DUTALND AnnualReport2013

Diunggah oleh

Hèñry LimJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

DUTALND AnnualReport2013

Diunggah oleh

Hèñry LimHak Cipta:

Format Tersedia

annual report 2013

www.dutaland.com.my

DutaLand Berhad

(7296-V)

2 Corporate Information

3 Operational and Financial Highlights

4 Chairmans Statement

8 Profile of Directors

12 Corporate Governance Statement

25 Additional Compliance Information

28 Statement on Risk Management and Internal Control

30 Audit Committee Report

35 Directors Report and Audited Financial

Statements

122 Properties Held by the Group

124 Distribution Schedule of Equity Securities

127 Notice of Annual General Meeting

130 Statement Accompanying Notice of

Annual General Meeting

Form of Proxy

Contents

2

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Information

STOCK EXCHANGE LISTING

Main Market of Bursa Malaysia Securities Berhad

REGISTERED OFFICE

Level 23, Menara Olympia

No. 8, Jalan Raja Chulan

50200 Kuala Lumpur

Tel : 603-20723993

Fax : 603-20723996

E-mail : dutaland@dutaland.com.my

AUDITORS

Messrs Ernst & Young (AF : 0039)

Chartered Accountants

Level 23A, Menara Milenium

Jalan Damanlela

Pusat Bandar Damansara

50490 Kuala Lumpur

PRINCIPAL BANKERS

Asian Finance Bank Berhad

RHB Investment Bank Berhad

RHB Bank Berhad

CIMB Bank Berhad

SHARE REGISTRAR

(Place where all registers of securities are kept)

Tricor Investor Services Sdn Bhd

Level 17, The Gardens North Tower

Mid Valley City, Lingkaran Syed Putra

59200 Kuala Lumpur

Tel : 603-22643883

Fax : 603-22821886

Website: www.tricorglobal.com

DATE AND PLACE OF INCORPORATION

26 July 1967, Malaysia

COMPANY NUMBER

7296-V

WEBSITE

www.dutaland.com.my

LISTING DATE

11 January 1973

BOARD OF DIRECTORS

YAM Tengku Datuk Seri Ahmad Shah Ibni Almarhum

Sultan Salahuddin Abdul Aziz Shah

Chairman

YBhg Tan Sri Dato Yap Yong Seong

Group Managing Director

Mr Yap Wee Chun

Executive Director

YBhg Tan Sri Dato Haji Lamin bin Haji Mohd Yunus

Independent Director

YBhg Dato Yap Wee Keat

Non-Independent Director

Mr Cheong Wong Sang

Independent Director

Encik Hazli bin Ibrahim

Independent Director

CHARTERED SECRETARIES

Ms Lim Yoke Si

MAICSA No. 0825971

Ms Pang Siok Tieng

MAICSA No. 7020782

Operational and

Financial Highlights

3

DutaLand Berhad (7296-V) Annual Report 2013

0

3

0

9

0

6

0

1

2

0

1

5

0

0

2

0

0

4

0

0

6

0

0

8

0

0

1

0

0

0

0

2

0

0

4

0

0

6

0

0

8

0

0

1

0

0

0

1

2

0

0

1

4

0

0

2

0

1

3

Y

e

a

r

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

2

0

1

3

Y

e

a

r

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

2

0

1

3

Y

e

a

r

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

2

0

1

3

Y

e

a

r

2

0

1

2

2

0

1

1

2

0

1

0

2

0

0

9

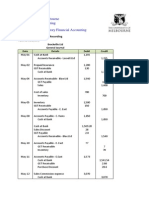

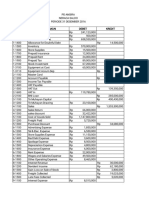

Revenue

(RM Million)

58.3

Profit from

Operations

(RM Million)

-7.7

Shareholders

Equity

(RM Million)

789.2

Total Assets

(RM Million)

1,050.0

Year Ended Year Ended Year Ended Year Ended

30 June 2012 30 June 2011 30 June 2010 30 June 2009

RM Million RM Million RM Million RM Million

INCOME STATEMENT

Revenue 115.5 121.2 100.5

(Loss)/profit from operations 16.1 33.8 96.2

(Loss)/profit before taxation 3.5 16.6 77.9

(Loss)/profit attributable to owners

of the parent 0.7 8.5 90.1

STATEMENT OF FINANCIAL POSITION

Issued and paid-up capital 593.1 592.7 586.1

Shareholders equity 850.9 856.1 766.7

Total assets 1,145.2 1,226.1 1,144.4

PER SHARE DATA

Gross (loss)/profit per share (sen) 1* 3* 14*

Net (loss)/profit per share (sen) 0.1* 1* 16*

Net tangible assets per share (sen) 143 144 131

* Based on weighted average number of shares issued during the year

Year Ended

30 June 2013

RM Million

58.3

(7.7)

(19.2)

(18.6)

846.1

789.2

1,050.0

(3)*

(2.8)*

93

95.2

4.3

(4.1)

(5.0)

602.4

820.7

1,065.0

(1)*

(0.8)*

136

-

1

0

0

2

0

3

0

1

0

4

0

5

0

6

0

7

0

8

0

9

0

1

0

0

THE YEAR

UNDER REVIEW

On behalf of the board of

directors of DutaLand, I am

pleased to present the annual

report and audited financial

statements for the financial

year ended 30 June 2013.

Financial Performance

For the financial year under review (FY2013),

the Group registered total revenue of RM58.3

million, which was RM36.9 million lower than

the preceding year of RM95.2 million. The

deterioration of 39% was attributable to the lower

revenues generated by its property division and

plantation division.

As compared with the previous years revenue

of RM51.1 million, the variance of RM12.7 million

to RM38.4 million at the plantation division was

attributed to the sharply lower average selling

prices of fresh fruit bunches (FFB) during the year

under review which arose from the worldwide

decline in the price of Crude Palm Oil (CPO).

The Groups lower revenue for the current year

was also due to substantially lower revenue from

its property division of RM19.8 million as compared

to RM44.1 million for the previous year, a shortfall

of RM24.3 million.

Whereas the bulk of revenue for the previous

year (RM32.0 million) was accounted for by

the sale of certain vacant land, the current

years revenue was derived from the Groups

commercial development project in Seremban

which accounted for almost all of the divisions

revenue for FY2013.

As a result, the Group recorded a higher loss

before tax of RM19.2 million for the current FY2013

as compared with a loss before tax of RM4.1

million for the previous FY2012.

YAM Tengku Datuk Seri Ahmad Shah

Ibni Almarhum Sultan Salahuddin Abdul Aziz Shah

Chairman

4

DutaLand Berhad (7296-V) Annual Report 2013

Chairmans Statement

The decline in FFB prices was in line with the average

CPO price recorded in Malaysia of RM2,410 per MT

during the under review which is a decline of RM700 or

23% against RM3,110 per MT during the previous year.

With lower revenue and higher operating costs

incurred during the year under review, the plantation

division recorded a loss before tax of RM2.3 million for

the current FY2013 as compared to a pre-tax profit of

RM13.8 million for the previous FY2012.

Property Development

During the year under review, prices in the high-end

residential market in prime areas such as KLCC and

Mont Kiara remained flat mainly due to concerns

of oversupply and the dampening effect of several

cooling measures instituted by the government in

recent years to curb speculative activities.

The property division contributed RM19.8 million to the

Group revenue for the year under review which was

55% lower than RM44.1 million reported for the previous

year. The Groups commercial development project in

Seremban performed well and accounted for RM18.4

million or 93% of the divisions revenue for FY2013.

Operational Review

Plantations

The year under review has been a challenging year

for the Malaysian palm oil industry as palm oil prices

declined from the build-up of stocks arising from high

stockpiles, increased CPO production as well as weaker

export demand.

The Groups plantation assets are held under its wholly-

owned sub-subsidiary, Pertama Land & Development

Sdn Bhd which owns about 12,000 hectares (Ha) of oil

palm lands in the district of Labuk-Sugut and Tongod,

Sabah.

