TABL2741 Case Note

Diunggah oleh

nessawho0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

774 tayangan7 halamanTAB2741 Case note - includes most of the cases used in the course.

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniTAB2741 Case note - includes most of the cases used in the course.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

774 tayangan7 halamanTABL2741 Case Note

Diunggah oleh

nessawhoTAB2741 Case note - includes most of the cases used in the course.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 7

LEGT2741 Case Note

ASIC v Adler [2002] NSWSC 171(HIH collapse)

ASIC v Hellicar [2012] HCA 17

Shafron v ASIC [2012] HCA 18

Gillfillan v ASIC [2012] NSWCA 370 [known as the James Hardie case]

ASIC v Healey [2011] FCA 717 [known as the Centro case]

ASIC v Rich

Week 2 Lecture

Duke Group Ltd v Pilmer

Significance

o In order to meet this criterion (acting in common), it is not necessary

that each of the alleged partners should take an active part in the

direction and management of the firm.

o The business may well be carried on by or on behalf of the partners by

someone else. The person carrying on the business must be doing so as

agent for all the other persons who are said to be partners.

Smith v Anderson (1880) 15 Ch.D. 247; A&B. No.22

Facts

o A trust was created for investment purposes to purchase shares and

debentures in a number of companies. Smith, an investor and holder of

trust certificates, applied to wind up the trust on the basis that it was

not a trust but an illegal partnership that exceeded 20 people.

Issue

o Was this a trust of a partnership?

Decision

o Held that it was not a partnership because the act being undertaken was

isolated and there was no intention to repeat the venture. The court

focused on the expression carrying on.

o It implies a repetition of acts and excludes the case of an association

formed for doing one particular act that is never to be repeated. That

series of acts is to be a series of acts which constitute a business

United Dominions Corporation Ltd v Brian Pty Ltd

Facts

o UDC and Brian were members of a joint venture with another company

SPL. Prior to forming the joint venture UDC and SPL entered into a

contract involving the proceeds of the future joint venture if SPL failed

to repay money lent to it by UDC. Brian was unaware of this contract.

o During the course of the joint venture UDC took all of the profits and

relied on the previous contract. The joint venture agreement specifically

stated that the participants were joint venturers not partners.

Issue

o Did a fiduciary relationship exist between UDC and Brian even though

they were involved in a joint venture?

Decision

o There was a fiduciary relationship between UDC and Brian and UDC was

ordered to pay Brian his share of the joint venture profits.

o A fiduciary relationship (duty of good faith, loyalty and honesty) may and

ordinarily will exist between prospective partners who have embarked

upon the conduct of the partnership business or venture before the precise

terms of partnership agreement have been settled.

Canny Gabriel Castle Jackson Advertising Pty Ltd v Volume Sales (Finance)

Ptd Ltd

Facts

o Fourth Media Management was a promoter that managed the Australian

tours for Cilla Black and Elton John. Volume Sales agreed to finance the

tours. A written agreement was entered into in which Fourth Media

Management agreed to assign to Volume Sales a half interest in the

contracts in the basis of a joint venture.

o The finance advanced by Volume Sales was described as a loan to the

joint venture. The net profits were to be divided at the end of the

contract.

o All matters were to be agreed by the parties and any losses were not to

be shared on the same basis as the profits. Subsequent to the agreement

with Volume Sales, an equitable charge (type of security) was granted to

Canny Gabriel (a third party) on the basis of additional finance being

advanced by the party.

Decision

o Partnership on the basis that profits were being shared equally between

the parties and the management and the conduct of the arrangement

was dictated by their joint agreement.

o Joint venture label has no effect on the courts judgment.

o It seems to us that the contract exhibited all the indicia of a partnership

except that it did not describe the parties as partners and did not provide

expressly for the sharing of losses, although we venture to think that it did

so impliedly.

Checker Taxicab Co Ltd v Stone

Facts:

A driver hired a taxi car from the owner of a garage. The written contract

provided for the taxi to be returned to the owners garage in good

condition after each use. The driver met the expense of running the car

and paid an agreed percentage of his earnings derived from this activity.

In a dispute between the parties, the court had to determine the

relationship between the owner and the driver of the taxi

Decision:

The relationship was not a partnership because it was not a business

being carried on by persons in common. The arrangement comprised two

distinct and separate businesses. The owner exercised no control over the

driver. There was no evidence of mutual rights and obligations between

the owner and the driver. The absence of acting in common meant that

the relationship was not a partnership.

