BMR Presentation

Diunggah oleh

Himanshu Nazkani0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

120 tayangan20 halamanCompanies act presentation by BMR

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniCompanies act presentation by BMR

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

120 tayangan20 halamanBMR Presentation

Diunggah oleh

Himanshu NazkaniCompanies act presentation by BMR

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 20

BMR Edge Special

Companies Bill, 2012 An Analysis

Foreword

Companies Bill 2012 approved by Lower House of Parliament on December 18, 2012 -

Comprehensive overhaul of corporate laws on the cards

Dear Readers,

We are pleased to bring to you the BMR Edge Special on Companies Bill 2012. The Companies Bill has

been finally passed by the Lower House of Parliament (Lok Sabha) on December 18, 2012, seven years

after it was first proposed. The Companies Bill is still not a law and is yet to be approved by the Upper

House of Parliament (Rajya Sabha). Once approved by Rajya Sabha, presidential assent would be

required to notify the Companies Bill as a statute replacing the existing Companies Act, 1956.

A comprehensive revision was warranted in view of the changing economic and commercial environment,

and for an alignment with other Indian regulations. The proposed law is an interesting blend of forward

looking measures, enhanced responsibilities on gatekeepers (auditors, advisors etc) of law, and plugging

loopholes in current legislation. Given the recent corporate scandals, there is a heightened focus on

corporate governance and transparency in various areas. There has been substantial changes in the

restructuring provisions with greater focus on disclosures and compliances. However, the need for

grandfathering provisions, if any, should be addressed.

To conclude, the Companies Bill is finally here and has made it through the first round in its approval

process. We expect it to be enacted by the first half of 2013, followed by various supporting rules being

issued through separate notifications.

This special edition takes a deep dive and analyses the impact of various key provisions introduced. We

hope you enjoy reading the newsletter, and it provides you with useful insights.

Rohit Berry

National Leader, M&A

C O N T E N T S

New concepts introduced

Shareholder and funding related

Restructuring provisions

Other key amendments

1. Directors

2. Financial statements/ Audit

3. Related party transactions

5

7

13

16

| 2

Contributors: Nitin Savara, Pankaj Jain, Vaidehi Dhuldhoya, Samudra Acharyya, Saurabh Agrawal and Kanchan Garg

| 3

Abbreviation Meaning

BIFR Board for Industrial and Financial Reconstruction

Bill Companies Bill 2012

CCI Competition Commission of India

CG Central Government

Co Act Companies Act 1956

ICAI Institute of Chartered Accountants of India

IT Income Tax

KMP Key Managerial Persons

NFRA National Financial Reporting Authority

NCALT National Company Law Appellate Tribunal

NCLT or Tribunal National Company Law Tribunal

OL Official Liquidator

RoC Registrar of Companies

RBI Reserve Bank of India

SARFAESI Securitisation and Reconstruction of Financial Assets and Enforcement of

Security Interest

SEBI Securities & Exchange Board of India

SPV Special Purpose Vehicle

Glossary of terms

New concepts

| 5

3. Corporate Social Responsibility (CSR)

Introduction of CSR has been one of the most widely debated provisions, over the past

few years. Corporates continued to oppose the mandatory nature of these provisions,

while the law makers themselves had differing views, with some suggesting CSR as a

recommendatory provision. CSR has finally been introduced as a mandatory

provision, making India the first country to include CSR in corporate laws. Key

highlights of CSR legislation:

Requirements

CSR is mandatory for a company fulfilling any of the following criteria:

o Net worth > INR 5 Billion (INR 500 crores), or

o Turnover > INR 10 Billion (INR 1,000 crores) or

o Net profit > INR 50 Million (INR 5 crores)

Minimum annual CSR spend - 2% of average net profits made during last three

financial years

Implementation of CSR

Corporate Social Responsibility Committee (CSRC) to be appointed. CSRC to have

3 directors, of which at least 1 director shall be an independent director

CSRC to formulate Corporate Social Responsibility Policy indicating the prescribed

corporate social activities to be undertaken, and recommend CSR expenditure, as

also monitor the same

Companies to give preference to the local area(s) of operations, for CSR spend

Non-compliance Follow a comply or report policy

No specific penalty provisions incorporated in law

Company required to specify reasons in the directors report

BMR comments

Consequences of default are not clearly laid out, since there is no specific penalty or

prosecution prescribed.

No clarity on treatment of unutilized CSR budget and whether it should be carried

forward for use to next year - The Standing Committee had suggested deposit of

unutilized amount in a fund, however, this suggestion has not been accepted

Need to align provisions for linkage to current year cash flows and current year

profits There may be situations, where a company does not have positive cash

flows in the current year, or a loss in the current year. Ideally, CSR spend in such

years should be deferred

1. Class Action Suits

In India, the basic concept of a class action lawsuit is captured to an extent in

corporate laws, where oppression and mismanagement claims can be filed by a

class of small shareholders, and broadly in the Civil Code. It is, however, applied

very sparingly.

The Companies Bill now provides for recognition of class action suits as a part of

Oppression and Mismanagement provisions, and lays down an enabling

framework, where stakeholders (shareholders or depositors) can directly approach

the Tribunal. Damages/ compensation can be sought against the company, its

directors, auditors or advisors, who have knowingly assisted in

wrongdoings. Orders of the Tribunal would be binding, with stringent penalties and

imprisonment for non-compliance with directions.

