S&OP Part III A Diagnostic Model Larry Lapide PDF

Diunggah oleh

Omar Enrique Gonzalez Rozo0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

283 tayangan4 halamanThis column represents the last of a three-part series covering the Sales and Operations Planning (S&OP) process. This column is designed to help users modify their S&OP processes to improve execution and accuracy of their supply-demand plans. Companies have spent over $12 billion in supply chain planning application software over the last 6 years.

Deskripsi Asli:

Judul Asli

S&OP Part III A Diagnostic Model Larry Lapide.pdf

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis column represents the last of a three-part series covering the Sales and Operations Planning (S&OP) process. This column is designed to help users modify their S&OP processes to improve execution and accuracy of their supply-demand plans. Companies have spent over $12 billion in supply chain planning application software over the last 6 years.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

283 tayangan4 halamanS&OP Part III A Diagnostic Model Larry Lapide PDF

Diunggah oleh

Omar Enrique Gonzalez RozoThis column represents the last of a three-part series covering the Sales and Operations Planning (S&OP) process. This column is designed to help users modify their S&OP processes to improve execution and accuracy of their supply-demand plans. Companies have spent over $12 billion in supply chain planning application software over the last 6 years.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

THE JOURNAL OF BUSINESS FORECASTING, SPRING 2005 13

(This is an ongoing column in The

Journal, which is intended to give

a brief view on a potential topic of

interest to practitioners of business

forecasting. Suggestions on topics

that you would like to see covered

should be sent via email to

llapide@mit.edu).

T

his column represents the last of a

three-part series covering the Sales

and Operations Planning (S&OP)

process. As discussed in Part I, S&OP has

been lately receiving a lot of attention as

industry-wide studies and companies are

recognizing its value in improving the

tactical and operational planning to

prepare the supply chain for meeting

anticipated customer demand. S&OP

appears to be driving supply chain

benefits such as better meeting customer

demand while at the same time resulting

in reduced inventories and minimized

supply chain operating costs.

In addition, an indicator of a longer

term interest in the S&OP process is the

fact that, according to AMR Research,

companies have spent over $12 billion in

supply chain planning application soft-

ware over the last 6 years. Yet while

spending significant sums of money on

the S&OP-related software, they are not

seeing the benefits they expected because

many did not change the process to fully

leverage the enabling technology.

This last column in the series is

designed to help users modify their S&OP

processes to improve the execution and

accuracy of their supply-demand plans, as

well as to help users determine the appro-

priate enabling technologies needed to

support changes to the process. Since it

makes sense to know where you are

before you determine where you want to

go, it recommends the use of a diagnostic

tool called the S&OP Maturity Model.

The model can be leveraged by users to

help assess where their process is and the

opportunities for improving it.

WHY A

MATURITY MODEL?

Process innovation and change are

always difficult in any organization

because it means changing:

The decision-making

The information used to make deci-

sions

The tasks that need to be done

The skill-sets of the people involved

These need to be identified first and

then software technology needs to be cho-

sen that best supports any changes.

Part I of this series dealt with the ele-

ments of an ideal S&OP process that are

needed to get the most out of S&OP and

ensure that its full benefits can be

achieved. Part II described an Integrated

Supply-Demand Planning Technology

Architecture that would be needed to fully

support this ideal S&OP process.

However, it is my experience that the

S&OP process at many companies is a far

cry from the ideal that was described. To

move close to an ideal S&OP process

companies would need to change signifi-

cantly by following an evolutionary path

determined in several steps. The first step

would be to assess the as-is S&OP

process in terms of the processes and

enabling technologies currently being

leveraged. This as-is process would

then be compared to the ideal process

described in Part I to identify any gaps

that might exist. Lastly, a roadmap would

need to be developed identifying what

gaps would be addressed and when, in

terms of the process changes needed and

the enabling technologies to be imple-

mented.

