Shivangi Internship Project

Diunggah oleh

GarvitNigam0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

88 tayangan57 halamanThis document provides a summary of an internship project report submitted as a partial fulfillment of a Post Graduate Diploma in Management. The report analyzes the market conditions of Raghunandan Industry Pvt. Ltd. through a survey of authorized persons and sub-brokers in Lucknow. The report includes an acknowledgement, executive summary, introduction on stock markets and their history, objectives and scope of the project, research methodology used, literature review, data analysis and interpretation through diagrams and charts, and conclusions.

Deskripsi Asli:

investment

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document provides a summary of an internship project report submitted as a partial fulfillment of a Post Graduate Diploma in Management. The report analyzes the market conditions of Raghunandan Industry Pvt. Ltd. through a survey of authorized persons and sub-brokers in Lucknow. The report includes an acknowledgement, executive summary, introduction on stock markets and their history, objectives and scope of the project, research methodology used, literature review, data analysis and interpretation through diagrams and charts, and conclusions.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

88 tayangan57 halamanShivangi Internship Project

Diunggah oleh

GarvitNigamThis document provides a summary of an internship project report submitted as a partial fulfillment of a Post Graduate Diploma in Management. The report analyzes the market conditions of Raghunandan Industry Pvt. Ltd. through a survey of authorized persons and sub-brokers in Lucknow. The report includes an acknowledgement, executive summary, introduction on stock markets and their history, objectives and scope of the project, research methodology used, literature review, data analysis and interpretation through diagrams and charts, and conclusions.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 57

1

Summer I nternship Project Report

ON

Comparative study of Authorised person/sub-broker of Raghunandan Money and

other broking companies.

I SO 9001:2000 CERTI FI ED

MAKI NG MORE POSSI BI LI TI ES FOR FI NANCI AL MARKETS

A report submitted to

Asian Business School, Noida

as a partial fulfillment of Full time

Post Graduate Diploma in Management (PGDM)

(Approved by AICTE, Ministry of HRD)

Submitted to : Ms. Sunita Verma Submitted by :Shivangi Mishra

Batch :PGDM(2012-2014)

Roll No. :0B12100

(2012-14)

Asian Business School (ABS)

A2, Sector 125, Noida

Website : www.abs.edu.in

2

ACKNOWLEDGEMENT

I wish to express my deep gratitude to Mr.Rupesh Verma & Mr.Jalaj Rai for acting as a guide

and providing me with continuous support and guidance. It gives me great pleasure in presenting

this report to the ASIAN BUINESS SCHOOL.This report could not have been completed

without the inputs and the words of advice from his far which I shall always remain grateful to

them I wish gratitude to my members of Department of Management, for taking Interest in my

project work when required. I fall short of words to express my gratitude to Raghunandan

Industries Pvt. Ltd., Lucknow for giving me the opportunity to work in this prestigious

organization. I acknowledge my deep sense of gratitude to Mr.Rupesh Verma &Mr. Jalaj Rai for

his generous guidance & advice before and also in analyzing the work. My overriding debt is to

my parents who provide me with the moral support & inspiration needed to prepare this report.

SHIVANGI MISHRA

3

EXECUTIVE SUMMARY

The present report is prepared for the partial of PGDM and as a part of curriculum. The survey is

an attempt to determine and analyze the market condition of RAGHUNANDAN INDUSTRY

PVT.LTD. To pursue this research, Lucknow was choosen, where the survey was conducted

through telephonic interview along with personal interaction with A.Ps (Authorized Person).

The data collection is analyzed and some practical tools were applied to get inference from the

survey.

The research report has two sections in its first section company and industry profile is given,

where as second section research methodology is given which includes sample design analysis

on sample & presentation is in the form of diagram and charts.

This project gave me a great learning experience and at a same time it gave me enough scope to

implement my analytical ability. The analysis and advice presented in this project is based on

market research on the basis of saving and investment.

This internship program helped me in building strong forte in the field of Portfolio Management.

This gave me in-depth knowledge related to basic financial terms such as stock market , mutual

fund and insurance .

4

CERTIFICATE

This is to certify that Ms. SHIVANGI MISHRA a student of ASIAN BUSINESS

SCHOOL has completed project work on COMPARITIVE STUDY OF

AUTHORISED PERSON/SUB-BROKER OF RAGHUNANDAN MONEY &

OTHER BROKING COMPANIES under my guidance and supervision.

Date- Mr. Rupesh Verma

Raghunandan Money

Office No:6, Ground Floor

Saran Chamber-1

5-Park Road

Hazratganj, Lucknow- 226001

5

DECLARATION

I hereby declare that this Project Report entitled Comparitive study of Authorised Person

/Sub-broker of Raghunandan Money and other Broking Companies submitted in the

summer internship report of POST GRADUATE DIPLOMA IN MANAGEMENT

(PGDM) of ASIAN BUSINESS SCHOOL, NOIDA is based on primary & secondary data

found by me through various departments , personal interviews and websites collected by

me under guidance of MR. RUPESH VERMA & MR.JALAJ RAI.

DATE: SHIVANGI MISHRA

PGDM(2012-2014)

6

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY 3

2. INTRODUCTION 9

3. INDUSTRY PROFILE 10-15

4. OBJECTIVES & SCOPE 16

5. RESEARCH METHODOLOGY 17

6. LITERATURE REVIEW 18-46

7. DATA ANALYSIS AND INTERPRETATION 47-55

8. CONCLUSIONS 56

9. QUESTIONAIRE 57

10. BIBLIOGRAPHY 58

7

INTRODUCTION

STOCK MARKET

A stock market is a public market for the trading of company stock and derivatives at an agreed

price; these are securities listed on a stock exchange as well as those only traded privately.

The size of the world stock market was estimated at about $36.6 trillion US at the beginning of

October 2008.The total world derivatives market has been estimated at about $791 trillion face

or nominal value, 11 times the size of the entire world economy. The value of the derivatives

market, because it is stated in terms of notional values, cannot be directly compared to a stock or

a fixed income security, which traditionally refers to an actual value.

Moreover, the vast majority of derivatives 'cancel' each other out (i.e., a derivative 'bet' on an

event occurring is offset by a comparable derivative 'bet' on the event not occurring.).

Many such relatively illiquid securities are valued as marked to model, rather than an actual

market price. The stocks are listed and traded on stock exchanges which are entities of a

corporation or mutual organization specialized in the business of bringing buyers and sellers of

the organizations to a listing of stocks and securities together.

The stock market in the United States includes the trading of all securities listed on the NYSE

Euronext, the NASDAQ, the Amex, as well as on the many regional exchanges, e.g. OTCBB and

Pink Sheets. European examples of stock exchanges include the London Stock Exchange, the

Deutsche Brse.

HISTORY

In 12th century France the courretiers de change were concerned with managing and regulating

the debts of agricultural communities on behalf of the banks. Because these men also traded with

debts, they could be called the first brokers. A common misbelief is that in late 13th

century Bruges commodity traders gathered inside the house of a man called Van der Beurze,

and in 1309 they became the "Brugse Beurse", institutionalizing what had been, until then, an

informal meeting, but actually, the family Van der Beurze had a building in Antwerp where

those gatherings occurred;

[7]

the Van der Beurze had Antwerp, as most of the merchants of that

period, as their primary place for trading. The idea quickly spread around Flanders and

neighboring counties and "Beurzen" soon opened in Ghent and Rotterdam.

In the middle of the 13th century, Venetian bankers began to trade in government securities. In

1351 the Venetian government outlawed spreading rumors intended to lower the price of

government funds. Bankers in Pisa, Verona, Genoa and Florence also began trading in

8

government securities during the 14th century. This was only possible because these were

independent city states not ruled by a duke but a council of influential citizens. Italian companies

were also the first to issue shares. Companies in England and the Low Countries followed in the

16th century.

The Dutch East India Company (founded in 1602) was the first joint-stock company to get a

fixed capital stock and as a result, continuous trade in company stock occurred on the

Amsterdam Exchange. Soon thereafter, a lively trade in various derivatives, among which

options and repos, emerged on the Amsterdammarket.

Dutch traders also pioneered short selling - a practice which was banned by the Dutch

authorities as early as 1610.

FUNCTI ON AND PURPOSE

The stock market is one of the most important sources for companies to raise money. This

allows businesses to be publicly traded, or raise additional financial capital for expansion by

selling shares of ownership of the company in a public market. The liquidity that an exchange

affords the investors gives them the ability to quickly and easily sell securities. This is an

attractive feature of investing in stocks, compared to other less liquid investments. Some

companies actively increase liquidity by trading in their own shares.

