JPM Global Data Watch A 2014-08-02 1459429

Diunggah oleh

Scott ShypulaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

JPM Global Data Watch A 2014-08-02 1459429

Diunggah oleh

Scott ShypulaHak Cipta:

Format Tersedia

Economic Research

August 1, 2014

Global Data Watch

Although growth has picked up, concerns about final demand linger

EM Asian trade and production bounces while Japan still slides

Its time for the Euro area to deliver above-trend growth

A pivot or another plotz?

A material lift in global growth is taking hold around midyear, as a rebound from

weakness the US and Japan is reinforcing a more modest acceleration in the Euro

area and Emerging Asia. These developments form the base for an anticipated

pivot to sustained above-trend global growth. If we are right, this episodes con-

tours should mirror growth pivots in earlier expansions (during 2003 and 1993).

This weeks data deluge provides important support for this view.

The constructive message from last weeks flash readings was confirmed in

the July global manufacturing PMI. With global output and orders readings

both holding stable at about 54, the PMI is consistent with 4.5% annualized

gains in factory output this quarter. Such an outcome would align with our

view that global GDP growth will accelerate by roughly a percentage point

from last quarters weak 2.2% annualized gain.

The 2Q US GDP release delivered a significant upside surprise with a 4%

annualized gain last quarter and an average of 0.7% annualized upside sur-

prise to the previous three quarters. Although the 2Q bounce needs to be

viewed alongside the deep contraction it followed, available July releases

employment, initial claims, auto sales, ISM manufacturing, PMI services

and consumer confidencepoint to growth momentum being maintained at

an above-trend pace this quarter.

Hard activity readings in EM Asia point to production and export growth

lifting sharply into mid year. It is also encouraging to see that the regional

output manufacturing PMI moved up 1.1 point in July to its highest level

since May 2011.

The false dawns of the past four years are fresh in our memories and it is far

too early too dismiss lingering concerns that the recent improvement could

prove transitory. Indeed, we are in the midst of the fourth episode of this ex-

pansion in which the US economy has delivered a two quarter average growth

rate over 3%. In the previous three, growth slipped back below trend. In two

of these episodes the growth slide was severe enough to produce a two quarter

average of sub-1% GDP growth.

Contents

US economy looks a little

different after the GDP report 13

Labor underutilization and wages

in the Euro area 15

Japans exports face both cy clical

and secular headwinds 17

EM Asia's credit woes 19

Changes in China's monetary policy

operational framework 23

Signals from Taiwan's ex porters

confirm global recovery 25

Global Economic Outlook Summary 4

Global Central Bank Watch 6

Nowcast of global growth 7

Selected recent research from

J.P. Morgan Economics

8

The J.P. Morgan View: Markets 9

Data Watches

United States 27

Euro area 35

Japan 41

Canada 45

Mexico 47

Brazil 49

Argentina 51

Chile 53

United Kingdom 55

Central Europe 59

South Africa 63

Australia and New Zealand 65

China, Hong Kong, and Taiwan 67

Korea 71

ASEAN 75

India 77

Asia focus 79

Regional Data Calendars 80

Bruce Kasman

(1-212) 834-5515

bruce.c.kasman@jpmorgan.com

JPMorgan Chase Bank NA

David Hensley

(1-212) 834-5516

david.hensley@jpmorgan.com

JPMorgan Chase Bank NA

Joseph Lupton

(1-212) 834-5735

joseph.p.lupton@jpmorgan.com

JPMorgan Chase Bank NA

www.jpmorganmarkets.com

0

1

2

3

4

2010 2011 2012 2013 2014 2015

% change over 2q, saar, 3Q forecast boxed

US real GDP

Source: BEA

-1

0

1

2

3

4

5

6

2010 2011 2012 2013 2014

% change over 2q, saar; 3Q est. boxed

US inventories and final sales of goods

Source: BEA

Final sales of goods

Non-farm

inventories

2

Economic Research

Global Data Watch

August 1, 2014

JPMorgan Chase Bank NA

Bruce Kasman (1-212) 834-5515

bruce.c.kasman@jpmorgan.com

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

Joseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

A central driver of the US and global mini-cycles has been

volatile corporate sector dynamics. In late 2010 and mid-2012

strong US goods demand contributed to a global industrial

upturn, reinforced by a stock building cycle. However, faced

with subsequent demand disappointment, firms quickly turned

cautious. A deceleration in business spending and stock build-

ing resulted, producing a downshift in growth.

With 2Q14 US growth being supported by a rebound in final

sales of goods and a 1.7%-pt contribution from inventories,

the sensitivity of growth to a negative demand shock could

again be pronounced. This message is reinforced by the sizea-

ble global increase in the finished goods inventory index in

the July PMI. It is against this backdrop, that the positive

message on US private final demand is encouraging. Growth

of domestic final sales at a 2.9% annualized rate last quarter

was stronger than expected and, if our forecast for this quarter

is realized, final sales will have increased 3% oya for the first

time in four years.

Waiting for Euro area demand lift

For much of this expansion, the Euro area has produced nega-

tive demand and financial shocks. Although these drags have

faded and the region exited recession, GDP growth still aver-

aged less than 1% during 1H14. The Euro area needs to be-

come a more important source of demand if we are pivoting,

and we expect growth to accelerate to a 2% pace during 2H..

The case for stronger Euro area growth is straightforward.

Confidence has recovered and financial conditions have im-

proved against a backdrop of very depressed levels of spend-

ing. We view recent developments as supportive of the view

that growth will accelerate this quarter. After last weeks re-

covery in the flash composite July PMI, this weeks EC sur-

vey showed economic sentiment holding at a level consistent

with 2%growth.

There are two supports that we anticipate will boost house-

hold spending in the coming months. The first is the decline

in unemployment that signals ongoing employment gains.

The second is the fall-off in headline inflation that points to

firmer purchasing power as food and energy prices fall. It is

noteworthy that German and French consumption indicators

posted solid gains in June.

The news on credit is also encouraging. According to the

ECBs bank lending survey, there was a broad easing of cred-

it standards in the second quarter. In particular, banks report-

ed a net easing of credit standards to corporates for the first

time since early 2007. Banks expect a further easing of lend-

ing standards in the current quarter. Also noteworthy is the

move down in borrowing rates for households and non-

financial businesses over the past couple of months. For

households, borrowing rates have declined by 10bps, while

for firms they have declined by 21bps. Perhaps not surprising-

ly, banks report increased loan demand by corporates and

households, a trend they expect to continue.

Although the data are moving in the right direction, the an-

nouncement of additional EU sanctions against Russia this

week highlights a risk to the outlook. We do not believe that

the Ukraine crisis has impacted the Euro area macro economy

yet, but there is understandable concern that there will be an

impact over time. Our judgment is that the current level of

sanctions will not alter the regional growth path. But we rec-

ognize the risk that sentiment could be affected more nega-

tively or conditions could worsen further.

Japan disappoints

Japans 1H14 performance is heavily impacted by the 3%

VAT hike introduced in April. Spending was front-loaded

ahead of the increase, which contributed to boomy 6.7% an-

nualized GDP growth in 1Q. This surge was followed by a

sharp decline in activity with the tax hike. Our forecast has

Japan stagnating in H1, but rebounding strongly this quarter.

With incoming data disappointing across a broad front, we

revised down our 2Q and 3Q GDP forecast to -7.5%q/q, saar

(from -6.5%) and 2.5% (from 3.0%), respectively, this week.

Although the first half now shows the economy contracting

modestly, we maintain our forecast of a significant bounce-

back, with growth expected to average 2.3% in 2H14more

than twice Japans trend growth rate.

June consumption indicators disappointed but continue to

show a bounce-back from the tax hike induced April lows.

June retail spending stands 1.4% above its 2Q average level,

and spending levels are recovering faster than after the 1997

tax hike. This partly reflects a solid fundamental backdrop for

consumers. This weeks labor market report shows the job-

95

97

99

101

103

Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct

1996-1997

2013-2014

Japan manufacturing around VAT tax hike

Source: J.P. Morgan

Index, Avg(t-6 to t-1) = 100, sa

VAT hike

3

Economic Research

Global Data Watch

August 1, 2014

JPMorgan Chase Bank NA

Bruce Kasman (1-212) 834-5515

bruce.c.kasman@jpmorgan.com

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

Joseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

offer to applicant ratio reaching its expansion high, with de-

pendent employment posting a solid gain. Summer bonuses

are also expected to boost income, a message likely to be con-

firmed by next weeks June Employers survey. The details of

this weeks Shoko Chukin surveywhere the nonmanufactur-

ing DI rose to 49.4 in July with the outlook DI predicting an

additional rise to 50.3also send a positive signal.

The more concerning element of Japanese growth is the disap-

pointing signal from industry. June industrial production fell

sharply and manufacturers expectations of lift in the coming

months do not fully offset this disappointment. Part of this poor

performance likely results from lost high-tech product competi-

tiveness and the ongoing shift of production abroad (see the RN

Japans exports faces both cyclical and secular headwinds), a

drag on growth that is expected to persist.

The slower-than-expected recovery in May and June, howev-

er, will have only a limited impact on BoJs policy. We think

that Governor Kuroda will remain bullish at his press confer-

ence after next weeks Monetary Policy Meetingholding on

to an upbeat near-term growth and inflation outlook and reit-

erating that 2% inflation (ex VAT) will be achieved in

FY2015. That said, we ultimately expect the BoJ will be dis-

appointed on both fronts.

