Maharashtra State Tax On Professions, Trades, Callings and Employments Act

Diunggah oleh

swapnilswayam0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan8 halamanJudul Asli

Maharashtra State Tax on Professions, Trades, Callings and Employments Act,

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

3K tayangan8 halamanMaharashtra State Tax On Professions, Trades, Callings and Employments Act

Diunggah oleh

swapnilswayamHak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 8

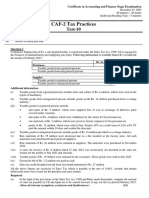

Maharashtra State Tax on Professions, Trades, Callings and

Employments Act, 1975

Schedule of rates of tax w.e.f. 1.04.2006

“SCHEDULE I

(See section 3)

Schedule of rates of tax on professions, trades, callings and employments

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

PART I Rs.

1. Salary and wage earners. Such persons

whose monthly salaries or wages,

(a) do not exceed rupees 2,500 Nil

(b) exceed rupees 2,500 but do not 60 per month

exceed rupees 3,500

(c) exceed rupees 3,500 but do not 120 per month

exceed rupees 5,000

(d) exceed rupees 5,000 but do not 175 per month

exceed rupees 10,000

(e) exceed rupees 10,000 2500 per annum, to be

paid in the following

manner: -

a) rupees two hundred

per month except for

the month of February;

b) rupees three hundred

for the month of

February

2. (a) Legal Practitioners including

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

Solicitor and Notaries;

(b) Medical Practitioners, including

Medical Consultants and Dentists;

(c) Technical and Professional

Consultants, including Architects,

Engineers, R.C.C. Consultants, Tax

Consultants, Chartered Accountants,

Actuaries and Management

Consultants;

(d)Chief Agents, Principal Agents,

Insurance Agents and Surveyors and

Loss Assessors registered or licensed

under the Insurance Act, 1938, U.T.I.

Agents under U.T.I. Scheme, N.S.S.

agents under postal Scheme;

(e)Commission Agents, Dalals and

Brokers (other than estate brokers

covered by any other entry elsewhere in

this Schedule);

(f)All types of Contractors (other than

building contractors covered by any

other entry elsewhere in this Schedule);

and

(g)Diamond dressers and diamond

polishers;

having not less than one year’s standing 2500 per annum

in the profession.

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

3. (a) Members of Association recognised 2,500 per annum

under the Forward Contracts

(Regulations) Act, 1952

(b) (i) Member of Stock Exchanges 2500 per annum

recognised under the Security

Contracts (Regulation) Act, 1956;

(ii) Remisiers recognised by the Stock 2500 per annum

Exchange;

4. (a) Building Contractors; 2500 per annum

(b) Estate Agents, Brokers or Plumbers,

having not less than one years standing 2500 per annum

in the profession.

5. Directors (other than those nominated by 2500 per annum

Government) of Companies registered

under the Companies Act, 1956, and

Banking Companies as defined in the

Banking Regulation Act, 1949,

Explanation : The term 'Directors' for the

purpose of this entry will not include the

persons who are Directors of the

companies whose registered offices are

situated outside the State of Maharashtra

and who are not residing in the State of

Maharashtra.

6. (a) Bookmakers and Trainers licensed by 2500 per annum

the Royal Western India Turf Club

Limited;

(b) Jockeys licensed by the said Club 2500 per annum

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

7. Self-employed persons in the Motion

Picture Industry, Theatre, Orchestra,

Television, Modelling or Advertising

Industries, as follows:

(a) Writers, Lyricists, Directors, Actors 2500 per annum

and Actresses (excluding Junior

Artists), Musicians, Play-back Singers,

Cameramen, Recordist, Editors and

Still-Photographers,

(b) Junior Artists, Production Managers, 1000 per annum

Assistant Directors, Assistant

Recordists, Assistant Editors and

Dancers.