As at June 2013, the planted oil palm area was at

10,557 Ha of which 8,410 Ha or 80% consisted of mature

area. The division has continued its effort to improve

the efficiency of the estates. Following such efforts, FFB

yield has improved over the previous year.

For the financial year under review, the plantation

division contributed RM38.4 million to the Groups

revenue as compared to RM51.1 million for the

previous year. The lower contribution was mainly due

to the significant drop in FFB prices to RM401 per metric

tonne (MT), a decrease of RM188 per MT or 31.9%

from RM589 per MT in the preceding year, despite an

increase of 10.5% in FFB production to 95,895 MT from

86,815 MT.

DutaLand Berhad (7296-V) Annual Report 2013

Chairmans Statement (contd)

5

For the year under review, the property division

registered an overall loss before tax of RM4.6 million

which is 67% lower than the loss before tax of RM13.9

million reported for the preceding year. The lower loss

for FY2013 was mainly due to higher contributions from

the commercial development project in Seremban.

Furthermore the previous years loss had included loss

on disposal and impairment of RM5.7 million of certain

properties.

The Groups commercial development project in

Seremban is being undertaken by its wholly-owned

subsidiary, Oakland Holdings Sdn Bhd (Oakland).

Revenue for the current year was mainly derived

from development of Phase 4D and Phase 4E which

comprises 75 units of 2-storey and 3-storey shop offices.

In June 2013, Oakland completed and handed over

vacant possession of Phase 4D which was fully sold.

Phase 4D which comprised 38 units of 2-storey shop

offices had a gross development value (GDV) of

RM14.6 million. Phase 4E which comprises 37 units of

2-storey and 3-storey shop offices with a GDV of RM23.2

million and saw a high take-up rate of 78%, is expected

to be completed by September 2013.

The Kenny Heights project which is located in the

affluent suburb of Sri Hartamas/Mont Kiara in Kuala

Lumpur, is being undertaken on a joint venture (JV)

basis with sister company, Olympia Industries Bhd in the

ratio of 58:42 respectively with DutaLands subsidiary

taking the majority role of developer.

Currently, the JV consortium has embarked on

the second phase of the project which entails the

development of 4 blocks (709 units) of high-end

condominiums with a GDV of RM1.5 billion. To date

earthworks have been undertaken on this phase.

Bearing in mind the project is a long-term township

development, the JV consortium is expected to review

the development plans of the project to suit the

changing market conditions.

Significant Corporate Developments

The year under review witnessed the completion of

DutaLands 6-year restructuring scheme which was

implemented in April 2007 to address the Groups

indebtedness which totaled RM769.1 million initially. As

of end April 2013, the Company has settled all debts

due and fulfilled all financial and legal obligations

under the scheme.

During the year under review, the Company repaid

all its remaining debts outstanding under the scheme

amounting to RM52.5 million nominal value comprising

RM27.0 million of 2007/2013 Restructured Term Loans

(RTL), RM13.1 million of 2007/2013 Redeemable

Unsecured Loan Stocks (RULS), RM4.1 million of

2007/2013 Irredeemable Convertible Bonds (ICB) and

RM8.3 million of 2007/2013 Irredeemable Convertible

Unsecured Loan Stocks (ICULS).

6

DutaLand Berhad (7296-V) Annual Report 2013

Chairmans Statement (contd)

In addition, RM7,644,000 of ICB, RM275,972,365 of

ICULS and USD1,320,000 (equivalent to RM4,024,020

based on the exchange rate of RM3.0485 to USD1.00)

of Irredeemable Exchangeable Bonds (IEB) were

converted into 243,762,793 new ordinary shares in

DutaLand on maturity date in April 2013. Following the

issuance of the new shares arising from the conversion

of the instruments, DutaLands issued and paid-up

capital was increased from RM602,355,246 comprising

of 602,355,246 ordinary shares of RM1.00 each to

RM846,118,039 comprising of 846,118,039 ordinary

shares of RM1.00 each.

On 6 August 2013, DutaLand entered into an agreement

with Melody Hallmark Sdn Bhd (MHSB) to dispose

of its 100% equity interest in Olympia Plaza Sdn Bhd

(OPSB) for a sale consideration of RM50.0 million. As

the Company holds 30% equity interest in MHSB, hence

the net effective equity interest in OPSB divested is 70%.

The transaction which netted cash proceeds of RM35.0

million to DutaLand, was completed on 3 September

2013.

Future Outlook

With the completion of the restructuring scheme, the

Group now stands on a much improved financial

position as it has degeared and consolidated its debts

to a manageable level. Going forward, DutaLand is

well placed to chart a new course for the future ahead.

For the immediate future, the Group will focus on its

core business areas namely the oil palm estates and

property development. The Company will continue to

explore ways to rationalize its operations and realize

the value of its investments.

Appreciation

On behalf of the Board, I would like to take this

opportunity to thank our shareholders, business partners

and government authorities for their continuing support

over the years.

The Board also wishes to register its appreciation to

the management and staff at DutaLand for their

dedication and loyalty to the Group throughout the

challenging years of the restructuring scheme which

has finally been completed in April this year.

In addition I wish to thank my fellow colleagues on the

Board for their invaluable guidance and support in

assisting me to discharge my duties as Chairman.

YAM TENGKU DATUK SERI AHMAD SHAH IBNI

ALMARHUM SULTAN SALAHUDDIN ADBUL AZIZ SHAH

Chairman

19 September 2013

Chairmans Statement (contd)

7

DutaLand Berhad (7296-V) Annual Report 2013

YAM Tengku Datuk Seri Ahmad Shah Ibni Almarhum Sultan Salahuddin Abdul Aziz Shah was appointed to the Board

on 25 February 2009 as an Independent Non-Executive Director and was subsequently redesignated as Chairman

of DutaLand Berhad on 23 November 2010.

YAM Tengku Datuk Seri Ahmad Shah completed his Diploma in Business Administration from Universiti Teknologi

MARA in 1974. He started his career in Charles Bradburne (1930) Sdn Bhd as a broker from 1974 to 1981. He was

a Director of TTDI Development Sdn Bhd from 1978 to 2000, a Director of Sime UEP Berhad from 1983 to 1987, a

Director of Sime Darby Healthcare Sdn Bhd from 2010 to 2013 and Chairman of Sime Darby Medical Centre Subang

Jaya Sdn Bhd from 1987 to 2013.

Presently, YAM Tengku Datuk Seri Ahmad Shah is also a Director of Global Oriental Berhad (formerly known as

Equine Capital Berhad), Melewar Industrial Group Berhad and Wawasan TKH Holdings Berhad, all of which are

listed on Bursa Malaysia Securities Berhad. He is also a Director of Sime Darby Property Berhad and Recycle Energy

Sdn Bhd. He is also involved in welfare organizations and is a member of the Board of Trustees of the Cancer

Research Initiatives Foundation (CARIF).

YAM Tengku Datuk Seri Ahmad Shah has no family relationship with any Director and/or major shareholder of

DutaLand Berhad, has no conflict of interest with DutaLand Berhad and has no conviction for any offences within

the past 10 years (other than traffic offences, if any).

YAM Tengku Datuk Seri Ahmad Shah attended all the five Board Meetings of DutaLand Berhad held in the financial

year ended 30 June 2013.

YBhg Tan Sri Dato Yap Yong Seong was appointed to the Board of DutaLand Berhad on 16 February 1993 and is a

member of the Remuneration Committee of DutaLand Berhad.

YBhg Tan Sri Dato Yap first ventured into the property business in the early 70s under the Duta Group which was

a pioneer in embarking on a reclamation project at the fore shore lands in Malacca which now stood the new

business centre known as Melaka Raya.