Asias North-South demand divide

Disappointment on Japanese growth contrasts with the more

upbeat news from elsewhere in Asia. This weeks PMI and

trade data from EM Asia suggest that exports are lifting into

mid year, fueled by a combination of firmer global demand

and as a tech-related product launch cycle.

Stronger domestic demand growth is also an important ele-

ment of the forecast, and the leading edge of the regional de-

mand cycle is coming from Greater China. Taiwans 2Q GDP

released this week followed Chinas lead in showing a lift in

domestic activity is taking hold. This quarter, the lens is fo-

cused on Korea where a combination of fading drags, stronger

external demand and policy supports is expected to produce a

demand rebound. Indeed, Korean GDP growth is expected to

bounce towards 5% annualized growth this quarter.

The ASEAN group is expected to produce a more muted de-

mand recovery. Not only will the direct impact of a stronger

global tech cycle benefit North Asia more than ASEAN (from

the Norths greater integration into the tablet and Smartphone

supply-chains) but their domestic cycles appear more set for a

lift from policy. In particular Indonesia, which makes up half

of ASEAN GDP, faces still-tight policy settings and an ongo-

ing terms of trade shock in its key commodity exports.

CEE: Poland lags lifting elsewhere

The strength in German demand over the past year has pro-

vided a powerful lift to CEE, which saw real GDP growth

accelerate from just 1% annualized in 1H13 to 4% as of

1Q14. However, the loss of German momentum damped

growth last quarter. At the same time, geopolitical uncertain-

ties surrounding Ukraine have weighed on trade and business

confidence. In response, real GDP decelerated to a modest 2%

growth pace last quarter. CEE growth looks likely to pick

back up alongside the improving global backdrop, but the

latest data suggest this lift will be held back by a sluggish

Poland. While July PMI reports show Czech Republic and

Hungary rebounding, the Polish PMI made its fifth consecu-

tive decline and now stands at a 13-month low. On balance,

we believe risks are to the downside to the Polish outlook.

Argentina: No contagion, no growth

Argentina defaulted this week as funds deposited for debt ser-

vice were withheld as a legal consequence of its failure to reach

a settlement with a minority of holdout creditors. Admittedly,

the default establishes a contrast between the US and Europe

where courts cannot interrupt debt service payments. But Ar-

gentinas legal issues are not indicative of a lack of capacity or

willingness to pay that normally drives sovereign defaults. And

its limited leverage and limited cross-border financial linkages

downplay risk of contagion to other economies or credits.

The authorities expect the economy to decouple from head-

aches generated by debt transfer problems, and Argentine

bond prices remain relatively stable, reflecting market hopes

for an eventual settlement. As long as this view is validated,

contagion to domestic FX markets should remain limited.

With strict capital controls already in place, authorities are

inclined to keep the peso stable to emphasize that current debt

problems are different from past experiences. But irrespective

of the peso defense, the economy is set to continue to con-

tract. After falling at about a 1.5% annualized pace in 1H14, a

more severe slump is projected for 2H.

46

48

50

52

54

56

58

Jan 13 Apr 13 Jul 13 Oct 13 Jan 14 Apr 14 Jul 14

DI, sa

Manufacturing PMI - headline

Source: J.P. Morgan

Poland

Hungary

Czech Republic

4

JPMorgan Chase Bank NA

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

Carlton Strong (1-212) 834-5612

carlton.m.strong@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

J oseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

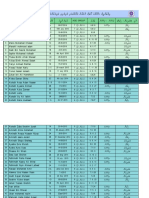

Global economic outlook summary

Real GDP Real GDP Consumer prices

%over a year ago %over previous period, saar %over a year ago

2013 2014 2015 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 4Q13

2Q14 4Q14 4Q15

United States 2.2 2.1 3.0 3.5 -2.1 4.0 3.0 3.0 3.0 1.2 2.1 2.1 1.9

Canada

2.0

2.2 2.6 2.7 1.2 2.2 2.5 2.7 2.8

0.9 2.5 2.3 2.0

Latin America 2.5 1.3 2.7 1.5 0.4 0.6 1.9 2.7 2.7 4.5 5.0 5.1 4.7

Argentina

2.9

-1.5 3.0 -1.8 -3.2 -0.1 -4.6 -1.4 5.0

10.7 36.0 35.0 40.0

Brazil 2.5 0.7 1.5 1.8 0.7 -1.0 1.1 2.6 1.1 5.8 6.3 6.3 6.3

Chile

4.1

2.5 3.5 -0.4 3.0 1.7 4.0 2.8 3.2

2.5 4.5 4.2 3.0

Colombia 4.7 5.0 4.5 3.7 9.7 2.0 4.0 4.0 5.0 1.8 2.8 3.2 3.0

Ecuador

4.5

3.3 4.0 4.7 2.0 1.5 2.0 2.5 3.5

2.3 3.4 3.5 4.0

Mexico 1.1 2.7 3.8 0.5 1.1 3.5 3.9 3.7 3.6 3.7 3.7 4.1 3.1

Peru

5.8

4.2 5.5 6.9 0.3 3.5 6.0 7.0 5.5

3.0 3.2 3.0 2.5

Uruguay 4.7 3.0 4.0 6.4 -1.8 4.5 6.0 4.0 3.0 8.6 8.1 7.8 7.3

Venezuela

1.3

-2.0 2.0 2.3 -10.0 -3.0 2.0 2.0 2.0 52.9 56.2 57.0 44.9

Asia/Pacific

4.6

4.5 4.7 4.3 5.4 2.1 5.1 5.0 4.8

3.2 3.3 3.0 3.3

Japan 1.5 1.0 1.3 0.3 6.7 -7.5 2.5 2.0 2.0 1.4 3.8 3.1 2.5

Australia

2.4

3.0 3.2 3.2 4.5 0.4 3.1 4.3 2.9

2.7 2.9 2.0 2.6

New Zealand 2.8 3.2 2.8 4.1 4.0 0.8 1.9 4.7 4.8 1.6 1.8 1.6 2.0

EM Asia

6.2

6.1 6.4 6.2 5.0 6.4 6.5 6.3 6.2

3.9 3.2 3.1 3.7

China 7.7 7.3 7.3 7.1 6.3 7.7 7.6 7.4 7.1 2.9 2.2 2.1 3.1

India

4.7

5.3 6.5 4.2 5.0 6.0 5.5 5.0 6.0

10.4

8.1

8.2

7.0

EM Asia ex China/India 4.0 4.0 4.5 5.1 2.3 3.9 4.8 4.6 4.4 3.3 3.2 2.9 3.4

Hong Kong

2.9

2.8 2.6 3.6 0.8 3.0 4.2 4.2 2.0

4.3 3.6 3.4 3.5

Indonesia 5.8 4.9 5.3 6.0 4.1 5.1 5.0 4.5 5.3 8.4 6.2 4.6 4.6

Korea

3.0

3.7 4.0 3.6 3.8 2.4 4.7 4.0 4.0

1.1

1.6

2.3

2.9

Malaysia 4.7 5.6 4.8 7.6 3.3 5.0 6.0 5.5 5.0 3.0 3.3 2.4 5.0

Philippines

7.2 6.0 6.4 6.1 4.9 7.8 5.7 5.7 6.6

3.5

4.0

3.6

3.8

Singapore 3.9 3.6 4.5 6.9 2.3 -0.8 5.7 7.4 4.9 2.0 2.4 1.1 2.4

Taiwan

2.1

4.0 3.9 7.6 1.9 5.9 4.0 4.2 3.8

0.6

1.6

1.7

1.7

Thailand 2.9 1.1 4.2 0.5 -8.2 3.5 4.0 4.0 4.2 1.7 2.6 2.9 3.8

Western Europe

0.1

1.4 2.2 1.6 1.2 1.4 1.8 2.2 2.2

1.0 0.8 0.9 1.3

Euro area -0.4 1.1 2.0 1.2 0.8 1.0 1.5 2.0 2.0 0.8 0.6 0.7 1.0

Germany

0.5

2.0 2.3 1.5 3.3 0.5 2.0 2.5 2.5

1.3

0.9

1.1

1.7

France 0.4 0.6 1.7 0.7 0.1 0.5 1.0 1.5 2.0 0.8 0.8 0.6 1.1

Italy

-1.8

0.0 1.3 0.5 -0.5 0.0 1.0 1.5 1.5

0.7

0.4

0.1 0.9

Spain -1.2 1.3 2.2 0.7 1.5 2.4 2.0 2.0 2.0 0.2 0.2 -0.1 0.0

Norway

2.0

1.9

2.3

2.0 1.9 2.0 1.9

2.1

2.3

2.3

1.8

1.6

2.2

Sweden 1.6 1.8 2.4 6.4 -0.4 1.0 2.0 2.5 2.5 0.1 0.0 0.6 1.6

United Kingdom

1.7

3.1 3.0 2.6 3.3 3.2 3.0 3.0 3.0

2.1

1.7

1.7

2.1

EMEA EM 2.0 1.8 2.5 3.2 0.6 1.2 2.1 2.1 2.4 5.1 5.7 5.3 4.3

Czech Republic

-0.9

2.8

2.8

6.1

3.2

1.8

2.0

2.3

4.2

1.1 0.0 1.0 1.9

Hungary 1.1 3.0 2.5 2.7 4.5 2.3 2.0 2.5 3.0 0.7 -0.1 0.6 2.9

Israel

3.4

3.3 3.8 3.3 2.9 3.3 3.6 4.5 3.2

1.9

1.0

1.3

1.9

Poland 1.6 3.2 3.2 2.8 4.5 2.0 3.0 3.5 3.5 0.7 -0.1 0.3 1.8

Romania

3.5

3.2 3.5 5.6 0.7 3.0 2.0 2.8 3.6

1.8

1.0

2.3

2.6

Russia 1.3 0.5 1.3 2.6 -3.4 0.8 1.5 1.5 1.0 6.4 7.6 6.6 4.5

South Africa

1.9

1.8 3.2 3.8 -0.6 0.9 4.5 3.8 2.9

5.4 6.5 6.5 5.8

Turkey 4.0 3.0 4.1 3.5 7.0 0.8 1.2 0.8 4.1 7.5 9.1 8.1 6.3

Global

2.5 2.6 3.3

3.1 1.7 2.2 3.2 3.4

3.3

2.3 2.6 2.5 2.6

Developed markets 1.3 1.7 2.4 2.3 0.8 1.1 2.4 2.6 2.5 1.2 1.9 1.8 1.8

Emerging markets 4.6

4.2 4.9

4.6

3.1 4.1 4.7

4.7

4.7

4.3 4.0 3.9 4.0

Global PPP weighted 3.0 3.1 3.7 3.5 1.8 2.9 3.6 3.7 3.7 2.8 2.9 2.9 2.9

Note: For some emerging economies seasonally adjusted GDP data are estimated by J.P. Morgan. Bold denotes changes from last edition of Global Data Watch, with arrows

