Capital Budgeting Vishaka

Diunggah oleh

Sakhamuri Ram'sHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital Budgeting Vishaka

Diunggah oleh

Sakhamuri Ram'sHak Cipta:

Format Tersedia

MBA PROGRAMME

INTRODUCTION

The field of capital budgeting is both comprehensive and

challenging .it is clearly plays a vital role in assisting most business firms

to achieve there various goals (e.g. ., profitability, growth, stability, risk

reduction, social goals, etc) it has been closely allied to the economic

problem. This is rather broadly defined as the allocation of scarcer

resources among competing alternatives.

Capital budgeting may be defined as the planning, evaluation, and

selection of capital expenditure proposal .as distinguished from operating

expenditures, whose chief benefits are recognized with in a period of one

year, capital expenditures represent outlay whose principal benefits will

be recognized over longer period of time. ecision relating to capital

expenditures as opposed to those for operating expenditures, are generally

irreversible, and they re!uire careful selection techni!ues and procedures.

Capital budgeting is commonly referred to as fixed asset

management, when integrated with the financial manager"s goal of

attending proper combination of assets) i.e., optimal asset mix), fixed

asset assume a great deal of significance. #ixed assets are also fre!uently

termed as the $earning asset" of the firm since they usually generate large

returns. %ince assets are the sources of revenue generation for the firm

and fixed asset its principal sources, it appears logical that future sales

growth is heavily correlated with the expansion of capital expenditures.

S.S & N COLLEGE Page &

MBA PROGRAMME

WHAT IS CAPITAL BUDGETING?

Capital budgeting is a re!uired managerial tool. 'ne duty of a financial

manager is to choose investments with satisfactory cash flows and rates

of return. Therefore, a financial manager must be able to decide whether

an investment is worth undertaking and be able to choose intelligently

between two or more alternatives. To do this, a sound procedure to

evaluate, compare, and select pro(ects is needed. This procedure is called

capital budgeting.

Capital i a li!ited "e#u"ce

)n the form of either debt or e!uity, capital is a very limited resource.

There is a limit to the volume of credit that the banking system can create

in the economy. Commercial banks and other lending institutions have

limited deposits from which they can lend money to individuals,

corporations, and governments. )n addition, the #ederal *eserve %ystem

re!uires each bank to maintain part of its deposits as reserves. +aving

limited resources to lend, lending institutions are selective in extending

loans to their customers. ,ut even if a bank were to extend unlimited

loans to a company, the management of that company would need to

consider the impact that increasing loans would have on the overall cost

of financing.

)n reality, any firm has limited borrowing resources that should be

allocated among the best investment alternatives. 'ne might argue that a

company can issue an almost unlimited amount of common stock to raise

capital. )ncreasing the number of shares of company stock, however, will

serve only to distribute the same amount of e!uity among a greater

number of shareholders. )n other words, as the number of shares of a

company increases, the company ownership of the individual stockholder

may proportionally decrease.

S.S & N COLLEGE Page -

MBA PROGRAMME

DE$INITION%

Capital budgeting is defined as .the firm decision to invest its current

funds most effectively in long term activities in anticipation of an

expected flow of future benefit over a serious of year.

Capital budgeting includes are those expenditure which are

expected to produce benefits to the firm over more than one year, and

encompasses both tangible and intangible assets. /any companies follow

the traditional benefits occurring only the expenditure on tangible fixed

assets.

.Capital ,udgeting involves the process of planning expenditure

whose returns are expected to extend beyond one year0.

& Wet#n ' B"ig(a!

.Capital budgeting is long term planning for making and financing

proposed capital outlay0

&C(a"le T) H#"nge"en

$EATURES O$ CAPITAL BUDGETING DECISION%

1otentially large anticipated benefits.

2 relatively high degree of risk.

2 relatively long time period between the initial outlay and the

anticipated returns.

S.S & N COLLEGE Page 3

MBA PROGRAMME

NATURE O$ CAPITAL BUDGETING DECISIONS4

The investment decision of a firm are generally know as the capital

budgeting, or capital expenditure decisions. 2 capital budgeting decision

may be defined as the firm"s decision to invest its current funds most

effectively in the long 5term assets in anticipation of an expended flow of

benefits over a series of years. The long 5term asset are those that affect

the firm"s operational beyond the one6year period.

)nvestment decisions generally include expansion, ac!uisition

modernization and replacement of the long6term asset sale of a division

or business (divestment) is also an investment decision. ecision like the

change in the method of sales distribution, or an advertisement campaign

or a research and developing program have long 5term implication for the

firm"s expenditures and benefits, and therefore e, they should also be

evaluated as investment decision.

The argument that capital is a limited resource is true of any form

of capital, whether debt or e!uity (short6term or long6term, common

stock) or retained earnings, accounts payable or notes payable, and so on.

7ven the best6known firm in an industry or a community can increase its

borrowing up to a certain limit. 'nce this point has been reached, the

firm will either be denied more credit or be charged a higher interest rate,

making borrowing a less desirable way to raise capital.

S.S & N COLLEGE Page 8

MBA PROGRAMME

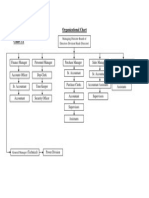

CAPITAL BUDGETING PROCESS%

Capital budgeting is a complex process as it involves decisions

relating to the investment of current funds for the benefits to be achieved

in future and the future is always uncertain. +owever, the following

procedure may be adapted in the process of capital budgeting. There are

five stages in the capital budgeting process.

Identi*icati#n #* in+et!ent #pp#"tunitie4

The capital budgeting process begins with the identification of potential

investment opportunities. Typically, the planning body (it may be an

individual or committee organized formally or informally) develops

estimates of future sales which identifying re!uired investment in plant

and e!uipment.

)dentification of investment ideas it is helpful to4

/onitor external environment regularly to scout investment

opportunities.

#ormulate a well6defined corporate strategy based on through analysis

of strengths, weaknesses, opportunities, and threats.

%hare corporate strategy and respective with persons.

S.S & N COLLEGE Page 9

)dentification of

investment

opportunities

2ssembling of

investments

ecision making

1erformance

review

)mplement

action

1reparation of

capital budget

MBA PROGRAMME

/otivate employees to make suggestions.

Ae!bling #* in+et!ent p"#p#al4

)nvestment proposal identified by the production department and

other department are usually submitted in a standardized capital

investment proposal form. :enerally, most of the proposal, before they

reach the capital budgeting committee or viewed from different angle. )t

also helps in creating a climate for bringing about co6ordinations of inters

related activities.

)nvestment, proposals are usually classified into various categories

for facilitating decision 5making, budgeting, and control.

*eplacement investments

7xpansion investments.

;ew product investments.

'bligatory and welfare investment.

Decii#n !a,ing%

2 system of rupee gateways usually characterized capital investment

decision6making. <nder this system executive are vested with the power

to pay investment proposals up to certain limits.

P"epa"ati#n #* capital budgeting%

1ro(ects involving smaller out lays and which executives at lower

levels can decide are often covered by a blanket appropriation for

expenditures action. 1ro(ects involving larger outlays are included in the

capital budget after necessary approvals. ,efore under facing such

pro(ects an appropriation order is usually re!uired. The purpose of this

S.S & N COLLEGE Page =

MBA PROGRAMME

check is mainly to ensure that the funds position of the firm satisfactory

at the time of implementation.

I!ple!entati#n%

Translating an investment proposal in to a concert pro(ect is a complex,

time consuming, and risk6fraught task.

Ade-uate *#"!ulati#n #* p"#.ect

The ma(or reasons for delay is insinuate formulation of pro(ects put

differently, if necessary home work in terms of preliminary

comprehensive and detailed formulation of the pro(ect .

Ue #* t(e p"incipal #* "ep#nibilit/ acc#unting

2ssigning specific responsibility to pro(ect managers for completing the

pro(ect within the defined time 5frame and cost limits is helpful for

expeditious execution and cost control.

Ue #* net0#", tec(ni-ue

#or pro(ect planning and control several network techni!ues like 17*T

(programmed evolution review techni!ues) and C1/ (critical path

method) is available.