YBhg Tan Sri Dato Yap also sits on the Board of Olympia Industries Berhad as the Group Managing Director and

on the Board of several companies within the DutaLand Berhad and Olympia Industries Berhad Groups. He is the

father of YBhg Dato Yap Wee Keat and Mr Yap Wee Chun. He is also the spouse of YBhg Puan Sri Datin Leong Li

Nar, a major shareholder of DutaLand Berhad.

Except for certain recurrent related party transactions of a revenue or trading nature which are necessary for the

day-to-day operations of DutaLand Berhad and its subsidiaries for which YBhg Tan Sri Dato Yap is deemed to be

interested, there are no other business arrangements with DutaLand Berhad in which he has personal interests. He

has no conviction for any offences within the past 10 years.

YBhg Tan Sri Dato Yap attended all the five Board Meetings of DutaLand Berhad held in the financial year ended

30 June 2013.

YAM TENGKU DATUK SERI AHMAD SHAH IBNI

ALMARHUM SULTAN SALAHUDDIN ABDUL AZIZ SHAH

YBHG TAN SRI DATO YAP YONG SEONG

Chairman Aged 58, Malaysian

Group Managing Director Aged 72, Malaysian

8

DutaLand Berhad (7296-V) Annual Report 2013

Profile of Directors

Mr Yap Wee Chun was appointed to the Board of DutaLand Berhad on 5 September 1996. He graduated in 1990

with a Bachelor of Arts, majoring in Business Administration and Economics from Richmond University of London.

Mr Yap began his career as an Officer with D & C Sakura Merchant Bank Bhd (now known as RHB Investment Bank

Berhad) in 1994.

Mr Yap sits on the Board of several companies within the DutaLand Berhad Group and a subsidiary in Olympia

Industries Berhad Group. He is the son of YBhg Tan Sri Dato Yap Yong Seong, the Group Managing Director and

YBhg Puan Sri Datin Leong Li Nar, both are major shareholders of DutaLand Berhad as well as the brother of

YBhg Dato Yap Wee Keat.

Except for certain recurrent related party transactions of a revenue or trading nature which are necessary for the

day-to-day operations of DutaLand Berhad and its subsidiaries for which Mr Yap is deemed to be interested, there

are no other business arrangements with DutaLand Berhad in which he has personal interests. He has no conviction

for any offences within the past 10 years (other than traffic offences, if any).

Mr Yap attended all the five Board Meetings of DutaLand Berhad held in the financial year ended 30 June 2013.

YBhg Tan Sri Dato Haji Lamin bin Haji Mohd Yunus was appointed to the Board of DutaLand Berhad on 28 December

2001. He is the Chairman of the Audit, Nomination and Remuneration Committees of DutaLand Berhad.

YBhg Tan Sri Dato Haji Lamin obtained his LLB (Honours) from the University of Singapore in 1963 and a postgraduate

Diploma in Socio-Legal Studies from the University College of Wales, Cardiff, United Kingdom. Upon graduation from

the University of Singapore in 1963, YBhg Tan Sri Dato Haji Lamin was admitted into the Diplomatic Service and served

both locally and overseas namely, Ministry of Foreign Affairs, Malaysia and the Malaysian Embassy in Bangkok.

In 1967, he began his illustrious working career in the Legal and Judicial service when he joined the Malaysian

Judicial and Legal Service. He rst served as Deputy Public Prosecutor in the Attorney Generals Chambers, Kuala

Lumpur and was later appointed Magistrate also in Kuala Lumpur. He served briey as Acting President of the

Sessions Court, Seremban before his appointment as Federal Counsel with the Ministry of Defence, Kuala Lumpur.

In 1972, he was appointed Senior Assistant Registrar, High Court, Kuala Lumpur and later Deputy Public Prosecutor,

Perak. In 1973, he assumed the post of Senior Federal Counsel in the Prosecution Division in the Attorney Generals

Chambers, Kuala Lumpur. He was appointed State Legal Advisor, Pahang in 1977 and was appointed Deputy Head

of Prosecution Division, AG Chambers, Kuala Lumpur in 1980.

In 1982, he returned to Pahang as Pahang State Legal Advisor and simultaneously, he was also the Judge Advocate

General in the Ministry of Defence, Kuala Lumpur. In 1983, he was appointed to Solicitor General and later in 1988,

he was promoted to Judge of the High Court Malaya, Pahang. In 1994, he was promoted to the position of Judge

of the Federal Court. He was the first President of the Court of Appeal of Malaysia, a position that he held for almost

seven years until his retirement in March 2001 after having served the six months extension as provided for under

article 125 (1) of the Federal Constitution.

MR YAP WEE CHUN

YBHG TAN SRI DATO HAJI LAMIN BIN HAJI MOHD YUNUS

Executive Director Aged 43, Malaysian

Independent Director Aged 78, Malaysian

9

DutaLand Berhad (7296-V) Annual Report 2013

Profile of Directors (contd)

On 24 August 2005, YBhg Tan Sri Dato Haji Lamin was elected as ad litem Judge of the International Criminal

Tribunal for the former Republic of Yugoslavia (ICTY) at the 59

th

session of the United Nations General Assembly for

a term of four years. In December 2011, he was appointed as a Judge to the Kuala Lumpur War Crimes Tribunal.

From May 7 to 12, 2012, he led the panel as President to hear the case against the former United States President,

George W. Bush together with seven other associates for committing the Crime of Torture.

YBhg Tan Sri Dato Haji Lamin is currently a Director of Taman TAR Development Sdn Bhd.

YBhg Tan Sri Dato Haji Lamin has no family relationship with any Director and/or major shareholder of DutaLand

Berhad, has no conflict of interest with DutaLand Berhad and has no conviction for any offences within the past 10

years (other than traffic offences, if any).

YBhg Tan Sri Dato Haji Lamin attended four out of five Board Meetings of DutaLand Berhad held in the financial

year ended 30 June 2013.

YBhg Dato Yap Wee Keat was appointed to the Board on 25 March 1992 and was instrumental in the property

development activities of the DutaLand Berhad Group. He is also currently an Executive Director of Olympia

Industries Berhad and has been responsible for the business operations of the Olympia Industries Berhad Group.

He spearheads the Kenny Heights Project, a development project embarked by DutaLand Berhad through the

consortium formed with Olympia Industries Berhad and which is undertaken by DutaLand Berhad sub-subsidiary,

KH Land Sdn Bhd.

YBhg Dato Yap obtained his LLB (Honours) degree from The London School of Economics And Political Science,

United Kingdom in 1989. With the Groups investment in Automobili Lamborghini, he was appointed deputy

chairman of Automobili Lamborghini from 1994 - 1998.

YBhg Dato Yap is also one of the founding trustees for Malaysian Tsunami Aid Foundation, Force of Nature Aid

Foundation, which was established in 2005, where he sits on the Board of Trustees.

YBhg Dato Yap is the eldest son of YBhg Tan Sri Dato Yap Yong Seong, the Group Managing Director and YBhg

Puan Sri Datin Leong Li Nar, both are major shareholders of DutaLand Berhad. He is the eldest brother to Mr Yap Wee

Chun, the Executive Director of DutaLand Berhad. YBhg Dato Yap also serves on the Board of several other private

companies within Olympia Industries Berhad and DutaLand Berhad.

Except for certain recurrent related party transactions of a revenue or trading nature which are necessary for

the day-to-day operations of DutaLand Berhad and its subsidiaries for which YBhg Dato Yap is deemed to be

interested, there are no other business arrangements with DutaLand Berhad in which he has personal interests. He

has no conviction for any offences within the past 10 years (other than traffic offences, if any).

YBhg Dato Yap attended all the five Board Meetings of DutaLand Berhad held in the financial year ended

30 June 2013.

YBHG DATO YAP WEE KEAT

Non-Independent Director Aged 45, Malaysian

10

DutaLand Berhad (7296-V) Annual Report 2013

Profile of Directors (contd)

Mr Cheong Wong Sang was appointed to the Board of DutaLand Berhad on 28 December 2001 and is a member

of the Audit Committee, Nomination Committee and Remuneration Committee of DutaLand Berhad.