SALES AND OPERATIONS PLANNING

PART III: A DIAGNOSTIC MODEL

By Larry Lapide

LARRY LAPIDE

Dr. Lapide is a Research Director at

MITs Center for Transportation and

Logistics where he manages its Supply

Chain 2020 Project focused on supply

chain management of the future. He

has extensive business experience in

industry, consulting, and research, and

has a broad range of forecasting experi-

ences. He was a forecaster in industry

for many years, has led forecasting-

related consulting projects for clients

across a variety of industries, and has

taught forecasting in a college setting.

In addition, for 7 years he was a leading

market analyst in the research of fore-

casting and supply chain software.

S&OP

MATURITY MODEL

Generally Maturity Models are useful

in going through process innovation and

change. These types of models are usual-

ly comprised of multiple stages in the

advancement of a business process

with the first stage being the least

advanced process and the last stage being

the most advanced process. Often the last

maturity stage is practically unachievable,

hence it becomes the ideal to which com-

panies strive to achieve, as well as is the

benchmark over time against which to

compare progress.

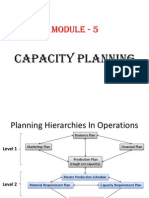

This column describes an S&OP Process

Maturity Model comprised of the follow-

ing four stages:

Marginal Process

Rudimentary Process

Classic Process

Ideal Process

I describe each stage below in terms of

meetings held, demand and supply plan

alignments, and enabling technologies

used. (See Figure 1.)

Stage 1: Marginal Process. Companies

that have an S&OP process in Stage 1

have some type of planning processes

going on but they tend to be less formal

and sporadic, and often display a chaotic

nature. This type of process can be viewed

only marginally as a genuine S&OP

process. Meetings that should be routine-

ly held among cross-departmental partici-

pants to align supply and demand plans

take place on a sporadic basis. Even if

they are pre-scheduled they are frequently

cancelled because participants state they

have better things to do with their time.

This type of S&OP process often exists

because departments historically evolved

focused on meeting their own goals, at

times at the expense of other departments

in a company. Companies with this type

of S&OP process are referred to as silo-

ed companies where integrated supply

chain management does not truly exist.

The silos lead to the implementation of a

Marginal S&OP process in which little

support is given to it by executive man-

agement, and managers half-heartedly

care about it.

Under this type of S&OP process

there are disjointed planning processes

taking place. Multiple demand plans are

independently developed by the demand-

side organizations (e.g., the Marketing,

Sales and Customer Service departments)

for their own operational planning pur-

poses. There is little attempt to develop a

consensus demand plan with each other or

with input from other departments in the

company. In addition, multiple supply

plans might be independently developed

by the supply-side organizations (e.g., the

Operations, Logistics and Finance depart-

ments), with little effort given to aligning

them with each other or with the demand

plans developed.

Very little software technology is

needed to enable a Marginal S&OP

process. Since plans are disjoint, each

department and user can just use a spread-

sheet to develop their isolated plans.

Spreadsheet technology suffices when

there is little concern that plans need to be

tied together in some way. The spread-

sheet-generated plans, however, are virtu-

ally impossible to tightly integrate if

someone tries to do so. (One company

confessed that they had almost one thou-

sand spreadsheets being generated as part

of their planning process it definitely

had a chaotic planning environment, with

little hope of ever aligning everyones

plans!)

Companies with a Stage 1 process

need to begin to move to Stage 2 by first

installing a more formal process that

everyone agrees to support and participate

in, and one in which some attempt is made

to consolidate and harmonize the multi-

tude of planning spreadsheets generated.

Stage 2: Rudimentary Process. Com-

panies that have a Stage 2 S&OP process

have formal planning processes going on,

but they are not fully participated in and

not fully integrated. This type of process

has some of the very basic or rudimentary

elements of an S&OP process. Meetings

are scheduled and routinely held among

cross-departmental participants to align

supply and demand plans. However, atten-

dance is spotty because participants ran-

domly decide from time-to-time they have

better things to do with their time that day.

