NCF Shqdljxo NPI Flash Report 3q09

Diunggah oleh

Sparkie6678Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

NCF Shqdljxo NPI Flash Report 3q09

Diunggah oleh

Sparkie6678Hak Cipta:

Format Tersedia

NPI Snapshot

3rd Quarter 2009

Market Value

3rd Quarter 2nd Quarter

($ Millions) Number of 1 Year

2009 2009

Percent of Total Properties Returns

Returns Returns

NCREIF Property Index

Total Index 243,818.3 6,186 Total -3.32 -5.20 -22.1

100.0% Income 1.56 1.50 5.8

Appreciation -4.88 -6.70 -26.7

Property Type Subindexes

Apartment 59,096.5 1,463 Total -3.00 -5.13 -23.0

24.2% Income 1.34 1.31 5.0

Appreciation -4.34 -6.44 -27.0

Hotel 4,756.7 77 Total -4.47 -5.46 -26.4

2.0% Income 1.12 1.23 4.3

Appreciation -5.59 -6.69 -29.8

Industrial 37,091.1 2,195 Total -3.94 -5.09 -22.4

15.2% Income 1.73 1.67 6.5

Appreciation -5.68 -6.76 -27.5

Office 88,747.8 1,499 Total -3.30 -6.52 -24.5

36.4% Income 1.63 1.56 5.9

Appreciation -4.93 -8.08 -29.1

Retail 54,126.2 952 Total -3.14 -3.03 -15.8

22.2% Income 1.60 1.53 6.2

Appreciation -4.75 -4.56 -21.0

Regional Subindexes

East 80,719.5 1,419 Total -2.44 -5.21 -23.5

33.1% Income 1.54 1.49 5.6

Appreciation -3.98 -6.71 -27.9

Midwest 25,808.6 871 Total -2.43 -4.46 -17.9

10.6% Income 1.69 1.61 6.3

Appreciation -4.12 -6.07 -23.1

South 51,695.6 1,779 Total -3.15 -4.60 -18.9

21.2% Income 1.58 1.55 6.1

Appreciation -4.73 -6.15 -23.9

West 85,594.5 2,117 Total -4.49 -5.75 -23.7

35.1% Income 1.52 1.45 5.7

Appreciation -6.01 -7.21 -28.1

1 of 2

NPI Snapshot

3rd Quarter 2009

NCREIF Property Index Methodology

• Calculations are based on quarterly returns of individual properties before deduction of investment

management fees.

• Each property’s return is weighted by its market value.

• Income and Capital Appreciation changes are also calculated.

Universe of Properties

• All properties have been acquired on behalf of tax-exempt institutions and held in a fiduciary

environment.

• All Data Contributing Members of NCREIF must submit all properties held in the U.S. (including

properties in taxable accounts and in all “lifecycles”), but only qualifying properties enter the NPI.

• Qualifying properties include:

- Wholly owned and joint venture investments.

- Existing properties only-no development projects.

- Only investment-grade, income-producing, operating properties: apartments, hotels, industrial,

office, and retail.

• The database increases quarterly as participants acquire properties and as new members join NCREIF.

• Sold properties are removed from the Index in the quarter the sales take place (historical data

remains).

• Each property’s market value is determined by real estate appraisal methodology, consistently

applied.

Rates of Return

• Total Return: includes appreciation (or depreciation), realized capital gain (or loss) and income. It is

computed by adding the Income return and Capital Appreciation return on a quarterly basis.

• Income Return: measures the portion of total return attributable to each property ’s net operating

income or NOI. It is computed by dividing NOI by the average quarterly investment for the quarter.

NOI

Beginning Market Value + 1/2 Capital Improvements - 1/2 Partial Sales - 1/3 NOI

• Capital Appreciation Return: measures the change in market value adjusted for any capital

improvements or partial sales for the quarter.

(Ending Market Value - Beginning Market Value) + Partial Sales - Capital Improvements

Beginning Market Value + 1/2 Capital Improvements - 1/2 Partial Sales - 1/3 NOI

The underlying data and text has been obtained from sources considered to be reliable; the information is

believed to be accurate, but is not guaranteed. This report is for information purposes only and is not to

be an offer, solicitation, or recommendation with respect to the purchase or sale of any security or a

recommendation of the services supplied by any money management organization. Past performance is

no guarantee of future results.

