Fiscal Guide Madagascar

Diunggah oleh

Venkatesh GorurHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Fiscal Guide Madagascar

Diunggah oleh

Venkatesh GorurHak Cipta:

Format Tersedia

TAX

Madagascar

Fiscal Guide

2012/13

kpmg.com

Introduction:

Madagascar Fiscal Guide 2012/13

Income tax

Business income

Resident companies are taxable on their Madagascar-sourced income and their worldwide passive

income. Non-residents are taxed only on Madagascar-sourced income (i.e. all prots or income relating to

property which they own, activities which they carry on and prot-making transactions which they carry

out in Madagascar). A company is deemed resident if it is incorporated or has its seat in Madagascar.

An Individual is deemed to be resident in Madagascar where:

the individual has a dwelling in Madagascar which he owns or rents;

the individual does not have a dwelling in Madagascar but has a habitual abode there; or

the individual lives outside Madagascar and continues to receive income from an enterprise or entity

which he owns in Madagascar.

An individual resident in Madagascar will be subject to personal income tax on his worldwide income. An

individual who is not resident in Madagascar will be subject to tax only on Madagascar-sourced income.

Tax year

Tax year is freely determined by each company but, generally, it is on a calendar basis i.e. 1 January to

31 December.

The date of ling depends on the nancial year of the company involved:

Enterprises whose nancial year coincides with the calendar year: before 15 May of the following year

at the latest

Enterprises with a nancial year ending 30 June: before 15 November of the same year at the latest

Enterprises with a different nancial year: within the 4 months following the close of the nancial year

For an Individual with only employment income, tax on employment income is withheld at source and

is nal. An individual with non-employment income but exercising an independent activity and whose

annual turnover exceeds Ariary (Ar) 20 000 000 must le an annual return of income from the previous

year.

An individual or company exercising independent activities (farming, trade, crafts, services, liberal

profession, senior managing partner) generating an annual turnover less than Ar 20 000 000 must le an

annual return of income from the previous year.

Date of ling: Before 31 March of each year

Rate: 5% of the annual turnover

Rates

| 1

Resident corporate income tax 21%

Non-resident corporate income tax 10%

Resident individuals:

1. Salary up to MGA 250 000 0%

2.Salary > MGA 250 000 21%

3. Non-employment income 21%

Withholding taxes

Withholding taxes:

Capital gains tax

Capital gains are taxed as ordinary income at the rate of 21% for resident companies and 10% for non-

resident companies.

Inheritances and donations

Transfer by death: Fixed rate between Ar10 000 and Ar40 000

Transfer inter-vivos: 6%

Value Added Tax

VAT is compulsory for companies and individuals with an annual turnover exceeding or equal to Ar200

million.

Individuals and companies with an annual turnover less than Ar200 million may opt to be liable for VAT.

Rate: 0% on export of goods and services

Common law rate: 20%

Stamp and transfer duties

There is no stamp duty in Madagascar.

Transfer duties:

House-letting 1% of the total rent

Professional/commercial lease 2% of the total rent

Estate exchange 4%

Formation and extension of companies, capital increase 0.5%

Company dissolution Ar 10 000

Estate sale 6%

Car sale 2%

Share transfer 0.5%

| 2

Dividends paid to non-resident companies 0%

Interest paid to non-resident companies 10%

Royalties paid to non-resident companies 10%

Technical and management fees derived by non-resident

companies

10%

Income paid to a non-resident individual 10% (if no PE) & 21% (if PE)

Other taxes

Visa duties:

Resident card duties:

Double tax treaties

Country Dividend Interest Royalties

France 15% and 25% 15% 10% or 15%

Mauritius 5% and 10% 10% 5%

- Stay 1 month Ar0

- 1 month > stay 2 months Ar100 000

- 2 months > stay 3 months Ar140 000

- 3 months > stay 3 years Ar150 000

- 3 years > stay 5 years Ar200 000

- Stay > 5 years and permanent visa Ar250 000

- Extension of visa Ar80 000

Resident card duplicate 91.47

Resident card for visa > 3 months to 6 months 99.47

Resident card for visa > 6 months to 1 year 228.67

Resident card for 2 years visa 381.12

Resident card for 3 years visa 533.57

Resident card for 5 years visa 609.80

Resident card for 10 years visa 838.47

Resident card for permanent visa 228.67

Investment information

Investment rules

Any individual or entity, Malagasy or foreign, is free to invest in Madagascar subject to the provisions

applicable to certain activities which have specic regulations such as banking, insurance, mining,

petroleum, telecommunications, medical, paramedical and pharmaceutical activities.