Pe"*#"!ance "e+ie0%

1erformance review, or post 5 completion audit, is a feed back device. )t

is a means for comparing actual performance with pro(ected performance.

)t may be conducted, moat appropriately. >hen the operation of the

pro(ect have stabilized.

)t is useful several ways.

S.S & N COLLEGE Page ?

MBA PROGRAMME

)t throws light on how realistic were the assumption underlying the

pro(ect.

)t provided a documented log of experience that is highly valuable for

decisional making.

C#!p#nent #* capital budgeting

Initial In+et!ent Outla/4

)t includes the cash re!uired to ac!uire the new e!uipment or build

the new plant less any net cash proceeds from the disposal of the replaced

e!uipment. The initial outlay also includes any additional working capital

related to the new e!uipment. 'nly changes that occur at the beginning of

the pro(ect are included as part of the initial investment outlay. 2ny

additional working capital needed or no longer needed in a future period

is accounted for as a cash outflow or cash inflow during that period.

Net Ca( bene*it #" a+ing *"#! t(e #pe"ati#n%

This component is calculated as under46

(The incremental change in operating revenues minus the incremental

change in the operating cost @ )ncremental net revenue) minus (taxes)

plus or minus (changes in the working capital and other ad(ustments).

Te"!inal Ca( *l#0%

)t includes the net cash generated from the sale of the assets, tax effects

from the termination of the asset and the release of net working capital.

T(e Net P"eent 1alue tec(ni-ue%

S.S & N COLLEGE Page A

MBA PROGRAMME

2lthough there are several methods used in Capital ,udgeting, the ;et

1resent Balue techni!ue is more commonly used. <nder this method a

pro(ect with a positive ;1B implies that it is worth investing in.

Baic tep #* capital budgeting

&. 7stimate the cash flows

-. 2ssess the riskiness of the cash flows.

3. etermine the appropriate discount rate.

8. #ind the 1B of the expected cash flows.

9. 2ccept the pro(ect if 1B of inflows C costs. )** C +urdle *ate andDor

1ayback E policy.

#aced with limited sources of capital, management should carefully

decide whether a particular pro(ect is economically acceptable. )n the

case of more than one pro(ect, management must identify the pro(ects that

will contribute most to profits and, conse!uently, to the value (or wealth)

of the firm. This, in essence, is the basis of capital budgeting.

In+et!ent decii#n & Capital budgeting

Capital budgeting is vital in marketing decisions. ecisions on

investment, which take time to mature, have to be based on the returns

which that investment will make. <nless the pro(ect is for social reasons

only, if the investment is unprofitable in the long run, it is unwise to

invest in it now.

S.S & N COLLEGE Page F

MBA PROGRAMME

'ften, it would be good to know what the present value of the

future investment is, or how long it will take to mature (give returns). )t

could be much more profitable putting the planned investment money in

the bank and earning interest, or investing in an alternative pro(ect.

Typical investment decisions include the decision to build another

grain silo, cotton gin or cold store or invest in a new distribution depot.

2t a lower level, marketers may wish to evaluate whether to spend more

on advertising or increase the sales force, although it is difficult to

measure the sales to advertising ratio.

C(apte" #b.ecti+e

This chapter is intended to provide4

2n understanding of the importance of capital budgeting in

marketing decision making

2n explanation of the different types of investment pro(ect

2n introduction to the economic evaluation of investment

proposals

The importance of the concept and calculation of net present value

and internal rate of return in decision making

The advantages and disadvantages of the payback method as a

techni!ue for initial screening of two or more competing pro(ects.

St"uctu"e #* t(e c(apte"

Capital budgeting is very obviously a vital activity in business.

Bast sums of money can be easily wasted if the investment turns out to be

S.S & N COLLEGE Page &G

MBA PROGRAMME

wrong or uneconomic. The sub(ect matter is difficult to grasp by nature of

the topic covered and also because of the mathematical content involved.

+owever, it seeks to build on the concept of the future value of money

which may be spent now. )t does this by examining the techni!ues of net

present value, internal rate of return and annuities. The timing of cash

flows are important in new investment decisions and so the chapter looks

at this HpaybackH concept.

Capital budgeting +e"u cu""ent e2penditu"e

2 capital investment pro(ect can be distinguished from current

expenditures by two features4

a) %uch pro(ects are relatively large

b) a significant period of time (more than one year) elapses between the

investment outlay and the receipt of the benefits.

2s a result, most medium6sized and large organizations have developed

special procedures and methods for dealing with these decisions. 2

systematic approach to capital budgeting implies4

a) The formulation of long6term goals

b) The creative search for and identification of new investment

opportunities

c) Classification of pro(ects and recognition of economically andDor

statistically dependent proposals

d) The estimation and forecasting of current and future cash flows

e) 2 suitable administrative framework capable of transferring the

re!uired information to the decision level

S.S & N COLLEGE Page &&

MBA PROGRAMME

f) The controlling of expenditures and careful monitoring of crucial

aspects of pro(ect execution

g) 2 set of decision rules which can differentiate acceptable from

unacceptable alternatives is re!uired.

The last point (g) is crucial and this is the sub(ect of later sections of the

chapter.

T(e clai*icati#n #* in+et!ent p"#.ect

a) ,y pro(ect size

%mall pro(ects may be approved by departmental managers. /ore

careful analysis and ,oard of irectorsI approval is needed for large

pro(ects of, say, half a million dollars or more.

b) ,y type of benefit to the firm

2n increase in cash flow

2 decrease in risk

2n indirect benefit (showers for workers, etc).

c) ,y degree of dependence

/utually exclusive pro(ects (can execute pro(ect 2 or ,, but not

both

Complementary pro(ects4 taking pro(ect 2 increases the cash flow of

pro(ect ,.

%ubstitute pro(ects4 taking pro(ect 2 decreases the cash flow of

pro(ect ,.

S.S & N COLLEGE Page &-

MBA PROGRAMME

d) ,y degree of statistical dependence

1ositive dependence

;egative dependence

%tatistical independence.

IN1EST3ENT PRO4ECTS

T(e ti!e +alue #* !#ne/4

*ecall that the interaction of lenders with borrowers sets an

e!uilibrium rate of interest. ,orrowing is only worthwhile if the return on

the loan exceeds the cost of the borrowed funds. Jending is only

worthwhile if the return is at least e!ual to that which can be obtained

from alternative opportunities in the same risk class.

The interest rate received by the lender is made up of4

i) The time value of money4 the receipt of money is preferred sooner

rather than later. /oney can be used to earn more money. The earlier the

money is received, the greater the potential for increasing wealth. Thus,

to forego the use of money, you must get some compensation.

ii) The risk of the capital sum not being repaid. This uncertainty re!uires

a premium as a hedge against the riskK hence the return must be

commensurate with the risk being undertaken.

S.S & N COLLEGE Page &3

MBA PROGRAMME

iii) )nflation4 money may lose its purchasing power over time. The lender

must be compensated for the declining spendingDpurchasing power of

money. )f the lender receives no compensation, heDshe will be worse off

when the loan is repaid than at the time of lending the money.

a5 $utu"e +alue6c#!p#und inte"et

#uture value (#B) is the value in dollars at some point in the future of one

or more investments.

The general formula for computing #uture Balue is as follows4

#B

n

@ B

o

(l L r)

n

>here

B

'

is the initial sum invested

r is the interest rate

n is the number of periods for which the investment is to receive interest.

Thus we can compute the future value of what B

o

will accumulate to in n

years when it is compounded annually at the same rate of r by using the

above formula.

>e can derive the 1resent Balue (1B) by using the formula4

#B

n

@ B

o

() L r)

n

S.S & N COLLEGE Page &8

MBA PROGRAMME

,y denoting B

o

by 1B we obtain4

#B

n

@ 1B () L r)

n

*ationale for the formula4

2s you will see from the following exercise, given the alternative of

earning &GM on his money, an individual (or firm) should never offer

(invest) more than N&G.GG to obtain N&&.GG with certainty at the end of the

year.

b5 Net p"eent +alue 7NP15

The ;1B method is used for evaluating the desirability of investments or

pro(ects.