History has shown that the price of shares and other assets is an important part of the dynamics

of economic activity, and can influence or be an indicator of social mood. An economy where

the stock market is on the rise is considered to be an up-and-coming economy. In fact, the stock

market is often considered the primary indicator of a country's economic strength and

development.

Rising share prices, for instance, tend to be associated with increased business investment and

vice versa. Share prices also affect the wealth of households and their consumption.

Therefore, central banks tend to keep an eye on the control and behavior of the stock market and,

in general, on the smooth operation offinancial system functions. Financial stability is the raison

d'tre of central banks.

Exchanges also act as the clearinghouse for each transaction, meaning that they collect and

deliver the shares, and guarantee payment to the seller of a security. This eliminates the risk to an

individual buyer or seller that the counterparty could default on the transaction.

The smooth functioning of all these activities facilitates economic growth in that lower costs and

enterprise risks promote the production of goods and services as well as possibly employment. In

this way the financial system is assumed to contribute to increased prosperity

9

INDUSTRY PROFILE

BOMBAY STOCK EXCHANGES

This stock exchange, Mumbai, popularly known as BSE was established in 1875 as The

Native share and stock brokers association, as a voluntary non- profit making association.

It has an evolved over the years into its present status as the premiere stock exchange in the

country. It may be noted that the stock exchanges the oldest one in Asia, even older than the

Tokyo Stock Exchange, which was founded in 1878.

The exchange, while providing an efficient and transparent market for trading in securities,

upholds the interests of the investors and ensures redressed of their grievances, whether against

the companies or its own member brokers.

It also strives to educate and enlighten the investors by making available necessary informative

inputs and conducting investor education programmers.

A governing board comprising of 9 elected directors, 2 SEBI nominees, 7 public representatives

and an executive director is the apex body, which decides the policies and regulates the affairs of

the exchange.

The Executive director as the chief executive officer is responsible for the day today

administration of the exchange. The average daily turnover of the exchange during the year

2000-01(April-March) was Rs 3984.19 crores and average number of daily trades 5.69 Lakhs.

However the average daily turnover of the exchange during the year 2001-02 has declined to Rs.

1244.10 crores and number of average daily trades during the period to 5.17 Lakhs.

The average daily turnover of the exchange during the year 2002-03 has declined and number of

average daily trades during the period is also decreased.

The Ban on all deferral products like BLESS AND ALBM in the Indian capital markets by SEBI

with effect from July 2, 2001, abolition of account period settlements, introduction of

compulsory rolling settlements in all scripts traded on the exchanges

with effect from Dec 31, 2001, etc., have adversely impacted the liquidity and

consequently there is a considerable decline in the daily turnover at the exchange.

The average daily turnover of the exchange present scenario is 110363(laces) and

number of average daily trades 1057(laces).

10

BSE I NDI CES

In order to enable the market participants, analysts etc., to track the various ups and downs in the

Indian stock market, the Exchange has introduced in 1986 an equity stock index called BSE-

SENSEX that subsequently became the barometer of the moments of the share prices in the

Indian Stock market.

It is a Market capitalization weighted index of 30 component stocks representing a sample of

large, well-established and leading companies. The base year of Sensex is 1978-79.

The Sensex is widely reported in both domestic and international markets through print as well

as electronic media. Sensex is calculated using a market capitalization weighted method.

As per this methodology, the level of the index reflects the total market value of all 30-

component stocks from different industries related to particular base period. The total market

value of a company is determined by multiplying the price of its stock by the number of shares

outstanding.

Statisticians call an index of a set of combined variables (such as price and number of shares) a

composite Index. An Indexed number is used to represent the results of this calculation in order

to make the value easier to work with and track over a time.

It is much easier to graph a chart based on Indexed values than one based on actual values world

over majority of the well-known Indices are constructed using Market capitalization weighted

method.

In practice, the daily calculation of SENSEX is done by dividing the aggregate market value of

the 30 companies in the Index by a number called the Index Divisor. The Divisor is the only link

to the original base period value of the SENSEX. The Divisor keeps the Index comparable over a

period or time and if the reference point for the entire Index maintenance adjustments.

SENSEX is widely used to describe the mood in the Indian Stock markets. Base year average is

changed as per the formula new base year average = old base year average*(new market

value/old market value).

NATI ONAL STOCK EXCHANGE

The NSE was incorporated in Now 1992 with an equity capital of Rs 25 crores. The International

securities consultancy (ISC) of Hong Kong has helped in setting up NSE.

ISE has prepared the detailed business plans and installation of hardware and software systems.

The promotions for NSE were financial institutions, insurances companies, banks and SEBI

capital market ltd, Infrastructure leasing and financial services ltd and stock holding corporation

ltd.

It has been set up to strengthen the move towards professionalisation of the capital market as

well as provide nation wide securities trading facilities to investors.NSE is not an exchange in

the traditional sense where brokers own and manage the exchange.

11

A two tier administrative set up involving a company board and a governing aboard of the

exchange is envisaged.NSE is a national market for shares PSU bonds, debentures and

government securities since infrastructure and trading facilities are provided.

NSE-NI FTY

The NSE on April 22, 1996 launched a new equity Index. The NSE-50. The new index, which

replaces the existing NSE-100 index, is expected to serve as an appropriate Index for the new

segment of futures and options.

Nifty means National Index for Fifty Stocks. The NSE-50 comprises 50 companies that

represent 20 broad Industry groups with an aggregate market capitalization of around Rs.

1,70,000 crs.

All companies included in the Index have a market capitalization in excess of Rs 500 crs each

and should have traded for 85% of trading days at an impact cost of less than 1.5%.

The base period for the index is the close of prices on Nov 3, 1995, which makes one year of

completion of operation of NSEs capital market segment. The base value of the Index has been

set at 1000.

NSE-MIDCAP INDEX

The base period for the index is Nov 4, 1996, which signifies two years for completion of

operations of the capital market segment of the operations. The base value of the Index has been

set at 1000. The NSE madcap Index or the Junior Nifty comprises 50 stocks that represents 21

aboard Industry groups and will provide proper representation of the madcap segment of the

Indian capital Market.

All stocks in the index should have market capitalization of greater than Rs.200 crores and

should have traded 85% of the trading days at an impact cost of less 2.5%.

Average daily turnover of the present scenario 258212 (Laces) and number of averages daily

trades 2160(Laces). At present, there are 24 stock exchanges recognized under the securities

contract (regulation) Act, 1956. They are:-

NAMES OF THE STOCK EXCHANGS

Bombay Stock Exchange (BSE)

National Stock Exchange of India (NSE)

Indian Commodity Exchange (ICEX)

United Stock Exchange of India (USE)

Multi Commodity Exchange (MCX)

12

Over the Counter Exchange of India (OTCEI)

Inter-connected Stock Exchange of India (ISE)

Madras Stock Exchange (MSE)

Coimbatore Stock Exchange (CSX)

Ahmedabad Stock Exchange (ASE)

Bhubaneshwar Stock Exchange (BhSE)

Cochin Stock Exchange (CSE)

Hyderabad Stock Exchange (HSE)

Calcutta Stock Exchange (CSE)

Delhi Stock Exchange (DSE)

Bangalore Stock Exchange

Madhya Pradesh Stock Exchange, Indore

Jaipur Stock Exchange (JSE)

Magadh Stock Exchange, Patna

UP Stock Exchange (UPSE)

Vadodara Stock Exchange,Vadodara (VSE)

Guwahati Stock Exchange Ltd

Ludhiana Stock Exchange Association Ltd

Kanara Stock Exchange Ltd

Mangalore Stock Exchange Ltd

Pune Stock Exchange Ltd

Saurashtra Kutch Stock Exchange Ltd

Meerut Stock Exchange Ltd

Intrex Trade Exchange Ltd

United Stock Exchange of India

COMMODI TY EXCHANGE

1. Multi Commodity Exchange of India Limited (MCX)

2. National Commodity & Derivatives Exchange Limited (NCDEX)

3. Indian National Multi-Commodity Exchange (NMCE)

4. Commodity Exchange Limited ICEX.

13

OBJECTIVES OF STUDY

Primary Objective:

To undertake a comparative study on Authorized Persons service at Raghunandan

Pvt Ltd in comparison to other broking companies.

To analyze the services provided by Raghunandan Pvt Ltd Authorized Persons to its

customer.

Secondary Objective:

To understand the position of Authorized Person in stock Market.

To summarize the process carried out to influence customers to invest.

