Lecture 9 ABC, CVP

Diunggah oleh

Shweta SridharJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Lecture 9 ABC, CVP

Diunggah oleh

Shweta SridharHak Cipta:

Format Tersedia

BU8101 Accounting: A User Perspective

Lecture 9

ACTIVITY-BASED COSTING (ABC)

COST-VOLUME-PROFIT ANALYSIS (CVP)

Compulsory Reading:

WHB Chapter 17 & 20

Other Reference:

Financial & Managerial Accounting

Wild and Chiappetta

Chapters 17, 18

9-1

Lecture date: 18 March, 2013

Lecture Outline

I. ACTIVITY-BASED COSTING (ABC)

a. Traditional Plant-wide, Single Overhead Rate

b. ABC Multiple Overhead Rates

c. Comparison between Traditional Costing vs. ABC

II. COST-VOLUME-PROFIT ANALYSIS (CVP)

a. Costs and Cost Behaviors

b. Contribution Margin Income Statement

c. Break-even Analysis

d. Business Applications of CVP

9-2

Manufacturing Manufacturing

Overhead

(estimate)

Job No. 1 Job No. 1

Job No. 2 Job No. 2

Job No. 3 Job No. 3

Charge direct

costs to each job

Charge direct

material and

direct labor

costs to each job

as work is

performed

Direct Materials Direct Materials

(actual)

Direct Labor Direct Labor

(actual)

I. Activity-Based Costing (ABC)

Apply overhead

to each job using

a predetermined

Apply overhead

to each job using

a predetermined

rate (POHR)

RECAP: Manufacturing Cost Flow

9-3

Traditional Costing System

9-4

Traditional cost systems were created when manufacturing

processes were labor intensive.

A single, company-wide overhead rate based on direct labor hours

may be used to allocate overhead costs to products in these labor-

intensive processes.

Today, manufacturing processes are highly automated and direct

labor costs have become less significant.

Is it still appropriate to use direct labor hours to allocate overhead

costs?

Traditional Costing System

Overhead Cost

Indirect

Costs

Cost

Allocation

Base

Single Plant-Wide

Overhead Rate

Cost

Objects

Product 1 Product 2

Product 3

9-5

Traditional Costing System

Advantages

Information is readily

available

Easy to implement

Often sufficient to meet

external financial

reporting needs

Disadvantages

Overhead costs may

not bear any

relationship with direct

labor hours

All products may not

use overhead costs in

the same proportion

9-6

How to improve OH allocation?

Traditional

Costing

Traditional vs. ABC Method

9-7

ABC Costing

ActivityBased Costing

In the ABC method, we recognize that many activities

within a department drive overhead costs.

9-8

Activity

An event that causes the

consumption of overhead

resources.

A cost bucket in which

costs related to a single

activity measure are

accumulated.

Activities and Cost Pools

Activity

Cost

Pool

9-9

Repair and Maintenance of

Equipment

$100,000

POHR

=

Multiple Overhead

Categories

Multiple POHR

9-10

Cost Pools Cost Drivers

Materials purchasing Number of purchase orders

Materials handling Number of materials

requisitions

Personnel processing Number of employees hired

or laid off

Equipment depreciation Number of products

produced or hours of use

Quality inspection Number of units inspected

Indirect labor for Number of setups required

equipment setups

Engineering costs for Number of modifications

product modifications

Cost Driver: activity that leads to the incurrence of costs

Cost Pools and Cost Drivers

9-11

Overhead Actual

Rate Activity

Rate =

Estimated overhead costs in activity cost pool

Estimated number of activity units

ABC: 5-step Computation

9-12

1. Identify activities that consume resources.

2. Assign costs to a cost pool for each activity.

3. Identify cost drivers / cost allocation base

associated with each activity.

4. Compute overhead rate for each cost pool:

5. Assign costs to products:

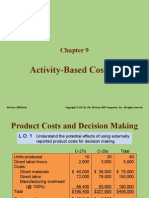

Example: Traditional Costing vs. ABC

Pear Company manufactures a product in regular and

deluxe models. Overhead is assigned on the basis of

direct labor hours. Budgeted overhead for the current

year is $2,000,000. Other information:

Deluxe Regular

Model Model

Direct Material 150 $ 112 $

Direct Labor Cost 16 8

Direct Labor Time 1.6 hours 0.8 hours

Expected Volume (units) 5,000 40,000

Lets determine the unit cost of each model using

traditional costing methods.

