2ECO0903 Chap5

Diunggah oleh

AhKan YontenJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2ECO0903 Chap5

Diunggah oleh

AhKan YontenHak Cipta:

Format Tersedia

Chapter 5

Market Structure

Market Structure Theory of a Firm

What is a Firm?

It is an institution that buys or hires factors of production and initiate the process

production to transform these factors of production to goods and services for sale.

What is the objective of a firm?

Is to minimize costs and maximize profits i.e. profit maximization

=

Accounting Profit vs. Economic Profit

Accounting profit only takes into consideration of explicit costs

Economic profit takes into consideration of total costs i.e explicit and implicit costs

Market Structure Equilibrium of A Firm

Equilibrium of a Firm

When profit is maximized and losses minimized

No tendency to increase or decrease output. Output level already gives the maximum

profit

Assumptions of Equilibrium of a Firm

1. A rational firm

Always have the intention to maximize profits

2. Production of one product

Only produce one type of goods

3. Least cost combination

Minimal production costs possible

Two methods to determine the equilibrium of a firm i.e. Total Approach and Marginal Approach

Total Approach

Total Approach use Total Revenue and Total Cost to determine the equilibrium

of a firm

A Firms Equilibrium is achieved when Total Revenue Total Cost is at the

maximum

Perfect Competition Market Imperfect Competition Market

a

a

a refers to the output where

profit is maximized

Marginal Approach use Marginal Revenue, MR and Marginal Cost, MC to

determine the equilibrium of a firm

A firms equilibrium is reached, when:

=

Marginal Approach

a

Perfect Competition Market

Imperfect Competition Market

Relationship between Price, AR and MR

Marginal Approach

Quantity Price

Total

Revenue

Average

Revenue

Marginal

Revenue

1 10 10 10 10

2 10 20 10 10

3 10 30 10 10

4 10 40 10 10

5 10 50 10 10

Perfect Competition Market

Quantity Price

Total

Revenue

Average

Revenue

Marginal

Revenue

1 10 10 10 10

2 9 18 9 8

3 8 24 8 6

4 7 28 7 4

5 6 30 6 2

Imperfect Competition Market

Price = Average Revenue = Marginal Revenue = Demand

Price = Average Revenue = Marginal Revenue = Demand

Relationship between MR and MC is as follows:

1. MR > MC : A firm can increase its profits by increasing output

2. MR < MC : A firm can reduce its loses by decreasing output

3. MR = MC : Profits are at a maximum

Marginal Approach

Definition of a Market

It is an arrangement that facilitates the buying and selling of a product,

service, factor of production or future commitment.

Definition of a Market Structure

It refers to the number and distribution size of buyers and sellers in the market

for particular goods and services.

Characteristics of market structure include:

Number of buyers and sellers

Market shares

The degree of product standardization

Ease of market entry and exit

Market Structure

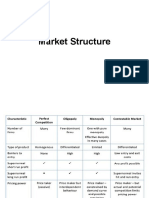

Market Structure Classifications

Market Form

Characteristics

Perfect Competition Monopolistic

Competition

Oligopoly Monopoly

Number of firms Large Number Large Few One

Type of Product Homogenous Differentiated Homogenous or

Differentiated

Unique, no close

substitute

Conditions for Entry Very easy Relatively Easy Significant obstacles Blocked

Control over price None Some Some Considerate

Price elasticity of demand Infinite (Perfectly

Elastic)

Large (Elastic) Small (Inelastic) Very Small (Perfectly

Inelastic)

Examples Wheat, corn Food, clothing Automobiles,

cigarettes

Local phone service

Characteristics of Perfect Competition

1. Large number of buyers and sellers

2. Homogenous / Identical products

3. Free entry / exit

4. Role of non-price competition

5. Perfect knowledge of the market

6. Perfect mobility of factors of production

7. Absence of transport costs

Market Structure Perfect Competition

Price Determination in Perfect Competition

1. Firms in perfect competition are price takers.

2. They take the price determined by the market and supply quantity of their choice

Market Structure Perfect Competition

Price

Quantity

SS

DD

Price

Quantity

P

P

AR = MR

Market Demand

Individual Demand

Firms Equilibrium

Market Structure Perfect Competition

Total Approach

Marginal Approach

Equilibrium Quantity

Profit for Perfect Competition

Supernormal Profit

Also known as Economic Profit

Price > ATC

Market Structure Perfect Competition

Price

Qtty

SS

DD

Market Structure Perfect Competition

Normal Profit

Also known as breakeven

Price equals to ATC

Total revenue equals to Total costs

SS

DD

Price

Quantity

Market Structure Perfect Competition

Subnormal Profit

Also known as Economic Loss

Price is lower than average total cost

Total revenue is less than total cost

SS

DD

Price

Quantity

Shutdown point for firms in perfect competition market

Golden rule : Firms should continue to produce as long as the price is higher than the average

variable cost.