14

METHODOLOGY

In order to achieve the above stated objective a detailed analysis of stock market

was conducted based upon secondary data along with collection of some primary

data.

Data Collection:

Primary Data : In order to accomplish above stated objective data was collected through

questionnaire given to APs of Raghunandan Money.

Secondary Data : Apart from the primary data collected through questionnaire the

data was also extracted from various sources such as magazines to form a

substantial based of literature review.

Sampling Technique: Convenience Technique

What is convenience Technique?

A statistical method of drawing representative data by selecting people because of the ease of

their volunteering or selecting units because of their availability or easy access. The advantages

of this type of sampling are the availability and the quickness with which data can be gathered.

The disadvantages are the risk that the sample might not represent the population as a whole, and

it might be biased by volunteers.

Sample Unit: LUCKNOW

Sample Size: 20

Data Analysis And Interpretation : Data analysis and interpretation is done through pie chart and

Bar diagram.

15

LIMITATIONS OF STUDY

1. The time constraint was one of the major problems.

2. The study is limited to the different schemes available under the mutual funds selected.

3. The study is limited to selected authorised persons services provided by Rghunandan Money

and other companies.

4. The lack of information sources for the analysis part.

16

Literature Review

Role of Stock market for economic development

There might be no consensus about the important role played by Stock markets in any given

economy and the ability of these markets in steering that economy into certain economic cycles

that ensure enhancing the growth of national economies. Stock markets also play an important

role in shaping the financial, economic and monetary policies, plans and programmes.

The establishment of stock markets in Arab countries came in line with the Arab governments'

policies and programmes. It came also after such governments realised the importance of the role

played by such markets in enhancing the comprehensive development processes taking place in

their countries especially the capital market experience in many countries has been very

successful.

It is a truth universally acknowledged that economic development at any country would require

large capitals to achieve the prospective growth rates in their budgets. Stock markets may

therefore become the ideal mean for collecting funds and channeling them into the different

investment channels. They may also act as communication links among the sectors that have

surpluses and other sectors that are in need for liquidity to fund their investments. This balance

will definitely bring benefits to any country.

The main role of the stock markets is thus to avail funds needed to finance the projects promoted

by existing or under development at reasonable terms that bring benefits for everyone.

Due to lack of financial resources and low capitals, especially in countries whose financial

resources are limited, stock markets may be the only source and main provider for the capitals of

such projects.

17

COMPANY PROFILE

http://www.rmoneyindia.com/

THE BACKGROUND

Raghunandan money is one of the prominent integrated financial services group providing

exhaustive range of financial and investment related products to our clients and associates

The company offers a complete financial services spectrum ranging from equity, equity

derivatives , Commodities derivatives, Depository services, Insurance broking, Currency

derivatives and distribution of mutual funds.Raghunandan's retail network is speard mainly

across Uttar Pradesh, Madhya Pradesh,Uttranchal, Harayana, Delhi/NCR, Bihar, Jharkhand,

Gujrat and Rajasthan and is heading towards pan India presence.

Raghunandan group is a member of NSE (Cash, F&O and Currency), BSE (Cash and F&O) ,

MCX, MCX-SX, NCDEX, NMCE, ICEX , USEIL , depository participant of CDSL and direct

broker (IRDA) .Raghunandan is also a member of NCDEX SPOT EXCHANGE & NSEL.

At Raghunandan, We believe in the power of knowledge and the entrepreneurial spirit that

makes it profitable. Raghunandan has a professional management team and ranks amongst the

best in technology and operations. We at Raghunandan have been working hard to bring to the

18

reach of the retail investor, the opportunities of the wealth creation presented by the financial

markets.

Raghunandan started its operations in august 2004 with four people running the operations.

Focus on customer first attitude , respect for professionalism and implementation of cutting edge

technology has enabled us to blossom into an almost 800 member team.

Raghunandan's distribution network spreads over 300 towns and cities comprising 800 business

associates mainly across Uttar Pradesh , Madhya Pradesh , Uttranchal ,

Harayana,Delhi/NCR,Bihar,Jharkhand, Gujrat and Rajasthan and is heading towards pan India

presence.

MI LESTONE

2004

NOVEMBER

:Acquired trading cum clearing membership of Multi

Commodity Exchange Ltd.

AUGUST

:Acquired Trading cum membership of National

Commodities and Derivatives

Exchange ltd.

2005

AUGUST : Acquired Direct broker license approved by IRDA

19

2008

NOVEMBER

: Acquired trading membership of MCX Stock Exchange

Ltd. in Currency futures segment

OCTOBER : Acquired trading membership of NSE (Cash and F& O )

SEPTEMBER

: Acquired trading cum clearing membership of NCDEX

Spot Exchange Ltd.

JULY : Acquired trading cum clearing membership of National

Spot Exchange Ltd.

Acquired trading cum clearing membership of National

Multi-Commodity Exchange

of India Ltd.

2009

JANUARY

: Acquired trading membership of NSE in currency derivative

segment

2010

AUGUST

: Acquired trading membership of united stock exchange for

currency derivative segment

JULY : Acquired trading membership of BSE ( Cash and f & O)

JANUARY

: Acquired trading cum clearing membership of : Indian

Commodity Exchange Limited

2011

AUGUST : HDFC Mutual Fund Declared us as Start Key Partner

FEBRUARY : Became the DP participant of CDSL

JANUARY : Our Company has certified by ISO 9001 : 2008

20

2012

AUGUST : Implement Drishti Solutions

JULY : Register as Self Clearing Member in NSE (F&O) Segment

Sales Head Office Shifted To Noida

JANUARY : Registered Intermediary of CLV, NDML & DOTEX

Implement CRM Software Talisma in Sales

2013

MARCH : Number of Business Associates800 +

FEBRUARY : Number of Employees500 +

JANUARY : Register as Trading Member in MCX-SX Cash Segment &

As Self Clearing Member

in MCX-SX (F&O) Segment

Implement CRM Software Talisma in Operations

21

SOCIAL RESPOSIBILITY

Raghunandan believes that it has a responsibility beyond its basic responsibility towards its

stake holders , a responsibility towards a larger constituently - the society .there are many who

may not be as privileged as we are and we consider it as our duty to help those deserving , to

provide them with opportunities and enhance their lives. It is an investment for the future of the

society

We are associated with the Ekal vidhalaya foundation which is a charitable trust that initiates ,

supports and runs non formal one teacher school (popularly known as Ekal vidyalayas) all over

the country with the participation of numerous non profit organization . This program has

become the greatest non governmental education movement in the country.

22

THE PROMOTERS

MR. SAURABH MITTAL (DIRECTOR)

Founder and promoter of the Raghunandan Money Group, Mr. Saurabh Mittal is a Management

Graduate having rich and extensive experience of more than 15 years. He has an in-depth

knowledge and strong understanding of various intricacies of Financial Markets. It is through his

exceptional leadership skills and outstanding commitment towards the group that Raghunandan

Money today has become the leading Broking House with extensive client base and wide spread

network of sub brokers & branches. His efforts have led to the diversification of group

businesses from Equity & Commodity Broking to Depository Services, IPOs & Mutual Funds

distribution, Insurance Products, Wealth Management, Advisory Services and Financial

Education. Under his leadership, the organization has rapidly expanded and made a widespread

presence across India and has seamlessly grown into a financial services company par excellence

MR. KAPIL MITTAL (DIRECTOR)

Mr. Kapil Mittal, co-promoter of the company, is an Engineering and Management Graduate

having more than 12 years of experience. He is heading the Research and Product Development

division of the company. His great dedication and devotion to his work is an inspiration for his

team. A man of great intellect, his ideas have helped Raghunandan in the introduction of new

financial services such as distribution of Mutual Funds, IPOs and Insurance Products. His style

of working is highly motivational to his team members. Mr. Mittal is a person with unmatched

sharp calculative skills and analytical bent of mind.

MR. DEEPANKAR SETH (HEAD OPERATIONS)

Mr. Deepankar Seth is a fellow member of the Institute of Chartered Accountants of India (ICAI)

having more that 12 years of experience in the Indian Financial Markets. Mr. Seth leads the

Broking Operations of Raghunandan Group including, Back office operations, entire

technological functioning of the business, Risk Management & Surveillance, Legal &

Compliance, Corporate Communications & Brand Management and IT & Software

Development.

23

MR. RAJESH KUMAR SINGH (DIRECTOR)

Mr. R K Singh is an Associate Member of Association of Certified Chartered Accountants

(ACCA, UK) & a Management Graduate having diversified experience of 11 years and has

worked with the leading institutions ICICI, HDFC, UTI, SMC & most recently with IFCI. He

has worked across all parts of India and has excelled in business development and strategy. At

Raghunandan, he is heading Business Development and Marketing division.