showing the direction of changes. Underline indicates beginning of J.P. Morgan forecasts. Unless noted, concurrent nominal GDP weights calculated with current FX rates are used

in computing our global and regional aggregates. Regional CPI aggregates exclude Argentina, Ecuador and Venezuela.

5

JPMorgan Chase Bank NA

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

Carlton Strong (1-212) 834-5612

carlton.m.strong@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

J oseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

G-3 economic outlook detail

2013 2014 2015

2013 2014 2015 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q

United States

Real GDP 2.2 2.1 3.0 3.5 -2.1 4.0 3.0 3.0 3.0 3.0 2.5

Private consumption 2.4 2.3 2.9

3.7 1.2 2.5 2.8 2.7 3.3 3.3 2.8

Equipment investment 4.6 5.3 5.9 14.1 -1.0 7.0 5.0 7.0 6.0 6.0 5.0

Non-residential construction -0.5 7.2 6.9

12.8 2.9 5.3 7.0 8.0 8.0 6.0 6.0

Intellectual property products 3.4 3.5 3.3 3.6 4.7 3.5 4.0 4.0 3.0 3.0 3.0

Residential construction 11.9 3.5 13.6

-8.5 -5.3 7.5 15.0 15.0 15.0 13.0 13.0

Inventory change ($ bn saar) 63.6 68.4 62.0 81.8 35.2 93.4 74.7 70.4 64.5 64.7 59.8

Government spending -2.0 -0.7 -0.1

-3.8 -0.8 1.6 -0.4 -0.5 -0.2 -0.1 0.0

Exports of goods and services 3.0 3.2 5.5 10.0 -9.2 9.5 6.0 5.5 5.0 5.0 5.0

Imports of goods and services 1.1 4.0 5.2

1.3 2.2 11.7 1.5 4.0 5.5 6.0 6.0

Domestic final sales contribution 1.9 2.2 3.0 2.3 0.7 2.9 2.9 3.0 3.3 3.2 2.9

Inventories contribution 0.0 0.0 0.0

0.1 -1.1 1.7 -0.5 -0.1 -0.2 0.0 -0.1

Net trade contribution 0.3 -0.2 0.0 1.1 -1.7 -0.6 0.6 0.2 -0.1 -0.2 -0.2

Consumer prices (%oya) 1.5 1.9 2.0

1.2 1.4 2.1 2.0 2.1 2.1 1.8 1.9

Excluding food and energy (%oya) 1.8 1.8 1.9 1.7 1.6 1.9 1.9 1.9 2.0 1.8 1.9

Federal budget balance (%of GDP, FY) -4.1 -2.8 -2.6

Personal saving rate (%) 4.9 5.2 5.2 4.4 4.9 5.3 5.3 5.4 5.3 5.3 5.2

Unemployment rate (%) 7.3 6.2 5.6

7.0 6.7 6.2 6.1 5.9 5.7 5.6 5.5

Industrial production, manufacturing 2.6 3.3 3.2 4.2 1.4 6.7 3.0 3.0 3.0 3.0 3.0

Euro area

Real GDP -0.4 1.1 2.0 1.2 0.8 1.0 1.5 2.0 2.0 2.3 2.3

Private consumption -0.6 0.6 1.5

0.3 0.6 0.5 1.0 1.5 1.5 1.8 1.8

Capital investment -2.8 1.8 3.2 3.8 0.7 1.0 2.5 3.0 3.0 4.0 4.0

Government consumption 0.2 0.8 1.1

-1.3 2.7 0.5 0.5 1.0 1.0 1.5 1.5

Exports of goods and services 1.5 2.6 3.4 5.5 0.7 1.0 3.0 3.0 3.5 4.0 4.0

Imports of goods and services 0.4 2.6 3.7

2.6 3.3 -1.0 3.0 3.5 4.0 4.5 4.5

Domestic final sales contribution -0.8 0.8 1.6 0.5 1.0 0.6 1.1 1.6 1.6 2.0 2.0

Inventories contribution -0.1 0.1 0.3

-0.8 0.8 -0.5 0.2 0.5 0.4 0.3 0.3

Net trade contribution 0.5 0.1 0.0 1.5 -1.0 0.9 0.1 -0.1 0.0 0.0 0.0

Consumer prices (HICP, %oya) 1.3 0.6 0.9

0.8 0.6 0.6 0.4 0.7 0.7 1.0 1.0

ex unprocessed food and energy 1.3 0.9 0.9 1.0 1.0 0.9 0.8 0.9 0.8 0.9 0.9

General govt. budget balance (%of GDP, FY) -3.0 -2.4 -2.3

Unemployment rate (%) 12.0 11.6 11.2 11.9 11.7 11.6 11.5 11.4 11.3 11.2 11.1

Industrial production -0.7 1.5 3.0

2.2 1.0 1.0 2.5 3.0 3.0 3.5 3.5

Japan

Real GDP 1.5 1.0 1.3 0.3 6.7 -7.5 2.5 2.0 2.0 2.2 3.5

Private consumption 2.0 0.2 1.5

1.5 9.2 -17.0 6.0 3.5 2.0 3.0 6.0

Business investment -1.4 5.8 2.4 6.6 34.2 -20.0 2.5 4.0 4.5 4.5 5.5

Residential construction 8.8 0.5 -3.2

18.2 13.0 -20.0 -20.0 -10.0 5.0 5.0 10.0

Public investment 11.5 5.3 -3.3 4.7 -10.5 5.0 10.0 5.0 -10.0 -10.0 -10.0

Government consumption 2.0 0.9 1.2

0.8 0.4 1.5 1.0 1.0 1.5 1.0 1.0

Exports of goods and services 1.6 6.7 4.5 1.8 26.3 -4.0 3.5 4.5 5.5 5.5 5.5

Imports of goods and services 3.4 6.8 3.8

15.5 27.6 -25.0 10.0 5.5 5.5 6.5 10.0

Domestic final sales contribution 2.1 1.3 1.2 2.4 7.8 -11.2 3.6 2.4 1.5 2.5 4.2

Inventories contribution -0.3 -0.4 0.0

-0.3 -1.1 0.0 -0.2 -0.3 0.5 -0.2 -0.2

Net trade contribution -0.2 0.1 0.2 -1.8 0.1 3.7 -0.8 -0.1 0.1 -0.1 -0.6

Consumer prices (%oya) 0.4 2.9 2.0

1.4 1.5 3.8 3.4 3.1 3.0 1.3 1.2

General govt. net lending (%of GDP, CY) -8.9 -8.1 -6.8

Unemployment rate (%) 4.0 3.5 3.4

3.9 3.6 3.6 3.5 3.4 3.4 3.4 3.3

Industrial production -0.6 3.1 2.2 7.6 12.5 -14.3 1.0 4.0 4.5 4.5 5.5

Memo: Global industrial production

1.9 3.1 3.1 4.3 2.1 2.5 3.8 4.4 4.0 4.4 4.4

%oya

3.2 3.2 3.0 3.1 3.1 3.6 4.2 4.3

Note: More forecast details for the G-3 and other countries can be found on J.P. Morgans Morgan Markets client web site

6

JPMorgan Chase Bank NA

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

J oseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

Olya E Borichevska (1-212) 834-5398

olya.e.borichevska@jpmorgan.com

Global Central Bank Watch

Official

Current

Change since (bp)

Last change Next mtg

Forecast Forecast (%pa)

rate rate (%pa)

05-07 avg Trough

1

Jul 11 next change

Sep 14 Dec 14 Mar 15 Jun 15 Sep 15

Global 2.34 -198 55 -34 2.31 2.32 2.33 2.34 2.44

excluding US 3.11 -113 69 -37 3.06 3.07 3.09 3.10 3.11

Developed 0.29 -320 0 -55 0.30 0.30 0.32 0.35 0.52

Emerging 6.05 -96 116 -22 6.10 6.12 6.12 6.11 6.07

Latin America 7.41 -334 160 -161 7.41 7.41 7.44 7.44 7.44

EMEA EM 6.11 -12 214 178 6.47 6.47 6.37 6.27 6.04

EM Asia 5.60 -19 112 -37 5.58 5.61 5.64 5.64 5.65

The Americas 1.59 -350 50 -41 1.52 1.52 1.52 1.54 1.80

United States Fed funds 0.125 -438 0 0 16 Dec 08 (-87.5bp) 29 Jul 14 3Q 15 (+25bp) 0.125 0.125 0.125 0.125 0.500

