Forex Problems

Diunggah oleh

Carissa Tiamlee TeeHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Forex Problems

Diunggah oleh

Carissa Tiamlee TeeHak Cipta:

Format Tersedia

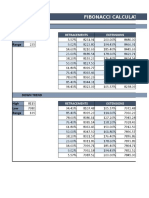

EXERCISE 1: CALCULATING AND USING EXCHANGE RATES

Currency US $ Equivalent

China (Yuan Renminbi) 0.1208

Japan (Yen) 0.0083

Mexico (Peso) 0.0940

Singapore (Dollar) 0.5617

Taiwan (Dollar) 0.02878

Turkey (Lira) 0.00000062

U.K. (Pound) 1.5734

Venezuela (Bolivar) 0.0006

Euro 1.0773

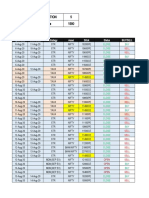

EXERCISE 2: CALCULATING CROSS EXCHANGE RATES

Use these exchanges to answer the questions below:

COUNTRY

China - Yuan Renminbi (CNY)

Japan - Yen (JPY)

Argentina - Peso (ARS)

Vietnam - Dong (VND)

A Japanese manufacturing firm, Japanohondapokemon, placed a purchase order with Beijing conglomerate,

Maydinchina, to procure 10,000 tons of raw materials at a cost of 9,030,200 yuan renminbi. How many yen

does the Japanese firm have to exchange in order to pay the bill in yuan renminbi?

A trader at a well-known investment banking firm, Silverman Pouches, has an Argentinian client who is interested

in investing in emerging markets. The trader suggests the purchase of Vietnamese government-issued bonds,

currently selling at 1,604,100 Vietnamese dong (VND) per bond. How many Argentine Pesos (ARS) will it cost if

the client wants to purchase 250 bonds?

CNY 9,030,200

1

USD $ 1

CNY 8.2871

X X

VND 1,604,100 x 250

1

USD $ 1

VND 16,041

X

EXERCISE 3: CALCULATING CROSS EXCHANGE RATES

US DOLLAR

EGYPT 5.97540

INDONESIA 9,356.60

TAIWAN 37.60

VIETNAM 16,041.00

UNITED STATES -

EXERCISE 4: CALCULATING BID/ASK SPREADS

BID

EUROS $ 1.194

YEN $ 0.009245

What are the bank's bid/ask spreads? How much would you lose if you converted $500 into euros and $500

into yen, and then back into dollars?

a.) BID/ASK SPREADS EURO

Ask Price 1.245

Less: Bid Price 1.194

Subtotal 0.051

Divided by Ask Price 1.245

Bid/Ask Spread 0.041

b.) HOW MUCH LOSS? EURO

USD $ Amount 500.00

Multiplied by Rate 0.80

Equivalent Amount 401.61

Multiplied by Rate 1.19

Equivalent USD $ 479.52

USD $ Amount 500.00

Loss on Conversion (20.48)

EXERCISE 5: CURRENCY APPRECIATIONS AND DEPRECIATIONS

DATES EXCHANGE RATE

1 VND 16,041

4/24/2003 0.91130 EUR/USD

4/28/2003 0.90630 EUR/USD

6/17/1997 23.2 BHT/USD

1/13/1998 55.8 BHT/USD

4/25/2002 1.6430 CHF/USD

4/26/2002 0.6140 USD/CHF

6/26/2002 0.0008324 USD/KRW

2/18/2003 0.0008286 USD/KRW

1/30/1999 1.0038 ARS/USD

2/5/2001 1.00050 USD/ARS

1/30/2000 2.3442 CAD/GBP

9/20/2000 2.0927 CAD/GBP

12/12/2002 0.01629 INR/IQD

2/2/2003 68.0289 IQD/INR

12/27/2002 1.776 AUD/USD

12/28/2002 1.7831 AUD/USD

AUD Australian Dollar EUR Euro

ARS Argentine Peso GBP British Pound

BHT Thai Baht INR Indian Rupee

CAD Canadian Dollar IQR Iraqi Dinar

CHF Swiss Franc KRW Korean Won

EXERCISE 6: MEASURING CURRENCY FLUCTUATIONS

If the Mexican Peso depreciates 50% against the U.S. Dollar, how much would the peso have to appreciate

to get back to its original level?