MEMBERSHIP

Raghunandan Capital (P) Ltd.: Member-NSE; BSE; MCX-SX; USEIL;

Depository Participant (CDSL)

NSE:TMID-13176 SEBI Regn. No: NSE (CASH):INB231317638;

NSE (F&O) I NF231317638;NSE(CURRENCY):INE231317638

BSE: TMID-6112 SEBI Regn. No.: BSE (CASH): INB011317634;

BSE (F&O) INF011317634

MCX-SX: TMID-52400 SEBI Regn.No :INE261317638

USEIL: TMID-13176 SEBI Regn.No. : INE271317633

CDSL DP: DPID : 12069700 SEBI regn. number : IN-DP-CDSL-607-2011

Raghunandan Industries (P) Ltd.: Member-MCX; NCDEX ; NMCE; ICEX; NSEL ; NCDEX

Spot

MCX:TMID- 16825 FMC Code No.:MCX/TCM/CORP/0050

NCDEX:TMID- 00189 FMC Code No.:NCDEX/TCM/CORP/0295

NMCE:TMID- CL0267 FMC Code No.:NMCE/TCM/CORP/0185

ICEX:TMID- 1107 FMC Code No.:ICEX/TCM/CORP/0120

NSEL:TMID- 10440

NCDEX Spot:TMID-10043

Raghunandan Insurance Brokers (P) Ltd.:Direct Broker-IRDA

Direct Broker Code : IRDA:DB/352

24

RAGHUNANDAN MONEY GROUPS

25

EQUITY

Investing in shares or stock market is inarguably the best route to long-term wealth accumulation.

However, it can also be a very risky proposition due to high risk-return trade-off prevalent in the

stock market. Hence, it is more appropriate to take help of an experienced and trustworthy expert

who will guide you as to when, where and how to invest.

Raghunandan provides guidance in the exciting world of stock market with suitable trading

solutions and value-added tools and services to enhance your trading experience.

Online Trading

Customized single screen Market Watch for multiple exchanges

Real-time rates

Flash news & intra-day calls

Intra-day & historical charts with technical tools

Online research

E-broking & back-office software training

Quality Research

Wide range of daily, weekly and special Research reports

Expert Sector Analysts with professional industry experience

Advisory

Real-time market information with News updates

Investment Advisory services

Dedicated Relationship Managers

Support

24x7 Web-enabled Back Office

Centralized customer care

Live Chat support system

26

EQUITY DERIVATIVES

The derivative segment is a highly lucrative market that gives investors an opportunity to earn

superlative profits (or losses) by paying a nominal amount of margin. Over past few years, Future

& Options segment has emerged as a popular medium for trading in financial markets. Future

contracts are available on Equities, Indices, Currency and Commodities.

Raghunandan being the member NSE and BSE Derivatives Segment, provides you a gateway to

the exciting world of derivative market.

CURRENCY DERIVATIVES

The global increase in trade and foreign investments has led to inter-connection of many national

economies. This and the resulting fluctuations in exchange rates, has created a huge international

market for Forex rendering investors another exciting avenue for trading. The Forex market offers

unmatched potential for profitable trading in any market condition or any stage of the business

cycle.

BENEFITS

Low Commissions: Brokerage fees are very low as the market is highly competitive.

No Middlemen : Futures/Options currency trading does away with the middleman and allows

clients to interact directly on the exchange platform.

Standardized Lot Size : In the futures markets, exchanges determine lot or contract sizes which

are fixed in nature. This allows traders to trade in multiple lots.

Low Transaction Cost : The retail transaction cost (the bid/ask spread) is typically less than

0.1% under normal market conditions. In large deals, the spread could be as low as 0.07%.

High Liquidity : With an average trading volume of over $4 trillion per day, Forex market has

high liquidity. It means that a trader can enter or exit the market at will in almost any market

condition.

Instant Transactions:This is a very advantageous by-product of high liquidity.

27

Low Margin, High Leverage: These factors increase the potential for higher profits (and losses).

Online Access: The big boom in Forex came with the advent of online trading platforms.

Interbank Market: The backbone of the Forex market consists of a global network of dealers.

They are mainly major commercial banks that communicate and trade with one another and with

their clients through electronic networks and by telephone. There is no organized exchange to

serve as a central location to facilitate transactions the way the New York Stock Exchange serves

the equity markets. The Forex market operates in a manner similar to that of the NASDAQ market

in the United States. Thus, it is also referred to as an over-the counter (OTC) market.

Self-Regulatory: The Forex market is so vast and has so many participants that no single entity,

not even a Central Bank, can control the market price for an extended period. Even interventions

by mighty Central Banks are becoming increasingly ineffectual and short-lived. Thus, Central

Banks are becoming less and less inclined to intervene and manipulate currency prices.

No Insider Trading: Because of the Forex market's size and non-centralized nature, there is

virtually no chance for ill effects caused by insider trading. Fraud possibilities, at least against the

system as a whole, are significantly less than in any other financial instruments.

Limited Regulation: There is limited governmental influence via regulation in the Forex markets,

primarily because there is no centralized location or exchange.

28

Advantages of Raghunandan :

Raghunandan provides user friendly online platform for currency trading in the leading currency

exchanges

Online Trading

Single screen customized market watch for currency derivatives with

BSE/NSE/MCX/NCDEX and NMCE

Streaming quotes

Top Quality Research

Exclusively daily commentary and research reports by our currency analyst team

Regular updates on Dollar INR movements with calls to buy and sell

Special consultancy to exporters , Importers & corporate for their forex transaction

Pro-Active Relationship Management

Active advisory desk

Receive education on the products through seminars / con-calls organized by

Raghunandan

Your margin with Raghunandan capital can be used for either segment equity / currency

29

SPOT

Commodity spot products (e series products) consists of a series of investment products in

commodities, which are designed for retail investors. These products, innovated by NSEL , allow

investors to put in their funds into commodities in smaller denominations and hold them in demat

form. These products are available for electronic trading on the pan-India electronic trading

platform set up by NSEL, which can be accessed through members of NSEL. Commodity spot

products (e-series products) provide a unique opportunity to buy, accumulate, hold and liquidate

commodities with easy entry and exit facility, besides a right to convert them into physical

deliveries in a seamless manner

Features

Promotes Systematic Investment & Savings

Investment can be as low as 1 gm of Gold, 100 gms of Silver and 1 Kg of Copper

Convenient, Secured and ease of Buying & Selling on electronic platform just like shares

Conversion to Physical gold/silver/copper possible

Flexibility of trade timings from 10 m to 11:30 pm - Monday to Friday

Single day contract with Settlement on T+2 basis

Arrangement with NSDL & CDSL as the depository for holding commodity units in Demat

form

Benefits

Transparent Pricing: e-Series is available on the order-driven electronic platform where

investors are allowed to quote their own buying and selling price. The same price is

available across the country. The impact cost is as low as 10 paise. The price quoted on the

screen is actionable price at which investors can buy or sell. This ensures transparency,

credibility and authenticity of pricing.

Uniform Pan-India Pricing: e-Series products provide the benchmark uniform price for

commodities that is valid in the entire country. In physical market, the price varies from

place to place. e-Series remove such regional bias, disparities and ambiguities and provide

a uniform price for the entire country. Hence, e-Series is the first

instrument in the country that implements the doctrine of Common

Indian Market.

Low custodian charges and transaction fee: The cost of holding e-Series units is zero.

Hence, investors can hold on to them for as long as they desire, without having to incur any

storage or holding cost.

Elimination of storage risk/ theft : Holding commodities in demat form, hence no risk of

commodity theft or storage loss

Diversification of portfolio : Diversification of portfolio by investing in a different asset

30

class

Delivery at different locations : Investors can get physical delivery of accumulated units

of Gold / Silver / Copper at various locations without any premium

E-series products

e-Gold

e-Silver

e-Copper

e-Zinc*

e-Nickel*

e-Lead*

e-Aluminium

e-Steel

e-Iron Ore

e-Platinum

e-Cadmium

e-Pig Iron

How to participate

Retail Investors who intend to trade / invest in E Series products have to register

with Raghunandan money. The process is exactly similar to client registration

process for trading in the equity market.

Investment can be initiated in two simple steps:

o Open Client A/c (trading a/c) with Raghunandan Money and start

trading/investing.

o As the instruments are dematerialized commodity units, the investor needs to

open a commodity beneficiary demat account with Raghunandan Money .

