

Delta, North East, North West, North Central Coast, South Central Coast,

Central Highlands, South East, and Mekong River Delta. Calculation of

TFP involves estimation of a log-linear version of Eq. (1) by means of

OLS with a correction for heteroskedasticity.

The estimated coefcients are reported in Table 5. The results in

Table 5 suggest that both capital and labor make a statistically signi-

cant contribution to regional output. Using the estimated coefcients

reported in Table 5 in Eq. (2), the logarithm of TFP of each region is

calculated, which is the dependent variable in the rest of this paper.

Instage two, making use of the estimatedvalues of the dependent var-

iable for eachregion, Eq. (3) is estimated. This involves the use of the two-

stage least squares (2SLS) with a correction for heteroskedasticity. In

order to avoid the endogeneity that results from the presence of FDI

and industrial characteristics, dummy variables were added to the right

hand side of Eq. (3). The inclusion of dummy variables tends to reduce

the severity of the endogeneity problem. This problem arises from the

fact that industries that are known to be highly productive, in relative

terms, are likely to attract more foreign and domestic rms. The industry

capital and human capital stocks of foreign and domestic rms may be

correlated with the error term. Accordingly, this paper includes industry

dummies as regressors. This helps to remove the error term's industry-

specic unobservable effect that may be correlated with the industry

stock variables. Inclusion of the dummy variables also allows one to re-

duce the effect of omitted time-varying industry-specic shocks that

may be correlated with the FDI variables and the error termin the regres-

sion. In addition, lagged values of relevant variables were used as instru-

ments to account for the potential endogeneity problem. As indicated by

Nowak-Lehmann, Dreher, Herzer, Klasen, and Martinez-Zarzoso (2012),

in general, lagged variables are not good instruments when persistent au-

tocorrelation is present. In the case of this paper, panel data is used where

the sample period covers only 6 years and hence autocorrelation is not a

serious problem.

The DurbinWuHausman test is used to test for endogeneity. The

null hypothesis is rejected, suggesting that OLS estimates might be biased

and inconsistent and hence OLS is not an appropriate estimation tech-

nique. As a result, Hansen's J-test is used to test for over-identication of

2SLS (i.e., the null hypothesis of correct model specication and valid

over-identifying restrictions is tested and the results are found to be

satisfactory).

Table 6 shows that both the horizontal and the backward linkage

effects on the TFP level of domestic rms vary across regions. The back-

ward linkage effects are positive and statistically signicant only in

Red River Delta, South Central Coast, South East and Mekong River

Delta whereas, in other regions, these effects are either negative

and signicant or positive but insignicant. This reects the fact

that the regions that attract higher volumes of FDI and where most

of Vietnam's exportables are produced will benet more from back-

ward linkages. As a result, the backward linkages impact positively

on TFP level of local rms. Local rms located in relatively developed

regions of Vietnam, where FDI is more productive, experience a rel-

atively rapid technology spillover from foreign to domestic rms as

compared to local rms that are located in remote regions. This

may also result in greater backward linkages for rms that are located

in relatively developed regions. The impact of FDI spillovers on TFP

varies across regions.

Table 6 shows that the impact of the horizontal spillover effect is pos-

itive and signicant only in North East, Central Highland, and Mekong

River Delta regions. The backward spillover effect is positive and statisti-

cally signicant only in Red River Delta, South Central Coast, South East,

and Mekong River Delta, whereas the forward spillover effect is positive

and signicant only in North West and North Central Coast regions. It is

interesting to note that backward linkages are signicant in those areas

that tend to receive a very big proportion of the total FDI. These are also

the areas where most of the exportable goods are produced. The introduc-

tionof domestic content requirements has contributed to stronger back-

ward linkages. For example, rms that export less than 30% of their

production were offered concessionary import duties only if these

rms satised the 30% local content requirement. This policy helped de-

velop stronger backward linkages in automotive, electronics and engi-

neering (Truong & Gates, 1996; Athukorala & Tien, 2012).

The empirical results presented in Table 7 suggest that local rms

located inrelatively more developed regions, where FDI is concentrated,

are in general more efcient and thus possess greater ability to benet

fromadvanced technologies that are introduced inthe regionby foreign

rms. These regions are in the secondstage of Dunning's investment de-

velopment path (IDP).

The presence of FDI-generated technology spillover effects also

depends on absorptive capability (as measured by the technology gap,

human capital, and nancial development) of domestic rms in host

economies (See Wang, 2010 andreferences therein). Inorder to examine

this hypothesis, this paper considers the impact of the interaction be-

tween (i) the technology gap and FDI spillovers, (ii) the stock of

human capital and FDI spillovers, and (iii) the level of nancial de-

velopment and FDI spillovers on TFP of manufacturing rms in

each of the eight regions of Vietnam. The main results of empirical

estimation are summarized in Table 7, whereas detailed results

appear in Appendices 18.

