Government Proposes Amendments To Four Labor Laws

Diunggah oleh

stellalaurenJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Government Proposes Amendments To Four Labor Laws

Diunggah oleh

stellalaurenHak Cipta:

Format Tersedia

AUG

2014

As part of the Compliance Calendar, Professional

Tax is due in Andhra Pradesh, Madhya Pradesh,

Karnataka, West Bengal, Maharashtra, Assam and

Kerala among other compliance requirements.

The Honourable Supreme Court has held that

artificial breaks in service are tantamount to 'unfair

labour practice'. The Honourable Punjab and

Haryana High Court have held that the termination of

a workman appointed for a fixed term is not illlegal.

The Court has also held that the employee of a

licensed contractor cannot raise a claim upon the

principal employer. The Honourable Delhi High

Court has pronounced that an employee employed

even for one day is to be counted for coverage under

Provident Fund Act. The Honourable Madras High

Court has held that Gratuity Act overrides all other

enactments.

The Ministry of Labour and Employment has

proposed certain amendments to the Factories Act,

1948, the Minimum Wages Act, 1948, the Child

Labour (Prohibition and Regulation) Act, 1986 and

the Labour Laws. The Centre may carry out

amendments to the Apprentice Act 1961 to drive

apprenticeship. The Delhi government has directed

employers of organised and unorganised labourers

to pay their employees' wages through cheque or

electronic mode. Construction companies and

developers will face cancellation of license if they do

not pay applicable minimum wages. Ministry of

Labour & Employment has signed a Memorandum

Of Understanding with Employee State Insurance

and Provident Fund Organisation for implementing

activities in the year 2014-2015.

We hope you find the contents of this newsletter

relevant and useful. We welcome your suggestions

and inputs for enriching the content of this

newsletter. Please write to: contactadp@adp.com

Hello Readers,

Compliance Calendar for Aug 2014 02

PAGES

03

Termination of a workman appointed

for a fixed term is not illegal

Artificial breaks in service tantamount

to 'unfair labour practice'

Employee of licensed contractor cannot

raise claim upon principal employer

An Employee employed even for one

day is to be counted for coverage under

Provident Fund Act.

Gratuity Act overrides all other

enactments

03

03

04

04

04

05

News to note

Government proposes amendments

to four labour laws

Centre may tweak bill to push

apprenticeship

Pay labourers through cheque or

e-transfers

Construction Companies Warned on

Minimum Wages

How to get a digital signature

05

05

05

Important Judgments

PAGE 02

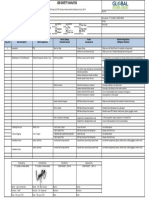

Compliance Calendar for the month of Aug 2014

10th Aug 14

15th Aug 14

20th Aug 14

21st Aug 14

31st Aug 14

Andhra Pradesh & Madhya Pradesh

Gujarat

By Challan

By Challan

By Challan

By Challan

By Challan

Karnataka

West bengal

Maharashtra, Assam, Orissa

State Wise regulations

Gujarat PT regulations

Karnataka PT regulations

WB PT regulations

State Wise regulations

31st Aug 14 Karnataka Karnataka PT regulations On line

20th Aug 14 Kerala State Labour Welfare By Challan

Labour Welfare Fund Remittances

15th Aug 14 Central - Remittance of Contribution EPF & MP Act 1952 By Challan

15th Aug 14

Central - International worker with

wages and nationality

EPF & MP Act 1952 Statement in IW 1

21st Aug 14

Remittance of Contribution

(Main code and Sub Codes)

ESIC Act 1948 By Challan

ESI

Due Date Activity Due Under Mode

Professional Tax Remittances

PF

PAGE 03

TERMINATION OF A WORKMAN APPOINTED FOR A FIXED TERM IS NOT ILLEGAL

In a case of Vijay Kumar Vs Industrial Tribunal Bhatinda and others, the honourable Punjab & Haryana High

Court through the verdict by honourable justices Mr. Sandhawalla pronounced that the termination of services

of a workman, appointed on contractual basis for a fixed term is not illegal retrenchment in violation of section

25F of Industrial Dispute Act, 1947 as it has protection under sec 2(00)(bb) of the act.

When contractual employment has protection under sec 2(00)(bb) of the Industrial Dispute Act, 1947,

termination of services of the workman would not be in violation of sections 25G and 25H of the Act.