>here4

C

t

@ the net cash receipt at the end of year t

)

o

@ the initial investment outlay

r @ the discount rateDthe re!uired minimum rate of return on investment

n @ the pro(ectDinvestmentIs duration in years.

Decii#n "ule%

)f ;1B is positive (L)4 accept the pro(ect

)f ;1B is negative (6)4 re(ect the pro(ect

d5 Pe"petuitie

1erpetuity is an annuity with an infinite life. )t is an e!ual sum of money

to be paid in each period forever.

S.S & N COLLEGE Page &9

MBA PROGRAMME

e5 T(e inte"nal "ate #* "etu"n 7IRR5

*efer students to the tables in any recognised published source.

The )** is the discount rate at which the ;1B for a pro(ect e!uals

zero. This rate means that the present value of the cash inflows for

the pro(ect would e!ual the present value of its outflows.

The )** is the break6even discount rate.

The )** is found by trial and error.

Net p"eent +alue +) inte"nal "ate #* "etu"n

)ndependent vs. dependent pro(ects

;1B and )** methods are closely related because4

i) both are time6ad(usted measures of profitability, and

ii) their mathematical formulas are almost identical.

%o, which method leads to an optimal decision4 )** or ;1BO

a5 NP1 +) IRR% Independent p"#.ect

)ndependent pro(ect4 %electing one pro(ect does not preclude the choosing

of the other.

>ith conventional cash flows (6PLPL) no conflict in decision arisesK in this

case both ;1B and )** lead to the same acceptDre(ect decisions.

;1B vs. )** )ndependent pro(ects

)f cash flows are discounted at k

&

, ;1B is positive and )** C k

&

4 accept

pro(ect.

S.S & N COLLEGE Page &=

MBA PROGRAMME

)f cash flows are discounted at Q

-

, ;1B is negative and )** E Q

-

4 re(ect

the pro(ect.

/athematical proof4 for a pro(ect to be acceptable, the ;1B must be positive, i.e.

>here * is the )**.

%ince the numerators C

t

are identical and positive in both instances4

)mplicitlyDintuitively * must be greater than k (* C k)K

)f ;1B @ G then * @ k4 the company is indifferent to such a pro(ectK

+ence, )** and ;1B lead to the same decision in this case.

b5 NP1 +) IRR% Dependent p"#.ect

;1B clashes with )** where mutually exclusive pro(ects exist.

<p to a discount rate of Q

o

4 pro(ect , is superior to pro(ect 2, therefore

pro(ect , is preferred to pro(ect 2.

,eyond the point Q

o

4 pro(ect 2 is superior to pro(ect ,, therefore pro(ect

2 is preferred to pro(ect ,

The two methods do not rank the pro(ects the same.

ifferences in the scale of investment

;1B and )** may give conflicting decisions where pro(ects differ in

their scale of investment. 7xample4

isadvantage of 1)4

Jike )** it is a percentage and therefore ignores the scale of investment.

T(e pa/bac, pe"i#d 7PP5

S.S & N COLLEGE Page &?

MBA PROGRAMME

The C)/2 defines payback as Ithe time it takes the cash inflows from a

capital investment pro(ect to e!ual the cash outflows, usually expressed in

yearsI. >hen deciding between two or more competing pro(ects, the usual

decision is to accept the one with the shortest payback.

1ayback is often used as a Hfirst screening methodH. ,y this, we mean

that when a capital investment pro(ect is being considered, the first

!uestion to ask is4 I+ow long will it take to pay back its costOI The

company might have a target payback, and so it would re(ect a capital

pro(ect unless its payback period was less than a certain number of years.

Diad+antage #* t(e pa/bac, !et(#d4

)t ignores the timing of cash flows within the payback period, the

cash flows after the end of payback period and therefore the total

pro(ect return.

)t ignores the time value of money. This means that it does not

take into account the fact that N& today is worth more than N& in

one yearIs time. 2n investor who has N& today can consume it

immediately or alternatively can invest it at the prevailing interest

rate, say 3GM, to get a return of N&.3G in a yearIs time.

)t is unable to distinguish between pro(ects with the same payback

period.

)t may lead to excessive investment in short6term pro(ects.

Ad+antage #* t(e pa/bac, !et(#d%

S.S & N COLLEGE Page &A

MBA PROGRAMME

1ayback can be important4 long payback means capital tied up and high

investment risk. The method also has the advantage that it involves a

!uick, simple calculation and an easily understood concept.

T(e acc#unting "ate #* "etu"n & 7ARR5

The 2** method (also called the return on capital employed (*'C7) or

the return on investment (*')) method) of appraising a capital pro(ect is

to estimate the accounting rate of return that the pro(ect should yield. )f it

exceeds a target rate of return, the pro(ect will be undertaken.

Diad+antage%

)t does not take account of the timing of the profits from an

investment.

)t implicitly assumes stable cash receipts over time.

)t is based on accounting profits and not cash flows. 2ccounting

profits are sub(ect to a number of different accounting treatments.

)t is a relative measure rather than an absolute measure and hence

takes no account of the size of the investment.

)t takes no account of the length of the pro(ect.

)t ignores the time value of money.

S.S & N COLLEGE Page &F

MBA PROGRAMME

T(e pa/bac, and ARR !et(#d in p"actice

espite the limitations of the payback method, it is the method most

widely used in practice. There are a number of reasons for this4

)t is a particularly useful approach for ranking pro(ects where a

firm faces li!uidity constraints and re!uires fast repayment of

investments.

)t is appropriate in situations where risky investments are made in

uncertain markets that are sub(ect to fast design and product

changes or where future cash flows are particularly difficult to

predict.

The method is often used in con(unction with ;1B or )** method

and acts as a first screening device to identify pro(ects, which are

worthy of further investigation.

)t is easily understood by all levels of management.

)t provides an important summary method4 how !uickly will the

initial investment be recoupedO

epreciation is charged on the straight6line basis. 1roblem4

a) Calculate the following for both proposals4

)) The payback period to one decimal place

ii) the average rate of return on initial investment, to one decimal place.

All#0ing *#" in*lati#n

S.S & N COLLEGE Page -G

MBA PROGRAMME

%o far, the effect of inflation has not been considered on the

appraisal of capital investment proposals. )nflation is particularly

important in developing countries, as the rate of inflation tends to be

rather high. 2s inflation rate increases, so will the minimum return

re!uired by an investor. #or example, one might be happy with a return of

&GM with zero inflation, but if inflation was -GM, one would expect a

much greater return.

E2pectati#n #* in*lati#n and t(e e**ect #* in*lati#n

&. >hen a manager evaluates a pro(ect, or when a shareholder

evaluates hisDher investments, heDshe can only guess what the rate

of inflation will be. These guesses will probably be wrong, at least

to some extent, as it is extremely difficult to forecast the rate of

inflation accurately. The only way in which uncertainty about

inflation can be allowed for in pro(ect evaluation is by risk and

uncertainty analysis.

-. )nflation may be general, that is, affecting prices of all kinds, or

specific to particular prices. :eneralized inflation has the following

effects4

a. )nflation will mean higher costs and higher selling prices. )t

is difficult to predict the effect of higher selling prices on

demand. 2 company that raises its prices by 3GM, because

the general rate of inflation is 3GM, might suffer a serious

fall in demand.

S.S & N COLLEGE Page -&

MBA PROGRAMME

b. )nflation, as it affects financing needs, is also going to affect

gearing, and so the cost of capital.

c. %ince fixed assets and stocks will increase in money value,

the same !uantities of assets must be financed by increasing

amounts of capital. )f the future rate of inflation can be

predicted with some degree of accuracy, management can

work out how much extra finance the company will need and

take steps to obtain it, e.g. by increasing retention of

earnings, or borrowing.

3. +owever, if the future rate of inflation cannot be predicted with a

certain amount of accuracy, then management should estimate what

it will be and make plans to obtain the extra finance accordingly.

1rovisions should also be made to have access to Icontingency

fundsI should the rate of inflation exceed expectations, e.g. a higher

bank overdraft facility might be arranged should the need arise.

8. /any different proposals have been made for accounting for

inflation. Two systems known as HCurrent purchasing powerH

(C11) and HCurrent cost accountingH (CC2) have been suggested.