Beckingham v Port Jackson and Manly Steamship Co. [19571 S.R. (NSW) 403;

A&B No.23

Facts

o A syndicate purchased a submarine with the purpose of having it open

to the public who could enter and tour by paying an entry fee. The

syndicate contracted with the Steamship Company to pay rent for wharf

space and to share the profits of this business venture with the

Steamship Co. The agreement stipulated that the syndicate was to

remain at all times in the ownership and possession of the syndicate.

o During a storm the Steamship Co. arranged for the submarine to be

towed into more open waters. During the towing the submarine was

wrecked. The syndicate sued the Steamship Co. for damages caused by

their negligence.

Issue

o What was the true status of the parties relationship - that of partners or

agents?

Decision

o A partnership did not exist.

o It is clear that the parties sought to avoid the creation of a partnership

and in particular, to prevent any authority from arising in the syndicate..

to pledge the credit fo the Steamship Company or the creation of any

liability in the Steamship Company to third parties the Steamship

Company is expressed to act as agents for the syndicate to manage the

syndicates business of exhibiting the submarine - all this for reward to the

Steamship Company in the form of a fixed annual rental and a percentage

of the net proceeds of the admission charges.

Significance

o Share of profits is not sufficient to constitute a partnership.

Re Megevand: Ex parts Delhasse (1 887-78) 7 Ch.D. 51 1; A.&B. No.24

Facts

o C lent 10.000 pounds to A and B to start a business. The written contract

stated:

o C was not a partner and it was a loan (creditor)

o C was to share profits and losses up to 25%

o C was entitled to examine the partnership books anytime

o C was entitled to a quarterly statement

o The loan was not repayable until the partnership was dissolved

o The loan was the firms only capital

Issue

o Was C a creditor or a partner?

Decision

o The loan agreement suggested that C was a dormant partner.

o If ever there was a case of partnership this is it. There is every element of

partnership in it. There is the right to control the property, the right to

receive profits, and the liability to share in losses.

Mercantile Credit Co v Garrod

Facts

o A and B were partners in a garage business. Without authority from B

and in breach of partnership agreement, A sold a car which did not own

to C.

Issue

o Could C sue B, an innocent partner, to recover the purchaser price even

though A was acting in accordance with the agreement?

Decision

o C was able to get a refund from innocent partner because the sale was

an act for carrying on in the usual way business of the kind carried on by

the firm.

Goldberg v Jenkins

Facts

o A partner borrowed money at 60% interest when normal rates were 6-

10%.

Issue

o Did the loan agreement bind the firm?

Decision

o The unrealistic rate of 60% interest was beyond the usual way and the

rest of the partners were not bound because of the excessive interest

rate.

o A partner can only bind his co-partners by conducting the business in a

way in which the businesses are ordinarily conducted, and consequently

has no authority to go outside the ordinary mode of transaction business

Polkinghorn v Holland

Facts

o A solicitor in a firm gave one of their clients negligent advice regarding

investments. Client sued all the partners to recover compensation for

the loss suffered.

Issue

o Were the innocent partners liable for the fraudulent activities of the

other partner?

Decision

o The giving of investment advice was within the scope of the errant

partners authority as a solicitor of the firm. The innocent partners were

liable for the loss suffered by the client.

National Commercial Banking Corp v Batty

Facts

Issue

Decision

Lynch v Stiff

Facts

o Williamson, a lawyer, practiced under the name of John Williamson and

Sons. The firms letterhead included the name of D as a partner.

o P always dealt with D for legal advice and invested money with the firm

which was stolen by Williamson.

Decision

o P successfully sued D for compensation on the basis that D was held out

to be a partner and credit was given to the firm based on the

representation.

Birtchell v Equity Trustees

Facts

o A partner in a real estate firm shared profits with the firms client arising

from land speculation activities without disclosing this information to

the other partners in the firm.

Decision

o The court ordered the partner to account to the firm for all profits

arising from the resulting conflict of interest.

Chan v Zacharia

Facts

o Chan and Zacharia, partners in a medical practice, dissolved their

partnership. Lease on the premises in which they conducted their

surgery, was a valuable asset of the firm. Option to renew the lease had

to be undertaken by both the partners. After dissolution, but before the

winding up of the partnership affairs, Chan sought to exclude Zacharia

from practising there by taking up a new lease in his own name alone. In

this way, Chan sought to continue the medical practice on his own.