9-13

1 : 8

Direct

Labor Hours

Deluxe Model 5,000 units @ 1.6 hours 8,000

Regular Model 40,000 units @ 0.8 hours 32,000

Total Direct Labor Hours (DLH) 40,000

Overhead Estimated overhead costs

Rate Estimated activity base

=

$2,000,000

40,000 DLH

=

$50 per DLH

Traditional Costing

=

9-14

Deluxe Regular

Model Model

Direct Material 150 $ 112 $

Direct Labor 16 8

Manufacturing Overhead

$50 per hour 1.6 hours 80

$50 per hour 0.8 hours 40

Total Unit Cost 246 $ 160 $

ABC will have different

overhead per unit.

Traditional Costing

9-15

Activity-Based Costing

Pear Company plans to adopt activity-based costing. Using

the following activity center data, determine the unit cost of

the two products using activity-based costing.

Overhead

Activity Cost for Cost Units of Activity

Cost Pool Activity Driver Deluxe Regular

Purchasing 84,000 $ Orders 400 800

Scrap Rework 216,000 Orders 300 600

Testing 450,000 Tests 4,000 11,000

Machine Related 1,250,000 Hours 20,000 30,000

Total Overhead 2,000,000 $

Step 1

Identify

Activities

Step 2

Assign cost to

Cost Pools

Step 3

Identify

Cost Driver

9-16

Overhead Units

Activity Cost Cost for of

Cost Pool Driver Activity Activity Rate

Purchasing Orders 84,000 $ 1,200 $ 70 per order

Scrap Rework Orders 216,000 900 $240 per order

Testing Tests 450,000 15,000 $ 30 per test

Machine Related Hours 1,250,000 50,000 $ 25 per hour

Total Overhead 2,000,000 $

Rate = Overhead Cost for Activity Units of Activity

Step 4

Compute

POHR

Activity-Based Costing

9-17

400 deluxe + 800 regular = 1,200

Deluxe Model Regular Model

Actual Cost Actual Cost

Activity Units of Allocated Units of Allocated

Cost Pool Rate Activity to Product Activity to Product

Purchasing $ 70/order 400 28,000 $ 800 56,000 $

Scrap Rework $240/order 300 ? 600 ?

Testing $ 30/test 4,000 ? 11,000 ?

Machine Related $ 25/hour 20,000 ? 30,000 ?

Total Overhead ? ?

Cost Allocated to Product = Rate (POHR) x Actual Units of Activity

Step 5

Allocate cost

to product

Activity-Based Costing

9-18

Deluxe Model Regular Model

Actual Cost Actual Cost

Activity Units of Allocated Units of Allocated

Cost Pool Rate Activity to Product Activity to Product

Purchasing $ 70/order 400 28,000 $ 800 56,000 $

Scrap Rework $240/order 300 72,000 600 144,000

Testing $ 30/test 4,000 120,000 11,000 330,000

Machine Related $ 25/hour 20,000 500,000 30,000 750,000

Total Overhead 720,000 $ 1,280,000 $

Cost Allocated to Product = Rate (POHR) Actual Units of Activity

Total overhead = $720,000 + $1,280,000 = $2,000,000

Recall that $2,000,000 was the original amount of overhead

assigned to the products using traditional costing.

9-19

Overhead Costs Assigned to Products:

Deluxe Model $720,000 5,000 units = $144 per unit

Regular Model $1,280,000 40,000 units = $32 per unit

Deluxe Regular

Model Model

Direct Materials 150 $ 112 $

Direct Labor 16 8

Manufacturing Overhead 144 32

Total Unit Cost 310 $ 152 $

Overhead Costs Assigned to Products:

Deluxe Model $720,000 5,000 units = $144 per unit

Regular Model $1,280,000 40,000 units = $32 per unit

Deluxe Regular

Model Model

Direct Materials 150 $ 112 $

Direct Labor 16 8

Manufacturing Overhead 144 32

Total Unit Cost 310 $ 152 $

Activity-Based Costing

9-20

This result is not uncommon when ABC is used.

Many companies have found that low-volume, specialized products

have greater overhead costs than previously realized.