It remains to be seen how Indian thought process on this subject would evolve and

the time involved in settlement of a class action suit, but as a starting point, the

framework is clearly laid out.

This new provision seems to be an outcome of the Satyam corporate scandal - to

pin responsibility not only on insiders but also on various gatekeepers who are

responsible for ensuring compliance with the law. Further, it is also in alignment

with similar provisions in matured economies.

2. Dispute resolution framework

Currently, corporate law matters are dealt by numerous judicial/ quasi-judicial

forums like District Court, High Court, BIFR and Company Law Board. This results

in time consuming litigation.

With a view to streamline the process and also put in place a single forum with

subject matter experts, it is now proposed that all corporate law matters would be

administered through NCLT and NCALT, which shall be granted requisite powers

for speedy and efficient decision making.

Time taken to settle litigation in India has always been a key concern. Accordingly,

initiatives are being taken to address the same:

o Special Courts - CG has been empowered to set up Special Courts to settle

disputes, across the country. Special Courts shall try summary proceedings for

offences punishable with imprisonment for a term not exceeding three years.

The appeal against the Special Court judgments would lie with the High Court

o Mediation and Conciliation panel - A panel of experts would be set up to

facilitate arbitration and mediation between the parties during the pendency of

any proceedings before the CG or NCLT or NCALT

Introduction of new concepts

Shareholder and funding

related

Shareholder related

| 7

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Maximum

members in

Private Company

200

50

Recognition to

Inter-se

shareholders

arrangements on

transferability

Any contract or arrangement between two or more persons in

respect of transfer of securities of a public company shall be

enforceable

Shareholders generally incorporate such

clauses in Articles of the company, for

enforceability

Divergent views exist on legal

enforceability of transfer restrictions

typically forming part of JV / investment

agreements in case of public companies

Further, a public company is required to

register all share transfers, and cannot

refuse the same

Provisions suggest that any transfer

restrictions agreed between shareholders

of a public company would be valid and

binding as a contract inter-se the

shareholders

Important amendment to bring some

clarity to the entire debate on transfer

restrictions in public companies This

was becoming a concern area, with

various judicial precedents upholding

different principles

Entrenchment -

Inclusion of

provisions,

which are more

stringent than

existing law

Articles can contain entrenchment provisions, which provide a

more stringent mechanism than the mechanism contained in

existing law for certain provisions i.e. Provisions requiring higher

shareholder approval % in voting than the prescribed majority

(51% or 75%) for certain matters

Articles currently also include commercial

provisions more stringent than existing law,

and this is a validly accepted norm

Concept of entrenchment more clearly

recognized in law. This would provide an

additional layer of protection for investors

with respect to voting and other commercial

terms agreed

Insider Trading Insider trading prohibited No specific provisions Alignment of corporate laws with securities

laws Penal provisions under corporate

laws would also apply to insider trading

Voting by

shareholders

Postal Ballot - Applies to all companies, public and private

Electronic voting introduced, for certain classes of companies

Postal ballot is applicable only to listed

public companies

Electronic voting applies only to top 500

listed companies, under securities laws

These modes are expected to increase

participation by members

Enabling provisions for electronic voting

included Expected to become a norm for

all companies over a period of time

Quorum for

shareholder

meetings of a

public company

Upto 1000 members 5 members present in person

1001 - 5000 members 15 members present in person

>5001 members 30 members present in person

5 members present in person

Concept of One Person Company and Small Company have been introduced for new corporate entrants, who are small in size. Such companies would be subjected to reduced compliances

Holding company

| 8

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Investment

through multiple

layers

Investment not permitted through more than two layers of

investment companies

Overseas multi-layered structures would be permitted

No restrictions on holding structures Transparency in flow of funds &

transactions sought to be achieved

Move may impact ability to raise funds

Large groups are usually structured in

various layers including a group holding

company, sector focused holding

company, region specific holding company

and SPVs

Impact on existing multi-layered

structures?

Classification as

holding

company

50% threshold to be based on share capital (i.e. both equity and

preference share capital) of the target company

Only equity shares are to be considered for

evaluating holding-subsidiary relationship

Companies with preference shares to

re-look shareholding

Conflict with the consolidation principles

under the Accounting Standards [which

are based on voting power or composition

of Board of Directors] and other laws

Share Capital/ Other securities (1/3)

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Fresh issue of securities

Private

Placement

Applicable to public and private companies with various

conditions prescribed

Apply only to public companies Prescribed

conditions are broadly similar

Concerns for private companies as they are

now required to comply with stringent norms

while raising funds through Private

Placement mode

Variation in

terms of contract

or objects in

Prospectus for

public offer

Permitted, subject to:

Shareholder approval through special resolution

Newspaper publication stating rationale

Exit opportunity for dissenting shareholders

Prior shareholder approval through ordinary

resolution

Aims to curb misuse of funds raised

Exit opportunity and newspaper

publication to act as deterrents for

arbitrary variation of prospectus

Issue of shares

at discount

Not permitted, except for sweat equity Permitted No significant impact - Issuance at discount

is not a regular feature; even current

provisions have limited utility

Bonus Shares Prior compliance with prescribed conditions, including:

Authorization in articles

Board and Shareholder approval

No default in payment of interest or principal in respect of

fixed deposits or debt securities issued by it

No default in payment of statutory dues of employees

Bonus share issuance is permitted and

recognized, though there are no

additional conditions prescribed in Co Act

However, similar conditions are already

prescribed for listed entities by SEBI

Creates additional pressure on unlisted

company to be regular in certain payments,

even though a bonus issue is a mere

capitalization of reserves, and does not even

result in any cash payout, or reduction in net

worth

| 9

| 10

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Reducing existing share capital