Please note that the demat account meant for equities (Securities) is not

eligible to hold E-Series units and a separate demat & trading account will

have to be opened for trading in E-Gold, E-Silver & E-Copper

The buying and selling of demat units takes place on the NSEL trading platform

from Monday to Friday (10AM -11.30 pm) under symbol E-Gold, E-Silver & E-

Copper. The trading units are: 1 Gram for Gold, 100 gram for Silver & 1 Kg for

Copper.

31

DEPOSITARY

Enjoy the dual benefits of trading and depository services under one roof and experience efficient,

risk-free and prompt depository service. Raghunandan is registered as a Depository Participant

withCDSL.

Raghunandan Advantage

Automated pay-in facility

Access information Anytime, Anywhere

Quarterly demat statements with valuation

Statements on demand

View Demat A/C statement online

Competitive transaction charges

Easiest

You can transfer securities 24 hours a day, 7 days a week through Internet

Consolidation Demat Account: Dematerialize your physical shares in various holding

patterns and consolidate all such scattered holdings into your primary demat account at

reduced cost.

The pay-in of funds and delivery shall take place at 1:00 PM and payout will be at

5:30 PM on T+2 day (T- Trading day) from Monday to Friday excluding holidays

notified by the Exchange.

The settlement takes place through the members pool a/c as in equity. In case of

buy, the client needs to disclose the beneficiary account to the member and in case of

sale the client needs to transfer the demat units to the members account on T+1 day.

There is a provision of conversion of demat units to physical units at specific

delivery centres.

32

Corporate Benefit Tracking

Track your dividend, interest, bonus through your account statement.

Mobile Alerts

Receive SMS alerts for all debits/credits

Dedicated customer care

Executives specially trained at our help desk, to handle all your queries.

Countrywide Branches

You are never far from Raghunandan Money Demat Services outlet.

Competitive Charges

You will find our service charges very competitive - offering the best value for your

money.

INSURANCE

Future is uncertain and one needs to provide for the uncertainty today. We at "Raghunandan

Money" help you secure your future through insurance products.

33

Our Trust is

To give value added and quality services to the insuring public and enable them to get

proper insurance coverage that will adequately indemnify them in time of need

To give risk management back up to clients through our team of managers and

experienced executives.

To work together with the customers, combining our skills, technologies and experience -

no matter what your business is or how difficult the situation is - we give it the correct

perception.

Our approach to insurance broking is holistic. Raghunandan money critically views the

need and adequacy of Insurance from a client's perspective:

Define risk profile

Propose a risk management plan

Source insurance quotes

Evaluate quotes with recommendations

Focus on coverage and cost optimization

Placement of insurance as per clients choice

Validate the policy in line with proposal

Policy updation

Our motto is "Total Customer Satisfaction."

Our core value helps us to build and sustain enduring corporate relationships.

As always, we put your needs first.

I PO

Initial Public offerings provide a very good opportunity for investors to enter into high growth

companies early one when they come to capital markets for the first time for raising funds.

Raghunandan Money provides complete transaction support to investors for investments in

primary markets through IPO's. The advisory team offers advise to investors to invest only in

fundamentally sound IPOs.

34

MUTUAL FUND

Mutual Funds provide money management by specialists fund managers. As an investment

options providing broad diversification and covering wide range of investment objectives,

philosophies, asset classes and risk exposures. Mutual funds have become a must have for any

well balanced investment portfolio. We at Raghunandan Money offer Mutual fund

investment across 1000+ schemes and 22+ fund houses through our dedicated advisors.

Raghunandan also provides recommendations based on in-depth research, mutual fund

performance and mutual fund ratings to help meet your investment goals.

RESEARCH

Creating wealth is our only goal.Keeping in view, we offer customized research based services

to our wide range of clients through in-depth understanding and analyzing the various investment

opportunities that exist in our financial markets.

Raghunandan Money triumphs in the development of Real- time Research with Trailing stops

(RRT), in financial markets. Raghunandan Money has taken years of research and extensive hard

work to finally give a new outlook to trading in Equity & Commodity Markets through RRT.

The whole idea behind developing RRT is to give a new Dimension and Perspective to the

thinking of investors on How to Trade in the Markets with Defined Profits & Capped Risk.

With the stops been trailed on a Real time basis, the client who follows will always minimize the

losses and maximizes the return. More over the visual impact of Live Chart view of Stocks and

Commodities with BUY Sell Signals with Stop Loss, doesnt require a professional to follow

or interpret, a client can do himself and follow meticulously and reap its benefits.

A strong research team of competent and experienced professionals work continuously to pick

up the best opportunities for our valuable customers. The activities of the group also provide the

synergy for optimizing the growth of business by adding greater value to our clients business.

Close and continuous monitoring of the Global Macro Economic Scenario at the Highest level is

a great Advantage.

We follow a very large bouquet of Trading Strategies to give a robust and consistent

performance in Equity & Commodity Markets.

35

COMPETI TORS

Brokerage firms are the business entities that deal with stock trading. India, with an increasing

capital market and a growing number of investors, has a number of brokerage firms. In Indian

retail brokerage industry, the brokerage firms primarily work as agents for buying and selling of

securities like shares, stocks and other financial instruments and earn commission for each of the

transactions.

There are many companies which are competitor of RAGHUNANDAN MONEY

Name Raghunandan Money

Terminals 3320

Sub Brokers 810

No. of Employees 500

No. of Branches 10

Name Kotak Securities Limited

Terminals 4320

Sub Brokers 910

No. of Employees 4008

No. of Branches 350

Name Karvy Stock Broking Limited

Terminals 1700

Sub Brokers 19000

No. of Employees 3910

No. of Branches 581

Name Indiabulls

Terminals 2876

Sub Brokers NA

36

No. of Employees 5873

No. of Branches 522

Name IL&FS Investmart Limited

Terminals 1644

Sub Brokers NA

No. of Employees 1900

No. of Branches 294

Name Motilal Oswal Securities

Terminals 7923

Sub Brokers 890

No. of Employees 2193

No. of Branches 63

Name Reliance Money

Terminals 2428

Sub Brokers 1494

No. of Employees 2037

No. of Branches

142

Name India Infoline

Terminals 173

Sub Brokers 173

No. of Employees NA

No. of Branches 605

Name Angel Broking Limited

Terminals 5715

Sub Brokers NA

No. of Employees 284

No. of Branches NA

Name Anand Rathi Securities Limited

Terminals 1527

37

Sub Brokers 320

No. of Employees 4566

No. of Branches 220

Name Geojit

Terminals 627

Sub Brokers 247

No. of Employees 343

No. of Branches 314

38

AUTHORISED PERSON

AP means any person not being a member of a stock exchange, who acts on behalf of a member-

broker as an agent or otherwise for market access and assisting the investors in buying, selling or

dealing in securities through such member broker.

A company would prefer to have someone else handling there centre link business on there

behalf . They authorize a person or organization to be there nominee or make enquiries only.

Nominee arrangements allow the company to authorize someone to act and/or receive the

companys centrelink payments on the companys behalf. This is referred to as a person

permitted to enquire about the company through authorized person.

Any person who is appointed as such by a stock broker (including trading member) and who

provides access to trading platform of a stock exchange as an agent of the stock broker is an

Authorized Person. An individual, Partnership Firm, Limited Liability Partnership (LLP) and a

Body Corporate meeting the requisite eligibility criteria prescribed by the stock exchange can

become an Authorized Person. The individual should be a resident of India, Partnership Firm

should be registered under Indian Partnership Act, 1932, LLP should be registered under the

Indian Limited Liability Partnership Act, 2008 and Body Corporate should be registered under

the Indian Companies Act, 1956. Same person cannot act as sub-broker with one stock broker

and as Authorized Person with another stock broker of the same stock exchange at a time.

Authorized Person can receive remuneration - fees, charges, commission, salary, etc. for his

services only from the stock broker and shall not charge any amount from the clients.

Accordingly, stock broker can share brokerage with the Authorized Person but shall not charge

any amount directly from the clients.

In case of an Authorized Person, as stipulated by SEBI, an agreement has to be entered between

stock broker and the Authorized Person in the format prescribed by the Exchange vide circular

no. 705 (download ref. no. 13601) dated December 3, 2009. (circular hyperlink to be provided

here). There is no requirement of a tripartite agreement in case of Authorized Person.

As per SEBI stipulations in person verification of clients can only be carried out by employees of

the stock broker, hence an Authorized Person who is not an employee of the stock broker cannot

carry out in person verification and same rule is even applicable to a sub-broker.