As long as total revenue can cover the firms total variable cost, the firm should

continue its operation

This is because variable cost is the cost component that varies with output. Fixed

costs is a cost that already incurred even prior to the start of production

Market Structure Perfect Competition

Loss due to Total

Fixed Cost i.e.

ABCP

A

B

Long run Effect : Entry into Industry

Market Structure Perfect Competition

B

Increase of supply drives down the

price from P to P1

Price equals to Average Revenue

and equals to Marginal Revenue

Producing at profit maximization

point i.e. MR = MC, Price, P1 is same

with ATC i.e. competitive firms just

breakeven in the long-run (normal

profit)

The supernormal / economic profit

ABPP1 earlier noted at Price P is

eliminated

Long run Effect : Exit from the Industry

Market Structure Perfect Competition

Firms exiting from the industry will

decrease of supply drives up the

price from P to P1

Price equals to Average Revenue

and equals to Marginal Revenue

Producing at profit maximization

point i.e. MR = MC, Price, P1 is same

with AC i.e. competitive firms just

breakeven in the long-run (normal

profit)

The initial losses is eliminated with

the decrease of supply, therefore

increasing the price

Market Structure Monopoly

Monopoly

A single seller in the market

producing product which has to

substitute

One Seller but a large

number of buyers

Product has no close

substitutes

The firm is a price

maker

High barrier of entry

The role of non-price

competition is low

Barriers of Entry

Market Structure Monopoly

Natural barriers

1. Required economies of scale

2. Huge investment costs

Legal barriers

1. Patent and Copyright

Deliberate barriers

1. Control of raw material

2. Deliberate underpricing to

deter new entries

Short run Producer Equilibrium

Aim to produce at quantity with maximum profit

Total Approach

Market Structure Monopoly

Producing at 6. Firm has the maximum profit i.e. TR TC

*Note : Why total revenue curve is non-linear?

As quantity increases, moving

down the demand curve,

elasticity reduces.

Therefore, when at the top of

the demand curve, elasticity is

high, drop in prices will increase

quantity demand, therefore TR

increases

However, at lower spectrum of

the demand curve, elasticity is

low, decrease of price, reduces

TR

Market Structure Monopoly

Marginal Approach and Long run equilibrium

In the long run because of :

1. High barrier of entry

2. Substantial market power due to single seller

Firm can choose to produce at profit maximization point where MR = MC

and charges a price higher than the competitive level and average cost,

therefore earning a supernormal profit

Market Structure Monopolistic Competition

Monopolistic

Competition

Large number of

sellers, therefore low

market power

Differentiated product

therefore non- price takers

but set its own price

The firm is a price

maker

Low barrier of entry

and exit

The role of non-price

competition is high,

therefore may substantially

increase selling cost

Short-run Equilibrium

1. Profit maximization point

MC firms can differentiate their product, therefore

has certain control over their prices. Thus, unlike

perfect competition, which are price takers, MC firms

set their own price

Therefore each firm has their individual demand

curve and is downward sloping

However, MC firms demand curve is more elastic

than monopoly but less elastic than perfect

competition

2. Profit taking

To maximize profit, firms produce at MR = MC

Depending on cost structure, firms may incur

supernormal, normal or subnormal profit in the short

run

Market Structure Monopolistic Competition, MC

Supernormal Profit

Normal Profit

Subnormal Profit

In the Long Run

In the long-run, firms in monopolistic competition market will only earn Normal Profit because:

1. If firms earn supernormal profit, in the short-run, more firms will enter the market and lower down the price

2. If firms earn subnormal profit, in the short-run, then firms will exit the market, slowing down the demand

and increases the price, therefore existing firms will earn Normal Profit

Market Structure Monopolistic Competition, MC

Note !!!