ARTIFICIAL BREAKS IN SERVICE

TANTAMOUNT TO 'UNFAIR LABOUR PRACTICE'

In an extraordinary case of Bhuvanesh Kumar Dwivedi Vs M/s

Indalco Industries Ltd, the Honourable Supreme Court under its

bench comprising the Honourable justices Mr. Gyan Sudha

Mishra and Mr. V Gopala Gowda pronounced that the artificial

break in service every year by reappointing the employee on the

same post with same badge number and I.D number

tantamount to unfair labour practice under section 2(ra) of the

Industrial Dispute Act, 1947.

When the repeated artificial periodical breaks in service are

proved, the termination of services of the workman would not

have protection of Section 2(00)(bb) of the act, which would

attract relief of reinstatement with full back-wages being illegal

retrenchment.

For entitlement of back-wages, burden of providing that the

workman was gainfully employed lies upon the employer, failing

which the workman would be entitled with back-wages.

EMPLOYEE OF LICENSED CONTRACTOR CANNOT RAISE CLAIM UPON PRINCIPAL EMPLOYER

In a case of Charan Singh Vs Presiding Officer, Industrial Tribunal-cum-labour Court II, Gurgaon and Another,

the Honourable Punjab & Haryana High Court through the verdict by Honourable Justices Mr. Sandhawalla

pronounced that when the application seeking employment, appointment letter, wage register, maintained by

the contractor, shows that the workman was employed by the contractor, who was having valid license under

the Contract Labour (Regulation & Abolition) Act, the workman's claim against the principal employer is not

sustainable.

When the workman has not produced any independent evidence in support of his claim that he was employee

of the principal employer, his claim against principal employer is not maintainable.

PAGE 04

AN EMPLOYEE EMPLOYED EVEN FOR ONE DAY IS TO BE COUNTED

FOR COVERAGE UNDER PROVIDENT FUND ACT.

In a peculiar case of DSOI through its society Vs Employee's Provident Fund Organisation, the honourable Delhi

High court under honourable justice Mr. V. Kameswar Rao pronounced that the definition of 'employee' as provided

under section 2(f) of Employee's Provident Fund and Miscelaneous Provisions Act, 1952, read with clause 26(2) of

the scheme does not exclude 'casual employee' even employed for one day or for more than one day, in or in

connection with the work of the establishment against wages, from the coverage of the act.

GRATUITY ACT OVERRIDES ALL

OTHER ENACTMENTS

In a case of Commissioner, Idappadi Municipalilty,

Idappadi, Selam Vs Joint Commissioner of Labour, the

appellate authority under the Payment of Gratuity Act,

Coimbatore & others the Madras High Court under

honourable Justice Mr. Hariprananthaman pronounced

that there is no distinction between permanent or

temporary or substitute employee under the Payment of

Gratuity Act.

Exemption from payment of gratuity is only in respect of

apprentice engaged under the Apprentice Act, 1961. The

words 'any person' under Payment of Gratuity Act clearly

imply that all employees including casual, temporary and /

or substituted, are entitled to gratuity under the act. Even

apprentices not engaged under Apprentice Act, 1961 are

entitled to gratuity.

The Ministry of Labour and Employment has proposed certain amendments to the Factories Act, 1948, the

Minimum Wages Act, 1948, the Child Labour (Prohibition and Regulation) Act, 1986 and the Labour Laws

(Exemption from Furnishing Returns and Maintaining Registers by Certain Establishments) Act, 1988. The Ministry

has invited comments from stakeholders on the proposed amendments to Minimum Wages Act, 1948 by June 30,

2014, Factories Act, 1948 by July 4, 2014 and Child Labour Act, 1986 by July 15, 2014 and Labour Laws Act, 1988

by July 22, 2014.

Key features of the proposed amendments are:

Factories Act, 1948: The owner or manager of a factory should ensure that the factory's expansion does not

involve any hazard to the workers' safety and workers involved in hazardous processes have protective equipment

and clothing. Adult women (except those who are pregnant or disabled) will now be allowed to work on moving

machinery. The state government may allow women to work during night shifts.

Minimum Wages Act, 1948: The central government will revise the National Floor Level for Minimum Wages every

five years, and update it every six months in line with consumer price inflation. State governments have to link

minimum wages to inflation or revise them every two years. State governments are also obliged to fix minimum

wages for all professions.