9. C11 is a system of accounting which makes ad(ustments to income

and capital values to allow for the general rate of price inflation.

=. CC2 is a system which takes account of specific price inflation

(i.e. changes in the prices of specific assets or groups of assets), but

not of general price inflation. )t involves ad(usting accounts to

reflect the current values of assets owned and used.

S.S & N COLLEGE Page --

MBA PROGRAMME

?. 2t present, there is very little measure of agreement as to the best

approach to the problem of Iaccounting for inflationI. ,oth these

approaches are still being debated by the accountancy bodies.

T8PES O$ CAPITAL BUDGETING DECISIONS%

Capital ,udgeting decisions are of paramount importance in

financial decision6making. )n first place they affect the profitability of the

firm. They also have a bearing on the competitive position of the firm

because they relate to fixed assets. The fixed assets are true goods than

can ultimately be sold for6profit. :enerally the capital budgeting of

investment decision includes addition, disposition, modification, and

replacement of fixed assets.

S.S & N COLLEGE Page -3

E9PANSION

DI1ERSI$ICATION

REPLACE3ENT

RESEARCH AND

DE1ELOP3ENT

3ISCELLANEOUS

PROPOSAL

MBA PROGRAMME

Types of

Capital budgeting

Decisions

E2pani#n%

The company may have to expand its production capacities on

accounts of high demand for its products or inade!uate production

capacity. This will need additional capital e!uipment.

Di+e"i*icati#n%

2 company may intend to reduce it risk by operating in several

activities. )n such a case capital investment may become necessary for

purchases of new machinery and facilities to handle the new product.

S.S & N COLLEGE Page -8

MBA PROGRAMME

Replace!ent%

The replacement of fixed assets in place of existing assets, either being

worn out or become out dated on account of new technology.

Reea"c( and De+el#p!ent%

Jarge sums of money may have to be spent for research and

development, in case those industries where technology is rapidly

changing. )n such cases large sums of money are needed for research and

development activities. %o these are also included in the proposals of

Capital ,udgeting.

3icellane#u P"#p#al%

2 Company may have to invest money in pro(ects, which do not

directly helping achieving profit6oriented goals. #or example, installation

of pollution control e!uipment may be necessary on account of legal

re!uirements. Therefore, funds are re!uired for such proposal also.

Capital Budgeting and Public $inancial 3anage!ent%

1ublic investment is an important potential contributor to economic

growth and achievement of social development ob(ectives. )n addition to

the level of investment and the sectoral allocation, the capital budgeting

process is an important determinant of the !uality of investment pro(ects

and their implementation.

*ecent years have seen renewed attention to capital investment for

economic growth and development. )n particular, much attention has been

given to finding fiscal space for increasing capital investment. ,ut, absent

good processes for using existing or new funds, the impact of capital

S.S & N COLLEGE Page -9

MBA PROGRAMME

investments will not yield the expected results. This post provides an

overview of selected issues regarding capital budgeting and capital

budgeting systems as an aid in understanding what goes wrong and what

might be done about it. The post draws directly from a chapter written by

the author for a >orld ,ank

Public *inancial !anage!ent 7P$35 and capital budgeting

Countries commonly adopt special processes for addressing capital

or investment spending given the size of the expenditures, their long6term

costs and benefits, and their importance for public service delivery and

economic development. The special treatment of capital goes beyond

simple budgeting to capital asset management.

espite the importance of special attention to capital assets, the

capital budgeting process cannot be considered outside of the over6all

public financial management system. Capital spending is only one

component of spending, and needs to be considered within the context of

government6wide and sector6specific multi6year strategies and ob(ectives.

The capital budgeting process must be fully integrated into the general

budgeting and public financial management process.

De*ining Capital

>hile seemingly a straight forward !uestion, governments around

the world, and even within a country, may define capital" differently.

Capital spending is generally about physical assets with a useful life of

more than one year. ,ut it also includes capital improvements or

rehabilitation of physical assets that enhance or extend the useful life of

the asset (as distinct from a repair or maintenance, which assures the asset

us functional for its planned life).

S.S & N COLLEGE Page -=

MBA PROGRAMME

Capital spending is sometimes e!uated with investment or

development spending, where expenditures have benefits extending years

into the future. <nder this definition, governments may include physical

assets for government use (e.g. office buildings), physical assets of a

public good nature that also enhance private sector development (e.g.

roads, water systems), and intangibles (e.g. education, research). )t can be

!uite difficult to distinguish between investment and non6investment

expenditures, and if investment spending receives favored treatment in

the annual budgeting process, nearly all spending, whether recurrent or

not, will end6up being classified as investment.

7very government establishes some arbitrary cut6off point to

distinguish capital from current expenditures. #or budgeting purposes, the

relevant distinction is between capital and current or operating

expenditures. Current expenditures are purchases of assets to be

consumed within one year, regardless of expenditure size. %mall

expenditures (e.g. less than <%N-9,GGG) are generally considered current,

regardless of useful life.

%ome countries use the )/# &FF= :overnment #inance %tatistics

as the basis for their budget classification system, including defining

capital expenditure. The &FF= :#% defines capital expenditure as4

.Capital expenditure. 7xpenditure for ac!uisition of land, intangible

assets, government stocks, and nonmilitary, non6financial assets, of more

than a minimum value and to be used for more than one year in the

process of productionK also for capital grants. Capital expenditure is

fre!uently separated (in some cases along with certain revenue) into a

separate section or capital account of the budget or into an entirely

separate budget for capital expenditure. That is, the capital budget. This

separation may sometimes follow different criteria, however.0 >hile

S.S & N COLLEGE Page -?

MBA PROGRAMME

allowing intangible assets and government stocks, it does not standardize

.minimal value,0 allowing countries to specify a value.

The important issues are to have a clear criterion, use it

consistently, and that the threshold value captures the type of capital

spending that government and spending ministry management want to

monitor. %ome countries are tempted to set too low of a threshold value,

meaning reported $capital" spending is misleading, capturing many small

items from office supplies and office furniture to roads and schools. %ome

may also include capital transfers or subsidies to state6owned enterprises,

again creating a misleading picture of capital formation in the country.

Capital Aet C#nditi#n and 3aintenance

*ather than only examining funding, it is important to examine

other aspects of capital spending performance, such as condition of

facilities and ade!uacy of maintenance spending. These are important

inputs and outputs of the capital budgeting process, and affect both

decision6making and efficiency of capital spending. 2 central or sector

ministry registry of current assets and their physical condition is a useful

tool to support budget formulation, execution, and management. /any

countries do not have such registries, and they can demand much human

capital to maintain current data, let alone use the data for decision6making

and management.

7ven where no central registry of capital assets and their condition

exists, countries may have information on asset depreciation and years of

service. These can give some indication of potential investment needs.

,ut, they are relatively crude measures telling more about facility age

than current condition, and not a satisfactory way to estimate

S.S & N COLLEGE Page -A

MBA PROGRAMME

maintenance costs or need for various types of capital investment. The

absence of better data should raise serious !uestions of whether more

investment in a sector is (ustified, or would be properly maintained and

serve its full useful life.

Ele!ent #* a #und capital aet !anage!ent p"#ce

2s noted in the introduction, good capital budgeting should be an

integral component of a sound over6all budgeting system. >hile there are

some important elements of the process specific to capital spending, a

robust public finance system and budget process are as important to

sound capital management as the capital budgeting elements themselves.

S#und #+e"&all P$3 p"#ce

2 country"s 1#/ process has three main ob(ectives4

&. 2ggregate fiscal discipline 66 allowing budgets to be set consistent

with a realistic macroeconomic framework and a sustainable fiscal

program, and brought in on targetK

-. 2llocate efficiency 66 re!uiring that resource allocations reflect the

policies and priorities of the government"s programK and,

TECHNI:UES O$ CAPITAL BUDGETING DECISIONS%

2t each point of time a business firm has a number of proposals

regarding various pro(ects in which it can invest funds. ,ut the funds

available with the firm are always limited and it is not possible to invest

S.S & N COLLEGE Page -F

MBA PROGRAMME

funds in all the proposals at a time. +ence, it is very essential to select

from amongst the various competing proposals, those, which give the

highest benefits. The crux of the capital budgeting is the allocation of

available resources to various proposals. There are many considerations,

economic as well as non6economics, which influence the capital

budgeting decisions. The crucial factor that influences the capital

budgeting decisions is the profitability of the prospective investment. Ret

the risk involved in the proposals cannot be ignored because profitability

and risk are directly related, i.e. higher profitability, the greater the risk

and vice6versa.