A choice has to be made on becoming Authorized Person or sub-broker and having both

concurrently for same segment is not permitted.

The sub-broker on the Capital Market segment can apply for appointment as Authorized Person

along with the application for cancellation of sub-broker. The stock exchange shall de-recognize

the entity as sub-broker and approve the appointment of the entity as Authorized Person so that

the business continuity is not affected. The KYCs need not be entered afresh in such cases.

Authorized Person can operate terminal on behalf of the stock broker. However, in respect of

stock brokers proprietary trading there are restrictions that it can take place only from locations

39

that have been declared so to the stock exchange. It is necessary for a Director level person to be

located at the place where proprietary trades are permitted.

As per Exchange requirement every client has to be individually registered with stock broker and

all funds and securities settlement have to take place between stock broker and the investor.

Recovery issues if any between stock broker and Authorized Person would depend on the

arrangements that they have entered into.

Arbitration mechanism of the stock exchange will be available for resolving the client disputes

against the Authorized Person and the stock broker wherein the Authorized Person can be made

party to it. The stock exchange arbitration mechanism will be available in case of any dispute

between the stock broker and the Authorized Person. An Authorized Person can have multiple

offices.

A single application specifying the segments can be submitted in case stock broker is seeking

approval of the stock exchange for appointment of Authorized Person in two or more segments

together. Further a single agreement between the stock broker and the Authorized Person will

suffice in such cases. However, it is necessary to keep the agreement separate for each stock

exchange.

The agreement between the stock broker and Authorized Person should be strictly as per the

format prescribed by the stock exchange. In case stock broker wishes to stipulate additional

terms and conditions, stock broker may include additional clauses clearly stating that these

clauses are mutually agreed to between stock broker and Authorized Person taking care to ensure

that such clauses are not in contravention with compliance requirements stipulated by

Exchange/SEBI.

The existing registration process of sub-brokers will continue and the existing Sub-brokers and

Authorized Persons can continue operating without getting registered again as per the new

process.

The obligations and liabilities of an Authorized Person are similar to that of a Sub-broker.

However, Authorized Person would not have a registration granted by SEBI. Further in all

representations to investors at large name of the affiliated stock broker along with its registration

number should be clearly displayed.

A stock broker may enter into any additional agreement with Authorised Person provided the

clauses of such agreements are not in contravention of SEBI/Stock Exchange stipulations.

A single notice board can be displayed mentioning the details of stock broker, sub-broker and

Authorized Person.

If the Authorized Person would be operating from the office of stock broker, the address of the

stock broker can be mentioned in the application form seeking appointment of Authorized

Person.

For change in affiliation of Authorized Person from one stock broker to the other stock broker of

the exchange, the application for appointment of Authorized Person shall be submitted by the

new affiliating member along with a No objection certificate from the earlier stock broker.

40

List of APs

1.Amit Mohan Upadhya (lucknow)

2.Sanjay Mangal (lucknow)

3.Jitendra Tiwari (Baliya)

4.Shivjeet Prasad (Banaras)

5.Vijay Kishore Pandey (Gorakhpur)

6.Seema Mishra (Kanpur)

7.Jyoti Mishra (Kanpur)

8.Bansh Raj (Barabanki)

9.Minoti Bhattacharya (Mau)

10.Shailendra Srivastava (Faizabad)

Competitors:

1. Kotak Securities Ltd.

2.Karvy Stock Broking Ltd.

3.India Bulls

4.IL &FS Investmart Ltd.

5.Motilal Oswal Securities

6.Reliance Money

7.Angel Broking

8.India Infoline

9.Anand Rathi Securities Ltd

10.Geojit

41

SWOT ANALYSIS

Strengths

Dedicated team of young professional and financial experts.

Efficient RMS team which serves as backbone to the company.

Vast network of outlets across India at best of Locations.

Technological backup including state of art LAN and WAN.

Technology, linked at the client-end too.

Transparency to the clients.

Personalized services to the clients.

With average of 27 years Unicon is youngest and most aggressive company in

Stock/Commodity broking space.

Huge market opportunities i.e. Internet trading (stocks and commodities) is one of the

worlds fastest growing and large markets.

Strong management, experienced backers, proprietary technology.

42

Opportunities

One of the fastest growing company, huge potential for growth.

This market has a huge investor base and hence, serves as an opportunity for the

company to capture it.

Technology has given scope to have presence in all segment of market

Weakness

Lack of promotional activity.

In house Research (for technical analysis).

Threats

Facing tough competition from big brands such as Indiabulls, ICICI direct and Kotak

Securities etc.

Market fluctuations.

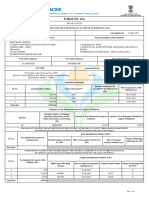

Data Analysis and Interpretation

SERVICE PROVIDED TO AP BY RAGHUNANDAN MONEY AND

OTHER COMPANY

LIST OF SERVICES

COMPANY- RAGHUNANDAN

MONEY

SECURITY DEPOSIT

25000 PER SEGMENT

ADVANCE BROKERAGE PLAN YES

SHARING TWO OPTION IN RATIO OR IN

FIX

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE

ODIN

SOFTWARE CHARGE NOMINAL

BACK OFFICE SOFTWARE

SHILPY

BACK OFFICE SOFTWARE

CHARGE

FREE

LIMIT IN NSE INTRADAY---16.5 TIMES

DELLEVARY- 5.5TIMES

LIMIT IN MCX INTRADAY- 5 TIMES

POSSITIONAL 2 TIMES

THIRD PARTY PRODUCT MUTUAL FUND, LIFE INSURANCE,

GENERAL INSURANCE, IPO, FD,

MANY MORE

LIST OF SERVICES

COMPANY- KOTAK

SECURITIES LTD.