8. Dealers registered under the Maharashtra

Value Added Tax Act, 2002, or Dealers

registered only under the Central Sales

Tax Act, 1956, whose annual turnover of

sales or purchases,-

(i) is rupees 25 lakh or less 2000 per annum

(ii) exceeds rupees 25 lakh 2500 per annum

9. Occupiers of Factories as defined in the 2500 per annum

Factories Act, 1948, who are not covered

by entry 8 above

10. (1) (1)(A) Employers of establishments as

defined in the Bombay Shops and

Establishment Act, 1948, where

their

establishments are situated within

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

an

area to which the aforesaid Act

applies, and who are not covered

by

entry 8 - Such employers of

establishments,-

(a) (a) where no employee is 1000 per annum

employed

(b) where not exceeding two 2000 per annum

employees are employed

(b) (b) where more than two 2500 per annum

employees

are employed

(B) Employers of establishments as

defined in the Bombay Shops and

Establishments Act, 1948, where their

establishments are not situated within

an area to which the aforesaid Act

applies, and who are not covered by

entry 8 –

Such employers of establishment,-

(a) where no employee is employed 500 per annum

(a) (a) where not exceeding two 1000 per annum

employees are employed,

(b) (b) where more than two employees 2500 per annum

are employed

(2) Persons owning / running STD / ISD 1000 per annum

booths or Cyber Cafes, other than those

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

owned or run by Government or by

physically handicapped persons;

(3) Conductors of Video or Audio 2500 per annum

Parlours, Video or Audio Cassette

Libraries, Video Game Parlours;

(4) Cable Operators, Film Distributors; 2500 per annum

(5) Persons owning / running marriage 2500 per annum

halls, conference halls, beauty

parlours, health centres, pool parlours;

(6) Persons running / conducting 2500 per annum

coaching classes of all types

11. Owners or Lessees of Petrol / Diesel / Oil 2500 per annum

Pumps and Service Stations / Garages and

Workshops of Automobiles

12. Licensed Foreign Liquor Vendors and 2500 per annum

employers of Residential Hotels and

Theatres as defined in the Bombay Shops

and Establishments Act, 1948.

13. Holders of permits for Transport Vehicles

granted under the Motor Vehicles Act,

1988, which are used or adopted to be

used for hire or reward, where any such

person holds permit or permits for,-

(a) three wheeler goods vehicles, for 750 per annum

each such vehicle

(b) any taxi, passenger car, for each 1000 per annum

such vehicle

(c) (i) goods vehicles other than those 1500 per annum

covered by (a)

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

(ii) trucks or buses 1500 per annum

for each such vehicle :

Provided that the total tax payable by a

holder under this entry shall not exceed

rupees 2,500 per annum.

14. Money lenders licensed under the Bombay 2500 per annum

Money-lender Act, 1946

15. Individuals or Institutions conducting 2500 per annum

Chit-Funds

16. Co-operative Societies registered or

deemed to be registered under the

Maharashtra Co-operative Societies Act,

1960 and engaged in any profession, trade

or calling --

(i) State level Societies 2,500 per annum

(ii) Co-operative sugar factories 2,500 per annum

and spinning Mills

(iii) District level Societies 750 per annum

(iv) Handloom weavers co-

operative societies 500 per annum

(v) All other co-operative societies not 750 per annum

covered by clauses (i), (ii),(iii) and (iv)

above.

17. Banking Companies, as defined in the 2500 per annum

Banking Regulation Act, 1949.

18. Companies registered under the 2500 per annum

Companies Act, 1956 and engaged in any

profession, trade or calling.

19. Each Partner of a firm (whether registered 2500 per annum

Sr. Class of Persons Rate of Tax

No.

1. 2. 3.

or not under the Indian Partnership Act,

1932) engaged in any profession, trade, or

calling.

20. Each Co-parcener (not being a minor) of a 2500 per annum

Hindu Undivided Family, which is

engaged in any profession, trade or calling.

21. Persons other than those mentioned in any 2500 per annum

of the preceding entries who are engaged

in any profession, trade, calling or

employment and in respect of whom a

notification is issued under the second

proviso to sub-section (2) of section 3

Note: 1. Notwithstanding anything contained in this Schedule, where a person is

covered by more than one entry of this Schedule, the highest rate of tax

specified under any of those entries shall be applicable in his case. This

provision shall not be applicable to entry 16(iv) of the schedule.

