Chapter 2: Asset Classes and Financial Instruments: Problem Sets

Diunggah oleh

Biloni Kadakia0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

104 tayangan6 halamanPreferred stock has a higher priority than common e#uity but a loer priority than bonds. Money market securities are called cash equivalents because of their high le"el of li#uidity. Epos are typically used by securities dealers as a means for obtaining funds to purchase securities.

Deskripsi Asli:

Judul Asli

BKM 10e Chap002 SM Final (4)

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniPreferred stock has a higher priority than common e#uity but a loer priority than bonds. Money market securities are called cash equivalents because of their high le"el of li#uidity. Epos are typically used by securities dealers as a means for obtaining funds to purchase securities.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

104 tayangan6 halamanChapter 2: Asset Classes and Financial Instruments: Problem Sets

Diunggah oleh

Biloni KadakiaPreferred stock has a higher priority than common e#uity but a loer priority than bonds. Money market securities are called cash equivalents because of their high le"el of li#uidity. Epos are typically used by securities dealers as a means for obtaining funds to purchase securities.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 6

Chapter 2 - Asset Classes and Financial Instruments

CHAPTER 2: ASSET CLASSES AND FINANCIAL

INSTRUMENTS

PROBLEM SETS

1. Preferred stock is like long-term debt in that it typically promises a fixed payment

each year. In this ay! it is a perpetuity. Preferred stock is also like long-term debt

in that it does not gi"e the holder "oting rights in the firm.

Preferred stock is like e#uity in that the firm is under no contractual obligation to

make the preferred stock di"idend payments. Failure to make payments does not set

off corporate bankruptcy. $ith respect to the priority of claims to the assets of the

firm in the e"ent of corporate bankruptcy! preferred stock has a higher priority than

common e#uity but a loer priority than bonds.

2. %oney market securities are called cash equivalents because of their high le"el

of li#uidity. &he prices of money market securities are "ery stable! and they can

be con"erted to cash 'i.e.! sold( on "ery short notice and ith "ery lo

transaction costs. )xamples of money market securities include &reasury bills!

commercial paper! and banker*s acceptances! each of hich is highly marketable

and traded in the secondary market.

+. 'a( A repurchase agreement is an agreement hereby the seller of a security

agrees to ,repurchase- it from the buyer on an agreed upon date at an agreed

upon price. .epos are typically used by securities dealers as a means for

obtaining funds to purchase securities.

/. 0preads beteen risky commercial paper and risk-free go"ernment securities

ill iden. 1eterioration of the economy increases the likelihood of default on

commercial paper! making them more risky. In"estors ill demand a greater

premium on all risky debt securities! not 2ust commercial paper.

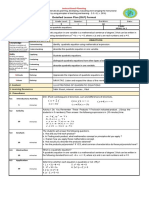

3.

Corp. 4onds Preferred 0tock Common 0tock

5oting rights 'typically( 6es

contractual obligation 6es

Perpetual payments 6es 6es

Accumulated di"idends 6es

Fixed payments 'typically( 6es 6es

Payment preference First 0econd &hird

2-1

Chapter 2 - Asset Classes and Financial Instruments

7. %unicipal bond interest is tax-exempt at the federal le"el and possibly at the

state le"el as ell. $hen facing higher marginal tax rates! a high-income in"estor

ould be more inclined to in"est in tax-exempt securities.

8. a. 6ou ould ha"e to pay the ask price of9

161.1875% of par value of $1,000 = $1611.875

b. The coupon rate is 6.25% implyin coupon payments of

$62.50 annually or, more precisely, $!1.25 semiannually.

c. &he yield to maturity on a fixed income security is also knon as its re#uired

return and is reported by The Wall Street Journal and others in the financial

press as the ask yield. In this case! the yield to maturity is 2.11+:. An in"estor

buying this security today and holding it until it matures ill earn an annual

return of 2.11+:. 0tudents ill learn in a later chapter ho to compute both

the price and the yield to maturity ith a financial calculator.