Redemption of

preference

shares

Companies can issue preference shares for a period

exceeding 20 years for specified infrastructure projects,

provided a certain % of shares are redeemed annually at the

option of the shareholder no upper limit is prescribed

Fresh preference shares can be issued to redeem existing

preference shares, which are due for redemption, and to pay

dividend on such preference shares, subject to:

o Approval of majority of preference shareholders

o Tribunal approval

o Cash redemption for dissenting preference shareholder

Preference shares to be redeemed within 20

years

Another flexible source of funds created for

Infrastructure companies, which go through

a long gestation period

Buy back of

shares

Minimum 1 year gap required between two buybacks

Buyback possible in case of following defaults, provided the

defaults have been remedied, and 3 years have passed:

o Repayment of deposit/ interest payable

o Redemption of debentures or preference shares

o Payment of dividend

o Repayment of any term loan or interest

No time gap prescribed for shareholder

approved buybacks

365 day time gap required between Board

approved buybacks

Buy back is not permitted, where any of

the defaults is subsisting

Limited buybacks possible due to 1 year

gap

Adversely impacts strategies used earlier

for cash repatriation through buyback

Capital

Reduction

Capital reduction not permitted if company has not repaid

deposits or interest payable

Notice of proposed capital reduction to be sent to CG, RoC,

SEBI and creditors; representations if any, to be made within

3 months

Statutory auditors certificate required for confirming

accounting treatment is in accordance with Indian GAAP

Specific authorization in Articles not required

Addition of words and reduced not required

Specific provisions for effecting capital

reduction

Additional compliances prescribed in

Listing Agreement, including auditors

certificate, applicable only to listed

companies

Overall timelines will increase due to

mandatory 3 months notice period

Restricted planning opportunities in

accounting treatment for unlisted

companies, since auditors certificate is

required upfront

Creates additional pressure on public

companies to settle any outstanding public

deposits

Share Capital Reducing existing capital (2/3)

| 11

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Capital Erosion - Sick Companies

Eligibility Criteria Provisions now cover any company instead of industrial

company

Only industrial companies covered within

the provisions of Sick Industrial Companies

Act

Enhanced coverage of law; now extends to

service companies as well

Sickness of a

company

Dispensation of net worth criteria (erosion of 50% of net worth)

for qualifying as a sick company

Now, if the company fails to repay or secure debt of secured

creditors of a company representing 50% of total debt, then

application can be made to tribunal for declaring the company

as sick company

Sickness of an industrial company

dependent on its:

Incorporation must be in existence for

minimum 5 years

Net worth Accumulated losses > Net

Worth

Positive move to remove the net worth

criteria A number of companies (including

many subsidiaries of large foreign parents)

were classified as sick companies on this

count and subjected to various compliances,

though business continued normally

Existing sickness law needs to be repealed,

once Bill is enacted

SARFAESI Act,

2002

Application for sickness can be made to Tribunal even when

financial assets have been acquired under SARFAESI Act, after

obtaining consent of securitisation/ reconstruction company

Application cannot be made, if financial

assets have been acquired by any

securitisation or reconstruction company

Increased scope for applying for sickness

Return on Capital Dividend

Restrictions on

declaration of

dividend / interim

dividend

No dividend declaration permitted, in the event of

non-compliance with provisions for acceptance and repayment

of public deposits

No specific provisions Introduced to curb situations where

shareholders receive dividends, despite

non-compliances in payment of public

deposits

Interim dividend In case company has incurred losses upto preceding quarter of

current financial year, then interim dividend shall not be

declared at a rate higher than average dividends declared by

company during immediately preceding 3 financial years

No specific provisions Restrictions imposed on interim dividend

payout for companies with recent history of

losses

Transfer to

reserves, upon

dividend

declaration

No requirement for mandatory transfer of % of profits to

reserves, at the time of declaration of dividend

Company to compulsorily transfer certain

amount of profits to reserves upon dividend

declaration, maximum being 10% of profits

Welcome move - Now possible to repatriate

entire profits of the company as dividend

Share Capital Erosion, Returns (3/3)

Restructuring Conceptual and

Procedural amendments

| 13

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Conceptual amendments

Cross Border

Merger

Merger of Indian company with foreign companies (in

specified jurisdictions - To be notified) permitted

Additional rules to be framed by CG with RBI

Merger of Indian company into overseas

company is not permitted

Only overseas company is permitted to

merge into an Indian company

Move would facilitate cross border listing

of entities with Indian assets and exits to

shareholders/ Investors

Exchange control policy and tax laws to be

aligned to facilitate mergers

Contractual

Mergers

Concept of contractual mergers introduced, where no prior

NCLT approval is required. Contractual merger permitted for:

o Small companies

o Parent company and wholly owned subsidiary

All companies required to obtain High Court/

CG approval for restructuring (merger,

demerger etc)