Let exchange rate be: 1USD = 10MXN

So, if MXN decreased by 50%, then rate: 1USD = 20MXN

To go back to its original level, MXN must appreciate by 50%

EXERCISE 7: MEASURING CURRENCY FLUCTUATIONS

Amount Change

Original Rate

=

X 100

The Brazilian Real (BRL) exchange rate moved from 3.2020 BRL/USD to 3.1606 BRL/USD over two days.

Calculate the Real's Percentage Change and note whether it appreciated or depreciated.

Original Rate

Less: Changed Rate

Amount Changed

Divided by Original Rate

Multiplied by 100%

Depreciation in USD

Original Rate

Less: Changed Rate

Amount Changed

Divided by Original Rate

Multiplied by 100%

Appreciation in BRL

EXERCISE 8: CALCULATING ACTUAL AND IMPLIED PPP EXCHANGE RATES

The Economist Big Mac Index

IN LOCAL CURRENCY

UNITED STATES 2.71

AUSTRALIA 3.00

BRAZIL 4.55

CHINA 9.90

DENMARK 27.75

EGYPT 8.00

HONG KONG 11.50

MALAYSIA 5.04

RUSSIA 41.00

SOUTH KOREA 3300.00

SWITZERLAND 6.30

EXERCISE 8: CALCULATING THE COST OF A FORWARD CONTRACT

A U.S. Multinational, Hoola Hoopa, Inc., hired a Canadian IT consulting firm to upgrade its internal network.

BIG MAC PRICES

In 6 months when the contract is over, Hoola Hoopa will need 1.5 million Canadian dollars to pay the

consultants. The company needs to decide whether or not it should enter into a forward contract to hedge its

exchange rate risk. Fill in the answers below using the US $ Equivalent rates listed in the table below.

COUNTRY MON

Canada (Dollar) 0.6879

1-month forward 0.6868

3-months forward 0.6844

6-months forward 0.6803

Switzerland (Franc) 0.7197

1-month forward 0.7203

3-months forward 0.7215

6-months forward 0.7232

U.K. (Pound) 1.5734

1-month forward 1.5703

3-months forward 1.5644

6-months forward 1.5555

a.) Canadian Dollar Spot Rate

b.) Canadian Dollar 6-Months Forward Rate

c. What it would cost Hoola Hoopa if the company were to purchase the Canadian Dollars spot on 04/15/2003?

Amount of CAD

Multiplied by Spot Rate

Cost to Hoola Hoopa

d.) What it would cost Hoola Hoopa if it hedged with a forward contract on 04/15/2003 to purchase 1.5 million

Canadian Dollars 6 months later on 10/15/2003?

Amount of CAD

Multiplied by Forward Rate

Cost to Hoola Hoopa

U.S. $ EQUIVALENT

Compare the cost of the forward contract, or the hedged position, with the cost of buying the Canadian Dollars

on the spot market on October 15, 2003. Fill in the table below to show the cost of buying C$1.5 million at

different spot rates, and then calculate Hoola Hoopa's potential gains or losses from hedging with a futures

contract

0.6521 978,150.00

0.6700 1,005,000.00

0.6803 1,020,450.00

0.6850 1,027,500.00

0.6900 1,035,000.00

Spot Rate on 10/15/2003 Unhedged Position

EXERCISE 1: CALCULATING AND USING EXCHANGE RATES

Currency per US $ Equivalent of 100 US $

8.2781 827.8146

120.38 12,038.00

10.64 1,064.28

1.78 178.03

34.75 3,474.64

1,612,903.00 161,290,300.00

0.64 63.56

1,597.44 159,744.00

0.93 92.82

EXERCISE 2: CALCULATING CROSS EXCHANGE RATES

CURRENCY PER USD $

8.2871

119.0400

2.9750

16,041.0000

A Japanese manufacturing firm, Japanohondapokemon, placed a purchase order with Beijing conglomerate,