Canada O/N rate 1.00 -273 75 0 8 Sep 10 (+25bp) 3 Sep 14 2Q 15 (+25bp) 1.00 1.00 1.00 1.25 1.25

Brazil SELIC O/N 11.00 -425 375 -150 2 Apr 14 (+25bp) 3 Sep 14 on hold 11.00 11.00 11.00 11.00 11.00

Mexico Repo rate 3.00 -487 0 -150 6 Jun 14 (-50bp) 5 Sep 14 4Q 15 (+25bp) 3.00 3.00 3.00 3.00 3.00

Chile Disc rate 3.75 -94 325 -150 15 Jul 14 (-25bp) 14 Aug 14 15 Aug 14 (-25bp) 3.25 3.00 3.00 3.00 3.00

Colombia Repo rate 4.25 -306 125 -25 31 Jul 14 (+25bp) 29 Aug 14 29 Aug 14 (+25bp) 4.75 5.00 5.00 5.00 5.00

Peru Reference 3.75 -31 250 -50 10 Jul 14 (-25bp) 7 Aug 14 7 Aug 14 (-25bp) 3.50 3.50 4.00 4.00 4.00

Europe/Africa 1.58 -216 25 -38 1.51 1.51 1.52 1.54 1.52

Euro area Refi rate 0.15 -283 0 -135 5 Jun 14 (-10bp) 7 Aug 14 3Q 18 (+10bp) 0.15 0.15 0.15 0.15 0.15

United Kingdom Bank rate 0.50 -444 0 0 5 Mar 09 (-50bp) 7 Aug 14 1Q 15 (+25bp) 0.50 0.50 0.75 1.00 1.25

Norway Dep rate 1.50 -169 25 -75 14 Mar 12 (-25bp) 18 Sep 14 on hold 1.50 1.50 1.50 1.50 1.50

Sweden Repo rate 0.25 -231 0 -175 3 Jul 14 (-50bp) 4 Sep 14 on hold 0.25 0.25 0.25 0.25 0.25

Czech Republic 2-wk repo 0.05 -235 0 -70 1 Nov 12 (-20bp) 5 Sep 14 On hold 0.05 0.05 0.05 0.05 0.05

Hungary 2-wk dep 2.10 -503 0 -390 22 Jul 14 (-20bp) 26 Aug 14 4Q 15 (+20bp) 2.10 2.10 2.10 2.10 2.10

Israel Base rate 0.50 -375 0 -275 28 Jul 14 (-25bp) 25 Aug 14 1Q 15 (+25bp) 0.50 0.50 1.00 1.25 1.25

Poland 7-day interv 2.50 -202 0 -200 3 Jul 13 (-25bp) 2 Sep 14 Sep 14 (-50bp) 2.00 2.00 2.00 2.00 2.00

Romania Base rate 3.50 -469 0 -275 4 Feb 14 (-25bp) 4 Aug 14 30 Sep 14 (-25bp) 3.25 3.00 2.75 2.75 2.75

Russia Key pol rate 8.00 N/A N/A N/A 25 Jul 14 (+50bp) 25 Jul 14 1Q 15 (-25bp) 8.00 8.00 7.75 7.50 7.00

South Africa Repo rate 5.75 -254 75 25 17 Jul 14 (+25bp) 18 Sep 14 29 Jan 14 (+25bp) 5.75 5.75 6.00 6.25 6.50

Turkey 1-wk repo 8.25 -741 324 200 24 Jun 14 (-50bp) 27 Aug 14 27 Aug 14 (-25bp) 8.00 8.00 8.00 8.00 8.00

Asia/Pacific 3.81 14 91 -31 3.80 3.82 3.84 3.84 3.87

Australia Cash rate 2.50 -344 0 -225 6 Aug 13 (-25bp) 5 Aug 14 On hold 2.50 2.50 2.50 2.50 2.75

New Zealand Cash rate 3.50 -388 100 100 24 Jul 14 (+25bp) 11 Sep 14 11 Dec 14 (+25bp) 3.50 3.75 4.00 4.25 4.25

Japan O/N call rate 0.05 -17 0 0 5 Oct 10 (-5bp) 7 Aug 14 On hold 0.05 0.05 0.05 0.05 0.05

Hong Kong Disc. wndw 0.50 -548 0 0 17 Dec 08 (-100bp) 30 Jul 14 3Q 15 (+25bp) 0.50 0.50 0.50 0.50 0.75

China 1-yr working 6.00 -14 69 -56 7 Jul 12 (-31bp) - On hold 6.00 6.00 6.00 6.00 6.00

Korea Base rate 2.50 -165 50 -75 9 May 13 (-25bp) 14 Aug 14 14 Aug 14 (-25bp) 2.25 2.25 2.25 2.25 2.25

Indonesia BI rate 7.50 -237 175 75 12 Nov 13 (+25bp) 14 Aug 14 On hold 7.50 7.50 7.50 7.50 7.50

India Repo rate 8.00 113 325 0 28 Jan 14 (+25bp) 5 Aug 14 4Q 14 (+25bp) 8.00 8.25 8.25 8.25 8.25

Malaysia O/N rate 3.25 1 125 25 10 Jul 14 (+25bp) 18 Sep 14 1Q 15 (+25bp) 3.25 3.25 3.50 3.50 3.50

Philippines Rev repo 3.75 -331 25 -75 31 Jul 14 (-25bp) 15 Sep 14 1Q 15 (+50bp) 3.50 3.50 4.00 4.00 4.00

Thailand 1-day repo 2.00 -183 75 -125 12 Mar 14 (-25bp) 6 Aug 14 1Q 15 (+25bp) 2.00 2.00 2.25 2.50 2.50

Taiwan Official disc. 1.875 -71 62.5 0 30 Jun 11 (+12.5bp) 30 Sep 14 1Q 15 (+12.5bp) 1.875 1.875 2.00 2.00 2.00

1 Refers to trough end-quarter rate from2009-present Effective rate can be adjusted on daily basis 3 BoJ targets 60-70tn/year expansion in monetary base

Bold denotes move since last GDWand forecast changes. Underline denotes policy meeting during upcoming week. Aggregates are GDP-weighted averages.

7

JPMorgan Chase Bank NA

J oseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

Olya E Borichevska (1-212) 834-5398

olya.e.borichevska@jpmorgan.com

Nowcast global growth: 3Q14

Healthy start quarter

This week we roll our nowcaster tracking period to 3Q14.

Before turning to the current quarter, however, it is worth

noting that the nowcaster ended 2Q having seen some of the

upside risk-gap closed this week. The J .P.Morgan GDP

growth projection for last quarter was revised up in

response to much stronger-than-expected US GDP growth

that more than offset a downward revision to our J apan

outlook. That said, the 2Q tracking exercise still points to

1.1%-pt of upside risk that looks increasingly likely to

become yet another large error on the heels of 1Qs

disappointment.

Turning to the current quarter, the J .P. Morgan bottom-up

projection points to a 3.2% annualized gain in global GDP.

At the country level, there have been a few revisions with

J apan revised down and Malaysia revised up. On net, this

resulted in downward DM and global revisions. Still, the

bounce from last quarters 2.2% is noteworthy. If our call is

right, the global economy should pivot sharply this quarter

from below-trend growth in 1H14 to above trend in 2H14.

In the event the global pivot plays out, we should see it

confirmed in our nowcaster. However, given that our

nowcaster never saw the unusual dip in 1H14, we will track

our pivot call by watching to see that the nowcaster holds

near its recent solid levels. In this regard, the tracking

exercise begins this quarter with the nowcaster pointing to

3% annualized global GDP growth, just a touch weaker

than the J.P.Morgan forecast. It is worth noting that the last

time the nowcaster ran below the J .P.Morgan forecast was

precisely a year ago in J uly 2013.

Given that most of the data for 3Q is not available, the

nowcaster predicts underlying data based on the historical

averages of cross- and serial-correlations to fill out the

quarter. So far, the only datum available for 3Q is the

manufacturing PMI. Todays J uly manufacturing PMI

shows global factory output rising 4.4% annualized this

quarter, in line with the J .P.Morgan global GDP forecast

and thus, not surprisingly, the nowcaster projection.

Next Tuesday will deliver the all-industry PMI for J uly.

Based on the US and Euro area flash reports, we are

expecting a solid reading. If true, the nowcaster should pick

up and likely align with the J .P.Morgan forecast. After the

J uly PMI readings, the next important data input will be the

hard activity signals for J une. Global IP, retail sales, and

capital goods orders will become available in mid-August.

In the past, we have noted that there is a contemporaneous

correlation between equity markets and the nowcaster

reading. Given this, we note that during the first half of

2014 both the stock market and the nowcaster pointed to

solid gains. This might be another evidence of the strange

nature of 1Q global GDP result.

Global real GDP

%q/q, saar (Current forecast shaded)

2Q14

2Q14

Current Last week 4 weeks ago

J.P. Morgan 2.2 3.2 .. ..

Global Nowcaster 3.1 3.0 .. ..

Global PMI model 3.0 3.2 .. ..

Source: J.P. Morgan; Prior weeks' PMI model revised due to coding error

J.P. Morgan global aggregates

Quarters are %3m/3m,saar (PMIs avg level); Months are %m/m (PMIs level)

2Q14 3Q14 Jun 14 Jul 14 Aug 14 Sep 14

PMI, mfg 53.5 53.8 54.0 53.9 53.8 53.7

PMI, serv 54.3 55.5 55.8 55.7 55.5 55.4

IP 2.2 2.5 0.4 0.2 0.3 0.2

Retail sales 1.8 3.4 0.3 0.3 0.3 0.3

Auto sales 1.5 2.3 -0.7 0.5 0.2 0.3

Cap. orders 25.3 -2.5 4.2 -1.4 1.2 0.0

Nowcast 3.1 3.0 3.1 3.0 3.0 3.0

Note. Shaded values showforecasts computed by the Kalman filter estimates fromthe dynamic factor model.