Also some that do religiously attend do so

14 THE JOURNAL OF BUSINESS FORECASTING, SPRING 2005

Informal Meetings

Sporadic

scheduling

Disjointed processes

Separate, disjoint

demand plans

Supply plans not

aligned to demand

plans

Minimal technology-

enablement

Multitude of

spreadsheets

Formal meetings

Routine schedule

Spotty attendance

and participation

Interfaced processes

Demand plans

reconciled

Supply plans aligned

to demand plans

Standalone applications

interfaced

Stand-alone demand

planning system

Standalone multi-

facility APS system

Systems interfaced

on a one-way basis

Formal meetings

100% attendance and

participation

Integrated Processes

Demand and supply

plans jointly aligned

External collaboration

with limited number of

suppliers and customers

Applications integrated

Demand planning

packages and supply

planning apps. integrated

External information

manually brought into

the process

Event-driven meetings

Scheduled when someone wants

to consider a change or when a

supply-demand imbalance is

detected

Extended processes

Demand and supply plans

aligned internally and externally

External collaboration with most

suppliers and customers

Full set of integrated technologies

An advanced S&OP workbench

External-facing collaborative

software integrated to internal

demand-supply planning

systems

Stage 1

Marginal Process

Stage 2

Rudimentary Process

Stage 3

Classic Process

Stage 4

Ideal Process

FIGURE 1

A FOUR-STAGE S&OP PROCESS MATURITY MODEL

half-heartedly by not preparing in

advance of meetings and not interacting

well with other attendees to collaborative-

ly develop consensus-based plans.

Under this type of S&OP process the

planning processes are interfaced.

Multiple demand plans are developed by

the demand-side organizations, however,

they are shared with each other so each

department knows what the other plans to

do in order to synchronize operations.

Meanwhile the supply-side organizations

use synchronized demand plans to devel-

op supply plans aligned with them tak-

ing the demand plans at face value.

Since the demand and supply plans are

separately developed, each organization

uses their own standalone enabling soft-

ware technology. Frequently, the demand-

side organizations use Demand Planner

software applications, the outputs of

which are transmitted to the systems

being used by the supply-side organiza-

tions. Meanwhile, the supply-side organi-

zations use multi-facility Advanced

Planning and Scheduling (APS) software

applications to develop supply plans that

are predicated on the demand plans shared

with them. The supply plans generated are

typically not transmitted to the demand-

side systems.

Companies with a Stage 2 process can

begin to move to Stage 3 by first getting

executive management buy-in and then

having the executives take action to

ensure that S&OP meetings are seriously

taken, and that people are well recognized

for their participation. These companies

should also begin to adjust both the sup-

ply and demand plans during the S&OP

meetings to move closer to consensus-

based integrated planning.

Stage 3: Classic Process. Companies that

have a Stage 3 S&OP process have formal

planning processes that follow the guide-

lines espoused by professional organiza-

tions such as APICS and training consult-

ants such as Oliver Wight as well as

follow many of the basic elements I dis-

cussed in Part I of this series. This type of

process has all the by-the-book elements

of an S&OP process. Meetings are rou-

tinely held and attended among empow-

ered cross-departmental participants to

align supply and demand plans.

Under this type of S&OP process the

planning processes are integrated so that

demand and supply plans are aligned

jointly by demand-side and supply-side

organizations. A single rough-cut demand

plan is developed and brought into the

S&OP meetings. In addition, a single

rough-cut supply plan is aligned to the

rough-cut demand plan, and it is also

brought into the S&OP meetings. During

the meetings, both rough-cut plans are

adjusted; neither are fixed in concrete, and

both are open for discussion by the cross-

functional team attending.

In more advanced Stage 3 processes,

collaborative information drawn from a

limited number of major customers about

their future demand needs is manually

brought into the S&OP process. Possibly,

collaborative information from a few crit-

ical-component suppliers that highlight

scarce materials might also be brought

into the S&OP meetings.

In this stage, the demand-side and sup-

ply-side software applications are inte-

grated, since final demand and supply

plans need to be jointly developed. For

example, changes in a Demand Planner

system need to be automatically incorpo-

rated into and reflected in the multi-facil-

ity APS systems; and vice versa.

Companies with a Stage 3 S&OP

process can begin to move to Stage 4 by

increasing the frequency of S&OP meet-

ings and continuing to increase the num-

ber of collaborative relationships with

suppliers and customers.