GOVERNMENT PROPOSES AMENDMENTS TO FOUR LABOUR LAWS

PAGE 05

Child Labour Act, 1986: The Child Labour (Prohibition and Regulation) Amendment Bill, 2012 is currently pending

in Rajya Sabha and the Standing Committee on Labour has submitted its report on the Bill. The Ministry has now

accepted two of the Standing Committee's suggestions: (i) to regulate the work of children in the entertainment

industry, and (ii) parents of adolescents working in hazardous occupations should not be punished in the first

instance, only repeat offenders.

Labour Laws Act, 1988: The Act exempts small establishments from filing returns and maintaining registers as

required by certain labour laws. The Labour Laws (Amendment) Bill, 2011 is currently pending in Rajya Sabha and

the Standing Committee on Labour has submitted its report on the Bill. The Ministry has now accepted some of the

Standing Committee's recommendations. These include: (i) allowing records to be maintained and submitted in

either physical or electronic form, (ii) changing the period and last date for submission of annual returns, and (iii)

including the names and addresses of employees/workers in annual return forms.

CENTRE MAY TWEAK BILL TO PUSH APPRENTICESHIP

The amendment to the Apprentice Act, 1961 which is approved by the cabinet will be the fist pending amendment to

be taken up. It will bring hope to nearly a million unemployed, unskilled young citizens of India.

The Apprentice Act is key to component of the National Skill Development Program. It had been delayed because

the government had to incorporate certain changes suggested by the industry.

PAY LABOURERS THROUGH CHEQUE OR E-TRANSFERS

The Delhi government has directed employers of organised and unorganized labourers to pay their employees'

wages through cheque or electronic mode to keep a tab on payment records and take action against errant

employers. The labour department had also directed employers including contractors to upload employee details

like category, nature of work, bank account numbers and payment details on their web sites, and they are given 90

days time for compliance. Employers have also been asked to discourage deployment of contract workmen.

CONSTRUCTION COMPANIES WARNED ON MINIMUM WAGES

Construction companies and developers will face cancellation of license for not paying applicable minimum wages.

Noticing large scale violations of its minimum wages order, the labour department of Delhi Government has issued

another order making it mandatory for all companies and contractors to pay minimum wages by cheque or

electronic cash transfer to workers and declare it on the website of companies.

All Joint Labour Commissioners have been made responsible for ensuring that the orders are complied with.

Transaction between employee and employer will be verified when Licenses under CLRA Act, 1970 are renewed

and if violations are found, the license will be cancelled.

Ministry of Labour & Employment signs a Memorandum Of Understanding with Employee State Insurance and

Provident Fund Organisation for implementing activities in the year 2014-2015 (Provide attachment access

provision)

HOW TO GET A DIGITAL SIGNATURE

Digital signatures are now increasingly accepted for identification and authentication online It is mandatory for

heads of companies to get a digital signature for filing taxes and other documents online.

Digital signatures reduce the possibility of fraud and ensure legal validity for online transactions Once you get your

Digital Signature, keep it safely and do not share it with anyone unless you are sure of the website's credential.

For more information, e-mail : info@cca.gov.in Website : http://cca.gov.in

PAGE 06

ADP India

Thamarai Tech Park, S.P. Plot No. 16 to 20 & 20A

Thiru Vi Ka Industrial Estate,Inner Ring Road, Guindy,

Chennai - 600 032.

Phone: 1-800-4190-237

Email: contactadp@adp.com

Get the ADP expertise working for you.

A 60 year track record that speaks for itself.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- CFA Level I: Ethical and Professional StandardsDokumen13 halamanCFA Level I: Ethical and Professional StandardsBeni100% (3)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- About The CompanyDokumen2 halamanAbout The CompanyAnkit KumarBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- CB Insights AI 100 Trends WebinarDokumen34 halamanCB Insights AI 100 Trends WebinarYannick Martineau GoupilBelum ada peringkat

- Requirements Classification Diagram PDFDokumen2 halamanRequirements Classification Diagram PDFPeaceBelum ada peringkat

- Globalization, Slobalization and LocalizationDokumen2 halamanGlobalization, Slobalization and LocalizationSadiq NaseerBelum ada peringkat