Decision

o Chan breached his fiduciary duty by failing to act with perfect fairness

and good faith and was accountable for that private profit.

o Chan abused his fiduciary as a trustee and former partner to seek an

advantage for himself

o He subjected the performance of his fiduciary obligations to the pursuit

of his personal interest.

ASIC v Citigroup Global Markets Australia

Facts

o Information communicated to a trader at the bank was alleged to

constitute insider trading by the bank. The communication came from

the traders manager. A senior manager of the advisory arm of the bank

informed the traders manager that as a result of the traders purchases

in Patrick Corporation we may have a problem. The traders manager

told him to stop buying shares in Patrick Corporation.

o The bank was advising Toll Holdings about a possible takeover strategy

against Patrick Corporation. The trader thought that he was being

reprimanded for an inappropriate investment portfolio selection and

sold the Patrick Corporation shares.

Issue

o Insider trading?

Decision

o Insider trading claims failed.

o Trader was not an officer of Citigroup and therefore his knowledge of

the information when he made the trades could not be attributed to the

company. Company also had a valid Chinese wall defence under s 1043F.

Salomon v Salomon & Co Ltd

Facts

o Salomon formed a company to the satisfaction of corporate

requirements. When the company went into liquidation, the company

could not pay both the secured (Salomon) and the unsecured creditors

(third party) on the basis of meeting priority claims.

Issue

o Was the company acting as a trustee for the beneficiary, Mr. Salomon. If

so under the law of trusts a trustee was entitled to an indemnity from

the beneficiary for debts incurred as trustee.

Decision

o The company was a "separate legal person", even though Salomon had

exercised a high level of management of the company's affairs.

Bradley Egg Farm Ltd v Clifford

Facts

o Bradley Egg Farm Ltd [Plaintiff] had its poultry tested by an employee of

an unincorporated association, Lancashire Utility Poultry Society, to

check if the birds where infected by any disease. This association was

formed for the purpose of providing various technical services to its

members. The test conducted by the employee was negligent-as a result

the birds either died or had to be killed. Plaintiff sued the members of

the committee for breach of contract. Committee members argued that

they were not liable.

Decision

o Committee members were found to be personally liable in damages for

breach of contract

Smith v Yarnold

Facts

o Smith, a spectator at a greyhound race, was injured when the

grandstand collapsed. The race was organised by the Taree Greyhound

Racing Club, an unincorporated association. Smith sued Yarnold, a

committee member. The legal action was under both tort (occupiers

liability) and contract (purchase of ticket).

Issue

o Were Yarnold and the other committee members liable?

Decision

o Court held that the committee was liable as occupiers of the premises.

Anda mungkin juga menyukai

- Question Tutorial 2Dokumen10 halamanQuestion Tutorial 2Atiyah AliasBelum ada peringkat

- Tabl2741 EsesayDokumen7 halamanTabl2741 EsesayDaniel Goh100% (1)

- ACCT2522 Past Year In-Class Test ExampleDokumen13 halamanACCT2522 Past Year In-Class Test Examplea7698998Belum ada peringkat

- LEGT2741 Assignment (Week 5)Dokumen9 halamanLEGT2741 Assignment (Week 5)Danny NgBelum ada peringkat

- ACCT2522 Notes Week 1Dokumen8 halamanACCT2522 Notes Week 1Kevin NguyenBelum ada peringkat

- LW3902 Assignment 11-12BDokumen3 halamanLW3902 Assignment 11-12BashtarbangashBelum ada peringkat

- Company Law For Business BLAW2006: Tutorial QuestionsDokumen6 halamanCompany Law For Business BLAW2006: Tutorial QuestionsYashrajsing LuckkanaBelum ada peringkat

- LW3902 Tutorial RevisionDokumen5 halamanLW3902 Tutorial RevisionWan Kam KwanBelum ada peringkat

- Negotiable InstrumentsDokumen3 halamanNegotiable InstrumentsMuhammadUmarNazirChishtiBelum ada peringkat

- Retention of Title by The SellerDokumen5 halamanRetention of Title by The SellerDennis GreenBelum ada peringkat

- Law Assignment IndividualDokumen7 halamanLaw Assignment IndividualMohamad WafiyBelum ada peringkat

- Associated Chemicals Limited and Hill and Delmain Zambia Limited and Ellis and CompanyDokumen4 halamanAssociated Chemicals Limited and Hill and Delmain Zambia Limited and Ellis and CompanyemmanuelmitengoBelum ada peringkat