Reduction in administrative burden,

timelines and costs for companies within

the threshold limits

Technically, provisions can be interpreted

to include only mergers, and not

applicable to demergers, though both are

restructuring routes. Some clarity on this

area may be required

Merger of listed

company with

unlisted

company

Specific provisions included for such mergers

Enabling provisions allowing transferee company to remain

an unlisted company, even post-merger

Exit opportunity to be provided to shareholders of listed

transferor company

No specific provisions for such reverse

mergers, involving a listed and an unlisted

company

Technically possible under Co Act,

though it may have certain securities laws

considerations

Formally recognized in law now - Provision

would facilitate delisting of a company/

major business through the scheme

Shareholders interest sought to be

protected through exit opportunity

Securities laws to be aligned for

implementation

Treasury shares

- Companies

holding their own

shares instead of

cancellation of

inter-co

shareholding

Any inter-company investments between the companies

involved in merger, would need to be cancelled. Holding

treasury stock would not be permitted

Companies generally prohibited from

holding own shares under normal course

No specific provisions or requirement for

cancellation of inter company stakes on

merger. Treasury stock can be created

instead of cancellation of inter-company

shareholdings

Treasury stock was often used to retain a

company's equity stake within its own

control for different purposes, including

liquidity and to increase promoter control

Prohibition on creation of treasury stock

on merger is in line with other corporate

law provisions, wherein a company is not

allowed to hold its own shares

Takeover and

Buyback, as part

of restructuring

scheme

An arrangement can include a takeover offer, subject to

compliance with securities laws regulations in respect of

listed companies

Buyback can also be done as part of the restructuring

scheme, subject to compliance with buyback provisions

No specific provisions for inclusion or

exclusion of buyback or takeover as part of

a scheme. There have been instances

where buyback was sought to be

undertaken as part of a scheme

Buyback through restructuring scheme

would now require specific compliance with

the buyback provisions

Restructuring schemes Conceptual amendments 1/2

| 14

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Procedural amendments

Valuation report

for Scheme

Valuation to be undertaken by registered valuers

Valuation report to be provided to shareholders/ creditors

along with notice convening meeting for considering the

scheme

No specific provisions Valuation is

undertaken by independent valuers

Share swap report need not be sent along

with the notice for meeting

Listed companies are required to send

fairness opinion with meeting notice

Level of detail in share swap/ valuation

report would need to be considered, since

there may be certain confidential

information

What if meetings are dispensed?

Objections to

Scheme

Objections to scheme can be made only by shareholders

holding 10% shareholding or creditors holding 5% of total

outstanding debt

No specific provisions defining a threshold

limit Objections can be raised by any

shareholder/ creditor and are then

appropriately considered by the Court

A rational step - There have been instances

in the past, when minority shareholders

holding very nominal shares have delayed

restructuring by raising objections

Method of voting Shareholder/ creditors to be provided option to vote by postal

ballot, in addition to voting physically at a meeting, in person or

by proxy

Physical meeting of shareholders/

creditors is required to be convened

Voting is allowed in person or by proxy at

such meeting

Postal ballot would lead to increased

participation by shareholders/ creditors,

while considering a scheme

Electronic voting has already been

introduced, and it is expected that this

would be followed for restructuring

schemes also

Auditors

certificate

mandatory

Mandatory for all companies (whether listed or unlisted) to

obtain statutory auditors certificate stating that the accounting

treatment in the scheme is compliant with Accounting

Standards

No specific provisions

As per listing agreement, listed

companies are required to submit such

certificate to the stock exchange

Presently, unlisted companies tend to

adopt varied accounting treatments in a

restructuring scheme, for meeting various

objectives

Going forward, reduced flexibility for

accounting treatment

Mandatory

notification of

Scheme

Scheme to be notified to various regulatory authorities,

including the CG, OL, IT authorities, SEBI, RBI, Stock

Exchanges, CCI, as may be necessary and to other

regulators

Notice to authorities to be circulated simultaneous to notice of

meeting. Timeline of 30 days provided to respond to the

notice

Notice of scheme is to be served to the CG,

RoC and OL as per directions of High Court,

after meetings have been convened

Will bring increased attention to

restructuring schemes and possible

scrutiny by authorities

Restructuring schemes Procedural amendments 2/2

Other key amendments

Board of Directors

| 16

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Maximum

number of

directorships by

a single person

Maximum 20 companies, including alternate directors Within

this limit, maximum of 10 public companies permitted

Maximum of 15 companies

Directorship in private companies,

unlimited company, non profit making

companies and alternate director excluded

from above limit

Maximum

directors in a

company;

women director

Maximum directors increased to 15 Increase beyond 15 is

subject to special resolution by shareholders

Certain class of companies to appoint 1 woman director

Public companies required to take CG

approval for appointing more than 12

directors

No requirement to appoint woman

directors

Shifting of powers from the government to

the shareholders, reduced administrative

burden

Stay of director

in India

At least 1 director should stay in India for 182 days or more in

the previous calendar year

No specific provision Discourages practice of companies being

wholly controlled by non-resident directors,

who may not be accessible in case of any

defaults or concerns raised

Independent

Directors

Listed company to have atleast 1/3 Independent Directors;