Maydinchina, to procure 10,000 tons of raw materials at a cost of 9,030,200 yuan renminbi. How many yen

does the Japanese firm have to exchange in order to pay the bill in yuan renminbi?

A trader at a well-known investment banking firm, Silverman Pouches, has an Argentinian client who is interested

in investing in emerging markets. The trader suggests the purchase of Vietnamese government-issued bonds,

currently selling at 1,604,100 Vietnamese dong (VND) per bond. How many Argentine Pesos (ARS) will it cost if

JPY 119.04

USD $ 1

X = JPY 129,714,255.70

ARS 2.975

USD $ 1

X = ARS 74,375.00

EXERCISE 3: CALCULATING CROSS EXCHANGE RATES

VIETNAM VNDONG TAIWAN TDOLLAR

0.0003725 0.1589

0.5833 248.845

0.002344 -

- 426.6212

0.00006234 0.02660

ASK

$1.245

$0.00967

What are the bank's bid/ask spreads? How much would you lose if you converted $500 into euros and $500

YEN

0.009670

0.009245

0.000425

0.009670

0.043950

YEN

500.00

103.41

51,706.31

0.01

478.02

500.00

(21.98)

EXERCISE 5: CURRENCY APPRECIATIONS AND DEPRECIATIONS

CURRENCY APPRECIATED

USD $ 1

USD U.S. Dollar

EXERCISE 6: MEASURING CURRENCY FLUCTUATIONS

If the Mexican Peso depreciates 50% against the U.S. Dollar, how much would the peso have to appreciate

So, if MXN decreased by 50%, then rate: 1USD = 20MXN

To go back to its original level, MXN must appreciate by 50%

EXERCISE 7: MEASURING CURRENCY FLUCTUATIONS

YES

YES

YES

USD

INR

CAD

YES

YES

BHT

EUR

USD

KRW

CHF

0.5

0.05

X = 10 100

The Brazilian Real (BRL) exchange rate moved from 3.2020 BRL/USD to 3.1606 BRL/USD over two days.

Calculate the Real's Percentage Change and note whether it appreciated or depreciated.

3.202

3.1606

0.0414

3.202 0.012929419

100%

1.29%

0.3123

0.3164

-0.0041

0.3123 0.0131

100%

1.31%

EXERCISE 8: CALCULATING ACTUAL AND IMPLIED PPP EXCHANGE RATES

IMPLIED PPP OF THE

IN DOLLARS DOLLAR

2.71 -

1.86 1.11

1.48 1.68

1.20 3.65

4.10 10.24

1.35 2.95

1.47 4.24

1.33 1.86

1.32 15.10

2.71 1217.71

4.59 2.32

EXERCISE 8: CALCULATING THE COST OF A FORWARD CONTRACT

A U.S. Multinational, Hoola Hoopa, Inc., hired a Canadian IT consulting firm to upgrade its internal network.

BIG MAC PRICES

In 6 months when the contract is over, Hoola Hoopa will need 1.5 million Canadian dollars to pay the

consultants. The company needs to decide whether or not it should enter into a forward contract to hedge its

exchange rate risk. Fill in the answers below using the US $ Equivalent rates listed in the table below.

FRI MON

0.6879 1.4537

0.6869 1.4560

0.6845 1.4611

0.6804 1.4699

0.7179 1.3895

0.7183 1.3883

0.7192 1.3860

0.7213 1.3827

1.5715 0.6356

1.5783 0.6368

1.5624 0.6392

1.5536 0.6429

0.6879

0.6803

c. What it would cost Hoola Hoopa if the company were to purchase the Canadian Dollars spot on 04/15/2003?