Explore to explain graphically how item 1 and 2 can occur

Market Structure Oligopoly

Oligopoly

Few sellers with

medium to large size

Can be differentiated or

homogeneous product

The firm is a price

maker

High barrier of entry

and exit

Oligopolistic firms are mutual

interdependence. Therefore

firms always consider the

reaction of their rival firms

before setting prices, quantity

of output, advertising and etc

Short-run / Long-run Equilibrium

1. Demand Curve

Oligopoly firms have kinked individual demand curve

Assuming after taking into consideration of rival firms reaction, firmsets price at P1

If firm decreases the price lower than P1, rival firms will react through price war, therefore firm will

hardly increase any quantity demanded. Thus, elasticity below the kink is inelastic

If firm increase the price, rival firms will not react, but firm will lose a lot of quantity demanded to

competitors, therefore elasticity is elastic above the kinked

In conclusion, there is no incentive for firm either increase or decrease its price, therefore price is rigid

and stable at P1

Market Structure Oligopoly

Price

Quantity

P1

Q1

Dd = AR

Short-run / Long-run Equilibrium

2. Profit Maximization

Just like firms from other market structure, oligopolies seek to produce at profit maximization point i.e.

MR = MC

Market Structure Oligopoly

Due to the kinked demand curve,

there is a gap in the MR curve i.e. ab

Therefore any shift of MC curve within

this gap will not change the profit

maximization output i.e. Q1

However, if MC were to shift to MC3,

profit maximization output will reduce

substantially vs. a smaller increase in

price, therefore revenue reduces

Therefore cost efficiency is essential in

oligopoly

a

b

Setting Prices and Output

We have determined that an oligopoly individual firms demand curve is kinked and producing at Q1 with

price P1 as below:

Market Structure Oligopoly

Quantity

P1

Q1

Dd = AR

Price

How then is P1 and Q1 set? As explained, an oligopoly firm when setting prices

and quantity of output must first consult the possible reaction of its rival firm.

Thus, the prices and quantity can be set through the below:

1. Cartel Formation (Explicit Collusion)

A group of firms collude with the objective to stifle the competitiveness

in the market

It eliminates uncertainty and improve profits by stabilizing the price

Under a Cartel, firms reach a collective agreement on the price to set

and quantity to produce.

Therefore collectively they can restrict supply and push up the prices

2. Price Leadership (Tacit Collusion)

Occurs when the market leader (with substantial market share) sets the

price and every other firms collectively follow without any formal or

explicit agreement

If product is homogenous or closely homogenous, smaller firms may

have to adjust their output to manage their marginal cost accordingly

Tutorial

Tutorial

Tutorial

9) A purely competitive seller is:

A. both a price maker and a price taker.

B. neither a price maker nor a price taker.

C. a price taker.

D. a price maker.

1. Draw the Total Revenue and Total Cost curves and identify the profit

maximizing quantity and profit maximizing price for :

Perfect Competition Market

Imperfect Competition Market

2. Draw the Marginal Revenue, Average Revenue and Marginal Cost to

identify the profit maximizing quantity and profit maximizing price

for:

Perfect Competition Market

Imperfect Competition Market

Tutorial

Causes of Market Failure

Market Failure and Government Policy

Market Failure

Market is where buyers and sellers meet

and transact. Market failure occurs

when the market fail to allocate

resources efficiently, therefore goods

and services are not distributed

optimally

Public Goods

Monopoly

Externality Inequality

Monopoly

Monopoly occurs when one seller has absolute market power, therefore manage to hold the prices higher than competitive

level but cutting down its supply.

Market Failure and Government Policy

Consumer surplus is the positive difference of between the price that he is willing to

pay and the actual price that he actually paid

Producer surplus is the positive difference between the price that producer is

willing to produce and supply and the actual price that he gets for supplying

Diagram 1

Diagram 2

Diagram 2 shows that monopoly choose to

produce at profit maximization point MC =

MR, instead of producing at the competitive

level of Qc, monopoly produce at Qm,

therefore:

1. Causes a deadweight loss of ABE

2. A transfer of surplus of AFGB from

consumer to producer

Deadweight loss is a resource allocation

inefficiency that occurs in the market when

the resources are not optimally used for

welfare

As such government has stringent policy that

against cartel formation or any type of

monopolistic practice

A

B

C

E

F

G

Price Discrimination

1. The deadweight loss created by monopoly can be compensated if the monopoly practice Price Discrimination.

2. Price Discrimination refers to the selling or the charging of different prices to different buyers for the same good.

3. Price discrimination can only happen if:

1. Existence of different market for the same good

2. The cost of differentiating the market must be low

3. Existence of different degree of elasticity of demand

4. No resale is permitted i.e. product purchased from market with low price, cannot resell in a higher price market

4. There are different degrees of price differentiation:

1. First degree differentiation

Price charged based on the maximum amount that each consumer is willing and capable to pay

2. Second degree differentiation

Price charged based on blocks of product. Example, photocopy single page is 10 cents but photocopy 100 pages

is RM8.00

3. Third degree differentiation

Price charges based on different segment / group of consumers. Example, privilege pricing for golden citizens or

free coverage for ladies night

Market Failure and Government Policy

Public Goods

Public good has two main characteristics :

Non-excludability where it is not possible to provide a good or service to one person without it thereby being available for

others to enjoy

Non-rivalry where the consumption of a good or service by one person will not prevent others from enjoying it

Therefore commercial firms are not interested to produce public goods as they are not able to charge a price and therefore

profit from it.