CG to specify minimum number of Independent Directors for

certain public companies

Independent Directors to be appointed only from approved

data banks maintained by institutions notified by CG; CG may

prescribe procedure for their selection

Diligence on the directors to be carried out by company

Maximum term in a company is 10 years Post 10 years, 3

years cooling off period required for re-appointment

No stock options can be given to Independent Directors

No specific provision prescribed in Co Act

Listed companies governed by Clause 49

of the Listing Agreement

o If Chairman is non executive director,

1/3 of the board should be independent

o If Chairman is executive director, then

1/2 of the board should be independent

o Allowed to hold stock options subject to

shareholders resolution

Positive step to ensure improved

transparency in conduct of business

Move to ensure that only qualified persons

can be appointed as Independent

Directors

Rotation of Independent Directors

envisaged

Notice for calling

Board Meetings

Minimum 7 days notice required; Shorter notice possible, if

atleast 1 Independent Director (if any) is present

No specific provision regarding notice period

for board meeting. Listing agreement

requires listed companies to issue prior

notice for certain matters

Improves operational transparency by

allowing adequate time for all directors to be

present; Typically included as a good

governance measure by many companies

under current law also

Resolution by

circulation

Possible for directors (1/3 of total) to require that a resolution

proposed to be passed by circulation, should not be passed by

circulation, and instead, be considered at a Board meeting

No such provision in the Co Act, for

circulation resolution to be considered at a

board meeting, even if certain directors

require

Ensures key decisions are not passed by

way of circular resolution, if certain directors

prefer a discussion on such matters at the

board meeting

Financial statements/ Audit

| 17

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Financial Statements

Accounting year Uniform accounting year ending 31st March of every year

Exception carved out for holding or subsidiary of a company

incorporated outside India and required to follow a different

financial year for consolidation of accounts prior approval of

Tribunal required

No provision for extension of financial year

Company can adopt any accounting year for

maintaining its accounts; Extension possible

Subsidiaries of overseas companies may

be able to maintain a different accounting

year in line with overseas parent

No avenues possible for stand alone

Indian companies or companies with

minority foreign holding to change

financial year

Accounting &

Auditing

Standards

Appointment of NFRA for formulating accounting and auditing

standards

NFRA to ensure compliance of accounting and auditing

standards

National Advisory Committee on Accounting

Standards examines the Accounting

Standards, and these standards are notified

Introduction of NFRA for auditing standards.

Earlier, this role was played only by ICAI

Audit

Secretarial Audit

and Internal

audit

Listed company and other prescribed companies to annex

secretarial audit report along with Directors report

Prescribed companies to appoint professionals for internal

audit

No specific provisions for secretarial audit,

or for conducting internal audit

Positive step to ensure more transparency

and scrutiny in companys dealings

Maximum tenure

of auditors

For listed companies and other prescribed companies

individual auditors to be rotated after every 5 years and audit

firm after every 10 years

No specific provision Mandatory rotation of auditors expected to

enhance auditors independence

Auditing

standards

Auditors required to comply with auditing standards No specific provision Positive step to ensure more transparency

and scrutiny in companys dealings

Restriction on

other services by

auditors

List of services (such as advisory, consultancy, investment

banking), which auditors cannot render, either directly or

indirectly, to the company and its affiliates

No specific provision Restrictions are in line with global audit

norms, which seek to remove conflict of

interest

Liability of

auditors

Prescribed penal actions against the auditors, if found involved

in fraud or has abetted or colluded in any fraud

Nominal penalty under law and action by

ICAI

Provisions introduced for increased liability

of auditors

Related Party Transactions

| 18

Provision New provisions Co Bill 2012 Existing law Co Act BMR Comments

Related party

transaction

Enhanced scope of transactions

Enhanced scope of related parties to include KMP and

relatives, directors with certain shareholding, persons in

advisory capacity (other than professional advice) to Board

Prior approval of shareholders in case paid-up capital

exceeds prescribed limit

Limited scope of transactions and persons

covered under Co Act

Prior approval of CG required in case

paid-up capital exceeds INR 10 Million

(INR 1 crore)

Increased scope for reporting transactions

enables greater transparency in

operations with key persons

Administrative burden of obtaining CG

approval dispensed

Loan and

investment by

company

Loans and investment to any person covered

Rate of interest benchmarked to interest on Government

Securities

Applicable to loans and investments made

only to body corporates

Rate of interest benchmarked to bank rate

Provision to curb managements power to

make investments, including loans to

promoters, beyond specified limits, unless

approved by shareholders

Loan to directors Applicable to both private and public companies

Prior shareholder consent required

Applicable to public companies

Prior approval of CG required

Private companies also included -

Increased compliances

Administrative burden of obtaining CG

approval dispensed

Transactions

with directors

Prior shareholder approval required for contracts with directors

to acquire assets for non-cash consideration

No specific provision Ensure fairness and transparency in

dealings

M&A Service Line Overview

M&A Service Offerings

M&A Advisory

Transaction Advisory and Support

Business Restructuring

Read more on www.bmradvisors.com

M&A Leadership

Rohit Berry

DID: 91 124 339 5030

rohit.berry@bmradvisors.com

Amit Jain

DID: 91 124 339 5025

amit.jain@bmradvisors.com

Rajendra Nalam

DID: 91 124 339 5023

rajendra.nalam@bmradvisors.com

Shivani Nagpaul

DID: 91 22 3021 7165

shivani.nagpaul@bmradvisors.com

Ashish Gulati

DID: 91 124 339 5007

ashish.gulati@bmradvisors.com

Vivek Gupta

DID: 91 124 339 5052

vivek.gupta@bmradvisors.com

Seiji Ota

DID: 91 124 339 5024

seiji.ota@bmradvisors.com

Nitin Savara

DID: 91 124 339 5015

nitin.savara@bmradvisors.com

Sujata Mody

DID: 91 22 3021 7027

sujata.mody@bmradvisors.com

Jagdeep Sharma

DID: 91 22 3021 7141

jagdeep.sharma@bmradvisors.com

| 19

BMR is a professional services firm offering a range of M&A, Tax and Risk advisory services for domestic and

global businesses of all sizes. The firm enhances value for clients by focusing on solutions that are innovative,

yet practical and that can be implemented. This is achieved by blending domain expertise with analytical

rigour, while maintaining an uncompromising focus on quality, and by hiring and nurturing high quality

professionals with a passion for excellence. BMR is committed to making a difference to clients and to its

people, and delivers this through the integrity of its effort and by living its core values.

