Tax obligations of resident Filipino citizens

Diunggah oleh

AJ QuimJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tax obligations of resident Filipino citizens

Diunggah oleh

AJ QuimHak Cipta:

Format Tersedia

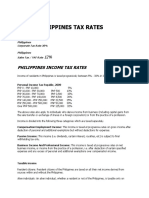

RESIDENT CITIZEN

Definition:

Citizen of the Philippines who has a permanent home or place of abode in the Philippines who which he/she

intends to return whenever he/she is absent for business or pleasure.

1. Taxable Income within and without the Philippines

Source of Income Tax Remarks

Compensation Income Taxable Compensation

Income (5%-32%)

Gross Compensation less premium

payments and/or hospitalization, personal

(P50,000.00) and additional exemptions

(P25,000.00 per child, max 4 child)

Business/Professional

Income and/or Trade

Taxable Business Income

(5%-32%)

Gross Income less itemized deduction or

optional standard deduction (40%) of

gross sales or gross receipts less personal

and additional exemption.

Passive Income

Royalties 20% final withholding tax on

gross amount

10% final withholding tax on royalties on

books, literary works and musical

compositions

Prized and other taxable

winnings

20% final withholding tax on

gross amount for those

prizes exceeding P10,000.00

Except PCSO and Lotto winnings

Interest Income from

Philippine currency

bank deposits and yield

or any other monetary

benefit from deposit

substitutes and from

trust funds and similar

arrangements

20% final income tax on the

gross amount

Interest Income from

long-term deposit

instruments pre-

terminated before the

5

th

year

4 yrs to less than 5 yrs -5%

3 yrs to less than 4 yrs -12%

Less than 3 yrs -20%

Interest Income from

foreign currency bank

deposits

7 % final tax on the gross

amount

Cash and/or property

dividends or

constructively received

and share of an

individual partner in the

net profits of a taxable

partnership

10% final withholding tax

Sale or exchange of

capital assets

Real property- 6% final tax

on gross selling price or fair

value whichever is higher

Shares of stocks not listed or

trade in any local stock

exchange shall be taxes on

the net capital gains, as

follows:

Not over P100k -5%

In Excess of P100k -10%

Informers Reward 10% final tax on the cash

reward received

Other Sources of Income

2. Deductions from Business and/or Professional Income

The following payments incurred in connection with the taxpayers profession, trade or businesses are

deductive from gross income:

a. Ordinary and necessary trade, business or professional expenses paid or incurred during the taxable

year

b. Interest

c. Taxes

d. Losses not compensated by insurance or other forms of indemnity

e. Net Operating Loss Carry-over

f. Bad Debts

g. Depreciation

h. Depletion of Oil and Gas Wells and Mines

i. Charitable and Other Contributions

j. Research and Development

k. Pension Trusts

l. OSD (40%) of gross sales or receipts

m. Premium Payment on Health and/or Hospitalization Insurance

n. Free Legal services

3. Filing of Returns

Every Filipino citizen residing in the Philippines (except persons not required to file income tax returns

and to those who are subject to substituted filing of income tax returns).

Anda mungkin juga menyukai

- How To Get Employer Identification NumberDokumen3 halamanHow To Get Employer Identification NumberChristian Jerrel SantosBelum ada peringkat

- General Banking Law (Case Digest)Dokumen22 halamanGeneral Banking Law (Case Digest)Na AbdurahimBelum ada peringkat

- Nonprofit Accounting Policies ManualDokumen20 halamanNonprofit Accounting Policies ManualLaurice Melepyano100% (1)

- Corporate Income TaxationDokumen39 halamanCorporate Income TaxationVinz G. VizBelum ada peringkat

- Philippine Veterans Bank v. Callangan, 2011 Case DigestDokumen1 halamanPhilippine Veterans Bank v. Callangan, 2011 Case DigestLawiswisBelum ada peringkat

- Rosales V Rosales DigestDokumen2 halamanRosales V Rosales DigestLawDroidBelum ada peringkat

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Dokumen33 halamanReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydBelum ada peringkat

- Tax Return ScribdDokumen5 halamanTax Return ScribdYvonne TanBelum ada peringkat