There are many methods of evaluating profitability of capital investment

proposals. The various commonly used methods are as follows.

Traditional methods or non6discounted Techni!ues4

&. 1ayback 1eriod /ethod or 1ay out or 1ay off /ethod.

-. )mprovement of traditional 2pproach to 1ay ,ack 1eriod /ethod.

3. *ate of *eturn /ethod or 2ccounting /ethod.

Time 5 ad(usted method or discounted Techni!ues4

8. ;et present Balue /ethod.

9. )nternal *ate of *eturn /ethod

=. 1rofitability )ndex /ethod.

T(e T#p ;< T(ing T# C#nide" W(en 3a,ing A Capital Budgeting

#" In+et!ent Decii#n

Consider these ten things when youIre using the ;1B, )**, or

payback method to make a capital budgeting or investment decision.

S.S & N COLLEGE Page 3G

MBA PROGRAMME

&) *emember that the reason youIre making a capital budgeting decision

is to create more value in the future than exists todayS onIt commit

yourself to a future course of action that is not profitable in the future

under all possible conditions you can think of today and expect tomorrow.

The value of a decision is not only centered in its expected results, but it

is raised or lowered according to the number of decisions in the future

that it does not preclude, but allows , and those for which space is

created. This statement has profound meaning for the futurity of decisions

and the design of decisions by decision makersS

=. 2lways use cash flows and not accounting income to create your

investment decision. Cash flows are the result of the total effects of

implementing the pro(ect or investment scenario only 2#T7* all costs

are removedS

3. o not include sunk costs in your investment analysis. They are

already spent, gone, kaputK use only the costs that will be incurred

by the new pro(ect or investment. There will be a tendency to66see

how much weIve already invested66use sunk costs to explain going

ahead with the pro(ect anyway66';ITS )t would be irrational to

use past expenditures to consider a decision which can only affect

the futureS

8. Rou must consider Hopportunity costsH as costs of the pro(ect or

investment. )f you use something that could be used for something else,

the cost to replace the use of the something else must be included in your

capital budgeting analysis. 2lways consider alternative uses of capital and

resources as costs to the capital budgeting pro(ect or investment.

S.S & N COLLEGE Page 3&

MBA PROGRAMME

9. Jook beyond. Rou must consider not (ust the first order of

conse!uences, but the orders of conse!uences following your pro(ect

decision. ,uild a scenario of contingencies given the pro(ect decision.

Jook at the downstream effects of the decision, what are the side effectsO

2re there hidden costs, if so add them to the decision. >ill the pro(ect

steal market share from ongoing investmentsO >hat is t(e e2pected

effect of these lossesO

=. >hat are the effects of the non6conformities. onIt let the assumptions

you make about the present and the future be Hblinding.H )n the world we

live in today, things change66overnightS >hat about the nonconforming

assumptions you makeO +ow flexible are the beliefs that you have

established the pro(ect parameters uponO 2ccounting for this now, will

keep the value of the pro(ect in real terms.

?. 1art of the reason that ;1B calculations come out the way they do is

because of )** or )nternal *ate of *eturn. )** is designed to calculate

the HdiscountH rate at which the cash flows of your pro(ect are discounted.

/ake sure that the )**, discount rate, hurdle rate and the pro(ect

discounting rate are sufficiently related or indexed to the market

environment. )f you used a discount rate of 9M and the real rate of

inflation soared to &GM during the pro(ect66which happened in the early

eighties66your pro(ect assumptions could create disaster for the company

or your investment. onIt (ust assume that because you have an )** of x

M that you should use that M to discount cash flows under ;1B

calculations.

A. Consider the utility of time not (ust the time value of money. >ith

change occurring so rapidly, how !uickly you get to the marketplace

often determines how much utility is available for your investment

S.S & N COLLEGE Page 3-

MBA PROGRAMME

decisions. )t is extremely difficult to calculate the utility of ideas66often

the marketplace is the only valuing entity66but as a planner you must gain

a feel for what happens if youIre not first, your pro(ect is outdated before

you go online, or sudden shifts in macroeconomic factors change pro(ect

assumptions. T+7*7 2*7;IT 2;R :<2*2;T77%66,<T, he who

ventures forth blindly, even though with courage and certainty, may need

a parachuteS

F.Consider risk management, contingency planning and disaster recovery

as a cost of the pro(ectS *isk analysis, business interruption and disaster

recovery are important factors when considering the ultimate cost or

discountability of cash flows. >hat is the risk level of the pro(ect or

investmentO +ow can this HcostH be factored into the calculationO )f the

pro(ect is a complete failure, is wiped out by unforseen contingencies or

even hampered by personnel problems, what will be the effect on the

company, organization or investmentO

&G.Jast, but not least, a maximum from professor %harpe at %tandford

<niversity who says, . )t is important to remember that investment

opportunities may influence one"s consumpton decision and that

consumption opportunities may influence one"s investment decision.

$act#" t# C#nide" in Dete"!ining Capital E2penditu"e

*ate of *eturn

,udget ceiling

1robability of success

S.S & N COLLEGE Page 33

MBA PROGRAMME

Competition

Tax rate

ollar amounts

Time value of money

*isk

Ji!uidity

Tax credits

Jong6term business strategy

#orecasting error

T/pe #* Capital Budgeting Decii#n

Cost reduction program

<ndertaking an advertising campaign

*eplacement of assets

'btaining new facilities or expanding existing ones

/erger analysis

*efinancing an outstanding debt issue

;ew and existing product evaluation

;o profit investments (e.g., health and safety)

COST E$$ECTI1E ANAL8SIS%

)n the cost effective analysis the pro(ect selection or technological

choice, only the costs of two or more alternative choices are considered

treating the benefits as identical this approach is used when the

S.S & N COLLEGE Page 38

MBA PROGRAMME

ac!uisition of how to minimize the costs for undertaking an activity at

given discount rate in case the benefits and operating costs are given, one

can minimize the capital cost to obtain the given discount.

P"#.ect planning4

The planning of a pro(ect is a technically predetermined set of inter

related activities involving the effective use of given material, human

technological and financial resources over given period of time. >hich in

association with other development pro(ect result in the achievement of

certain predetermined ob(ectives such as the production of specified

goods and servicesO

1ro(ect planning is spread over a period of time and is not a one shot

activity. The importance stages in the life of a pro(ect areK

)ts identification

)ts initial formulation

)ts evaluation (whether to select or re(ect)

)ts final formulation

)ts implementation

)ts completion and operation

The time taken for the entire process is the gestation period of the

pro(ect the seriously trying to over come certain problems. They

may be non utilization to over come available funds. 1lant capacity

expansion, etc..

C#ntent #* t(e p"#.ect "ep#"t%

*aw material

/arket and marketing

%ite of the pro(ect

S.S & N COLLEGE Page 39

MBA PROGRAMME

1ro(ect engineering dealing with technical aspects of the

pro(ect

Jocation and layout of the pro(ect building

,uilding

1roduction capacity

>ork schedule

Detail #* t(e c#t #* t(e p"#.ect%

Cost of land

Cost of building

Cost of plant and machinery

7ngineering know how fee

7xpenses on training and erection supervision

/iscellaneous fixed assets

1reliminary expanses

1reoperative expenses

1rovisions for contingences

I3PORTANCE O$ CAPITAL BUDGETING%

Capital budgeting decisions are among the most crucial and critical

decisions and they have significant impact on the future profitability of

the firm. 2 special care should taken while making capital decisions,

because it influences all the branches of a company such as production,

marketing, personnel, etc. the other reasons for keeping more attention on

capital budgeting decisions include the following4

;)L#ng te"! i!plicati#n4

The effect of a capital budgeting decisions will be felt over a long

time period. )t has an influence on the rate and direction of the growth of

S.S & N COLLEGE Page 3=

MBA PROGRAMME

the company. The effects of capital budgeting decision extend into the

future to be put up with for a longer period than the conse!uences of

current operating expenditures.