;. &reasury bills are discount securities that mature for <1=!===. &herefore! a specific &-

bill price is simply the maturity "alue di"ided by one plus the semi-annual return9

P > <1=!===?1.=2 > <@!;=+.@2

@. &he total before-tax income is </. After the 8=: exclusion for preferred stock

di"idends! the taxable income is9 =.+= </ > <1.2=

&herefore! taxes are9 =.+= <1.2= > <=.+7

After-tax income is9 </.== A <=.+7 > <+.7/

.ate of return is9 <+.7/?</=.== > @.1=:

1=. a. 6ou could buy9 <3!===?<7/.7@ > 88.2@ shares. 0ince it is not possible to trade in

fractions of shares! you could buy 88 shares of B1.

b. 6our annual di"idend income ould be9 88 <2.=/ > <138.=;

c. &he price-to-earnings ratio is @.+1 and the price is <7/.7@. &herefore9

<7/.7@?)arnings per share > @.+ )arnings per share > <7.@7

d. Beneral 1ynamics closed today at <7/.7@! hich as <=.73 higher than

yesterdayCs price of <7/.=/

2-2

Chapter 2 - Asset Classes and Financial Instruments

11. a. At t > =! the "alue of the index is9 '@= D 3= D 1==(?+ > ;=

At t > 1! the "alue of the index is9 '@3 D /3 D 11=(?+ > ;+.+++

&he rate of return is9 ';+.+++?;=( 1 > /.18:

b. In the absence of a split! 0tock C ould sell for 11=! so the "alue of the

index ould be9 23=?+ > ;+.+++ ith a di"isor of +.

After the split! stock C sells for 33. &herefore! e need to find the di"isor

'd( such that9 ;+.+++ > '@3 D /3 D 33(?d d > 2.+/=. &he di"isor fell!

hich is alays the case after one of the firms in an index splits its

shares.

c. &he return is Eero. &he index remains unchanged because the return for

each stock separately e#uals Eero.

12. a. &otal market "alue at t > = is9 '<@!=== D <1=!=== D <2=!===( > <+@!===

&otal market "alue at t > 1 is9 '<@!3== D <@!=== D <22!===( > </=!3==

.ate of return > '</=!3==?<+@!===( A 1 > +.;3:

b. &he return on each stock is as follos9

rA > '@3?@=( A 1 > =.=337

rB > '/3?3=( A 1 > A=.1=

rC > '11=?1==( A 1 > =.1=

&he e#ually eighted a"erage is9

F=.=337 D '-=.1=( D =.1=G?+ > =.=1;3 > 1.;3:

1+. &he after-tax yield on the corporate bonds is9 =.=@ '1 A =.+=( > =.=7+ > 7.+=:

&herefore! municipals must offer a yield to maturity of at least 7.+=:.

1/. )#uation '2.2( shos that the e#ui"alent taxable yield is9 r > r

m

?'1 A t(! so simply

substitute each tax rate in the denominator to obtain the folloing9

a. /.==:

b. /.//:

c. 3.==:

d. 3.81:

2-+

Chapter 2 - Asset Classes and Financial Instruments

13. In an e#ually eighted index fund! each stock is gi"en e#ual eight regardless of its

market capitaliEation. 0maller cap stocks ill ha"e the same eight as larger cap

stocks. &he challenges are as follos9

Bi"en e#ual eights placed to smaller cap and larger cap! e#ual-

eighted indices ')$I( ill tend to be more "olatile than their market-

capitaliEation counterpartsH

It follos that )$Is are not good reflectors of the broad market that they

representH )$Is underplay the economic importance of larger

companies.

&urno"er rates ill tend to be higher! as an )$I must be rebalanced

back to its original target. 4y design! many of the transactions ould be

among the smaller! less-li#uid stocks.

17. a. &he ten-year &reasury bond ith the higher coupon rate ill sell for a higher

price because its bondholder recei"es higher interest payments.

b. &he call option ith the loer exercise price has more "alue than one ith a

higher exercise price.

c. &he put option ritten on the loer priced stock has more "alue than one

ritten on a higher priced stock.

