CPAR Conceptual Framework

Diunggah oleh

rommel_0070 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

548 tayangan5 halamanThe document provides an overview of the Framework for the Preparation and Presentation of Financial Statements. It describes the purpose and status of the framework, which serves as a guide for developing accounting standards. It outlines the objective of financial statements to provide useful information to users about an enterprise's financial position, performance, and cash flows. The framework also identifies qualitative characteristics like relevance, reliability, and comparability that make financial statement information useful.

Deskripsi Asli:

Conceptual Framework

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document provides an overview of the Framework for the Preparation and Presentation of Financial Statements. It describes the purpose and status of the framework, which serves as a guide for developing accounting standards. It outlines the objective of financial statements to provide useful information to users about an enterprise's financial position, performance, and cash flows. The framework also identifies qualitative characteristics like relevance, reliability, and comparability that make financial statement information useful.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

548 tayangan5 halamanCPAR Conceptual Framework

Diunggah oleh

rommel_007The document provides an overview of the Framework for the Preparation and Presentation of Financial Statements. It describes the purpose and status of the framework, which serves as a guide for developing accounting standards. It outlines the objective of financial statements to provide useful information to users about an enterprise's financial position, performance, and cash flows. The framework also identifies qualitative characteristics like relevance, reliability, and comparability that make financial statement information useful.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

PAGE 1

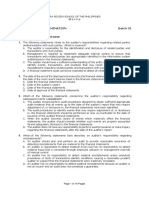

FRAMEWORK FOR THE PREPARATION

AND

PRESENTATION OF FINANCIAL STATEMENTS

PURPOSE AND STATUS OF THE FRAMEWORK

The FRSC Framework for the Preparation and Presentation of Financial Statements describes the

basic concepts by which financial statements are prepared. The Framework serves as a guide to

the Board in developing accounting standards and as a guide to resolving accounting issues that

are not addressed directly in Philippine ccounting Standards or Philippine Financial Reporting

Standards or !nterpretations. The purpose of the framework as outlined is to"

a. ssist the Financial Reporting Standards Council #FRSC$ in developing accounting

standards that represent generally accepted accounting principle%

b. ssist the FRSC in its review and adoption of e&isting !nternational ccounting Standards%

c. ssist preparers of the financial statements in applying FRSC Statements of Financial

ccounting Standards and in dealing with topics that have yet to form the sub'ect of an

FRSC statement%

d. ssist auditors in forming an opinion as to whether financial statements conform with

Philippine (P%

e. ssist users of financial statements in interpreting information contained in the financial

statements prepared in conformity with Philippine (P%

f. Provide those who are interested in the work of the FRSC with information about its

approach to the formulation of Statements of Financial ccounting Standards

Scope of the Framework

)efines the o!"ect#$e of financial statements%

!dentifies the %&a'#tat#$e character#(t#c( that make information in financial statements

useful% and

Def#)e( the basic elements of financial statements and the concepts for reco*)#+#)* and

mea(&r#)* them in financial statements.

Concepts of cap#ta' a), cap#ta' ma#)te)a)ce.

-e)era' P&rpo(e F#)a)c#a' Stateme)t(

The Framework addresses general purpose financial statements including consolidated financial

statements that a business enterprise prepares and presents at least annually to meet the

commo) #)format#o) needs of a wide range of users e&ternal to the enterprise. Therefore* the

Framework does not necessarily apply to special purpose financial reports such as reports to ta&

authorities* reports to governmental regulatory authorities* prospectuses prepared in connection

with securities offerings* and reports prepared in connection with business combinations.

U(er( a), the#r I)format#o) Nee,(

The principal classes of users of financial statements are pre(e)t a), pote)t#a' #)$e(tor(.

emp'o/ee(. 'e),er(. (&pp'#er( a), other tra,e cre,#tor(. c&(tomer(. *o$er)me)t( a), the#r

a*e)c#e( a), the *e)era' p&!'#c. ll of these categories of users rely on financial statements to

help them in ,ec#(#o) mak#)*.

+hile financial statements cannot meet all of the information needs of these user groups* there are

information needs that are common to all users* and general,purpose financial statements focus on

meeting these needs.