=)In+et!ent #* la"ge *und%

Capital decisions re!uires large amount of capital outlay. +ence

the company should carefully plan its capital budgeting programme, so

that it may get funds at the right time and they must be put to most

profitable use. 2 wise investment can maximize the wealth of the

company and an ill advised and incorrect decision can (eopardize the

profitable potion and can also be the cause for the closer of the company.

>) I""e+e"ible decii#n%

The capital budgeting decisions are irreversible in ma(ority of the

cases. )t is due to the fact that, it is very difficult to find a market for such

capital terms once they have re!uired. The only alternative is to treat the

entire value of the asset as a scrap. This will result in heavy loss.

8.3#t di**icult t# !a,e%

Capital budgeting decisions involves forecasting of future benefits,

which is almost uncertain. )t is very difficult to pro(ect sales revenue,

costs and benefits accurately in !uantitative terms because of the

influence of economic, political, social and technological factors.

?) Riing #* *und

There must be a perfect plan to raise the funds systematically. The

company, planning for a ma(or capital expenditure, needs to arrange

finance in advance, to be sure of having the availability of funds.

NEED O$ THE STUD8

S.S & N COLLEGE Page 3?

MBA PROGRAMME

Capital budgeting ecisions are the investment decisions of a firm

are generally known as the capital budgeting, or capital expenditure

decisions. 2 capital budgeting decisions may be defined as the firm"s

decision to invest in current funds most effectively and efficiently in the

long6term assets in anticipation of an expected flow of benefits over a

series of years. The long 5 term assets are those that affect the firm"s

operations beyond the one year period.

The firm"s investment decisions would generally include

expansion, ac!uisition, modernization and replacement of the long6term

assets. %ale of a decision or business is also an investment decision.

ecision like the change in the methods of sales distribution or an

advertisement comparison or research T development program have long

5term implications in the firm"s expenditure and benefits, and there fore

they should also he evaluated as investment decision.

SCOPE O$ THE STUD8

S.S & N COLLEGE Page 3A

MBA PROGRAMME

The study of capital budgeting in Bizag steel plalnt includes

analyzing the investment decision of the firm.

2s substantial amounts are tied up in such decision, it needs careful

analysis and proper management .in order to minimize the

manufacturing costs and maximize its profits.

2s the information available is limited and the sub(ect is vast the

study is combined to overall capital budgeting techni!ues followed

at the firm

OB4ECTI1ES O$ THE STUD8

S.S & N COLLEGE Page 3F

MBA PROGRAMME

&. To present theoretical framework relating to the capital

budgeting.

-. To study the financial aspects for future expansion of B%1.

3. To discuss the process of pro(ect evaluation followed by B%1.

8. To evaluate the elements consider by B%1 for expansion

pro(ect.

9. To summarize and offer suggestions for the better investment

proposals.

3ETHODOLOG8

S.S & N COLLEGE Page 8G

MBA PROGRAMME

/ethodology is a systematic procedure of collecting information in

order to analyze and verify a phenomenon. The collection of

information is done two principle sources. They are as follows4

&. 1rimary ata

-. %econdary ata

P"i!a"/ Data

The primary data needed for the study is gathered through

interviews with concerned officers and staff, either individually or

collectively, sum of the information has been verified or supplemented

with personal observation conducting personal interviews with the

concerned officers of finance department of Bisakhapatnam %teel

1lant.

Sec#nda"/ Data

The secondary data needed for the study was collected from

published sources such as, pamphlets of annual reports, returns and

internal records, reference from textbooks and (ournals relating to

financial management.

#urther the data needed for the study was also needed 4

S.S & N COLLEGE Page 8&

MBA PROGRAMME

(a) Collection of re!uired data from annual records of Bisakhapatnam

%teel 1lant.

(b) *eference from textbooks and (ournals relating to financial

management.

DATA SOURCES

S.S & N COLLEGE Page 8-

DATA

SOURCES

PRIMARY

SOURCES

SECONDARY

SOURCES

MANAGEME

NT

RESPONDENT

S

ANNUAL

REPORTS

PERSONAL

OBSERVANC

E

TEXT

BOOKS,

JOURNALS

INSIDE THE

COMPANY

OUTSIDE

THE

COMPANY

MBA PROGRAMME

LI3ITATIONS O$ THE STUD8

The following are the limitations of the study.

&. %ince the procedure and polices of the company will not allow to

disclose confidential financial information, the pro(ect has to be

completed with the available data given to us.

-. The study is carried basing on the information and documents

provided by the organization and based on the interaction with the

various employees of the respective departments.

3. There was no scope of gathering current information, as the

auditing has not been done by the time of pro(ect work.

S.S & N COLLEGE Page 83

MBA PROGRAMME

INDUSTR8 PRO$ILE

%teel is an alloy of iron usually containing less than &M carbon

is a versatile material with multitude of useful properties used most

fre!uently in the automotive and construction industries. %teel can be cast

into bars strips, sheets, nails, spikes, wire, rods or pipes as needed by the

intended user. The consumption of steel is regarded as the index of

industrialization and the economic maturity any country has attained.

The development of steel industry in )ndia should be viewed in

con(unction with the type and system of government that had been ruling

the country. The production of steel in significant !uantity started after

&FGG. The growth of steel industry can be conveniently studied by

dividing in the period into pre T post independence era (or before &F9GT

after &F9G).The total installed capacity for in6got %teel production in

during pre independence era was &.9 millions tones Dyear, which has risen

to about A million tones of ingot by the seventies. This is the result of the

bold steps taken by the government to develop this sector.

PRE&INDEPENDENCE

&A3G 6 Uosiah, /arshall +ealth constructed the first manufacturing

&A3& 6 1lant at port /ove in /adras presidency.

&A?8 6 Uames 7rskin founded the ,engal iron works.

&AFF 6 Uamshed(i Tata initiated the scheme for an integrated steel plant.

&FG= 6 #ormation of T)%C'.

&F&& 6 Tata iron T steel company started production.

&F&= 6 T)%)C' was founded.

&F8G689 6 #ormation of /ysore iron T steel limited, and ,hadravati

in Qarnataka.

S.S & N COLLEGE Page 88

MBA PROGRAMME

POST&INDPENDENCE

&F9&69= 6 #irst #ive Rear 1lan.

;o new steel plant came up .The +industan steel Jtd.

was born on &F

th

Uanuary, &F98 with the decision of

setting up three steel plants each with one million tone

input steel per year in at *oukela, ,hilai and

urgapurK T)%C' stated its expansion programme.

&F9=.=& 6 %econd #ive Rear 1lan

2 bold decision was taken up to increase the ingot

steel output )ndia to = /illion tones per year T

production at *ourkela, ,hilai and urgapur steel

plant started.

&F=&.== 6 Third #ive Rear 1lan

uring the third five year plan the three steel plants

under +%J, T)%C' T +%C' were expanded as show.

)n Uanuary &F=8 ,okaro steel plant came into

existence.

&F==.=F 6 *ecession 1eriod

The entire expansion programme was actively

executed during this period.

&F=F6?8 6#ourth #ive Rear 1lan

Jicenses were given for setting up of many mini steel

plants and re6rolling mills.

S.S & N COLLEGE Page 89

MBA PROGRAMME

:ovt. 'f. )ndia accepted setting up two more steel

plants in south. 'ne each at Bisakhapatnam and

+ospet(Qarnataka).

%2)J was formed during this period on -8

th

Uanuary,

&F?3. The total installed capacity from = integrated

plants was &G= /t.

&F?F 6 2nnual 1lan

The erstwhile %oviet <nion agreed to help in setting

up the visakhapatnam steel plant.

&FAG.A9 6 %ixth #ive Rear 1lan

>ork on visakhapatnam steel plant was started with a

big bang and top priority was accorded to start the

plant.

%cheme for modernization of ,hilai steel plant,

*ourkela, urgapur, T)%C' were initiated.

&FA96F& 6 %eventh #ive Rear 1lan

7xpansion work of ,hilai and ,okaro steel plants

completed.