2 of 2

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Maths ProjectDokumen22 halamanMaths ProjectANSHIT GUPTA70% (254)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Business Finance - Midterm Exams Problem 3Dokumen2 halamanBusiness Finance - Midterm Exams Problem 3Rina Lynne BaricuatroBelum ada peringkat

- E Waste RecyclingDokumen49 halamanE Waste RecyclingaskmeeBelum ada peringkat

- Consumer Math Score GuidesDokumen30 halamanConsumer Math Score GuidesCrystal WelchBelum ada peringkat

- Agad-Mabato DigestDokumen60 halamanAgad-Mabato DigestReuben EscarlanBelum ada peringkat

- AKIJ Capital LTDDokumen9 halamanAKIJ Capital LTDRafat SafayetBelum ada peringkat

- Detailed Project Report For: Bus - OfficeDokumen15 halamanDetailed Project Report For: Bus - OfficeRohit ManeBelum ada peringkat

- Credit Risk: Credit Relationship Manager Chief Risk Officer Disagree Over The Proposal Have To Wait LongerDokumen3 halamanCredit Risk: Credit Relationship Manager Chief Risk Officer Disagree Over The Proposal Have To Wait LongerAfriyantiHasanahBelum ada peringkat

- Acctng 1 pt1 NmarasignaDokumen3 halamanAcctng 1 pt1 NmarasignaMarielle Red AlmarioBelum ada peringkat

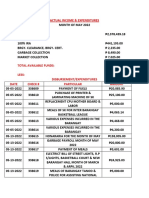

- Actual Income & ExpendituresDokumen5 halamanActual Income & Expendituressan nicolas 2nd betis guagua pampangaBelum ada peringkat

- Cap Bud - UltDokumen11 halamanCap Bud - UltKhaisarKhaisarBelum ada peringkat

- Impact of GST On Supply Chains in India: MBA (Logistics & Supply Chain Management)Dokumen52 halamanImpact of GST On Supply Chains in India: MBA (Logistics & Supply Chain Management)Anuj Bali80% (5)

- Employees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationDokumen3 halamanEmployees' State Insurance Corporation E-Pehchan Card: Insured Person: Insurance No.: Date of RegistrationJayakrishnan JBelum ada peringkat

- Shankarlal Agrawal College of Management Studies Gondia (M.S.)Dokumen86 halamanShankarlal Agrawal College of Management Studies Gondia (M.S.)Ravi JoshiBelum ada peringkat

- Tally Notes - Basic Accounting PDFDokumen31 halamanTally Notes - Basic Accounting PDFSudhir Kumar100% (1)

- 1369920797-5. Altman Model - FullDokumen6 halaman1369920797-5. Altman Model - FullShubhamAgarwalBelum ada peringkat

- International Entry Modes: Shikha SharmaDokumen32 halamanInternational Entry Modes: Shikha SharmashikhagrawalBelum ada peringkat

- Curriculum Vita PDFDokumen5 halamanCurriculum Vita PDFNur AbdallahBelum ada peringkat

- Grade 11 Acc - Summary Atp 2024Dokumen4 halamanGrade 11 Acc - Summary Atp 2024tapiwamakamure2Belum ada peringkat

- Chapter 9: The Analysis of Competitive MarketsDokumen46 halamanChapter 9: The Analysis of Competitive Marketsmas_999Belum ada peringkat

- HDFCDokumen10 halamanHDFCNishant ThakkarBelum ada peringkat

- Work Sheet AnalysisDokumen7 halamanWork Sheet AnalysisMUHAMMAD ARIF BASHIRBelum ada peringkat

- Income Taxation NotesDokumen33 halamanIncome Taxation NotesMa Yra YmataBelum ada peringkat

- 2014 - Quiz 3Dokumen12 halaman2014 - Quiz 3rohitmahato10Belum ada peringkat

- Chapter 10 Shareholders EquityDokumen10 halamanChapter 10 Shareholders EquityMarine De CocquéauBelum ada peringkat

- Baskin Horror Decision TreeDokumen9 halamanBaskin Horror Decision Treespectrum_480% (2)

- Why Engineers Need To Understand The Financial Statements?: Contemporary Engineering Economics, 5th Edition. ©2010Dokumen8 halamanWhy Engineers Need To Understand The Financial Statements?: Contemporary Engineering Economics, 5th Edition. ©2010GhostBelum ada peringkat

- R V Airbus Statement of Facts PDFDokumen40 halamanR V Airbus Statement of Facts PDFThavam RatnaBelum ada peringkat

- IRJAF Case Studies in Finance and Accounting Vol IIDokumen187 halamanIRJAF Case Studies in Finance and Accounting Vol IIHammad Mian100% (1)

- EconomicsDokumen6 halamanEconomicsRishav ChoudharyBelum ada peringkat