Traditional Costing ABC

Deluxe Regular Deluxe Regular

Model Model Model Model

Direct materials 150 $ 112 $ 150 $ 112 $

Direct labor 16 8 16 8

Overhead 80 40 144 32

Total cost 246 $ 160 $ 310 $ 152 $

Traditional Costing vs. ABC

9-21

Cost

Distortions

Activity Levels

Activity Cost Consumption Consumption

Cost Pool Driver Deluxe Ratio Regular Ratio

Purchasing Orders 400 33% 800 67%

Scrap Rework Orders 300 33% 600 67%

Testing Tests 4,000 27% 11,000 73%

Machine Related Hours 20,000 40% 30,000 60%

ABC Consumption Ratios

Proportion of each activity consumed by a product.

Physical Units

Deluxe Regular

5,000 40,000

1 : 8

11% 89%

Deluxe model consumes more

overhead resoures and should be

allocated more overhead costs!

9-22

Advantages and Disadvantages of ABC

Advantages

More accurate

overhead cost allocation

More effective overhead

cost control

Many uses: service

firms, customer

profitability studies (eg,

marketing/distribution/

customer service costs)

Disadvantages

Costs to implement and

maintain

Complexity may hamper

support for

implementation

9-23

II. Cost-Volume-Profit Analysis (CVP)

Understanding Costs

Fixed Costs

Variable Costs

Semivariable /

Mixed Costs

Cost behavior

Relationship between cost and activity level (eg, output).

How a cost behaves or changes as the amount of output changes

within the relevant range.

9-24

Total fixed costs

remain constant as

activity increases.

Number of Local Calls

M

o

n

t

h

l

y

B

a

s

i

c

T

e

l

e

p

h

o

n

e

B

i

l

l

Cost per call

declines as

activity increases.

Number of Local Calls

M

o

n

t

h

l

y

B

a

s

i

c

T

e

l

e

p

h

o

n

e

B

i

l

l

p

e

r

L

o

c

a

l

C

a

l

l

Fixed Costs

Total FC FC per unit

9-25

Variable Costs

Total variable

costs increase as

activity increases.

Minutes Talked

C

o

s

t

p

e

r

M

i

n

u

t

e

Minutes Talked

Cost per Minute

is constant as

activity increases.

T

o

t

a

l

L

o

n

g

D

i

s

t

a

n

c

e

T

e

l

e

p

h

o

n

e

B

i

l

l

Total VC VC per unit

9-26

Variable Costs Fixed costs

Per Unit

Remains the same even when

activity level changes.

Changes as activity level

changes.

Total

Changes as activity level

changes.

Remains the same over wide

ranges of activity.

Variable Cost vs. Fixed Cost

9-27

Quick Check

Which of the following statements about cost

behavior are true?

a. Fixed costs per unit vary with the level of activity.

b. Variable costs per unit are constant within the

relevant range.

c. Total fixed costs are constant within the relevant

range.

d. Total variable costs are constant within the relevant

range.

9-28

Semivariable Costs (Mixed Costs)

Mixed costs contain a fixed portion that is

incurred even when facility is unused, and a

variable portion that increases with usage.

Example: monthly electric utility charge

Fixed service fee

Variable charge per

kilowatt hour used

9-29

Variable

Utility Charge

Activity (Kilowatt Hours)

T

o

t

a

l

U

t

i

l

i

t

y

C

o

s

t

Fixed Monthly

Utility Charge

Slope is

variable cost

per unit

of activity.

Semivariable Costs (Mixed Costs)

9-30

Separating Semivariable Cost

Accounting records typically show only the total cost and the

associated amount of activity of a semivariable (mixed) cost

item.

Separate mixed costs into their fixed and variable components

for cost estimation purposes. E.g. Budgeting, CVP analysis.

Methods:

High-low

Scattergraph method

Method of least squares (regression analysis)

Managerial judgments

9-31

Total Cost

=

Total Fixed Cost

+

Total Variable Cost

Total Cost

= Total Fixed Cost + Variable Rate x Output

Separating Semivariable Cost

The Cost Formula

9-32

The High-Low Method

Matrix, Inc. recorded the following production activity and

maintenance costs for two months:

Using these two levels of activity, compute:

1. the variable cost per unit.

2. the total fixed cost.

3. total cost formula.