18. a. 6ou bought the contract hen the futures price as <8.;+23 'see Figure

2.11 and remember that the number to the right of the apostrophe represents an

eighth of a cent(. &he contract closes at a price of <8.;823! hich is <=.=/ more

than the original futures price. &he contract multiplier is 3===. &herefore! the

gain ill be9 <=.=/ 3=== > <2==.==

b. Ipen interest is 1+3!88; contracts.

1;. a. Ining the call option gi"es you the right! but not the obligation! to buy at

<1;=! hile the stock is trading in the secondary market at <1@+. 0ince the

stock price exceeds the exercise price! you exercise the call.

&he payoff on the option ill be9 <1@+ - <1;= > <1+

&he cost as originally <12.3;! so the profit is9 <1+ - <12.3; > <=./2

b. 0ince the stock price is greater than the exercise price! you ill exercise the call.

&he payoff on the option ill be9 <1@+ - <1;3 > <;

&he option originally cost <@.83! so the profit is <; - <@.83 > -<1.83

c. Ining the put option gi"es you the right! but not the obligation! to sell at <1;3!

but you could sell in the secondary market for <1@+! so there is no "alue in

2-/

Chapter 2 - Asset Classes and Financial Instruments

exercising the option. 0ince the stock price is greater than the exercise price!

you ill not exercise the put. &he loss on the put ill be the initial cost of

<12.=1.

1@. &here is alays a possibility that the option ill be in-the-money at some time prior to

expiration. In"estors ill pay something for this possibility of a positi"e payoff.

2=.

5alue of Call at )xpiration Initial Cost Profit

= / -/

= / -/

= / -/

3 / 1

1= / 7

5alue of Put at )xpiration Initial Cost Profit

1= 7 /

3 7 -1

= 7 -7

= 7 -7

= 7 -7

21. A put option con"eys the right to sell the underlying asset at the exercise price. A

short position in a futures contract carries an obligation to sell the underlying asset

at the futures price. 4oth positions! hoe"er! benefit if the price of the underlying

asset falls.

22. A call option con"eys the right to buy the underlying asset at the exercise price. A

long position in a futures contract carries an obligation to buy the underlying asset

at the futures price. 4oth positions! hoe"er! benefit if the price of the underlying

asset rises.

CFA PROBLEMS

1. 'd( &here are tax ad"antages for corporations that on preferred shares.

2. &he e#ui"alent taxable yield is9 7.83:?'1 =.+/( > 1=.2+:

+. 'a( $riting a call entails unlimited potential losses as the stock price rises.

2-3

Chapter 2 - Asset Classes and Financial Instruments

/. a. &he taxable bond. $ith a Eero tax bracket! the after-tax yield for the

taxable bond is the same as the before-tax yield '3:(! hich is greater than

the yield on the municipal bond.

b. &he taxable bond. &he after-tax yield for the taxable bond is9

=.3 '1 A =.1=( > /.3:

c. 6ou are indifferent. &he after-tax yield for the taxable bond is9

=.=3 '1 A =.2=( > /.=:

&he after-tax yield is the same as that of the municipal bond.

d. &he municipal bond offers the higher after-tax yield for in"estors in tax

brackets abo"e 2=:.

3. If the after-tax yields are e#ual! then9 =.=37 > =.=; J '1 A t(

&his implies that t > =.+= >+=:.

2-7

Anda mungkin juga menyukai

- Rental-Property Profits: A Financial Tool Kit for LandlordsDari EverandRental-Property Profits: A Financial Tool Kit for LandlordsBelum ada peringkat

- Piping Presentation - PpsDokumen61 halamanPiping Presentation - PpsVijayabaraniBelum ada peringkat

- Case #84 Risk and Rates of Return - Filmore EnterprisesDokumen9 halamanCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- Solution For "Financial Statement Analysis" Penman 5th EditionDokumen16 halamanSolution For "Financial Statement Analysis" Penman 5th EditionKhai Dinh Tran64% (28)

- BEC 0809 AICPA Newly Released QuestionsDokumen22 halamanBEC 0809 AICPA Newly Released Questionsrajkrishna03Belum ada peringkat