A Certified Public Accountant (CPA) and a Certified Management Accountant (CMA) by profession, Mr Cheong

has varied and extensive direct hands-on specialised business experiences, both in Malaysia and overseas. He

started his early articleship training with an international accounting firm and simultaneously graduated as a

Chartered Management Accountant. He specialises in turn-around situations, portfolio management, divestment

exercise, Mergers & Acquisitions activities and high level negotiations involving privatisation of national projects.

Prior to that, he has worked and participated as a professional manager in various senior executive positions

including as director and adviser to the Board of various business entrepreneurial organisations including public

listed entities in the Asia-Pacific region.

Mr Cheong has no family relationship with any Director and/or major shareholder of DutaLand Berhad, has no

conflict of interest with DutaLand Berhad and has no conviction for any offences within the past 10 years (other

than traffic offences, if any).

Mr Cheong attended all the five Board Meetings of DutaLand Berhad held in the financial year ended 30 June

2013.

Encik Hazli bin Ibrahim was appointed to the Board of DutaLand Berhad on 2 January 2008 and is a member of the

Audit Committee and Nomination Committee of DutaLand Berhad.

Encik Hazli graduated with a Bachelor of Finance with Accounting from the University of East London in 1986 and is

a fellow member of the Association of Chartered Certified Accountants (ACCA). He obtained his Master of Business

Administration (MBA) in 1993 from Cass Business School in London.

Encik Hazli started his career in London with several chartered accountants firms. Upon his return to Malaysia in

August 1994, he joined Aseambankers Malaysia Berhad, the investment banking arm of Maybank Berhad as

Manager in the Corporate Finance Division. Subsequently in November 1996, he moved to Amanah Merchant Bank

Berhad (now known as Alliance Investment Bank Berhad) as Assistant General Manager. He left Amanah Group

in September 1998 to join Pengurusan Danaharta Nasional Berhad (Danaharta), a national asset management

company of Malaysia as the Head of Corporate Planning, Corporate Services Division.

Encik Hazli left Danaharta in October 2002 to set up Haziq Capital Sdn Bhd, a consultancy firm, specializing in

corporate finance, where he is currently the Managing Director. His key areas of expertise include taking companies

for listing on Bursa Malaysia Securities Berhad, corporate and debt restructuring and fund raising exercise. He is

currently an Independent Non-Executive Director of Mentiga Corporation Berhad and Lebtech Berhad. He is also

a Director of several private companies.

Encik Hazli has no family relationship with any Director and/or major shareholder of DutaLand Berhad, has no

conflict of interest with DutaLand Berhad and has no conviction for any offences within the past 10 years (other

than traffic offences, if any).

Encik Hazli attended all the five Board Meetings of DutaLand Berhad held in the financial year ended 30 June 2013.

MR CHEONG WONG SANG

ENCIK HAZLI BIN IBRAHIM

Independent Director Aged 56, Malaysian

Independent Director Aged 50, Malaysian

11

DutaLand Berhad (7296-V) Annual Report 2013

Profile of Directors (contd)

Corporate Governance Statement

The Board of Directors (Board) of DutaLand Berhad (DutaLand or Company) is committed towards ensuring

that good Corporate Governance is observed throughout the Group. Upholding integrity and professionalism

in its management of the affairs of the Group, the Board aims to enhance business prosperity and corporate

accountability with the ultimate objective of realising long-term shareholders value and safeguarding interests of

other stakeholders.

The Board will continuously evaluate the status of the Groups corporate governance practices and procedures

with a view to adopt and implement the best practices in so far as they are relevant to the Group, bearing in mind

the nature of the Groups businesses and the size of its business operations.

The Board is pleased to disclose below how the Group has applied the principles set out in the Malaysian Code

on Corporate Governance 2012 (Code) to its particular circumstances, having regard to the recommendations

stated under each principle and the Main Market Listing Requirements (MMLR) of Bursa Malaysia Securities

Berhad (Bursa Securities) and the extent to which it has complied with the principles and recommendations for

the financial year ended 30 June 2013.

BOARD OF DIRECTORS

Board Charter

The Board had adopted a Board Charter on 29 August 2012 which was designed to provide Directors and

Officers with greater clarity regarding the expanding role of the Board, the requirements of Directors in

carrying out their roles and discharging their duties to the Company, and the Boards operating practices.

The Board Charter will be reviewed from time to time and updated in accordance with the needs of the

Company and any new regulations that may have an impact on the roles and responsibilities of the Board.

The core areas of the Board Charter include the following:-

(i) Board Membership, which includes composition, appointments and re-election, independence of

Director and new directorship;

(ii) Board Role, which includes duties and responsibilities and matters reserved for the Board;

(iii) Board Leadership which includes the Chairman and the Group Managing Director;

(iv) Board Committees;

(v) Board Meetings;

(vi) Directors Remuneration;

(vii) Board Governance;

(viii) Board Evaluation and Performance;

(ix) Directors Training & Continuing Education;

(x) Board Relationship with Shareholders;

(xi) Management of Risks;

(xii) Share Dealings by Board Members; and

(xiii) Chartered Secretaries.

The details of the Board Charter are available for reference in DutaLand corporate website at

www.dutaland.com.my.

12

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Board Composition and Balance

The Board comprises one (1) Group Managing Director, one (1) Executive Director and a strong

presence of five (5) Non-Executive Directors of whom four (4) are Independent Non-Executive Directors.

Hence, the Company has fully complied with the provisions of the MMLR of Bursa Securities for independent

non-executive directors to make up at least one third (1/3

rd

) of the Board membership and for a director

who is qualified under Paragraph 15.09 (1)(c) of the MMLR of Bursa Securities to sit on the Audit Committee.

The Board is satisfied that the current composition with a balance mix of executive and non-executives

members does fairly represent the investment of the majority and minority shareholders in the Company.

The current Board brings with it a broad range of business, financial, technical and public service background.

This balance enables the Board to provide clear and effective leadership to the Group and bring informed

and independent judgement to many aspects of the Groups strategy and performance. Furthermore, the

current number of Board members is conducive for efficient deliberations at Board Meetings and effective

conduct of Board decision making.

There is a clear division of responsibilities at the helm of the Company to ensure a balance of authority

and power as the roles of the Chairman and the Group Managing Director are distinct and separate.

The Chairman of the Company is an Independent Non-Executive Director which provides effective

oversight over Management and reflects the Companys commitment to uphold corporate governance.

The Independent Non-Executive Chairman is primarily responsible for the orderly conduct of meetings of

the Board and facilitates matters between the Board and its investors. The Independent Non-Executive

Chairman will also be responsible for the leadership effectiveness conduct and governance of the Board.

The Group Managing Director is responsible for the development and implementation of policies/decision

approved by the Board, strategy, and managing the day-to-day operations of the Group. The Group

Managing Director acts as the Groups official spokesperson and is also responsible for planning the future

direction of the Group for the Boards consideration and approval.

The Group has complied throughout the financial year with the best practices of the Code except for

the identification of a Senior Independent Non-Executive Director. Given the current composition of the

Board which reflects a strong independent element and the separation of the roles of the Chairman and

the Group Managing Director, the Board does not consider it necessary at this juncture to identify a Senior

Independent Non-Executive Director. The Board is of the view that any concerns from shareholders can be

easily brought to the attention of the Board via the Chartered Secretaries.

The Board is also mindful of the recommendation of the Code on limiting the tenure of independent directors

to nine (9) years of service. Each of the four (4) Independent Directors of the Company has provided an

annual confirmation of his independence to the Nomination Committee and to the Board. The Nomination

Committee and the Board have determined at the assessment carried out on the Independent Directors,

in particular YBhg Tan Sri Dato Haji Lamin bin Haji Mohd Yunus and Mr Cheong Wong Sang, who have both

served on the Board for more than eleven (11) years, that:

a. they have no interest or ties in the Company that could adversely affect independent and objective

judgement and place the interest of the Company above all other interests;

b. they have met the criteria for independence as set out in Chapter 1 of the MMLR of Bursa Securities;

c. they continue to remain objective and are able to exercise independent judgement in expressing their

views and in participating in deliberations and decision making of the Board and Board Committees

in the best interest of the Company; and

d. they exercise due care as Independent Directors of the Company and carries out their profession

and fiduciary duties in the interest of the Company and shareholders.