Re(po)(#!#'#t/ for F#)a)c#a' Stateme)t(

The ma)a*eme)t of an enterprise has the pr#mar/ re(po)(#!#'#t/ for preparing and presenting

the enterprise-s financial statements.

The O!"ect#$e of F#)a)c#a' Stateme)t(

The ob'ective of financial statements is to provide information about the f#)a)c#a' po(#t#o).

performa)ce a), cha)*e( #) f#)a)c#a' po(#t#o) of an enterprise that is useful to a wide range of

users in making economic decisions.

F#)a)c#a' Po(#t#o)

PAGE 2

The financial position of an enterprise is affected by the eco)om#c re(o&rce( it controls* its

f#)a)c#a' (tr&ct&re. #t( '#%&#,#t/ a), (o'$e)c/. a), #t( capac#t/ to a,apt to cha)*e( #) the

e)$#ro)me)t in which it operates. The !a'a)ce (heet presents this kind of information.

Performa)ce

Performance is the ability of an enterprise to earn a profit on the resources that have been invested

in it. !nformation about the amounts and variability of profits helps in forecasting future cash flows

from the enterprise-s e&isting resources and in forecasting potential additional cash flows from

additional resources that might be invested in the enterprise. The Framework states that

information about performance is primarily provided in an #)come (tateme)t.

Cha)*e( #) F#)a)c#a' Po(#t#o) or Ca(h F'ow(

.sers of financial statements seek information about the #)$e(t#)*. f#)a)c#)* a), operat#)*

act#$#t#e( that an enterprise has undertaken during the reporting period. This information helps in

assessing how well the enterprise is able to generate cash and cash e/uivalents and how it uses

those cash flows. The ca(h f'ow (tateme)t provides this kind of information.

U),er'/#)* A((&mpt#o)( 0Po(t&'ate(1

The Framework sets out the underlying assumptions of financial statements"

Accr&a' 2a(#(3 The effects of transactions and other events are recogni0ed when they

occur* rather than when cash or its e/uivalent is received or paid* and they are reported in

the financial statements of the periods to which they relate.

-o#)* Co)cer)3 The financial statements presume that an enterprise will continue in

operation indefinitely or* if that presumption is not valid* disclosure and a different basis of

reporting are re/uired.

The FRSC conceptual framework mentions two assumptions only. 1owever* it is widely believed

that an inherent trait of the financial statements are the basic assumptions of"

Acco&)t#)* E)t#t/3 The business is separate from the owners* managers* and employees

who constitute the business. Therefore transactions of the said individuals should not be

included as transactions of the business.

T#me Per#o,3 Financial reports are to be prepared for one year or a period of twelve

months.

Mo)etar/ &)#t3 There are two aspects under this assumption. First is the %&a)t#f#a!#'#t/

of the pe(o* meaning that the elements of the financial statements should be stated under

one unit of measure which is the Philippine Peso. Second is the (ta!#'#t/ of the pe(o*

means that there is still an assumption that the purchasing power of the peso is stable or

constant and that instability is insignificant and therefore ignored.

4&a'#tat#$e Character#(t#c( of F#)a)c#a' Stateme)t(

These characteristics are the attributes that make the #)format#o) #) f#)a)c#a' (tateme)t(

&(ef&' to investors* creditors* and others. The Framework identifies four principal /ualitative

characteristics"

a3 U),er(ta),a!#'#t/

!3 Re'e$a)ce

c3 Re'#a!#'#t/

,3 Compara!#'#t/

Pr#mar/ Character#(t#c(

Re'e$a)ce , !nformation in financial statements is relevant when it influences the economic

decisions of users. !t can do that both by #a$ helping them evaluate past* present* or future events

relating to an enterprise and by #b$ confirming or correcting past evaluations they have made.

I)*re,#e)t( of re'e$a)ce

Pre,#ct#$e 5a'&e 2 !nformation can help users increase the likelihood of correctly

predicting or forecasting the outcome of certain events.

PAGE 3

Fee,!ack 5a'&e 2 !nformation can help users confirm or correct earlier e&pectations.

3ote that the predictive and confirmatory roles of information are interrelated.