1,500,000.00

0.6879

1,031,850.00

d.) What it would cost Hoola Hoopa if it hedged with a forward contract on 04/15/2003 to purchase 1.5 million

1,500,000.00

0.6803

1,020,450.00

CURRENCY PER U.S. $ U.S. $ EQUIVALENT

Compare the cost of the forward contract, or the hedged position, with the cost of buying the Canadian Dollars

on the spot market on October 15, 2003. Fill in the table below to show the cost of buying C$1.5 million at

different spot rates, and then calculate Hoola Hoopa's potential gains or losses from hedging with a futures

Potential Gains/Losses in

U.S.$ from Hedge

1,020,450.00 (42,300.00)

1,020,450.00 (15,450.00)

1,020,450.00 -

1,020,450.00 7,050.00

1,020,450.00 14,550.00

Hedged Position

INDONESIA RUPIAH EGYPT EPOUND

0.0006386 -

- 1,565.8530

0.004019 6.2925

1.7144 2,684.5065

0.0001069 0.1674

DEPRECIATIED

YES

YES

YES

Actual Dollar Exchange Under(-)/Over(+) valuation

Rates. April 22, 2003 against the dollar %

- -

1.61 -31.06

3.07 -45.00

8.28 -56.00

6.78 51.00

5.93 -50.00

7.80 -46.00

3.80 -51.00

31.10 -51.45

1220.00 -

1.37 69.03

FRI

1.4537

1.4558

1.4609

1.4697

1.3930

1.3922

1.3904

1.3864

0.6363

0.6336

0.6400

0.6437

CURRENCY PER U.S. $

Anda mungkin juga menyukai

- Solution Manual For Investment Science by David LuenbergerDokumen94 halamanSolution Manual For Investment Science by David Luenbergerkoenajax96% (28)

- Cell To Singularity CalculatorDokumen10 halamanCell To Singularity CalculatorChris LongBelum ada peringkat

- Compound Monthly GainDokumen8 halamanCompound Monthly GainLast PlayerBelum ada peringkat

- Fibo - Gann SqureDokumen50 halamanFibo - Gann SqureTHIRUNAVUKKARASU EBelum ada peringkat

- Basic Derivatives ExplainedDokumen5 halamanBasic Derivatives ExplainedJaymee Andomang Os-ag27% (11)

- Chapter 10 Question Answer KeyDokumen56 halamanChapter 10 Question Answer KeyBrian Schweinsteiger Fok100% (1)

- Volume 4 Derivatives IRRM & RMDokumen168 halamanVolume 4 Derivatives IRRM & RMTejas jogadeBelum ada peringkat

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Dokumen12 halaman3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali67% (3)

- Forex Market Opening Hours GuideDokumen1 halamanForex Market Opening Hours Guidemr_dzahhirBelum ada peringkat

- MaximDokumen31 halamanMaximForexProBelum ada peringkat

- Linear Regression and Correlation of Test Scores and GPADokumen5 halamanLinear Regression and Correlation of Test Scores and GPAJeffersonTalanBelum ada peringkat

- Analyze Current Market Price with Gann Square of 9Dokumen3 halamanAnalyze Current Market Price with Gann Square of 9Linley FluggeBelum ada peringkat

- Month Deposit (USD) Profit WD USD Realisasi MAXDokumen23 halamanMonth Deposit (USD) Profit WD USD Realisasi MAXditaBelum ada peringkat

- Crude and Currency CalculatorDokumen5 halamanCrude and Currency CalculatorsathyasonyBelum ada peringkat

- 1000 Forex Plan Shows Monthly Growth to $163k Income in 5 YearsDokumen2 halaman1000 Forex Plan Shows Monthly Growth to $163k Income in 5 YearsKumaran SgBelum ada peringkat