Stage 4: Ideal Process. A Stage 4 S&OP

is a process that can never fully be

achieved by any company, but should be

used as a benchmark for guiding the con-

tinual improvement of the process. A

Stage 4 process executes all the processes

covered in Part I of this series extremely

well, and are enabled by the Integrated

Supply-Demand Planning Technology

Architecture described in Part II.

The S&OP meetings in this stage are

event-driven. They are scheduled on-

demand only when someone wants to

change any of the existing plans or when

a supply-demand imbalance is detected.

This implies that the process is supported

by systems that are constantly keeping

track of supply and demand in real-time

and when necessary, alerting everyone

that is part of the S&OP process that they

need to meet immediately. Meeting atten-

dees or their proxies would need to be

tracked down and notified that a meeting

needs to take place as soon as possible.

The meeting itself would be conducted on

virtual basis so no one has to travel to get

to it, thus enabling a global process.

An advanced S&OP Workbench sys-

tem would need to be used to support the

meetings with everyone having access to

it on a global basis. The Workbench sys-

tem would allow users to instantaneously

evaluate any changes being discussed so

the S&OP attendees can modify any sup-

ply or demand plans, and quickly see the

implications of any changes. In the most

advanced Stage 4 process, the S&OP

Workbench system would re-optimize the

plans and recommend the changes that

need to be made to the demand and supply

plans currently in place.

In Stage 4, processes are extended

externally, so that collaborative informa-

tion is drawn from most customers and

suppliers, enabled by the use of Demand

Collaborator and Supply Collaborator

systems that are fully integrated to all the

internal planning systems. In this way,

S&OP plans are aligned not only on an

internal basis, but also externally aligned

with the plans of both suppliers and cus-

tomers.

USING THE MODEL

The S&OP Maturity Model should be

used as a diagnostic tool for helping a

company improve its planning processes.

THE JOURNAL OF BUSINESS FORECASTING, SPRING 2005 15

Users should use the model to diagnose

what stage they are currently in. (I believe

most companies that think they have an

S&OP process in place today will find

that they are in either Stage 2 and Stage 3,

or between them. Just a few of these will

be surprised to find they really dont have

much of an S&OP process at all, placing

them in or close to Stage 1.)

Once the stage of a companys S&OP

process is established, the company

should look to move closer to the next

stage. (Moving more than one stage is

over-ambitious and will likely lead to fail-

ure.) Comparing the current processes to

the processes of the next stage will identi-

fy the gaps that need to be closed over

time. Initiatives aimed at closing each gap

should be analyzed on a cost/benefit basis

that accounts for the process and technol-

ogy changes needed. Based on the analy-

ses, the company should then develop a

roadmap that specifies when each initia-

tive would be undertaken. Generally a

company should start with initiatives that

give proven benefits in the shortest

amount of time.

Using the S&OP Maturity Model may

never get your company to Stage 4, but

will help it move closer yielding sub-

stantial benefits along the way.

16 THE JOURNAL OF BUSINESS FORECASTING, SPRING 2005

UPCOMING EVENTS

Business Forecasting: A Tutorial

Boston, Massachusetts U.S.A.

June 20 & 21, 2005

Business Forecasting: A Tutorial

Chicago, Illinois U.S.A.

August 22 & 23, 2005

Demand Planning & Forecasting

Best Practices Conference

Orlando, Florida U.S.A.

October 23-25, 2005

Statistical Forecasting Workshop

New York City, New York U.S.A.

November 2005

Call For Information at IBF:

800.440.0499

BE A MEMBER OF

THE INSTITUTE OF BUSINESS FORECASTING

Journal of Business Forecasting

Subscription

Each issue will give you a variety of

jargon-free articles on how to obtain,

recognize, and use good forecasts. Plus,

it will give you new, practical fore-

casting ideas to help you make vital

decisions affecting sales, capital outlays,

credit, plant expansion, financial

planning, budgeting, inventory control,

production scheduling, and marketing

strategies.

Job Opportunity Newsletter

The newsletter brings you information

on companies, positions, qualifications,

requirements, salary, and contact names

for each available job.