Note: 2. For the purposes of Entry 8 of the Schedule, the Profession Tax shall be

calculated on the basis of the "turnover of sales or purchases" of the previous

year. If there is no previous year for such dealer, the rate of Profession Tax

shall be Rs. 2000. The expressions "turnover of sales" or "turnover of

purchases" shall have the same meaning as assigned to them, respectively,

under the Maharashtra Value Added Tax Act, 2002. ”

Anda mungkin juga menyukai

- Game Rules PDFDokumen12 halamanGame Rules PDFEric WaddellBelum ada peringkat

- Iq TestDokumen9 halamanIq TestAbu-Abdullah SameerBelum ada peringkat

- DLL - The Firm and Its EnvironmentDokumen5 halamanDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Inside Animator PDFDokumen484 halamanInside Animator PDFdonkey slapBelum ada peringkat

- Polyol polyether+NCO Isupur PDFDokumen27 halamanPolyol polyether+NCO Isupur PDFswapon kumar shillBelum ada peringkat

- M8-2 - Train The Estimation ModelDokumen10 halamanM8-2 - Train The Estimation ModelJuan MolinaBelum ada peringkat

- Insider Threat ManagementDokumen48 halamanInsider Threat ManagementPatricia LehmanBelum ada peringkat

- Quality Management in Digital ImagingDokumen71 halamanQuality Management in Digital ImagingKampus Atro Bali0% (1)

- Profession Tax-Schedule 1Dokumen3 halamanProfession Tax-Schedule 1SAYAN BHATTABelum ada peringkat

- Punjab Finance Act 2019Dokumen14 halamanPunjab Finance Act 2019DETDGKHANBelum ada peringkat

- Tax Rates KPT PDFDokumen16 halamanTax Rates KPT PDFAbhishek KumarBelum ada peringkat

- Notfctn 29 2018 CGST Rate English RCM On SecurityDokumen4 halamanNotfctn 29 2018 CGST Rate English RCM On SecurityA KumarBelum ada peringkat

- Rates On Profession TaxDokumen7 halamanRates On Profession Taxknikesh58Belum ada peringkat

- RateDokumen13 halamanRatejustndn4u6307Belum ada peringkat

- KPK Professional Tax Act SummaryDokumen6 halamanKPK Professional Tax Act SummaryHumayunBelum ada peringkat

- PT Schedule Tax RatesDokumen4 halamanPT Schedule Tax RatesMehar ThotaBelum ada peringkat

- Amended Professional Tax ScheduleDokumen5 halamanAmended Professional Tax ScheduleACCT LVO 150Belum ada peringkat

- Tax Rates KPTDokumen14 halamanTax Rates KPTHitheswar ReddyBelum ada peringkat

- Changes Made in Income Tax Act 2058Dokumen10 halamanChanges Made in Income Tax Act 2058shankarBelum ada peringkat

- Itcst Nov06Dokumen27 halamanItcst Nov06api-3825774Belum ada peringkat

- 06 Modaraba Companies Ordinance 1980Dokumen19 halaman06 Modaraba Companies Ordinance 1980Nasir HussainBelum ada peringkat

- Test 10Dokumen4 halamanTest 10ls786580302Belum ada peringkat

- Local ServiceDokumen6 halamanLocal ServicepetermasakalaBelum ada peringkat

- Act 631 Finance Act 2003Dokumen20 halamanAct 631 Finance Act 2003Adam Haida & CoBelum ada peringkat

- CAF-2-TAX-Autumn-2019Dokumen5 halamanCAF-2-TAX-Autumn-2019duocarecoBelum ada peringkat

- F Business Taxation 671079211Dokumen4 halamanF Business Taxation 671079211anand0% (1)

- GST Ca Interg9 QuestionDokumen6 halamanGST Ca Interg9 QuestionVishal Kumar 5504Belum ada peringkat

- PT ScheduleDokumen14 halamanPT ScheduleRaghavendra karekarBelum ada peringkat

- CS Professional DT IDT Most Expected Questions For DECEMBER 2023Dokumen285 halamanCS Professional DT IDT Most Expected Questions For DECEMBER 2023Dhanush GunisettyBelum ada peringkat

- TAXQDokumen7 halamanTAXQcashubhamkelaBelum ada peringkat

- Commerce Paper II Questions and Ledger AccountsDokumen5 halamanCommerce Paper II Questions and Ledger AccountsM JEEVARATHNAM NAIDUBelum ada peringkat

- Setting Up Business Entities GuideDokumen16 halamanSetting Up Business Entities Guidemadhu kolamaudiBelum ada peringkat

- Past Paper Tax PDFDokumen102 halamanPast Paper Tax PDFUmar AkhtarBelum ada peringkat

- Supplement For: Setting Up of Business Entities and ClosureDokumen16 halamanSupplement For: Setting Up of Business Entities and ClosurePritam BanikkBelum ada peringkat