- MD Boiler Asme WTDokumen159 halamanMD Boiler Asme WTdodikBelum ada peringkat

- Chapter 7: Optimal Risky Portfolios: Problem SetsDokumen13 halamanChapter 7: Optimal Risky Portfolios: Problem SetsBiloni KadakiaBelum ada peringkat

- Investments Global Edition 10th Edition Bodie Solutions ManualDokumen6 halamanInvestments Global Edition 10th Edition Bodie Solutions Manuala609526046Belum ada peringkat

- Hydratight Flange Facing MachineDokumen30 halamanHydratight Flange Facing MachineDilipBelum ada peringkat

- Reference BookDokumen313 halamanReference BooknirdeshBelum ada peringkat

- eAM Data Model 012808Dokumen19 halamaneAM Data Model 012808Shanish Poovathodiyil100% (1)

- Length Standards EngDokumen1 halamanLength Standards EngAsif Hameed100% (2)

- Basic Industrial BiotechnologyDokumen29 halamanBasic Industrial BiotechnologyBharathiBelum ada peringkat

- Executive Leadership-Asia-Pacific: Mukesh Ambani: - Biloni Doshi - Tom PhillipsDokumen15 halamanExecutive Leadership-Asia-Pacific: Mukesh Ambani: - Biloni Doshi - Tom PhillipsBiloni KadakiaBelum ada peringkat

- Chapter 9: The Capital Asset Pricing Model: Problem SetsDokumen11 halamanChapter 9: The Capital Asset Pricing Model: Problem SetsBiloni KadakiaBelum ada peringkat

- Chap 010Dokumen107 halamanChap 010sucusucu3Belum ada peringkat

- Chap 012Dokumen77 halamanChap 012limed1100% (1)

- 6-Heat Transfer in Multi Phase Materials PDFDokumen460 halaman6-Heat Transfer in Multi Phase Materials PDFJoselinaSosaZavalaBelum ada peringkat

- Investments BKM - 9e SolutionsDokumen246 halamanInvestments BKM - 9e SolutionsMichael Ong100% (3)

- Answers To Practice Questions: Capital Budgeting and RiskDokumen9 halamanAnswers To Practice Questions: Capital Budgeting and RiskAndrea RobinsonBelum ada peringkat

- Shapiro CHAPTER 2 SolutionsDokumen14 halamanShapiro CHAPTER 2 SolutionsPradeep HemachandranBelum ada peringkat

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Dokumen12 halamanChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourBelum ada peringkat

- Shapiro CHAPTER 2 SolutionsDokumen14 halamanShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Ch3 AnsDokumen19 halamanCh3 Anssamuel_dwumfourBelum ada peringkat

- Multiple Choice QuestionsDokumen7 halamanMultiple Choice Questionsermelindaferreira10Belum ada peringkat

- MBA711 - Answers To Book - Chapter 3Dokumen17 halamanMBA711 - Answers To Book - Chapter 3noisomeBelum ada peringkat

- Chap 013Dokumen56 halamanChap 013saud1411100% (10)

- MAS - Cost of Capital 11pagesDokumen11 halamanMAS - Cost of Capital 11pageskevinlim186100% (1)

- Chapter 25 - AnswerDokumen10 halamanChapter 25 - AnswerReanne Claudine Laguna71% (7)

- Angol SZ Kozep-TetelDokumen64 halamanAngol SZ Kozep-TetelBarnabás Riz67% (3)

- Testbank - Chapter 19Dokumen2 halamanTestbank - Chapter 19naztig_017Belum ada peringkat

- Questions 3Dokumen6 halamanQuestions 3Pamela-Jo RefuerzoBelum ada peringkat

- Lecture No 9 - Financial InstrumentsDokumen10 halamanLecture No 9 - Financial Instrumentsasekur_teeBelum ada peringkat