Our Professional Certification

Program at a Discount

With immediate on-the-job applicability,

the program's study aids, workshops, and

multimedia materials will assist you in

becoming IBF Certified, as well as

enhance your value and recognition at

your company. Certification is more than

a credential, as the IBF has the highest

reputation for objectivity, top-of-the-line

research, and backlog of experience. The

program is designed to meet the needs of

a practitioner and sets the standard in

business forecasting and supply-chain

management.

Discounts on Conferences and

Tutorials

These events can raise forecasting

accuracy to new levels. (For a full

schedule of our upcoming events, please

visit our website, www.ibf.org).

Discounts on our Forecasting Books

Our books are geared towards helping

professionals learn, process, interpret,

and use effectively business forecasting

information. In addition, if you happen to

miss one of our conferences, we offer

manuals that detail each speaker's

presentation from every one of our

conferences.

Access to Our Online Discussion

Group

You can connect with peers to share their

concerns, questions, problems, ideas,

suggestions, and even predictions in

business forecasting.

Business Research Reports

Our research reports cover important, yet

under-reported topics through our

studies, which have resulted from various

surveys of forecasting professionals and

other sources.

Benefits include:

Individual Membership

$200 Domestic

$225 Foreign

Corporate Membership

(8 People Maximum)

$1400 Domestic

$1600 Foreign

Name:___________________________________________________________________

Title:____________________________________________________________________

Address:_________________________________________________________________

City:______________________________________________________________

Sate___________________ Zip_________________ Tel.__________________________

Visa/Mastercard/American Express__________________Ex. Date:__________________

Signature:________________________________________________________________

For further information: Write/call

516.504.7576 800.440.0499

E-mail: info@ibf.org www.ibf.org

Anda mungkin juga menyukai

- Wow Your C-Suite: With Eight Key Strategies For Your S&OP ProcessDokumen18 halamanWow Your C-Suite: With Eight Key Strategies For Your S&OP ProcessSivaBelum ada peringkat

- Business Process ReengineeringDokumen18 halamanBusiness Process ReengineeringMatthew LukerBelum ada peringkat

- Module 5 Capacity Planning Aggregate PlanningDokumen11 halamanModule 5 Capacity Planning Aggregate PlanningVi H ArBelum ada peringkat

- (2010) Handbook Strategy As PracticeDokumen367 halaman(2010) Handbook Strategy As PracticeViniciusBelum ada peringkat

- ERP Demystified - PresentationDokumen53 halamanERP Demystified - PresentationJayaraman Raghunathan100% (1)

- Get the Most Out of Your Nutanix Cloud Platform TrainingDokumen12 halamanGet the Most Out of Your Nutanix Cloud Platform TrainingJohramoBelum ada peringkat

- FMCG Marketing and Sales: Organizing Trade Marketing, Category Management, and Shopper Marketing PDFDokumen242 halamanFMCG Marketing and Sales: Organizing Trade Marketing, Category Management, and Shopper Marketing PDFSilmi KaffahBelum ada peringkat

- Sales Inventory and Operations PlanningDokumen2 halamanSales Inventory and Operations Planningemba2015100% (1)

- Lesson Exemplar in Science - Using The IDEA Instructional Process Learning Area Learning Delivery ModalityDokumen5 halamanLesson Exemplar in Science - Using The IDEA Instructional Process Learning Area Learning Delivery ModalityLeilani Pelisigas100% (1)

- Corporate Strategic Information Systems PlanningDokumen28 halamanCorporate Strategic Information Systems PlanningFakhrulrazi Ibrahim0% (1)

- Business Anlaytics NewDokumen358 halamanBusiness Anlaytics NewRathan kBelum ada peringkat

- Process Analysis WSDDokumen28 halamanProcess Analysis WSDAkhilesh ChaudharyBelum ada peringkat

- An Investigation of Smart Manufacturing Using Digital Thread and Digital Twin Technology For Enhancement of Product Life CycleDokumen9 halamanAn Investigation of Smart Manufacturing Using Digital Thread and Digital Twin Technology For Enhancement of Product Life CycleIJRASETPublicationsBelum ada peringkat