13

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Board Composition and Balance (contd)

The Board is of the view that there are significant advantages to be gained from the long-serving Directors

who possess tremendous insight and knowledge of the Companys affairs. Furthermore, the ability of a

Director to serve effectively as an Independent Director is very much a function of his calibre, qualification,

experience and personal qualities, particularly of his integrity and objectivity in discharging his responsibilities

in good faith in the best interest of the Company and his duty to vigilantly safeguard the interests of the

minority shareholders of the Company, has no compelling relationship to his tenure as an Independent

Director. Although term limits could help to ensure that there are fresh ideas and viewpoints available to the

Board, they do pose the disadvantage of losing experienced Independent Directors who overtime have

developed increased insight in the Companys and/or the Groups operations and therefore, provide an

increasing contribution to the effectiveness of the Board as a whole.

The Board therefore opined that imposing a fixed term limit for Independent Directors does not necessarily

assure independence. The Board, therefore, recommends and supports the retention of YBhg Tan Sri Dato

Haji Lamin bin Haji Mohd Yunus and Mr Cheong Wong Sang as Independent Non-Executive Directors of the

Company.

The profile of the Board members are set out on pages 8 to 11 of this Annual Report.

Duties and Responsibilities of the Board

The Board leads the Group and is responsible for, amongst others, formulating and reviewing the overall

strategic plan, key policies, control and operations of the Group, identifying risks and ensuring the existence

of adequate internal controls and management systems to measure and manage risks. The presence of

Independent Non-Executive Directors helps in providing an independent and constructive views, advice and

opinions to the benefit of the investors, customers and other stakeholders. They also represent the element of

objectivity, impartiality and independent judgment of the Board. This ensures that there is adequate check

and balance at the Board level.

Board Meetings and Supply of Information

During the financial year ended 30 June 2013, the Board had met five (5) times whereby all Directors have

complied with the requirements in respect of Board Meeting attendance which are as follows:-

Name of Director

Number of Board Meetings

Held

(during tenure)

Attended

Tengku Datuk Seri Ahmad Shah Ibni Almarhum

Sultan Salahuddin Abdul Aziz Shah

5 5

Tan Sri Dato Yap Yong Seong 5 5

Yap Wee Chun 5 5

Dato Yap Wee Keat 5 5

Tan Sri Dato Haji Lamin bin Haji Mohd Yunus 5 4

Hazli bin Ibrahim 5 5

Cheong Wong Sang 5 5

14

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Board Meetings and Supply of Information (contd)

Board Meetings are scheduled to be held regularly, at least four (4) times in a financial year with sufficient

notice given for all Board Meetings of issues to be discussed. Additional Board Meetings may be called as

and when significant issues arise and which require the Boards decision. The dates for Board Meetings for

the ensuing financial year are scheduled well in advance and the Board has formal schedule of matters

specifically reserved for the Boards discussion and/or approval. The schedule ensures that the direction and

control of the Group are in the hands of the Board.

All issues discussed and all decisions made during the Board Meetings will be properly recorded by the

Chartered Secretaries and reviewed by the Board for completeness and accuracy. The minutes of Board

Meetings are circulated to all Directors for their perusal prior to confirmation of the minutes by the Chairman

of the meetings to be done at the commencement of the following Board Meeting. Senior Management

staff usually attends Board Meetings for purposes of briefing the Board on various matters submitted for their

consideration. The Board is satisfied with the level of commitment given by the Directors towards fulfilling

their roles and responsibilities as Directors of the Company.

In between Board Meetings, approvals on matters requiring the sanction of the Board are sought by way

of circular resolutions enclosing all relevant information to enable the Board to make informed decisions.

All circular resolutions approved by the Board will be tabled for notation and confirmation at the next Board

Meeting.

Notices of meetings setting out the agenda and the relevant Board papers are provided to all Directors

for their review in a timely manner prior to meetings. Financial and relevant information are also promptly

supplied by Senior Management to the Board at each meeting for purposes of discharging their duties and

responsibilities.

More details affecting business units ground operations, strategies and performances are usually presented

and discussed at the Management Executive Committee Meetings level held prior to the Board Meetings.

Specific matters that are reserved for the full Boards decision are key corporate strategies and plan involving

acquisitions and disposals of material assets, major investment decisions affecting the Groups direction and

policies and approvals of all financial results and announcements.

The Chairman of the Audit Committee would inform the Directors at the Board Meetings, of any salient

matters raised at the Audit Committee Meetings and which require the Boards notice or direction. The Board

has unrestricted and constant access to and interaction with the Senior Management of the Company and

also full access to all information within the Company whether as a full Board or in their individual capacities,

in furtherance of their duties.

The appointment of Chartered Secretaries is based on the capability and proficiency determined by the

Board. All members of the Board, whether as a whole or in their individual capacity, have access to the

advice of the Chartered Secretaries on all matters relating to the Group to assist them in the furtherance

of their duties. The Board is regularly updated and kept informed by the Chartered Secretaries and the

Management of the requirements such as restriction in dealing with the securities of the Company and

updates as issued by the various regulatory authorities including the latest developments in the legislations

and regulatory framework affecting the Group. The Articles of Association of the Company permits the

removal of Chartered Secretaries by the Board.

Where necessary, the Directors may, whether collectively as a Board or in their individual capacities, seek

external and independent professional advice from experts on any matter in furtherance of their duties as

they may deem necessary and appropriate at the Companys expense.

15

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Board Committees

The Board has also delegated specific responsibilities to Board Committees, namely the Audit Committee,

Nomination Committee and Remuneration Committee, all of which operate within defined terms of

reference. All these Board Committees do not have executive power but report to the Board on all matters

they have considered and recommended thereon.

A summary of the various Board Committees at DutaLand and their compositions are as follows:-

Name of Director

Audit

Committee

Remuneration

Committee

Nomination

Committee

Tengku Datuk Seri Ahmad Shah Ibni Almarhum

Sultan Salahuddin Abdul Aziz Shah

- - -

Tan Sri Dato Yap Yong Seong - Member -

Yap Wee Chun - - -

Tan Sri Dato Haji Lamin bin Haji Mohd Yunus Chairman Chairman Chairman

Dato Yap Wee Keat - - -

Hazli bin Ibrahim Member - Member

Cheong Wong Sang Member Member Member

Notes: -

1. the Audit Committee is comprised exclusively Independent Directors (compliance with Paragraph

15.09 of the MMLR of Bursa Securities)

2. the Remuneration Committee is comprised mainly Non-Executive Directors (as recommended in the

Code)

3. the Nomination Committee is comprised entirely Independent Directors (compliance with Paragraph

15.08A of the MMLR of Bursa Securities)

The Company also convenes regular Management Executive Committee Meetings which are attended by

Executive Directors and Senior Management personnel at least once quarterly to review and monitor the

performance of the Groups business units in meeting with its financial budgets and business targets.

Audit Committee

The Audit Committee takes on the role of reviewing the adequacy and integrity of the internal control

system and management information system of the Company and Group.

More details on the composition, terms of reference and functions of the Audit Committee are provided

under the Audit Committee Report set out on pages 30 to 33 of this Annual Report.