Table 7 shows that the interaction of human capital and horizontal

spillovers has a strong positive effect on TFP of Red River Delta. This is

also true for North East and the Central Highlands. The impact of the in-

teraction between human capital and backward spillovers is positive

and signicant in all regions except South Central Coast and South

East. The interaction of human capital and forward spillovers is positive

and signicant only in South Central Coast. The impact of technology

gap and horizontal spillovers is negative and signicant in Red River

Delta, North Central Coast, South East, and Mekong River Delta regions.

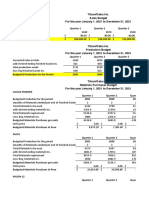

Table 5

Estimated production functions for Vietnamese regions.

Independent variables Red River Delta North East North West North Central Coast South Central Coast Central Highlands South East Mekong River Delta

log (K) 0.6641 0.5403 0.5174 0.6051 0.6882 0.5038 0.7008 0.8546

(67.05)* (32.90)* (13.30)* (37.84)* (51.18)* (19.51)* (58.97)* (77.45)*

log (L) 0.4843 0.7434 0.6403 0.5081 0.4576 0.6207 0.4165 0.3056

(36.46)* (34.53)* (10.96)* (21.64)* (28.12)* (18.57)* (50.01)* (22.13)*

Constant 0.63127 0.2301 0.7193 0.8432 0.5869 1.202 0.7275 0.3234

(14.75)* (3.60)* (4.13)* (12.71)* (8.87)* (9.24)* (21.80)* (6.59)*

Adjusted R

2

number

of observations

0.68 0.77 0.72 0.75 0.77 0.71 0.73 0.64

15,843 4436 465 2987 3885 1354 24,286 11,922

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

1379 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

The interaction of technology gap and backward spillovers is negative

and signicant in Red River Delta, North East, North Central Coast, and

South East regions. The interaction of technology gap and forward spill-

overs is negative and signicant in all regions except Red River Delta,

North East, and North Central Coast regions. The interaction of the

level of nancial development and horizontal spillovers is positive and

signicant only in Red River Delta, North Central Coast, and South

East regions. The interaction of the level of nancial development

and backward spillovers is positive and signicant only in Red

River Delta and North East regions. Finally, the interaction of the

level of nancial development and forward spillovers is positive and

signicant only in South East region. It is clear that, as far as the level

of nancial development is concerned, Vietnam has a long way to go.

In others words, steps need to be taken to improve the level of nancial

development in Vietnam.

5. Conclusion

This paper focuses on the impact of FDI and FDI-generated spillovers

ontotal factor productivity (TFP) growthof manufacturing rms located

in all eight regions of Vietnam. An increase in TFP can be attributed to

technological advancement. The empirical analysis presented in this

paper is based onpanel data that covers a large number of manufacturing

rms over the period 20002005. Unlike the existing studies, this paper

considers the impact of FDI spillovers on TFP growth via both horizontal

and vertical linkages in different regions of Vietnam. The paper also con-

siders the role of absorptive capacity.

The results presented in this paper suggest that impact of FDI and

FDI spillovers on TFP of Vietnam's manufacturing rms varies across

regions. In other words, the presence of foreign rms is contributing

to technological advancement in Vietnam but the rate of such ad-

vancement varies considerably across regions of Vietnam. Backward

linkages with foreign rms are an important channel of technology

transfer from foreign to domestic rms in Red River Delta, South

Central Coast, South East, and Mekong River Delta. These regions are

well known for (i) better quality infrastructure, (ii) higher level of

human capital stock, and (iii) relatively more advanced technology.

The empirical analysis presented in this paper also suggests that the

effect of horizontal and vertical linkages with foreign rms on TFP

of local rms also depends on Vietnamese regions' absorptive capac-

ity. Regions with better technology, stock of human capital and a rel-

atively higher level of nancial development gain more benets from

FDI spillovers. It appears that North East, North West, North Central

Coast, and Central Highlands regions have not signicantly beneted

Table 6

The impact of FDI on TFP of domestic rms in Vietnam's regions.

Independent variables Dependent variable: log (TFP)

Red River Delta North East North West North Central Coast South Central Coast Central Highlands South East Mekong River Delta

Human capital [log(H)] 1.1017 1.2744 0.4105 0.4797 1.3199 0.7480 0.6994 1.8812

(7.20)* (5.17)* (8.04)* (21.34)* (5.01)* (2.35)* (5.71)* (16.48)*

Scale (S) 6.7832 16.2509 3.1745 0.1383 19.2282 5.0855 1.2087 9.9852

(2.66)* (3.69)* (0.53) (0.13) (3.32)* (0.31) (1.85)*** (6.17)*

Concentration (C) 0.2600 0.3224 0.6395 0.3367 0.4171 0.1886 0.1723 0.3275

(1.92)* (2.42)* (1.67)*** (2.67)* (1.91)** (0.39) (1.30) (1.70)***

Technology gap (T) 0.0003 0.0002 0.0046 0.0021 0.0008 0.0060 0.0003 0.0004

(26.51)* (0.92) (7.12)* (11.53)* (4.54)* (3.94)* (11.54)* (1.15)

Horizontal FDI spillovers 0.0029 0.0044 0.0008 0.0018 0.0019 0.0037 0.0051 0.0115