- Agency LawDokumen9 halamanAgency LawWa HidBelum ada peringkat

- The Companies (Amendment) Act 2015Dokumen29 halamanThe Companies (Amendment) Act 2015Vikram PandyaBelum ada peringkat

- Anika Company Law Ans PaperDokumen9 halamanAnika Company Law Ans PaperMehedi Hasan ShaikotBelum ada peringkat

- Law Project 1Dokumen13 halamanLaw Project 1Victorian_Roses100% (1)

- Hw1 Andres-Corporate FinanceDokumen8 halamanHw1 Andres-Corporate FinanceGordon Leung100% (2)

- Seminar 10 LiquidationDokumen33 halamanSeminar 10 Liquidation靳雪娇Belum ada peringkat

- Cases in - AgencyDokumen18 halamanCases in - AgencyLepelynSarausValdezBelum ada peringkat

- Articles of Association EssayDokumen4 halamanArticles of Association EssayChristopher HoBelum ada peringkat

- Acct3708 Major AssignmentDokumen10 halamanAcct3708 Major AssignmenthereisgoneBelum ada peringkat

- Lecture 7 - Minority ProtectionDokumen37 halamanLecture 7 - Minority ProtectionZale EzekielBelum ada peringkat

- Commercial LawDokumen51 halamanCommercial Lawdorothy92105Belum ada peringkat

- Natal Land and Colonisation Company V Pauline Colliery SyndicateDokumen12 halamanNatal Land and Colonisation Company V Pauline Colliery SyndicateYabo LesetediBelum ada peringkat

- Commercial LawDokumen32 halamanCommercial LawYUSHA-U YAKUBUBelum ada peringkat

- A Review On The Regulation of Limited LiabilityDokumen10 halamanA Review On The Regulation of Limited LiabilitysotszngaiBelum ada peringkat

- Constructive NoticeDokumen13 halamanConstructive NoticeAbhishek SinghBelum ada peringkat

- University of London La3021 OctoberDokumen6 halamanUniversity of London La3021 OctoberdaneelBelum ada peringkat

- C Law T2Dokumen5 halamanC Law T2hudaBelum ada peringkat

- SA U5 Law of Tort - Final Web PDFDokumen6 halamanSA U5 Law of Tort - Final Web PDFsaidatuladani100% (1)

- AgencyDokumen41 halamanAgencySimeony SimeBelum ada peringkat

- F4eng 2010 AnsDokumen12 halamanF4eng 2010 AnssigninnBelum ada peringkat

- The Etridge CaseDokumen1 halamanThe Etridge CaseMarina Dragiyska100% (1)

- Jamaica Business ComplianceDokumen4 halamanJamaica Business CompliancePrince McknightBelum ada peringkat

- Limited Partnership: Partnership Notes 2016 Dean VillanuevaDokumen4 halamanLimited Partnership: Partnership Notes 2016 Dean VillanuevaJas Em BejBelum ada peringkat

- Class Notes Business Entities, The ChoicesDokumen10 halamanClass Notes Business Entities, The ChoicesLydia.m. Asaba100% (1)

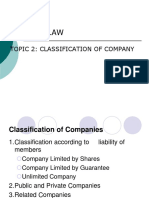

- TOPIC 2 - Classification of CompanyDokumen24 halamanTOPIC 2 - Classification of CompanyShahrizatSmailKassimBelum ada peringkat

- Company Law Revision Outline 2017无注释版Dokumen4 halamanCompany Law Revision Outline 2017无注释版靳雪娇Belum ada peringkat

- CH 7 Insurance Law and Regulation 1Dokumen35 halamanCH 7 Insurance Law and Regulation 1PUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- International Electronic Commerce and Administrative Law: The Need For Harmonized National ReformsDokumen24 halamanInternational Electronic Commerce and Administrative Law: The Need For Harmonized National ReformsdorianBelum ada peringkat

- Business Law NotesDokumen4 halamanBusiness Law NotesnishuBelum ada peringkat

- Biz Tut 5Dokumen6 halamanBiz Tut 5How Kwang Ming100% (1)

- Consideration & Promissory EstoppelDokumen6 halamanConsideration & Promissory EstoppelSultan Mughal100% (1)

- Business Law#1Dokumen1 halamanBusiness Law#1Christina NicoleBelum ada peringkat