16

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Board Committees (contd)

Nomination Committee

The Nomination Committee was established by the Board on 27 February 2002 comprising entirely

Independent Directors to assist the Board in carrying out the following duties:-

a. To review, from time to time, the Policy Framework on the nomination and recommendation of

candidates to be members of the Board. In making its recommendations, the Nomination Committee

shall take into consideration candidates proposed by the Group Managing Director and, within

the bounds of practicability, by any other director or shareholder. The Nomination Committee shall

evaluate the candidates on the aspect of their:-

- skills, knowledge, expertise and experiences;

- professionalism;

- integrity; and

- for position of independent non-executive director, the candidates ability to discharge such

responsibilities/functions independently as expected from the independent non-executive

director.

b. To review annually the Boards required mix of skills, experience and other qualities including the core

competencies which non-executive directors should bring to the Board;

c. To assess annually the effectiveness of the Board as a whole, the standing committees of the Board

and the contribution of each individual Director, including the Independent Non-Executive Directors,

the Group Managing Director and the Executive Director through a process directed by the Board.

In line with the Code, the Nomination Committee carries out annual evaluation on the effectiveness of the

Board as a whole, the various Committees and each Independent Non-Executive Directors contribution to

the effectiveness of the Boards decision making process.

All assessments and evaluations carried out by the Nomination Committee are properly documented.

The Nomination Committee met once during the financial year ended 30 June 2013 and all the members

attended the meeting.

Remuneration Committee

The Remuneration Committee was established by the Board on 27 February 2002 and comprises mainly

Non-Executive Directors.

The Remuneration Committees main responsibility is to review and recommend to the Board the framework

of Executive Directors remuneration, in particular, the remuneration packages for the Executive Directors in

all its forms, drawing from outside advice, where necessary and fees payable to the Non-Executive Directors.

The Board as a whole determines the remuneration package of Non-Executive Directors. The respective

Directors shall abstain from deliberations in respect of their own remuneration packages.

The Remuneration Committee met once during the financial year ended 30 June 2013 with full attendance

of its members.

17

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Board Evaluation

The Board has conducted an annual evaluation of the effectiveness of the Board and its Board Committees.

The evaluation process is led by the Nomination Committee Chairman and supported by the Chartered

Secretaries. The evaluation results are considered by the Nomination Committee, which then make

recommendations to the Board, are aimed at helping the Board to discharge its duties and responsibilities.

The evaluation of the Board is based on specific criteria, covering areas such as the Board composition

and structure, principal responsibilities of the Board, the Board process, the Group Managing Directors

performance, succession planning and Board governance.

The 2012 performance evaluation of the Board has been structured to ensure a balanced and objective

review by the Directors for the above key areas.

Following the evaluation, the Board concluded that the Board as a whole and its committees had performed

well, were effective and had all the necessary skills, experiences and qualities to lead the Company.

The Board has also undertaken an annual assessment of the independence of its Independent Directors.

The criteria for assessing the independence of an Independent Director were developed by the Nomination

Committee with the support of the Chartered Secretaries which include the relationship between the

Independent Director and the Company and his involvement in any significant transaction with the Company.

Appointment of Directors

The Board, through the Nomination Committee, will review the suitability of an individual to be appointed

on the Board taking into account the skills, expertise, background and experience. The decision as to who

shall be nominated remains the responsibility of the full Board after considering the recommendations of

the Nomination Committee. Following appointment, new Director(s) will be duly briefed via an orientation

familiarisation programme, the Company and Groups businesses, operations and management level to

facilitate better understanding overall.

The Board appoints its members through an independent and objective selection process. This process has

been reviewed and approved by the Board. The potential candidates will be considered and evaluated

by the Nomination Committee. The Nomination Committee will then recommend the candidates to be

approved and appointed by the Board. The Chartered Secretaries will ensure that all appointments are

properly made, all the necessary information is obtained as well as all legal and regulatory obligations are

met.

The Nomination Committee in evaluating the appointment of Directors look for diversity of skills and

experience in its Directors and the selection is not just based on gender. DutaLand does not have a policy

on boardroom diversity but believes in providing equal opportunity to all candidates based on merit.

Re-appointment and Re-election of Directors

As the capacity, energy and enthusiasm of a Director is not necessarily link to age, it is deemed not

appropriate to prescribe age limits for the retirement of Directors. The Board believes in having a healthy mix

of age and experience and therefore does not prescribe a minimum or maximum age limit for the Board

apart from what is laid down under the Companies Act, 1965.

18

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Re-appointment and Re-election of Directors (contd)

Pursuant to Section 129(2) of the Companies Act, 1965, Directors who have attained the age of 70 years are

required to retire at every annual general meeting and may offer themselves for re-appointment to hold

office until the next annual general meeting.

The Articles of Association of the Company provides for all Directors to retire from office at least once

every three (3) years at each annual general meeting in compliance with the MMLR of Bursa Securities.

Each retiring Director is eligible for re-election. In addition, one third (1/3

rd

) of the Board, including the Group

Managing Director, shall retire by rotation and shall be eligible for re-election at each annual general

meeting. This provides an opportunity for the Companys shareholders to renew their mandate. The said

Articles of Association also provides that a Director appointed by the Board during the financial year shall

be subject to re-election at the forthcoming annual general meeting after his appointment.

Retiring Directors who are seeking re-election are subject to Directors assessment overseen by the Nomination

Committee. Following the assessment, the Board, on the recommendation of the Nomination Committee,

make a determination as to whether it will endorse a retiring Director for re-election and/or re-appointment.

Upon the recommendation of the Nomination Committee, the following Directors shall retire at the

forthcoming Forty-Sixth Annual General Meeting of the Company and had offered themselves for

re-election: -

a. Mr Yap Wee Chun, retiring pursuant to Article 85 of the Articles of Association of the Company;

b. Mr Cheong Wong Sang, retiring pursuant to Article 85 of the Articles of Association of the Company;

c. YBhg Tan Sri Dato Yap Yong Seong, retiring pursuant to Section 129 of the Companies Act, 1965; and

d. YBhg Tan Sri Dato Haji Lamin bin Haji Mohd Yunus, retiring pursuant to Section 129 of the Companies

Act, 1965.

As a policy, the Board itself would assess, evaluate and determine the independence of an Independent

Director when he is due for retirement and/or re-appointment at the annual general meeting of the

Company, notwithstanding that the tenure of the Independent Director has been more than nine (9) years.

Directors Training

All members of the Board have successfully completed the Mandatory Accreditation Programme as

required by Bursa Securities. The Directors are aware and are encouraged to attend continuing education

programmes, seminars and conferences to keep themselves abreast of the current developments and

business environment affecting their roles and responsibilities to the Group.

The Chartered Secretaries facilitate Directors attendances at external programmes and keep a complete

records of the training received or attended by the Directors.

19

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

BOARD OF DIRECTORS (contd)

Directors Training (contd)

For the financial year ended 30 June 2013, all Directors have attended the following training programme:

Director Training Programme

Mode of

Training

Duration of

Training

Tengku Datuk Seri Ahmad

Shah Ibni Almarhum Sultan

Salahuddin Abdul Aziz Shah

Director Duties, Regulatory Updates

And Governance Seminar For

Directors Of PLCs 2013

Seminar 1-day

Enterprise Risk Management

What A Director Must Know

Training 1-day

Tan Sri Dato Yap Yong Seong Advocacy Sessions On Corporate

Disclosure For Directors

Talk -day

Tan Sri Dato Haji Lamin bin

Haji Mohd Yunus

International Conference: Plight Of

The Rohingya : Solution?

Conference 1 day

International Conference on 9/11

Revisited Seeking The Truth

Conference 1 day

International Conference on

War-Affected Children

Conference -day

Yap Wee Chun Fraud Detection And Prevention

A Necessity, Not A Choice

Seminar -day

Dato Yap Wee Keat Forbes Global CEO Conference Conference 3-day

Cheong Wong Sang Fraud Detection And Prevention

A Necessity, Not A Choice

Seminar -day

Hazli bin Ibrahim Audit Committee Expanded

Governance Oversight Role :

Are You Equipped

Seminar -day

Related Party Transaction Doing It

Right For Results

Presentation -day

The Board views the aforementioned training programmes attended and/or participated by the Directors,

and the updates provided to the Directors from time to time as sufficient to meet the skills and knowledge

required to carry out their duties as Directors.