T#me'#)e((, !nformation loses its relevance if it is not timely

Re'#a!#'#t/ , !nformation in financial statements is reliable if it is free from material error and bias

and can be depended upon by users to represent events and transactions faithfully. !nformation is

not reliable when it is purposely designed to influence users- decisions in a particular direction.

Factor( of re'#a!#'#t/

Fa#thf&' Repre(e)tat#o) 2 !nformation must represent faithfully the transactions and

events it either purports to represent or could reasonably purport to represent.

S&!(ta)ce o$er form 6 Transactions are to be accounted for and presented according

to their substance and economic reality and not merely their legal form.

Ne&tra'#t/ 7 !nformation contained in the financial statements must be free from bias

and error.

Pr&,e)ce 0Co)(er$at#(m1 2 The inclusion of a degree of caution in the e&ercise of

'udgments needed in making estimates or choosing alternatives so that the outcome will

have the least effect on e/uity.

Comp'ete)e(( 6 to be reliable* the information in the financial statements must be

complete within the bounds of materiality and cost.

Co)(tra#)t( to Re'e$a)t a), Re'#a!'e I)format#o)

T#me'#)e(( 6 .ndue delay in reporting of information may lead to the loss of relevance

even though enhancing it reliability. +hile providing information before all aspects of a

transaction or other events are known may increase the relevance of information* thus

impairing its reliability.

2a'a)ce !etwee) 2e)ef#t a), Co(t 7 The benefits derived from relevant and reliable

information should e&ceed the cost of providing it.

Seco),ar/ Character#(t#c(

U),er(ta),a!#'#t/ , !nformation should be presented in a way that is readily understandable by

users who have a reasonable knowledge of business and economic activities and accounting and

who are willing to study the information diligently.

Compara!#'#t/ , .sers must be able to compare the financial statements of an enterprise o$er

t#me so that they can identify trends in its financial position and performance. .sers must also be

able to compare the financial statements of ,#ffere)t enterprises. )isclosure of accounting policies

is essential for comparability especially when the enterprise adopts a new or changes its

accounting policies.

The E'eme)t( of F#)a)c#a' Stateme)t(

Financial statements portray the financial effects of transactions and other events by grouping

them into broad classes according to their economic characteristics. These broad classes are

termed the elements of financial statements.

The elements directly related to f#)a)c#a' po(#t#o) and their ,ef#)#t#o) accor,#)* to the

framework are"

A((et7 n asset is a resource controlled by the enterprise as a result of past events and

from which future economic benefits are e&pected to flow to the enterprise.

L#a!#'#t/7 liability is a present obligation of the enterprise arising from past events* the

settlement of which is e&pected to result in an outflow from the enterprise of resources

embodying economic benefits.

E%&#t/7 4/uity is the residual interest in the assets of the enterprise after deducting all its

liabilities.

PAGE 4

The elements directly related to performa)ce and their ,ef#)#t#o) accor,#)* to the framework

are"

I)come7 !ncome is increases in economic benefits during the accounting period in the form

of inflows or enhancements of assets or decreases of liabilities that result in increases in

e/uity* other than those relating to contributions from e/uity participants.

E8pe)(e7 4&penses are decreases in economic benefits during the accounting period in

the form of outflows or depletions of assets or incurrence of liabilities that result in

decreases in e/uity* other than those relating to distributions to e/uity participants.

Reco*)#t#o) of the E'eme)t( of F#)a)c#a' Stateme)t(

Recognition #( the proce(( of #)corporat#)* in the balance sheet or income statement an item

that meets the ,ef#)#t#o) of a) e'eme)t a), (at#(f#e( the fo''ow#)* cr#ter#a for reco*)#t#o)

!t is probable that any future economic benefit associated with the item will flow to or from

the enterprise% and

The item-s cost or value can be measured with reliability.

Based on these general criteria"

A) a((et is recogni0ed in the balance sheet when it is probable that the future economic

benefits will flow to the enterprise and the asset has a cost or value that can be measured

reliably.

A '#a!#'#t/ is recogni0ed in the balance sheet when it is probable that an outflow of

resources embodying economic benefits will result from the settlement of a present

obligation and the amount at which the settlement will take place can be measured reliably.