- Notice Pay To Terminated EmployeeDokumen10 halamanNotice Pay To Terminated EmployeestellalaurenBelum ada peringkat

- Designing A Simple Compensation StructureDokumen18 halamanDesigning A Simple Compensation StructurestellalaurenBelum ada peringkat

- ADP Labour Ministry Prepares Mega Housing Scheme Jan 2015Dokumen11 halamanADP Labour Ministry Prepares Mega Housing Scheme Jan 2015stellalaurenBelum ada peringkat

- Spotlight On Payroll and HR OutsourcingDokumen8 halamanSpotlight On Payroll and HR OutsourcingstellalaurenBelum ada peringkat

- 7 Common Mistakes Found While Outsourcing HR FunctionDokumen16 halaman7 Common Mistakes Found While Outsourcing HR FunctionstellalaurenBelum ada peringkat

- Remittances For Professional Tax, PF and ESIDokumen8 halamanRemittances For Professional Tax, PF and ESIstellalaurenBelum ada peringkat

- Labour Laws To Be Reviewed - Dec'14Dokumen9 halamanLabour Laws To Be Reviewed - Dec'14stellalaurenBelum ada peringkat

- ADP India - Labour Laws To Be Reviewed-Sep-2014Dokumen6 halamanADP India - Labour Laws To Be Reviewed-Sep-2014stellalaurenBelum ada peringkat

- Proposed Amendments To The Apprentices Act, 1961Dokumen7 halamanProposed Amendments To The Apprentices Act, 1961stellalaurenBelum ada peringkat

- Proposed Amendments To The Apprentices Act, 1961Dokumen7 halamanProposed Amendments To The Apprentices Act, 1961stellalaurenBelum ada peringkat

- Outsourcing Statutory ComplianceDokumen4 halamanOutsourcing Statutory CompliancestellalaurenBelum ada peringkat

- Labour Laws To Be ReviewedDokumen6 halamanLabour Laws To Be ReviewedstellalaurenBelum ada peringkat

- ADP - Payroll On CloudDokumen6 halamanADP - Payroll On CloudstellalaurenBelum ada peringkat

- Employees' State Insurance Corporation - Special DriveDokumen9 halamanEmployees' State Insurance Corporation - Special DrivestellalaurenBelum ada peringkat

- Mandatory Registration of Digital Signature For PF ActivitiesDokumen8 halamanMandatory Registration of Digital Signature For PF ActivitiesstellalaurenBelum ada peringkat

- EPFO Warns Employer On Delaying PF ClaimsDokumen9 halamanEPFO Warns Employer On Delaying PF ClaimsstellalaurenBelum ada peringkat

- EPFO For Universal Account NumberDokumen7 halamanEPFO For Universal Account NumberstellalaurenBelum ada peringkat

- ADP's Leave Management SolutionsDokumen2 halamanADP's Leave Management SolutionsstellalaurenBelum ada peringkat

- ADP - Payroll Outsourcing BenefitsDokumen12 halamanADP - Payroll Outsourcing BenefitsstellalaurenBelum ada peringkat

- ADP - HR Outsourcing and BusinessesDokumen6 halamanADP - HR Outsourcing and BusinessesstellalaurenBelum ada peringkat

- ADP - HR Outsourcing and The HR LeaderDokumen5 halamanADP - HR Outsourcing and The HR LeaderstellalaurenBelum ada peringkat

- HR Outsourcing and The Finance Leader - ADPDokumen5 halamanHR Outsourcing and The Finance Leader - ADPstellalauren100% (1)

- ADP - HR Outsourcing With IT FlexibilityDokumen6 halamanADP - HR Outsourcing With IT FlexibilitystellalaurenBelum ada peringkat

- Employer Is Liable To Pay ESI Contribution For Contract WorkersDokumen7 halamanEmployer Is Liable To Pay ESI Contribution For Contract WorkersstellalaurenBelum ada peringkat

- Show-Cause Notice Not Required Before Termination of A ProbationerDokumen9 halamanShow-Cause Notice Not Required Before Termination of A Probationerstellalauren100% (1)

- Every Contractor Shall Issue Employment-Cum-Wage Card in Proforma XIVDokumen10 halamanEvery Contractor Shall Issue Employment-Cum-Wage Card in Proforma XIVstellalaurenBelum ada peringkat