- Company - Director Duties (Problems) 2017 ZA B Q7Dokumen5 halamanCompany - Director Duties (Problems) 2017 ZA B Q7Yip MfBelum ada peringkat

- Week 3 - Tutorial QuestionsDokumen3 halamanWeek 3 - Tutorial QuestionsshivnilBelum ada peringkat

- Partnership Act 1932-Questions & Answers (BL)Dokumen13 halamanPartnership Act 1932-Questions & Answers (BL)Erfan KhanBelum ada peringkat

- Tutorial 8 Group WorkDokumen10 halamanTutorial 8 Group WorkChew Jin HaoBelum ada peringkat

- Relation of Partners To One Another Unde PDFDokumen7 halamanRelation of Partners To One Another Unde PDFL lawlietBelum ada peringkat

- Seminar 6 - Directors Duty of CareDokumen32 halamanSeminar 6 - Directors Duty of Care靳雪娇Belum ada peringkat

- Assignment 2014 Fraudulent Trading (Recklessness)Dokumen17 halamanAssignment 2014 Fraudulent Trading (Recklessness)ShinadeBelum ada peringkat

- Winding Up - 2017Dokumen44 halamanWinding Up - 2017Lim Yew TongBelum ada peringkat

- Law by Kolapo SamuelDokumen118 halamanLaw by Kolapo SamuelO. OBelum ada peringkat

- Piercing The Corporate Veil in Taxation Matters (Autosaved)Dokumen17 halamanPiercing The Corporate Veil in Taxation Matters (Autosaved)PRERNA BAHETIBelum ada peringkat

- Alternative Dispute ResolutionDokumen8 halamanAlternative Dispute ResolutionCHIMOBelum ada peringkat

- WS7 - Disability Discrimination Model AnswerDokumen3 halamanWS7 - Disability Discrimination Model AnswerRebecca MorganBelum ada peringkat

- Prohibitions On Financial Assistance For AcquistionDokumen5 halamanProhibitions On Financial Assistance For AcquistiontrendiciousBelum ada peringkat

- Assignment Partnership1Dokumen8 halamanAssignment Partnership1vivek1119100% (1)

- Refusal To Deal in The EUDokumen32 halamanRefusal To Deal in The EUFrancis Njihia KaburuBelum ada peringkat

- Characteristics of PartnershipDokumen1 halamanCharacteristics of PartnershipImranSheikBelum ada peringkat

- LEGT2751 Business Taxation Sem 1 2012Dokumen4 halamanLEGT2751 Business Taxation Sem 1 2012nessawhoBelum ada peringkat

- TABL2751 Tutorial NotesDokumen48 halamanTABL2751 Tutorial Notesnessawho50% (2)

- Legt2751 s1 2009 Final ExamDokumen7 halamanLegt2751 s1 2009 Final ExamYvonne ChanBelum ada peringkat

- TABL 2751 Course OutlineDokumen19 halamanTABL 2751 Course OutlinenessawhoBelum ada peringkat

- TABL2751/LAWS3147 Assignment QuestionDokumen4 halamanTABL2751/LAWS3147 Assignment Questionnessawho100% (1)

- Acct3610 - Ups IpoDokumen4 halamanAcct3610 - Ups Iponessawho67% (6)

- Acct3708 Finals, Sem 2, 2010Dokumen11 halamanAcct3708 Finals, Sem 2, 2010nessawhoBelum ada peringkat

- Final Stats Project 2012 ECON1203Dokumen6 halamanFinal Stats Project 2012 ECON1203nessawhoBelum ada peringkat

- ACCT3610 - America Online Case StudyDokumen3 halamanACCT3610 - America Online Case Studynessawho100% (1)

- Walmart ValuationDokumen24 halamanWalmart ValuationnessawhoBelum ada peringkat

- FINS1612 Quiz 3 NotesDokumen3 halamanFINS1612 Quiz 3 NotesnessawhoBelum ada peringkat

- 2020 Fiscal Plan For COSSEC As Certified by FOMB On June 29 2020 Pna Fiscal de COSSECDokumen42 halaman2020 Fiscal Plan For COSSEC As Certified by FOMB On June 29 2020 Pna Fiscal de COSSECRubén E. Morales RiveraBelum ada peringkat

- Activities of ": Uttara Finance and Investment LTD"Dokumen2 halamanActivities of ": Uttara Finance and Investment LTD"FarukIslamBelum ada peringkat