I)come is recogni0ed in the income statement when an increase in future economic

benefits related to an increase in an asset or a decrease of a liability has arisen that can be

measured reliably. This means* in effect* that recognition of income occurs simultaneously

with the recognition of increases in assets or decreases in liabilities

E8pe)(e( are recogni0ed when a decrease in future economic benefits related to a

decrease in an asset or an increase of a liability has arisen that can be measured reliably.

This means* in effect* that recognition of e&penses occurs simultaneously with the

recognition of an increase in liabilities or a decrease in assets.

Mea(&reme)t of the E'eme)t( of F#)a)c#a' Stateme)t(

5easurement involves a((#*)#)* mo)etar/ amo&)t( at which the elements of the financial

statements are to be recogni0ed and reported. The Framework acknowledges that a variety of

measurement bases are used today to different degrees and in varying combinations in financial

statements* including"

H#(tor#ca' co(t

C&rre)t co(t

Net rea'#+a!'e 0(ett'eme)t1 $a'&e

Pre(e)t $a'&e 0,#(co&)te,1

1istorical cost is the measurement basis most commonly used today* but it is usually combined

with other measurement bases. The Framework does not include concepts or principles for

selecting which measurement basis should be used for particular elements of financial statements

or in particular circumstances. The /ualitative characteristics do provide some guidance in this

matter.

Co)cept( of Cap#ta'

F#)a)c#a' co)cept of cap#ta' , capital is synonymous with net assets of the enterprise.

This is the concept of capital adopted by most enterprises.

Ph/(#ca' co)cept of cap#ta' 2 capital is regarded as the productive capacity of the

enterprise based on* for e&le* units of output per day.

Co)cept( of Cap#ta' Ma#)te)a)ce

F#)a)c#a' cap#ta' ma#)te)a)ce 2 .nder this concept* a profit is earned only if the financial

#or money$ amount of the net assets at the end of the of the period e&ceeds the financial #or

PAGE 5

money$ amount of the net assets at the beginning of the period* after e&cluding any

distributions to* and contributions from* owners during the period.

Ph/(#ca' cap#ta' ma#)te)a)ce 2 .nder this concept* a profit is earned only if the physical

productive capacity #or operating capability$ of the enterprise #or the resources need to

achieve that capacity$ at the end of the period e&ceeds the physical productive capacity at

the beginning of the period* after e&cluding any distributions to* and contributions from*

owners during the period.

7 7 END 7 7

Anda mungkin juga menyukai

- Form 8 Assignment For The General Benefit of CreditorsDokumen1 halamanForm 8 Assignment For The General Benefit of CreditorsRisah ahhhBelum ada peringkat

- SAFE National Test OutlineDokumen17 halamanSAFE National Test Outlinejshen5Belum ada peringkat

- Transfer PricingDokumen26 halamanTransfer Pricingrommel_007Belum ada peringkat

- 7 Shortcuts TO CREDIT MASTERYDokumen16 halaman7 Shortcuts TO CREDIT MASTERYNICKBelum ada peringkat

- Book of JudgesDokumen23 halamanBook of Judgesrommel_007Belum ada peringkat

- 08Dokumen110 halaman08bibrannBelum ada peringkat

- Principles of Bank LendingDokumen14 halamanPrinciples of Bank LendingRishav Malik100% (1)

- Module 2 Interest and Money Time RelationshipsDokumen29 halamanModule 2 Interest and Money Time RelationshipsBenj Paulo Andres83% (6)

- Efx-Creditreport 20240114Dokumen18 halamanEfx-Creditreport 20240114Adrian GoldanescuBelum ada peringkat

- Computing Loans Involving Partial Payments Before MaturityDokumen2 halamanComputing Loans Involving Partial Payments Before MaturityIcekwim05Belum ada peringkat

- PeerDokumen8 halamanPeerronnelBelum ada peringkat

- Jardenil vs. SolasDokumen2 halamanJardenil vs. SolasDenise Jane DuenasBelum ada peringkat

- Ease of Doing Business and Efficient Delivery of Government Service ActDokumen7 halamanEase of Doing Business and Efficient Delivery of Government Service ActGwyn OliverBelum ada peringkat

- Corp Finance Chapter 30Dokumen2 halamanCorp Finance Chapter 30discreetmike50Belum ada peringkat