(5.43)* (3.59)* (0.33) (1.91)** (1.78)*** (1.84)*** (10.79)* (8.14)*

Backward FDI spillovers 0.0003 0.0001 0.0028 0.0060 0.0021 0.0010 0.0022 0.0019

(2.18)** (0.14) (1.36) (7.70)* (2.12)** (0.54) (5.54)* (1.83)***

Forward FDI spillovers 0.0041 0.0086 0.0165 0.0043 0.0087 0.0051 0.0078 0.0411

(2.55)* (2.87) (2.93)* (2.04)** (3.57)** (1.10) (9.01)* (15.45)*

Financial development (F) 0.7444 1.0106 0.8286 0.9349 0.8172 1.0561 1.0828 0.7001

(8.95)* (9.95)* (5.00)* (11.99)* (10.65)* (9.38)* (39.24)* (10.95)*

Time dummies Yes Yes Yes Yes Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes Yes Yes Yes Yes

Hansen test (p-value) 0.21 0.22 0.45 0.55 0.18 0.22 0.28 0.68

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00

Number of observations 15,843 4436 465 2987 3885 1354 24,286 11,922

R-squared 0.30 0.27 0.38 0.43 0.25 0.34 0.43 0.27

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

Table 7

Absorptive capacity and TFP growth in Vietnamese regions.

Red River Delta North

East

North

West

North Central

Coast

South Central

Coast

Central

Highlands

South

East

Mekong River

Delta

Interaction of H and horizontal spillovers P & S P & S N & IS N & IS N & S P & S P & IS N & IS

Interaction of H and backward spillovers P & S P & S P & IS P & S N & S P & S N & S P & S

Interaction of H and forward spillovers N & S N & S P & IS N & IS P & S N & S P & IS P & IS

Interaction of T and horizontal spillovers N & S N & IS P & IS P & S N & S N & IS N & S N & S

Interaction of T and backward spillovers N & S N & S P & S N & S P & IS P & IS N & S N & IS

Interaction of T and forward spillovers N & IS P & IS N & S P & IS N & S N & S N & S N & S

Interaction of F and horizontal spillovers P & S N & IS N & IS P & S N & IS N & IS P & S N & IS

Interaction of F and backward spillovers P & S P & S P & IS P & IS N & S P & IS N & S N & S

Interaction of F and forward spillovers P & IS N & S N & IS N & IS P & IS N & IS P & S N & IS

Notes: Hstock of human capital; T technology gap; F the level of nancial development; P positive effect on TFP; Nnegative effect on TFP; S signicant and IS insignicant.

1380 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 1.1017 1.1975 2.3708 1.0868

(7.20)* (5.58)* (2.36)** (5.39)*

Scale (S) 6.7832 8.3485 2.5549 6.5548

(2.66)* (2.36)** (2.31)** (1.90)***

Concentration (C) 0.2600 0.2069 0.9492 0.2536

(1.92)* (1.15) (1.15) (1.48)

Technology gap (T) 0.0003 0.0001 0.0003 0.0002

(26.51)* (1.79)*** (5.28)* (5.60)*

Horizontal FDI spillovers 0.0029 0.3163 2.9881 0.5786

(5.43)* (5.24)* (1.75)*** (4.38)*

Backward FDI spillovers 0.0003 0.0002 0.0099 0.0023

(2.18)** (0.40) (3.36)* (1.99)**

Forward FDI spillovers 0.0041 0.0037 0.0543 0.0001

(2.55)* (1.92)** (1.52) (1.20)

Financial development (F) 0.7444 0.6946 0.7977 0.6102

(8.95)* (6.44)* (6.17)* (4.41)*

Technology gap horizontal 0.00001

(1.92)**

Technology gap backward 0.00001

(2.62)*

Technology gap forward 0.00005

(3.21)*

Human capital horizontal 0.0169

(1.94)**

Human capital backward 0.0055

(3.60)*

Human capital forward 0.0316

(1.53)

Financial development horizontal 0.0052

(2.20)**

Financial development backward 0.0049

(2.48)*

Financial development forward 0.0075

(1.56)

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.21 0.12 0.14 0.57

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 15,843 15,843 15,843 15,843

R-squared 0.30 0.27 0.20 0.31

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

from backward linkages but these regions have beneted from hori-

zontal or forward linkages. It seems that government policy that en-

courages foreign rms to invest in outer regions of Vietnamhas so far

not worked.

Based on the empirical analysis presented in this paper, Vietnam

can gain more benets from FDI by improving its absorptive capacity.

At the central level, Vietnam needs to further develop its nancial

system. Increased transparency is the rst step in this direction

followed by further liberalization. Increase in real spending on ad-

vanced education and training may help to reduce the technology

gap between foreign and local rms and increase the stock of

human capital. This combined with infrastructure improvement can

help to boost manufacturing sector productivity.

5.1. Limitations and areas for further research

The quality of Vietnamese data is questioned in some prior stud-

ies. The General Statistics Ofce of Vietnam has taken steps to im-

prove reliability of the data collection process. More recent data,

when it becomes available, is likely to be relatively more reliable.