Investment incentives

For export activities, a set of nancial, tax and social incentives measures is offered (free zone status,

export company)

Extension of activities eligible to the free zone status: design and software development,

telemarketing and telecommunications and banking offshore

New measures authorising foreign access to real estate

The lifting of custom duties and taxes on capital goods and some essential products like rice

The establishment of the Economic Development Board of Madagascar (EDBM) to simplify

administrative procedures for company formation and investment

Import liberalisation.

| 3

Exchange controls

Since 2004, Madagascar has adopted a oating exchange rate. Exchange rate parity varies every day,

depending on the volume of transactions in the currencies interbank market.

Operations not subject to prior authorisation (require only a transfer declaration to a local bank): opening

of foreign currency account, short term foreign currency loan, allocation of foreign currencies to resident

passengers, transfer abroad of prots after taxes, expatriate, allowances and savings, etc.

Operations subject to the authorisation of the Ministry of Finance: capital operations such as operations

relating to stock transfers, sale of business and assets etc.

Occupation permits

Expatriate workers may apply for and obtain occupation permits provided all information/documents

required are submitted. The duration of the occupation permit depends on the length of their Malagasy

employment contract, but not exceeding 3 years.

Finance Act adoption

The Finance Act is generally adopted between September and November for the tax year commencing

1 January thereafter. A correcting Finance Act may be adopted during Parliaments sessions in May or in

September.

Trade and bilateral agreements

Membership: WTO (World Trade Organisation), COI (Indian Ocean Commission), COMESA (Common

Market for Eastern and Southern Africa), SADC (Southern African Development Community), CBI (Cross

Border Initiative), IOR-ARC (Indian Ocean Rim Association for Regional Cooperation), ACP-EU Cotonou

Agreement.

Economic statistics

Travel information

Visa requirements

Any person wishing to stay more than 1 month in Madagascar must apply for a visa.

Flights

These are limited but some well-known airlines do y to Madagascar. Major ones are Air Madagascar, Air

France, Kenya Airways and Air Mauritius.

Currency

The Ariary (Ar)

Languages

The ofcial languages are Malagasy, French and English.

Prime Interest rate Between 13.8% and 15%

Ination (2011) 10.90%

GDP per capita (2011) US$ 982

| 4

Ofcial holidays

Fixed dates:

1 January (New Years Day)

8 March (Womens International Day only for women)

29 March (Commemoration of the events of 29 March 1947)

1 May (Labour Day)

26 June (Independence Day)

15 August (Assumption)

1 November (All Saints Day)

25 December (Christmas).

Variable dates: Easter Monday, Whit Monday, and Ascension.

5 | | 5

Key contacts

Wasoudeo Balloo

Director, Tax

T: +230 406 9891

F: +230 406 9998

M: +230 940 2367

E: wballoo@kpmg.mu

Roomesh Ramchurn

Manager, Tax

T: +230 406 9893

F: +230 406 9988

E: rramchurn@kpmg.mu

Peggy Wong

Manager, Tax

T: +230 406 9999

F: +230 4069998

E: pwong@kpmg.mu

Notice: Whilst reasonable steps have been taken to ensure the accuracy and integrity of information contained in this document,

we accept no liability or responsibility whatsoever if any information is, for whatever reason, incorrect. We further accept no

responsibility for any loss or damage that may arise from reliance on information contained in this document.

This document is based on our interpretation of the current income tax law and international tax principles. These principles are

subject to change occasioned by future legislative amendments and court decisions. You are therefore cautioned to keep abreast

of such developments and are most welcome to consult us for this purpose.

2011 KPMG Africa Limited, a Cayman Islands company and a member rm of the KPMG network of independent member rms

afliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved. MC9197

The KPMG name, logo and cutting through complexity are registered trademarks or trademarks of KPMG International.