Units Cost

High activity level 9,000 9,700 $

Low activity level 5,000 6,100

Change / Difference 4,000 3,600 $

9-33

Units Cost

High activity level 9,000 9,700 $

Low activity level 5,000 6,100

Change 4,000 3,600 $

1. Unit variable cost = = = $0.90 per unit

2. Fixed cost = Total cost Total variable cost

Using High activity level

Fixed cost = $9,700 ($0.90 per unit 9,000 units)

Fixed cost = $9,700 $8,100 = $1,600

3. Total cost = $1,600 + $.90 per unit

in cost

in units

$3,600

4,000

The High-Low Method

9-34

Used primarily for

external reporting

Used primarily for

internal decision making

Both formats report the same Operating Income!

Different Income Statement Formats

9-35

Total Unit

Sales Revenue 100,000 $ 50 $

Less: Variable costs 60,000 30

Contribution margin 40,000 $ 20 $

Less: Fixed costs 30,000

Operating income 10,000 $

The contribution margin format emphasizes cost behavior.

Contribution margin covers fixed costs

and provides for income.

Contribution Margin (CM) = Sales Variable Costs

The Contribution Margin Format

9-36

Contribution Margin Ratio (CMR) =

Contribution Margin

Sales

Contribution Margin Ratio (CMR) =

Contribution Margin

Sales

The Contribution Margin Format

Now that youve learnt Cost Behaviors and CM format income

statement, lets start making some decisions..

9-37

CVP for Decision Making

Cost-volume-profit (CVP) analysis is used to

answer questions such as:

How will income be affected if I increase selling

prices or reduce costs? (cost)

What will happen to profitability if I expand

capacity? (volume)

How much must I sell to earn my desired income?

(profit)

How will income be affected if I reduce selling

prices to increase sales volume?

9-38

CVP: Computing Break-Even Point

The break-even point (expressed in units of

product or dollars of sales) is the unique

sales level at which a company neither

earns a profit nor incurs a loss.

9-39

Volume in Units

C

o

s

t

s

a

n

d

R

e

v

e

n

u

e

i

n

D

o

l

l

a

r

s

Break-even

Point

Profit

Loss

Break-Even Point

A Graphical Representation

9-40

Total Revenue

Total Cost

How Many Units Must We Sell to Break-Even?

Break-even

point in units

Fixed costs

Contribution margin per unit

Unit sales price - unit variable cost Unit sales price - unit variable cost

($50 $30 = $20 in previous example)

=

9-41

The break-even formula may also be

expressed in sales dollars.

Unit contribution margin

Unit sales price

How Much Sales Dollars to Break-Even?

Break-even

point in dollars

Fixed costs

Contribution margin ratio

=

9-42

ABC Co. sells product XYZ at $5.00 per unit. If

fixed costs are $200,000 and variable costs are

$3.00 per unit, how many units must be sold to

break even?

a. 100,000 units

b. 40,000 units

c. 200,000 units

d. 66,667 units

Computing Break-Even Sales Units

9-43

Use the contribution margin ratio formula to

determine the amount of sales revenue ABC must

have to break even. All information remains

unchanged: fixed costs are $200,000; unit sales

price is $5.00; and unit variable cost is $3.00.

a. $200,000

b. $300,000

c. $400,000

d. $500,000

Computing Break-Even Sales Dollars

9-44

Computing Sales Needed to Achieve

Target Operating Income

Break-even formulas may be adjusted to Break-even formulas may be adjusted to

show the sales volume needed to earn

any amount of operating income.

Break-even

Units =

Fixed costs + Target income

Contribution margin per unit

Fixed costs + Target income

Contribution margin ratio

9-45

Break-even

Sales Dollars =

ABC Co. sells product XYZ at $5.00 per unit. If fixed

costs are $200,000 and variable costs are $3.00 per

unit, how many units must be sold to earn

operating income of $40,000?

a. 100,000 units

b. 120,000 units

c. 80,000 units

d. 200,000 units

Computing Sales Needed to Achieve

Target Operating Income

9-46

Related Concept: Margin of Safety

Margin of safety is the amount by which sales may

decline before reaching break-even sales:

The dollar amount by which Sales can decrease before

the company incurs a loss.