Empirical analysis of more recent data when available would allow

one to assess the impact FDI-related spillovers in the post global

nancial crisis period. In addition to the impact of FDI on productiv-

ity in Vietnam, one can also examine the impact of FDI on product

quality. Recent studies such as Chang, Kao, Kuo, and Chiu (2012)

have highlighted the importance of governance quality in the con-

text of rm entry choices. It would be useful to examine the interac-

tion of governance quality and FDI on industrial growth in Vietnam.

Finally, one can also examine the impact of FDI on entrepreneurship

in Vietnam; specically, the impact of FDI on entry and exit of domestic

rms.

Acknowledgments

This paper has greatly beneted from extremely useful com-

ments and suggestions received from two anonymous reviewers.

The authors are also grateful to Dr Robert Alexander and participants

of seminar at Grifth University (QLD, Australia) and Flinders Uni-

versity (SA, Australia). However, the authors are solely responsible

for all remaining errors and imperfections.

Appendix 1. The effect of FDI on TFP in Red River Delta

1381 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Appendix 2. The effect of FDI on TFP in North East

Appendix 3. The effect of FDI on TFP in North West

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 1.2744 0.4035 0.3194 0.6056

(5.17)* (1.10) (0.76) (1.83)***

Scale (S) 16.2509 2.9655 2.8065 5.6267

(3.69)* (0.49) (0.91) (0.96)

Concentration (C) 0.3224 0.1418 0.2266 0.1542

(2.42)* (0.73) (0.85) (0.87)

Technology gap (T) 0.0002 0.0034 0.0009 0.0006

(0.92) (2.71)* (3.52)* (2.48)**

Horizontal FDI spillovers 0.0044 0.3061 0.2457 0.5952

(3.59)* (1.98)** (0.41) (2.06)**

Backward FDI spillovers 0.0001 0.0025 0.0088 0.0071

(0.14) (2.08)** (3.99)* (3.62)*

Forward FDI spillovers 0.0086 0.0039 0.0200 0.0072

(2.87) (0.69) (0.93) (1.30)

Financial development (F) 1.0106 1.2495 1.2794 1.3992

(9.95)* (10.25)* (17.76)* (11.59)*

Technology gap horizontal 0.00002

(0.36)

Technology gap backward 0.00018

(2.62)*

Technology gap forward 0.00045

(2.20)**

Human capital horizontal 0.0027

(0.94)

Human capital backward 0.0052

(4.51)*

Human capital forward 0.0101

(0.76)

Financial development horizontal 0.0064

(1.36)

Financial development backward 0.0141

(3.79)*

Financial development forward 0.0209

(2.56)*

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.22 0.52 0.19 0.18

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 4436 4436 4436 4436

R-squared 0.27 0.31 0.47 0.46

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 0.4105 0.7991 1.3296 0.6477

(8.04)* (3.19)* (2.24)** (2.81)*

Scale (S) 3.1745 1.4416 1.0360 0.4318

(0.53) (0.51) (0.40) (0.18)

Concentration (C) 0.6395 0.6292 0.9543 0.6638

(1.67)*** (1.64)*** (2.18)** (1.82)***

Technology gap (T) 0.0046 0.0041 0.0039 0.0033

(7.12)* (3.20)* (4.49)* (2.34)**

Horizontal FDI spillovers 0.0008 0.3213 0.2272 0.4882

(0.33) (1.00) (0.26) (0.82)

Backward FDI spillovers 0.0028 0.0048 0.0208 0.0062

(1.36) (2.16)** (2.25)* (1.19)

Forward FDI spillovers 0.0165 0.0160 0.1071 0.0222

(2.93)* (2.67)* (2.15)** (1.65)***

Financial development (F) 0.8286 0.7067 0.7631 0.9694

(5.00)* (3.34)* (4.17)* (2.67)*

Technology gap horizontal 0.00004

(0.59)

Technology gap backward 0.00004

(1.01)

Technology gap forward 0.00011

(0.85)

1382 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Appendix 4. The effect of FDI on TFP in North Central Coast

(continued)

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital horizontal 0.0032

(0.71)

Human capital backward 0.0108

(2.00)**

Human capital forward 0.0588

(1.82)***

Financial development horizontal 0.0086

(0.75)

Financial development backward 0.0065

(0.63)

Financial development forward 0.0087

(0.33)

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.45 0.39 0.38 0.37

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 465 465 465 465

R-squared 0.38 0.32 0.28 0.36

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

Appendix 3 (continued)

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 0.4797 0.6584 0.5863 0.9498

(21.34)* (1.87)*** (0.93) (2.23)**

Scale (S) 0.1383 1.3827 3.3211 3.0785

(0.13) (0.62) (1.47) (1.09)

Concentration (C) 0.3367 0.0173 0.2098 0.1061

(2.67)* (0.12) (1.32) (0.46)

Technology gap (T) 0.0021 0.0028 0.0037 0.0007

(11.53)* (2.27)** (3.22)* (0.71)