Read more on www.bmradvisors.com

2012 BMR Advisors, Published in India.

All rights reserved

This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for

detailed research or the exercise of professional judgment. Neither BMR Advisors nor its associate concerns can accept any responsibility for loss

occassioned to any person acting or refraining from action as a result of any material in this publication. On any specific matter, reference should be

made to the appropriate advisor.

About BMR Advisors

Gurgaon

22nd Floor, Building No. 5

Tower A

DLF Cyber City, DLF Phase III

Gurgaon 122 002

Tel: 91 124 339 5000

Fax: 91 124 339 5001

Mumbai

BMR House

36B Dr . RK Shirodkar Marg

Parel

Mumbai - 400 012

Tel: 91 22 3021 7000

Fax: 91 22 3021 7070

Bangalore

Level 3, Prestige Nebula - I

No 8-12, Cubbon Road

Opp Income Tax office

Bangalore 560 001

Tel: 91 80 4032 0000

Chennai

No.33 South Beach Avenue

MRC Nagar

Chennai 600 028

Tel: 91 44 4298 7000

Fax: 91 44 4298 7001

| 20

Anda mungkin juga menyukai

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Dari EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Belum ada peringkat

- Corporate Governance: A practical guide for accountantsDari EverandCorporate Governance: A practical guide for accountantsPenilaian: 5 dari 5 bintang5/5 (1)

- Companies Act AcomparisionDokumen9 halamanCompanies Act AcomparisionSiddharth BhargavaBelum ada peringkat

- by AZB & PARTNERS Companies Act, 2013 and Draft Rules Mr-Ajay-BahlDokumen12 halamanby AZB & PARTNERS Companies Act, 2013 and Draft Rules Mr-Ajay-Bahlm_jain_ca100% (1)

- Economics For Everyone: The Insolvency and Bankruptcy Code in India and The National Company Law Tribunal (NCLT)Dokumen9 halamanEconomics For Everyone: The Insolvency and Bankruptcy Code in India and The National Company Law Tribunal (NCLT)KatyayaniBelum ada peringkat

- Corporate Law Course ASS 1Dokumen7 halamanCorporate Law Course ASS 1Surabhi singhalBelum ada peringkat

- IBC Amendment Bill 2021 UPSC NotesDokumen5 halamanIBC Amendment Bill 2021 UPSC NotesAvik PodderBelum ada peringkat

- 01 Secretarial Standards - VisionDokumen8 halaman01 Secretarial Standards - VisionChandrikaprasdBelum ada peringkat

- Starting A New BusinessDokumen2 halamanStarting A New BusinessThabani NcubeBelum ada peringkat

- 20211BBL0001Dokumen13 halaman20211BBL0001bobby devaiahBelum ada peringkat

- Company Law EssaysDokumen118 halamanCompany Law EssaysNavin Soborun100% (1)

- The New Ethiopian Commercial Code A Highlight of Major ChangesDokumen5 halamanThe New Ethiopian Commercial Code A Highlight of Major ChangesBooruuBelum ada peringkat

- Bharat Bohra ProjectDokumen63 halamanBharat Bohra ProjectManvendra AcharyaBelum ada peringkat

- Companies (Amendment) Bill 2016Dokumen29 halamanCompanies (Amendment) Bill 2016REETIKABelum ada peringkat

- Topic - Overview of Object + Purpose of Ibc Code Class-Syllb Sem 4 Division - A Roll No - 23 Subject - Law Relating To Insolvency and BankruptcyDokumen5 halamanTopic - Overview of Object + Purpose of Ibc Code Class-Syllb Sem 4 Division - A Roll No - 23 Subject - Law Relating To Insolvency and BankruptcyAananya DanielBelum ada peringkat

- TRANSACTION COST THEORY CGDokumen12 halamanTRANSACTION COST THEORY CGDevanshu YadavBelum ada peringkat

- Research Paper On NCLT Assessing Fairness To A Scheme of MergerDokumen15 halamanResearch Paper On NCLT Assessing Fairness To A Scheme of Mergerreshmi duttaBelum ada peringkat

- Research Paper On NCLT Assessing Fairness To A Scheme of MergerDokumen15 halamanResearch Paper On NCLT Assessing Fairness To A Scheme of Mergerreshmi duttaBelum ada peringkat

- Chairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Dokumen26 halamanChairman's Message: Frequently Asked Questions On The Code of Corporate Governance (Revised)Faizan MotiwalaBelum ada peringkat

- Corporate LawDokumen36 halamanCorporate LawJahnnavi SarkhelBelum ada peringkat

- Countdown To Companies Act 2013 Impact On Transactions and Corporate RestructuringDokumen18 halamanCountdown To Companies Act 2013 Impact On Transactions and Corporate Restructuringeqbal.sayed@exensys.comBelum ada peringkat

- Assignment - CG & BEDokumen4 halamanAssignment - CG & BErajesh laddhaBelum ada peringkat