- PT Amendment BillDokumen2 halamanPT Amendment BillSomashekarBelum ada peringkat

- KP Finance Act 2021Dokumen19 halamanKP Finance Act 2021Arshad MahmoodBelum ada peringkat

- Roll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Dokumen8 halamanRoll No.......................... Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Suppy PBelum ada peringkat

- Islamabad Capital Territory (Tax On Services) Ordinance, 2001Dokumen12 halamanIslamabad Capital Territory (Tax On Services) Ordinance, 2001Bilal KhanBelum ada peringkat

- Question IDT GM 1Dokumen13 halamanQuestion IDT GM 1Prajwal AradhyaBelum ada peringkat

- A Consent To Establish (Noc) : Industries Having Capital InvestmentDokumen8 halamanA Consent To Establish (Noc) : Industries Having Capital InvestmentAnkit GuptaBelum ada peringkat

- The Maharashtra Advertisements Tax Act, 1967Dokumen8 halamanThe Maharashtra Advertisements Tax Act, 1967ENACT LEGALBelum ada peringkat

- Instructions To Fill Up The Common Application Form For Clearances / Approvals / Services For Operation of An Industrial UnitDokumen8 halamanInstructions To Fill Up The Common Application Form For Clearances / Approvals / Services For Operation of An Industrial UnitsuryanathBelum ada peringkat

- Business Improvement Area Regulation: Municipal Government ActDokumen16 halamanBusiness Improvement Area Regulation: Municipal Government Actg8xzkmy58dBelum ada peringkat

- Trade Union Act 1926Dokumen15 halamanTrade Union Act 1926sanjuviewsonicBelum ada peringkat

- I.TAx 302Dokumen4 halamanI.TAx 302tadepalli patanjaliBelum ada peringkat

- Sr. No. Capital Investment Cost of Industries/project Fee Amount (RS.)Dokumen12 halamanSr. No. Capital Investment Cost of Industries/project Fee Amount (RS.)deepali_nih9585Belum ada peringkat

- New Profession Tax Rates in W.BDokumen5 halamanNew Profession Tax Rates in W.BUdayan GautamBelum ada peringkat

- Mock Sep 2023 - Question PaperDokumen8 halamanMock Sep 2023 - Question Paperfahadkhn871Belum ada peringkat

- Institute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsDokumen2 halamanInstitute of Cost and Management Accountants of Pakistan Fall (Winter) 2009 ExaminationsSyed Mohammad Ali Zaidi KarbalaiBelum ada peringkat

- Time Allowed: 3 Hours Max Marks: 100: Paper A1Dokumen3 halamanTime Allowed: 3 Hours Max Marks: 100: Paper A1KashifBelum ada peringkat

- TAX COMPUTATIONDokumen5 halamanTAX COMPUTATIONRamzan AliBelum ada peringkat

- Mba 3 Sem Tax Planning and Management Jan 2019Dokumen3 halamanMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhBelum ada peringkat

- DocumentsRequirementGuidelines FinalDokumen13 halamanDocumentsRequirementGuidelines Finalsumit4up6rBelum ada peringkat

- CCCBA Intermediate Exam Taxation I AnswersDokumen3 halamanCCCBA Intermediate Exam Taxation I AnswersAporupa BarBelum ada peringkat

- Test 9Dokumen4 halamanTest 9lalshahbaz57Belum ada peringkat

- ZJC Tax Rates Tables - Tax Year 2023Dokumen11 halamanZJC Tax Rates Tables - Tax Year 2023Mux ConsultantBelum ada peringkat

- Corporate Accounting Ii-1Dokumen4 halamanCorporate Accounting Ii-1ARAVIND V KBelum ada peringkat

- Pakistan Institute of Public Finance Accountants: TaxationDokumen3 halamanPakistan Institute of Public Finance Accountants: TaxationAzfar AliBelum ada peringkat

- Trade Unions Act 1926-1Dokumen12 halamanTrade Unions Act 1926-1AMIT KUMARBelum ada peringkat

- The Sales Tax Act, 1990Dokumen509 halamanThe Sales Tax Act, 1990Muhammad Hassaan AhmadBelum ada peringkat