Anda mungkin juga menyukai

- Game of Thrones: This Article Is About The TV Series. For The Novel, See - For Other Works of The Same Name, SeeDokumen1 halamanGame of Thrones: This Article Is About The TV Series. For The Novel, See - For Other Works of The Same Name, SeeLGCPBelum ada peringkat

- Fiscal Guide TanzaniaDokumen12 halamanFiscal Guide TanzaniaVenkatesh GorurBelum ada peringkat

- Motiwala Capital Quarterly Letter Q1 2015Dokumen4 halamanMotiwala Capital Quarterly Letter Q1 2015CanadianValue100% (1)

- 2014-2015 Tanzania Tax GuideDokumen16 halaman2014-2015 Tanzania Tax GuideVenkatesh GorurBelum ada peringkat

- New YearDokumen7 halamanNew YeardoubleV2Belum ada peringkat

- Tea CakeDokumen2 halamanTea CakeVenkatesh GorurBelum ada peringkat

- Ben Graham InterviewDokumen7 halamanBen Graham InterviewCanadianValueBelum ada peringkat

- On Snow: View SourceDokumen6 halamanOn Snow: View SourceVenkatesh GorurBelum ada peringkat

- Adis AbabaDokumen8 halamanAdis AbabaVenkatesh GorurBelum ada peringkat

- Jurisdiction Report - Maldives: Purpose of This PaperDokumen4 halamanJurisdiction Report - Maldives: Purpose of This PaperVenkatesh GorurBelum ada peringkat

- Idi AminDokumen3 halamanIdi AminVenkatesh GorurBelum ada peringkat

- Myanmar Tax GuideDokumen12 halamanMyanmar Tax GuideVenkatesh GorurBelum ada peringkat

- Maryland Tax ExemptionDokumen2 halamanMaryland Tax ExemptionVenkatesh GorurBelum ada peringkat

- Double Taxation Treaties in UgandaDokumen32 halamanDouble Taxation Treaties in UgandaVenkatesh GorurBelum ada peringkat

- Deloitte Tanzania GuideDokumen13 halamanDeloitte Tanzania GuideVenkatesh GorurBelum ada peringkat

- Dta-Us & UkDokumen61 halamanDta-Us & UkVenkatesh GorurBelum ada peringkat

- DTA IcelandDokumen20 halamanDTA IcelandVenkatesh GorurBelum ada peringkat

- DTC Agreement Between India and United KingdomDokumen33 halamanDTC Agreement Between India and United KingdomOECD: Organisation for Economic Co-operation and DevelopmentBelum ada peringkat

- Enron Ethical Collapse-CausesDokumen5 halamanEnron Ethical Collapse-CausesVenkatesh GorurBelum ada peringkat

- DTA IcelandDokumen20 halamanDTA IcelandVenkatesh GorurBelum ada peringkat

- Dta-Us & UkDokumen61 halamanDta-Us & UkVenkatesh GorurBelum ada peringkat

- Roasted Eggplant With Tomatoes and MintDokumen3 halamanRoasted Eggplant With Tomatoes and MintVenkatesh GorurBelum ada peringkat

- Cement ManufactureDokumen8 halamanCement ManufactureVenkatesh GorurBelum ada peringkat

- MormonsDokumen1 halamanMormonsVenkatesh GorurBelum ada peringkat

- Worldwide Tax Guide Slovak RepublicDokumen14 halamanWorldwide Tax Guide Slovak RepublicVenkatesh GorurBelum ada peringkat

- Tax Guide IcelandDokumen22 halamanTax Guide IcelandVenkatesh GorurBelum ada peringkat

- Czech Republic PKF Tax Guide 2013Dokumen15 halamanCzech Republic PKF Tax Guide 2013Venkatesh GorurBelum ada peringkat

- Budget Pocket Guide 2014Dokumen2 halamanBudget Pocket Guide 2014Venkatesh GorurBelum ada peringkat

- Mauritius Tax GuideDokumen14 halamanMauritius Tax GuideVenkatesh GorurBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Department of Labor: Nov05-1Dokumen1 halamanDepartment of Labor: Nov05-1USA_DepartmentOfLaborBelum ada peringkat

- RFP CATALYZE 217772 Ethiopia 2023 008 FI Skilled LaborDokumen10 halamanRFP CATALYZE 217772 Ethiopia 2023 008 FI Skilled LaborEstiphanos GetBelum ada peringkat

- Kid English PDFDokumen30 halamanKid English PDFPhilBoardResultsBelum ada peringkat

- Economic Base TheoryDokumen5 halamanEconomic Base TheoryBagus AndriantoBelum ada peringkat