- Sop Maturity ModelDokumen4 halamanSop Maturity ModelarrivaBelum ada peringkat

- Week-1 Introduction To BDDA-TWM PDFDokumen48 halamanWeek-1 Introduction To BDDA-TWM PDFANNISA SARAH FADHILABelum ada peringkat

- Science DLP Parts of PlantsDokumen8 halamanScience DLP Parts of PlantsMishell AbejeroBelum ada peringkat

- Aerospace PCF ComparisionDokumen733 halamanAerospace PCF ComparisionMani Rathinam RajamaniBelum ada peringkat

- Integration of MES and ERP in Supply Chains Effect PDFDokumen9 halamanIntegration of MES and ERP in Supply Chains Effect PDFRohan SmithBelum ada peringkat

- Sample Statement of Purpose Computer Engineering (SOP)Dokumen1 halamanSample Statement of Purpose Computer Engineering (SOP)theonlybbb86% (7)

- Business Process ManagementDokumen20 halamanBusiness Process ManagementAhmad Tariq BhattiBelum ada peringkat

- S&OP Part I The Process Larry Lapide PDFDokumen3 halamanS&OP Part I The Process Larry Lapide PDFOmar Enrique Gonzalez RozoBelum ada peringkat

- Using Sustainability For Competitive AdvantageDokumen6 halamanUsing Sustainability For Competitive AdvantageAnca ButnariuBelum ada peringkat

- B. S&OP Larri Lapide PDFDokumen33 halamanB. S&OP Larri Lapide PDFDAVID CARMONABelum ada peringkat

- Erp Pliva Case Study FinalERP System Implementation and Business Process Change: Case Study of A Pharmaceutical CompanyDokumen13 halamanErp Pliva Case Study FinalERP System Implementation and Business Process Change: Case Study of A Pharmaceutical CompanyNota Razi100% (13)

- A5E SAP CapabilitiesDokumen17 halamanA5E SAP Capabilitiessharmil_jainBelum ada peringkat

- The Future of The Manufacturing Supply Chain - Networked, Mobile, and CollaborativeDokumen13 halamanThe Future of The Manufacturing Supply Chain - Networked, Mobile, and CollaborativeAbhi RamBelum ada peringkat

- S&OP Part II Enabling Technology Larry Lapide PDFDokumen3 halamanS&OP Part II Enabling Technology Larry Lapide PDFOmar Enrique Gonzalez RozoBelum ada peringkat

- Supply Chain Modeling and Analysis: Forecasting, Planning, InventoryDokumen15 halamanSupply Chain Modeling and Analysis: Forecasting, Planning, InventoryAbo HamzaBelum ada peringkat

- Value Added Course ProposalDokumen4 halamanValue Added Course ProposalPrajjwal SinghBelum ada peringkat

- BUSS-B 3005 Air Cargo Management QP1Dokumen12 halamanBUSS-B 3005 Air Cargo Management QP1SaraBelum ada peringkat

- Production Demand Inventory Planner in Houston TX Resume William Patrick HammondDokumen2 halamanProduction Demand Inventory Planner in Houston TX Resume William Patrick HammondWilliamPatrickHammondBelum ada peringkat

- GTU MCA Semester-I Enterprise Resources Planning (ERPDokumen2 halamanGTU MCA Semester-I Enterprise Resources Planning (ERPVirendra Arekar100% (1)

- Project Report on Inventory Management at VideoconDokumen84 halamanProject Report on Inventory Management at VideoconPallavi MaliBelum ada peringkat

- Impedement To LeanDokumen30 halamanImpedement To LeanIzumi KōheiBelum ada peringkat

- Improving Fill Rate Performance - Supply ChainDokumen8 halamanImproving Fill Rate Performance - Supply Chaineuge_prime2001Belum ada peringkat

- BCom SCM Year 3 Supply Chain Management 3A January 2019Dokumen107 halamanBCom SCM Year 3 Supply Chain Management 3A January 2019Brilliant MycriBelum ada peringkat