Horizontal FDI spillovers 0.0018 0.0128 2.2669 0.4616

(1.91)** (0.08) (1.85)*** (1.71)***

Backward FDI spillovers 0.0060 0.0075 0.0047 0.0064

(7.70)* (8.18)* (1.15) (3.12)*

Forward FDI spillovers 0.0043 0.0074 0.0501 0.0085

(2.04)** (1.49) (1.81)*** (1.64)***

Financial development (F) 0.9349 0.8135 0.9892 0.7537

(11.99)* (6.81)* (12.46)* (4.27)*

Technology gap horizontal 0.00002

(0.41)

Technology gap backward 0.00012

(2.25)**

Technology gap forward 0.00028

(1.40)

Human capital horizontal 0.0110

(1.69)***

Human capital backward 0.0062

(2.80)*

Human capital forward 0.0346

(1.97)

Financial development horizontal 0.0087

(2.09)**

Financial development backward 0.0005

(0.16)

Financial development forward 0.0131

(1.42)

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.55 0.19 0.16 0.12

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 2987 2987 2987 2987

R-squared 0.43 0.43 0.34 0.34

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

1383 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Appendix 5. The effect of FDI on TFP in South Central Coast

Appendix 6. The effect of FDI on TFP in Central Highlands

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 1.3199 2.27651 9.4182 1.4996

(5.01)* (3.26)* (2.11)** (4.52)*

Scale (S) 19.2282 46.9831 76.0676 23.8597

(3.32)* (2.46)** (2.03)** (2.98)*

Concentration (C) 0.4171 1.1422 6.0229 0.6587

(1.91)** (2.36)** (1.93)*** (2.12)**

Technology gap (T) 0.0008 0.0015 0.0001 0.0006

(4.54)* (0.89) (0.23) (1.98)**

Horizontal FDI spillovers 0.0019 0.5698 18.7057 0.3917

(1.78)*** (1.38) (1.91)*** (1.10)

Backward FDI spillovers 0.0021 0.0001 0.0205 0.0019

(2.12)** (0.04) (1.30) (0.79)

Forward FDI spillovers 0.0087 0.0300 0.4149 0.0017

(3.57)** (2.92)* (1.97)** (0.36)

Financial development (F) 0.8172 0.5706 1.6669 1.4744

(10.65)* (3.18)* (4.19)* (7.37)*

Technology gap horizontal 0.0005

(2.13)**

Technology gap backward 0.00001

(0.24)

Technology gap forward 0.0013

(2.36)**

Human capital horizontal 0.0915

(1.94)***

Human capital backward 0.0121

(1.49)

Human capital forward 0.2405

(2.00)**

Financial development horizontal 0.0105

(1.80)***

Financial development backward 0.0002

(0.06)

Financial development forward 0.0003

(2.22)**

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.18 0.29 0.56 0.21

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 3885 3885 3885 3885

R-squared 0.25 0.12 0.16 0.14

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 0.7480 0.5904 2.3187 0.8272

(2.35)* (1.39) (2.99)* (2.40)**

Scale (S) 5.0855 0.4973 5.7480 10.6405

(0.31) (0.03) (0.52) (0.66)

Concentration (C) 0.1886 0.1021 0.0004 0.2474

(0.39) (0.15) (0.11) (0.42)

Technology gap (T) 0.0060 0.0111 0.0083 0.0060

(3.94)* (2.92)* (4.49)* (3.10)*

Horizontal FDI spillovers 0.0037 0.1436 5.1689 0.4214

(1.84)*** (0.49) (2.99)* (0.96)

Backward FDI spillovers 0.0010 0.0035 0.0151 0.0025

(0.54) (1.74)*** (1.42) (0.65)

Forward FDI spillovers 0.0051 0.0004 0.1011 0.0081

(1.10) (0.05) (1.91)*** (0.92)

Financial development (F) 1.0561 1.1004 1.2021 1.5293

(9.38)* (8.97)* (9.47)* (6.25)*

Technology gap horizontal 0.0002

(1.70)***

Technology gap backward 0.0002

(1.88)***

Technology gap forward 0.0004

(1.60)***

1384 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Appendix 7. The effect of FDI on TFP in South East

(continued)

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital horizontal 0.0238

(2.85)

Human capital backward 0.0072

(1.34)

Human capital forward 0.0597

(2.01)**

Financial development horizontal 0.0023

(0.28)

Financial development backward 0.0008

(0.13)

Financial development forward 0.0260

(1.52)

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.22 0.14 0.29 0.31

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 1354 1354 1354 1354

R-squared 0.34 0.39 0.31 0.32

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

Appendix 6 (continued)

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 0.6994 0.7547 2.1076 1.6723

(5.71)* (1.78)*** (6.99)* (11.32)*

Scale (S) 1.2087 0.9034 1.6491 3.2606

(1.85)*** (0.44) (3.85)* (3.63)

Concentration (C) 0.1723 0.1004 0.5606 0.0765

(1.30) (0.52) (2.44)* (0.43)

Technology gap (T) 0.0003 0.0004 0.0003 0.0001

(11.54)* (1.45) (2.06)** (0.77)