- HR Metrics For Various HR Processes IN Mondelez InternationalDokumen19 halamanHR Metrics For Various HR Processes IN Mondelez InternationalJammigumpula PriyankaBelum ada peringkat

- Ojt Narrative Report Group 5Dokumen64 halamanOjt Narrative Report Group 5Jeffrey RegondolaBelum ada peringkat

- WORK FROM HOME SET UP OF Y COMPANY DURING THE PANDEMIC FinalDokumen64 halamanWORK FROM HOME SET UP OF Y COMPANY DURING THE PANDEMIC FinalApril RetioBelum ada peringkat

- Resume Construction PDFDokumen8 halamanResume Construction PDFafiwhwlwx100% (2)

- EPM-1.3 Performance ManagementDokumen41 halamanEPM-1.3 Performance ManagementSandeep SonawaneBelum ada peringkat

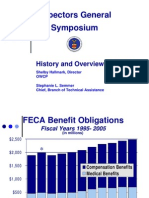

- Department of Labor: OwcpDokumen41 halamanDepartment of Labor: OwcpUSA_DepartmentOfLabor100% (1)

- Truman Loyalty Oath 1947Dokumen4 halamanTruman Loyalty Oath 1947Anonymous nYwWYS3ntV100% (1)

- Occupational Health and Safety Management Systems - Requirements With Guidance For UseDokumen16 halamanOccupational Health and Safety Management Systems - Requirements With Guidance For UseDede Rochman100% (1)

- The Impact of Virtual Interships On Accountancy Profession: Erica Abegonia Saint Paul School of Professional StudiesDokumen10 halamanThe Impact of Virtual Interships On Accountancy Profession: Erica Abegonia Saint Paul School of Professional StudiesIvan AnaboBelum ada peringkat

- CASE DIGEST - D.M. - CONSUNJI - INC - V - MARIA - JUEGODokumen2 halamanCASE DIGEST - D.M. - CONSUNJI - INC - V - MARIA - JUEGOVicente Ang100% (1)

- Thesis RecruitmentDokumen62 halamanThesis Recruitmentmkarora122Belum ada peringkat

- DDUGKY - DARPG - Goa - Anil SubramaniamDokumen24 halamanDDUGKY - DARPG - Goa - Anil SubramaniamRS ShekhawatBelum ada peringkat

- CRM Case Study PresentationDokumen20 halamanCRM Case Study PresentationAnonymous QVBtzHYmxC100% (1)

- Research Proposal of Bba 7th SemesterDokumen10 halamanResearch Proposal of Bba 7th SemesterAhmed MumtazBelum ada peringkat

- Performance ReviewDokumen13 halamanPerformance ReviewsupalakBelum ada peringkat

- Rizwana Zahir: Tata Teleservices Limited 2004 - PresentDokumen2 halamanRizwana Zahir: Tata Teleservices Limited 2004 - PresentHRD CORP CONSULTANCYBelum ada peringkat

- Chapter TwoDokumen91 halamanChapter TwoAimeereen Cureg100% (1)

- CourseDokumen3 halamanCourseKBelum ada peringkat

- Practical Aspects in Health, Safety, Welfare in The Work EnvironmentDokumen14 halamanPractical Aspects in Health, Safety, Welfare in The Work EnvironmentkailasamsomuBelum ada peringkat

- SM5-Case 10-Vick's Pizza CorpDokumen3 halamanSM5-Case 10-Vick's Pizza CorpMohamed ZakaryaBelum ada peringkat

- Project On MarketingDokumen117 halamanProject On MarketingAnuj PandeyBelum ada peringkat

- helloBSBHRM614 Hel Lpassessment Task 3 2021 (4599) (1qqqqq) 2Dokumen9 halamanhelloBSBHRM614 Hel Lpassessment Task 3 2021 (4599) (1qqqqq) 2Pradip RawalBelum ada peringkat

- Resume-Sohail (27MA23)Dokumen4 halamanResume-Sohail (27MA23)Divya TulsaniBelum ada peringkat

- Class Xii Compiled by Sudhir Sinha Business StudiesDokumen7 halamanClass Xii Compiled by Sudhir Sinha Business StudiesSudhir SinhaBelum ada peringkat

- Heizer Om10 ch06Dokumen80 halamanHeizer Om10 ch06henryBelum ada peringkat

- Use The Following Information For Questions 100 and 101Dokumen4 halamanUse The Following Information For Questions 100 and 101Carlo ParasBelum ada peringkat