- Multiple Hedging 08042017Dokumen170 halamanMultiple Hedging 08042017Mohamed RizwanBelum ada peringkat

- Board Lot Table and Stock Price CalculatorDokumen14 halamanBoard Lot Table and Stock Price CalculatoricdiazBelum ada peringkat

- Markstein's Criteria: CAPA-alphaDokumen2 halamanMarkstein's Criteria: CAPA-alphaRegie Rey AgustinBelum ada peringkat

- Spreadsheet stock purchase informationDokumen36 halamanSpreadsheet stock purchase informationkkhgkhggkhsssaBelum ada peringkat

- Fibonacci CalculatorDokumen2 halamanFibonacci CalculatorKumarappan SambamurthyBelum ada peringkat

- Fibonacci CalculatorDokumen3 halamanFibonacci Calculatorlolr2Belum ada peringkat

- Gold Pecker Setup GuideDokumen2 halamanGold Pecker Setup GuideEmmanuel MuneneBelum ada peringkat

- Enter 8: Currencies With 4 Decimal Places Swing 1.6550 E5 E6 E7 E8 E10 E11 E12Dokumen7 halamanEnter 8: Currencies With 4 Decimal Places Swing 1.6550 E5 E6 E7 E8 E10 E11 E12viresh333Belum ada peringkat

- Pivot CEDokumen25 halamanPivot CEdoddyBelum ada peringkat

- Trading Audit TemplateDokumen67 halamanTrading Audit TemplateFitzBelum ada peringkat

- Siddharth Deora: Global IndicesDokumen5 halamanSiddharth Deora: Global IndicesskuttamBelum ada peringkat

- Forecasting Volatility in Stock Market Using GARCH ModelsDokumen43 halamanForecasting Volatility in Stock Market Using GARCH ModelsramziBelum ada peringkat

- 7 India Stock Market TrackerDokumen8 halaman7 India Stock Market TrackerVijayakumar SubramaniamBelum ada peringkat

- Traders CalculatorsDokumen542 halamanTraders Calculatorspatelpratik1972Belum ada peringkat

- Option ModelDokumen102 halamanOption Modelseanraboin34Belum ada peringkat

- EVENING AND MORNING PATTERNSDokumen22 halamanEVENING AND MORNING PATTERNSsundaram veerappanBelum ada peringkat

- Camarilla Support and Resistance LevelsDokumen2 halamanCamarilla Support and Resistance LevelsSyed KhalidBelum ada peringkat

- Moving Average Trading SystemDokumen3 halamanMoving Average Trading SystemrajaBelum ada peringkat

- Important AnalysisDokumen32 halamanImportant AnalysisSandeep KumarBelum ada peringkat

- Azmat S&P CNX NIFTY Inc Shariah LIVE Exponential Moving AveragesDokumen2 halamanAzmat S&P CNX NIFTY Inc Shariah LIVE Exponential Moving Averagesc806Belum ada peringkat

- Excellent Money Advisor: Date Script LOT Position Level TG-1 TG-2 TG3Dokumen3 halamanExcellent Money Advisor: Date Script LOT Position Level TG-1 TG-2 TG3excellentmoneyBelum ada peringkat

- For Ex CalculatorDokumen5 halamanFor Ex CalculatorArvind ChaudharyBelum ada peringkat

- Analyzing Indian companies using financial metricsDokumen8 halamanAnalyzing Indian companies using financial metricsKrishna MoorthyBelum ada peringkat

- Details: Art Technology Group IncDokumen14 halamanDetails: Art Technology Group Incmer57rsBelum ada peringkat

- Share Hold SellDokumen4 halamanShare Hold SellIshwor sharmaBelum ada peringkat

- Day 18 - Wealth Building Money Management - Equity Management ModelDokumen4 halamanDay 18 - Wealth Building Money Management - Equity Management ModelTing ywanBelum ada peringkat