- UPES-First Indian University To Implement SAPDokumen4 halamanUPES-First Indian University To Implement SAPUniversity Of Petroleum And Energy Studies0% (1)

- Schneider Electric Supplier Guidebook - December 17Dokumen20 halamanSchneider Electric Supplier Guidebook - December 17Ahmad Iksan Kurnianto100% (1)

- Volvo Cars Sustainability Report 2013Dokumen64 halamanVolvo Cars Sustainability Report 2013JM MANOJKUMARBelum ada peringkat

- Ch-8 (Business Process Reengineering)Dokumen22 halamanCh-8 (Business Process Reengineering)Shrutit21Belum ada peringkat

- Operations Consulting and Reengineering: ©the Mcgraw-Hill Companies, Inc., 2004Dokumen29 halamanOperations Consulting and Reengineering: ©the Mcgraw-Hill Companies, Inc., 2004gudunBelum ada peringkat

- Rummlers ModelDokumen1 halamanRummlers Modelapi-252222018Belum ada peringkat

- 3PL, 4PLand Reverse Logistics, Part 1 by B. S. SahayDokumen92 halaman3PL, 4PLand Reverse Logistics, Part 1 by B. S. SahayYudaBelum ada peringkat

- EI Design Why You Should Adopt Gamification For Corporate Training PDFDokumen49 halamanEI Design Why You Should Adopt Gamification For Corporate Training PDFrajeevBelum ada peringkat

- Understand Big Data and Data AnalyticsDokumen46 halamanUnderstand Big Data and Data AnalyticsFitra NurwindaBelum ada peringkat

- Process CostingDokumen13 halamanProcess CostingPrateekBelum ada peringkat

- MGI Globalization in Transition The Future of Trade and Value Chains Full ReportDokumen144 halamanMGI Globalization in Transition The Future of Trade and Value Chains Full ReportParveshBelum ada peringkat

- Novo Nordisk 3Dokumen25 halamanNovo Nordisk 3Asad Ali0% (2)

- Applying analytics to improve supply chain managementDokumen1 halamanApplying analytics to improve supply chain managementTushar PrasadBelum ada peringkat

- BPR Implementation in Icici BankDokumen21 halamanBPR Implementation in Icici BankPravah Shukla100% (4)

- B2 MMLDokumen10 halamanB2 MMLvpascarielloBelum ada peringkat

- ERP - Other Case StudiesDokumen61 halamanERP - Other Case StudiesVarna KanungoBelum ada peringkat

- Swot Analysis: S W O TDokumen38 halamanSwot Analysis: S W O TA Sailesh ChandraBelum ada peringkat

- BPR Case StudyDokumen32 halamanBPR Case StudyN.Vivekananthamoorthy0% (1)

- # (Article) Using Scorecards For Improving and Sustaining The S&OP Process (2018)Dokumen4 halaman# (Article) Using Scorecards For Improving and Sustaining The S&OP Process (2018)M YazdkhastiBelum ada peringkat

- Excel ToolkitDokumen11 halamanExcel ToolkitJose LopezBelum ada peringkat

- BetaCodex - 02 Double Helix Transformation Framework PDFDokumen19 halamanBetaCodex - 02 Double Helix Transformation Framework PDFUgoRibeiroBelum ada peringkat

- 2017 Top 20 Enterprise Resource Planning Software ReportDokumen8 halaman2017 Top 20 Enterprise Resource Planning Software ReportSagePartnerBelum ada peringkat

- Operational ExcellenceDokumen38 halamanOperational ExcellenceRabia JamilBelum ada peringkat

- Managing Intl LogisticsDokumen48 halamanManaging Intl Logisticsvijib100% (1)

- UCEED 2018 Paper1: Undergraduate Common Entrance Examination For DesignDokumen40 halamanUCEED 2018 Paper1: Undergraduate Common Entrance Examination For Designmothish SivakumarBelum ada peringkat

- ERP ImplementationDokumen20 halamanERP ImplementationAN101Belum ada peringkat

- BPR 03 ProcessRe DesignDokumen21 halamanBPR 03 ProcessRe Designapi-3731067Belum ada peringkat