- Chap 002Dokumen43 halamanChap 002Jose MartinezBelum ada peringkat

- Chap 012Dokumen77 halamanChap 012sucusucu3Belum ada peringkat

- Quiz 5 Equity Valuation M7 AnswerDokumen63 halamanQuiz 5 Equity Valuation M7 AnswerPrabu PrabaBelum ada peringkat

- Property Dispositions Solutions Manual Discussion QuestionsDokumen61 halamanProperty Dispositions Solutions Manual Discussion Questionscraig52292Belum ada peringkat

- Cost of CapitalDokumen10 halamanCost of CapitalRobinvarshneyBelum ada peringkat

- Vye Chapter16 Review Questions 12.8.13Dokumen6 halamanVye Chapter16 Review Questions 12.8.13Isaiah YoungBelum ada peringkat

- Present Value of The Investment Project Assuming The Company Has An 8% Hurdle RateDokumen15 halamanPresent Value of The Investment Project Assuming The Company Has An 8% Hurdle RategerralanuzaBelum ada peringkat

- Forex MGMT SFMDokumen98 halamanForex MGMT SFMsudhir.kochhar3530Belum ada peringkat

- Midterm in Financial Accounting 2 For PrintingDokumen6 halamanMidterm in Financial Accounting 2 For PrintingMarvin CeledioBelum ada peringkat

- Viney7e SM Ch06Dokumen16 halamanViney7e SM Ch06eternitystarBelum ada peringkat

- Chapter 7 VDokumen18 halamanChapter 7 VAdd AllBelum ada peringkat

- A Bond Issue May Be Retired byDokumen5 halamanA Bond Issue May Be Retired bynaztig_017Belum ada peringkat

- Investments 11th Edition Bodie Solutions ManualDokumen36 halamanInvestments 11th Edition Bodie Solutions Manualthither.aleuronic.acbtk100% (48)

- Suggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisDokumen20 halamanSuggested Answers: May 2005 Final Course: Group 1 Paper - 2: Management Accounting and Financial AnalysisQueasy PrintBelum ada peringkat

- ch10 Intro To FinanceDokumen44 halamanch10 Intro To Financebrookelynn145Belum ada peringkat

- Solutions Manual The Investment SettingDokumen7 halamanSolutions Manual The Investment SettingQasim AliBelum ada peringkat

- 84 QuestionsDokumen6 halaman84 QuestionsSean RichardsonBelum ada peringkat

- Cost of CapitalDokumen5 halamanCost of Capitalblu3t00thBelum ada peringkat

- Risk and Rates of ReturnDokumen22 halamanRisk and Rates of ReturnJollybelleann MarcosBelum ada peringkat

- Costs For Decision Making: © The Mcgraw-Hill Companies, Inc., 2014Dokumen5 halamanCosts For Decision Making: © The Mcgraw-Hill Companies, Inc., 2014gerralanuzaBelum ada peringkat

- Debt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredDokumen5 halamanDebt Funds Are Not As "Safe" As They Sound.: Safety Is Not AssuredRajat KaushikBelum ada peringkat

- Unit 2: Who's Who in FinanceDokumen5 halamanUnit 2: Who's Who in FinanceDaniel ChiruBelum ada peringkat

- Net Sales Gross Sales - (Returns and Allowances)Dokumen11 halamanNet Sales Gross Sales - (Returns and Allowances)kanchanagrawal91Belum ada peringkat

- Chapter12 Outline IMPORTANTDokumen16 halamanChapter12 Outline IMPORTANTsalehin1969Belum ada peringkat

- Types and Costs of Financial Capital: True-False QuestionsDokumen8 halamanTypes and Costs of Financial Capital: True-False Questionsbia070386Belum ada peringkat

- Chapter 2 Determinants of Interest Rates: True/False QuestionsDokumen16 halamanChapter 2 Determinants of Interest Rates: True/False QuestionsĐoàn Ngọc Thành LộcBelum ada peringkat

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesDokumen5 halaman2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraBelum ada peringkat

- Homework 1 - Due 10/3/2012: MBA 570xDokumen4 halamanHomework 1 - Due 10/3/2012: MBA 570xNicholas Reyner TjoegitoBelum ada peringkat