- At-5909 Risk AssessmentDokumen7 halamanAt-5909 Risk Assessmentshambiruar100% (2)

- Chap 011Dokumen36 halamanChap 011Angel TumamaoBelum ada peringkat

- Group Accounts - ConsolidationDokumen14 halamanGroup Accounts - ConsolidationWinnie GiveraBelum ada peringkat

- Applied Auditing Audit of Investment: Problem No. 1Dokumen3 halamanApplied Auditing Audit of Investment: Problem No. 1JessicaBelum ada peringkat

- This Study Resource Was: Profit Loss Profit LossDokumen9 halamanThis Study Resource Was: Profit Loss Profit LossrogealynBelum ada peringkat

- BusinessLaw 2012Dokumen170 halamanBusinessLaw 2012rommel_007100% (1)

- RFBT Review Cooperatives Jan 2024Dokumen43 halamanRFBT Review Cooperatives Jan 2024angel caoBelum ada peringkat

- Cpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Dokumen4 halamanCpa Review School of The Philippines: Auditing Problems Audit of Investments - Quizzers Problem No. 1Anthoni BacaniBelum ada peringkat

- Quiz - IntangiblesDokumen1 halamanQuiz - IntangiblesAna Mae HernandezBelum ada peringkat

- BSA4A-Midterm Exam - Questions PDFDokumen6 halamanBSA4A-Midterm Exam - Questions PDFRochelleDianRaymundoBelum ada peringkat

- DLP Pauline M. CustodioDokumen7 halamanDLP Pauline M. CustodioPauline Custodio100% (2)

- FAR and IAs Quali Exams With AnswersDokumen17 halamanFAR and IAs Quali Exams With AnswersReghis AtienzaBelum ada peringkat

- Toa - 2011Dokumen7 halamanToa - 2011EugeneDumalagBelum ada peringkat

- Developing Operational Review Programme For Managerial and AuditDokumen26 halamanDeveloping Operational Review Programme For Managerial and AuditruudzzBelum ada peringkat

- Essentials of Financial Management - CH 3 BHDokumen7 halamanEssentials of Financial Management - CH 3 BHMuhtar RasyidBelum ada peringkat

- PSBA - GAAS and System of Quality ControlDokumen10 halamanPSBA - GAAS and System of Quality ControlephraimBelum ada peringkat

- Afar 09Dokumen14 halamanAfar 09RENZEL MAGBITANGBelum ada peringkat

- Afar-03: Corporate Liquidation: - T R S ADokumen4 halamanAfar-03: Corporate Liquidation: - T R S AJenver BuenaventuraBelum ada peringkat

- Practical Accounting 1: I ExamcoverageDokumen12 halamanPractical Accounting 1: I ExamcoverageCharry Ramos0% (2)

- CHAPTER 10 - Pre-Board ExaminationsDokumen34 halamanCHAPTER 10 - Pre-Board Examinationsmjc24Belum ada peringkat

- Audit of LiabilitiesDokumen12 halamanAudit of LiabilitiesAcier KozukiBelum ada peringkat

- Audit of PPEDokumen1 halamanAudit of PPEAlexis BagongonBelum ada peringkat

- Chapter 3 - Solution ManualDokumen20 halamanChapter 3 - Solution Manualjuan100% (1)

- AUD Final Preboard Examination QuestionnaireDokumen16 halamanAUD Final Preboard Examination QuestionnaireJoris YapBelum ada peringkat

- Nfjpia Nmbe Far 2017 Ans-1Dokumen10 halamanNfjpia Nmbe Far 2017 Ans-1Stephen ChuaBelum ada peringkat

- Ppe Depreciation and DepletionDokumen21 halamanPpe Depreciation and DepletionEarl Lalaine EscolBelum ada peringkat

- AP Summary Lecture (16 May 2021)Dokumen9 halamanAP Summary Lecture (16 May 2021)Joanna MalubayBelum ada peringkat

- Chapter 28 AnsDokumen9 halamanChapter 28 AnsDave ManaloBelum ada peringkat

- Unit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Dokumen8 halamanUnit 6. Audit of Property, Plant and Equipment - Handout - T21920 (Final)Alyna JBelum ada peringkat