1rogress on visakhapatnam steel plant picked up and

rationalized concept has been introduced to

commission the plant with 3.G/t li!uid steel capacity

by &FFG.

S.S & N COLLEGE Page 8=

MBA PROGRAMME

&FF&6F= 6 7ight #ive Rear plan

Bishakapatanam steel plant started its production

modernization of other steel plants is also duly

envisaged.

&FF?6-GG- 6 ;inth #ive Rear 1lan

Bisakhapatnam steel plant had foreseen a ?M growth

during the entire plan period.

-GG-6-GG? 6 Tenth #ive Rear 1lan

%teel industry registers the a growth of F.F M

visakhapatnam steel plant high regime targets

achieved the best of them.

T+7 /2U'* %T77J 2; *7J2T7 C'/12;)7% ); );)2

&. ,harat *efactories Jtd.

-. +industan %teel >orks Construction Jtd.

3. Uindal %teel and 1ower Jtd.

8. Qudremukh)ron 're Company Jtd.

9. /anganese ore ()ndia ) Jtd.

=. /etal %crap Trade Corporation Jtd.

?. /etallurgical and 7ngineering Consultants )ndia Jtd.

A. ;ational /ineral evelopment Corporation (;/C).

F. *ashtriya )spat ;igam Jtd.

&G. %ponge )ron )ndia Jtd.

&&. %teel 2uthority )ndia ltd.

&-. Tata )ron %teel Company.

S.S & N COLLEGE Page 8?

MBA PROGRAMME

The global steel industry has witnessed several revolutionary changes

during the last century. The changes have been in the realms of both

technology T business strategy. The ultimate ob(ect of all these changes

is to remain competitive and open global market.

The )ndian steel industry is growing very rigorously with the

ma(or producers like %2)J, *);J, T)%C', UBJ and many others. 'ur

steel industry has amply demonstrated its ability of adopt to the changing

scenario and to survive in the global market that is becoming increasingly

competitive. This has been possible to a large extent due to the adoption

of innovative operating practices and modern technologies.

)ndustrial evelopment in )ndia has reached a high degree of self6

reliance, and the steel industry occupies a primary place in the strategy

for future development. 2t present the production of steel industry

country is 38/t. the public sector steel industry has been restructured to

meet challenges and a separate fund has been established for

moderanisation and future development of the industry. )t is now being

proposed that )ndian steel industry should :ear up to achieve a

production level of about &GG /t by the year-GGG.

GLOBAL SCENARIO

2s per ))%)

)n /arch" -GG9 world Crude steel out put was F-A/t when

compared to march -GG8 (A?-/t), VThe change in

percentage was =.9M.

S.S & N COLLEGE Page 8A

MBA PROGRAMME

China remained the world largest crude steel producer in

-GG9 also (-?9/t) followed by Uapan (F=/t) and <%2

(A&/t). )ndia occupied A

th

position (8-/t).

<%2 remained the largest importer of semi finished and

finished products in -GG- followed by China and :ermany.

Uapan remained the largest exporter of semi finished and

finished steel products in -GG- followed by *ussia and

<kraine.

'ther significant recent developments in the global steel

scenario have been4<nder the auspices of the '7C

('rganization #or 7conomic Co6operation T evelopment)

the negotiations among the ma(or steel producing countries

for a steel subsidy agreement (%%2) held in -GG3 with the

ob(ective to agree on a complete negotiating test for the

%%2 by the /iddle of -GG8. )t also set subsidies for the steel

industry of a ceiling of G.9M of the value of production to be

used exclusively for *esearch T evelopment

The global economy witnessed a gradual recovery from late

-GG3 on words. China has become one of the ma(or factors

currently driving the world economy.

2s a result of these economic developments ))%) has

pro(ected an increase by =.-M or 9.3 /t in -GG8 in the

global consumption of finished steel products. ))%) has split

the growth into two separate areas, china and the rest of the

world (*'>). %teel consumption in china has been

estimated to increase by &3.&M or 3&/t in -GG8.

<%2 has repealed the safeguard measures on import of steel

as a result of a ruling by a >T' dispute resolution panel,

S.S & N COLLEGE Page 8F

MBA PROGRAMME

which held these measures to be illegal under the >T'

regime.

3AR@ET SCENARO

The year -GG86G9 was a remarkable one for the steel industry with

the world crude steel production crossing the one billion mark for the first

time in the history of the steel industry. The world :1 growth about 8M

lends supports to the expectations the steel market is all set for strong

revival after prolonged period of depression .The )ndian economy also

become robust with annual growth rates of ?6A M this will provide a

ma(or boost the steel industry. >ith the nations focus on infrastructure

development coupled with the growth in the manufacturing sector, the

)ndian steel industry all set for north ward movement. The draft national

steel police envisages production of =G /t by -G&- and &&G/t by-G-G,

and annual growth rate of =6?M. 2ll this should there fore augur well for

the )ndian steel industry.

PRODUCTION SCENARIO

%teel industry was de6licensed and decontrolled in

&FF&T&FF- respectively.

)ndia is the A

th

largest producer of steel in the world.

)n -GG36G8 finished steel production was 3=.&F3/t.

1ig iron production in -GG36G8 was 9.--&/t.

S.S & N COLLEGE Page 9G

MBA PROGRAMME

%ponge iron production was AG.A9 /t during the

year -GG36G8

The annual growth rate of crude steel production in

-GG-6G3was AM and in -GG36G8 was =M.

The last five year production performance is as under4

Table 4&

()n /illion tones)

8EAR PIGIRON SPONGEIRON $INISHED

STEEL

-GGA6GF 3.3F 9.88 -F.-?

-GGF6&G 8.GA 9.88 3G.=3

-G&G6&& 9.-A =.88 33.=?

-G&&6&- 3.?= A.GF 3F.&-

-G&-6&3 3.&A F.F3 8&.&9

$igu"e%=

S.S & N COLLEGE Page 9&

MBA PROGRAMME

DE3AND&A1AILABILIT8 PRO4ECTION%

emand62vailability of iron and steel in the country is pro(ected by

ministry of steel annually.

:aps in availability are met mostly through imports.

)nterface with consumers by way of %teel Consumer Council exists,

which is conducted on regular basis.

)nterface helps in redressing availability problems, complaints related

to !uality.

PRICING ' DISTRIBUTION %

1rice regulation of iron T steel was abolished on &=6G&6&FF-.

istribution controls on ironT steel removed except 9 priority

sectors, viz efense, *ailways, %mall %cale )ndustries

Corporations,

7xporters of 7ngineering :oods and ;orth 7astern region.

2llocation to priority sectors is made by /inistry of steel.

:overnment has no control over prices of iron T steel.

'pen market prices are generally on rise.

S.S & N COLLEGE Page 9-

MBA PROGRAMME

1rice increases of late have taken place mostly in long products

than flat products.

CO3PAN8 PRO$ILE

Bisakhapatnam %teel 1lant (B%1), the first coast based %teel 1lant

of )ndia is located, &= Q/ %outh >est of city of estiny i.e.

Bisakhapatnam. ,estowed with modern technologies, B%1 has an

installed capacity of 3 million Tones per annum of Ji!uid %teel and -.=9=

million Tones of saleable steel. 2t B%1 there is emphasis on total

automation, seamless integration and efficient up gradations, which result

in wide range of long and structural products to meet stringent demands

of discerning customers within )ndia and abroad. B%1 products meet

exacting )nternational Wuality %tandards such as U)%, );, and ,)%, ,%

etc.

B%1 has become the first integrated %teel 1lant in the country to

be certified to all the three international standards for !uality ()%'6FGG&),

for 7nvironment /anagement ()%'6&8GG&) T for 'ccupational +ealth T

%afety ('+%2%6&AGG&). The certificate covers !uality systems of all

'perational, /aintenance and %ervice units besides 1urchase systems,

Training and /arketing functions spreading over 8 *egional /arketing

'ffices, -8 branch offices and stock yards located all over the country.