- Chapter 9: Stocks ValuationDokumen35 halamanChapter 9: Stocks ValuationTaVuKieuNhiBelum ada peringkat

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsDari EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsBelum ada peringkat

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoDari EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoBelum ada peringkat

- Chapter Twenty-One Managing Liquidity Risk On The Balance SheetDokumen15 halamanChapter Twenty-One Managing Liquidity Risk On The Balance SheetBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsDokumen6 halamanSolutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsDokumen12 halamanSolutions Manual Chapter Twenty-Three: Answers To Chapter 23 QuestionsBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Twenty-Four: Answers To Chapter 24 QuestionsDokumen6 halamanSolutions Manual Chapter Twenty-Four: Answers To Chapter 24 QuestionsBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Twenty-Two: Answers To Chapter 22 QuestionsDokumen8 halamanSolutions Manual Chapter Twenty-Two: Answers To Chapter 22 QuestionsBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Eighteen: Answers To Chapter 18 QuestionsDokumen5 halamanSolutions Manual Chapter Eighteen: Answers To Chapter 18 QuestionsBiloni KadakiaBelum ada peringkat

- Chapter Seventeen Mutual Funds and Hedge FundsDokumen17 halamanChapter Seventeen Mutual Funds and Hedge FundsBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Nineteen: Answers To Chapter 19 QuestionsDokumen8 halamanSolutions Manual Chapter Nineteen: Answers To Chapter 19 QuestionsBiloni KadakiaBelum ada peringkat

- Chapter Sixteen Securities Firms and Investment BanksDokumen14 halamanChapter Sixteen Securities Firms and Investment BanksBiloni KadakiaBelum ada peringkat

- Chapter 13: Empirical Evidence On Security Returns: Problem SetsDokumen11 halamanChapter 13: Empirical Evidence On Security Returns: Problem SetsBiloni Kadakia100% (1)

- Chapter 8: Index Models: Problem SetsDokumen14 halamanChapter 8: Index Models: Problem SetsBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsDokumen7 halamanSolutions Manual Chapter Fourteen: Answers To Chapter 14 QuestionsBiloni KadakiaBelum ada peringkat

- Chapter 11: The Efficient Market Hypothesis: Problem SetsDokumen9 halamanChapter 11: The Efficient Market Hypothesis: Problem SetsBiloni KadakiaBelum ada peringkat

- Chapter 10: Arbitrage Pricing Theory and Multifactor Models of Risk and ReturnDokumen9 halamanChapter 10: Arbitrage Pricing Theory and Multifactor Models of Risk and ReturnBiloni KadakiaBelum ada peringkat

- Solutions Manual Chapter Fifteen: Answers To Chapter 15 QuestionsDokumen6 halamanSolutions Manual Chapter Fifteen: Answers To Chapter 15 QuestionsBiloni KadakiaBelum ada peringkat

- Chapter 12: Behavioral Finance and Technical Analysis: Problem SetsDokumen13 halamanChapter 12: Behavioral Finance and Technical Analysis: Problem SetsBiloni Kadakia100% (1)

- Chapter 4: Mutual Funds and Other Investment Companies: Problem SetsDokumen6 halamanChapter 4: Mutual Funds and Other Investment Companies: Problem SetsBiloni KadakiaBelum ada peringkat

- Chapter 5: Introduction To Risk, Return, and The Historical RecordDokumen7 halamanChapter 5: Introduction To Risk, Return, and The Historical RecordBiloni KadakiaBelum ada peringkat

- Chapter 6: Risk Aversion and Capital Allocation To Risky AssetsDokumen14 halamanChapter 6: Risk Aversion and Capital Allocation To Risky AssetsBiloni KadakiaBelum ada peringkat

- BKM 10e Chap003 SM FinalDokumen7 halamanBKM 10e Chap003 SM FinalVivianWangBelum ada peringkat

- Chapter 1: The Investment Environment: Problem SetsDokumen6 halamanChapter 1: The Investment Environment: Problem SetsBiloni KadakiaBelum ada peringkat