Underlined values are our estimates based on available data and our judgment. Source: J.P. Morgan, Markit, and

national statistical agencies.

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

Jan 11 Jul 11 Dec 11 Jun 12 Dec 12 Jun 13 Dec 13 Jun 14

%q/q, saar; Box shows J.P. Morgan projection for 2Q14, 3Q14

Global real GDP

Nowcaster

(dashed line shows %m/m, saar)

Actual/JPM

(%q/q, saar)

Source:J.P.Morgan

-18

-12

-6

0

6

12

18

0

1

2

3

4

5

6

00 02 04 06 08 10 12 14

%3m, saar

J.P.Morgan Global GDP nowcast and equity prices

%3m

Global GDP nowcast

Equity price

(local FX)

Trend growth

Source: J.P. Morgan

8

JPMorgan Chase Bank NA

Bruce Kasman (1-212) 834-5515

bruce.c.kasman@jpmorgan.com

David Hensley (1-212) 834-5516

david.hensley@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

J oseph Lupton (1-212) 834-5735

joseph.p.lupton@jpmorgan.com

Selected recent research

1

from J .P. Morgan Economics

Global

EM unemployment rates fall despite slower job growth, Jul 3, 2014

Global trade stuck in low gear, Apr 25, 2014

The winter of global GDP's disconnect, Apr 4, 2014

United States and Canada

US: a field guide to wage-watching, Jul 25, 2014

IP chimes in on US economic performance, Jul 18, 2014

US: labor market debates, past and future, Jul 11, 2014

Canada: BoC to fade inflation run-up, Jul 11, 2014

US: Are we under-investing? Jul 3, 2014

US food price inflation will get a little easier to swallow, Jul 3, 2014

US: housing reality is happier than the myths, Jun 27, 2014

US: Who are the involuntary part-timers? Jun 13, 2014

US: 5 reasons why productivity will remain stuck in the mud, Jun 6, 2014

Stressed US state and local budgets hold back spending, Jun 6, 2014

US: Stay thirsty my friends: the mechanics of liquidity-draining, May 30, 2014

Early 2014: stronger US bank lending, weaker GDP, May 30, 2014

US pipeline prices moving up, deflation risks fading, May 16, 2014

Western Europe

Mixed supply side message from Euro area labor market, Jul 25, 2014

All mixed up: fiscal flexibility and structural reformin the Euro area, Jul 25, 2014

UK: the household sector can cope with gradual rate rises, Jul 25, 2014

The issue with the Euro area debt rule: the Italian case, Jul 18, 2014

Taking stock of Euro area growth: 2014 down, 2015 up, Jul 11, 2014

Europe's politics are shifting in the periphery's direction, Jul 11, 2014

Greece returns to growth but still needs fiscal flexibility, Jul 11, 2014

Euro area wage growth: an update, Jul 3, 2014

Riksbank feels the pressure from low inflation, Jul 3, 2014

Euro area: time for a change. Renzi+Merkel=Renkel? Jun 27, 2014

Previewing the ECB's comprehensive assessment, Jun 20, 2014

UK: FPC to step up its macroprudential response, Jun 20, 2014

Britain & the EU: Not (yet) knockin' on the exit door, Jun 20, 2014

ECB tilts Euro area growth risks to the upside, Jun 13, 2014

Euro area: From Brussels with (not so tough) love, Jun 6, 2014

ECB delivers a big package and a big signal, Jun 6, 2014

UK: Your payrise is lost in the mail but should arrive soon, Jun 6, 2014

ECB: some thoughts about targeted LTROs, May 30, 2014

Credit in the Euro area and the UK: closer than you think, May 23, 2014

Euro area new fiscal forecasts, May 16, 2014

Sweden: tougher capital rules pave the way for July rate cut, May 16, 2014

What if Scotland votes yes? Some lessons from history, May 16, 2014

\An update on Euro area slack, May 9, 2014

Central Europe, Middle East, and Africa

Turkey: CAD still a vulnerability despite export resilience, Jul 25, 2014

Saudi Arabia: lessons from the 2009 H1N1 pandemic, Jun 13, 2014

Iraqi elections put al-Maliki closer to a third mandate, May 23, 2014

De-escalation = acceptance of Russias vision for Ukraine, Apr 11, 2014

Turkey: CBRTs flexibility on display, Apr 11, 2014

Japan

Japan: VAT shock fading, but recovery is not a done deal, Jul 3, 2014

Japan: new growth strategy focus is corporate governance, Jun 20, 2014

BoJ to stay on holdchange in reaction function, Jun 6, 2014

Japan: new growth strategy no game-changer, May 9, 2014

Non-Japan Asia and Pacific

Tracking expansion plans for Australia's corporate sector, Jul 18, 2014

EM Asia's exports: US lift offset by drags elsewhere, Jul 18, 2014

Hostile senators derailing Australia's budget repair job, Jul 11, 2014

Australias competitiveness slide: lower wages, anyone? Jul 3, 2014

Indias budget: what to expect when youre expecting, Jul 3, 2014

Falling terms of trade a hurdle for Aussie corporate sector, Jun 27, 2014

Australia's neutral cash rate ain't what it used to be, Jun 20, 2014

China's role in shaping Hong Kong's monetary conditions, Jun 20, 2014

Taiwan: macro implications of property market boom, Jun 20, 2014

India: a policy agenda for the new government, Jun 13, 2014

Forecast change: RBA no longer expected to ease, Jun 6, 2014

What's Okun not telling us about the Aussie labor market? May 30, 2014

Containing China's financial risk, May 30, 2014

Undercurrents in China's consumption, May 30, 2014

Indonesia's budget revisions reflect rising macro headwinds, May 30, 2014

Singapore: getting to the core (inflation) of the matter, May 30, 2014

Chinas property market: a major macro risk, May 23, 2014

Aussie 2014-15 Budget outcome: Hockeys stick, May 16, 2014

Chinas small steps toward structural changes, May 9, 2014

China: RRR as a sterilization instrument, May 9, 2014

Is Emerging Asias tech sector losing its cyclical mojo? May 9, 2014

Indonesia's credit cycle: watching the fuel gauge, May 9, 2014

Latin America

Brazil: fiscal deterioration in cyclical and policy drivers, Jul 3, 2014

Mexico's balance of payments: changes brewing, Jun 27, 2014

Special Reports and Global Issues

Pressures forcing the G4 central banks apart, July 16, 2014

Portugal after the clean exit, May 8, 2014

ECB needs to do a lot more to meet its mandate (but probably won't), May 1, 2014

India: elections, markets, & the tyranny of economic reality, Apr 2, 2014

Euro area inflation: the building downside risk, Mar 25, 2014

Euro area slack: there is much more than you think, Feb 3, 2014

India in 2014five questions that keep us awake, Jan 26, 2014

The US economic outlook in 2014, Jan 2, 2014

We will grow, but can we heal? 2014 global economic outlook, Dec 19, 2013

Ten questions about China, Dec 18, 2013

Enjoying the interval in the Euro area drama, Oct 24, 2013

US future isn't what it used to be: potential growth falls below 2%, Aug 12, 2013

Job gains to lag global growth lift, Jul 24, 2013

BoJ to succeed by failing to hit its inflation goal, Jul 24, 2013

Chinas financial sector: concerns about the mounting risks, Jul 18, 2013

The challenge of very low inflation in the Euro area, Jul 9, 2013

1. Research notes listed have been published in GDW; Special Reports and Global Issues are stand-alone features, but may also have appeared in some formin GDW.

9

JPMorgan Chase Bank NA

Jan Loeys (1-212) 834-5874

jan.loeys@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

The J.P. Morgan View: Markets

Not a fundamental correction

Asset allocation Sell off is consistent with large spec

positions, is not supported by any worsening in

fundamentals, and is not producing contagion. We

accept volatility, prefer liquid risk assets and stay OW

EM.

Economics Surveys and hard data remain consistent

with the global economy moving to a 3% plus growth

pace in Q3, with little sign of inflationary pressures, or

earlier Fed tightening. Ideal for risk markets.

Fixed Income Flat duration in DM and long in EM.

We keep a 110bp target for 10yr Spain and Italy vs.

Germany by year end.

Equities Technicals suggest the correction in the

S&P 500 is not over.

Credit Argentinas default should not result in

contagion.

FX We are flattening our overall USD position from

a net short. Be long USD vs G10, but short vs EM Asia.

Commodities We raise our aluminum, copper, zinc

and gold price forecasts, but lower nickel and silver.

Equities sold off heavily yesterday, somewhat out of the blue

and without a smoking gun, in our opinion. Global stocks are

now almost 3% below their peak from a few weeks ago.

Bonds are broadly flat on the week, and credit spreads are a

bit wider, but not greatly so. EM outperformed again in

equities, but is flattish to slightly down vs. DM in other asset

classes.

Our technical strategists have been highlighting the risk of an

equity market correction this past month given, among others,

extended long hedge fund positions (chart p. 10 and

JPMorgan View two weeks ago). We decided then that we

did not want to trade this as the downside did not appear

extreme to us, given no change in underlying fundamentals,

and the likelihood that we would be forced back into the

market relatively quickly, with no guarantee that we would be

able to buy back at a lower price than where we sold. We stay

with that view, even as we accept that corrections are

typically not over in one day as they lead often to follow-on

position squaring.