Margin of safety = Actual sales Break-even sales

9-47

Total Per Unit Percent

Sales (500 bikes) 250,000 $ 500 $ 100%

Less: variable expenses 150,000 300 60%

Contribution margin 100,000 $ 200 $ 40%

Less: fixed expenses 80,000

Operating income 20,000 $

Business Applications of CVP

Consider the following information developed by the

accountant at Speedo, a bicycle retailer:

9-48

Should Speedo spend $12,000 on advertising to

increase sales by 10 percent?

Total Per Unit Percent

Sales (500 bikes) 250,000 $ 500 $ 100%

Less: variable expenses 150,000 300 60%

Contribution margin 100,000 $ 200 $ 40%

Less: fixed expenses 80,000

Operating income 20,000 $

9-49

500 550

Bikes Bikes

Sales 250,000 $ 275,000 $

Less: variable expenses 150,000 165,000

Contribution margin 100,000 $ 110,000 $

Less: fixed expenses 80,000 92,000

Operating income 20,000 $ 18,000 $

550 $300

$80K + $12K

No!

Income has decreased.

550 $500

Should Speedo spend $12,000 on advertising to

increase sales by 10 percent?

9-50

500 625

Bikes Bikes

Sales 250,000 $ 281,250 $

Less: variable expenses 150,000 187,500

Contribution margin 100,000 $ 93,750 $

Less: fixed expenses 80,000 92,000

Operating income 20,000 $ 1,750 $

625 $300

$80K + $12K

No!

Income has decreased even more.

625 $450

Now, in combination with the advertising,

Speedo is considering a 10 percent price reduction that will

increase sales by 25 percent.

What is the effect on income ?

1.25 500

9-51

500 750

Bikes Bikes

Sales 250,000 $ 337,500 $

Less: variable expenses 150,000 243,750

Contribution margin 100,000 $ 93,750 $

Less: fixed expenses 80,000 42,000

Operating income 20,000 $ 51,750 $

Yes!

The combination of advertising, a price cut,

and change in compensation increases income.

750 ($300+25)

$80K+$12K-$50K

750 $450

Now, in combination with advertising and a 10% price cut,

Speedo will replace $50,000 in sales salaries with

a $25 per bike commission, increasing sales by 50 percent

above the original 500 bikes. What is the effect on income?

1.5 500

9-52

CVP

Multiple Products

Different products have different selling prices,

Sales mix is the relative combination in which

a companys different products are sold.

Different products have different selling prices,

costs, and contribution margins.

If Speedo sells bikes and roller blades, how

will we deal with break-even analysis?

9-53

Multiple Products

Break-even in Sales Dollars

The overall contribution margin ratio is:

= 48% (rounded)

Bikes Roller Blades Total

Sales 250,000 $ 100% 300,000 $ 100% 550,000 $ 100%

Var. exp. 150,000 60% 135,000 45% 285,000 52%

Contrib. margin 100,000 $ 40% 165,000 $ 55% 265,000 $ 48%

Fixed exp. 170,000

Net income 95,000 $

$265,000

$550,000

9-54

Weighted

CMR

=

Bikes Roller Blades Total

Sales 250,000 $ 100% 300,000 $ 100% 550,000 $ 100%

Var. exp. 150,000 60% 135,000 45% 285,000 52%

Contrib. margin 100,000 $ 40% 165,000 $ 55% 265,000 $ 48%

Fixed exp. 170,000

Operating income 95,000 $

Multiple Products

Break-even in Sales Dollars

9-55

= $354,167

(combined sales)

$170,000

.48

BE Sales

Dollars

=

Description

Breakeven

Sales

% of

Total

Individual

Sales

Bikes $354,167 45.0% $159,375

Roller Blades $354,167 55.0% $194,792

Total units $354,167

$250k/550k = 45% $300k/550k = 55%

Multiple Products

Break-even in Units

9-56

Bikes Roller Blades Total Units

Sales 250,000 $ 300,000 $ 550,000 $ 500

Var. exp. 150,000 135,000 285,000 300

CM 100,000 $ 165,000 $ 265,000 $ 800

Fixed exp. 170,000

Net income 95,000 $

CM / unit

$265,000

800

= = $331.25 (combined)

BE Sales

Units

= =

FC $170,000

$331.25

513.20 (combined)

Multiple Products

Break-even in Units

Description

Number of

Units

% of

Total

Bikes 500 62.5% (500 800)

Roller Blades 300 37.5% (300 800)