- Auditing Theory-100 Questions - 2015Dokumen20 halamanAuditing Theory-100 Questions - 2015yukiro rinevaBelum ada peringkat

- ReceivablesDokumen16 halamanReceivablesJanela Venice SantosBelum ada peringkat

- Lecture Notes On Trade and Other ReceivablesDokumen5 halamanLecture Notes On Trade and Other Receivablesjudel ArielBelum ada peringkat

- KY-385 KUCHEF Multi-Cooker IM-V1.2Dokumen40 halamanKY-385 KUCHEF Multi-Cooker IM-V1.2al83rt777750% (2)

- CPAR Financial StatementsDokumen5 halamanCPAR Financial StatementsAnjo EllisBelum ada peringkat

- ReSA First Preboard Complete Answer Key Batch 39Dokumen3 halamanReSA First Preboard Complete Answer Key Batch 39Paul Adriel BalmesBelum ada peringkat

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDokumen12 halamanACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaBelum ada peringkat

- Accounting For Labor 3Dokumen13 halamanAccounting For Labor 3Charles Reginald K. HwangBelum ada peringkat

- TBCH 08-567 Ffea 6 e 7240Dokumen54 halamanTBCH 08-567 Ffea 6 e 7240mikeeBelum ada peringkat

- Preweek Practical Accounting 1Dokumen24 halamanPreweek Practical Accounting 1alellieBelum ada peringkat

- Advanced Accounting LupisanDokumen25 halamanAdvanced Accounting LupisanDaniel Tadeja53% (17)

- Exercises Lesson 16 IAS 37Dokumen2 halamanExercises Lesson 16 IAS 37Florentina O. OpanioBelum ada peringkat

- Prac2 ReviewerDokumen12 halamanPrac2 ReviewerRay Jhon Ortiz0% (1)

- Auditing Theory Finals PDF FreeDokumen11 halamanAuditing Theory Finals PDF FreeMichael Brian TorresBelum ada peringkat

- MAS Practice Set Problems 1Dokumen4 halamanMAS Practice Set Problems 1Kristine Wali0% (1)

- AP03-03-Audit of Liabilities - EncryptedDokumen7 halamanAP03-03-Audit of Liabilities - EncryptedMark Ehrolle S. SisonBelum ada peringkat

- Cash and Accrual BasisDokumen2 halamanCash and Accrual Basisviji9999Belum ada peringkat

- Aud Plan 123Dokumen7 halamanAud Plan 123Mary GarciaBelum ada peringkat

- Property, Plant and Equipment - Wasting AssetsDokumen42 halamanProperty, Plant and Equipment - Wasting Assetstopakin09Belum ada peringkat

- At 3rd Evals ExamDokumen12 halamanAt 3rd Evals ExamJohn Remy SamsonBelum ada peringkat

- Auditing Exam Part IDokumen2 halamanAuditing Exam Part Ianna19 lopezBelum ada peringkat

- Misstatements in The Financial StatementsDokumen56 halamanMisstatements in The Financial StatementsKimberly Pilapil MaragañasBelum ada peringkat

- TOA Quizzer 1 - Intro To PFRSDokumen6 halamanTOA Quizzer 1 - Intro To PFRSmarkBelum ada peringkat

- 21decentralized Operations and Segment ReportingDokumen142 halaman21decentralized Operations and Segment ReportingyejiBelum ada peringkat

- AT.2820 - Performing Related Services Engagements PDFDokumen2 halamanAT.2820 - Performing Related Services Engagements PDFMaeBelum ada peringkat

- 8533 AnDokumen25 halaman8533 AnunsaarshadBelum ada peringkat

- Long Term Construction ContractsDokumen2 halamanLong Term Construction ContractsJM BalanoBelum ada peringkat

- Ind AS1Dokumen33 halamanInd AS1SaibhumiBelum ada peringkat

- SM Chapter 01Dokumen36 halamanSM Chapter 01mfawzi010Belum ada peringkat

- Chapter 1 The Conceptual Framework: 1. ObjectivesDokumen18 halamanChapter 1 The Conceptual Framework: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Framework For The Preparation and Presentation of Financial Statements (Teks Asli Bahasa Inggris Dari Iasc)Dokumen3 halamanFramework For The Preparation and Presentation of Financial Statements (Teks Asli Bahasa Inggris Dari Iasc)Septiawan BhotBelum ada peringkat