- Top 17 stocks with strong fundamentals and returns up to 14Dokumen6 halamanTop 17 stocks with strong fundamentals and returns up to 14pmishra3Belum ada peringkat

- Amba Canslim1Dokumen9 halamanAmba Canslim1api-266993521Belum ada peringkat

- Types of Investments and Best Options for High ReturnsDokumen11 halamanTypes of Investments and Best Options for High ReturnsTelepathy Girithara Mahadevan BabaBelum ada peringkat

- Option Calc v1.0Dokumen2 halamanOption Calc v1.0mr_gauravBelum ada peringkat

- Trade Data SummaryDokumen310 halamanTrade Data SummaryJose GuzmanBelum ada peringkat

- Arbitrage Calculator 3Dokumen4 halamanArbitrage Calculator 3Eduardo MontanhaBelum ada peringkat

- Nifty Premium Trading Track Record: Exit at Cost Grand TotalDokumen12 halamanNifty Premium Trading Track Record: Exit at Cost Grand TotalNvrao RaoBelum ada peringkat

- Bank nifty intraday OI data analysis and preopen levelsDokumen6 halamanBank nifty intraday OI data analysis and preopen levelsDisha ParabBelum ada peringkat

- Day Trading AlgorithmDokumen11 halamanDay Trading AlgorithmSonia SheikhBelum ada peringkat

- 3X5EMADokumen57 halaman3X5EMAAkash NathBelum ada peringkat

- Annual financial statement analysis of assets, equity and liabilities from 2019-2021Dokumen4 halamanAnnual financial statement analysis of assets, equity and liabilities from 2019-2021Muhammad AkmalBelum ada peringkat

- Fibo Nacchi and Gaann Degree CalculationDokumen2 halamanFibo Nacchi and Gaann Degree CalculationVijay ShahBelum ada peringkat

- Range Breakouts in Daily TFDokumen30 halamanRange Breakouts in Daily TFManish SharmaBelum ada peringkat

- Reward To Risk Ratio WorkbookDokumen2 halamanReward To Risk Ratio WorkbookPrathik RaiBelum ada peringkat

- TestplanDokumen18 halamanTestplanprayas_taraniBelum ada peringkat

- StockDokumen6 halamanStockLalit mohan PradhanBelum ada peringkat

- Pivot Point CalculatorDokumen2 halamanPivot Point Calculatorrsa_9Belum ada peringkat

- Open Position 5 Brokrage 1580: Open Date Close Date Strategy Asset Strick Status Buy/SellDokumen8 halamanOpen Position 5 Brokrage 1580: Open Date Close Date Strategy Asset Strick Status Buy/SellAnshul ThakkarBelum ada peringkat

- Nifty Technical AnalysisDokumen136 halamanNifty Technical Analysisapi-3728932Belum ada peringkat

- Fibonacci Retracement - The Gartley Method (Bullish Ascent) : A C TargetDokumen4 halamanFibonacci Retracement - The Gartley Method (Bullish Ascent) : A C TargetKanna KBelum ada peringkat

- Advanced Camarilla Trading Technique in ExcelDokumen4 halamanAdvanced Camarilla Trading Technique in Excelcselvz24Belum ada peringkat

- XYZ Stock Trading Data Entry Sheet Tracks 500 Shares Over 5 DaysDokumen12 halamanXYZ Stock Trading Data Entry Sheet Tracks 500 Shares Over 5 DayshfjiBelum ada peringkat

- Stock Market Analysis Project Overview: Visualizing Data for Tesla, Ford, and GM StocksDokumen1 halamanStock Market Analysis Project Overview: Visualizing Data for Tesla, Ford, and GM StocksRhea Joy OrcioBelum ada peringkat

- Forex ProblemsDokumen17 halamanForex ProblemsFoo Chuan Mao100% (1)

- R46 Commodities and Commodity Derivatives Q Bank PDFDokumen7 halamanR46 Commodities and Commodity Derivatives Q Bank PDFZidane KhanBelum ada peringkat