On the fundamental side, Q2 earnings are coming in more

than fine, with 10% plus gains oya so far in the US, Europe,

and Japan (ex financials and utilities). Activity data and

surveys are supporting our view that world growth is

rebounding to an above trend rate of over 3%, a pace we

expect to be kept into next year. Both the FOMC statement

and the US payrolls report suggest to us there is little inflation

pressure in the US and the Fed is in no hurry to hike rates

(see D. Silver, Focus: taking stock of wage inflation

measures, Aug 1). We stay of the opinion that the FOMC will

only start hiking in Q3 of next year.

Even with no change in modal views, risk markets can easily

fall if there is a rise in tail risks. Clearly, the conflagration in

the Middle East is not abating, but is probably not the cause

of the equity correction as oil prices are down over the past

month. We stay long energy, despite recent losses, both as a

hedge and because it provides ample carry. Argentinas

default is an isolated conflict that has no bearing on the

ability of Latam sovereigns to pay their debts. The escalating

East-West conflict around the Ukraine has greater potential,

but to us not yet. The main thing to watch is whether the

conflict starts interrupting the flow of energy.

At times, a sell off in markets itself creates contagion and in

turn worsens fundamentals that then feed back into a further

worsening of risk assets. So far, we are not seeing this.

Contagion with risk assets is currently very limited. The

dollar is up half a percent within G10, and 1.5% vs EM. But

EM credit has barely moved vs US spreads, and EM equities

are actually outperforming. There is no real flight to quality

into bonds, and if there were, it would improve borrowing

costs. High yield is getting hit hard and borrowing costs are

rising here, but this should be offset by improvements in bank

lending standards in the USA and Europe. Wealth effects on

consumer spending of the 3% drop in global stocks appear

negligible.

Impact on strategy. Despite the losses on our portfolio, we

feel comfortable with our asset allocation. We suspect heavy

long equity positions are in DM and not in EM. With Asian

EM activity data and surveys in particular impressing, and

little signs of contagion, we stay long EM Asia against DM in

equities and currencies. And with investor concerns focused

on the effect of earlier Fed hikes, we continue to hold most of

our longs in risk assets via equities and very little in credit.

US high yield last month lost as much as global equities

(-1.2% each). We continue to see the combination of value,

positions and fundamentals as much less favorable for credit

than for equities.

Fixed Income

Bonds are broadly unchanged on the week, despite solid

economic data during the week, and fireworks in the equity

market. To some degree, the impact of better economic data

has been offset by the sudden drop in equity prices. Our

medium-term macro story remains intact, with a solid growth

dynamic in US, UK and Euro. We believe the growth and

10

Economic Research

The J.P. Morgan View: Markets

August 1, 2014

JPMorgan Chase Bank NA

Jan Loeys (1-212) 834-5874

jan.loeys@jpmorgan.com

inflation outlook will create a divergence in monetary policy

and stick to our cross-market trades, with short duration in

US against long duration in the Euro area. The positive macro

outlook provides support to our medium-term view of tighter

peripheral spreads and we keep a 110bp target for 10Y

Spain and Italy vs. Germany by the end of the year

(GFIMS, Bassi et al., Aug 1).

In the US, we are bearish on duration but limit our short

trading to weeks leading up to payrolls. There has been a

well-defined intra-month pattern to Treasuries, with yields

rising in the week before the employment report, only to

decline over the following week. Our US fixed income

strategists now take profit on the tactical short they put

on last week. With the data calendar relatively light,

volatility still subdued and the strong pattern of yields falling

in the week following payrolls, we see an opportunity for

carry trading. See todays US FIMS for recommendations of

the most attractive carry trades at present.

Equities

World equity markets were down almost 2% this week across

most regions except Japan, which was flat. Eurostoxx 50 has

now erased all of this years gains and is now down on the

year. This weeks news around Russia has weighed heavily

on European equities, making it the worst performing

regional equity market on the week.

How serious is the current correction? While we see a valid

argument to underweight European equities (vs EM), we

see no fundamental support for the correction in the

S&P500 index given a robust US reporting season and

positive US economic news this week. In our mind, the

correction is similar to the five mini corrections, of 5% or so,

the S&P500 index has experienced since the summer of 2012,

after the euro area crisis ended. Each of these five corrections

proved a good opportunity to add risk.

How much further can the correction go? Our US equity

technical analyst expects the correction to last until early

September. But the absence of a broad multi-month

distribution pattern leaves the longer-term bull market intact.

(Tips Breakevens and S&P 500 Index Technical Update, J.

Hunter and S. Seceleanu, Jul 29).

Our EM OW vs. DM continues to perform well despite the

weakness in EM currencies breaching the previous high seen

on Apr 11. The positive data flow from Taiwan, Korea, and

China supports our overweight in Asia within EM. Our

sectoral overweight in US semiconductors lost money this

month, with the Philadelphia Semiconductor Index (SOX

Index) down 7% from its peak in mid July. Despite this,

YTD, semiconductors have outperformed the S&P500 by

around 10%. We believe mixed Q3 guidance has resulted in

the recent pullback, resetting expectations. As a result, we

exit the trade tactically for this quarter and look to re-

enter once the negative sentiment fades into Q4. Overall

we believe fundamentals in the segment remain positive and

there are no indications of a negative supply demand

imbalance. Moreover, semiconductor indicators such as unit

growth rates, margins, utilization rates, etc, are not suggestive

of a peaking in fundamentals (see Despite Recent Selloff,

Semi Fundamentals Remain Constructive, H. Sur et al., Jul 28).

Credit

There are some similarities between the current risk asset

decline and the sell-off we saw last year in May. Then, a

more hawkish Fed hurt the assets that had benefited the most

from the QE fueled search for yield. Foremost among these

were EM and HY credit. This time around, we find it hard to

argue the Fed has become much more hawkish, but signs of

some tightening in labor markets are likely resulting in

position squaring, once again hurting credit. However, the

-0.30

-0.20

-0.10

0.00

0.10

0.20

0.30

0.40

0.50

0.60

Jan-12 May-12 Sep-12 Jan-13 May-13 Sep-13 Jan-14 May-14

Macro HF: beta to the S&P500

Equity L/S HF: beta to the S&P500

Hedge fundmonitor

Rolling 21-day beta of macro and equity L/S hedge fundreturns to the returns on the

S&P500. The beta represents the average exposure of macro hedge funds to equities

Source: Datastream, Bloomberg, J.P. Morgan

-5 0 5 10

EM FX

US cash

GSCI TR

Topix*

EM Local Bonds**

MSCI Europe*

US Fixed Income

Global Gov Bonds**

US High Yield

MSCI AC World*

Europe Fixed Inc*

S&P500

US High Grade

Gold

EM $ Corp.

MSCI EM*

EMBIG

YTD returns through:

%, equities in lighter color.

31-Jul

Source: J.P. Morgan, Bloomberg

11

Economic Research

Global Data Watch

August 1, 2014

JPMorgan Chase Bank NA

Jan Loeys (1-212) 834-5874

jan.loeys@jpmorgan.com

magnitude is far smaller. We expect this correction to be

short lived and it thus does not change our investment

strategy. We keep our small OW in credit.

Following Argentinas default and the expiry of the 30-day

Grace Period, the ISDA Determinations Committee has

decided that this event will trigger CDS. We do not expect

this event to result in any contagion to other markets as

Argentine bonds have been experiencing significant volatility

for sometime already and have traded on their own with little

correlation to anything else. Additionally, Argentinas weight

in the EMBIG index is less than 2% and it is not in the GBI-

EM or MSCI EM indices.

Foreign Exchange

After todays payrolls, the hard call for us is not the one-

year outlook. It is instead the next two months. The

medium-term call for a higher USD index remains anchored

in a view that the US economy will be breaking out in H2

after serial disappointment over the past three years, and that

2015 will deliver the sort of monetary policy divergences

required to generate a meaningful trend in the dollar index.

Hence, no change in the forecast for a 2% rise in JPM's trade-

weighted dollar index (JPMQUSD) by year end, nor in

benchmark currency targets for December like EUR/USD

1.30, USD/JPY 106, GBP/USD 1.67, AUD/USD 0.91,

USD/CAD 1.12, USD/BRL 2.35, but USD/MXN 12.80,

USD/CNY 6.15 and USD/KRW 1000.

The dollars near-term direction is less clear because a

good-but-not-great payroll frustrates momentum in the US 2-

yr required to give the dollar index its upward trend.

Normally we would simply affirm our summer-long strategy

of holding three buckets of trades: earning carry for another

few weeks in emerging markets (CNY); holding the odd USD

long versus a currency with a lot of tolerance for inflation

(NOK) or a major event risk (GBP); holding currencies of

counties with the strongest balance of payments (CHF,

KRW); and holding selective vol hedges, usually on a spread

basis (NZD/USD vs USD/MXN, EUR/USD and GBP/USD

vs EUR/GBP). Overall these themes have resulted in a net

short USD exposure, which has been profitable due to pair

selection but would have worked for the USD index this year.

Since the trade-weighted USD index is about unchanged this

year but non-USD currencies are higher yielding, a structural

short in the dollar this year would have generated alpha, as it

usually does in the years when the Fed is on hold.

But this time is different: We are neutralising USD

exposure for the first time in several months. Consider the

rationale more a risk bias than a strong directional one.