- Maud MS 218Dokumen16 halamanMaud MS 218Avinash SarwanBelum ada peringkat

- Advanced Accounting: Computer Lab - PracticalDokumen37 halamanAdvanced Accounting: Computer Lab - PracticalSaif UddinBelum ada peringkat

- Sample IDTDokumen34 halamanSample IDTsaraBelum ada peringkat

- MCQ On TDS, TCS & Advance TaxDokumen15 halamanMCQ On TDS, TCS & Advance TaxPrakhar GuptaBelum ada peringkat

- SBEC Supplement June 2019Dokumen16 halamanSBEC Supplement June 2019arjunjoshiBelum ada peringkat

- M17MBA004 Tax AssignmentDokumen9 halamanM17MBA004 Tax AssignmentZaibee 'zBelum ada peringkat

- Tax AssignmentDokumen4 halamanTax AssignmentkaRan GUptД100% (1)

- Chapter 3 of David CrystalDokumen3 halamanChapter 3 of David CrystalKritika RamchurnBelum ada peringkat

- Break Even AnalysisDokumen4 halamanBreak Even Analysiscyper zoonBelum ada peringkat

- EIN CP 575 - 2Dokumen2 halamanEIN CP 575 - 2minhdang03062017Belum ada peringkat

- Cold Rolled Steel Sections - Specification: Kenya StandardDokumen21 halamanCold Rolled Steel Sections - Specification: Kenya StandardPEng. Tech. Alvince KoreroBelum ada peringkat

- MODULE+4+ +Continuous+Probability+Distributions+2022+Dokumen41 halamanMODULE+4+ +Continuous+Probability+Distributions+2022+Hemis ResdBelum ada peringkat

- Evaluating Sources IB Style: Social 20ib Opvl NotesDokumen7 halamanEvaluating Sources IB Style: Social 20ib Opvl NotesRobert ZhangBelum ada peringkat

- GLF550 Normal ChecklistDokumen5 halamanGLF550 Normal ChecklistPetar RadovićBelum ada peringkat

- Marshal HMA Mixture Design ExampleDokumen2 halamanMarshal HMA Mixture Design ExampleTewodros TadesseBelum ada peringkat

- Ensayo Bim - Jaime Alejandro Martinez Uribe PDFDokumen3 halamanEnsayo Bim - Jaime Alejandro Martinez Uribe PDFAlejandro MartinezBelum ada peringkat

- Rubber Chemical Resistance Chart V001MAR17Dokumen27 halamanRubber Chemical Resistance Chart V001MAR17Deepak patilBelum ada peringkat

- Data Sheet: Experiment 5: Factors Affecting Reaction RateDokumen4 halamanData Sheet: Experiment 5: Factors Affecting Reaction Ratesmuyet lêBelum ada peringkat

- Circular Flow of Process 4 Stages Powerpoint Slides TemplatesDokumen9 halamanCircular Flow of Process 4 Stages Powerpoint Slides TemplatesAryan JainBelum ada peringkat

- Free Radical TheoryDokumen2 halamanFree Radical TheoryMIA ALVAREZBelum ada peringkat

- Accomplishment Report 2021-2022Dokumen45 halamanAccomplishment Report 2021-2022Emmanuel Ivan GarganeraBelum ada peringkat

- Maj. Terry McBurney IndictedDokumen8 halamanMaj. Terry McBurney IndictedUSA TODAY NetworkBelum ada peringkat

- GMWIN SoftwareDokumen1 halamanGMWIN SoftwareĐào Đình NamBelum ada peringkat

- 8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemDokumen13 halaman8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemSatish JadhaoBelum ada peringkat

- Resume of Deliagonzalez34 - 1Dokumen2 halamanResume of Deliagonzalez34 - 1api-24443855Belum ada peringkat

- Additional Help With OSCOLA Style GuidelinesDokumen26 halamanAdditional Help With OSCOLA Style GuidelinesThabooBelum ada peringkat

- DNA Gel Electrophoresis Lab Solves MysteryDokumen8 halamanDNA Gel Electrophoresis Lab Solves MysteryAmit KumarBelum ada peringkat

- If V2 would/wouldn't V1Dokumen2 halamanIf V2 would/wouldn't V1Honey ThinBelum ada peringkat

- Surgery Lecture - 01 Asepsis, Antisepsis & OperationDokumen60 halamanSurgery Lecture - 01 Asepsis, Antisepsis & OperationChris QueiklinBelum ada peringkat