- RR 2-98Dokumen21 halamanRR 2-98Joshua HorneBelum ada peringkat

- V. Builder, Planter, SowerDokumen8 halamanV. Builder, Planter, SowerAJ QuimBelum ada peringkat

- Part I - ICPAU Audit ManualDokumen166 halamanPart I - ICPAU Audit Manualsamaan100% (3)

- Province of Antique Vs CalabocalDokumen2 halamanProvince of Antique Vs CalabocalAJ QuimBelum ada peringkat

- Division of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsDokumen7 halamanDivision of Profits and Losses Case #1: Sufficient Profit: Partnership OperationsJuliana Cheng100% (3)

- Corporation As A TaxpayerDokumen27 halamanCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- Other Percentage TaxesDokumen40 halamanOther Percentage TaxesKay Hanalee Villanueva NorioBelum ada peringkat

- Amount of Net Taxable Income Rate Over But Not OverDokumen11 halamanAmount of Net Taxable Income Rate Over But Not OverKayle MoralesBelum ada peringkat

- Gatchalian V Cir Case DigestDokumen1 halamanGatchalian V Cir Case DigestfredBelum ada peringkat

- LRTA & Roman Not Liable for Navidad DeathDokumen2 halamanLRTA & Roman Not Liable for Navidad DeathDyrene Rosario Ungsod100% (2)

- Value Added TaxDokumen26 halamanValue Added TaxAimee100% (1)

- Tax-on-Individuals PhilippinesDokumen21 halamanTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- Classification of Individual Taxpayers:: Income Tax RatesDokumen21 halamanClassification of Individual Taxpayers:: Income Tax RatesAngelica E. RefuerzoBelum ada peringkat

- Income TaxationDokumen32 halamanIncome TaxationkarlBelum ada peringkat

- TAXATION LAW HIGHLIGHTSDokumen4 halamanTAXATION LAW HIGHLIGHTSJM BermudoBelum ada peringkat

- Gross IncomeDokumen32 halamanGross IncomeMariaCarlaMañagoBelum ada peringkat

- Income Taxation LectureDokumen78 halamanIncome Taxation LectureMa Jodelyn RosinBelum ada peringkat

- For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDokumen5 halamanFor Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionMarvin H. Taleon IIBelum ada peringkat

- Philippine Income Taxation: Atty. Janine Crystal C. Sayo-Villavicencio, RPMDokumen22 halamanPhilippine Income Taxation: Atty. Janine Crystal C. Sayo-Villavicencio, RPMGracely Calliope De JuanBelum ada peringkat

- Final Income TaxationDokumen15 halamanFinal Income TaxationElizalen MacarilayBelum ada peringkat

- INCTAX QuizletDokumen4 halamanINCTAX QuizletJoshua LisingBelum ada peringkat

- Kind of Income Tax RateDokumen2 halamanKind of Income Tax RateTJ MerinBelum ada peringkat

- Unit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeDokumen10 halamanUnit 5 - Inclusions & Exclusions To Bus & Other Sources of IncomeJoseph Anthony RomeroBelum ada peringkat

- tAX LESSON B .Dokumen10 halamantAX LESSON B .intramuramazingBelum ada peringkat

- Lecture Notes - Atty Steve Part 1Dokumen9 halamanLecture Notes - Atty Steve Part 1Tesia MandaloBelum ada peringkat

- A Government Employee May Claim The Tax InformerDokumen3 halamanA Government Employee May Claim The Tax InformerYuno NanaseBelum ada peringkat

- Gross IncomeDokumen24 halamanGross IncomeMariaCarlaMañagoBelum ada peringkat

- Chapter 2Dokumen38 halamanChapter 2Alyssa Camille DiñoBelum ada peringkat

- Types of Income and Corresponding Tax RatesDokumen13 halamanTypes of Income and Corresponding Tax RatesJessa Belle EubionBelum ada peringkat

- Lesson Income TaxDokumen8 halamanLesson Income TaxEfren Lester ReyesBelum ada peringkat

- Tax For Rental Income in The PhilippinesDokumen3 halamanTax For Rental Income in The PhilippinesRESIE GALANGBelum ada peringkat