To solve the problem, government will step in to produce such goods and services, funded by tax revenue that collected

fromeconomic agents. Subsequently the government may seek to privatize strategically the supply of the goods and services

to a commercial firm as such charges will be applied and certain consumers will be excluded from the consumption of the

goods and services.

Example are : Healthcare (public hospitals are moving into semi private e.g. Hospital University), roads, security (police force)

and etc

Market Failure and Government Policy

Externalities

Externalities are spill-over effects due to production or

consumption of certain product, which are not appropriately

compensated or accounted for in the pricing mechanism.

Externalities are divided to :

1. Positive externalities

Positive spillover effect which will bring benefits to the

society

2. Negative externalities

Negative spillover effect which will be damaging to the

society

In a perfect environment, the positive externalities have to be

appropriately rewarded and negative externalities have to be

penalized accordingly. However, the market or pricing mechanism

fail to account this.

As such government need to step in to provide subsidy for

positive externalities such as Research and Development carry out

by firms and impose tax on negative externalities such as waste

products that are damaging to the environment

Market Failure and Government Policy

With the subsidy provided, quantity can be

increased, therefore increasing the trade and

prices lower, therefore increasing the consumer

surplus

Market Failure and Government Policy

When subsidy is provided

With the subsidy provided, quantity can be

increased, therefore increasing the trade and

prices lower, therefore increasing the consumer

surplus

When tax is imposed

When tax is imposed on top of the price, price increases and

quantity demanded will reduce, therefore causing a deadweight

loss. Nevertheless, the tax received can negate the negative

externality therefore compensate the deadweight loss.

Supply1

Society Inequality

Market failure can be caused by inequality, which commonly happens in market economy, due to inefficient distribution of

wealth, which is attributable to:

1. Uneven growth due to geographical area i.e. urban vs suburban

2. Unequal distribution of opportunities

Inequality causes market failure due to huge disparity of living standard, which will affect demand of certain products.

Government can intervene to regulate the income disparity by using certain policy such as :

1. Price Ceiling

2. Price Floor

Market Failure and Government Policy

Society Inequality

Market Failure and Government Policy

Price Ceiling

Government can impose a price ceiling to certain necessity market

such as flour, sugar and etc.

Price ceiling imposed is Pc

Price ceiling imposed will increase consumer surplus and reduce the

producer surplus, thus increasing the consumers welfare

Nevertheless, deadweight loss will be created

Government can choose to provide subsidy so that output can be

increased to meet the shortage

Society Inequality

Market Failure and Government Policy

Price Floor

Price floor is aptly applicable in labour market i.e. minimum wage

1. Price floor will increase the seller (labour surplus) and reduce the buyer (firm) surplus

2. A deadweight loss will also be created

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- 2ECO0903 Pastyearquestion1Dokumen11 halaman2ECO0903 Pastyearquestion1AhKan YontenBelum ada peringkat

- 2ECO0903 Chap6Dokumen15 halaman2ECO0903 Chap6AhKan YontenBelum ada peringkat

- 2ECO0903 Chap2 QuestionDokumen11 halaman2ECO0903 Chap2 QuestionAhKan YontenBelum ada peringkat

- 2ECO0903 Chap4Dokumen38 halaman2ECO0903 Chap4AhKan YontenBelum ada peringkat

- 3070 Practice QuestionsDokumen48 halaman3070 Practice QuestionsDheeraj AroraBelum ada peringkat

- 2ECO0903 Chap1Dokumen9 halaman2ECO0903 Chap1AhKan Yonten100% (3)

- Hypnosis and BeyondDokumen37 halamanHypnosis and BeyondAhKan YontenBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- ECO 501 - Assignment 3Dokumen3 halamanECO 501 - Assignment 3NAVID ANJUM KHANBelum ada peringkat

- Literature Review Herzberg Two Factor TheoryDokumen8 halamanLiterature Review Herzberg Two Factor Theorylixdpuvkg100% (1)

- Industrial Organization: Markets and StrategiesDokumen101 halamanIndustrial Organization: Markets and StrategiesMisbahul IslamBelum ada peringkat