B%1 by successfully installing T operating efficiently *s. 8=G

crores worth of 1ollution Control and 7nvironment Control 7!uipments

and converting the barren landscape by planting more than 3 million

S.S & N COLLEGE Page 93

MBA PROGRAMME

plants has made the %teel 1lant, %teel Township and surrounding areas

into a heaven of lush greenery. This has made %teel Township a greener,

cleaner and cooler place, which can boast of 3 to 8X C lesser temperature

even in the peak summer compared to Bisakhapatnam City.

B%1 exports Wuality 1ig )ron T %teel productsI to %ri Janka,

/yanmar, ;epal, /iddle 7ast, <%2, China and %outh 7ast 2sia. *);J6

B%1 was awarded H%tar Trading +ouseH status during &FF?6-GGG. +aving

established a fairly dependable export market, B%1 plans to make a

continuous presence in the export market.

+aving a total manpower of about &=,=GG B%1 has envisaged a

labor productivity of -=9 Tones per man6year of Ji!uid %teel.

BAC@GROUND%

>ith a view to give impetus to )ndustrial growth and to meet the

aspirations of the people from 2ndhra 1radesh, :overnment of )ndia

decided to establish )ntegrated %teel 1lant in 1ublic %ector at

Bisakhapatnam (21). The announcement to this effect was made in the

1arliament on &?th 2prilI &F?G by the then 1rime /inister of )ndia late

%mt. )ndira :andhi.

2 site was selected near ,alacheruvu creak near Bisakhapatnam

city by a Committee set up for the purpose, keeping in view the

topographical features, greater availability of land and proximity to a

future port. %mt. :andhi laid the foundation stone for the plant on

-G.G&.&F?&.

%eeds were thus sown for the construction of a modern T

sophisticated %teel 1lant having annual capacity of 3.8 /illion Tones of

hot metal. 2n agreement was signed between :overnments of )ndia and

the erstwhile <%%* on Uune &-th, &F?F for setting up of an )ntegrated

S.S & N COLLEGE Page 98

MBA PROGRAMME

%teel 1lant to produce structural T long products on the basis of detailed

1ro(ect report prepared by /Ds /.;. ustur T Company. 2

Comprehensive revised 1* (ointly prepared by %oviets T /Ds ustur T

Company was submitted in ;ovI &FAG to :ovt. of )ndia.

The construction of the 1lant started on &st #ebruary &FA-.

:overnment of )ndia on &Ath #ebIA- formed a new Company called

*ashtriya )spat ;igam Jtd. (*);J) and transferred the responsibility of

constructing, commissioning T operating the 1lant at Bisakhapatnam

from %teel 2uthority of )ndia Jtd. to *);J.

ue to poor resource availability, the construction could not keep

pace with the plans, which led to appreciable revision of the plant cost. )n

view of the critical fund situation and need to check further increase in

the plant costs, a rationalized concept was approved which was to cost

*s. =A8F crores based on 8th Wuarter of &FAA.

The rationalized concept was based on obtaining the maximum

output from the e!uipments already installed, planned D ordered for

procurement and achieving higher levels of operational efficiency and

labor productivity. Thus the plant capacity was limited to 3.G /illion

Tones of Ji!uid %teel per annum. )n the process, one of the %teel /elt

%hops and one of the mills were curtailed.

The availability of resources were continued to be lower than what

was planned and this further delayed the completion of the construction

of the plant. #inally all the units were constructed and commissioned by

UulyI F- at a cost of *s.A9-F Crores. The plant was dedicated to

nation by the then prime /inister of )ndia Jate %ri 1. B. ;arasimha *ao

on &

st

2ugust &FF-.

%ince Commissioning B%1 has already crossed many milestones

in the fields of production, productivity T exports. Coke rate of the order

S.S & N COLLEGE Page 99

MBA PROGRAMME

of 9GF QgDTon of +ot metal, average converter life of -A=8 heats an

average of -3.= heats per se!uence in continuous ,loom Caster. %pecific

energy consumption of =.G? : Qal D ton of li!uid steel, a specific

refractory consumption of A.F8 kg and a labor productivity of -=9 Ton D

man6year are some of the peaks achieved (during the year -GG86G9) in

pursuit of excellence.

3ISSION 1ISION ' OB4ECTI1ES

To attain &Gmillion ton li!uid steel capacity through technological

up6gradation, operational efficiency and expansion4 to produce steel at

international standards of cost and !uality4 and to meet the aspirations of

the stakeholders.

1ISION

To be a continuously growing world6class company, )t

harnesses the growth potential and sustain profitable growth

eliver high !uality and cost competitive products and be the

#irst choice of customers

Create an inspiring work environment to unleash the creative

energy of people

2chieve excellence in enterprise management

,e a respected corporate citizen, ensure clean and green

environment and develop vibrant communities around

OBJECTIVES

7xpand plant capacity to &G million ton by -G&36&8 with the

mission to attain &9 million ton capacity in two subse!uent

1hases.

S.S & N COLLEGE Page 9=

MBA PROGRAMME

>ipe out accumulated losses by -GGF6&G

,e amongst top five lowest cost li!uid steel producers in the

world by -G&G6&&.

/ake *);J the employer of choice by caring for employees.

evelop people as knowledge workers by -G&G6&& and

achieve.

2n improvement of 9 percentage points in employee

satisfaction Jevels every alternate year.

,e ranked as an excellent business organization by -G&&6&-

7nsure zero effluent discharge by -GGF6&G and contribute to

)mproving !uality of life (health, literacy, and water) in at least

one village every year.

CORE VALUES

Commitment

Customer %atisfaction

Continuous )mprovement

Concern for 7nvironment

Creativity T )nnovation

)%' 1'J)CR

To trainee -GGG employees through suitable )n6house training

and external training.

To implement = number of !uality circle pro(ects.

To provide 38 number of valuable suggestion to the top

management.

S.S & N COLLEGE Page 9?

MBA PROGRAMME

UALIT! "OLIC!

Bisakhapatnam %teel 1lant is committed to meet the needs and

expectations of their customers and other interested parties. To

accomplish this, they will

%upply !uality goods and services to customers delight

2chieve !uality of the products by following systematic

approach

Through planning, documented procedures and timely review of

Wuality ob(ectives.

Continuously improve the !uality of all materials, processes and

1roducts.

/aintain an enabling environment of all employees with their

)nvolvement.

#R "OLIC!

Bisakhapatnam %teel 1lant, believe that its employees are the

most important resources. To realize the full potential of

employees, the company is committed to4

1rovide work environment that makes the employees

Committed and motivated for maximizing productivity.

7stablish systems for maintaining transparency, fairness and

e!uality in dealing with employees.

7mpower employees for enhancing commitment,

*esponsibility and accountability.

7ncourage teamwork, creativity, innovativeness and high

achievement orientation.

1rovide growth and opportunities for developing skill and

Qnowledge.

S.S & N COLLEGE Page 9A

MBA PROGRAMME

7nsure functioning of effective communication channels with

employees.

S.S & N COLLEGE Page 9F

MBA PROGRAMME

CUSTO$ER "OLIC!

B%1 will endeavor to adopt a customer6focused approach

2t all times with transparency.

B%1 will strive to meet more than the customer needs

and expectations pertaining to products, !uality, and

Balue for money and satisfaction.

B%1 greatly values its relationship with customers and

would make efforts at strengthening these relations for

/utual benefit.

IT "OLIC!

*);JDB%1 is committed to leverage )nformation Technology as

the vital enabler in improving the customer6satisfaction,

organizational efficiency, productivity, decision6making,

transparency and cost6effectiveness, and thus adding value to

the business of steel making. Towards this, *);J shall4

#ollow best practices in process 2utomation T ,usiness

1rocesses through )T by in6house efforts D outsourcing and

collaborative efforts with other organization D expert groups D

institutions of higher learning, etc., thus ensuring the !uality of

product and services at least cost.

#ollow scientific and structured methodology in the software

development processes with total user6involvement, and thus

delivering integrated and !uality products to the satisfaction of

internal and external customers.

S.S & N COLLEGE Page =G

MBA PROGRAMME

)nstall, maintain and upgrade suitable cost6effective )T

hardware, software and other )T infrastructure and ensure high

levels of data and information security

%trive to spread )T6culture amongst employees based on

organizational need, role and responsibilities of the personnel