- Enabling S&OP with TechnologyDokumen5 halamanEnabling S&OP with TechnologyJoaquin GonzalezBelum ada peringkat

- (Article) Sales and Operations Planning Part I - The Process (2004)Dokumen3 halaman(Article) Sales and Operations Planning Part I - The Process (2004)M YazdkhastiBelum ada peringkat

- C++ Project On Payroll ManagementDokumen5 halamanC++ Project On Payroll ManagementGameo CraftBelum ada peringkat

- University of Southern Mindanao: Kabacan, Cotabato PhilippinesDokumen7 halamanUniversity of Southern Mindanao: Kabacan, Cotabato PhilippinesAlexis banicioBelum ada peringkat

- My Early DaysDokumen14 halamanMy Early DaysVigneshwar .kBelum ada peringkat

- Social Work NotesDokumen4 halamanSocial Work NoteszahidazizBelum ada peringkat

- Sample Research Paper On Classroom ManagementDokumen7 halamanSample Research Paper On Classroom Managementc9sf7pe3Belum ada peringkat

- SUPPORT Doctor Letter of Support - BognerDokumen6 halamanSUPPORT Doctor Letter of Support - BognerKen WolskiBelum ada peringkat

- Experimental Research - Research DesignDokumen15 halamanExperimental Research - Research Designvanilla_42kpBelum ada peringkat

- Varistors Based in The ZnO-Bi2O3 System, Microstructure Control and PropertiesDokumen6 halamanVaristors Based in The ZnO-Bi2O3 System, Microstructure Control and PropertiesJanja TothBelum ada peringkat

- Chem 105 Syllabus 2013 SpringDokumen4 halamanChem 105 Syllabus 2013 SpringemuphychemBelum ada peringkat

- Managing ServiceguardDokumen534 halamanManaging ServiceguardSagar BachalBelum ada peringkat

- CV 11607816Dokumen1 halamanCV 11607816wolvarine 999Belum ada peringkat

- Adobe Scan Oct 19, 2023Dokumen10 halamanAdobe Scan Oct 19, 2023niladriputatunda1Belum ada peringkat

- Emirates Future International Academy Grade-5 WorksheetDokumen2 halamanEmirates Future International Academy Grade-5 WorksheetSajir ThiyamBelum ada peringkat

- ThesisDokumen108 halamanThesisDebasis PandaBelum ada peringkat

- Dr. Ram Manohar Lohiya National Law UniversityDokumen6 halamanDr. Ram Manohar Lohiya National Law UniversityShivam VermaBelum ada peringkat

- The Lion Sleeps TonightDokumen1 halamanThe Lion Sleeps Tonightncguerreiro100% (1)

- Weather Lesson PlanDokumen13 halamanWeather Lesson Planapi-194520027Belum ada peringkat

- TERNA ENGINEERING COLLEGE ACADEMIC CALENDARDokumen5 halamanTERNA ENGINEERING COLLEGE ACADEMIC CALENDARPuppysinghBelum ada peringkat

- Are Women Better Leaders Than MenDokumen5 halamanAre Women Better Leaders Than MenArijanaBelum ada peringkat

- Outside State Colleges Email DetailsDokumen84 halamanOutside State Colleges Email Detailsuniquerealestate098Belum ada peringkat

- Immersion Portfolio: Submitted By: Montebon, Maylyn R Submitted To: Remolado, Jan Michael RDokumen19 halamanImmersion Portfolio: Submitted By: Montebon, Maylyn R Submitted To: Remolado, Jan Michael RBashier AmenBelum ada peringkat

- English 9 exam reading comprehension and language registersDokumen5 halamanEnglish 9 exam reading comprehension and language registersAnjieyah Bersano FabroBelum ada peringkat

- Sme Chapther Unsa: Plan Anual 2018Dokumen6 halamanSme Chapther Unsa: Plan Anual 2018JuniorMendoza97Belum ada peringkat

- Bachelor of Arabic Language and Literature (New Course Code)Dokumen3 halamanBachelor of Arabic Language and Literature (New Course Code)Anonymous ZDk2hLVBelum ada peringkat