- Current List of HART Manufacturer ID Codes - FieldComm Group Support PortalDokumen15 halamanCurrent List of HART Manufacturer ID Codes - FieldComm Group Support PortalHooman KaabiBelum ada peringkat

- Syllabus Ebd 2033-Industrial OrganizationDokumen4 halamanSyllabus Ebd 2033-Industrial OrganizationAdib RedzaBelum ada peringkat

- Elms Quiz: Oligopoly I. MULTIPLE CHOICE (10 Items X 2 Points)Dokumen2 halamanElms Quiz: Oligopoly I. MULTIPLE CHOICE (10 Items X 2 Points)Thirdy SuarezBelum ada peringkat

- Panjiva US - Imports All Results - 1 - To - 384 - of - 384 2020 06 21 10 1020200621 12342 Klhte4Dokumen187 halamanPanjiva US - Imports All Results - 1 - To - 384 - of - 384 2020 06 21 10 1020200621 12342 Klhte4Vân Gỗ Anpro SànBelum ada peringkat

- Market Structure of Tokyo Cement CoDokumen7 halamanMarket Structure of Tokyo Cement CoDilshan KaviratneBelum ada peringkat

- Cournot OligopolyDokumen30 halamanCournot OligopolyHarleen KaurBelum ada peringkat

- Monopolistic Competition: Anne-Claire RamserDokumen18 halamanMonopolistic Competition: Anne-Claire RamsersuffiBelum ada peringkat

- Monopolistic CompetitionDokumen12 halamanMonopolistic CompetitionMishika AdwaniBelum ada peringkat

- LECTURE 4 Monopoly and Monopolistic CompetitionDokumen46 halamanLECTURE 4 Monopoly and Monopolistic CompetitionHashma KhanBelum ada peringkat

- Jurnal SCP 1Dokumen9 halamanJurnal SCP 1ayuBelum ada peringkat

- Principles of Microeconomics: Powerpoint Presentations ForDokumen51 halamanPrinciples of Microeconomics: Powerpoint Presentations Forsamantha davidsonBelum ada peringkat

- Perfect Competition Vs MonopolyDokumen36 halamanPerfect Competition Vs MonopolyOds Guys100% (1)

- ME 8 OligopolyDokumen19 halamanME 8 Oligopolyshourya vardhaniBelum ada peringkat

- Economics Practice ExamDokumen33 halamanEconomics Practice ExamMelissa Douglas100% (1)

- Chapter 7 Study GuideDokumen4 halamanChapter 7 Study Guideapi-236813988Belum ada peringkat

- Market StructureDokumen19 halamanMarket StructureSri HarshaBelum ada peringkat

- INDUSTRY ORGANIZATION, POLICY & STATE REGULATIONDokumen2 halamanINDUSTRY ORGANIZATION, POLICY & STATE REGULATIONNikos SalaminaBelum ada peringkat

- B.a.H Sem IV 08 Intermediate Microeconomics II Jan. 2018Dokumen6 halamanB.a.H Sem IV 08 Intermediate Microeconomics II Jan. 2018paras hasijaBelum ada peringkat

- Cournot-Bertrand Model For Homogenous GoodsDokumen3 halamanCournot-Bertrand Model For Homogenous GoodsAnurag RastogiBelum ada peringkat

- Assignment 1567149977 SmsDokumen31 halamanAssignment 1567149977 SmsdipanajnBelum ada peringkat

- Cash and Liquidity Optimisation Europe Conference, Partnered With CrowdReviews - Com, Announces Xelix As The Treasury Innovation Fintech WinnerDokumen2 halamanCash and Liquidity Optimisation Europe Conference, Partnered With CrowdReviews - Com, Announces Xelix As The Treasury Innovation Fintech WinnerPR.comBelum ada peringkat

- Evaluate The Monopolistic and Oligopolistic MarketsDokumen6 halamanEvaluate The Monopolistic and Oligopolistic Marketszakuan79Belum ada peringkat

- Market StructureDokumen7 halamanMarket StructureMuhammad AbrarrBelum ada peringkat

- ECO 415 - THEORY OF FIRMs - OligopolyDokumen36 halamanECO 415 - THEORY OF FIRMs - Oligopolykimi9090Belum ada peringkat

- Point A: (Kôr-Nō Ɡēnäɡäwä Mō)Dokumen1 halamanPoint A: (Kôr-Nō Ɡēnäɡäwä Mō)Evan PavonBelum ada peringkat

- Perfect Competition and Market Structures in 40 CharactersDokumen33 halamanPerfect Competition and Market Structures in 40 CharactersKassandra BayogosBelum ada peringkat