SECURITY DEPOSIT RS.100000 PER SEGMENT

ADVANCE BROKERAGE PLAN NO

SHARING ONLY ONE OPTION IN RATIO

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE ODIN

SOFTWARE CHARGE CHARGEBLE

BACK OFFICE SOFTWARE OTHER

BACK OFFICE SOFTWARE

CHARGE

GHARGEABLE

LIMIT IN NSE INTRADAY---10 TIMES

DELLEVARY- 3TIMES

LIMIT IN MCX INTRADAY- 2TIMES

POSSITIONAL 1 TIMES

THIRD PARTY PRODUCT MUTUAL FUND, LIFE INSURANCE,

GENERAL INSURANCE, IPO, FD,

MANY MORE

LIST OF SERVICES

COMPANY- ANGEL BROKING

SECURITY DEPOSIT RS.50000 PER SEGMENT

ADVANCE BROKERAGE PLAN NO

SHARING ONLY ONE OPTION IN RATIO

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE ODIN

SOFTWARE CHARGE CHARGEBLE

BACK OFFICE SOFTWARE OTHER

BACK OFFICE SOFTWARE

CHARGE

GHARGEABLE

LIMIT IN NSE INTRADAY---10 TIMES

DELLEVARY- 3TIMES

LIMIT IN MCX INTRADAY- 2TIMES

POSSITIONAL 1 TIMES

THIRD PARTY PRODUCT NO

LIST OF SERVICES

COMPANY- KARVY STOCK

BROKING LTD

SECURITY DEPOSIT RS.50000 PER SEGMENT

ADVANCE BROKERAGE PLAN NO

SHARING ONLY ONE OPTION IN RATIO

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE ODIN

SOFTWARE CHARGE CHARGEBLE

BACK OFFICE SOFTWARE OTHER

BACK OFFICE SOFTWARE

CHARGE

GHARGEABLE

LIMIT IN NSE INTRADAY---10 TIMES

DELLEVARY- 3TIMES

LIMIT IN MCX INTRADAY- 2TIMES

POSSITIONAL 1 TIMES

THIRD PARTY PRODUCT MUTUAL FUND, LIFE INSURANCE,

GENERAL INSURANCE, IPO, FD,

MANY MORE

LIST OF SERVICES

COMPANY- INDIABULL

SECURITY DEPOSIT RS.50000 PER SEGMENT

ADVANCE BROKERAGE PLAN NO

SHARING ONLY ONE OPTION IN RATIO

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE PIB

SOFTWARE CHARGE FREE

BACK OFFICE SOFTWARE OTHER

BACK OFFICE SOFTWARE

CHARGE

GHARGEABLE

LIMIT IN NSE INTRADAY---10 TIMES

DELLEVARY- 3TIMES

LIMIT IN MCX INTRADAY- 2TIMES

POSSITIONAL 1 TIMES

THIRD PARTY PRODUCT MUTUAL FUND, LIFE INSURANCE,

GENERAL INSURANCE, IPO, FD,

LIST OF SERVICES

COMPANY- SHRIRAM

INSIGHT

SECURITY DEPOSIT RS.50000 PER SEGMENT

ADVANCE BROKERAGE PLAN NO

SHARING ONLY ONE OPTION IN RATIO

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE D2C

SOFTWARE CHARGE FREE

BACK OFFICE SOFTWARE OTHER

BACK OFFICE SOFTWARE

CHARGE

GHARGEABLE

LIMIT IN NSE INTRADAY---10 TIMES

DELLEVARY- 3TIMES

LIMIT IN MCX INTRADAY- 2TIMES

POSSITIONAL 1 TIMES

THIRD PARTY PRODUCT NO

LIST OF SERVICES

COMPANY- INDIAINFOLINE

SECURITY DEPOSIT RS.100000 PER SEGMENT

ADVANCE BROKERAGE PLAN NO

SHARING ONLY ONE OPTION IN RATIO

SEGMENT NSE CASH, NSE-F&O, NSE-

CURRENCY,

MCX,NCDEX, MCX-SX,NSDEL

SOFTWARE ODIN

SOFTWARE CHARGE FREE

BACK OFFICE SOFTWARE OTHER

BACK OFFICE SOFTWARE

CHARGE

GHARGEABLE

LIMIT IN NSE INTRADAY---10 TIMES

DELLEVARY- 3TIMES

LIMIT IN MCX INTRADAY- 2TIMES

POSSITIONAL 1 TIMES

THIRD PARTY PRODUCT NO

Segments provided by Raghunandan Money to their A.Ps

Segments Total No. Of A.Ps

Mixed 9(45%)

Commodity 6(30%)

Equity 5(25%)

Total 20

Data Interpretation:-

Out of 20 A.Ps 45% subscribe mixed segment, 30% subscribe commodity and

25% subscribe equity of Raghunandan Money.

45%

30%

25%

Mixed

Commodity

Equity

Security deposit taken by Raghunandan Money from A.Ps per segment

NAME OF

COMPANY

BROKERAGE/SEGMENT

R Money 25000

Indian Infoline 100000

Kotak Securities 100000

Angel Broking 50000

Karvy Stock Broking 50000

India Bulls 50000

Shriram Insight 50000

Data Interpretation:

After analyzing 7 broking companies we can find out that Raghunandan Money is one of the

broking company which provides all the segments at lesser brokerage amount and Indian

Infoline and Kotak Securities take higher amount among all.

0

20000

40000

60000

80000

100000

120000

BROKERAGE

BROKERAGE

Ques3. What is the amount of securities deposited by the A.P to the company while

taking the franchise ?

1.100000 2.75000

c.25,000 4.50,000

Ans. Minimum 25,000 amount of security is must to get themselves registered as authourized

person.

NAME OF THE COMPANY BROKERAGE

RAGHUNANDAN MONEY 25000

INDIA INFOLINE 100000

ANGEL BROKING 50000

INDIAN BULLS 50000

KOTAK SECURITIES 100000

Data interpretation:-

In comparison with other broking companies Raghunandan Money take lesser amount as

brokerage from there A.Ps

Q4. Is any advance brokerage deposited by the A.P before taking franchisee?

a.Yes b.No.

Ans. Yes

100000

75000

25000

50000

1

2

3

4

Q5. What is the ratio of brokerage offered by the companys to their A.Ps?

a.70:30 b.60: 40

c.50:50

Ans. 70.30

Q6. What are the segment offered to the A.P for their customers?

a.NSE b.NCDEX

c.MCX-SX d.NSDEL

Ans. NSE

Q7. Is software of odding is given to the A.P or not and whether it is chargeable

or not?

a.YES b.NO

Ans. Yes

Q8. Whether back office software is chargeable or not?

a.YES b.NO

Ans. NO

Q9. What are the limits process in the company?

a.5 times b.2 times

c.3 times d.10 times

Ans.5 times

Q10. Whether the companys provide third party product to consumer?

a.YES b. NO

Ans. Yes

FINDINGS

A.P plays the role of middle man between clients and company.

There are various segment offered in stock market such as equity and commodity.

Knowlegde about Life Insurance and Mutual funds as third party product.

To know about the current prices of share and commodities we use terminal as

source.

Awareness about customers preferences.

Importance of saving and investments in current scenario.

Raghunandan is the company which provides best service at lower charges from

there A.Ps.

SUGGESTION

The company needs to analyze the market and need to know about their

competitors.

They should use various market strategies and create awareness about there

product more in the market

They provide more training to there sells person and A.Ps so that they can

give correct knowledge to there clients

CONCLUSION

The analysis and interpretation of data on study of comparison between A.Ps of different

companies and Raghunandan Money. These are the following findings of the project:

Working of the stock market.

Working of the terminals to check prices of the shares.

Services provided to A.Ps by Raghunandan Money.

Various research tips provided by the company to the A.Ps to attract more

clients.

Promotion and marketing material provided by the company to A.Ps.

ANNEXURE

QUESTIONNAIRE

Q1. What is the amount of securities deposite by the A.P to the company while

taking the franchise ?

a.50,000 b.1,00,000

c.25,000 d.75,000

Q2. Is any advance brokerage deposited by the A.P before taking franchisee?

a.Yes b.No.

Q3. What is the ratio of brokerage offered by the companys to their A.Ps?

a.70:30 b.60: 40

c.50:50

Q4. What are the segment offered to the A.P for their customers?

a.NSE b.NCDEX

c.MCX-SX d.NSDEL

Q5. Is software of odding is given to the A.P or not and whether it is chargeable

or not?

a.YES b.NO

Q6. Whether backoffice software is chargeable or not?

a.YES b.NO

Q7. What are the limits process in the company?

a.5 times b.2 times

c.3 times d.10 times

Q8. Whether the companys provide third party product to consumer?

a.YES b.NO

BIBLIOGRAPHY

WWW.NSC INDIA.COM

WWW.GOOGLE.COM

WWW.MONEYCONTROL.COM

WWW.RMONEY.COM

Anda mungkin juga menyukai

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessDari EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessBelum ada peringkat

- PRINCE2 in Action: Project management in real termsDari EverandPRINCE2 in Action: Project management in real termsPenilaian: 4 dari 5 bintang4/5 (2)

- Summer Internship Project: ON Performance Appraisal Effectiveness IN Hindalco Flat Rolled Product, HirakudDokumen92 halamanSummer Internship Project: ON Performance Appraisal Effectiveness IN Hindalco Flat Rolled Product, HirakudUmrah NaushadBelum ada peringkat

- Nims University, JaipurDokumen71 halamanNims University, JaipurAjay AshokBelum ada peringkat

- Govt. S.P.M.R. College of Commerce, Jammu: A Summer Training Report OnDokumen7 halamanGovt. S.P.M.R. College of Commerce, Jammu: A Summer Training Report OnSwyam DuggalBelum ada peringkat

- Summer Training ReportDokumen51 halamanSummer Training ReportRachit KhareBelum ada peringkat

- Project Report On: in Partial Fulfilment of The Requirements For The Award of The Degree ofDokumen77 halamanProject Report On: in Partial Fulfilment of The Requirements For The Award of The Degree ofTushar PunjaniBelum ada peringkat

- A StudyDokumen33 halamanA StudyCutE々 GirLBelum ada peringkat

- Satya OriginalDokumen65 halamanSatya OriginalsaiBelum ada peringkat

- Sharekhan ProjectDokumen111 halamanSharekhan ProjectSandeep KumarBelum ada peringkat

- Project Report ON Strategic Analysis OFDokumen5 halamanProject Report ON Strategic Analysis OFRahul RamchandaniBelum ada peringkat

- Final FileDokumen69 halamanFinal FileGulshan kumarBelum ada peringkat

- GYANRAJ (Recruitment in Escorts) MBA UN HRDokumen114 halamanGYANRAJ (Recruitment in Escorts) MBA UN HRlalsinghBelum ada peringkat

- Outlook Sip ReportDokumen80 halamanOutlook Sip ReportSujay SinghviBelum ada peringkat

- Pms ProjectDokumen117 halamanPms Projectsd1207Belum ada peringkat

- Project of Ratio Analysis MBA 2Dokumen63 halamanProject of Ratio Analysis MBA 2Pooja MhetreBelum ada peringkat

- Religare ProjectDokumen129 halamanReligare ProjectJayesh Singh100% (4)