- Accounting Information SystemDokumen55 halamanAccounting Information SystemMd. Nurunnabi SarkerBelum ada peringkat

- Philippines Corporation CodeDokumen68 halamanPhilippines Corporation Coderommel_007Belum ada peringkat

- Warehouse CycleDokumen34 halamanWarehouse Cyclerommel_007100% (1)

- Audit BoyntonDokumen35 halamanAudit BoyntonMasdarR.MochJetrezzBelum ada peringkat

- Inventory ProgramDokumen25 halamanInventory ProgramTristian LimBelum ada peringkat

- Philippine Accountancy Act of 2004Dokumen17 halamanPhilippine Accountancy Act of 2004rommel_007Belum ada peringkat

- Tax RateDokumen3 halamanTax Raterommel_007Belum ada peringkat

- Isqc 1Dokumen35 halamanIsqc 1JecBelum ada peringkat

- Finance Exam 2 Cheat Sheet: by ViaDokumen2 halamanFinance Exam 2 Cheat Sheet: by ViaKimondo KingBelum ada peringkat

- Article 1279Dokumen6 halamanArticle 1279Danica BalinasBelum ada peringkat

- Afar 02: Corporate Liquidation: I. True or False - Theory of AccountsDokumen5 halamanAfar 02: Corporate Liquidation: I. True or False - Theory of AccountsRoxell CaibogBelum ada peringkat

- Provision For Doubtful DebtsDokumen28 halamanProvision For Doubtful DebtsGeneva GomezBelum ada peringkat

- Chapter 6 Sample ProblemsDokumen3 halamanChapter 6 Sample ProblemsShaiTengcoBelum ada peringkat

- Perwira Habib Bank Malaysia BHD V Lum Choon Realty SDN BHDDokumen39 halamanPerwira Habib Bank Malaysia BHD V Lum Choon Realty SDN BHDCold DurianBelum ada peringkat

- Outbound Fronter Script 3.0Dokumen3 halamanOutbound Fronter Script 3.0Andrés FlórezBelum ada peringkat

- Form D - Workman & EmployeeDokumen4 halamanForm D - Workman & EmployeeAmarBelum ada peringkat

- Aclan - Solvency RatioDokumen3 halamanAclan - Solvency RatioTRCLNBelum ada peringkat

- Icici Bank Home Finance Limited - Kandepu Subhash ChandraboseDokumen3 halamanIcici Bank Home Finance Limited - Kandepu Subhash ChandraboseBhanu GBelum ada peringkat

- Final Assesment: I. Problem SolvingDokumen12 halamanFinal Assesment: I. Problem SolvingKaren Nicole Borreo MaddelaBelum ada peringkat

- Digest 25. Serrano de Agbayani vs. PNB, 38 SCRA 429Dokumen1 halamanDigest 25. Serrano de Agbayani vs. PNB, 38 SCRA 429Inez Monika Carreon PadaoBelum ada peringkat

- MGMT2023 Lecture 7 BOND VALUATION - Parts I IIDokumen66 halamanMGMT2023 Lecture 7 BOND VALUATION - Parts I IIIsmadth2918388Belum ada peringkat

- Credit Mortgage CasesDokumen7 halamanCredit Mortgage Casesalex trincheraBelum ada peringkat

- MSME Pulse Jun 19 - With Statewise RankingDokumen23 halamanMSME Pulse Jun 19 - With Statewise RankingmeenaldutiaBelum ada peringkat

- Minutes of Board of Directors Meeting 10 06 2011Dokumen2 halamanMinutes of Board of Directors Meeting 10 06 2011LightRIBelum ada peringkat

- Rights and Liabilities of SuretyDokumen10 halamanRights and Liabilities of SuretyValar75% (4)

- 5BDF Orientation DeckDokumen25 halaman5BDF Orientation DeckEralyn OloresBelum ada peringkat

- Affirm Media Kit 03102020 1Dokumen3 halamanAffirm Media Kit 03102020 1api-546051431Belum ada peringkat