- Non Resident CitizensDokumen3 halamanNon Resident CitizensJessa Belle EubionBelum ada peringkat

- Accounting TaxationDokumen2 halamanAccounting TaxationAia Sophia SindacBelum ada peringkat

- Income Taxation Power NotesDokumen10 halamanIncome Taxation Power NotesJezelle NanoBelum ada peringkat

- Abitan, Alexandra Cabral, Hannah Beatriz Perez, Maria Hannah Resident and Non-Resident AlienDokumen5 halamanAbitan, Alexandra Cabral, Hannah Beatriz Perez, Maria Hannah Resident and Non-Resident AlienAlexPamintuanAbitanBelum ada peringkat

- Philippines Tax RatesDokumen7 halamanPhilippines Tax RatesRonel CacheroBelum ada peringkat

- Categories of Income and Tax RatesDokumen5 halamanCategories of Income and Tax RatesRonel CacheroBelum ada peringkat

- Module 2 BACC 14A Income Taxation Train LawDokumen59 halamanModule 2 BACC 14A Income Taxation Train LawFranzing LebsBelum ada peringkat

- Passive IncomeDokumen5 halamanPassive IncomeRandom VidsBelum ada peringkat

- Chapter 5 - Final Income TaxationDokumen13 halamanChapter 5 - Final Income TaxationBisag AsaBelum ada peringkat

- Annual Income Tax Comp1Dokumen3 halamanAnnual Income Tax Comp1dhuno teeBelum ada peringkat

- Income Taxation and Tax Rates in The PhilippinesDokumen3 halamanIncome Taxation and Tax Rates in The Philippinesओतगो एदतोगसोल एहपोीूदBelum ada peringkat

- Nonresident Citizen Philippines TaxationDokumen5 halamanNonresident Citizen Philippines TaxationJM GapisaBelum ada peringkat

- Colaste, Carl John Sanchez, Honorio Jr. Napiza, Jose Miguel TAX 3F/ Atty. Acosta Summary of Income Tax RatesDokumen8 halamanColaste, Carl John Sanchez, Honorio Jr. Napiza, Jose Miguel TAX 3F/ Atty. Acosta Summary of Income Tax RatesJosh NapizaBelum ada peringkat

- By Leonard C. Canamo CPA, MBADokumen39 halamanBy Leonard C. Canamo CPA, MBAGabriel L. CaringalBelum ada peringkat

- The Final Tax On Winnings Applies To CorporationsDokumen6 halamanThe Final Tax On Winnings Applies To CorporationsYuno NanaseBelum ada peringkat

- RR No. 11-2018 SummaryDokumen6 halamanRR No. 11-2018 SummaryCaliBelum ada peringkat

- Withholding Taxes 2023Dokumen23 halamanWithholding Taxes 2023Antonette Frilles GibagaBelum ada peringkat

- Final Income TaxesDokumen13 halamanFinal Income TaxesEar TanBelum ada peringkat

- Taxation Basics & PrinciplesDokumen8 halamanTaxation Basics & PrinciplescesalyncorillaBelum ada peringkat

- HumRes TaxDokumen3 halamanHumRes TaxJob Noel BernardoBelum ada peringkat

- Philippines Tax Rates Guide for Individuals and BusinessesDokumen3 halamanPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoBelum ada peringkat

- Lecture 2 - Income Taxation (Individual)Dokumen8 halamanLecture 2 - Income Taxation (Individual)Lovenia Magpatoc100% (1)

- Chapter 2.1 - Income Subject To Final TaxDokumen30 halamanChapter 2.1 - Income Subject To Final Taxjudel ArielBelum ada peringkat

- Tax Rates - SPSPS ReviewDokumen10 halamanTax Rates - SPSPS ReviewKenneth Bryan Tegerero TegioBelum ada peringkat

- Philippines Tax RatesDokumen7 halamanPhilippines Tax RatesJL GEN0% (1)

- Tax 1 - Summary of Important MattersDokumen18 halamanTax 1 - Summary of Important MattersBon BonsBelum ada peringkat

- Income Taxation Finals - CompressDokumen9 halamanIncome Taxation Finals - CompressElaiza RegaladoBelum ada peringkat