- Project ReportDokumen95 halamanProject ReportPragya DixitBelum ada peringkat

- Organizational Study On STATE BANK OF HYDERBADDokumen60 halamanOrganizational Study On STATE BANK OF HYDERBADram100% (1)

- Summer Training Report ON Traning and Development Undertaken atDokumen71 halamanSummer Training Report ON Traning and Development Undertaken atbhavbhutiBelum ada peringkat

- A Project Report On: Working Capital Management in Contract Broiler Farming SectorDokumen66 halamanA Project Report On: Working Capital Management in Contract Broiler Farming SectorIas Prasad Ganesh Gavhane0% (1)

- Share Market and Mutual Fund " For: "A Study of Performance and Investors Opinion AboutDokumen73 halamanShare Market and Mutual Fund " For: "A Study of Performance and Investors Opinion AboutakshayBelum ada peringkat

- 1NH19MBA17Dokumen71 halaman1NH19MBA17Shreyash GaikwadBelum ada peringkat

- Project Report ON: Financial Analysis of DLF, Unitech & Ansal ApiDokumen61 halamanProject Report ON: Financial Analysis of DLF, Unitech & Ansal Apiprachi158Belum ada peringkat

- Financial Analysis OF International Tractors Limited HoshiarpurDokumen20 halamanFinancial Analysis OF International Tractors Limited HoshiarpurAndrew MeyerBelum ada peringkat

- Final FinanceDokumen95 halamanFinal FinanceSagar ChauhanBelum ada peringkat

- My New Report - Edit 2Dokumen61 halamanMy New Report - Edit 2Akhlad IqbalBelum ada peringkat

- 1 Patanjali Content 13 MAYDokumen7 halaman1 Patanjali Content 13 MAYSumit GuptaBelum ada peringkat

- Project Report 34Dokumen73 halamanProject Report 34Suchitra Kumari NayakBelum ada peringkat

- Summer Internship Project - Swastika Investmart Limited.Dokumen50 halamanSummer Internship Project - Swastika Investmart Limited.Ronak Jain100% (3)

- Study On Working Capital ManagementDokumen68 halamanStudy On Working Capital ManagementShaRiq KhAnBelum ada peringkat

- IrshadDokumen82 halamanIrshadRupali BoradeBelum ada peringkat

- Study of Online Trading OcrDokumen111 halamanStudy of Online Trading OcrD J GamingBelum ada peringkat

- SIP Soft Copy - (FINAL) SakshiDokumen58 halamanSIP Soft Copy - (FINAL) SakshiimsakshibajajBelum ada peringkat

- Uday Marketing Final Project 2022Dokumen72 halamanUday Marketing Final Project 2022Vivan JainBelum ada peringkat

- Study On Financial Statement AnalysisDokumen95 halamanStudy On Financial Statement Analysispeter sumanthBelum ada peringkat

- Project Report On Costing and Cost ReductionDokumen51 halamanProject Report On Costing and Cost ReductionNiraj TulaskarBelum ada peringkat

- Project Report Sanu New PDFDokumen87 halamanProject Report Sanu New PDFSadhanaBelum ada peringkat

- Recruitment and Selection Process in PepsiCoDokumen80 halamanRecruitment and Selection Process in PepsiCoprasanth shanmugam0% (5)

- A Study On "Market Potential in Indian Stock Markets" With Special Reference To (Karvy Stock Broking Ltd. Visakhapatnam)Dokumen109 halamanA Study On "Market Potential in Indian Stock Markets" With Special Reference To (Karvy Stock Broking Ltd. Visakhapatnam)Ramesh SahukariBelum ada peringkat

- A Project Report On Comparative Study inDokumen82 halamanA Project Report On Comparative Study inBhawna Rajput100% (1)

- Comparative Study in Equity Schemes of Various Companies Mutual FundDokumen82 halamanComparative Study in Equity Schemes of Various Companies Mutual FundJayesh PatelBelum ada peringkat

- New SIP RECRUITMENT AND SELECTION Samsung Electronics HR RESEARCHDokumen99 halamanNew SIP RECRUITMENT AND SELECTION Samsung Electronics HR RESEARCHUplaksh KumarBelum ada peringkat

- 1-6 Starting Pages Rupanshi Completed.........Dokumen6 halaman1-6 Starting Pages Rupanshi Completed.........himanshu.ahirwarfeaBelum ada peringkat

- SVT Report - First Few PagesDokumen19 halamanSVT Report - First Few PagesRohitBelum ada peringkat

- Sip Report DhanshreeDokumen27 halamanSip Report DhanshreeSandesh GajbhiyeBelum ada peringkat

- Business Process Analysis of Kotak SecuritiesDokumen98 halamanBusiness Process Analysis of Kotak SecuritiesROHIT SINGH0% (1)

- "To Study of Inventory Management With Referance To Bajaj Auto LTD, Nigdi, PuneDokumen17 halaman"To Study of Inventory Management With Referance To Bajaj Auto LTD, Nigdi, Puneshrikrushna javanjalBelum ada peringkat

- Customer Perception Towards Trading in SharekhanDokumen37 halamanCustomer Perception Towards Trading in SharekhanSuraj Pratap SinghBelum ada peringkat

- Final SIP Project LOKESHDokumen46 halamanFinal SIP Project LOKESHshrikrushna javanjalBelum ada peringkat

- A Project Report MbaDokumen21 halamanA Project Report MbaDebBelum ada peringkat

- Project ReportDokumen149 halamanProject ReportShreyansh RavalBelum ada peringkat

- PROJECT REPORT-1814511 (Ankita Saini)Dokumen64 halamanPROJECT REPORT-1814511 (Ankita Saini)Ankit KumarBelum ada peringkat

- A Summer Internship Project ReportDokumen92 halamanA Summer Internship Project ReportSusmita NayakBelum ada peringkat

- Ratio AnalysisDokumen90 halamanRatio AnalysisJayavardhan 2B1 8Belum ada peringkat

- 14 Harshdeep PandeDokumen61 halaman14 Harshdeep PandepopliyogeshanilBelum ada peringkat

- OutputDokumen50 halamanOutputNeha toshniwalBelum ada peringkat

- WIP Final - 1 - 1Dokumen41 halamanWIP Final - 1 - 1deepak gusainBelum ada peringkat

- Enterprise Resource Planning: Fundamentals of Design and ImplementationDari EverandEnterprise Resource Planning: Fundamentals of Design and ImplementationBelum ada peringkat

- Project Managers’ Leadership Styles in Information Technology Sector of PakistanDari EverandProject Managers’ Leadership Styles in Information Technology Sector of PakistanBelum ada peringkat

- CUP Collected Writings Keynes-Flyer & StockDokumen3 halamanCUP Collected Writings Keynes-Flyer & StockdulixuexiBelum ada peringkat

- ANSWERS Calculate Expected Return and Standard Deviation For Individual Stocks and PortfoliosDokumen3 halamanANSWERS Calculate Expected Return and Standard Deviation For Individual Stocks and PortfoliosKashifBelum ada peringkat

- Aether Analytics October ConspectusDokumen73 halamanAether Analytics October ConspectusAlex Bernal, CMTBelum ada peringkat

- MF DistributorsDokumen13 halamanMF DistributorsjvmuruganBelum ada peringkat

- GM7 School of Business and Management, Institut Teknologi Bandung, Jakarta EmailDokumen14 halamanGM7 School of Business and Management, Institut Teknologi Bandung, Jakarta EmailTri Septia Rahmawati KaharBelum ada peringkat

- Statement of Title To The Lands of Ballyogloghs in The County of AntrimDokumen6 halamanStatement of Title To The Lands of Ballyogloghs in The County of AntrimNevinBelum ada peringkat

- Reliance Life InsuranceDokumen89 halamanReliance Life InsuranceGaurav2853090% (10)

- Indian Weekender #63Dokumen40 halamanIndian Weekender #63Indian Weekender100% (1)

- Non-Agency Mbs PrimerDokumen50 halamanNon-Agency Mbs Primerab3rd100% (1)

- Mother Dairy: Creating A National Footprint: POLITICAL FactorsDokumen2 halamanMother Dairy: Creating A National Footprint: POLITICAL FactorsAkankshaAhujaBelum ada peringkat

- Thinking Fast and SlowDokumen13 halamanThinking Fast and SlowRamanjeet Singh55% (11)

- Feasibility Report Parts and FunctionDokumen12 halamanFeasibility Report Parts and FunctionAldrian Ala75% (4)

- Sulekha - Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentDokumen2 halamanSulekha - Sept 25, 2008 - Qualified Institutional Placements Value Down 42 PercentJagannadhamBelum ada peringkat