Weve thought for months that the US rates market and FX

vols have had a valuation problem, which exposed them to a

sharp correction if the US economy ever delivered consistent

growth with some inflation pressures. A shift in Fed tone

would helpeither Chair Yellens speech at Jackson Hole or

the September FOMC press conferencebut wasnt strictly

necessary since the market is priced even more dovishly than

the Feds somewhat dovish dot plot. Data prints over the past

month are evidencing more consistency on the activity and

price fronts than perhaps the US economy has posted this

cycle, while valuations remain poor and positions quite

skewed towards non-USD currencies. So while the position

changes are not large, they shift the Macro Portfolio from

overall short USD to flat USD, with shorts in G10 currencies

like NOK, GBP (existing) and JPY (new) offsetting longs in

EM Asian currencies like CNY, KRW and PHP.

Commodities

Commodities followed other risk assets lower this week,

with all sectors down. Our metals strategists have revised

their price forecasts, raising aluminum, copper, zinc and gold,

but lowering nickel. For copper, the Q4 forecast is in line

with forwards, suggesting our supply/demand expectations

are inline with the market. For zinc, our forecast represents a

fall of 11% vs. current market pricing, while nickel and

aluminum are expected to rise modestly in Q4. For gold, we

expect stronger Indian demand in H2 as import restrictions

are steadily relaxed; this is consistent with current market

pricing (Metals Quarterly, Kaneva et al., Jul 31).

Our chief commodity strategist, Colin Fenton,

recommends owning energy, aluminum and copper. We

have been long energy for two months, over which time

prices first rallied and then sold off and are now down 2%

since we opened the position (CMOS, Colin Fenton, Jul 31).

We stay long on still attractive carry, improving US refinery

demand, low inventories and our view that Libyan production

estimates are far too optimistic.

12

Economic Research

The J.P. Morgan View: Markets

August 1, 2014

JPMorgan Chase Bank NA

Jan Loeys (1-212) 834-5874

jan.loeys@jpmorgan.com

Forecasts & Strategy

Interest rates Current Sep-14 Dec-14 Mar-15 Jun-15

United States Fed funds rate 0.125 0.125 0.125 0.125 0.125

10-year yields 2.49 2.70 3.00 3.10 3.20

Euro area Refi rate 0.15 0.10 0.10 0.10 0.10

10-year yields 1.13 1.35 1.50 1.60 1.70

United Kingdom Repo rate 0.50 0.50 0.50 0.75 1.00

10-year yields 2.55 2.20 2.50 2.70 2.85

Japan Overnight call rate 0.05 0.05 0.05 0.05 0.05

10-year yields 0.53 0.55 0.55 0.65 0.70

Emerging markets GBI-EM - Yield 6.58 6.77

Credit Markets

US high grade (bp over UST) 128 110

Euro high grade (bp over Euro gov) 89 75

USD high yield (bp vs. UST) 412 375

Euro high yield (bp over Euro gov) 325 315

EMBIG (bp vs. UST) 302 275

EM Corporates (bp vs. UST) 331 300

Foreign Exchange

EUR/USD 1.34 1.34 1.30 1.30 1.28

USD/JPY 102 102 106 107 107

GBP/USD 1.68 1.71 1.67 1.68 1.66

AUD/USD 0.93 0.92 0.91 0.90 0.91

USD/BRL 2.27 2.30 2.35 2.45 2.50

USD/CNY 6.17 6.2 6.15 6.15 6.15

USD/KRW 1033 1000 1000 995 985

USD/TRY 2.13 2.15 2.15 2.15 2.15

Commodities Current 14Q3 14Q4 15Q1 15Q2

Brent ($/bbl) 105 115 112 105 110

Gold ($/oz) 1295 1300 1300 1300 1275

Copper ($/metric ton) 7124 7100 7050 7000 6800

YTD Equity Sector Performance* US Europe Japan EM$

Energy 11.8% 8.4% UW 7.9% UW 5.0% UW

Materials 8.6% 6.5% OW -2.0% UW 2.2% UW

Industrials 3.6% -0.7% OW 4.7% OW 5.6% OW

Discretionary 0.8% 1.9% N -3.7% OW 9.3% N

Staples 5.5% 5.3% UW 7.4% OW 4.6% UW

Healthcare 9.9% 10.5% N 6.0% UW 13.1% N

Financials 4.6% 0.5% OW -12.7% OW 7.2% N

Information Tech. 10.5% -3.0% OW 6.0% UW 15.9% OW

Telecommunications 7.8% -0.3% UW -2.5% OW 3.9% UW

Utilities 13.4% 15.6% N -5.3% UW 15.0% N

Overall 6.5% 4.5% -1.9% 8.1%

*Levels/returns as of July 31, 2014

Source: J.P. Morgan

Investment themes and impacts

Low growth means money stays easy

The current US recovery is the slowest since WWII.

Global growth will barely exceed potential. Easy money

stays for a long time.

Low macro vol drives carry trades

ZIRP and low macro vol make earning risk premia and

carry very attractive

Rotate risk from over-owned and -valued

to better valued and less owned risk assets. Credit

OWs are now small, and exposure is moved to equity,

EM and commodity roll.

OW EM across asset classes

Relative macro momentum is switching to EM. EM

growth expectations are stabilizing while those in DM

have come down badly. Investors seem UW EM, while it

offers better value. OW EM across bonds, FX, credit and

equities.

Avoid and hedge what is suspect

Our UWs are not just based on value and macro

momentum but also on what seems uncertain, coming

from event risk, such as the Middle East and China, or

from the unexplained (fall in U-rate and Q1 GDP).

Hedges include oil futures, UW US FI vs EU, UW US

equity vs EM.

Past half-time in the global business cycle

June marks the 5th anniversary of the recovery. Working

hypothesis is an 8-year recovery. That keeps equity rally

on track, but makes the credit rally mature.

Source: J.P. Morgan, GMOS, Jul 2, 2014.

Tactical overview

Direction Country Sector

Asset

allocation

Bullish risk EM OW Equities, HY

vs bonds.

Equities Long EM, Dax

Semiconductors;

J-REITs; cycls

Bonds

Flat Duration

in DM; long

in EM

EU vs. US,

UK. OW,

NZ, Spain;

AU, Brazil.

Credit Small OW EU HY, FINs, EM.

FX Long EM

Carry from:

COP,

CNY, PHP,

NGN

Long SEK, NOK vs.

EUR; short ZAR vs.

USD.

Comds Small OW

Energy on carry;

Copper on better

demand from China.

Source: J.P. Morgan

13

JPMorgan Chase Bank NA

Robert E Mellman (1-212) 834-5517

robert.e.mellman@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

Economic Research Note

US economy looks a little

different after the GDP report

Real GDP rose 4.0% in 2Q14, but with real final sales

up 2.3% and a big build in inventories

Upward revision to income is a plus for consumer

spending; lower estimate of profits is negative for capex

GDP forecast for 2H14 is still 3.0%, with somewhat

stronger final sales and a sharper inventory correction

Real GDP posted 4.0% saar growth in 2Q14, and growth for

the previous three quarters was revised up an average of

0.7%-pt per quarter. But the implications of the GDP report

for growth in 2H14 are mixed, as current data show a

modestly stronger trend in real final sales than expected (a

positive for near-term growth) accompanied by a substantially

larger inventory build in 2Q14 than expected (a negative for

near-term growth). Consequently, the J.P. Morgan forecast of

3.0% real GDP growth through 2H14 is unchanged.

The 4.0% increase in real GDP in 2Q14 consists of a

moderate 2.3% increase in real final sales and a 1.75pt

contribution to growth from the increase in the rate of

inventory accumulation. Growth of real final sales last quarter

was stronger than the 1.9% J .P. Morgan forecast, and the

trend in real final sales over the year through 1Q14 was

revised up to 1.8% (from 1.5%). The somewhat stronger trend

in final sales would, all else equal, tend to boost growth

prospects for the second half.

However, the large build in inventories in 2Q14 is an

offsetting negative. Growth of real private inventories reached

$93.4 billion in 2Q14, up from $35.2 billion in 1Q14 and

average growth of $64.0 billion over the year ended 1Q14.

Relative to the recent past, the largest increase in inventory

accumulation has been in manufacturing. The substantial

increase in farm inventories previously reported in the five

quarters through 1Q14 has been largely revised away.

It is difficult to know just how much inventories will subtract

from growth in the second half of this year. When inventory

accumulation reached comparable levels in 3Q10, inventories

took an average 1.3%-pts off of real GDP growth over the

next two quarters. And when inventory accumulation peaked

at a similar pace in 3Q13, inventories took an average 0.8%

off of real GDP growth over the following two quarters. But

when inventories reached a similarly elevated level in 4Q11,

inventories were essentially neutral for growth through much

of 2012. The forecast looks for inventories to take a little less

than a half percent off of growth in 2H14.

Consumer spending prospects a bit better

The outlook for consumer spending looks a bit stronger than it

did prior to the latest GDP release. Real consumer spending

increased 2.5% saar in 2Q14, surpassing our 1.9% forecast.

Moreover, prior estimates of spending growth were revised

up, to 1.2% from 1.0% in 1Q14 and to 2.8% from 2.3% in

2013 (4Q/4Q).

Probably more important for near-term spending, recent

growth of labor compensation and real disposable income has

been revised substantially higher. Real disposable income in

1Q14 was revised to growth of 3.5% saar (from 1.5%), and

real disposable income in 2Q14 increased 3.8% (above the

forecast of 3.1%). The shift to much stronger real income

-1

0

1

2

3

4

2011 2012 2013 2014

%ch saar

Real final sales of domestic product

Source: BEA

Over prior

quarter

Over year ago

-3

-2

-1

0

1

2

3

-25

25

75

125

2010 2011 2012 2013 2014

$bn, saar

Real private inventory accumulation and its contribution to growth

pct. pt. contrib. to real GDP growth

Source: BEA

Change in real

inventories

Contribution to annualized

real GDP growth

1.5

2.0

2.5

3.0

2012 2013 2014

%oya

Real consumer spending

Source: BEA

Current data

Pre-revision data

.