Horizontal FDI spillovers 0.0051 0.5525 4.9724 1.4650

(10.79)* (8.15)* (4.63)* (11.20)*

Backward FDI spillovers 0.0022 0.0027 0.0161 0.0114

(5.54)* (3.46)* (7.48)* (7.28)*

Forward FDI spillovers 0.0078 0.0079 0.0230 0.0163

(9.01)* (5.86)* (2.78)* (6.40)*

Financial development (F) 1.0828 1.0737 1.1141 0.5483

(39.24)* (18.68)* (42.27)* (7.24)*

Technology gap horizontal 0.00004

(1.41)

Technology gap backward 0.00003

(2.07)**

Technology Gap Forward 0.00001

(0.73)

Human capital horizontal 0.0216

(5.07)*

Human capital backward 0.0057

(6.84)*

Human capital forward 0.0154

(3.93)*

Financial development horizontal 0.0152

(7.47)*

Financial development backward 0.0137

(5.81)*

Financial development forward 0.0084

(2.18)**

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.28 0.51 0.92 0.16

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 24,286 24,286 24,286 24,286

R-squared 0.43 0.44 0.31 0.26

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

1385 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Appendix 8. The effect of FDI on TFP in Mekong River Delta

References

Abu-Bader, S., & Abu-Qarn, A. S. (2008). Financial development and economic growth:

The Egyptian experience. Journal of Policy Modeling, 30, 887898.

Alvarez, R., & Lpez, R. A. (2008). Is exporting a source of productivity spillovers? Review

of World Economics, 144, 723749.

Anwar, S., & Nguyen, L. P. (2010a). Foreign direct investment and economic growth in

Vietnam. Asia Pacic Business Review, 16, 183202.

Anwar, S., & Nguyen, L. P. (2010b). Absorptive capacity, foreign direct investment-linked

spillovers and economic growth in Vietnam. Asian Business & Management, 9,

553570.

Anwar, S., & Nguyen, L. P. (2011a). Foreign direct investment and trade: The case of

Vietnam. Research in International Business and Finance, 25(2011), 3952.

Anwar, S., & Nguyen, L. P. (2011b). Foreign direct investment and export spillovers:

Evidence from Vietnam. International Business Review, 20, 177193.

Athukorala, P., & Tien, T. Q. (2012). Foreign direct investment in industrial transition: The

experience of Vietnam. Journal of the Asia Pacic Economy, 17(3), 446463.

Barbosa, N., & Eiriz, V. (2009). Linking corporate productivity to foreign direct invest-

ment: An empirical assessment. International Business Review, 18, 113.

Beugelsdijk, S., Smeets, R., & Zwinkels, R. (2008). The impact of horizontal and vertical FDI

on host's country economic growth. International Business Review, 17, 452472.

Binh, N., & Haughton, J. (2002). Trade liberalization and foreign direct investment in

Vietnam. ASEAN Economic Bulletin, 19, 302318.

Bitzer, J., Geishecker, I., & Grg, H. (2008). Productivity spillovers through vertical link-

ages: Evidence from 17 OECD countries. Economics Letters, 99(2), 328331.

Blomstrm, M., & Sjoholm, F. (1999). Technology transfer and spillovers: Does local par-

ticipation with multinationals matter? European Economic Review, 43, 915923.

Bwalya, S. M. (2006). Foreign direct investment and technology spillovers: Evidence from

panel data analysis of manufacturing rms in Zambia. Journal of Development

Economics, 81, 514526.

Chang, Y., Kao, M., Kuo, A., & Chiu, C. (2012). Howcultural distance inuences entry mode

choice: The contingent role of host country's governance quality. Journal of Business

Research, 65, 11601170.

Du, L., Harrison, A., & Jefferson, G. H. (2012). Testing for horizontal and vertical foreign

investment spillovers in China, 19982007. Journal of Asian Economics, 23(3),

324343.

Fernandes, A.M., & Paunov, C. (2012). Foreign direct investment in services and

manufacturing productivity: Evidence for Chile. Journal of Development Economics,

97, 305321.

Giroud, A. (2007). MNE vertical linkages: The experience of Vietnam. International

Business Review, 16, 159176.

Grima, S., Grg, H., & Pisu, K. (2008). Exporting, linkages and productivity spillovers from

foreign direct investment. Canadian Journal of Economics, 41, 320340.

GSO (2013). General Statistics Ofce of Vietnam. http://www.gso.gov.vn

Jenkins, R. (2006). Globalization, FDI and employment in Viet Nam. Transnational

Corporations, 15, 115142.

Le, T. (2005). Technological spillovers from foreign direct investment: The case of Vietnam.

Graduate School of Economics, University of Tokyo.

Lin, F. (2010). The determinants of foreign direct investment in China: The case

of Taiwanese rms in the IT industry. Journal of Business Research, 63, 479485.

Lipsey, R., & Carlaw, K. (2004). Total factor productivity and the measurement of techno-

logical change. Canadian Journal of Economics, 37(4), 11181150.

Liu, Z. (2002). FDI and technology spillovers: Evidence from China. Journal of Comparative

Economics, 30, 579602.