Total sold 800 100.0%

9-57

BE Sales (Units)

= 513.20 (combined)

Description

Breakeven

Units

% of

Total

Individual

Sales

Units

Bikes 513.20 62.5% 321

Roller Blades 513.20 37.5% 192

Total units 513

Check List

Do you have a good understanding of:

ABC

Activity-based costing (ABC) methodologies

Difference between traditional vs. ABC costing

CVP

Types of cost behaviour

Breakout mixed costs by using High-Low method

Break-even and CVP computations

Break-even computations for single product and

multiple products

END END

9-58

Anda mungkin juga menyukai

- The 123s of ABC in SAP: Using SAP R/3 to Support Activity-Based CostingDari EverandThe 123s of ABC in SAP: Using SAP R/3 to Support Activity-Based CostingBelum ada peringkat

- Ch04 Activity Based CostingDokumen52 halamanCh04 Activity Based CostingDaniel John Cañares LegaspiBelum ada peringkat

- Activity Based CostingDokumen52 halamanActivity Based CostingAfrina AfsarBelum ada peringkat

- Chapter 2 Activity Based Costing: 1. ObjectivesDokumen13 halamanChapter 2 Activity Based Costing: 1. ObjectivesNilda CorpuzBelum ada peringkat

- Cost Management: A Case for Business Process Re-engineeringDari EverandCost Management: A Case for Business Process Re-engineeringBelum ada peringkat

- MAHM6e Ch04.Ab - AzDokumen49 halamanMAHM6e Ch04.Ab - Azlita2703Belum ada peringkat

- Cost & Managerial Accounting II EssentialsDari EverandCost & Managerial Accounting II EssentialsPenilaian: 4 dari 5 bintang4/5 (1)

- Cost AacctDokumen19 halamanCost AacctKiraYamatoBelum ada peringkat

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageDari EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantagePenilaian: 5 dari 5 bintang5/5 (1)

- Study Objectives: Activity-Based CostingDokumen48 halamanStudy Objectives: Activity-Based Costingsueern100% (1)

- ABC Costing Lecture NotesDokumen12 halamanABC Costing Lecture NotesMickel AlexanderBelum ada peringkat

- A to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationDari EverandA to Z Cost Accounting Dictionary: A Practical Approach - Theory to CalculationBelum ada peringkat

- Study Objectives Study ObjectivesDokumen59 halamanStudy Objectives Study ObjectivesAiza S. Maca-umbosBelum ada peringkat

- Manufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesDari EverandManufacturing Wastes Stream: Toyota Production System Lean Principles and ValuesPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- ABC Hansen & Mowen ch4 P ('t':'3', 'I':'669594619') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Dokumen22 halamanABC Hansen & Mowen ch4 P ('t':'3', 'I':'669594619') D '' Var B Location Settimeout (Function ( If (Typeof Window - Iframe 'Undefined') ( B.href B.href ) ), 15000)Aziza AmranBelum ada peringkat

- Earned Value Project Management (Fourth Edition)Dari EverandEarned Value Project Management (Fourth Edition)Penilaian: 1 dari 5 bintang1/5 (2)

- ABC: A Tool for Better Decision MakingDokumen75 halamanABC: A Tool for Better Decision MakingNavleen Kaur100% (1)

- The Official Supply Chain Dictionary: 8000 Researched Definitions for Industry Best-Practice GloballyDari EverandThe Official Supply Chain Dictionary: 8000 Researched Definitions for Industry Best-Practice GloballyPenilaian: 4 dari 5 bintang4/5 (4)

- Activity Based CostingDokumen49 halamanActivity Based CostingEdson EdwardBelum ada peringkat

- Lecture 6 - ABC Costing RevisedDokumen22 halamanLecture 6 - ABC Costing RevisedMJ jBelum ada peringkat

- CH 14 SMDokumen21 halamanCH 14 SMRyan James B. Aban100% (1)

- Activity-Based Costing: Mcgraw-Hill/IrwinDokumen17 halamanActivity-Based Costing: Mcgraw-Hill/IrwinImran KhanBelum ada peringkat

- Lec4 ABCDokumen31 halamanLec4 ABCnathan panBelum ada peringkat

- Lecture 2 - Activity Based CostingDokumen38 halamanLecture 2 - Activity Based Costingmea_thermopolisBelum ada peringkat