- Derivatives Security MarketDokumen18 halamanDerivatives Security MarketYujinBelum ada peringkat

- Jovanovic Slobodan - Hedging Commodities - A Practical Guide To Hedging Strategies With Futures and Options - 2014, Harriman House - Libgen - LiDokumen809 halamanJovanovic Slobodan - Hedging Commodities - A Practical Guide To Hedging Strategies With Futures and Options - 2014, Harriman House - Libgen - LiazertyBelum ada peringkat

- IBF301 Ch007 2020Dokumen39 halamanIBF301 Ch007 2020Giang PhanBelum ada peringkat

- Hull Fund 9 e CH 05 Problem SolutionsDokumen10 halamanHull Fund 9 e CH 05 Problem Solutionsnandkishore patankarBelum ada peringkat

- FAQs On The Securities and Futures Reporting of Derivatives Contracts Regulations 2013 10 Jan 2022Dokumen37 halamanFAQs On The Securities and Futures Reporting of Derivatives Contracts Regulations 2013 10 Jan 2022Abhimanyun MandhyanBelum ada peringkat

- International Finance AssignmentDokumen9 halamanInternational Finance AssignmentVinay Nadar100% (4)

- FRM Exam2000Dokumen62 halamanFRM Exam2000emilija prodanoskaBelum ada peringkat

- R42 Derivatives Strategies IFT Notes PDFDokumen24 halamanR42 Derivatives Strategies IFT Notes PDFZidane KhanBelum ada peringkat

- CA IPCC Group 2 Accounting StandardsDokumen53 halamanCA IPCC Group 2 Accounting Standardskisan83% (23)

- 1.CFA二级基础段经济 Vincent 标准版Dokumen142 halaman1.CFA二级基础段经济 Vincent 标准版tong gongBelum ada peringkat

- Chap 7Dokumen63 halamanChap 7Avanish VermaBelum ada peringkat

- Training Report On Anand RathiDokumen92 halamanTraining Report On Anand Rathirahulsogani123Belum ada peringkat

- Principles of Risk Management and InsuranceDokumen184 halamanPrinciples of Risk Management and InsuranceGeorge John Amegashie100% (1)

- Lecture 4 - Determining Foreign Exchange RatesDokumen40 halamanLecture 4 - Determining Foreign Exchange RateslekokoBelum ada peringkat

- Topic 6-Futures BUFN740Dokumen26 halamanTopic 6-Futures BUFN740PranjalPhirkeBelum ada peringkat

- Reasury Rash Ourse: by Jawwad Ahmed FaridDokumen13 halamanReasury Rash Ourse: by Jawwad Ahmed FaridmohamedBelum ada peringkat

- 30779rtpfinalnov2013 2Dokumen26 halaman30779rtpfinalnov2013 2Waqar AmjadBelum ada peringkat

- Fuel Hedging in The Airline IndustryDokumen55 halamanFuel Hedging in The Airline IndustryZorance75100% (2)

- CFA-Quiz #4Dokumen7 halamanCFA-Quiz #4joezh3Belum ada peringkat

- Hull OFOD10e MultipleChoice Questions and Answers Ch02Dokumen6 halamanHull OFOD10e MultipleChoice Questions and Answers Ch02Afafe ElBelum ada peringkat

- Guidelines For Foreign Exchange Transactions - Bangladesh BankDokumen441 halamanGuidelines For Foreign Exchange Transactions - Bangladesh BankAshiq RayhanBelum ada peringkat

- Chapter 1: Overview of Financial Risk ManagmentDokumen30 halamanChapter 1: Overview of Financial Risk ManagmentQuynh DangBelum ada peringkat

- Financial Instruments Noor 2Dokumen14 halamanFinancial Instruments Noor 2NoorULAinBelum ada peringkat

- Exchange Arithmetic - Problems PDFDokumen13 halamanExchange Arithmetic - Problems PDFNipul BafnaBelum ada peringkat