- Resident Citizens (RC)Dokumen2 halamanResident Citizens (RC)Ezi AngelesBelum ada peringkat

- Determine Taxpayer Status for Income TaxDokumen4 halamanDetermine Taxpayer Status for Income TaxMel Loise DelmoroBelum ada peringkat

- Axsdaqgasdgasdg 123123 Aeasdfw SadgDokumen6 halamanAxsdaqgasdgasdg 123123 Aeasdfw SadgMark LimBelum ada peringkat

- Philippines Income Tax Rates Guide - Individual, Corporate, Capital GainsDokumen6 halamanPhilippines Income Tax Rates Guide - Individual, Corporate, Capital GainsKristina AngelieBelum ada peringkat

- 3 Income Tax ConceptsDokumen37 halaman3 Income Tax ConceptsRommel Espinocilla Jr.Belum ada peringkat

- O o o o o O: Who Are Required To File Income Tax Returns?Dokumen8 halamanO o o o o O: Who Are Required To File Income Tax Returns?Aliyah SandersBelum ada peringkat

- Magallona Vs ErmitaDokumen9 halamanMagallona Vs ErmitaAJ QuimBelum ada peringkat

- Meanings of key parties in negotiable instrumentsDokumen1 halamanMeanings of key parties in negotiable instrumentsAJ QuimBelum ada peringkat

- G.R. No. 154380 October 5, 2005 Republic of The Philippines, Petitioner, Cipriano Orbecido Iii, RespondentDokumen8 halamanG.R. No. 154380 October 5, 2005 Republic of The Philippines, Petitioner, Cipriano Orbecido Iii, RespondentAJ QuimBelum ada peringkat

- Capitol WirelessDokumen2 halamanCapitol WirelessAJ QuimBelum ada peringkat

- BJE Is A Far More Powerful Entity Than The Autonomous Region Recognized in The ConstitutionDokumen3 halamanBJE Is A Far More Powerful Entity Than The Autonomous Region Recognized in The ConstitutionAJ QuimBelum ada peringkat

- Abacus Securities Corporation v. Ampil: G.R. No. 160016, 27 February 2006 FactsDokumen3 halamanAbacus Securities Corporation v. Ampil: G.R. No. 160016, 27 February 2006 FactsAJ QuimBelum ada peringkat

- TranspoDokumen6 halamanTranspoAJ QuimBelum ada peringkat

- GIL MIGUEL T. PUYAT, Petitioner, v. RON ZABARTE, RespondentDokumen7 halamanGIL MIGUEL T. PUYAT, Petitioner, v. RON ZABARTE, RespondentAJ QuimBelum ada peringkat

- BPI vs. De Reny Fabric on LC liabilityDokumen2 halamanBPI vs. De Reny Fabric on LC liabilityAJ QuimBelum ada peringkat

- Legal Med Full CaseDokumen5 halamanLegal Med Full CaseAJ QuimBelum ada peringkat

- Regime of IslandsDokumen1 halamanRegime of IslandsAJ QuimBelum ada peringkat

- BPI vs. De Reny Fabric on LC liabilityDokumen2 halamanBPI vs. De Reny Fabric on LC liabilityAJ QuimBelum ada peringkat

- Union Bank of The Philippines VsDokumen1 halamanUnion Bank of The Philippines VsAJ QuimBelum ada peringkat

- SEC FS Deadline ExtensionsDokumen3 halamanSEC FS Deadline ExtensionsBrunxAlabastroBelum ada peringkat

- 2 Trust Reciept CaseDokumen4 halaman2 Trust Reciept CaseAJ QuimBelum ada peringkat

- FIS Year-End Checklist PDFDokumen3 halamanFIS Year-End Checklist PDFAJ QuimBelum ada peringkat

- Union Bank of The Philippines VsDokumen1 halamanUnion Bank of The Philippines VsAJ QuimBelum ada peringkat

- Issuance of Notice of Informal Conference in Tax AssessmentsDokumen2 halamanIssuance of Notice of Informal Conference in Tax AssessmentsAJ QuimBelum ada peringkat

- Key Tax Issues at Year End For Re Investors 2019 20 PDFDokumen202 halamanKey Tax Issues at Year End For Re Investors 2019 20 PDFAJ QuimBelum ada peringkat