20

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

DIRECTORS REMUNERATION

Remuneration, Procedures and Disclosure

The level and make-up of remuneration

The Board endeavours to ensure that the levels of remuneration offered for Directors are sufficient to attract

and retain people needed to run the Group successfully. In the case of the Group Managing Director and

Executive Director, the component parts of their remuneration are structured to link rewards to corporate

and individual performance while ensuring that the level of remuneration commensurate with the market,

the experience and the level of responsibilities undertaken. The Executive Directors are not paid any

Directors fee. In the case of Non-Executive Directors, the level of fees reflects the contribution and level of

responsibilities undertaken by the particular non-executives concerned.

The Directors fees recommended for Independent Directors reflect the experience and responsibilities levels

of the Directors concerned. Directors fees payable to Independent Directors are subject to the approval

of the shareholders of the Company at annual general meeting held yearly. Independent Directors are also

paid meeting allowances for each Board Meetings, Audit Committee Meetings and also general meetings

that they attend.

Disclosure on Directors Remuneration

The aggregate remuneration of Directors, and Directors fees of the Company, distinguishing between

Executive and Non-Executive Directors for the financial year ended 30 June 2013, are categorised into the

following components:

Directors

Fees

(RM000)

Basic Salary

(RM000)

Bonuses/

Commissions

(RM000)

Allowances

& Statutory

Contribution

(RM000)

Benefits-

in-kind

(RM000)

Total

(RM000)

Executive - 1,754 180 373 458 2,765

Non-Executive 144 - - 12 - 156

The number of Directors whose remunerations fall in each successive band of RM50,000 are shown as follows:

Range of Remuneration

Number of Directors

Executive Non-Executive

Below RM50,000 - 4

RM1,150,001 to RM1,200,000 1 -

RM1,600,001 to RM1,650,000 1 -

Directors Share Options

There is no Directors Share Options Scheme in the Company during the financial year ended 30 June 2013.

21

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

RELATIONSHIP WITH SHAREHOLDERS AND INVESTORS

The Board firmly believes that the annual general meeting of the Company (AGM) is the best forum to promote a

closer relationship with our shareholders, enabling us to continue our engagement process with them and to keep

shareholders informed of all material business and corporate developments concerning the Group. The AGM also

provides an opportunity for the Companys shareholders to participate in a Question and Answer Session relevant

to the Companys business. To encourage shareholders participation at general meeting, the Chairman will also

inform shareholder of their right to demand a poll vote at the commencement of the general meeting. In addition,

a press conference where necessary, will be held immediately after the AGM to provide any further clarifications

and to respond to questions raised.

Another important channel to reach its shareholders and investors is through the Annual Report. Besides including

comprehensive financial performance and information on the business activities, the Group strives to improve the

contents of the Annual Report in line with the developments in corporate governance practices. Notice of AGM

and annual report are sent to all shareholders of the Company at least twenty one (21) days before the date of the

AGM. The Company Annual Report can be accessed at the Companys website via a direct link to Bursa Securities

website.

The corporate website, www.dutaland.com.my also provides an avenue for the Companys shareholders,

investors and members of the public to access the Groups information and corporate announcements. The Board

acknowledges the need for the Companys shareholders and investors to be informed of all material businesses

and corporate developments concerning the Group in a timely manner. In addition to various announcements

made during the year, the timely release of the Groups consolidated financial results on quarterly basis provides

the shareholders and investors with an overview of the Groups financial and operational performances so as to

enable the investment community to make careful and informed investment decisions on the Companys securities.

With a direct link to Bursa Securities website, all announcements made by the Company to Bursa Securities are

published shortly after the same are released on Bursa Securities website.

Apart from the mandatory announcement on the Groups financial results and corporate developments to Bursa

Securities, investors and members of the public who wish to contact on any matters can channel their questions

through email to dutaland@dutaland.com.my. All shareholders queries will be received by the Chartered

Secretaries who will provide feedback and responses to shareholders queries where such information can be

made available to the public.

ACCOUNTABILITY AND AUDIT

Financial Reporting

The Board is responsible for the quality and completeness of publicly disclosed financial reports. In presenting

the annual financial statements, quarterly reports and the annual reports to the shareholders of the

Company, the Board takes appropriate steps to present a clear and balanced assessment of the Groups

position and prospects. This also applies to other price-sensitive public announcements and reports to the

regulatory authorities.

The Groups financial statements and quarterly announcements, prepared using appropriate accounting

policies, consistently and supported by reasonable and prudent judgments and estimates, will be reviewed

and deliberated by the Audit Committee in the presence of the external auditors, internal auditors of the

Company and the Head of Group Finance prior to recommending them for adoption by the Board. The Audit

Committee ensures that the information to be disclosed are accurate, adequate and in compliance with

the various disclosure requirements imposed by the relevant authorities. The Board discusses and reviews the

recommendations proposed by the Audit Committee prior to its adoption. The Board also ensures accurate

and timely release of the Groups quarterly and annual financial results to Bursa Securities.

22

DutaLand Berhad (7296-V) Annual Report 2013

Corporate Governance Statement (contd)

ACCOUNTABILITY AND AUDIT (contd)

Directors Responsibility Statement

The Directors are required under the Companies Act, 1965 (Act), to prepare financial statements for each

financial year which give a true and fair view of the financial position of the Group and of the Company and

of its financial performance and cash flows for the financial year then ended. As required by the Act and

the MMLR of Bursa Securities, the financial statements have been prepared in accordance with Financial

Reporting Standards and the Companies Act, 1965 in Malaysia.

The Directors consider that, in preparing these financial statements, the Group and the Company have used

appropriate accounting policies and applied them consistently and made judgements and estimates that

are reasonable and prudent. The Directors also ensure that all applicable approved accounting standards

have been followed.

The Directors are responsible and have ensure that proper accounting records are kept under the Act,

that disclose with reasonable accuracy, the financial positions and results of the Group and the Company.

The Directors are also responsible for taking necessary and reasonable steps to safeguard the assets of the

Company and the Group and to prevent and detect fraud and other irregularities.

Risk Management Framework and Internal Control

The Board acknowledges its overall responsibilities for maintaining a sound system of internal control which

covers not only financial controls but also operational, compliance and risk management. The Audit

Committee of the Company has been established, which is assisted by an independent internal audit

function in the discharge of its duties and responsibilities.

The Groups Statement on Risk Management and Internal Control is set out on pages 28 to 29 of this Annual

Report.

Relationship with External Auditors

A formal mechanism has been established by the Audit Committee to ensure that there is frank, transparent

and candid dialogue with the external auditors. The external auditors attended three (3) out of the five

(5) Audit Committee Meetings of the Company held during the financial year. The external auditors will

highlight to the Audit Committee and the Board on matters that require the Audit Committees or the

Boards attention together with the recommended corrective actions thereof. The Management is held

responsible for ensuring that all these corrective actions are undertaken within an appropriate time frame.

The Audit Committee also meets the external auditors at least once during the financial year without the

presence of the Executive Directors and Management. This allows the Audit Committee and the external

auditors the exchange of free and honest views and opinions on matters related to external auditors audit

and findings.

The external auditors has confirmed their independence and provided the required independent

declaration to the Audit Committee for the financial year ended 30 June 2013 in accordance with the firms

requirements and with the provisions of the By-Laws on Professional Independence of the Malaysian Institute

of Accountants.

A report by the Audit Committee together with its summary of Terms of Reference is set out on pages 30 to 33

of this Annual Report.

23

DutaLand Berhad (7296-V) Annual Report 2013

CODE AND POLICIES

Directors Code of Conduct

The Board has adopted a Directors Code of Conduct on 29 August 2012. In addition to the Company

Directors Code of Ethics established by the Companies Commission of Malaysia, the Directors Code of

Conduct is the Boards commitment towards establishing a corporate culture which engenders ethical

conduct that permeates throughout the Company and ensuring the implementation of appropriate internal

systems to support, promote and ensure its compliance.