2Q14 sequential

growth rate, 2.5%

14

Economic Research

US economy looks a little different

after the GDP report

August 1, 2014

JPMorgan Chase Bank NA

Robert E Mellman (1-212) 834-5517

robert.e.mellman@jpmorgan.com

growth would normally be associated with a turn to stronger

spending growth.

To be sure, growth of real disposable income has substantially

outpaced growth of real consumer spending so far this year,

and the saving rate has increased from 4.4% in 4Q13 to 5.3%

in 2Q14. The implications of a higher saving rate for

consumer spending can be argued both ways. A pullback in

spending relative to income can be viewed as a sign of

consumer caution that is a negative for spending. Or it could

be viewed as a temporary spending pause and prelude to

reacceleration. This past weeks increase in the Conference

Board measure of consumer confidence to a new high for the

expansion and the recent strength in auto sales suggest that

the rise in the saving rate is not a symptom of a serious

deterioration in sentiment and that real consumer spending

will turn stronger in 2H14. The recent moderation in food and

energy price increases is another near-term positive for real

consumer spending.

Business spending prospects a bit weaker

The recent news on business fixed investment (BFI) is more

mixed. Real BFI increased 5.5% saar in 2Q14, a little short of

our 7.3% forecast. But there were modest upward revisions to

recent history, with business investment in 1Q14 revised up to

1.6% (from -1.2%) and BFI for 2013 revised up to 4.7%

(4Q/4Q) growth from 2.6%.

Whereas the recent trend in real disposable income had been

revised noticeably higher, providing more fuel for consumer

spending, the recent trend in corporate profits was revised

substantially weaker and may act as a restraint on business

spending. The level of adjusted after-tax earnings in 1Q14

was revised down 9.0% relative to the earlier government

estimates reflecting a lower prior-quarter level, a slightly

sharper drop in pretax earnings, and a substantial upward

revision to tax liabilities. Adjusted after-tax profits now show

a decline of 16.3% saqr in 1Q14.

Corporate earnings are not the only or even dominant influence

on capital spending. But the sharp drop in earnings early in the

year helps explain why real business fixed investment slowed

fromaverage growth of 7.9% saar in 2H13 to only 3.5% in 1H14,

and it is a potential negative for near-termcapital spending.

An increase in government spending

Another feature of growth in 2Q14 was a 1.6% saar increase

in real government spending, the largest increase since 3Q12

(when government spending was boosted by an anomalous

surge in military outlays). Details show that real federal

spending posted a modest decline. The total was boosted by

3.1% growth in real spending of state and local governments.

While state and local government spending has shifted from a

declining trend through 2012 to modest increases since, results

for 2Q14 were clearly boosted by a weather-related rebound

in construction spending. The underlying trend in real state

and local government spending is closer to 1.0% growth.

Slightly higher inflation

Revisions to the major price measures were relatively minor

but tended to be upward. Current data show the core PCE

price index running 1.25%oya in 1Q14 (revised up from

1.12%), and the core PCE price index increased 1.96% saar in

2Q14 (vs. J .P. Morgans forecast of 1.9%). The GDP price

index now shows an increase of 1.43%oya in 1Q14 (revised

up from 1.36%), and the increase in 2Q14 was 2.0% (vs.

J .P. Morgans forecast of 1.7%).

Real government spending

%ch saar

3Q13 4Q13 1Q14 2Q14

All government 0.17 -3.79 -0.83 1.61

Federal -1.21 -10.33 -0.14 -0.75

Defense 0.44 -11.43 -3.99 1.04

Other -3.94 -8.54 6.59 -3.73

State and Local 1.08 0.62 -1.25 3.12

Construction -1.19 -3.05 -12.51 16.09

All other 1.43 1.19 0.55 1.32

Source: BEA

1250

1350

1450

1550

1650

1750

2010 2011 2012 2013 2014

$bn, saar

Adjusted after-tax corporate profits

Source: BEA

Current

data

Pre-revision

data

-8

-6

-4

-2

0

2

4

2010 2011 2012 2013 2014

%ch saar

Real government spending

Source: BEA

Over prior

quarter

Over year ago

15

JPMorgan Chase Bank N.A, London Branch

David Mackie (44-20) 7134-8325

david.mackie@jpmorgan.com

Economic Research

Global Data Watch

August 1, 2014

Economic Research Note

Labor underutilization and

wages in the Euro area

Slack is greater than the unemployment rate suggests

It will be reabsorbed as unemployment falls

It will keep wage growth subdued

We recently discussed Eurostats four measures of labor

underutilization: individuals who are unemployed, inactive

individuals seeking work but not immediately available,

inactive individuals immediately available but not seeking

work, and part-timers who would like to work longer hours

(see Mixed supply side message from Euro area labor

market, GDW, J uly 23, 2014).

Our measure of the aggregate amount of underutilized labor in

the Euro areaadding the individual measures together after

applying a factor of 0.5 to underemployed part-timersshows

an increase from 13.7% of the labor force at the start of 2008

to 19.8% of the labor force at the start of this year. These data

suggest two things: first, an enormous amount of slack that

can be reabsorbed before the output gap is closed, and second,

very subdued wage growth for the indefinite future.

Unfortunately, these data only begin in 1Q08, so it is not

possible to look at previous cyclical experience. However, it

is possible to look at two economiesGermany and the

UKthat have seen a significant decline in unemployment

over recent years. If Eurostats measures of underutilization

really do represent additional labor supply, we would expect

to see two things: first, other measures of underutilization

falling alongside the decline in unemployment, second, wages

remaining unusually subdued relative to unemployment. This

is exactly what we see in the German and UK labor markets.

Our inclination is to think that similar developments will

occur in the rest of the region.

Potential additions to the labor force

Eurostat defines potential additions to the labor force as

individuals who are classified as economically inactive but

are either seeking work but not immediately available (e.g.,

students) or immediately available but not seeking work (e.g.,

discouraged workers). In the Euro area, as the unemployment

rate has risen by 4.7%-pts since 2008, this measure of labor

underutilization has risen by 0.9%-pt (as a percentage of the

labor force). For potential additions to the labor force to

represent additional labor supply, they would need to decline

as the business cycle moves forward. This is exactly what has

happened in Germany and the UK.

4.0

4.5

5.0

5.5

7

8

9

10

11

12

13

2008 2009 2010 2011 2012 2013 2014 2015

% of labor force, both scales

Euro area unemployment and potential additions to the labor force

Source: Eurostat

Unemployment

Potential additions

2.0

2.5

3.0

3.5

4.0

5

6

7

8

9

2008 2009 2010 2011 2012 2013 2014 2015

%of labor force, both scales

German unemployment and potential additions to the labor force

Source: Eurostat

Unemployment

Potential additions

3.0

3.3

3.6

3.9

5

6

7

8

9

2008 2009 2010 2011 2012 2013 2014 2015

%of labor force, both scales

UK unemployment and potential additions to the labor force

Source: Eurostat

Unemployment

Potential additions

3.0

3.5

4.0

4.5

7

8

9

10

11

12

13

2008 2009 2010 2011 2012 2013 2014 2015

% of labor force, both scales

Euro area unemployment and underutilized part-timers

Source: Eurostat

Unemployment

Underutilized

part-timers

16

Economic Research

Labor underutilization and wages in

the Euro area

August 1, 2014

JPMorgan Chase Bank N.A, London Branch

David Mackie (44-20) 7134-8325

david.mackie@jpmorgan.com

In Germany the unemployment rate has been trending lower

since 2008, with a decline of 2.7%-pts from 1Q08 to 1Q14.

Meanwhile, over this period the number of potential additions

to the labor force has declined by 1.1%-pts. In fact, Germany

has seen a sharp fall in other inactive individuals as well,

which has contributed to a 2.8%-pts increase in the

participation rate since the beginning of 2008.

The UK provides a greater sense of cyclicality in these data.

From 2008 to 2010, unemployment and potential additions to

the labor force both rose; from 2011 onwards both have

declined. If anything, potential additions to the labor force

have fallen faster relative to unemployment than might have

been expected. Meanwhile, other inactive individuals have

actually increased since 2011, but the participation rate has

nevertheless moved higher.

Underutilized part-timers

Eurostat defines underutilized part-timers as those part-timers

who would like to work longer hours. There are no data on

full-time workers who would like to work longer hours. In the

Euro area, the number of underutilized part-timers has risen

by 0.9%-pt since the start of 2008. There is some debate about

whether this genuinely represents additional labor supply,

because a desire to work longer hours may reflect someone

else in the household losing their job. If that other member of

the household gets a new job, the part-timer may not wish to

work longer hours. The data do not enable us to discern the

extent of this effect. At the very least, we would expect to see

underutilized part-timers correlated with unemployment.

Firms are likely to increase utilization of existing employees

before adding new ones.

This is exactly what we see in the data. In Germany, the

number of underutilized part-timers has fallen by 2.1%-pts

since the start of 2008, alongside the decline in

unemployment. The sense of cyclicality in the UK is not as

striking as with potential additions to the labor force. The

number of underutilized part-timers rose through 2012, but

has declined only modestly since then even as unemployment

has fallen sharply.

What about wages

If Eurostats measures of labor underutilization really do

reflect additional slack, we would expect to see wage growth