- Key Tax Issues at Year End For Re Investors 2019 20 PDFDokumen202 halamanKey Tax Issues at Year End For Re Investors 2019 20 PDFAJ QuimBelum ada peringkat

- 1601-EQ Final Jan 2018 Rev DPADokumen2 halaman1601-EQ Final Jan 2018 Rev DPAjose80% (5)

- Kumar Tridev 100010242 FY 2018-19 KEC OfficersDokumen4 halamanKumar Tridev 100010242 FY 2018-19 KEC Officersrahul ranjanBelum ada peringkat

- NSB Tax CalculatorDokumen2 halamanNSB Tax CalculatorHassan RanaBelum ada peringkat

- Itr 21-22Dokumen1 halamanItr 21-22Jatin KaushalBelum ada peringkat

- Old Tax Regime Vis-A - Vis New Tax Regime Final 010323Dokumen22 halamanOld Tax Regime Vis-A - Vis New Tax Regime Final 010323Amisha KhannaBelum ada peringkat

- Flipkart Labels 21 May 2023 01 21Dokumen5 halamanFlipkart Labels 21 May 2023 01 21Nikhil BisuiBelum ada peringkat

- WRL0002 TMPDokumen2 halamanWRL0002 TMPAbdulqader SidhpurwalaBelum ada peringkat

- UN Salary ScaleDokumen8 halamanUN Salary Scalemaconny20Belum ada peringkat

- Alison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateDokumen7 halamanAlison Is Qualifies To Income Tax From Business and Compensation, OSD and 8% Fixed Tax RateNichole TumulakBelum ada peringkat

- Narayana Group of Schools: Bill of Supply OriginalDokumen1 halamanNarayana Group of Schools: Bill of Supply OriginalSk Nurhasan0% (1)

- Quiz 5 Income TaxDokumen9 halamanQuiz 5 Income TaxjohndanielsantosBelum ada peringkat

- GPF Interest CalculatorDokumen5 halamanGPF Interest CalculatorSushma VermaBelum ada peringkat

- Po SGRCTC 00039Dokumen2 halamanPo SGRCTC 00039rahateyash9Belum ada peringkat

- Business Tax - Output VAT ActivityDokumen4 halamanBusiness Tax - Output VAT ActivityDrew BanlutaBelum ada peringkat

- MGTC70H (Personal Financial Management) L01: Final Exam Date: August 28, 2012Dokumen5 halamanMGTC70H (Personal Financial Management) L01: Final Exam Date: August 28, 2012agcoreBelum ada peringkat

- Acknowledgement Slip Income Tax ReturnDokumen4 halamanAcknowledgement Slip Income Tax ReturnMohsin Ali Shaikh vlogsBelum ada peringkat

- Journal Voucher ReportDokumen1 halamanJournal Voucher ReportWaris Corp.Belum ada peringkat

- InvoiceDokumen1 halamanInvoiceatipriya choudharyBelum ada peringkat

- E-Way Bill SystemDokumen1 halamanE-Way Bill SystemamruthamalleshBelum ada peringkat

- Salary Slip (10511035 December, 2016)Dokumen1 halamanSalary Slip (10511035 December, 2016)Syed Tabish AliBelum ada peringkat

- Irs New Form 1040Dokumen2 halamanIrs New Form 1040ForkLogBelum ada peringkat

- GST Numericals2Dokumen11 halamanGST Numericals2Kautilya VithobaBelum ada peringkat

- Inv Ap B1 78160637 104375634240 August 2022Dokumen2 halamanInv Ap B1 78160637 104375634240 August 2022Narasimha RaoBelum ada peringkat

- 2020 BillDokumen1 halaman2020 BillDev KumarBelum ada peringkat

- Agreement For Mediator PartnershipDokumen3 halamanAgreement For Mediator Partnershipज्ञानेन्द्र यादवBelum ada peringkat

- UK Payroll ProcessDokumen3 halamanUK Payroll ProcessNisha JoshiBelum ada peringkat

- Proforma Invoice MTC - MDokumen4 halamanProforma Invoice MTC - MSHAILENDRABelum ada peringkat