Liu, Z. (2008). Foreign direct investment and technology spillovers: Theory and evidence.

Journal of Development Economics, 85, 176193.

Liu, X., & Wang, C. (2003). Does foreign direct investment facilitate technological progress?

Evidence from Chinese industries. Research Policy, 32, 945953.

Meyer, K. E., & Sinani, E. (2009). When and where does foreign direct investment generate

positive spillovers? Journal of International Business Studies, 40, 10751094.

Independent variables Dependent variable: log (TFP)

Estimation without

interaction

Estimation with interaction

between FDI spillover and H

Estimation with interaction

between FDI spillover and T

Estimation with interaction

between FDI spillover and F

Human capital [log(H)] 1.8812 1.9586 1.9339 1.7709

(16.48)* (15.72)* (3.55)* (14.92)*

Scale (S) 9.9852 13.4318 10.3396 11.0623

(6.17)* (2.68)* (1.95)** (2.60)*

Concentration (C) 0.3275 0.4462 2.3368 0.2645

(1.70)*** (1.83)*** (1.58) (1.21)

Technology gap (T) 0.0004 0.0011 0.0049 0.0010

(1.15) (1.86)*** (1.59) (1.72)***

Horizontal FDI spillovers 0.0115 1.1771 1.7551 1.3946

(8.14)* (7.49)* (3.41)* (4.51)*

Backward FDI spillovers 0.0019 0.0009 0.0147 0.0079

(1.83)*** (0.88) (0.95) (3.50)*

Forward FDI spillovers 0.0411 0.0415 0.1651 0.0342

(15.45)* (14.86)* (2.22)** (6.46)*

Financial development (F) 0.7001 0.6999 0.5823 1.2198

(10.95)* (10.79)* (2.53)** (8.03)*

Technology gap horizontal 0.00005

(0.12)

Technology gap backward 0.00008

(1.66)***

Technology gap forward 0.00007

(0.09)

Human capital horizontal 0.3114

(3.37)*

Human capital backward 0.0058

(0.74)

Human capital forward 0.1177

(2.81)*

Financial development horizontal 0.0037

(0.68)

Financial development backward 0.0127

(2.95)*

Financial development forward 0.0137

(1.37)

Time dummies Yes Yes Yes Yes

Industry dummies Yes Yes Yes Yes

Hansen test (p-value) 0.68 0.18 0.36 0.21

DurbinWuHausman (p-value) 0.00 0.00 0.00 0.00

Number of observations 11,922 11,922 11,922 11,922

R-squared 0.27 0.23 0.35 0.32

Notes: (i) Robust t-statistics in parentheses; (ii) ***signicant at 10%, **signicant at 5%, and *signicant at 1%.

1386 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Nguyen, A. N., & Nguyen, T. (2007). Foreign direct investment in Vietnam: An overview and

analysis of the determination of spatial distribution. Hanoi, Vietnam: Development and

Polices Research Center.

Nguyen, A. N., Nguyen, T. L., Dang, T. P., Quang, N., Nguyen, D. C., & Nguyen, D. N. (2008).

Foreign direct investment in Vietnam: Is there any evidence of technological spillover

effects? Development and Policies Research Center Working Paper, Hanoi, Vietnam.

Nguyen, D. T. H., & Sun, S. (2012). FDI and domestic rms' export behaviour: Evidence

from Vietnam. Economic Papers, 31(3), 380390.

Nowak-Lehmann, F., Dreher, A., Herzer, D., Klasen, S., & Martinez-Zarzoso, I. (2012). Does

foreign aid really raise per capita income? A time series perspective. Canadian Journal

of Economics, 45(1), 288313.

Pan, Y. (2003). The inow of foreign direct investment to China: the impact of country-

specic factors. Journal of Business Research, 56, 829833.

Stancik, J. (2007). Horizontal and vertical FDI spillovers: Recent evidence from the Czech

Republic. Center for Economic Research & Graduate Education - Economics Institute

(CERGE-EI) Working Paper No. 340.

Suyanto, S., Salim, R. A., & Bloch, H. (2009). Does foreign direct investment lead to produc-

tivityspillovers? Firmlevel evidence fromIndonesia. World Development, 37, 18611876.

Truong, D., & Gates, C. L. (1996). Vietnam in ASEAN Economic reform, openness and

transformation: An overview. ASEAN Economic Bulletin, 13(15968), 1996.

Wang, Y. (2010). FDI and productivity growth: The role of inter-industry linkages. Canadian

Journal of Economics, 43(4), 12431272.