- What Is Excel Swiss Knife - Excel Swiss KnifeDokumen1 halamanWhat Is Excel Swiss Knife - Excel Swiss KnifevaskoreBelum ada peringkat

- Solow Model Extension-Human CapitalDokumen16 halamanSolow Model Extension-Human CapitalQusay Falah Al-dalaienBelum ada peringkat

- Chapter 13Dokumen5 halamanChapter 13Shrey MangalBelum ada peringkat

- WORK (Diwa, Angela Marie M.)Dokumen17 halamanWORK (Diwa, Angela Marie M.)Angela Miranda DiwaBelum ada peringkat

- Predictors of Failure of Endoscopic Retrograde Cholangiography in Clearance of Bile Duct Stones On Initial Procedure: A Moroccan Retrospective StudyDokumen4 halamanPredictors of Failure of Endoscopic Retrograde Cholangiography in Clearance of Bile Duct Stones On Initial Procedure: A Moroccan Retrospective StudyIJAR JOURNALBelum ada peringkat

- Atellica IM Analyzers: Technical SpecificationsDokumen4 halamanAtellica IM Analyzers: Technical SpecificationsNazarii KordupelBelum ada peringkat

- Cuda GDBDokumen64 halamanCuda GDBVinícius LisboaBelum ada peringkat

- Physical and Chemical Properties of Crude Oil and Oil ProductsDokumen10 halamanPhysical and Chemical Properties of Crude Oil and Oil ProductsEnegineer HusseinBelum ada peringkat

- U2 Lec4 SizeAdjustmentDokumen69 halamanU2 Lec4 SizeAdjustmentVy NguyenBelum ada peringkat

- Compiled Question File FSPDokumen22 halamanCompiled Question File FSPsyed aliBelum ada peringkat

- ISO-14236-2000 Traducido EspañolDokumen11 halamanISO-14236-2000 Traducido EspañolPablo A.100% (1)

- Predictive Data Mining and Discovering Hidden Values of Data WarehouseDokumen5 halamanPredictive Data Mining and Discovering Hidden Values of Data WarehouseLangit Merah Di SelatanBelum ada peringkat

- Detailed Lesson Plan (DLP) Format: Nowledge ObjectivesDokumen2 halamanDetailed Lesson Plan (DLP) Format: Nowledge ObjectivesErwin B. NavarroBelum ada peringkat

- Business Magazine SOFIA FABALDokumen4 halamanBusiness Magazine SOFIA FABALSofia FabalBelum ada peringkat

- Case StudyDokumen8 halamanCase Studymilan GandhiBelum ada peringkat

- 24/10/2017. ",, IssnDokumen2 halaman24/10/2017. ",, IssnMikhailBelum ada peringkat

- Lab 3 4 Traffic Flow Measurement Amp Analysis Traffic Volume Amp JunctionDokumen12 halamanLab 3 4 Traffic Flow Measurement Amp Analysis Traffic Volume Amp JunctionDEBRA DEIRDRE S. ONONG DEBRA DEIRDRE S. ONONGBelum ada peringkat

- CLT2Dokumen13 halamanCLT2Yagnik KalariyaBelum ada peringkat

- Mid-Semester Paper 09Dokumen2 halamanMid-Semester Paper 09Harsh ThakurBelum ada peringkat

- Nama: Fazlun Nisak NIM: 180170127 MK: Kecerdasan Buatan (A2) Tugas PerceptronDokumen8 halamanNama: Fazlun Nisak NIM: 180170127 MK: Kecerdasan Buatan (A2) Tugas PerceptronFazlun NisakBelum ada peringkat

- Sorting in ALV Using CL - SALV - TABLE - SAP Fiori, SAP HANA, SAPUI5, SAP Netweaver Gateway Tutorials, Interview Questions - SAP LearnersDokumen4 halamanSorting in ALV Using CL - SALV - TABLE - SAP Fiori, SAP HANA, SAPUI5, SAP Netweaver Gateway Tutorials, Interview Questions - SAP LearnerssudhBelum ada peringkat