- Understanding Oracle Certification Support Licensing Vmware Environments-White-Paper PDFDokumen18 halamanUnderstanding Oracle Certification Support Licensing Vmware Environments-White-Paper PDFmanuel benitezBelum ada peringkat

- GMF 2019 2038 Airbus Commercial Aircraft Book PDFDokumen86 halamanGMF 2019 2038 Airbus Commercial Aircraft Book PDFjuan manuelBelum ada peringkat

- Golads of A CompanyDokumen8 halamanGolads of A CompanyAhmed khanBelum ada peringkat

- Retail KPI Dashboard RCM ModifiedDokumen9 halamanRetail KPI Dashboard RCM ModifiedUppiliappan Gopalan100% (2)

- Group A Case Magna International, Inc (12156)Dokumen4 halamanGroup A Case Magna International, Inc (12156)Jesus BerumenBelum ada peringkat

- CBMC - U3 - L3,4 - Advertising - Meaning, Nature, Scope & Classification - 8 Jan 2024Dokumen56 halamanCBMC - U3 - L3,4 - Advertising - Meaning, Nature, Scope & Classification - 8 Jan 2024shubhdeep jainBelum ada peringkat

- Din en 13599 - 2014Dokumen23 halamanDin en 13599 - 2014alferedBelum ada peringkat

- Matemáticas y Música (Síndrome de Williams)Dokumen24 halamanMatemáticas y Música (Síndrome de Williams)Raquel Fraile RodríguezBelum ada peringkat

- Risk Analysis and Risk AllocationDokumen21 halamanRisk Analysis and Risk Allocationkhalid alsadBelum ada peringkat

- READMEDokumen2 halamanREADMEtien khongduochoiBelum ada peringkat

- MC 99Dokumen10 halamanMC 99Henry DiazBelum ada peringkat

- AKSHATDokumen41 halamanAKSHATSakshamBelum ada peringkat

- GTI 2011 Chapter 4 Audit Evidence and Audit ProceduresdocxDokumen8 halamanGTI 2011 Chapter 4 Audit Evidence and Audit ProceduresdocxAsad MuhammadBelum ada peringkat

- Chapter 3 - Enterprise, Business Growth and SizeDokumen26 halamanChapter 3 - Enterprise, Business Growth and SizeShreya ModaniBelum ada peringkat

- Project Report Pts-6: An Analytical Study On Tourism Marketing in IndiaDokumen26 halamanProject Report Pts-6: An Analytical Study On Tourism Marketing in IndiaAshish D JosephBelum ada peringkat

- Core Competencies 1and 2full 1Dokumen32 halamanCore Competencies 1and 2full 1Mykaila ValdezBelum ada peringkat

- Villanueva V PNBDokumen3 halamanVillanueva V PNBDebroah Faith PajarilloBelum ada peringkat

- Rail Wheel FactorDokumen11 halamanRail Wheel Factorkiran mBelum ada peringkat

- Updates On HDMF Housing Loan Program: Juanito V. Eje Task Force Head Business Development SectorDokumen28 halamanUpdates On HDMF Housing Loan Program: Juanito V. Eje Task Force Head Business Development SectorcehsscehlBelum ada peringkat

- Emirates Integrated Telecommunications Company PJSC and Its Subsidiaries Consolidated Financial Statements For The Year Ended 31 December 2020Dokumen70 halamanEmirates Integrated Telecommunications Company PJSC and Its Subsidiaries Consolidated Financial Statements For The Year Ended 31 December 2020Vanshita SharmaBelum ada peringkat

- Strategy Formulation and ExecutionDokumen37 halamanStrategy Formulation and ExecutionHeba ElzeerBelum ada peringkat

- A Synopsis Report ON A Study On Investment Analysis AT Icici Bank LTDDokumen9 halamanA Synopsis Report ON A Study On Investment Analysis AT Icici Bank LTDMOHAMMED KHAYYUMBelum ada peringkat

- Coupling Effect of Iron Class 12 ProjectDokumen12 halamanCoupling Effect of Iron Class 12 ProjectTamil SelvanBelum ada peringkat

- JSA LandFill KHPT-BBB JODokumen1 halamanJSA LandFill KHPT-BBB JOICEDA HumBelum ada peringkat

- Chennai Express Case StudyDokumen16 halamanChennai Express Case StudychromiumbsuBelum ada peringkat