- SSRN Id3425370Dokumen21 halamanSSRN Id3425370Poonam SharmaBelum ada peringkat

- IbcDokumen62 halamanIbcpankaj vermaBelum ada peringkat

- Regulatory Framework of Corporate GovernanceDokumen21 halamanRegulatory Framework of Corporate GovernanceKEVAL SHAHBelum ada peringkat

- Executive Compensation Update 2011Dokumen13 halamanExecutive Compensation Update 2011brent-buford-9451Belum ada peringkat

- 1 Role of Regulators in Corporate GovernanceDokumen23 halaman1 Role of Regulators in Corporate Governancesana khanBelum ada peringkat

- Code of Corporate Governance FAQ'sDokumen12 halamanCode of Corporate Governance FAQ'sSyed Shujat AliBelum ada peringkat

- Chapter 13 Audit of Co Operative Societies PMDokumen8 halamanChapter 13 Audit of Co Operative Societies PMJyotiParangeBelum ada peringkat

- FIJI LAW SOCIETY - Companies Bill Submission 070415Dokumen9 halamanFIJI LAW SOCIETY - Companies Bill Submission 070415Seni NabouBelum ada peringkat

- MSME IBC2 FootDokumen26 halamanMSME IBC2 FootPriyadarshan NairBelum ada peringkat

- Tentative ChapterisationDokumen13 halamanTentative ChapterisationNikhil kumarBelum ada peringkat

- Unit 4 - Insolvency & Bankruptcy CodeDokumen18 halamanUnit 4 - Insolvency & Bankruptcy CodeChandana M NBelum ada peringkat

- Final Draft of The Role of IRP Under IBC CodeDokumen24 halamanFinal Draft of The Role of IRP Under IBC CodeHemantPrajapatiBelum ada peringkat

- Proposed Companies ActDokumen65 halamanProposed Companies ActArshad Khan AfridiBelum ada peringkat

- THE IBC, 2016 SymbiosisDokumen35 halamanTHE IBC, 2016 SymbiosisNavya TomerBelum ada peringkat

- Company Act 1956 Vs Company Act 2013Dokumen8 halamanCompany Act 1956 Vs Company Act 2013Prashant Kumar100% (1)

- U-4 Insolvency and Bankruptcy Code 2016Dokumen26 halamanU-4 Insolvency and Bankruptcy Code 2016HIMANI PALAKSHABelum ada peringkat

- Value Addition Notes - Indian EconomyDokumen6 halamanValue Addition Notes - Indian Economynikitash1222Belum ada peringkat

- Merger and ConsolidationDokumen40 halamanMerger and ConsolidationalbycadavisBelum ada peringkat

- Understanding Companies Bill 2012 - Analysis of Accounting, Auditing and Corporate Governance ChangesDokumen56 halamanUnderstanding Companies Bill 2012 - Analysis of Accounting, Auditing and Corporate Governance ChangesananndBelum ada peringkat

- Summary Due To Law ChangeDokumen35 halamanSummary Due To Law ChangeAayush NigamBelum ada peringkat

- 8141principles of Corporate Governance - OECD Annotations and Indian ConnotationsDokumen8 halaman8141principles of Corporate Governance - OECD Annotations and Indian Connotations2nablsBelum ada peringkat

- Companies Bill 2012: Presented by Ca Pratik AroraDokumen40 halamanCompanies Bill 2012: Presented by Ca Pratik Arorababy0310Belum ada peringkat

- Insolvency Code and Implication On Business Organizations-An AnalysisDokumen12 halamanInsolvency Code and Implication On Business Organizations-An AnalysisSHARON SORENG 22Belum ada peringkat

- Ibbi Regulations 2018Dokumen5 halamanIbbi Regulations 2018Treesa JoseBelum ada peringkat

- IBC 2016 and IBC Amendment Bill, 2021Dokumen5 halamanIBC 2016 and IBC Amendment Bill, 2021Keshav GuptaBelum ada peringkat

- Missive Volume IV - July 2011: Transaction AdvisorsDokumen11 halamanMissive Volume IV - July 2011: Transaction AdvisorsAkhil BansalBelum ada peringkat

- Accountancy PresentationDokumen20 halamanAccountancy PresentationArmaan GuptaBelum ada peringkat

- LACF - Revision ClassDokumen13 halamanLACF - Revision Classbennyv1990Belum ada peringkat

- IIBF Monthly ColumnDokumen3 halamanIIBF Monthly ColumnNavneet PatelBelum ada peringkat

- Companies Act-Valuations May 2014 PDFDokumen8 halamanCompanies Act-Valuations May 2014 PDFBrahmpal BhardwajBelum ada peringkat

- 7 Steps To Set Up A Joint VentureDokumen6 halaman7 Steps To Set Up A Joint VentureChristos FloridisBelum ada peringkat

- DSAIDokumen11 halamanDSAIkipkarBelum ada peringkat

- The Companies Act 2013 Simplified - EY IndiaDokumen92 halamanThe Companies Act 2013 Simplified - EY Indiaeyindia.pd100% (1)

- Asset Reconstruction Companies An OverviewDokumen6 halamanAsset Reconstruction Companies An OverviewKaushal JhaveriBelum ada peringkat

- The Companies Act 2015Dokumen3 halamanThe Companies Act 2015Anungo KaveleBelum ada peringkat

- The Companies Act 2014tom Courtney 26th March 2015Dokumen57 halamanThe Companies Act 2014tom Courtney 26th March 2015Valentin RascalBelum ada peringkat