1387 S. Anwar, L.P. Nguyen / Journal of Business Research 67 (2014) 13761387

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Cam 5 Test 1 W1Dokumen1 halamanCam 5 Test 1 W1Nguyễn Thanh TùngBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- IELTS Essays by Ngoc BachDokumen11 halamanIELTS Essays by Ngoc BachTrần Văn Tâm100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- 2011 Petri TPPDokumen73 halaman2011 Petri TPPNguyễn Thanh TùngBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- CDM Web Download Excel 1421140204841Dokumen2 halamanCDM Web Download Excel 1421140204841Nguyễn Thanh TùngBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Wpp2012 Pop f01 1 Total Population Both SexesDokumen436 halamanWpp2012 Pop f01 1 Total Population Both SexesNguyễn Thanh TùngBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Ban Tin Kinh Te Vi Mo So 10 - FinalDokumen24 halamanBan Tin Kinh Te Vi Mo So 10 - FinalNguyễn Thanh TùngBelum ada peringkat

- Ban Tin Kinh Te Vi Mo So 10 - FinalDokumen24 halamanBan Tin Kinh Te Vi Mo So 10 - FinalNguyễn Thanh TùngBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- BCDR AT&T Wireless CommunicationsDokumen17 halamanBCDR AT&T Wireless CommunicationsTrishBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hershey Case StudyDokumen16 halamanHershey Case StudyNino50% (2)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Business Basics Test: Please Complete This Puzzle by Finding The Hidden WordsDokumen1 halamanBusiness Basics Test: Please Complete This Puzzle by Finding The Hidden WordsCavene ScottBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Remedy Applicatin PermissionsDokumen75 halamanRemedy Applicatin PermissionsVenkat SBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- McMurray Métis 2015 - Financial Statements - Year Ended March 31, 2015Dokumen13 halamanMcMurray Métis 2015 - Financial Statements - Year Ended March 31, 2015McMurray Métis (MNA Local 1935)Belum ada peringkat

- Auditing Theory - Risk AssessmentDokumen10 halamanAuditing Theory - Risk AssessmentYenelyn Apistar CambarijanBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Autobus Vs BautistaDokumen1 halamanAutobus Vs BautistaJoel G. AyonBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Acctg 202 Di Pa FinalDokumen10 halamanAcctg 202 Di Pa FinalJoshua CabinasBelum ada peringkat

- Bizna in BusinessDokumen16 halamanBizna in BusinessJanno van der LaanBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Na SW Atio Witch Onal HB (NP Lpa Bang PSB Aym Gla B) Men Des NT SHDokumen37 halamanNa SW Atio Witch Onal HB (NP Lpa Bang PSB Aym Gla B) Men Des NT SHArafatBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Faculty of Liberal Studies BBA (Hons.) Semester - I Division - CDokumen13 halamanFaculty of Liberal Studies BBA (Hons.) Semester - I Division - CPrince BharvadBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Need For Time Management Training Is Universal: Evidence From TurkeyDokumen8 halamanThe Need For Time Management Training Is Universal: Evidence From TurkeyAnil AkhterBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- CIMA Certificate Paper C4 Fundamentals of Business Economics Practice RevisionDokumen241 halamanCIMA Certificate Paper C4 Fundamentals of Business Economics Practice RevisionNony Um'yioraBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Data Warehousing & DATA MINING (SE-409) : Lecture-2Dokumen36 halamanData Warehousing & DATA MINING (SE-409) : Lecture-2Huma Qayyum MohyudDinBelum ada peringkat

- Unit 4 The Hospitality Industry: Ntroduction To Tourism HMGTDokumen44 halamanUnit 4 The Hospitality Industry: Ntroduction To Tourism HMGTdilanocockburnBelum ada peringkat

- EPC Vs EPCmDokumen4 halamanEPC Vs EPCmjsaulBelum ada peringkat

- Selection - of - A - Pressure - Vessel - Manufacturer PDFDokumen6 halamanSelection - of - A - Pressure - Vessel - Manufacturer PDFNagendra KumarBelum ada peringkat

- What Is Commerce?: Comprehensive DefinitionDokumen31 halamanWhat Is Commerce?: Comprehensive Definitionmuhammad riazBelum ada peringkat

- HBX 6516DS VTMDokumen2 halamanHBX 6516DS VTMRoma Zurita100% (1)

- Nestle CSRDokumen309 halamanNestle CSRMaha AbbasiBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Research Project ReportDokumen21 halamanResearch Project ReportinternationalbankBelum ada peringkat

- LBO ModelingDokumen31 halamanLBO Modelingricoman1989Belum ada peringkat

- One Point LessonsDokumen27 halamanOne Point LessonsgcldesignBelum ada peringkat

- GST Proposal Presentation 1Dokumen47 halamanGST Proposal Presentation 1pmenocha879986% (7)

- Bbap2103 Akaun PengurusanDokumen10 halamanBbap2103 Akaun PengurusanEima AbdullahBelum ada peringkat

- Batman GuidesDokumen3 halamanBatman GuidesMarco MazzaiBelum ada peringkat

- Capital Gains TaxDokumen5 halamanCapital Gains TaxJAYAR MENDZBelum ada peringkat

- Civil Code of The Philippines Common CarriersDokumen4 halamanCivil Code of The Philippines Common CarriersKathrynne NepomucenoBelum ada peringkat

- Article of Association of LIMITED LIABILITY COMPANY - NUMBERDokumen15 halamanArticle of Association of LIMITED LIABILITY COMPANY - NUMBERandriBelum ada peringkat

- Bpo Management SystemDokumen12 halamanBpo Management SystembaskarbalachandranBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)