- Glossary of Banking, Economic and Financial TermsDokumen22 halamanGlossary of Banking, Economic and Financial Termssourav_cybermusicBelum ada peringkat

- Ubs - DCF PDFDokumen36 halamanUbs - DCF PDFPaola VerdiBelum ada peringkat

- G.R. No. 207161 (Y-I Leisure Phils. v. Yu) Full CaseDokumen10 halamanG.R. No. 207161 (Y-I Leisure Phils. v. Yu) Full CaseEricha Joy GonadanBelum ada peringkat

- Topic 10 Law of Partnership (Part I)Dokumen23 halamanTopic 10 Law of Partnership (Part I)Ali0% (1)

- Sale of Goods ActDokumen52 halamanSale of Goods Actrishabh jainBelum ada peringkat

- Yamashita Teacher Corps Rules and RegulationsDokumen6 halamanYamashita Teacher Corps Rules and Regulationsapi-283452741Belum ada peringkat

- Special Power of Attorney (SPA, HQP-HLF-064, V02)Dokumen2 halamanSpecial Power of Attorney (SPA, HQP-HLF-064, V02)Rpadc CauayanBelum ada peringkat

- Money SupplyDokumen8 halamanMoney Supplyladankur23Belum ada peringkat

- Loan Application Form: XXXXXXX X XXXXXXXXDokumen10 halamanLoan Application Form: XXXXXXX X XXXXXXXXgopikiran6Belum ada peringkat

- Findings From The China Household Finance SurveyDokumen80 halamanFindings From The China Household Finance Surveychenhu90100% (1)

- Prestige Tranquility BrochureDokumen15 halamanPrestige Tranquility Brochuremunish45Belum ada peringkat

- Universal Work QueueDokumen19 halamanUniversal Work QueueThulasee RamBelum ada peringkat

- ECOR 3800 - Assignment 2 SolutionsDokumen8 halamanECOR 3800 - Assignment 2 SolutionsJason ChenBelum ada peringkat

- ICICIDokumen33 halamanICICIBansalrenukaBelum ada peringkat

- VisionPLUS ServicesDokumen13 halamanVisionPLUS Servicesajinkyajain100% (2)

- Strategic Analysis of Poh KongDokumen36 halamanStrategic Analysis of Poh KongDin Aziz50% (4)

- Discounted Cash Flow Analysis Input Parameters and SensitivityDokumen13 halamanDiscounted Cash Flow Analysis Input Parameters and Sensitivityfr5649Belum ada peringkat

- Spouses Bautista vs. Premiere Development Bank (Full Text, Word Version)Dokumen10 halamanSpouses Bautista vs. Premiere Development Bank (Full Text, Word Version)Emir MendozaBelum ada peringkat

- Ch05 Mini CaseDokumen8 halamanCh05 Mini CaseSehar Salman AdilBelum ada peringkat

- Loan Application Form FOR Rooftop Solar PV Grid Connected/Interative Power ProjectsDokumen25 halamanLoan Application Form FOR Rooftop Solar PV Grid Connected/Interative Power ProjectsVishal DagadeBelum ada peringkat

- Introduction : La W C o Ntrac TDokumen11 halamanIntroduction : La W C o Ntrac TIacobDorinaBelum ada peringkat

- RCBC Vs IACDokumen13 halamanRCBC Vs IACAudrey MartinBelum ada peringkat

- Enter A Better Life: Sub: Sanctlon Letter For Financial FacilityDokumen2 halamanEnter A Better Life: Sub: Sanctlon Letter For Financial Facilityinfoski khan100% (2)

- News 5 Kim Hastie IndictmentDokumen18 halamanNews 5 Kim Hastie IndictmentJb BiunnoBelum ada peringkat

- T8-R54-Rose-Ch12Ch13-20.13-20.14-v1 - Practice QuestionsDokumen10 halamanT8-R54-Rose-Ch12Ch13-20.13-20.14-v1 - Practice Questionsshantanu bhargavaBelum ada peringkat

- Money Markets: Source: Darskuviene, Valdone, Financial Market, 2010 EditionDokumen15 halamanMoney Markets: Source: Darskuviene, Valdone, Financial Market, 2010 EditionMaria TheresaBelum ada peringkat

- Tally - Erp9 NotesDokumen52 halamanTally - Erp9 NotessandeepBelum ada peringkat

- Bank Guarantee TypesDokumen4 halamanBank Guarantee TypesecpsaradhiBelum ada peringkat