- Pan African Enetwork Project: Master of Finance and ControlDokumen116 halamanPan African Enetwork Project: Master of Finance and ControlMr DamphaBelum ada peringkat

- Managerial Accounting, Fourth EditionDokumen48 halamanManagerial Accounting, Fourth EditionSpider177Belum ada peringkat

- Ma2 - Acca - Chapter 1Dokumen24 halamanMa2 - Acca - Chapter 1leducBelum ada peringkat

- ABC system eliminates cross-subsidies between productsDokumen5 halamanABC system eliminates cross-subsidies between productsWillen Christia M. MadulidBelum ada peringkat

- Lecture 2 Activity Based CostingDokumen6 halamanLecture 2 Activity Based Costingmaharajabby81Belum ada peringkat

- Mowen Chapter 4Dokumen49 halamanMowen Chapter 4Dhani SardonoBelum ada peringkat

- Activity-Based CostingDokumen49 halamanActivity-Based CostingKartika Wulandari IIBelum ada peringkat

- Cma CH 3 - Abc March 2019-1Dokumen43 halamanCma CH 3 - Abc March 2019-1Henok FikaduBelum ada peringkat

- Activity Based Costing: A Tool for Decision MakingDokumen20 halamanActivity Based Costing: A Tool for Decision MakingImmanuel Sultan Simanjuntak100% (2)

- Activity Based CostingDokumen33 halamanActivity Based CostingSujay Ravishankar GowdaBelum ada peringkat

- Activity-Based Costing Chapter04NPPTsDokumen49 halamanActivity-Based Costing Chapter04NPPTsDibakar DasBelum ada peringkat

- Group 6 PPT CaseDokumen33 halamanGroup 6 PPT CaseRavNeet KaUr100% (1)

- Activity Based Costing: By: Kasahun N. (M.SC.)Dokumen20 halamanActivity Based Costing: By: Kasahun N. (M.SC.)Mulugeta WoldeBelum ada peringkat

- Activity Based CostingDokumen40 halamanActivity Based CostingHaseeb JavedBelum ada peringkat

- CH 5 Test BankDokumen10 halamanCH 5 Test BankSehrish Atta100% (3)

- Activity-Based Costing (ABC) and Activity-Based ManagementDokumen60 halamanActivity-Based Costing (ABC) and Activity-Based ManagementRaden Bagoes Zow BoroBelum ada peringkat

- Activity Based CostingDokumen13 halamanActivity Based CostingAyushi NagoriBelum ada peringkat

- ABC Costing vs Traditional CostingDokumen27 halamanABC Costing vs Traditional CostingCriscel BogñalosBelum ada peringkat

- Activity-Based Costing and Customer Profitability AnalysisDokumen44 halamanActivity-Based Costing and Customer Profitability AnalysisKim DedicatoriaBelum ada peringkat

- ABC Costing: 4 Steps to Identify Activity Pools & DriversDokumen45 halamanABC Costing: 4 Steps to Identify Activity Pools & Driversrusfazairaaf100% (1)

- Activity Based Costing and Just in TimeDokumen120 halamanActivity Based Costing and Just in TimePaulo M.P. Harianja100% (2)

- Activity Based CostingDokumen32 halamanActivity Based CostingBhupesh DuaBelum ada peringkat

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 4Dokumen34 halamanSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 4jasperkennedy092% (37)

- PPC Ch. 4Dokumen20 halamanPPC Ch. 4Mulugeta WoldeBelum ada peringkat

- Activitybased Costing May 20 GMSISUCCESSDokumen29 halamanActivitybased Costing May 20 GMSISUCCESSChetan BasraBelum ada peringkat

- Activity Based CostingDokumen25 halamanActivity Based Costingttongoona3Belum ada peringkat

- Activity-Based CostingDokumen46 halamanActivity-Based CostingRiska A. ThamrinBelum ada peringkat

- Activity-Based Costing and Management for Improved Decision MakingDokumen55 halamanActivity-Based Costing and Management for Improved Decision MakingPawan PoynauthBelum ada peringkat

- Activity Based CostingDokumen52 halamanActivity Based CostingraviktatiBelum ada peringkat

- Abc & CVPDokumen17 halamanAbc & CVPSandesh BharadwajBelum ada peringkat

- ABC System Eliminates Product Cost DistortionDokumen16 halamanABC System Eliminates Product Cost DistortionPoint BlankBelum ada peringkat