- Slides For Study Unit 2 Memorandum of Incorporation FDokumen33 halamanSlides For Study Unit 2 Memorandum of Incorporation Fu22619942Belum ada peringkat

- PVT Co To Pub CDokumen9 halamanPVT Co To Pub CJjjo ChitimbeBelum ada peringkat

- 100 To 1 in Stock MarketDokumen133 halaman100 To 1 in Stock MarketHimanshu NazkaniBelum ada peringkat

- NBFC Guidelines RBI Clarification On NBFC NCD IssueDokumen2 halamanNBFC Guidelines RBI Clarification On NBFC NCD IssueHimanshu NazkaniBelum ada peringkat

- Presentation On Companies Bill Aug 26Dokumen64 halamanPresentation On Companies Bill Aug 26Himanshu NazkaniBelum ada peringkat

- Mergers by Icici GroupDokumen10 halamanMergers by Icici GroupHimanshu NazkaniBelum ada peringkat

- Materi Pembelajaran 8Dokumen2 halamanMateri Pembelajaran 8ayuluisaBelum ada peringkat

- Fidic White BookDokumen28 halamanFidic White Bookmustafaayman675% (8)

- Simple Loan AgreementDokumen3 halamanSimple Loan AgreementFrancis Dave Flores100% (4)

- LTIADokumen43 halamanLTIAEd SengBelum ada peringkat

- ADR ProcessesDokumen4 halamanADR Processesfarheen rahmanBelum ada peringkat

- Court Annexed MediationDokumen15 halamanCourt Annexed MediationResci Angelli Rizada-NolascoBelum ada peringkat

- Negotiation Skills - Fall 2020 - Ghufran AhmadDokumen12 halamanNegotiation Skills - Fall 2020 - Ghufran AhmadFarhan AshrafBelum ada peringkat

- Portfolio ResumeDokumen2 halamanPortfolio Resumeapi-353164729Belum ada peringkat

- SEMESTER-VIDokumen15 halamanSEMESTER-VIshivam_2607Belum ada peringkat

- SPRC BasicsDokumen50 halamanSPRC BasicstkurasaBelum ada peringkat

- Trust in Mediation - Beyond IntractabilityDokumen4 halamanTrust in Mediation - Beyond IntractabilityPratik Ghosh [OFFICIAL]Belum ada peringkat

- ADR Slides - MergedDokumen259 halamanADR Slides - MergedkipkarBelum ada peringkat

- Midstream and Downstream Petroleum Alternative Dispute Resolution Regulations 2023Dokumen18 halamanMidstream and Downstream Petroleum Alternative Dispute Resolution Regulations 2023Justice FCOBelum ada peringkat

- Am No. 07-11-08-scDokumen37 halamanAm No. 07-11-08-scFaith Alexis GalanoBelum ada peringkat

- Marital Mediation - A Negotiation Between The Spouse To Renew Their MarriageDokumen6 halamanMarital Mediation - A Negotiation Between The Spouse To Renew Their MarriageInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

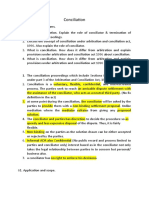

- ConciliationDokumen5 halamanConciliationRehanbhikanBelum ada peringkat

- Legal and Contractual Issues SyllabusDokumen2 halamanLegal and Contractual Issues SyllabusChow Kwan HangBelum ada peringkat

- Stereotype, Realism and Struggle Over Representation HandoutsDokumen7 halamanStereotype, Realism and Struggle Over Representation Handoutsxeno_saitoBelum ada peringkat

- Construction Lawjournal: (2008) 24 Const. L.J. 265-372, T45-T62Dokumen132 halamanConstruction Lawjournal: (2008) 24 Const. L.J. 265-372, T45-T62soumenBelum ada peringkat

- Construction Law UAEDokumen66 halamanConstruction Law UAELee Barry100% (5)

- Iiam Empanelment Form For Neutrals: InstructionsDokumen6 halamanIiam Empanelment Form For Neutrals: InstructionsSiddharth PandeyBelum ada peringkat

- Title III - Bureau of Labor RelationDokumen38 halamanTitle III - Bureau of Labor RelationszusaBelum ada peringkat

- UNIT - II - IRLW 2 Mark Question With AnswerDokumen4 halamanUNIT - II - IRLW 2 Mark Question With AnswervelmuruganbBelum ada peringkat

- Alternative Dispute Resolution Mechanisms and Criminal CasesDokumen18 halamanAlternative Dispute Resolution Mechanisms and Criminal CasesSurbhi GuptaBelum ada peringkat

- Role of ADR in Settling Sports ContractsDokumen3 halamanRole of ADR in Settling Sports ContractskeerthiBelum ada peringkat

- Story Board SampleDokumen16 halamanStory Board SampleRiddhi JainBelum ada peringkat

- Adm. Circular No. 14-93Dokumen3 halamanAdm. Circular No. 14-93Boy BarnisBelum ada peringkat

- Assignment of Human Resource ManagementDokumen14 halamanAssignment of Human Resource Managementhyder imamBelum ada peringkat

- The Role of The State in Employment Relations: What The Chapter CoversDokumen14 halamanThe Role of The State in Employment Relations: What The Chapter CoversKatinka AsquithBelum ada peringkat

- 10 5923 J Sociology 20160601 02Dokumen17 halaman10 5923 J Sociology 20160601 02Esrael KanbataBelum ada peringkat