The details of the Directors Code of Conduct are available for reference on DutaLands corporate website

at www.dutaland.com.my.

Whistle-Blowing Policy

The Whistle-Blowing Policy of the Company was adopted on 29 August 2012 following the introduction of

the Whistleblower Protection Act 2010 to enhance the coverage and protection to whistleblowers, which

encompasses report of suspected and/or known misconduct, wrongdoings, corruption and instances of

fraud, waste, and/or abuse involving the resources of the Group. The aim of this policy is to encourage the

reporting of such matters, in good faith, with the confidence that employees making such reports will, to the

extent possible, be protected from reprisal.

The Whistle-Blowing Policy is posted on DutaLand corporate website at www.dutaland.com.my for ease of

access for reporting by employees and associates of the Group.

Corporate Disclosure Policy

The Board places importance in ensuring disclosure made to shareholders and investors is comprehensive,

accurate and on a timely and even basis as it is critical towards building and maintaining corporate

credibility and investor confidence.

A Corporate Disclosure Policy for the Group was adopted on 29 August 2012 to set out the policies and

procedures on disclosure of material information of the Group following emphasis by Bursa Securities as

outlined in Bursa Securities Corporate Disclosure Guide.

This Corporate Governance Statement has been approved by the Board of DutaLand on 19 September 2013.

Corporate Governance Statement (contd)

24

DutaLand Berhad (7296-V) Annual Report 2013

Additional Compliance Information

a) Non-Audit Fees

The amount of non-audit fee incurred for services rendered to the Group by the external auditors and their

affiliated companies for the financial year ended 30 June 2013 was RM6,000.00.

b) Material Contracts

There were no material contracts entered into by the Company and its subsidiaries involving Directors and

major shareholders interests still subsisting at the end of the financial year ended 30 June 2013 except for a

consortium agreement dated 14 February 2003 entered into between KH Estates Sdn Bhd, a wholly-owned

subsidiary of DutaLand (KHE) and Olympia Properties Sdn Bhd, a wholly-owned subsidiary of Olympia

Industries Berhad (OIB) (OP) for the proposed joint development of the land measuring approximately

41.14 and 32.3 acres situated at Mukim Batu, District of Kuala Lumpur, State of Wilayah Persekutuan.

YBhg Tan Sri Dato Yap Yong Seong, YBhg Dato Yap Wee Keat and Mr Yap Wee Chun are Directors of

DutaLand and deemed major shareholders of both DutaLand and OIB. Both YBhg Tan Sri Dato Yap Yong

Seong and YBhg Dato Yap Wee Keat are also common Directors of OIB, except for Mr Yap Wee Chun who

is not a Director of OIB. YBhg Tan Sri Dato Yap Yong Seong, YBhg Dato Yap Wee Keat and Mr Yap Wee Chun

are deemed interested in the subsidiaries of DutaLand and OIB by virtue of their direct and indirect equity

interests each in DutaLand and OIB respectively. OIB is a former associated company of DutaLand.

c) Recurrent Related Party Transactions of a Revenue or Trading Nature (RRPT)

The Company had obtained shareholders mandate at the Forty-Fifth Annual General Meeting of the

Company held on 24 October 2012 to allow the Group to enter into RRPT with related parties.

The transactions entered into were in the ordinary course of business and were carried out on terms and

conditions not materially different from those obtainable from transactions with unrelated parties.

The details of the RRPT under Paragraph 10.09 of Bursa Securities MMLR conducted during the financial year

ended 30 June 2013 pursuant to the shareholders mandate are as follows: -

Related Parties involved

with DutaLand and/or its

subsidiaries Nature of Transactions Relationship

Aggregate value for

financial year ended

30 June 2013

(RM000)

Miles And Miles Leisure Sdn

Bhd (MNM) and Olympia

Travels & Tours (Singapore)

Pte Ltd (OTTS)

Purchase of air

tickets, hotel

accommodation

and other travel

arrangements from

MNM and OTTS,

which are in the travel

business

MNM and OTTS are

both wholly-owned

subsidiaries of OlB

677

Dairy Maid Resort &

Recreation Sdn Bhd (DMRR)

Rental of office

space and parking at

Menara Olympia,

No. 8, Jalan Raja

Chulan, 50200 Kuala

Lumpur which is

owned by DMRR

DMRR is a wholly-

owned subsidiary

of OlB

802

Total 1,479

25

DutaLand Berhad (7296-V) Annual Report 2013

Additional Compliance Information (contd)

c) Recurrent Related Party Transactions of a Revenue or Trading Nature (RRPT) (contd)

The details of the RRPT for the provision of financial assistance under Practice Note 12 of Bursa Securities

MMLR conducted during the financial year ended 30 June 2013 pursuant to the shareholders mandate are

as follows: -

Related Parties involved

with DutaLand and/or its

subsidiaries Nature of Transactions Relationship

Aggregate value for

financial year ended

30 June 2013

(RM000)

Duta Grand Hotels Sdn

Bhd (DGH)

1) Provision of financial

assistance to meet

preliminary costs such

as consultants fees

and other professional

fees as well as

pre-operational

costs such as

insurances, quit rents,

assessments, staff

costs, security services

for the upkeep and

maintenance relating

to the DGH project

DGH is 76% owned

by DutaLand with

the remaining 24%

held by Duta Credit

Sdn Bhd, a company

controlled by the

major shareholders

and/or certain

Directors of DutaLand

850

2) Provision of corporate

guarantee to

contractors and sub-

contractors relating to

the DGH project

Nil

Total 850

d) Share Buybacks

The Company does not have a scheme to buy back its own shares.

e) Options or Convertible Securities

The following convertible securities which were issued by the Company pursuant to the Trust Deeds dated

25 August 2006 respectively, made between DutaLand and Malaysian Trustees Berhad (21666-V), were

exercised during the financial year ended 30 June 2013: -

1. Conversion of 6-Year Irredeemable Convertible Unsecured Loan Stocks 2007/2013 (ICULS)

There was an issuance of 233,874,756 new ordinary shares of RM1.00 each arising from the conversion

of RM275,972,365.00 nominal value of ICULS (including those ICULS reaching maturity) at a conversion

price of RM1.18 nominal value of ICULS for one new ordinary share of the Company.

2. Conversion of 6-Year Irredeemable Convertible Bonds 2007/2013 (ICB)

There was an issuance of 6,477,851 new ordinary shares of RM1.00 each arising from the mandatory

conversion of RM7,644,000.00 nominal value of ICB (on reaching maturity) at a conversion price of

RM1.18 nominal value of ICB for one new ordinary share of the Company.

During the financial year ended 30 June 2013, 3,410,186 new ordinary shares of RM1.00 each were also issued

by the Company pursuant to the mandatory exchange of USD1,320,000.00 [equivalent to RM4,024,020.00

(being the RM Equivalent Rate of RM3.0485 to USD1.00)] nominal value of 6-Year Irredeemable Exchangeable

Bonds 2007/2013 (IEB) (on reaching maturity) at an exchange price of RM1.18 nominal value of IEB for one

new ordinary share of the Company.

26

DutaLand Berhad (7296-V) Annual Report 2013

Additional Compliance Information (contd)

e) Options or Convertible Securities (contd)

Save as disclosed above, there were no options or other convertible securities exercised and the Company

did not issue any options or convertible securities during the financial year.

f) Depository Receipt Programme

The Company did not sponsor any depository receipt programme during the financial year under review.

g) Variation in Results

There were no variances of 10% or more between the audited results for the financial year ended 30 June

2013 and the unaudited results previously announced.

h) Sanctions and/or Penalties

The Company and its subsidiaries, Directors and Management have not been imposed with any sanctions

and/or penalties by the relevant regulatory bodies for the financial year ended 30 June 2013.

i) Profit Guarantee

There were no profit guarantees given by the Company during the financial year.

j) Utilisation of Proceeds from Corporate Proposal

The proceeds raised from the divestment of 70% effective equity interest in Olympia Plaza Sdn Bhd, a wholly-