- Activity Based CostingDokumen11 halamanActivity Based CostingAmie Jane MirandaBelum ada peringkat

- Seminar 13 Managerial Accounting Tools - Self Practice PDFDokumen1 halamanSeminar 13 Managerial Accounting Tools - Self Practice PDFShweta SridharBelum ada peringkat

- Classical Mechanics Homework 11Dokumen4 halamanClassical Mechanics Homework 11Shweta SridharBelum ada peringkat

- A Quantum Mechanic's ManualDokumen12 halamanA Quantum Mechanic's ManualShweta SridharBelum ada peringkat

- SUMS Elementary Number Theory (Gareth A. Jones Josephine M. Jones) PDFDokumen317 halamanSUMS Elementary Number Theory (Gareth A. Jones Josephine M. Jones) PDFtkov1100% (15)

- Classical Mechanics Homework 12Dokumen2 halamanClassical Mechanics Homework 12Shweta SridharBelum ada peringkat

- Mathematical Folk Humor Explored in Collection of Classic JokesDokumen11 halamanMathematical Folk Humor Explored in Collection of Classic JokesRavikiran B ABelum ada peringkat

- Zen Pencils PosterDokumen1 halamanZen Pencils PostershreyakediaBelum ada peringkat

- Lecture 9 ABC, CVP PDFDokumen58 halamanLecture 9 ABC, CVP PDFShweta SridharBelum ada peringkat

- Calculus: Fundamental TheoremDokumen4 halamanCalculus: Fundamental TheoremShweta SridharBelum ada peringkat

- Physics PHD Qualifying 97Dokumen8 halamanPhysics PHD Qualifying 97saliya_kumaraBelum ada peringkat

- Life's Little Instruction Book PDFDokumen45 halamanLife's Little Instruction Book PDFa7118683100% (5)

- Testing Born Rule For QMDokumen8 halamanTesting Born Rule For QMShweta SridharBelum ada peringkat

- Fall 2010 Part 1Dokumen10 halamanFall 2010 Part 1Shweta SridharBelum ada peringkat

- Ultrasound 1Dokumen8 halamanUltrasound 1Shweta SridharBelum ada peringkat

- HW1Dokumen1 halamanHW1Shweta SridharBelum ada peringkat

- ELECTROSTATICS PROBLEM SOLUTIONSDokumen22 halamanELECTROSTATICS PROBLEM SOLUTIONSsreejusl50% (2)

- ANT10Dokumen95 halamanANT10Shweta SridharBelum ada peringkat

- Classical Mechanics Homework 10Dokumen2 halamanClassical Mechanics Homework 10Shweta SridharBelum ada peringkat

- Groups and SymmetryDokumen68 halamanGroups and SymmetryHoogahBelum ada peringkat

- 2013 MidtermDokumen1 halaman2013 MidtermShweta SridharBelum ada peringkat

- Tutorial2 LineSurfVolIntDokumen2 halamanTutorial2 LineSurfVolIntShweta SridharBelum ada peringkat

- Bead On Hoop PDFDokumen26 halamanBead On Hoop PDFShweta SridharBelum ada peringkat

- Classical Mechanics by J J Binney 31pDokumen31 halamanClassical Mechanics by J J Binney 31pcrguntalilibBelum ada peringkat

- GroupsDokumen22 halamanGroupsShweta SridharBelum ada peringkat

- Physics 127a: Class Notes on Ideal Fermi Gas PropertiesDokumen7 halamanPhysics 127a: Class Notes on Ideal Fermi Gas PropertiesShweta SridharBelum ada peringkat

- Lecture 15 PDFDokumen7 halamanLecture 15 PDFShweta SridharBelum ada peringkat

- Lecture 19 PDFDokumen5 halamanLecture 19 PDFShweta SridharBelum ada peringkat

- Physics 127a class notes on fundamental postulateDokumen1 halamanPhysics 127a class notes on fundamental postulateShweta SridharBelum ada peringkat

- Thermo PDFDokumen1 halamanThermo PDFShweta SridharBelum ada peringkat

- Derivation of Fermi Energy PDFDokumen1 halamanDerivation of Fermi Energy PDFShweta SridharBelum ada peringkat